How to Monitor Your Employees — While Respecting Their Privacy

A recent survey found that 55 percent of millennials that had partaken in the survey plan to leave employers that prioritize profits over people. Read this blog post to learn more.

Even before Covid-19 sent an unprecedented number of people to work from home, employers were ramping up their efforts to monitor employee productivity. A 2018 Gartner report revealed that of 239 large corporations, 50% were monitoring the content of employee emails and social media accounts, along with who they met with and how they utilized their workspaces. A year later an Accenture survey of C-suite executives reported that 62% of their organizations were leveraging new tools to collect data on their employees.

These statistics were gathered before the coronavirus pandemic, which has made working from home a necessity for thousands of companies. With that transition having happened so rapidly, employers are left wondering how much work is actually going on. The fear of productivity losses, mingling with the horror of massively declining revenues, has encouraged many leaders to ramp up their employee monitoring efforts.

There is no shortage of digital tools for employee monitoring — or, as privacy advocates put it, “corporate surveillance.” Multiple services enable stealth monitoring, live video feeds, keyboard tracking, optical character recognition, keystroke recording, or location tracking. One such company, Hubstaff, implements random screen capture that can be customized for each person and set to report “once, twice, or three times per 10 minutes,” if managers so wish. Another company, Teramind, captures all keyboard activity and records “all information to comprehensive logs [that] can be used to formulate a base of user-based behavior analytics.”

Despite the easy availability of options, however, monitoring comes with real risk to the companies that pursue it. Surveillance threatens to erode trust between employers and employees. Accenture found that 52% of employees believe that mishandling of data damages trust — and only 30% of the C-suite executives who were polled reported themselves as “confident” that the data would always be used responsibly. Employees who are now subject to new levels of surveillance report being both “incredibly stressed out” by the constant monitoring and also afraid to speak up, a recipe for not only dissatisfaction but also burnout, both of which — ironically — decrease productivity. Worse, monitoring can invite a backlash: In October of 2019 Google employees went public about spy tools allegedly created to suppress internal dissent.

Tempting as it may be to implement monitoring in the service of protecting productivity, it also stands in stark contrast to recent trends in the corporate world. Many organizations have committed to fostering a better employee experience, with a particular focus on diversity and inclusion. There are not only strong ethical reasons for having one’s eye on that ball, but good bottom line reasons as well. The Deloitte Global Millennial Survey from 2019 found that 55% of millennials plan to leave employers that prioritize profits over people. Retention — which should be a priority for all companies, given the high expense of making and onboarding new hires — becomes difficult and costly for companies that don’t reflect those values. Given the risk of alienating employees coupled with the possibility of error and misapplication of these tools, it is quite likely that, for many, the juice just isn’t worth the squeeze.

Even so, some companies will still find it worth the tradeoffs. Justified fear of a collapsing economy reasonably drives employers to monitor their employees to ensure they are being productive and efficient. Indeed, they may even have ethically admirable aims in doing so, such as for the sake of their employees’ health and the health of the country as a whole. Furthermore, if the tools are deployed with the goal of discovering which employees are in need of additional help — more on this below — that may be all the more reason to monitor. But if your business concludes that it ought to monitor employees (for whatever reason), it is important to do so in a way that maximally respects its employees.

Here are six recommendations on how to walk this tightrope.

1. Choose your metrics carefully by involving all relevant stakeholders.

Applying numbers to things is easy, as is making quick judgments based on numeric scores spit out by a piece of software. This leads to both unnecessary surveillance and ill-formed decisions. It’s simply too easy to react to information that, in practice, is irrelevant to productivity, efficiency, and revenue. If you insist on monitoring employees, make sure what you’re tracking is relevant and necessary. Simply monitoring the quantity of emails written or read, for instance, is not a reliable indicator of productivity.

If you want the right metrics, then engage all of the relevant stakeholders in the process to determine those metrics, from hiring managers to supervisors to those who are actually being monitored. With regards to employee engagement it is especially important to reach both experienced and new employees, and that they are able to deliver their input in a setting where there is no fear of reprisal. For instance, they can be in discussion with a supervisor — but preferably not their direct supervisor, who has the authority to fire or promote them.

2. Be transparent with your employees about what you’re monitoring and why.

Part and parcel of respecting someone is that you take the time to openly and honestly communicate with them. Tell your employees what you’re monitoring and why. Give them the opportunity to offer feedback. Share the results of the monitoring with them and, crucially, provide a system by which they can appeal decisions about their career influenced by the data collected.

Transparency increases employee acceptance rates. Gartner found that only 30% of employees were comfortable with their employer monitoring their email. But in the same study, when an employer shared that they would be monitoring and explained why, more than 50% of workers reported being comfortable with it.

3. Offer carrots as well as sticks.

Monitoring or surveillance software is implicitly tied to overseers who are bent on compliance and submission. Oppressive governments, for example, tie surveillance with threats of fines and imprisonment. But you don’t need to pursue monitoring as a method of oppression. You would do better to think about it as a tool by which you can figure out how to help your employees be more productive or reward them for their hustle. That means thinking about what kinds of carrots can be used to motivate and boost relevant numbers, not just sticks to discourage inefficiencies.

4. Accept that very good workers will not always be able to do very good work all the time — especially under present circumstances.

These are unique times and it would be wrong — both ethically and factually — to make decisions about who is and who is not a good employee or a hard worker based on performance under these conditions. Some very hard-working and talented employees may be stretched extraordinarily thin due to a lack of school and child care options, for instance. These are people you want to keep because, in the long run, they provide a tremendous amount of value. Ensure that your supervisors take the time to talk to their supervisees when the numbers aren’t what you want them to be. And again, that conversation should reflect an understanding of the employee’s situation and focus on creative solutions, not threats.

5. Monitor your own systems to ensure that people of color and other vulnerable groups are not disproportionately affected.

Central to any company’s diversity and inclusion effort is a commitment to eliminating any discrimination against traditionally marginalized populations. Precisely because they have been marginalized, those populations tend to occupy more junior roles in an organization — and junior roles often suffer the most scrutiny. This means that there is a risk of disproportionately surveilling the very groups a company’s inclusivity efforts are designed to protect, which invites significant ethical, reputational, and legal risks.

If employee monitoring is being used, it is important that the most junior people are not surveilled to a greater extent than their managers, or at least not to an extent that places special burdens on them. For instance, it would be particularly troublesome if very junior employees received a level of surveillance — say, sentiment analysis or keyboard logging — that only slightly more senior people did not. A policy that says, “This is how we monitor all employees” raises fewer ethical red flags than a policy that says, “This is how we monitor most employees, except for the most junior ones, who undergo a great deal more surveillance.” Equal application of the law, in other words, legitimately blunts the force of charges of discrimination.

