Making the Case for Pay Transparency

Is your organization increasing pay transparency? According to this article from SHRM, pay transparency is a strategic move that delivers measurable business benefits. Read this blog post to learn more.

Recommending to senior leadership that your organization increase pay transparency can be a difficult sell for HR professionals. However, pay transparency is a strategic move that delivers measurable business benefits – and it’s an issue on which HR should lead.

It is important to understand that most executives in America today rose through organizational ranks that viewed compensation as a private matter. Few within organizations had access to salary information, and even fewer talked about it. As a result, many leaders still believe it is appropriate to dissuade or prohibit employees from discussing their own compensation with other employees.

Yet we now understand these outdated cultural norms have contributed to the wage gap for women and minorities, among other negative outcomes. Pay transparency can help close those gaps and produce benefits for both employers and employees.

For example, providing employees with pay ranges for their current position and those positions in their career path sets realistic expectations. This is crucial, as many employees hold unrealistic expectations based on internet salary searches for job titles that often do not account for or accurately reflect important factors such as experience level, geography, company size, actual tasks and responsibilities, or other types of compensation. These unrealistic salary expectations create serious challenges, including employee disengagement, low morale and retention problems.

Clearly communicating your company’s pay ranges facilitates an open dialogue about how those ranges are set, when and why they change, and how employees can move up within them. These discussions in turn increase mutual trust and engagement and foster productive compensation communication — all of which help retain employees, which is especially important in today’s tight labor market.

Increasing pay transparency also helps businesses attract and retain a more diverse workforce, which numerous studies have demonstrated translates into better business results. Sharing compensation data advances this effort by ensuring women and minorities have a clearer picture of the going rate for their skill sets, education, experience and performance. While many factors contribute to pay gaps, women and minority groups may have accepted lower compensation in the past because they could not access the information necessary to determine what they should be making based on what they bring to the table.

While recommending greater pay transparency to senior leadership in your organization may seem daunting, it is an important discussion to have and a compelling case for HR professionals to make. In a highly competitive labor market, businesses that make the right strategic move of increasing pay transparency will ultimately attract and retain the best talent and come out ahead of those that do not.

SOURCE: Ponder, L. (4 April 2019) "Making the Case for Pay Transparency" (Web Blog Post). Retrieved from https://blog.shrm.org/blog/making-the-case-for-pay-transparency-0

DOL Focuses on ‘Joint Employer’ Definition

On April 1, the U.S. Department of Labor (DOL) announced a proposed rule that narrows the definition of "joint employer" under the Fair Labor Standards Act (FLSA). Read this blog post from SHRM to learn more about this proposed rule.

The U.S. Department of Labor (DOL) announced on April 1 a proposed rule that would narrow the definition of "joint employer" under the Fair Labor Standards Act (FLSA).

The proposed rule would align the FLSA's definition of joint-employer status to be consistent with the National Labor Relations Board's proposed rule and update the DOL's definition, which was adopted more than 60 years ago.

Four-Factor Test

The proposal addresses the circumstances under which businesses can be held jointly responsible for certain wage violations by contractors or franchisees—such as failing to pay minimum wage or overtime. A four-factor test would be used to analyze whether a potential joint employer exercises the power to:

- Hire or fire an employee.

- Supervise and control an employee's work schedules or employment conditions.

- Determine an employee's rate and method of pay.

- Maintain a worker's employment records.

The department's proposal offers guidance on how to apply the test and what additional factors should and shouldn't be considered to determine joint-employer status.

"This proposal would ensure employers and joint employers clearly understand their responsibilities to pay at least the federal minimum wage for all hours worked and overtime for all hours worked over 40 in a workweek," according to the DOL.

In 2017, the department withdrew an interpretation that had been issued by former President Barack Obama's administration that broadly defined "joint employer."

The Obama-era interpretation was expansive and could be taken to apply to many companies based on the nature of their business and relationships with other companies—even when those relationships are not generally understood to create a joint-employment relationship, said Mark Kisicki, an attorney with Ogletree Deakins in Phoenix.

The proposed test aligns with a more modern view of the workplace, said Marty Heller, an attorney with Fisher Phillips in Atlanta. The test is a modified version of the standard that some federal courts already apply, he noted.

Additional Clarity

Significantly, the proposed rule would remove the threat of businesses being deemed joint employers based on the mere possibility that they could exercise control over a worker's employment conditions, Heller said. A business may have the contractual right under a staffing-agency or franchise agreement to exercise control over employment conditions, but that's not the same as doing so.

The proposal focuses on the actual exercise of control, rather than potential (or reserved) but unexercised control, Kisicki explained.

The rule would also clarify that the following factors don't influence the joint-employer analysis:

- Having a franchisor business model.

- Providing a sample employee handbook to a franchisee.

- Allowing an employer to operate a facility on the company's grounds.

- Jointly participating with an employer in an apprenticeship program.

- Offering an association health or retirement plan to an employer or participating in a plan with the employer.

- Requiring a business partner to establish minimum wages and workplace-safety, sexual-harassment-prevention and other policies.

"The proposed changes are designed to reduce uncertainty over joint employer status and clarify for workers who is responsible for their employment protections, promote greater uniformity among court decisions, reduce litigation and encourage innovation in the economy," according to the DOL.

The proposal provides a lot of examples that are important in the #MeToo era, said Tammy McCutchen, an attorney with Littler in Washington, D.C., and the former head of the DOL's Wage and Hour Division under President George W. Bush.

