HR’s recurring headache: Convincing employees to get a flu shot

According to The National Institute for Occupational Safety and Health, the flu cost U.S. companies billions of dollars in medical fees and lost earnings. Read this blog post to learn how HR departments are convincing their employees to get a flu shot.

Elizabeth Frenzel and her team are the Ford assembly line of flu shots: They can administer about 1,800 flu shots in four hours.

Frenzel is the director of employee health and wellbeing at the University of Texas MD Anderson Cancer Center, and with 20,000 employees, she is no stranger to spearheading large flu shot programs. The center where Frenzel administers flu shots has roughly a 96% employee vaccination rate. Back in 2006, only about 56% of employees got their shots.

“When you run these large clinics, safety is critically important,” she says.

Problems like Frenzel’s are not unique. Every fall, HR departments send mass emails encouraging employees to get vaccinated. The flu affects workforces across the country, costing U.S. companies billions of dollars in medical fees and lost earnings, according toThe National Institute for Occupational Safety and Health. It is not only a cause of absenteeism but a sick employee can put their coworkers at risk. Last year the flu killed roughly 80,000 people, according to the Centers for Disease Control.

Even if an employer offers a flu shot benefit, the push to get employees to sign up for the vaccine can be a two-month slough, with reminder emails going unanswered. Moreover, companies often contend with misconceptions about the shot, such as the popular fallacy that shots will make you sick, running out of the vaccine, and sometimes just plain employee laziness.

In Frenzel’s case, increasing the number of employees who got flu shots weren’t just a good idea, but it was needed to protect the lives of the cancer patients they interact with every day. The most startling fact, she says, was that healthcare workers who interact with patients daily were less likely to get vaccinated.

“So that’s how we started down the path,” she says. “Really targeting these people who had the closest patient contact.”

Frenzel credits the significant increase in employee participation in the flu shot program to several factors. They made the program mandatory — a common move in the healthcare industry — but Frenzel says their improvement also was related to flu shot education. The center made it a priority to explain to staff members exactly why they should get vaccinated. Frenzel made it more convenient, offering the vaccine at different hours of the day, so all employees could fit it into their schedule. They also made it fun, offering stickers for employees to put on their badge once they got a shot. Every year, she says, they pick a new color.

Employers outside of the medical industry are focused on improving their flu shot programs, including Edward Yost, manager of employee relations and development at the Society for Human Resource Management, who helped organize a health fair and flu shot program for 380 employees.

Yost says onsite flu shot programs are more effective than vouchers that allow employees to get vaccinated at a primary care doctor or pharmacy. The more convenient you make the program, he says, the more likely employees will use it.

“There’s no guarantee that those vouchers are going to be used,” he says. “Most people aren’t running out to a Walgreens or a CVS saying, please stab me in the arm.”

Besides the convenience, employees are more likely to sign up for a shot when they see co-workers getting vaccinated, Yost says. If a company decides to offer an onsite program, planning ahead is key. Sometimes employees will not sign up in advance for the vaccine but then decide they want to get one once the vendor arrives onsite. Yost recommends companies order extra vaccines.

“Make sure that you’re building in the expectation that there's going to be at least a handful of folks who are more or less what you call walk-ins in that circumstance,” he says.

Incentivizing employees to get the flu shot is also important, Yost says. Some firms will offer a gym membership or discounted medical premiums if they attend regular checkups and get a biometric screening in addition to a flu shot. He recommends explaining to employees how a vaccine can help reduce the number of sick days they may use.

“Employees need to see that there’s something in it for them,” Yost says. “And quite honestly, being sick is a miserable thing to experience.”

Affiliated Physicians is one of the vendors that can come in and administer flu shots in the office. The company has provided various employers with vaccines for more than 30 years, including SourceMedia, the parent company of Employee Benefit News andEmployee Benefit Adviser. In the past 15 years, Ari Cukier, chief operating officer of the company, says there’s been an increase in the amount of smaller companies signing up for onsite vaccines. HR executives should be aware of the number of employees signing up for vaccinations when scheduling an onsite visit.

“We can’t go onsite for five shots, but 20-25 shots and up, we’ll go,” Cukier says.

Cukier agrees communication between human resources departments and employees is crucial in getting people to sign up for shots. Over the years, he’s noticed that more people tend to sign up for shots based on the severity of the previous flu season.

“Last year, as bad as it was, we have seen a higher participation this year,” he says.

Brett Perkison, assistant professor of occupational medicine at the University of Texas School of Public Health in Houston, says providing a good flu shot program starts from the top down. The company executives, including the CEO and HR executives, should set an example by getting and promoting the shots themselves, he says.

It’s also important to listen to employee concerns. Before implementing a program, if workers are taking issue with the shot, it’s best to hold focus groups to alleviate any worries before the shots are even being administered, he says.

Some employees may even believe misconceptions like the flu shot will make one sick or lead to long-term illnesses, he says. Others may question the effectiveness of the shot. Having open lines of communication with employees to address these concerns will ensure that more will sign up, Perkison says.

Regardless of the type of flu shot program, the most important part is preventing illness, SHRM’s Yost says. While missing work and losing money are important consequences of a flu outbreak, having long-term health issues is even more serious, he says. Plus, no one likes being sick.