6. Decrease monitoring when and where you can.

The impulse to monitor is understandable, especially in these times. But as people return to their offices — and even as some continue to work from home — look for places to pull back monitoring efforts where things are going well. This communicates trust to employees. It also corrects for the tendency to acquire more control than necessary when circumstances are not as severe as they once were.

At the end of the day, your employees are your most valuable assets. They possess institutional knowledge and skills others do not. You’ve invested time and money in them and they are very expensive to replace. Treating them with respect is not only something they deserve — it’s crucial for a company’s retention efforts. If your company does choose to move ahead with surveillance software in this climate, you need to remind yourself that you are not the police. You should be monitoring employees not with a raised baton, but with an outstretched hand.

SOURCE: Blackman, R. (28 May 2020) "How to Monitor Your Employees — While Respecting Their Privacy" (Web Blog Post). Retrieved from https://hbr.org/2020/05/how-to-monitor-your-employees-while-respecting-their-privacy

Older Workers Are a Valuable Talent Pool

Currently, Americans 55 and older make up less than a quarter of the nation's labor force, according to AARP. While many HR leaders have been focused on finding out how to meet the different expectations and needs of Millennials, they also need to be aware of the bigger demographic challenge ahead - the role of people over 55. Read this blog post to learn more.

Over the last decade, most HR leaders have been obsessed by the role of millennials at work and figuring out how to meet the different expectations and needs of these young workers.

Certainly, this has been important work. But, leaders need to be aware of a much bigger demographic challenge ahead: the role of people over the age of 55.

The U.S. Bureau of Labor Statistics projects that in the next 10 years, the fastest-growing segments of the workforce will be for employees over 65. According to AARP, Americans 55 and older make up slightly less than a quarter of the nation’s labor force, but they filled almost half (49 percent) of the 2.9 million jobs gained in 2018—the biggest share of any age group.

This trend will continue. We are living longer and having fewer children. The fertility rates in the U.S., U.K., Germany, Japan, and almost every other developed country are below replacement. As a result, populations—and our workforces—are going to get older.

Obviously, this has an impact on public policy, immigration, and healthcare investments. But the more interesting aspect for those of us in HR is the huge impact this will have on work.

Attitudes About Age

How do most employers feel about older people? They aren’t that thrilled to have them around. While older employees may be wiser and more reliable, they usually make more money than younger workers. Many employers believe older workers can’t keep up with today’s always-on digital workplace.

A few years ago, we asked employers whether age was a competitive advantage or competitive disadvantage in their company. Almost 60 percent of respondents said that age was a disadvantage. In other words, when a young employee competes with an older employee for a job, the young person wins.

This discriminatory perception was summed up perfectly by Mark Zuckerberg in 2007 when he said in an interview, “Younger people are just smarter.”

Forced Transitions

I’ve seen this in my own personal life. Many of my friends from college (we’re all in our early 60s) are starting to think about retiring, primarily because they’ve been forced out of their companies. Most of us will live well into our 80s, 90s, or longer, and as we age, work becomes one of the most gratifying things we do. But employers just don’t see it this way.

According to a recent analysis by the Urban Institute and ProPublica, more than half of workers over 50 lose longtime jobs before they are ready to retire. Of those, 9 out of 10 never recover their previous earning power. Why? Employers simply do not want them back.

Age Discrimination

Companies are now being sued for age discrimination. Recruiters have been caught saying things like “you’re too old for this job” or “we only hire people with less than seven years of experience.” Even Facebook has been forced to remove age as a criterion for job placements in its online advertisements.

The above are examples of explicit discrimination. However, in most companies, age discrimination is much more subtle. Older people have higher salaries, so they are just passed over for many positions.

New Ideas for Older Workers

But change is ahead. Not only does age discrimination fly in the face of most diversity and inclusion programs, but the reality is that employers really need older workers because of record unemployment rates and extreme talent shortages.

“Re-careering” programs—in which employers invite retirees back to work, give them training and new skills, and let them work part-time—are cropping up in companies such as Boeing, Bank of America, and Apple. I encourage all employers to invest this way.

Business leaders also need to keep in mind that baby boomers are the biggest buying population in the world and has as much disposable income as the rest of the population combined. These consumers want to do business with organizations that respect older individuals and don’t view age as a negative.

Think about your company’s attitudes about age. Older workers are often more stable, they understand how to work in teams, and they are likely to be more loyal over time. Generational diversity in workforces is also reflective of good corporate citizenship.

Now is the time for HR leaders to work to actively eliminate age discrimination in their workforces and view generational diversity as a valuable goal.

SOURCE: Bersin, J. ( 25 July 2019) "Older Workers Are a Valuable Talent Pool" (Web Blog Post). Retrieved from https://blog.hrps.org/blogpost/Older-Workers-Are-a-Valuable-Talent-Pool

A 16-Year-Old Explains 10 Things You Need to Know About Generation Z

What was life like when you were a teenager? The world has been focused on understanding and adapting to Millennials. Now Generation Z is beginning to graduate and enter the workforce. Read this blog post for 10 things the world should know about Gen Z.

Think about what life was like when you were 16. The clothes you wore, the places you shopped. What was most important to you then?

Whenever I speak to an organization eager to learn about Generation Z, I always ask that question. I get responses that include everything from the fleeting fashion trends of the day (bell-bottom jeans, anyone?) to the time-honored tradition of getting a driver’s license.

What I hope to achieve as a 16-year-old in 2018 is probably not all that different from what anyone else wanted when they were my age. It’s the way people go about reaching their goals that evolves over time—and that’s what also forms the basis of most generational clashes.

For the past several years, the world has been focused on understanding and adapting to Millennials, the largest and most-educated generation in history. Born between 1981 and the mid-1990s, this group has inspired important dialogues about generational differences and challenged all industries to evolve to meet their needs. In the workplace, Millennials have helped drive a greater focus on flexibility and collaboration and a rethinking of traditional hierarchies.

Of course, any analysis of generations relies on generalities that can’t possibly describe every person or situation. It’s important to remember that generations exist on a continuum—and that there is a large degree of individual variation within them. The point of this type of research is to identify macro trends among age groups that can help foster workplace harmony. Essentially, it’s a way of attempting to understand people better by getting a sense of their formative life experiences. The generation to which one belongs is among the many factors, such as race, religion and socioeconomic background, that can shape how a person sees the world.

But there’s little doubt that gaps among the U.S. generations have widened dramatically. For example, an 8-year-old boy in the United States who grew up with a tablet will likely have more in common with an 8-year-old in China who used a similar mobile device than he will with his 70-year-old U.S. grandparents.