Importantly, companies would not be deemed joint employers simply because they ask or require their business partners to maintain anti-harassment policies, provide safety training or otherwise ensure that their business partners are good corporate citizens, she said.

Review Policies and Practices

Employers and other interested parties will have 60 days to comment on the proposed rule once it is published in the Federal Register. The DOL will review the comments before drafting a final rule—which will be sent to the Office of Management and Budget for review before it is published.

"Now is the time to review the proposal and decide if you want to submit a comment," Heller said. Employers that wish to comment on the proposal may do so by visiting www.regulations.gov.

"Take a look at what's been proposed, look at the examples in the fact sheet and the FAQs," McCutchen said. Employers may want to comment on any aspects of the examples that are confusing or don't address a company's particular circumstances. "Start thinking about your current business relationships and any adjustments that ought to be made," she said, noting that the DOL might make some changes to the rule before it is finalized.

"The proposed rule will not be adopted in the immediate future and will be challenged at various steps by worker-advocacy groups, so it will be quite some time before there is a tested, final rule that employers can safely rely upon," Kisicki said.

SOURCE: Nagele-Piazza, L. (1 April 2019) "DOL Focuses on ‘Joint Employer’ Definition" (Web Blog Post). Retrieved from https://www.shrm.org/resourcesandtools/legal-and-compliance/employment-law/pages/labor-department-seeks-to-revise-joint-employer-rule.aspx

A 16-Year-Old Explains 10 Things You Need to Know About Generation Z

What was life like when you were a teenager? The world has been focused on understanding and adapting to Millennials. Now Generation Z is beginning to graduate and enter the workforce. Read this blog post for 10 things the world should know about Gen Z.

Think about what life was like when you were 16. The clothes you wore, the places you shopped. What was most important to you then?

Whenever I speak to an organization eager to learn about Generation Z, I always ask that question. I get responses that include everything from the fleeting fashion trends of the day (bell-bottom jeans, anyone?) to the time-honored tradition of getting a driver’s license.

What I hope to achieve as a 16-year-old in 2018 is probably not all that different from what anyone else wanted when they were my age. It’s the way people go about reaching their goals that evolves over time—and that’s what also forms the basis of most generational clashes.

For the past several years, the world has been focused on understanding and adapting to Millennials, the largest and most-educated generation in history. Born between 1981 and the mid-1990s, this group has inspired important dialogues about generational differences and challenged all industries to evolve to meet their needs. In the workplace, Millennials have helped drive a greater focus on flexibility and collaboration and a rethinking of traditional hierarchies.

Of course, any analysis of generations relies on generalities that can’t possibly describe every person or situation. It’s important to remember that generations exist on a continuum—and that there is a large degree of individual variation within them. The point of this type of research is to identify macro trends among age groups that can help foster workplace harmony. Essentially, it’s a way of attempting to understand people better by getting a sense of their formative life experiences. The generation to which one belongs is among the many factors, such as race, religion and socioeconomic background, that can shape how a person sees the world.

But there’s little doubt that gaps among the U.S. generations have widened dramatically. For example, an 8-year-old boy in the United States who grew up with a tablet will likely have more in common with an 8-year-old in China who used a similar mobile device than he will with his 70-year-old U.S. grandparents.

In thinking about the generations, a key thing to understand is that these groups are typically categorized by events rather than arbitrary dates. Generation Z’s birth years are generally recognized as 1996 to 2009. The start year was chosen so that the cohort would include only those who do not remember the Sept. 11 terrorist attacks. The belief is that if you were born in 1996 or later, you simply cannot process what the world was like before those attacks. For Generation Z, the War on Terror has always been the norm.

Like all other generations, mine has been shaped by the circumstances we were born into, such as terrorism, school shootings and the Great Recession. These dark events have had profound effects on the behavioral traits of the members of Generation Z, but they have also inspired us to change the world.

Earlier this year, XYZ University, a generations research and management consulting firm where I act as the director of Gen Z studies, surveyed more than 1,800 members of Generation Z globally and released a study titled “Ready or Not, Here Comes Z.” The results were fascinating.

We discovered key characteristics about Generation Z and what the arrival of my generation will mean for the future of work. At 57 million strong and representing the most diverse generation in U.S. history, we are just starting to graduate from college and will account for 36 percent of the workforce by 2020.

Needless to say, Generation Z matters. And it is more important than ever for HR professionals to become familiar with the following 10 characteristics so that they know how to engage with my generation.

1. Gen Z Always Knows the Score

Members of this generation will put everything on the line to win. We grew up with sports woven into the fabric of our lives and culture. To us, the NFL truly does own a day of the week. But it’s more than just professional, college or even high school teams that have shaped us; it’s the youth sports that we played or watched throughout our childhoods. This is the generation of elite young teams and the stereotypical baseball mom or dad yelling at the umpire from the bleachers.

Our competitive nature applies to almost everything, from robotics to debates that test mental fortitude. We carry the mindset that we are not necessarily at school just to learn but to get good grades that will secure our place in the best colleges. Generation Z has been thrown into perhaps the most competitive educational environment in history. Right or wrong, we sometimes view someone else’s success as our own failure or their failure as our success.

We are also accustomed to getting immediate feedback. A great example is the online grading portals where we can get frequent updates on our academic performance. In the past, students sometimes had to wait weeks or longer to receive a test grade. Now, we get frustrated if we can’t access our scores within hours of finishing an exam—and sometimes our parents do, too.