“Who’s going to argue about that?” he says.

This article originally appeared in Employee Benefit News.

SOURCE: Hroncich, C (24 October 2018) "HR’s recurring headache: Convincing employees to get a flu shot" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/news/hrs-recurring-headache-convincing-employees-to-get-a-flu-shot

8 ways to maintain HSA eligibility

Is your high-deductible health plan still HSA qualified? Ensuring your high-deductible health plan remains HSA qualified is no easy task. Read this blog post for eight ways employers can maintain HSA eligibility.

For employers sponsoring high-deductible health plans with health savings accounts, ensuring that the HDHP continuously remains HSA qualified is no easy task. One challenge in this arena is that most of the rules and regulations are tax-related, and most benefit professionals are not tax professionals.

To help, we’ve created a 2019 pre-flight checklist for employers.

With 2019 rapidly approaching and open enrollment season beginning for many employers, now’s a great time to double-check that your HDHP remains qualified. Here are eight ways employers can maintain HSA eligibility.

1. Ensure in-network plan deductibles meet the 2019 minimum threshold of $1,350 single/$2,700 family.

To take the bumps out of this road, evaluate raising the deductibles comfortably above the thresholds. That way, you won’t have to spend time and resources amending the plan and communicating changes to employees each year that the threshold increases. Naturally, plan participants may not be thrilled with a deductible increase; however, if your current design requires coinsurance after the deductible, it’s likely possible on a cost neutral basis to eliminate this coinsurance, raise the deductible and maintain the current out-of-pocket maximum. For example:

| Current | Proposed | |

| Deductible | $1,350 single / $2,700 family | $2,000 single / $4,000 family |

| Coinsurance, after deductible | 80% | 100% |

| Out-of-pocket maximum | $2,500 single / $5,000 family | $2,500 single / $5,000 family |

This technique raises the deductible, improves the coinsurance and does not change the employee’s maximum out-of-pocket risk. The resulting new design may also prove easier to explain to employees.

2. Ensure out-of-pocket maximums do not exceed the maximum 2019 thresholds of $6,750 single/$13,500 family.

Remember that the 2019 HDHP out-of-pocket limits, confusingly, are lower than the Affordable Care Act 2019 limits of $7,900 single and $15,800 family. (Note to the U.S. Congress: Can we please consider merging these limits?) Also, remember that out-of-pocket costs do not include premiums.

3. If your plan’s family deductible includes an embedded individual deductible, ensure that each individual in the family must meet the HDHP statutory minimum family deductible ($2,700 for 2019).

Arguably, the easiest way to do so is making the family deductible at least $5,400, with the embedded individual deductible being $5,400 ÷ 2 = $2,700. However, you’ll then have to raise this amount each time the IRS raises the floor, which is quite the hidden annual bear trap. Thus, as in No. 1, if you’re committed to offering embedded deductibles, consider pushing the deductibles well above the thresholds to give yourself some breathing room (e.g., $3,500 individual and $7,000 family).

For the creative, note that the individual embedded deductible within the family deductible does not necessarily have to be the same amount as the deductible for single coverage. But, whether or not your insurer or TPA can administer that out-of-the-box design is another question. Also, beware of plan designs with an embedded single deductible but not a family umbrella deductible; these designs can cause a family to exceed the out-of-pocket limits outlined in No. 2.

Perhaps the easiest strategy is doing away with embedded deductibles altogether and clearly communicating this change to plan participants.

4. Ensure that all non-preventive services and procedures, as defined by the federal government, are subject to the deductible.

Of note, certain states, including Maryland, Illinois and Oregon, passed laws mandating certain non-preventive services be covered at 100%. While some of these states have reversed course, the situation remains complicated. If your health plan is subject to these state laws, consult with your benefits consultant, attorney and tax adviser on recommended next steps.

Similarly, note that non-preventive telemedicine medical services must naturally be subject to the deductible. Do you offer any employer-sponsored standalone telemedicine products? Are there any telemedicine products bundled under any 100% employee-paid products (aka voluntary)? These arrangements can prove problematic on several fronts, including HSA eligibility, ERISA and ACA compliance.

Specific to HSA eligibility, charging a small copay for the services makes it hard to argue that this isn’t a significant benefit in the nature of medical care. While a solution is to charge HSA participants the fair market value for standalone telemedicine services, which should allow for continued HSA eligibility, this strategy may still leave the door open for ACA and ERISA compliance challenges. Thus, consider eliminating these arrangements or finding a way to compliantly bundle the programs under your health plan. However, as we discussed in the following case study, doing so can prove difficult or even impossible, even when the telemedicine vendor is your TPA’s “partner vendor.”

Finally, if your firm offers an on-site clinic, you’re likely well aware that non-preventive care within the clinic must generally be subject to the deductible.

5. Depending on the underlying plan design, certain supplemental medical products (e.g., critical illness, hospital indemnity) are considered “other medical coverage.” Thus, depending on the design, enrollment in these products can disqualify HSA eligibility.

Do you offer these types of products? If so, review the underlying plan design: Do the benefits vary by underlying medical procedure? If yes, that’s likely a clue that the products are not true indemnity plans and could be HSA disqualifying. Ask your tax advisor if your offered plans are HSA qualified. Of note, while your insurer might offer an opinion on this status, insurers are naturally not usually willing to stand behind these opinions as tax advice.

