What's the Dish? A Family Recipe for Salsa Lovers

In this month's Dish, we bring you the delicious "Dine In" and "Dine Out" choices from our very own, Abby Graham!

Abby Graham is a Wellness Director Saxon Financial Services. She has been in the insurance, health and wellness industry for over 12 years. Prior to joining Saxon Financial, she spent the last 7 years working for Humana/HumanaVitality. She is passionate about making sure members understand their medical and wellness benefits as well as how to maximize their potential.

Abby holds a degree in Human Resource Development from the University of Tennessee. She has also received her Group Benefits Disability Specialist (GBDS) certification.

She is an active member and board member of the Cincinnati Modern Quilt Guild. Abby also enjoys sewing, quilting, and spending time with her husband, Jon and her son, Carter.

Stay In:

Abby's favorite family recipe is Corn Avocado Salsa. She and her husband make it together. It’s best in the summer when the tomatoes are ripe and the corn is sweet!

1 ripe tomato

1 avocado

1 ear of corn

½ cup chopped cilantro

1 sweet onion

1 jalapeno

2-3 garlic cloves

1 ripe lime

Salt to taste

Grill the tomato until the skin is cracked and peeling off. Cut the avocado and grill it face down for about 5 minutes. Grill the corn until it is cooked all the way. In the meantime, finely chop the onion, jalapeno, cilantro and garlic cloves. Squeeze ½ of the lime over onion, jalapeno, cilantro and garlic combination.

Once tomato, avocado, and corn are finished grilling, cut corn off of the cob, and peel skin off of tomato. Dice tomato and avocado and add to chopped mix. Add salt to taste and serve warm with tortilla chips!

Dine Out:

Her favorite place to Dine Out is Dilly Café. Want driving directions? Get them here.

Our favorite restaurant is the Dilly Café in Mariemont. The outside seating is perfect on a nice night and/or when we have our little one with us. They generally have a band playing, the food is excellent, and the beer and wine list are great! Their crab cakes, wings and burgers are my favorites!

YUM! We hope you enjoy Abby's recipe and dining suggestions. We know we will!

CenterStage...Open Season for Open Enrollment

In this month’s CenterStage, we interviewed Rich Arnold for some in-depth information on Medicare plans and health coverage. Read the full article below.

Open Season for Open Enrollment: What does it mean for you?

There are 10,000 people turning 65 every single day. Medicare has a lot of options, causing the process to be extremely confusing. Rich – a Senior Solutions Advisor – works hard to provide you with the various options available to seniors in Ohio, Kentucky and Indiana and reduce them to an ideal, simple, and easy-to-follow plan.

“For me, this is all about helping people.”

– Rich Arnold, Senior Solutions Advisor

What does this call for?

To provide clients with top-notch Medicare guidance, Rich must analyze their current doctors and drugs for the best plan option and properly educate them to choose the best program for their situation and health. It’s a simple, free process of evaluation, education, and enrollment.

For this month’s CenterStage article, we asked Rich to break down Medicare for the senior population who are in desperate need of a break from the confusion.

Medicare Break Down

Part A. Hospitalization, Skilled Nursing, etc.

If you’ve worked for 40 quarters, you automatically obtain Part A coverage.

Part B. Medical Services: Doctors, Surgeries, Outpatient visits, etc.…

You must enroll and pay a monthly premium.

Part C. Medicare Advantage Plans:

Provides most of your hospital and medical expenses.

Part D.

Prescription drug plans available with Medicare.

Under Parts A & B there are two types of plans…

Supplement Plan or Medigap Plan

A Medicare Supplement Insurance (Medigap) policy can help pay some of the health care costs that Original Medicare doesn’t cover, like copayments, coinsurance, and deductibles, coverage anywhere in the US as well as travel outside of the country, pay a monthly amount, and usually coupled with a prescription drug plan.

Advantage Plan

A type of Medicare health plan that contracts with Medicare to provide you with all your Part A and Part B benefits generally through a HMO or PPO, pay a monthly amount from $0 and up, covers emergency services, and offers prescription drug plans.

How does this effect you?

Medicare starts at 65 years of age, but Rich advises anyone turning 63 or 64 years of age to reach out to an advisor, such as himself, for zero cost, to be put onto their calendar to follow up at the proper time to investigate the Medicare options. Some confusion exists about Medicare and Social Security which are separate entities. Social Security does not pay for the Supplement or Advantage plans.

Medicare Open Enrollment: Open Enrollment occurs between October 15th and December 7 – yes, right around the corner! However, don’t panic, Rich and his services can help you if you are turning 65 or if you haven’t reviewed your current plan in over a year – you should seek his guidance.