2. Gen Z Adopted Gen X’s Skepticism and Individuality

Generations are shaped by the behavioral characteristics of their parents, which is why clumping Millennials and Generation Z together is a mistake. In fact, when it comes to each generation’s behavioral traits, Millennials are most similar to their parents—the Baby Boomers. Both are large, idealistic cohorts with influences that will shape consumer and workplace behavior for decades.

Members of Generation Z, on the other hand, are more akin to their parents from Generation X—a smaller group with a skeptical, individualistic focus—than they are to Millennials. That’s why many generational traits are cyclical. Just because Millennials and members of Generation Z are closer in age does not necessarily mean they share the same belief systems.

3. Gen Z Is Financially Focused

Over the past 15 to 20 years, HR professionals have been hyper-focused on employee engagement and figuring out what makes their workers tick. What drives someone to want to get up in the morning and come to work for your organization?

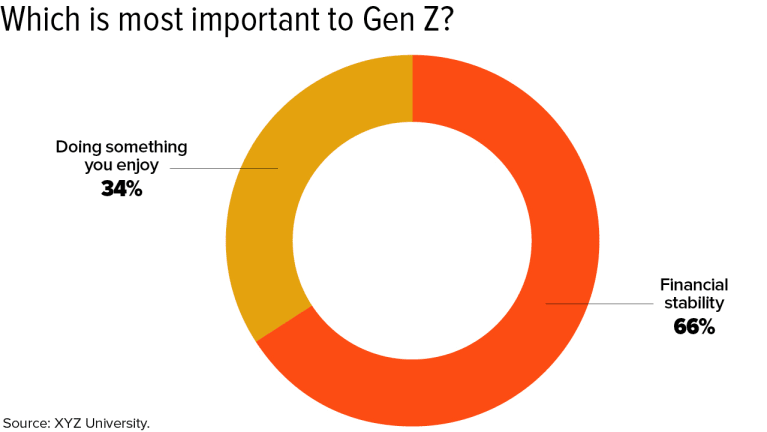

As it turns out, workplace engagement matters less to Generation Z than it did to previous generations. What’s most important to us is compensation and benefits. We are realists and pragmatists who view work primarily as a way to make a living rather than as the main source of meaning and purpose in our lives.

Obviously, we’d prefer to operate in an enjoyable environment, but financial stability takes precedence. XYZ University discovered that 2 in 3 Generation Zers would rather have a job that offers financial stability than one that they enjoy. That’s the opposite of Millennials, who generally prioritize finding a job that is more fulfilling over one that simply pays the bills.

That financial focus likely stems in part from witnessing the struggles our parents faced. According to a study by the Pew Charitable Trust, “Retirement Security Across Generations: Are Americans Prepared for Their Golden Years?,” members of Generation X lost 45 percent of their wealth during the Great Recession of 2008.

“Gen X is the first generation that’s unlikely to exceed the wealth of the group that came before it,” says Erin Currier, former project manager of Pew’s Economic Mobility Project in Washington, D.C. “They have lower financial net worth than previous groups had at this same age, and they lost nearly half of their wealth in the recession.”

Before Generation Z was decreed the ‘official’ name for my generation, there were a few other candidates, including the ‘Selfie Generation’ and ‘iGen.’

Employers will also need to recognize that members of Generation Z crave structure, goals, challenges and a way to measure their progress. After all, the perceived road to success has been mapped out for us our entire lives.

At the same time, it’s important to be aware of the potential for burnout among young overachievers—and to incorporate fun and breaks into the work environment and provide access to healthy escapes focused on relaxation and stress relief.

4. Gen Z Is Entrepreneurial

Even though they witnessed their parents grapple with financial challenges and felt the impact of the worst economic meltdown since the Great Depression, members of Generation Z believe there is a lot of money to be made in today’s economy. Shows like “Shark Tank” have inspired us to look favorably on entrepreneurship, and we’ve also seen how technology can be leveraged to create exciting—and lucrative—business opportunities with relatively low overhead. Fifty-eight percent of the members of my generation want to own a business one day and 14 percent of us already do, according to XYZ University.

Organizations that emphasize Generation Z’s desire for entrepreneurship and allow us space to contribute ideas will see higher engagement because we’ll feel a sense of personal ownership. We are motivated to win and determined to make it happen.

5. Gen Z Is Connected

Before Generation Z was decreed the “official” name for my generation, there were a few other candidates, including the “Selfie Generation” and “iGen.”

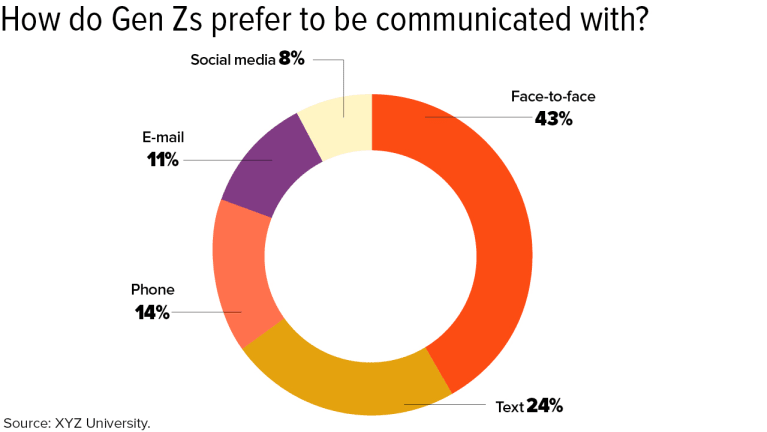

I find those proposed names both condescending and misleading. While it’s often assumed that Generation Z is focused solely on technology, talking face to face is our preferred method of communication. Sure, social media is important and has undoubtedly affected who we are as a generation, but when we’re communicating about something that matters to us, we seek authenticity and honesty, which are best achieved in person.