6. The healthcare flexible spending account 2 ½-month grace period and $500 rollover provisions — just say no.

If your firm sponsors non-HDHPs (such as an HMO, EPO or PPO), you may be inclined to continue offering enrollees in these plans the opportunity to enroll in healthcare flexible spending accounts. If so, it’s tempting to structure the FSA to feature the special two-and-a-half month grace period or the $500 rollover provision. However, doing so makes it challenging for an individual, for example, enrolled in a PPO and FSA in one plan year to move to the HDHP in the next plan year and become HSA eligible on day one of the new plan year. Check with your benefits consultant and tax adviser on the reasons why.

Short of eliminating the healthcare FSA benefit entirely, consider prospectively amending your FSA plan document to eliminate these provisions. This amendment will, essentially, give current enrollees more than 12 months’ notice of the change. While you’re at it, if you still offer a limited FSA program, consider if this offering still makes sense. For most individuals, the usefulness of a limited FSA ebbed greatly back in 2007. That’s when the IRS, via Congressional action, began allowing individuals to contribute to the HSA statutory maximum, even if the individual’s underlying in-network deductible was less.

7. TRICARE

TRICARE provides civilian health benefits for U.S Armed Forces military personnel, military retirees and their dependents, including some members of the Reserve component. Especially if you employ veterans in large numbers, you should become familiar with TRICARE, as it will pay benefits to enrollees before the HDHP deductible is met, thereby disqualifying the HSA.

8. Beware the incentive.

Employers can receive various incentives, such as wellness or marketplace cost-sharing reductions, which could change the benefits provided and the terms of an HDHP. These types of incentives may allow for the payment of medical care before the minimum deductible is met or lower the amount of that deductible below the statutory minimums, either of which would disqualify the plan.

This article originally appeared in Employee Benefit News.

SOURCE: Pace, Z.; Smith, B. (22 October 2018) "8 ways to maintain HSA eligibility" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/opinion/8-ways-to-maintain-hsa-eligibility

How to Optimize Open Enrollment for Workers

From the rising cost of prescription medications to the ever-changing status of the ACA, benefit administrators are faced with many challenges when it comes to healthcare programs. Read this blog post to learn more.

Administrators of employer-sponsored healthcare programs face myriad challenges these days, from the rising cost of medications to the fluctuating status of the Affordable Care Act and state healthcare exchanges. As we head into the 2019 open enrollment season, it’s clear that these issues will continue to impact every type and rank of employee in the coming year.

To that end, I’ve outlined several key trends in open enrollment that frazzled HR leaders should explore before enrollment season begins. If it’s too late to make changes to your program this year, use these key points as a basis for measuring and evaluating current programs so you can begin planning for a more engaging, transparent and streamlined process next year.

You don’t have to take it all on yourself.

Employers are realizing that as great as some decision support and health advocacy tools may be, attempts to make employees better healthcare consumers have been only marginally effective. High-performing (aka narrow) networks may be a viable solution as they enable better rates negotiated with the carriers and providers while reducing waste, errors and unnecessary costs. It’s the steerage option, but plan designs can provide incentives for employees to elect these plans and networks. In turn, the HPNs can provide:

- more concierge-like service;

- better coordinated care between providers for high-cost claimants—where much of runaway costs reside; and

- support to ensure compliance with treatment protocols—for chronic conditions such as diabetes, CAD, COPD, etc.

In turn, these plans have the potential for shaving points off healthcare cost trend.

But it’s vital that communication strategies help reduce fears of reduced network choices (avoiding bad memories of restrictive HMO networks) while increasing confidence in the ability of the HPNs to drive results that actually enhance care while also reducing costs.

The best strategy is to provide easy-to-understand examples and scenarios that represent typical situations based on your company’s demographics and employee personas.

Use all the channels you have.

Education and engagement need to be done through a variety of channels to address the specific needs and preferences of demographic groups. Employees need to compare their options based on anticipated needs to look at both premiums (per paycheck costs) and out-of-pocket costs (deductible, copays, coinsurance), as well as employer-provided HSA contributions and incentives. The premium doesn’t tell the whole story—some people over-insure themselves by paying a higher premium for coverage that they may not use because they fear a higher deductible and out-of-pocket maximum.

Cost-comparison tools, interactive personalized assessment tools, microsites that are mobile-optimized with clear, consistent messaging, and extremely brief interactive videos make the message relevant to each individual.

Remember too that your company portal is both a useful tool in ensuring a personalized message to the employee, and a way for you to collect aggregated data about your employees’ interests, needs, action or inaction, and the user experience.

Don’t try to hit all the bases.

Trying to communicate too much information at one time tends to obscure the key message. Focus only on providing information needed to make effective enrollment decisions and use other points during the year to educate about broader topics like wellness.

A common failure is going paperless and forgetting that you really need to drive employees to resources to get them to pay attention. There may be very robust online content and resources but a very low rate of use of that valuable information. Remember that spouses at home often may be making the majority of the healthcare decisions for a family or, at the very least, for themselves. So going too far with the paperless approach can miss getting the message—and the needed information—to those key stakeholders.