In thinking about the generations, a key thing to understand is that these groups are typically categorized by events rather than arbitrary dates. Generation Z’s birth years are generally recognized as 1996 to 2009. The start year was chosen so that the cohort would include only those who do not remember the Sept. 11 terrorist attacks. The belief is that if you were born in 1996 or later, you simply cannot process what the world was like before those attacks. For Generation Z, the War on Terror has always been the norm.

Like all other generations, mine has been shaped by the circumstances we were born into, such as terrorism, school shootings and the Great Recession. These dark events have had profound effects on the behavioral traits of the members of Generation Z, but they have also inspired us to change the world.

Earlier this year, XYZ University, a generations research and management consulting firm where I act as the director of Gen Z studies, surveyed more than 1,800 members of Generation Z globally and released a study titled “Ready or Not, Here Comes Z.” The results were fascinating.

We discovered key characteristics about Generation Z and what the arrival of my generation will mean for the future of work. At 57 million strong and representing the most diverse generation in U.S. history, we are just starting to graduate from college and will account for 36 percent of the workforce by 2020.

Needless to say, Generation Z matters. And it is more important than ever for HR professionals to become familiar with the following 10 characteristics so that they know how to engage with my generation.

1. Gen Z Always Knows the Score

Members of this generation will put everything on the line to win. We grew up with sports woven into the fabric of our lives and culture. To us, the NFL truly does own a day of the week. But it’s more than just professional, college or even high school teams that have shaped us; it’s the youth sports that we played or watched throughout our childhoods. This is the generation of elite young teams and the stereotypical baseball mom or dad yelling at the umpire from the bleachers.

Our competitive nature applies to almost everything, from robotics to debates that test mental fortitude. We carry the mindset that we are not necessarily at school just to learn but to get good grades that will secure our place in the best colleges. Generation Z has been thrown into perhaps the most competitive educational environment in history. Right or wrong, we sometimes view someone else’s success as our own failure or their failure as our success.

We are also accustomed to getting immediate feedback. A great example is the online grading portals where we can get frequent updates on our academic performance. In the past, students sometimes had to wait weeks or longer to receive a test grade. Now, we get frustrated if we can’t access our scores within hours of finishing an exam—and sometimes our parents do, too.

2. Gen Z Adopted Gen X’s Skepticism and Individuality

Generations are shaped by the behavioral characteristics of their parents, which is why clumping Millennials and Generation Z together is a mistake. In fact, when it comes to each generation’s behavioral traits, Millennials are most similar to their parents—the Baby Boomers. Both are large, idealistic cohorts with influences that will shape consumer and workplace behavior for decades.

Members of Generation Z, on the other hand, are more akin to their parents from Generation X—a smaller group with a skeptical, individualistic focus—than they are to Millennials. That’s why many generational traits are cyclical. Just because Millennials and members of Generation Z are closer in age does not necessarily mean they share the same belief systems.

3. Gen Z Is Financially Focused

Over the past 15 to 20 years, HR professionals have been hyper-focused on employee engagement and figuring out what makes their workers tick. What drives someone to want to get up in the morning and come to work for your organization?

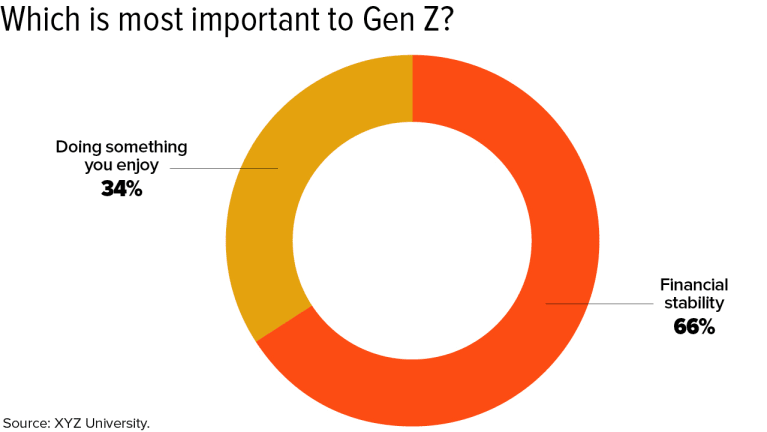

As it turns out, workplace engagement matters less to Generation Z than it did to previous generations. What’s most important to us is compensation and benefits. We are realists and pragmatists who view work primarily as a way to make a living rather than as the main source of meaning and purpose in our lives.

Obviously, we’d prefer to operate in an enjoyable environment, but financial stability takes precedence. XYZ University discovered that 2 in 3 Generation Zers would rather have a job that offers financial stability than one that they enjoy. That’s the opposite of Millennials, who generally prioritize finding a job that is more fulfilling over one that simply pays the bills.

That financial focus likely stems in part from witnessing the struggles our parents faced. According to a study by the Pew Charitable Trust, “Retirement Security Across Generations: Are Americans Prepared for Their Golden Years?,” members of Generation X lost 45 percent of their wealth during the Great Recession of 2008.

“Gen X is the first generation that’s unlikely to exceed the wealth of the group that came before it,” says Erin Currier, former project manager of Pew’s Economic Mobility Project in Washington, D.C. “They have lower financial net worth than previous groups had at this same age, and they lost nearly half of their wealth in the recession.”

Before Generation Z was decreed the ‘official’ name for my generation, there were a few other candidates, including the ‘Selfie Generation’ and ‘iGen.’

Employers will also need to recognize that members of Generation Z crave structure, goals, challenges and a way to measure their progress. After all, the perceived road to success has been mapped out for us our entire lives.

At the same time, it’s important to be aware of the potential for burnout among young overachievers—and to incorporate fun and breaks into the work environment and provide access to healthy escapes focused on relaxation and stress relief.

4. Gen Z Is Entrepreneurial

Even though they witnessed their parents grapple with financial challenges and felt the impact of the worst economic meltdown since the Great Depression, members of Generation Z believe there is a lot of money to be made in today’s economy. Shows like “Shark Tank” have inspired us to look favorably on entrepreneurship, and we’ve also seen how technology can be leveraged to create exciting—and lucrative—business opportunities with relatively low overhead. Fifty-eight percent of the members of my generation want to own a business one day and 14 percent of us already do, according to XYZ University.

Organizations that emphasize Generation Z’s desire for entrepreneurship and allow us space to contribute ideas will see higher engagement because we’ll feel a sense of personal ownership. We are motivated to win and determined to make it happen.

5. Gen Z Is Connected

Before Generation Z was decreed the “official” name for my generation, there were a few other candidates, including the “Selfie Generation” and “iGen.”