“Gen Z has the power of technology in their hands, which allows them to communicate faster, more often and with many colleagues at one time; but it also brings a danger when it’s used as a crutch for messages that are better delivered face to face,” says Jill Katz, CHRO at New York City-based Assemble HR. “As humans in the workplace, they will continue to seek empathy, interest and care, which are always best received face to face.”

XYZ University’s research found that cellphones and other electronic devices are primarily used for the purpose of entertainment and are tapped for communication only when the face-to-face option isn’t available.

However, successfully engaging with Generation Z requires striking a balance between conversing directly and engaging online. Both are important, and we need to feel connected in both ways to be fully satisfied.

6. Gen Z Craves Human Interaction

Given that members of Generation Z gravitate toward in-person interactions, HR leaders should re-evaluate how to best put the “human” aspect back into business. For example, hiring processes should emphasize in-person interviews more than online applications.

A great way to engage us is to hold weekly team meetings that gather everyone together to recap their achievements. Although members of Generation Z don’t necessarily need a pat on the back, it’s human nature to want to feel appreciated. This small gesture will give us something to look forward to and keep us feeling optimistic about our work. In addition, we tend to work best up against a deadline—for example, needing to have a project done by the team meeting—due to our experience facing time-sensitive projects at school.

7. Gen Z Prefers to Work Independently

Millennials generally prefer collaborative work environments, which has posed a challenge to conventional workplace cultures and structures. In fact, many workplaces have eliminated offices and lowered cubicle walls to promote more interaction. Yet recent studies indicate that totally open offices may actually discourage people from working together. The noise and lack of privacy could prompt more people to work at home or tune others out with headphones. Since different types of work require varying levels of collaboration, focus and quiet reflection, ideal workplaces incorporate room for both togetherness and alone time.

It’s important to be aware of the potential for burnout among young overachievers—and to incorporate fun and breaks into the work environment and provide access to healthy escapes focused on relaxation and stress relief.

The emphasis on privacy will likely only intensify under Generation Z. Unlike Millennials, we have been raised to have individualistic and competitive natures. For that reason—along with growing research into optimal office design—we may see the trend shift away from collaborative workplaces toward more individualistic and competitive environments.

8. Gen Z Is So Diverse That We Don’t Even Recognize Diversity

Generation Z marks the last generation in U.S. history where a majority of the population is white. Given the shifting demographics of the country, we don’t focus as much on someone’s color, religion or sexual orientation as some of our older counterparts might. To us, a diverse population is simply the norm. What we care about most in other people is honesty, sincerity and—perhaps most important—competence.

Indeed, we have been shaped by a society that celebrates diversity and openness. A black man occupied the White House for most of our lives, and we view gay marriage as a common and accepted aspect of society.

9. Gen Z Embraces Change

Compared to teenagers of other generations, Generation Z ranks as the most informed. We worry about our future and are much less concerned about typical teen problems, such as dating or cliques, than we are about becoming successful in the world.

The chaos and unrest in our political system have inspired us to want to get involved and make a difference. Regardless of which side of the aisle we are on, most of us are informed and passionate about the issues facing our society today. Witness, for example, the students of Marjory Stoneman Douglas High School in Parkland, Fla., who organized a political movement around gun control in the wake of a mass shooting at their school.

Social media allows us to have a voice in our political system even before we can vote. This opportunity has forced us to develop critical-thinking and reasoning skills as we engage in sophisticated debates about important issues that might not even affect us yet.

“Gen Z has a strong ability to adapt to change,” says Paul Carney, an author and speaker on HR trends and a former HR manager with the Navy Federal Credit Union. “For those of us who have spanned many decades in the workplace, we have seen the rate of change increase and it makes most of us uncomfortable. Gen Z are the people who will help all of us adapt better.”

According to numerous polls, the political views of Generation Z trend fiscally conservative (stemming from our need for financial stability) and socially liberal (fueled by diverse demographics and society).

10. Gen Z Wants a Voice

Given how socially aware and concerned its members are, Generation Z seeks jobs that provide opportunities to contribute, create, lead and learn.

“One of the best ways I have seen leaders engage with Gen Z is to ask them how they would build a product or service or design a process,” Carney says. “Gen Z has some amazing abilities to bring together information, process it and take action. When we do allow them to share ideas, great things happen.”

We’re also an exceptionally creative bunch. Managers will need to give members of this generation the time and freedom to come up with innovative ideas and accept that, despite our young age, we have valuable insights and skills to offer—just like the generations that came before us and those that will follow.

The HR tech disconnect: Are there too many digital tools?

According to a new survey of more than 500 HR employees, 87 percent of HR professionals reported that having tools that integrate with existing technology is key. Continue reading this blog post from Employee Benefit Advisor to learn more.

Investing in new technology that combines with current systems looks to be a priority for HR departments.

That’s according to a new survey of more than 500 HR employees from Reward Gateway, which found that 87% of HR professionals say having tools that integrate into their existing technology is key.

That priority is likely due to the fact that HR technology is siloed, the employee engagement technology company found. Many employers use separate platforms for tasks relating to employee communication, recognition, applicant tracking, onboarding and performance management.