Don’t fear transparency.

It’s intriguing to me that some employers are wary about communicating their level of cost-sharing with employees and how it benchmarks against peer companies. Employees often assume they are paying a far larger share than they are. There are other ways of being transparent about cost-sharing beyond the employer-employee split. For instance, we created an infographic for a client to explain the concept of self-insurance and are using it in an ongoing educational series with fact sheets and videos, getting across the idea that the decisions each of us make about our health and informed healthcare purchasing affect the costs in our individual as well as collective pockets.

The bottom line is that helping employees get smart about how they use healthcare and choose insurance options will save your company money. That’s not as callous as it sounds. If employers can’t find more and better ways to control healthcare and benefits costs, they’ll simply have to shift more of the burden to employees. Healthcare access is onerous enough. No one wants to make it harder or deprive workers of needed care. Healthy, satisfied, financially stable workers are better for business, productivity and the overall economy. Commit to exploring these key trends and making meaningful improvements to open enrollment in 2019 and beyond.

SOURCE: Brooks, B. (16 October 2018) "How to Optimize Open Enrollment for Workers" (Web Blog Post). Retrieved from https://hrexecutive.com/how-to-optimize-open-enrollment-for-workers/

5 ways employers can leverage tech during open enrollment

Are you leveraging technology advancements during open enrollment? Advances in technology are creating a more seamless and interactive healthcare experience for employees. Read on for five ways employers can leverage technology during 2019 open enrollment.

Technology continues to reshape how employers select and offer healthcare benefits to employees, putting access to information at our fingertips and creating a more seamless and interactive healthcare experience. At the same time, these advances may help employees become savvier users of healthcare, helping simplify and personalize their journey toward health and, in the process, help curb costs for employers.

The revolution can be important to remember during open enrollment, which occurs during the fall when millions of Americans select or switch their health benefits for 2019. With that in mind, here are five tips employers should be aware of during open enrollment and year-round.

Make sense of big data

Help people understand their options

Encourage your people to move more

Offer incentives to employees who comparison shop for care

Integrate medical and ancillary benefits

5 things small business owners should know about this year's open enrollment

For small business owners, the benefits they offer are crucial to the way they attract and retain employees. Read this blog post for five things small business owners should know for 2019 open enrollment.

As a small business owner, offering competitive employee benefits is a crucial way to attract and retain strong talent. Whether you currently provide them and are planning next year’s renewal, or you are thinking of offering them for the first time, here are five things you should consider before your employees enter the open enrollment period for next year on November 1st:

1. Small businesses don’t have to wait until open enrollment to offer benefits to their employees

While your employees won’t be able to enroll in health insurance plans until November comes along, small business owners don’t have to wait at all to secure health insurance for their employees. The sooner you act, the better, to guarantee that you and your employees are protected. According to recent studies, healthier employees are happier employees, and as a result, will contribute to a more productive workplace. And a more positive and constructive work environment is better for you, your employees, and your business as a whole.

2. Health literacy is important

Whether you’ve provided health insurance to your employees before, or you’re looking into doing so for the first time, it is always worthwhile to prioritize health insurance literacy. There is a host of terminology and acronyms, not to mention rules and regulations that can be overwhelming to wrap your head around.

Thankfully, the internet is full of relevant information, ranging from articles to explainer videos, that should have you up to speed in no time. Having a good understanding of insurance concepts such as essential health benefits, employer contributions, out-of-pocket maximums, coinsurance, provider networks, co-pays, premiums, and deductibles is a necessary step to being better equipped to view and compare health plan options side-by-side. A thorough familiarization with health insurance practices and terms will allow you to make the most knowledgeable decisions for your employees and your business.

3. Offering health insurance increases employee retention

Employees want to feel like their health is a priority, and are more likely to join a company and stay for longer if their health care needs are being met. A current survey shows that 56 percent of Americans whose employers were sponsoring their health care considered whether or not they were happy with their benefits to be a significant factor in choosing to stay with a particular job. The Employee Benefit Research Institute released a survey in 2016 which showed a powerful connection between decent workplace health benefits and overall employee happiness and team spirit—59 percent percent of employees who were pleased with their benefits were also pleased with their jobs. And only 8 percent of employees who were dissatisfied with their benefits were satisfied with their jobs.

4. Alleviate health insurance costs

High insurance costs can be an obstacle for small business owners. A new survey suggests that 53 percent of American small business owners stress over the costs of providing health care to their employees. The 2017 eHealth report reveals that nearly 80 percent of small businesses owners are concerned about health insurance costs, and 62 percent would consider a 15 percent increase in premiums to make small group health insurance impossible to afford. However, there are resources in place to help reduce these costs, so they aren’t too much of a barrier. One helpful way to cut down on health insurance costs is to take advantage of potential tax breaks available to small business owners. All of the financial contributions that employers make to their employees’ premiums are tax-deductible, and employees’ financial contributions are made pre-tax, which will successfully decrease a small business’ payroll taxes.

Additionally, if your small business consists of fewer than 25 employees, you may be eligible for tax credits if the average yearly income for your employees is below $53,000. It is also beneficial to note that for small business owners, the biggest driver on insurance cost will be the type of plan chosen in addition to the average age of your employees. Your employees’ health is not a relevant factor.