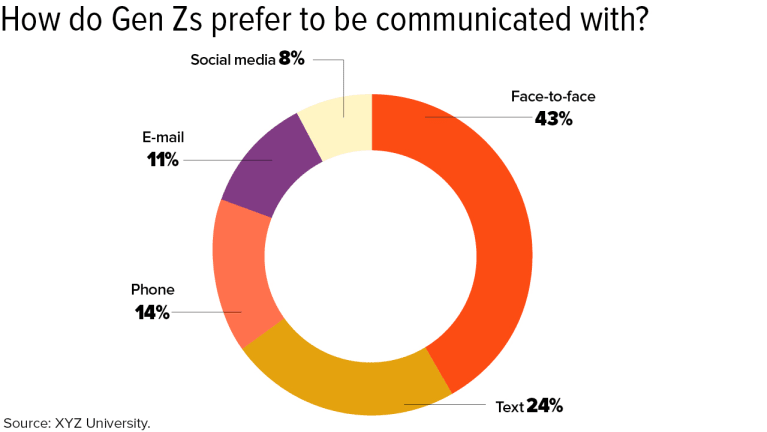

I find those proposed names both condescending and misleading. While it’s often assumed that Generation Z is focused solely on technology, talking face to face is our preferred method of communication. Sure, social media is important and has undoubtedly affected who we are as a generation, but when we’re communicating about something that matters to us, we seek authenticity and honesty, which are best achieved in person.

“Gen Z has the power of technology in their hands, which allows them to communicate faster, more often and with many colleagues at one time; but it also brings a danger when it’s used as a crutch for messages that are better delivered face to face,” says Jill Katz, CHRO at New York City-based Assemble HR. “As humans in the workplace, they will continue to seek empathy, interest and care, which are always best received face to face.”

XYZ University’s research found that cellphones and other electronic devices are primarily used for the purpose of entertainment and are tapped for communication only when the face-to-face option isn’t available.

However, successfully engaging with Generation Z requires striking a balance between conversing directly and engaging online. Both are important, and we need to feel connected in both ways to be fully satisfied.

6. Gen Z Craves Human Interaction

Given that members of Generation Z gravitate toward in-person interactions, HR leaders should re-evaluate how to best put the “human” aspect back into business. For example, hiring processes should emphasize in-person interviews more than online applications.

A great way to engage us is to hold weekly team meetings that gather everyone together to recap their achievements. Although members of Generation Z don’t necessarily need a pat on the back, it’s human nature to want to feel appreciated. This small gesture will give us something to look forward to and keep us feeling optimistic about our work. In addition, we tend to work best up against a deadline—for example, needing to have a project done by the team meeting—due to our experience facing time-sensitive projects at school.

7. Gen Z Prefers to Work Independently

Millennials generally prefer collaborative work environments, which has posed a challenge to conventional workplace cultures and structures. In fact, many workplaces have eliminated offices and lowered cubicle walls to promote more interaction. Yet recent studies indicate that totally open offices may actually discourage people from working together. The noise and lack of privacy could prompt more people to work at home or tune others out with headphones. Since different types of work require varying levels of collaboration, focus and quiet reflection, ideal workplaces incorporate room for both togetherness and alone time.

It’s important to be aware of the potential for burnout among young overachievers—and to incorporate fun and breaks into the work environment and provide access to healthy escapes focused on relaxation and stress relief.

The emphasis on privacy will likely only intensify under Generation Z. Unlike Millennials, we have been raised to have individualistic and competitive natures. For that reason—along with growing research into optimal office design—we may see the trend shift away from collaborative workplaces toward more individualistic and competitive environments.

8. Gen Z Is So Diverse That We Don’t Even Recognize Diversity

Generation Z marks the last generation in U.S. history where a majority of the population is white. Given the shifting demographics of the country, we don’t focus as much on someone’s color, religion or sexual orientation as some of our older counterparts might. To us, a diverse population is simply the norm. What we care about most in other people is honesty, sincerity and—perhaps most important—competence.

Indeed, we have been shaped by a society that celebrates diversity and openness. A black man occupied the White House for most of our lives, and we view gay marriage as a common and accepted aspect of society.

9. Gen Z Embraces Change

Compared to teenagers of other generations, Generation Z ranks as the most informed. We worry about our future and are much less concerned about typical teen problems, such as dating or cliques, than we are about becoming successful in the world.

The chaos and unrest in our political system have inspired us to want to get involved and make a difference. Regardless of which side of the aisle we are on, most of us are informed and passionate about the issues facing our society today. Witness, for example, the students of Marjory Stoneman Douglas High School in Parkland, Fla., who organized a political movement around gun control in the wake of a mass shooting at their school.

Social media allows us to have a voice in our political system even before we can vote. This opportunity has forced us to develop critical-thinking and reasoning skills as we engage in sophisticated debates about important issues that might not even affect us yet.

“Gen Z has a strong ability to adapt to change,” says Paul Carney, an author and speaker on HR trends and a former HR manager with the Navy Federal Credit Union. “For those of us who have spanned many decades in the workplace, we have seen the rate of change increase and it makes most of us uncomfortable. Gen Z are the people who will help all of us adapt better.”

According to numerous polls, the political views of Generation Z trend fiscally conservative (stemming from our need for financial stability) and socially liberal (fueled by diverse demographics and society).

10. Gen Z Wants a Voice

Given how socially aware and concerned its members are, Generation Z seeks jobs that provide opportunities to contribute, create, lead and learn.

“One of the best ways I have seen leaders engage with Gen Z is to ask them how they would build a product or service or design a process,” Carney says. “Gen Z has some amazing abilities to bring together information, process it and take action. When we do allow them to share ideas, great things happen.”

We’re also an exceptionally creative bunch. Managers will need to give members of this generation the time and freedom to come up with innovative ideas and accept that, despite our young age, we have valuable insights and skills to offer—just like the generations that came before us and those that will follow.

How to build a multigenerational benefits strategy

Employers and HR teams are now managing workforces that stretch across three to five different generations. Continue reading this blog post to learn more about why having a multigenerational benefits strategy is important.

Employers and HR teams are managing employees for a workforce that stretches across three to five generations. This workforce is complex, and its workers have varying needs from generation to generation. That’s why a multigenerational benefits strategy is in order.

Baby boomers preparing for retirement may have an ongoing relationship with doctors and a number of medical appointments in a given year. On the other hand, millennials and members of Generation Z— the latest generation to enter the workforce — may shy away from primary care doctors and focus more on options to pay off student loans and start saving for retirement.

Given these dynamics, it’s important that two separate departments, finance and HR, need to develop a benefits strategy that keeps costs as low as possible while being useful to employees. Finance leaders understand they need to retain employees — turnover is expensive — but they’re still interested in cost containment strategies.