More than a fifth of companies use 10 or more different systems and applications at work, and roughly 60% are using more than five systems every day. In addition, HR professionals spent 512 hours a year, nearly two hours a day, manually checking, responding to and keeping up with multiple HR applications, Reward Gateway says.

“Many companies have systems-of-record in place with up-to-date details on their employees,” says Will Tracz, chief technology officer at Reward Gateway. “Creating and maintaining data in other systems, outside of this, often takes time and is prone to error, particularly in fast-moving businesses.”

The new survey echoes similar findings, which indicate that while employers may be increasingly using HR tech, they may not be doing so efficiently. For instance, research from the Association of Executive Search and Leadership Consultants found that HR departments could be dropping the ball when it comes to using HR technology.

Karen Greenbaum, president and CEO of AESC told Employee Benefit News in November that total digital transformation is about more than just implementing new tech in the office.

“It’s not just, ‘Do they understand what artificial intelligence means,’ or what augmented reality means,” she says. “[It’s] ‘Do you really have an organization that can adapt to a new world?’”

Still, HR leaders are turning to tech solutions. Data from global talent acquisition and management firm Randstad Sourceright found that HR departments are going on a tech “buying spree.” The vast majority (92%) of those in the Randstad survey of more than 800 C-suite and HR leaders and 1,700 professionals believe that technology enhances the attraction, engagement and retention of talent.

Reward Gateway received similar responses. HR teams are hoping new tech will not only integrate with existing systems, but also help them achieve their goals, which include higher employee engagement, increased productivity and attracting talent.

This article originally appeared in Employee Benefit News.

SOURCE: Hroncich, C. (29 March 2019) "The HR tech disconnect: Are there too many digital tools?" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/news/hr-tech-disconnect-are-there-too-many-digital-tools?brief=00000152-146e-d1cc-a5fa-7cff8fee0000

7 ways employers can support employee caregivers

Seventy-three percent of employees in the United States act as caregivers for a child, parent or friend, according to research from Harvard Business School. Continue reading for seven ways employers can support employee caregivers.

The number of caregiving adults in the U.S. has reached a tipping point.

As the baby boomer generation gets older, an increasing number of people in the workforce are taking on the role of unpaid caregiver for a family member or friend. Many also are in the midst of raising their own children, which means they’re pulled in many different directions, trying to keep up with work commitments and family responsibilities. In fact, according to researchers at Harvard Business School, 73% of employees in the U.S. are caring for a child, parent or friend.

What do all these statistics point to? They mean that employers have an opportunity to play a role in helping employees balance these often competing priorities.

The Harvard study highlights the impact of employee caregiving responsibilities on the workplace. While only 24% of employers surveyed believed employee caregiving influenced their employees’ performance at work, 80% of the employees who were surveyed admitted that caregiving had an effect on their productivity at work and interfered with their ability to do their best work.

The survey also found that caregiving can affect employee retention, with 32% of the employees surveyed saying they had left a job because of their caregiving responsibilities. In addition, employees who are caregivers are more likely to miss work, arrive late or leave early, which affects not only productivity, but also the employees’ ability to progress in their careers.

Employers can take a proactive role in supporting employees who are caregivers. That support, in turn, can have a positive effect on productivity, morale and employee retention. Here are seven strategies employers should consider.

Create an organization-wide understanding of the challenges caregivers face.

Employees who aren’t sure that their managers and leaders would understand the juggling they’re doing and the stresses they face are more likely to not only have problems at work, but — because they face high stress levels trying to get everything done at home and work — they also are at higher risk for a number of health problems such as depression and heart disease. By creating a culture that allows employees to openly express their challenges and ask for support, employers can not only keep employees healthy and productive, they also can reduce secondary costs associated with decreased productivity and chronic health problems.

Know what challenges employees face.

Regular employee surveys can help employers assess employees’ needs in terms of caregiving and tailor the benefits the organization offers to help meet those needs.

Communicate the benefits that are available.

In many cases, employers already offer programs and benefits that can help employees who are caregivers such as an employee assistance program and referral services for finding caregivers who can help when the employee isn’t able to. However, many employees aren’t aware these programs are available, so it’s important to continuously share information about them in company newsletters, emails and at meetings.

Consider flex time and remote work options.

Depending on the employees’ work responsibilities, employers can offer flexible work arrangements that allow employees to work different hours or to telecommute for a certain number of days per week.

Change the approach to paid time off.

Rather than dividing paid time off into vacation days, sick days and personal days, consider grouping all time off into one category. That allows employees to take time off for caregiving as needed. A growing number of companies, including Adobe, Deloitte, Bristol-Meyers Squibb and Coca-Cola, are also offering paid family leave benefits so that employees can take time off to provide care.

Connect employees with resources.

Beyond an EAP and referral services, employers can offer programs that connect caregivers with resources for both their caregiving role and for the self-care they need to remain healthy and able to handle both job and caregiving roles better. Those resources can include:

Beyond an EAP and referral services, employers can offer programs that connect caregivers with resources for both their caregiving role and for the self-care they need to remain healthy and able to handle both job and caregiving roles better. Those resources can include:

- Advisory services that help employees connect with healthcare providers for their parents, children and themselves

- Nurse managers, case managers and geriatric care managers who can help employees who are managing the care of a family member who’s living with a serious health condition or disability

- Advocates who can help employees who are dealing with complex insurance claims for the person they care for, planning for long-term care, or managing the legal and financial complexities that can arise when a parent or spouse dies

Internal caregiver resources groups that bring together employees who are dealing with the issues surrounding caregiving so that they can share ideas and experiences

Measure how well your support is working.