5. Utilize digital resources

You don’t have to be an insurance industry expert to shop for medical plans. There are resources and tools available that make buying medical plans as easy as purchasing a plane ticket or buying a pair of shoes online – Simple, transparent. Insurance is a very complex industry that can easily be simplified with the use of the advanced technology and design of online marketplaces. These platforms are great tools for small business owners to compare prices and benefits of different plans side-by-side. Be confident while shopping for insurance because all of the information is laid out on the table. Technological solutions such as digital marketplaces serve as useful tools to modernize the insurance shopping process and ensure that you and your team are covered without going over your budget.

SOURCE: Poblete, S. (15 October 2018) "5 things small business owners should know about this year's open enrollment" (Web Blog Post). Retrieved from https://www.benefitspro.com/2018/10/15/5-things-small-business-owners-should-know-about-t/

Ready for the sounds of office sniffles?

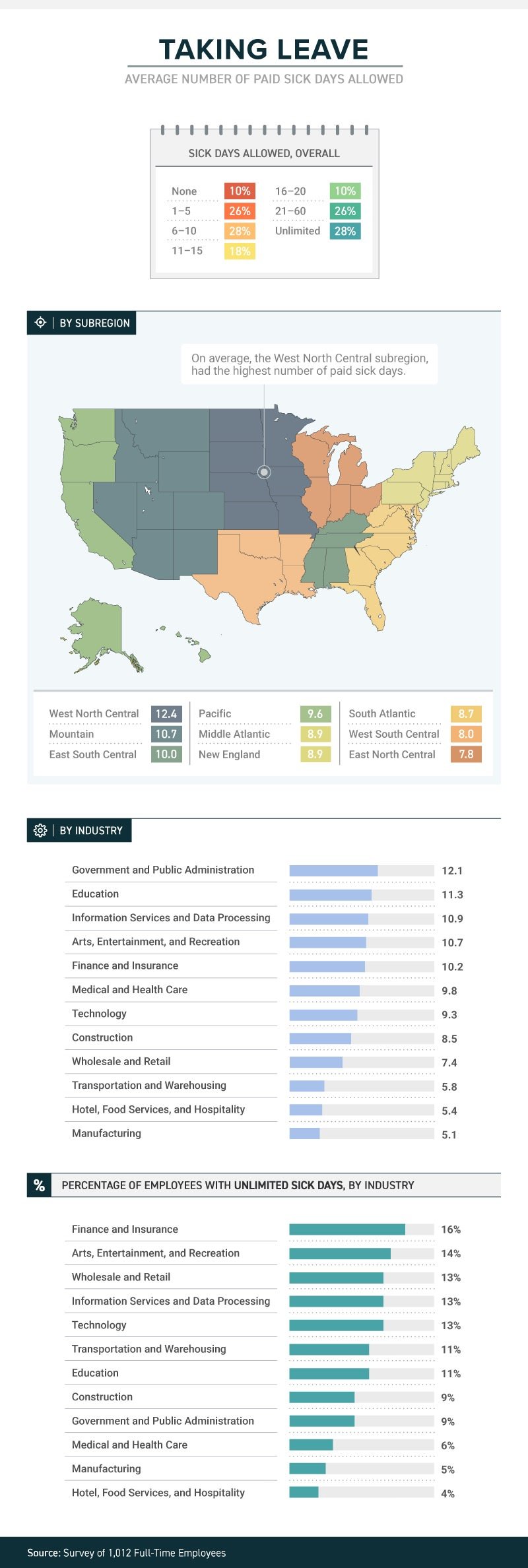

A recent study by law firm, Farah and Farah, states that one in four full-time workers receive between 1 and 5 sick days. Continue reading to learn more.

It’s not just a matter of whether they feel well enough to work, or whether they have sick days. The boss’s attitude about whether workers should take sick days or not can determine whether they actually do stay home when they’re sick, or instead come to work to spread their germs to all and sundry.

A new study from law firm Farah & Farah finds that even though it can take a person some 10 days to fully recover from a cold, approximately 10 percent of full-time workers in the U.S. get no sick days at all (part-timers don’t usually get them either), while more than 1 in 4 have to make do with between 1 and 5 sick days. Just 18 percent get enough sick time to actually recover from that cold—between 11 and 15 days.

The amount (or presence) of sick time varies from industry to industry, with government and public administration providing the most (an average of 12.1) and both hotel, food services and hospitality and manufacturing providing the least (an average of 5.4 for the hospitality industry and 5.1 for manufacturing). Some lucky souls actually get unlimited sick days, although even then they don’t always use them.

Regardless of industry, or quantity, just because workers get sick days it doesn’t mean they use them. Workers often worry that they’ll be discouraged from using them, with employers who may provide them but not encourage employees to stay home when ill. In fact, 38 percent of workers show up to work whether they’re contagious or not. Sadly for the people they encounter at work, the most likely to do so are in hospitality, medical and healthcare and transportation. Plenty of germ-spreading to be done in those professions!