Employers should approach their multigenerational benefits strategy on finding a balance between cost containment and employee engagement.

Cost containment

For the first time in six years, the number of employers offering only high-deductible health plans is set to drop 9%. But the idea of employee consumerism is here to stay as employers see modest rises in health insurance premiums.

To effectively contain costs, employers should first weigh the pros and cons of their funding model. While most companies start out with fully-insured models, employers should seriously evaluate a move toward self-funding. Sure, self-funding requires a larger appetite for risk, but it provides insight into claims and utilization data that you can leverage to make informed decisions about cost containment.

One way to move toward a self-funded model is with level-funding, which allows employers the benefit of claims data while paying a consistent premium each month. In a level-funded plan, employers work with a third-party administrator to determine their expected claims for the year. This number, plus administrative fees and stop-loss coverage, divided by 12, becomes the monthly premium.

A tiered contribution model might also help to contain costs without negatively affecting employees. In a typical benefit plan, employers cover a specific percentage and employees contribute the rest — say 90% and 10%, respectively. In a tiered contribution plan, employees with salaries under a certain dollar amount pay less than those high earners. That means your employee making $48,000 pays $50, while your employee making $112,000 pays more. It’s a way to distribute the contribution across the workforce that enables everyone to more easily shoulder the burden of rising healthcare costs.

Employee engagement

To create a roadmap that not only helps you gain control of your multigenerational benefits strategy but keeps employees of all ages happy, it’s necessary to consider employee engagement. While new options like student loan repayment could be useful to part of your workforce, it’s best to start much simpler with something that affects everyone: time away from work.

A more aggressive paid time off policy, telecommuting policies and paid family leave are becoming increasingly popular. Many companies are offering PTO just for employees to pursue charitable work — a benefit that resonates with younger workers and can improve company culture. And a generous telecommuting policy recognizes that employees have different needs and shows that employers understand their modern, diverse workforce. Beyond basic time away from work, an extended leave policy outside what the law guarantees is another tool that can keep employees engaged.

Making it easier for employees to get care is another trending benefit, which can keep employees happy and contribute to cost containment. Concierge telemedicine has been called the modern version of a doctor’s house call. This relatively inexpensive benefit provides your employees access to care 24/7 by phone or video chat, which is convenient regardless of the user’s generation.

Employees and other covered individuals can connect to a doctor to discuss symptoms and get advice, whether they are prescribed a medication or they need to seek further care. This is another benefit that’s useful for young workers who may not have a primary care doctor or older workers with families.

Finally, your tech-savvy workforce expects to access their plan information wherever they need it. Ensure your carrier offers a mobile app to house insurance cards, coverage and provider information.

When it comes to a multigenerational benefits strategy, creating harmony between finance and HR might seem like a daunting task. But considering some relatively small benefit changes could be what allows you to offer a benefits package that pleases both departments — and all of your employees.

This article originally appeared in Employee Benefit News.

SOURCE: Blemlek, G. (26 February 2019) "How to build a multigenerational benefits strategy" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/opinion/how-to-build-a-multigenerational-benefits-strategy?brief=00000152-146e-d1cc-a5fa-7cff8fee0000

Younger generations driving lifestyle benefits

Millennials will make up seventy-five percent of the U.S. workforce by 2025, according to a study by Forbes. The self-confidence of younger generations is pushing companies to adopt more non-traditional benefits. Continue reading to learn more.

Younger generations are often characterized as entitled and demanding — but that self-confidence in their work is pushing companies to adopt benefits outside the traditional healthcare and retirement packages.

By 2025, millennials will make up 75% of the U.S. workforce, according to a study by Forbes. The first wave of Generation Z — millennials’ younger siblings — graduated college and entered the workforce last year. With these younger generations flooding the workplace, benefit advisers need to steer clients toward innovative benefits to attract and retain talent, according to panelists during a lifestyle benefits discussion at Workplace Benefits Renaissance, a broker convention hosted by Employee Benefit Adviser.

“Millennials came into the workforce with a level of entitlement — which is actually a good thing,” said Lindsay Ryan Bailey, founder and CEO of Fitpros, during the panel discussion. “They’re bringing their outside life into the workplace because they value being a well-rounded person.”

Catering benefits to younger generations doesn’t necessarily exclude the older ones, the panelists said, in a discussion led by Employee Benefit Adviser Associate Editor Caroline Hroncich. Older generations are accustomed to receiving traditional benefits, but that doesn’t mean they won’t appreciate new ones introduced by younger generations.

“Baby boomers put their heads down and get stuff done without asking for more — that’s just how they’ve always done things,” Bailey said. “But they see what millennials are getting and are demanding the same.”

In a job market where there are more vacant positions than available talent to fill them, the panelists said it’s important now, more than ever, to advise clients to pursue lifestyle benefits. While a comprehensive medical and retirement package is attractive, benefits that help employees live a more balanced life will attract and retain the best employees, the panelists said.

“Once you’ve taken care of their basic needs, have clients look at [lifestyle benefits],” said Dave Freedman, general manager of group plans at LegalZoom. “These benefits demonstrate to workers that the employer has their back.”

The most attractive lifestyle benefits are wellness centered, the panelists said. Wellness benefits include everything from gym memberships, maternity and paternity leave, flexible hours and experiences like acupuncture and facials. But no matter which program employers decide to offer, if it’s not easily accessible, employees won’t use it, the panel said.

“Traditional gym memberships can be a nightmare with all the paperwork,” said Paul O’Reilly-Hyland, CEO and founder of Zeamo, a digital company connecting users with gym memberships. “[Younger employees] want easy access and choices — they don’t want to be locked into contracts.

Freedman said brokers should suggest clients offer benefits catered to people based on life stages. He says there are four distinct stages: Starting out, planting roots, career growth and retirement. Providing benefits that help entry-level employees pay down student debt, buy their first car or rent their first apartment will give companies access to the best new talent.

To retain older employees, Freedman suggests offering programs to help employees buy their first house, in addition to offering time off to bond with their child when they start having families. The career growth phase is when most divorces happen and kids start going to college, Freedman said. Offering legal and financial planning services can help reduce employee burdens in these situations. And, of course, offering a comprehensive retirement plan is a great incentive for employees to stay with a company, Freedman said.

Clients may balk at the additional costs of implementing lifestyle benefits, but they help safeguard against low employee morale and job turnover. Replacing existing employees can cost companies significant amounts of money, the panelists said.

“Offering these benefits is a soft dollar investment,” Freedman said. “Studies show it helps companies save money, but employers have to be in the mindset that this is the right thing to do.”