The first step to supporting caregivers in the workforce is to implement policies, programs and benefits that offer them the tools they need to balance work and caregiving. An equally important second step is to regularly review what is offered, how much the offerings are used, and by which employees. Ask employees for feedback on how effectively what the organization provides is in helping them with issues they face as working caregivers and solicit ideas for new approaches and tools they’d like to have.

SOURCE: Varn, M. (25 March 2019) "7 ways employers can support employee caregivers" (Web Blog Post). Retrieved from https://www.benefitnews.com/list/7-ways-employers-can-support-employee-caregivers

DOL proposes new rule clarifying, updating regular rate of pay

The Department of Labor (DOL) recently released a proposal that defines and updates what forms of payment employers can include and exclude in the time-and-one-half calculation when determining overtime rates. Read this blog post to learn more.

For the first time in 50 years, the Department of Labor has proposed changing the definition of the regular rate of pay.

The proposal, announced Thursday, “defines and updates” what forms of payment employers include and exclude in the time-and-one-half calculation when determining workers’ overtime rates, according to the DOL.

The regulations the DOL is proposing to revise govern how employers must calculate the regular rate and overtime pay rate, including the types of compensation that must be included and may be excluded from the overtime pay calculation, says Tammy McCutchen, a principal at Littler Mendelson and former administrator of the Department of Labor’s Wage and Hour Division.

The regular rate of pay is not just an employee’s hourly rate, she says, but rather includes “all remuneration for employment” — unless specifically excluded by section 7(e) of the FLSA.

Under current rules, employers are discouraged from offering more perks to their employees as it may be unclear whether those perks must be included in the calculation of an employees’ regular rate of pay, the DOL says. The proposed rule focuses primarily on clarifying whether certain kinds of perks, benefits or other miscellaneous items must be included in the regular rate.

The DOL proposes that employers may exclude the following from an employee’s regular rate of pay:

- The cost of providing wellness programs, onsite specialist treatment, gym access and fitness classes and employee discounts on retail goods and services;

- Payments for unused paid leave, including paid sick leave;

- Reimbursed expenses, even if not incurred solely for the employer’s benefit;

- Reimbursed travel expenses that do not exceed the maximum travel reimbursement permitted under the Federal Travel Regulation System regulations and that satisfy other regulatory requirements;

- Discretionary bonuses;

- Benefit plans, including accident, unemployment, and legal services; and

- Tuition programs, such as reimbursement programs or repayment of educational debt.

The proposed rule also includes additional clarification about other forms of compensation, including payment for meal periods and call back pay.

The regulations will benefit employees, primarily, ensuring that employers can continue to provide benefits that employees’ value — tuition reimbursements, student loan repayment, employee discounts, payout of unused paid leave and gym memberships, McCutchen says.

“Remember, there is no law that employers must provide employees these types of benefits,” she adds. “Employers will not provide such benefits if doing so creates risk of massive overtime liability.”

Knowing when employers must pay overtime on these types of benefits, how to calculate the value of those benefits and overtime pay are all difficult questions, she adds. “Unintentional mistakes by good faith employers providing valued benefits to employees is easy. With this proposed rule, the DOL is embracing the philosophy that good deeds should not be punished.”

She notes the proposal does not include any specific examples of what reimbursements may be excluded from the regular rate.

“One big open question is whether employers must pay overtime when they provide employees with subsidies to take public transportation to work — as the federal government does for many of its own employees — I think around $260 per month in the DC Metro area,” she adds.

The DOL earlier this month proposed to increase the salary threshold for overtime eligibility to $35,308 up from the current $23,660. If finalized, the rule would expand overtime eligibility to more than a million additional U.S. workers, far fewer than an Obama administration rule that was struck down by a federal judge in 2017.

Employers are expected to challenge the new rule as well, based on similar complaints of administrative burdens, but a legal challenge might be more difficult to pass this time around.

SOURCE: Otto, N. (28 March 2019) "DOL proposes new rule clarifying, updating regular rate of pay" (Web Blog Post). Retrieved from https://www.benefitnews.com/news/dol-proposes-new-rule-on-regular-rate-of-pay-calculation?brief=00000152-14a5-d1cc-a5fa-7cff48fe0001

Half of older Americans have nothing in retirement savings

Almost half of Americans approaching retirement have nothing saved in a 401(k) or another individual account, according to the U.S. Government Accountability Office. Read this blog post to learn more.

The bad news is that almost half of Americans approaching retirement have nothing saved in a 401(k) or other individual account. The good news is that the new estimate, from the U.S. Government Accountability Office, is slightly better than a few years earlier.

Of those 55 and older, 48% had nothing put away in a 401(k)-style defined contribution plan or an individual retirement account, according to a GAO estimate for 2016 that was released Tuesday. That’s an improvement from the 52% without retirement money in 2013.

Two in five of such households did have access to a traditional pension, also known as a defined benefit plan. However, 29% of older Americans had neither a pension nor any assets in a 401(k) or IRA account.

The estimate from the GAO, the investigative arm of Congress, is a brief update to a more comprehensive 2015 report on retirement savings in the U.S. Both are based on the Federal Reserve’s Survey of Consumer Finances.