And their employers’ attitudes play a role in how satisfied they are with their jobs. Among those who work for the 34 percent of bosses who encourage sick employees to stay home, 43 percent said they’re satisfied with their jobs in general. Among those who work for the 47 percent of bosses who are neutral about the use of sick days, that drops to 21 percent—and among the unfortunate workers who work for the 19 percent of bosses who actually discourage workers from staying home while ill, just 12 percent were satisfied with their jobs.

When it comes to mental health days (no, not that kind; the ones people really need to deal with diagnosed mental health conditions), fewer than 1 in 10 men and women were willing to call in sick. Taking “mental health days” when physically healthy, however, either to play hooky or simply have a vacation from the office, is something that 15 percent of respondents admitted to.

SOURCE: Satter, M (5 October 2018) "Ready for the sounds of office sniffles?" (Web Blog Post). Retrieved from https://www.benefitspro.com/2018/10/05/ready-for-the-sounds-of-office-sniffles/

Original report retrieved from https://farahandfarah.com/studies/sick-days-in-america

U.S. Unemployment Drops to Lowest Rate in 50 Years

Last month the U.S. unemployment rate fell to 3.7 percent, the lowest it’s been in 50 years. Continue reading to learn how the low jobless rate is affecting the U.S. labor market.

Unemployment in the U.S. fell to 3.7 percent in September—the lowest since 1969, according to the Bureau of Labor Statistics (BLS).

The low jobless rate, down from 3.9 percent in August, is further evidence of a strong economy—employers added 134,000 new jobs in September, extending the longest continuous jobs expansion on record at 96 months. The continued gains run counter to economists' expectations for a significant slowdown in hiring as the labor market tightens. Through the first nine months of the year, employers added an average of 211,000 workers to payrolls each month, well outpacing 2017's average monthly growth of 182,000.

"This morning's jobs report marked a new milestone for the U.S. economy," said Andrew Chamberlain, chief economist at Glassdoor. "With good news in most economic indicators today, it's likely the economy will continue its march forward through the remainder of 2018."

Cathy Barrera, chief economist at online employment marketplace ZipRecruiter, pointed out that the jobless rate ticked down for all education levels. "Anecdotal evidence has suggested that employers have experienced labor shortages for entry-level positions, and the decline in unemployment for these groups reflects that," she said. "More of those joining or rejoining the labor force are moving directly into jobs, reflecting the high demand for workers."

The sectors showing the strongest jobs gains in September include:

- Professional and business services (54,000 new jobs).

- Healthcare (26,000).

- Transportation and warehousing (24,000).

- Construction (23,000).

- Manufacturing (18,000).

"Retail job losses—20,000 jobs—were widespread, and the leisure and hospitality sector lost 17,000 jobs, largely confined to restaurants," said Josh Wright, chief economist for recruitment software firm iCIMS, based in Holmdel, N.J.

"We can clearly point to a slowdown in retail trade for the dip in [overall] payroll numbers in September," said Martha Gimbel, research director for Indeed's Hiring Lab, the labor market research arm of the global job search engine. "Retail trade had a strong first half of the year but has slowed down in recent months. In addition, recent Hiring Lab research saw a slight dip in the number of holiday retail postings, suggesting that the sector may struggle in months to come."

Prior to September, employment in leisure and hospitality had been on a modest upward trend and the losses last month may reflect the impact of Hurricane Florence.

The Department of Labor said it's possible that employment in some industries was affected by Hurricane Florence which struck the Carolinas in September. Nearly 300,000 workers nationwide told the BLS that bad weather kept them away from their jobs last month.

"That's far below the level in September 2017 amid hurricanes Harvey and Irma, but significantly above the average of about 200,000 over the prior 13 years," Wright said. Upward revisions are likely, he added.

Wages Stubborn but Rising

In September, average hourly earnings for private-sector workers rose 8 cents to $27.24. Over the year, average hourly earnings have increased by 73 cents, or 2.8 percent.

"That's down slightly from the 2.9 percent pace last month, but consistent with a steady upward trend in wage growth we've seen as the job market tightens and more employers face labor shortages," Chamberlain said. "We expect to see that pace continue to rise throughout the holiday season, likely topping 3 percent within the next six months."

Glassdoor has recorded strong wage growth in tech-heavy metropolitan areas such as San Francisco, New York and Los Angeles.

"If the true wage growth rate is at or below 2.8 percent year-over-year, it is disappointing that it is not growing faster," Barrera said. "Given how tight the labor market has been not only with overall unemployment below 4 percent, but particularly so at the entry level, we would expect wage growth to be higher. The labor turnover numbers suggest that mobility is lower than it historically has been in periods where unemployment is very low. This is one reason wages may not be rising as quickly as we'd expect."

Labor Force Participation Stalled?

The nation's labor force participation rate held at 62.7 percent.

"Looking at the labor flows data, the rate of movement of the civilian population into the labor force hasn't moved much in the last couple of years, however, more of those folks are moving directly into employment rather than into unemployment," Barrera said.

Wright noted that the number of new labor force entrants and reentrants going directly to unemployment was just 33,000. "This raises interesting questions—whenever we get a recession, how long will these reentrants and new entrants continue searching for jobs before leaving the labor force?" he asked.

The percentage of the population in their prime working years with a job also held around 79 percent, where it's been for about eight months, Gimbel said, adding that the measure suggests that the number of workers remaining to pull into the labor force may be exhausted.