SOURCE: Webster, K. (25 February 2019) "Younger generations driving lifestyle benefits" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/news/younger-generations-driving-lifestyle-benefits?brief=00000152-1443-d1cc-a5fa-7cfba3c60000

No primary care doc, no problem: How millennials are changing healthcare

Do you have a primary care physician? Forty-five percent of 18- to 29-year-olds reported that they do not have a primary care physician. Read this blog post from Employee Benefit News to learn more.

Millennials, and Generation Z behind them, are changing the way they access healthcare. In fact, 45% of 18- to 29-year-olds say they don’t have a primary care physician. Instead, they’re opting for on-demand healthcare.

Traditionally, individuals and families see primary care physicians several times a year and build relationships with their doctors over time. Visiting the same primary care physician when an illness strikes, or for an annual wellness checkup, can help the doctor notice changes in a patient’s health and catch issues before they become more serious (and costly).

But for millennials, having a primary care physician isn’t necessarily a priority.

That’s in part because they seem to prefer on-demand healthcare options, such as urgent care, drug store clinics and telemedicine services, which are easily accessible and typically include shorter wait times. The number of urgent care centers reflects the trend — they’re projected to grow by 5.8% in 2018, according to the Urgent Care Association.

Then there is employers’ shift away from health maintenance organizations, which often required that each employee choose a primary care doctor at the start of the plan. HMOs also require a referral from the primary care physician to see specialists. Recent research shows that most often, employers offer preferred provider organizations (84%), while 40% offer consumer-directed health plans and 35% offer HMOs.

Finally, physician shortages are leading to longer wait times for appointments. The U.S. population continues to grow and age, which may lead to a shortage of 120,000 primary and specialty doctors by 2030, according to the Association of American Medical Colleges.

For employers, it’s important to understand the reasons behind the shift to on-demand healthcare and educate employees to ensure they can get appropriate medical attention when they need it.

One crucial part of this education is helping employees understand when they should visit urgent care versus the emergency room, and reminding them that telemedicine is available. More than 95% of large employers and just over one-third of small- and mid-size employers offer telemedicine benefits. But adoption rates among employees remain low — only 20% of large employers report utilization rates above 8%, according to the National Business Group on Health.

Ensure your employees know that the service is available throughout the year and help them understand the cost if any is associated with the service. You may consider offering $0 copays for telemedicine visits to encourage employee use.

Encourage employees to get a wellness visit each year to help uncover health issues and take steps to prevent others. One way to do this without forcing employees to wait for an appointment or commit to a doctor is to bring the service in-house. Increasingly, large employers are adding this service to help employees stay healthy. In fact, one-third of employers with more than 5,000 employees and 16% of employers with 500-4,999 employees now have onsite clinics. Another 8% of midsize employers plan to add clinics in 2019.

Providing health assessments as part of a health and wellness program is another way to get employees, especially money conscious millennials, in front of a doctor. Younger workers are likely to embrace incentives or premium discounts that are tied to a physician visit.

Direct primary care is yet another employer option to provide easy-to-access primary care. With direct primary care, employers partner with primary care physicians to offer a designated doctor for their employees. The benefit for employees is more face time with a doctor and the opportunity to get personalized care.

Importantly, employees who have known chronic issues should see a primary care doctor regularly to help monitor and manage their condition.

The trend toward seeking on-demand healthcare at alternative sites isn’t likely to reverse direction any time soon. Instead, it’s up to employers to understand why it’s happening and educate employees of all ages on their options for care.

SOURCE: Milne, J. (7 January 2019) "No primary care doc, no problem: How millennials are changing healthcare" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/no-primary-care-doc-no-problem-how-millennials-are-changing-healthcare?brief=00000152-14a5-d1cc-a5fa-7cff48fe0001

3 trends and 4 survival tips for managing millennials in 2019

Millennials: America's most diverse and overly stereotyped generation. Whether you like or dislike millennials, it's hard to avoid the fact that they are going to be the prime engine of the workplace for years to come. Continue reading to learn more.

anyone knows more about millennials than an actual millennial, it’s Brian Weed, CEO of Avenica. Founded in 1998, Avenica’s personnel services are focused exclusively on recent college graduates and the companies who are looking for such talent.

“Our goal is to place recent college graduates on the right career-track, finding entry-level positions for them at companies offering strong professional growth,” Weed says.

Millennials have been given “kind of a bad rap” by being overly stereotyped and studied. “Millennials are America’s most diverse generation. They hold more college degrees than any other generation, and they’ve experienced economic and political turmoil. They’re savvy, educated, skeptical, and on top of it all, they’re idealists. All of this has led to vast changes in the ways today’s workforce views business, engages with their organizations and leaders and makes decisions about their careers,” he says. And yet, just as with any generation, one must be cautious about assuming one profile fits all.

However one feels about this generation, there’s the fact that millennials are going to be the prime engine of the workplace for years to come. “The truth is that companies have to adapt to them, not the other way around,” he says.

Given the company’s focus and its tenure of service, BenefitsPRO asked Weed to identify three top millennial worker trends for 2019. Here’s his list:

1. Shifting motivations

Salary and culture continue to rank high on the list for attracting millennial and Gen Z candidates, but the following factors are increasingly important:

Flexibility: They expect more control over where and when they can work, with the ability (enough PTO and work-life balance) to travel and have other life experiences.

Mission driven: They are more in touch with the environment, society, and the future of both. They feel they are not only representative of their organization, but their organization also represent who they are as individuals and want to be a part of organizations that share similar views. They look for leaders who will make decisions that will better the world, not just their organizations, and solve the problems of the world through their work.

Development and training opportunities: Because millennials have seen such dramatic shifts in the economy, they seek to have more control over the future of their careers. Not only to “recession proof” but also to “future proof” their careers by constantly learning and developing.

2. Declining levels of loyalty and increased job hopping

These phenomena, well-known to employers or millennials, are largely due to:

Shifting motivations (outlined above): The key to managing this group is understanding the shifting motivations and finding ways to meet those needs/wants will help organizations attract and retain top talent.

Higher value placed on experiences, constantly wanting to try and learn new things: Managers need to give these employees opportunities to grow and develop in their roles is essential, but also opportunities to explore different fields and disciplines is also key. Keeping the work and the environment interesting and diverse will keep millennial employees engaged for longer.

Less patience, with a desire for frequent indicators of career progress (higher pay and/or promotions): Job hopping often allows the quickest opportunity to make more money and climb the career ladder. As a result, organizations are building in a quicker cadence for promotions and pay raises.