The previous report found the median household of those age 65 to 74 had about $148,000 saved, the equivalent of an inflation-protected annuity of $649 a month.

“Social Security provides most of the income for about half of households age 65 and older,” the GAO said.

The Employee Benefit Research Institute estimated earlier this month that 41% of U.S. households headed by someone age 35 to 64 are likely to run out of money in retirement. That’s down 1.7 percentage points since 2014.

EBRI found these Americans face a combined retirement deficit of $3.83 trillion.

SOURCE: Steverman, B.; Bloomberg News (27 March 2019) "Half of older Americans have nothing in retirement savings" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/articles/half-of-older-americans-have-no-retirement-savings

A guide to managing employee website usage

With remote workers, employers need to be mindful of the types of websites their employees are accessing on company-issued technology. Continue reading for key considerations and best practices to review when properly managing employee website usage.

Whether employees are working from home, the coffee shop or the office, employers need to be mindful of the types of websites workers are accessing on their company-issued technology.

New accessibility creates greater flexibility, but employers need to be vigilant to ensure workers maintain the expectation of productivity and workplace privacy. Now more than ever, the workplace heavily relies on technology and companies must understand how to manage it to avoid risk.

Nowhere is the tension between technology and privacy rights more prevalent than in today’s workplace. At the forefront of this discussion is whether employers should block access to certain websites on company-issued technology. Here are key considerations and best practices to review when properly managing employee website usage.

Creating boundaries between work and personal affairs, without invading privacy. Employees typically emphasize that their private affairs should not be accessed by their employer. But the federal Electronic Communications Privacy Act (ECPA) states an employer-provided computer system is the property of the employer, so when an employee visits certain websites during typical office hours using company-issued technology, what is accessed by the employee becomes the employer’s business as well.

There is no denying that placing blocks on certain websites is an effective way to separate work and personal matters, maintain professionalism, protect the company’s security, respect company property and utilize work time appropriately. However, employers should beware of potential legality issues regarding privacy. For example, employees are given some protection from computer and other forms of electronic monitoring under certain circumstances.

Productivity distractions. Blocking certain websites will not prevent an employee from utilizing company time for personal reasons, but doing so reminds employees to have integrity, focus and discipline when it comes to using technology in the workplace. Some employees will use company-issued technology to visit a plethora of websites such as social media platforms, personal email accounts, instant messengers, financial institutions, sports, entertainment and music sites, as well as inappropriate websites. It is easy to become distracted with an overabundance of virtual activity at our fingertips, and blocking sites sends a serious message to workers that business technology and time is for business-purposes only.

Security of confidential company data and information. In today’s interconnected world, employers recognize the importance of protecting confidential company information. Employers often choose to block certain websites because of the risk of a security breach. Employers are concerned with the exposure of any release of its data, work products, ideas and information not otherwise disclosed to the public or its competitors. Blocking certain websites gives an organization an opportunity to decrease the risk of its confidential information being accessed by external influences.

What employers can do to be more transparent with staff

There are no foolproof methods to preventing an employee from using their work time for personal reasons or inadvertently exposing the company to security breaches.

Employees can still access many websites of their choosing through their personal technology. However, the aforementioned reasons are convincing enough for employees to take more accountability in using company-issued technology for business purposes only. An employer that endorses a policy and practice of business technology for business reasons sets a clear expectation for employees to remember and follow.

- Enforce a written policy that sets clear expectations for in-house and remote employees about not using company-issued technology to visit certain websites and explain the reason for such policies. Policies and procedures should be well-defined, widely communicated and reviewed at least annually.

- Inform new employees that certain websites are not accessible via company technology. Highlight the written policy for both new and existing employees. Again, explain the reason for this policy.

- Offer training and other educational opportunities that motivate productivity during times when work focus suffers.

- Work with the company’s internal IT department to ensure that websites are properly blocked.

Usually, when employers remain transparent with staff regarding why a policy exists, employees are more receptive. In general, employers are encouraged to consult with an experienced HR professional or employment lawyer to avoid any potential legality pitfalls in the workplace.

SOURCE: Banks, S. (11 March 2019) "A guide to managing employee website usage" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/a-guide-to-managing-employee-website-usage?brief=00000152-14a5-d1cc-a5fa-7cff48fe0001

Understanding Group Health Insurance

Health insurance can easily be defined as bookended in volumes of mystery. You know you need the coverage, you want to have the coverage for your employees, but chances are you simply do not know enough about it to make the first two points happen. For an employer thinking about introducing group health insurance to your employees, it can be unclear why you should provide something that is surrounded with much confusion. In this installment of CenterStage, Kelley Bell, a Group Health Benefits Consultant at SAXON, sheds some light onto the darkness that group health insurance so often casts.

What is Group Health Insurance?

In its most basic definition, group health insurance is a plan that covers all the employees who work for a given company or organization, and it potentially covers their spouses and other dependents. As the individual marketplace continues to change, Kelley noted the “increasingly difficult task of finding desirable plan designs, lower deductibles and doctors and hospitals that are in the network”. “Individuals with marketplace plans have even been told by many doctors and hospitals,” Kelley added, “that they will not accept the ACA plans from the individual marketplace. Here are reasons that considering a group plan makes more sense than leaving your employees at the mercy of the exchange:”

- Group Health Insurance has larger networks of doctors and hospitals.

- Employee premiums can be deducted pre-tax. The premium can be divided among pay periods, allowing them the convenience of paying less in from a total income perspective and allowing the premium to be broken in pieces versus a monthly sum income.