"The share of the labor force working part-time but who wants a full-time job unfortunately ticked up," she said. "Any remaining slack in the economy may be concentrated in part-time workers who want more hours."

SOURCE: Maurer, R. (5 October 2018) "U.S. Unemployment Drops to Lowest Rate in 50 Years" (Web Blog Post). Retrieved from https://www.shrm.org/resourcesandtools/hr-topics/talent-acquisition/pages/us-unemployment-drops-lowest-50-years-bls-jobs.aspx/

Are you ready for self-funding? Three tools to help you decide

Are you ready for a self-funded health plan? Self-funding and other alternative funding options may seem risky to many HR professionals. Continue reading for three tools to help you decide if you’re ready to switch.

When your health plan is fully insured, it’s easy for your finance department to budget for the cost — you just pass on the health insurer’s annual renewal premium amount to them and that becomes the annual budget number. But you and your broker may have come to suspect that you are leaving money on the table by continuing on a fully insured basis, and you may want to test the self-funded waters.

By now, you may already know there are significant benefits to self-funding, but actually making the switch is a scary prospect for HR directors.

Before you can transition to a self-funded plan, you need to be financially stable and willing to take a bit of a risk. As a safeguard, you also need to familiarize yourself with the two forms of stop-loss insurance. One caps the impact on any one covered member’s claims (individual or specific stop loss), and the other caps your total annual claim liability (aggregate stop loss). Your broker can guide you on which stop loss levels and which stop-loss coverage periods are right for your population when transitioning from fully insured to self-funding.

Beyond these stop-loss safeguards, size will dictate how you pay. If you have fewer than 100 covered employees, you may be able to pay the same amount monthly, just as you do with your fully insured premium. This monthly payment equals projected claims plus an aggregate margin, a monthly administration fee and the stop loss charge. This eliminates unpredictable monthly payments for a small self-funded group.

However, for larger groups of over 100 employees, moving to self-funding will mean paying claims as they are processed (which means uneven claim payments), plus stop loss and administration.

To help you determine if you’re ready for self-funding, you may want to analyze your plan in a few different ways.

1. Look back: A look back analysis is just what it sounds like — a view of how your plan would have performed over the last couple years had you been self-funded, compared to how it did perform under a fully insured model. This should be an easy enough task for your broker to take on, especially if they have sought out self-funded quotes from claim administrators and stop-loss carriers on your behalf. In addition, they should know what your actual claims costs were. The result is that you’ll know whether you would have saved money or not.

2. Look forward: You may already know what your upcoming fully insured renewal looks like. But even if you don’t have hard numbers yet, you can work with your broker to determine a strong estimate of what your proposed premiums will be. Then, your broker should get a self-funded quote, which includes the expected and maximum claims, plus the administrative fees and stop-loss premiums. This is your expected self-funded costs for the upcoming policy period. Compare that estimate to your fully insured renewal costs. (Make sure the self-funded costs are on the same “incurred claims with runout” basis that the fully insured costs would be, for a fair apples-to-apples comparison.)

3. Probability. While the “look forward” analysis compares your fully insured costs to your expected self-funded costs, it is based on “expected” claims. The risky part of self-funding is that your actual claims will not ultimately materialize exactly as expected. There are some more sophisticated tools that combine group-specific data (such as your claims history, demographics and the proposed fixed costs) with a fairly large actuarial database to come up with thousands of possible outcomes.

By charting all of these outcomes, you can produce likelihood percentages of where your actual claims will come in at — versus the “expected” level, and versus the fully insured renewal rate. Not all brokers have this tool on hand, and as a result, there may be a cost associated with producing one. The output from this tool may appeal to your colleagues in the finance department.

Other considerations

During your analysis, you may want to set your self-funded policy year liability based on incurred claims (plus fixed costs), even though your actual paid claims within that policy year may be less due to the lag between when provider services occur and when you actually fund them. The lag is a cash-flow advantage but it does not represent a reduced claim liability.

Finally, don’t lose sight of the cost of high claimants, an important part of planning if you choose the self-funding route. Will your past high claimants continue into your renewal period? Are you aware of new high claimants on the horizon? Stop-loss carriers generally insure only “unknown risks,” not “known risks.” If a plan member has an expensive chronic condition, such as kidney failure, a stop loss carrier may “laser” that individual and set a higher individual stop-loss threshold. It’s important that you know what’s excluded and factor in any uncovered catastrophic claimants into your analysis.

In the end, it may turn out that self-funding is not a good fit, or possibly that this year is just not the year for it. But whether it is, or it isn’t, it is comforting to know that you’ve done your due diligence and have documentation supporting the decision you’ve reached.

SOURCE: DePaola, Raymond (5 October 2018) "Are you ready for self-funding? Three tools to help you decide" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/ready-for-self-funding-three-tools-to-help-you-decide

IRS updates required tax notice to address plan loan offsets

The model notices that all plan sponsors are required to send to plan participants before they receive an eligible rollover distribution from qualified plans were recently updated by the IRS. Continue reading to learn more.

The IRS has updated the model notice that is required to be provided to participants before they receive an “eligible rollover distribution” from a qualified 401(a) plan, a 403(b) tax-sheltered annuity, or a governmental 457(b) plan.