3. An increasing lack of basic professional skills/awareness

Many of these talented young people lack essential knowledge about what to wear, how to act and how to/engage in an office setting. Here’s how to respond:

Managers need to be ready to guide these new workforce entries into the professional skills areas. They often don’t have a network of older (parents/relatives) professionals around them to set an example and advise on what “professionalism” looks like and means. And colleges often don’t provide education in professionalism in an office setting: aside from business schools, many colleges don’t prepare students—especially those in the liberal arts—on meeting etiquette, business apps and technology, and other everyday professional practices.

Corporate onboarding of new entry-level employees often excludes the “basics” (meeting protocols, MS Office skills, etc.). While companies typically have some type of job-specific training programs, they often assume these basic office skills are there and aren’t able to see a candidate’s potential when lack of professional skills/awareness is present. This can create a barrier for highly qualified but more “green” candidates, especially first-generation graduates. Effective companies will develop training, coaching, and mentorship programs can help once on the job.

Weed’s 4 survival tips to managers of millennials

1. Create clear and fast-moving career tracks.

- Create distinct career tracks with clear direction on how to advance to each level.

- Restructure promotion and incentive programs that give smaller, more incremental promotions and salary raises, giving more consistent positive reinforcement and closer goals that make it more enticing to stay.

- Create professional development opportunities that help them advance in those career tracks and build other skills they need and want.

- Create ways young employees can explore other career tracks without leaving the company. Millennials and Gen Z’s have a higher propensity for changing their minds and/or wanting different experiences, so consider ways that enable employees to make lateral moves, or create rotational programs that allow inexperienced professionals to get experience in a variety of business capacities and are then more prepared to choose a track.

2. Alongside competitive compensation packages that include 401k matching programs and comprehensive insurance offerings, provide benefits that allow them to have a sense of flexibility when it comes to how they work.

- Working remotely, flex schedules/hours

- Floating holidays–especially beneficial as the workforce becomes more and more diverse

- Restructure PTO that gives employees more autonomy and responsibility for their work

- Tuition reimbursement programs to increase retention and build leaders internally

3. Create a strong company culture: company culture is one of the strongest recruiting and retention tools. Go beyond the flashy tactics of having an on-site game room and fun company outings and bring more focus to the company’s mission. Create and live/work by a set of core values that represents your company’s mission. People will be more engaged and move beyond just being their role or position when they feel connected to the mission.

4. Challenge without overworking. Boredom and stress are equally common as factors for driving millennials out of a workplace. Allow involvement in bigger, higher-level projects and discussions to provide meaningful learning opportunities, and create goals that stretch their capabilities but are attainable.

SOURCE: Cook, D. "3 trends and 4 survival tips for managing millennials in 2019" (Web Blog Post). Retrieved from https://www.benefitspro.com/2018/11/13/3-trends-and-4-survival-tips-for-managing-millenni/

Culture is key to attracting younger talent, but you can make it mutually beneficial

According to an article in Harvard Business Review, six in ten millennials are ready to change jobs at any moment, creating a great opportunity for recruitment. Read this blog post to learn how organizations can attract younger talent.

Millennials with jobs are more likely to be looking for a new job than any other generation in the workplace, according to a Harvard Business Review article by Brandon Rigoni and Amy Adkins. They report that six in ten millennials are ready to jump ship at any given time.

This is a challenge for keeping workers, but it’s also a golden opportunity for recruitment. For the most part, these are bright workers who are deconstructing the great American job search.

Firms can seize this opportunity by honing their HR brand to appeal to younger generations and balancing this with assessments that assure a good match with most new hires.

Compensation is still important, but millennials are looking for jobs that are in sync with their values and can help define who they are. Getting hired has become a matter of personal identity.

As an employer, you are being evaluated more than the candidates. How will your firm make the cut? And if you do, will you hire the right people?

Major corporations have overhauled their approach in the scramble for talent.

- General Mills began using virtual reality headsets to allow candidates to see themselves working inside General Mills, including using the company’s gym.

- Two Volvo engineers recently built a Baja racer for collegiate competitions to attract young engineers to the legacy truck builder.

- General Electric’s humorous “What’s the Matter with Owen” television campaign said bupkis about GE products. Instead, Owen touted the company’s geek chic HR brand as a bespectacled new employee being effusive about his job of programming life-changing technology to help people.

- McDonald’s eschews traditional media to engage 16 to 24-year-old candidates via Snapchat, offering “Snaplications” and video clips of young McDonald’s employees talking about their jobs.

Not everyone can serve up cold brew coffee in a corporate cafeteria. Still, there are practical steps most firms can take to enhance their HR brand for millennial and Gen Z values.

Does your organization operate with a high degree of transparency? Is it socially responsible? Do employees have paid leave for volunteer work? Are young team members valued and encouraged to contribute to relevant and visible projects and products?

Are there ways to present your products and services to be more relevant and important to society? For example, a textile manufacturer might not actually make exciting products anyone can buy, but its fabrics are used in the space program or to save lives in emergency rooms. Maybe a law firm has a pro bono clinic for low-income families.

Yes. HR needs to make your employer brand attractive to these talented but fickle job seekers, but this doesn’t mean that everyone who’s attracted to your organizational hipness is going to be cool for your company.

There are two tools to make sure both parties get what they want. The first is assessments.

Talent acquisition assessments greatly improve your odds of hiring an individual who is well matched to your company’s needs. The best are scientifically valid and EEOC compliant, focusing on the candidate’s motivation and likely work traits as compared to the job description. You’ll save a lot of money in not having to re-hire for a position.

The second tool is the “Shared Success Model,” which is a process hiring managers can establish that aligns individual development plans with organizational strategies to identify where overlap exists and where there may be gaps.

It has five components:

- Individual needs—What is important to the candidate, both professionally and personally? What aligns with their values and interests?

- Individual offer—What value does the organization bring to the candidate?

- Company needs—What does your organization require for success now and in the future? What do you need from your leaders and employees?

- Company offer—What is your corporate value proposition to the candidate? What opportunities do you provide? What culture do you provide?

- Plan—Analyze the gaps and overlap between each quadrant. Develop and implement a plan that balances your grid for shared success.

As younger candidates seek more of a cultural match, the Shared Success Model is a good way to make sure the culture you promise is a culture that supports your mission and business model.

SOURCE: Warrick, D. (8 October 2018) "Culture is key to attracting younger talent, but you can make it mutually beneficial" (Web Blog Post). Retrieved from https://www.benefitspro.com/2018/10/08/culture-is-key-to-attracting-younger-talent-but-yo/

5 reasons to offer a student loan repayment benefit in 2019

Are you looking for ways to help add more value to your talent through your 2019 benefits packages? Continue reading to learn why you should offer student loan repayment as one of your employee benefits.