- The employer still selects the health insurance plan(s) to offer, thus choosing an appropriate plan for the staff versus allowing them to choose the “cheapest” that will hurt them financially if they need to pay for the large deductible.

- Employer contributions are tax deductible, allowing the company to save versus paying payroll tax on any compensation provided to the employee in lieu of offering health insurance.

Do I Need Group Health Insurance?

Why should you consider a group health insurance plan? Outfitting your team with health benefits simplifies the process for employees to include regular and urgent doctor visits, hospital stays and medical treatments such as physical therapy.

Health plans are the primary benefit (aside from compensation) individuals seek out when applying for employment. Your overall benefits offerings are crucial to your company or organization’s ability to attract and retain employees. Therefore, why would you not want to offer health coverage as a part of your overall compensation package?

Group health insurance involves assuming the shared risk and shared costs. Kelley defines shared risk as covering a multitude of individuals who are fairly, healthy people. “This can help keep your premium rates lower than individual plans whose rates are based solely on a person’s age and assumed risk versus the sharing of risk over a pooled premium. This relationship creates savings that reward good behavior,” Kelley said. Shared costs mean the premium can be shared between you the employer and employees. Employers have the flexibility of paying varying percentages of the premium, which could reduce the amount the employee pays versus the individual market premiums.

Working alongside a broker such as SAXON is highly recommended for smaller businesses. SAXON specializes in assisting employers with 1 to 50 employees on how to discover and purchase the benefits they need within their budget. SAXON begins each engagement process by listening to you – the employer – to develop and discover the best course of action for your business or organization. We have a proven history of discovering healthcare plans that are vital to the recruitment and retainment of talented employees.

Saxon’s Role When Considering Group Health Insurance

It is important to understand the needs of every client and educate their employees on how to use their healthcare. SAXON values client education and service above all else. We make educating employees a priority and ensure their benefits are understood and easy to use, making them value the relationship they have with you that much more. SAXON represents you, allowing us to secure the best plans and rates for you and your staff, which we review annually.

If you are considering offering group health insurance to your employees, contact Kelley Bell today at (513) 774-5493 or (937) 672-1547 or via email at kbell@gosaxon.com to begin exploring the benefits of adding this superior level of coverage today.

To check or not to check: Managing blood sugar in diabetic employees

There's been a growing prevalence of Type 2 diabetes in the U.S. over the last 20 years. This chronic condition significantly impacts employees, their family members and even employers clinically and financially. Read this blog post to learn more.

Over the last 20 years, there’s been a growing prevalence in the U.S. of Type 2 diabetes, a chronic condition that significantly impacts employers, their employees and family members clinically, financially and through quality of life. With that comes an increase in the use of insulin for people with Type 2 diabetes to better control blood sugar to reduce long-term complications, which includes eye, kidney and cardiac disease, as well as neuropathic complications.

Most of these patients manage their condition with oral medicines versus insulin, and it’s estimated that 75% of patients with Type 2 diabetes regularly test their blood sugar, even though doing so may not be needed. Blood sugar testing is an important tool in managing diabetes as it can help a patient be more aware of their disease and potentially control it better. But it also can be painful, inconvenient and costly.

Blood sugar testing can be an important tool in managing diabetes, and there are two types of tests. The first is a test conducted at home by the patient that shows the blood sugar at a specific point in time. The second type is called HA1c (a measure of long-term blood sugar control) that shows the average blood sugar over the last two to three months. The value of at-home testing is now thought to be questionable.

In 2012, the Patient-Centered Outcomes Research Institute began a study to evaluate the value of daily blood sugar testing for people with Type 2 diabetes not taking insulin. The endpoint for the study was whether there was a difference in HA1c levels for those who did daily testing and those that did not. The conclusion of the study found that there were no significant differences between those two populations.

In response to these findings, the institute developed an initiative called Rethink the Strip that involves stakeholders including primary care practices, healthcare providers, patients, health plans, coalitions and employers. Given the cost for test strips and monitors for patients with Type 2 diabetes who test their blood sugar daily, it’s important to adopt an evidence-based patient-centered approach around the need for and frequency of self-monitoring of blood glucose.

As employees and employers cope with the costs associated with blood sugar testing, there are several strategies that should be considered to better manage this issue. They include:

1. Support shared decision-making. Like all interventions within healthcare, it’s important to weigh both the benefits and the risks of daily blood sugar testing in a thoughtful manner between the patient and their provider.

2. Managed benefit design. Employers should pay for daily blood sugar test strips in cases where it brings value (e.g., Type 1 and Type 2 patients who are taking insulin as well as patients that are either newly diagnosed or are going through a transition period, for example, post hospitalization or beginning a new medication regimen).

3. Involve vendors. To ensure alignment in all messaging to plan members, ask health systems and/or health plans and third-party vendors to align their communication, measurement and provider feedback strategies on when it’s appropriate for daily blood sugar testing.

These strategies can help employees with diabetes understand how their daily activities (nutrition, exercise and stress) and medications impact their condition. This benefits the employee in reaching treatment goals and feeling their best, while also helping employers and employees reduce the need for unnecessary and costly test strips.

This article originally appeared in Employee Benefit News.

SOURCE: Berger, J. (14 March 2019) "To check or not to check: Managing blood sugar in diabetic employees" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/opinion/managing-blood-sugar-in-diabetic-employees?brief=00000152-146e-d1cc-a5fa-7cff8fee0000