Notice 2018-74, which was published on September 18, 2018, modifies the prior safe-harbor explanations (model notices) that were published in 2014. Like the 2014 guidance, the 2018 Notice — sometimes referred to as the “402(f) Notice” or “Special Tax Notice” — includes two separate “model” notices that are deemed to satisfy the requirements of Code Section 402(f): one for distributions that are not from a designated Roth account, and one for distributions from a designated Roth account. The 2018 Notice also includes an appendix that can be used to modify (rather than replace) existing safe-harbor 402(f) notices.

The model notices were updated to take into consideration certain legislation that has been enacted, and other IRS guidance that has been published, since 2014. They include:

- changes related to qualified plan loan offsets under the Tax Cuts and Jobs Act of 2017;

- changes in the rules for phased retirement under the Moving Ahead for Progress in the 21st Century Act (“MAP-21”);

- changes in the exceptions to the 10% penalty for early distributions from governmental plans under the Defending Public Safety Employees’ Retirement Act; and

- IRS guidance (in Revenue Procedure 2016-47) regarding a self-certification procedure for waivers of the 60-day rollover deadline.

The model notices also make some “clarifying” changes to the 2014 notices, including:

- clarification that the 10% additional tax on early distributions applies only to amounts includible in income;

- an explanation of how the rollover rules apply to governmental 457(b) plans that include designated Roth accounts;

- clarification that certain exceptions to the 10% tax on early distributions do not apply to IRAs; and

- recognizing that taxpayers affected by federally declared disasters and other events may have an extended deadline for making rollovers.

The updated model 402(f) notices should be particularly useful in communicating to participants the extension, under the Tax Cuts and Jobs Act, of the time to roll over a “qualified plan loan offset amount.”

Inside the plan load offset

By way of background, Notice 2018-74 reminds us that distribution of a “plan loan offset amount” is an eligible rollover distribution, and that a “plan loan offset” occurs when, under the plan terms governing a plan loan, the participant’s accrued benefit is reduced, or offset, in order to repay the loan. According to the Notice, this can occur when, for example, the terms of the plan loan require that, in the event of an employee’s termination of employment or request for a distribution, the loan is to be repaid immediately or treated as in default.

The Notice also indicates that a plan loan offset may occur when, under the terms of the plan loan, the loan is canceled, accelerated, or treated as if it were in default (for example, when the plan treats a loan as in default upon an employee’s termination of employment or within a specified period thereafter). The Notice also reminds us, however, that a plan loan offset cannot occur prior to a distributable event.

This is helpful guidance for distinguishing between a “deemed distribution” of a defaulted loan (a taxable event which is not eligible for rollover) and a “plan loan offset amount,” which is an eligible rollover distribution.

Generally, if a default occurs before the participant has a distributable event (such as termination of employment, or attainment of age 59½), and the default is not cured by the last day of the cure period, it must be treated as a “deemed distribution” and reported on Form 1099. Such defaulted amounts are not eligible for rollover.

However, if the default occurs at or after a distribution event, and the plan terms require that the participant’s account be offset to pay off the loan, then the reduction of the account may be treated as a plan loan offset, which is an eligible rollover distribution.

Notice 2018-74 (and the new model notices) also reflect that, prior to the Tax Cuts and Jobs Act of 2017, participants who incurred a “plan loan offset” only had 60 days to “roll” an equivalent amount of money to an IRA or another employer plan (to avoid the offset being treated as a taxable distribution). However, for plan loan offsets that occur after December 31, 2017, if the plan loan offset is a “qualified plan loan offset” (meaning it occurs in connection with termination of employment or termination of the plan), then the participant has significantly more time (until the extended due date of the participant’s tax return for the year of the offset) in which to roll an amount equal to the loan offset amount to an IRA or another employer plan.

SOURCE: Browning, R (4 October 2018) "IRS updates required tax notice to address plan loan offsets" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/opinion/irs-updates-required-tax-notice-to-address-plan-loan-offsets?brief=00000152-146e-d1cc-a5fa-7cff8fee0000

8 keys to developing a successful return to work program

What does your return to work program look like? Read this blog post for 8 tips to developing a successful return to work program at your organization.

No matter the size of your organization, there’s about a 99% chance at some point dealing with employees going on leave. Most HR professionals are well-versed on the logistics of what to do when an employee is on short- or long-term disability — but what sort of culture do you have in place that encourages and supports them with a return to work (RTW)? Developing a positive and open RTW culture benefits not only the organization but the employee and their teams as well.

An effective RTW program helps an injured or disabled employee maintain productivity while recuperating, protecting their earning power and boosting an organization’s output. There also are more intangible benefits including the mental health of the employee (helping them feel valued), and the perception by other team members that the organization values everyone’s work.

See also: 7 Ways Employers Can Support Older Workers And Job Seekers

Some other benefits of an RTW program can include improvement of short-term disability claims, improvement of compliance and reduction of employer costs (replacing a team member can cost anywhere from half to twice that employee’s salary, so doing everything you can to keep them is a wise investment).

Some of these may seem like common sense, but I’m continually surprised how many (even large) organizations don’t have an established RTW program. Here are eight critical elements of a successful program.