With human resources managers across the country working to finalize their 2019 benefits packages this month, many are asking themselves: How can we add more value for our talent and help the company grow? For many employers, the answer is helping employees manage their student loan debt.

Over the years, student loan debt has reached an astronomical sum. As of 2008, college tuition fees rose by 439% from 1982. And by the first quarter of 2018, 44 million Americans owed a total of $1.5 trillion in student loan debt, exceeding both credit card debt and auto loan debt, according to the Federal Reserve. Not only is this an extreme amount of debt, but has also taken an enormous emotional toll, with more than half of college-educated adults (54%) surveyed by Laurel Road in 2018 feeling that they will never make enough money to reach their financial goals.

Fast forward to today, and borrowers are seeking creative ways to tackle their debt and save more. Recently, in a private ruling, the IRS granted Abbott Laboratories, a national healthcare company, the option to contribute to employee 401(k) plans based on the employee’s student loan payments. Other companies — from corporate behemoths to busy startups — have partnered with student loan refinancing companies to offer employees refinancing options that can help them save, often at no cost to the company.

With Americans quitting their jobs at the fastest rate since 2001, keeping employees happy is imperative. And part of keeping millennials happy is to provide practical benefits, not just the fun perks. Employees are looking to foster meaningful relationships with their employers — so looping in student loan repayment benefits can pay off for both the employer and the employee.

So what’s to gain? Here are some of the top reasons employers should consider incorporating student loan repayment benefits into their 2019 benefits package.

1. Recruit, retain and stand out

2. It’s flexible and free

3. Eliminate the student loan vs. retirement conflict

4. Help employees save

One of the reasons why the student loan benefit is attractive for employees is the significant savings it can lead to. If refinancing is an option, employees have the potential to save thousands of dollars over the life of their loan through a lower loan interest rate and lower monthly payments.

In the long run, the cumulative savings can add up to several thousand dollars or more. Employers should keep in mind that the savings amount will change depending on the financing company you choose to work with. Many can offer employer customers exclusive rates, which leads to even greater savings.

5. Boost morale and productivity

According to another benefits company, 31% of employees surveyed say their money concerns affect their work. Meanwhile, 74% of people feel stress daily about their student loan debt and spend time at work thinking about it, impacting their overall productivity in the workplace. So in addition to the hard savings employees are earning through these programs, they are also rewarded with the soft benefits of reduced stress and anxiety at work.

With student loan debt reaching record highs in recent years, employers have recognized that there’s a crucial need to provide employees with options to help them pay down their student loan debt. And when options like refinancing come at no cost to them, this benefit will likely become more popular. In the future, we can expect more employers to pave the way for student loan repayment programs. Will you be one of the trailblazers?

Unleash voluntary benefits to attract millennials

Does your company know how to recruit the younger generations? Employers can use voluntary benefits to help attract millennials. Continue reading to learn more.

A war for talent is being waged. Boomers are retiring and seeking new challenges and now is the time to woo the millennials. Just how do you attract the right millennials for your company? Like most organizations, you probably offer a total rewards package that includes competitive compensation and core benefits, like medical, dental, life, disability and a 401(k) plan.

See also: One sure-fire way to engage employees in voluntary benefits

What about those ancillary benefits you hear about in the marketplace? While a ping pong table in the break room may entice some, many millennials seek help for specific needs from their potential employer. Voluntary benefit products can be the missing puzzle piece in your total benefits package and can help younger candidates feel confident that your benefit plan is tailored to them.

Millennials want real choice, access and ease of use. In this Amazon Prime world we live in, it’s important that enrolling in benefits and paying for them are as easy as possible. Exceptional communications, smart enrollment options and ease of payment are key to success.

Here are some voluntary benefit options to consider:

Accident & hospital indemnity insurance programs

While critical illness insurance may not appeal to a millennial, certain worksite benefits are beneficial. These benefits help employees pay for unexpected out-of-pocket medical costs, as well as cover the financial gaps of traditional coverage like deductibles and coinsurance. Worksite benefits pay cash to the individual, allowing the participant the flexibility to use the funds however she or he sees fit — for rent, car payments, living expenses or out-of-pocket medical expenses. Accident Insurance generally pays a cash reimbursement based on an injury benefit schedule. So, if the employee has a bicycle or paddleboard accident and breaks a leg, cash payments will be made for the type of injury and treatment. A similar type of benefit is Hospital Indemnity Insurance that pays a lump sum for an initial hospital admission and then a per diem benefit. The best part is the cost of these benefits is relatively inexpensive — like paying for a few cappuccinos a month.

See also: 3 Ways to Reshape How You Communicate About Benefits with Millennials

Student loan refinancing programs

Millennials are feeling the brunt of their student loans. One in four millennials owe more than $30,000 in college debt and think that it will take more than 20 years to pay them off, according to an ORC International Survey. Student loan stress is making millennials feel less financially secure than their older work colleagues. This can have an adverse effect on any type of savings plans an employer offers such as a 401(k). More employers are considering programs that can help employees manage their student loan debt. There are typically three ways to look at these programs:

- Refinancing options: There are many lenders that work specifically with student debt and will refinance and consolidate existing student loans and may offer a special incentive if this is done through their employer. Keep in mind, if an employee has a federally-backed student loan, refinancing may not be the best solution.

- Debt management resources: Many lenders that provide refinancing options have educational tools and resources to assist employees in managing their debt.

- Employer contribution: Of course, this would not necessarily be a voluntary benefit-only program, but employers are looking into helping their employees pay their loans back through employer-sponsored match programs.

Employee purchase programs

Millennials’ student loans may prevent them from making certain necessary purchases. Employee Purchase Programs offered through employers can help workers pay for items they may need immediately, like a washer and dryer replacement over a period of time. Like other voluntary benefits, this one comes with the added convenience of payroll deduction and repayment, helping millennials feel more empowered to make these more expensive purchases and build their credit.

Auto & Homeowners Insurance and legal insurance

Group auto and homeowners’ insurance offered through an employer can provide discounts based on tenure and payroll deductions that are not available in the individual market. Group legal insurance may be attractive to millennials who need to create a will for the first time or buy a new house. Most services are covered and family members are also sometimes eligible to be part of the plan.

See also: 15 employee benefits on the rise

In a time when cost-saving initiatives may be pinching employer-sponsored health plans, voluntary benefits may help cover gaps left by high deductible plans and provide value to employees without adding cost to the bottom line. With diverse offers, easy enrollment, low premiums and payroll deductions, voluntary benefits are worth considering and should be an integral part of your attraction and retention program for millennials.

SOURCE: Marcia, P. (17 September 2018) "Unleash voluntary benefits to attract millennials" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/opinion/unleash-voluntary-benefits-to-attract-millennials