Your plan needs to be reviewed every year to best fit your needs. If you’re on the verge of 65, turning 65 in the next few months, or over 65, you should consult your Medicare advisor as soon as possible. For a no cost analysis of your needs contact Rich, Saxon Senior Solutions Advisor, rarnold@gosaxon.com, 513-808-4879.

Health Care Sector Earnings: Major Companies Open The Books On Q3 Results In Weeks Ahead

Photo Credit: Shutterstock

The health care sector has been one of the better-performing sectors in 2017, bouncing back after being the only sector in the S&P 500 to finish last year in the red. So far this year, the S&P Health Care Select Sector Index is outperforming the S&P 500 by 5.75% as of October 6.

The sector got a bump recently when Republicans’ released an initial framework for tax reform, with CNBC pointing out that some of the largest companies in the health care sector could be primary beneficiaries of the proposed repatriation tax break. For the sector’s upcoming earnings, analyst estimates are calling for low to mid-single-digit growth for both earnings and revenue.

Within the S&P 500, the health care sector is expected to report year-over-year revenue growth of 4.8% and earnings growth of 2.5%, according to FactSet, with profit margins estimated to decline from 10.3% to 10.1% across the sector. Those estimates are slightly below the sector’s estimated revenue and earnings growth rates expected for the full year.

Beyond the proposed tax reform, below we’ll take a look at what’s been happening in the sector as companies prepare to report earnings in the upcoming weeks.

thinkorswim

thinkorswimAfter underperforming by a large margin in 2016, the health care sector has been recovering in 2017. The S&P Health Care Select Sector Index, charted above, is up 18.49% year-to-date, compared to a 12.74% increase in the S&P 500, the teal line. The Nasdaq Biotechnology Index, the purple line, has outperformed both and climbed 25.6% year-to-date. Chart source: thinkorswim® by TD Ameritrade. Data source: Standard & Poor’s. Not a recommendation. For illustrative purposes only. Past performance does not guarantee future results.

Biotech Industry Outperforming

So far this year, the biotechnology industry has outpaced the broader health care sector, with the Nasdaq Biotechnology Index up 25.6% versus a 18.49% increase in the S&P Health Care Select Sector Index. However, looking at 2016, the Nasdaq Biotechnology Index fared far worse than the S&P Health Care Select Sector Index, declining 22.01% when the latter only declined 4.37%.

Stocks in the biotech industry are notoriously volatile and it can take many years, even decades, for a company to undergo research and development, and the clinical trial process. A 2014 study by Tufts University’s Center for the Study of Drug Development found that only 11.8% of drugs that enter clinical trials end up being approved by the FDA.

Washington on Health Care

Drug pricing scrutiny has been an ongoing focus in Congress, but there’s yet to be concrete legislation pushed forward to address the issue. Dr. Scott Gottlieb, the head of the Food and Drug Administration (FDA), recently said high drug prices are a “public health concern” and in a post on the FDA’s official blog, outlined several steps the agency is taking to make the generic approval process for complex drugs easier.

On October 17, the Senate Health Committee is scheduled to hold a second hearing as part of its investigation into high drug prices. Representatives from drug company and pharmacy benefit managers—essentially middle men between pharmacies and drug companies—have been invited to speak before the panel. Depending on how that hearing goes, there could be heightened volatility in healthcare stocks.

Due to the costly process of developing drugs, companies often go to great lengths to protect patents. Those practices have also started to come into scrutiny in Congress as well. Allergan announced last month it had transferred the patent rights for its drug Restasis to the St. Regis Mohawk Indian Nation, which would license them back to Allergan in exchange for ongoing payments to the tribe.

The tribe’s sovereign immunity would potentially shield the drug from certain patent reviews. “Allergan has argued that the legal maneuver is aimed at removing administrative patent challenges through inter partes review by the U.S. Patent Trial and Appeal Board, and not challenges in federal court”, according to Reuters.Shortly after Allergan transferred the patent rights, U.S. Senator Claire McCaskill quickly announced she had drafted a bill to prevent tribal sovereign immunity from being used to block U.S. Patent and Trademark Office review of a patent in response to the move.

Aging Demographics and More Disease as Population Grows

There are some trends that analysts anticipate to be tailwinds for the sector for years to come. One of them is aging demographics and the other is growth of certain diseases. Approximately 10,000 baby boomers turn 65 every day, according to Pew Research, and that trend is expected to continue until 2030, when the last of the boomers reach retirement age and roughly 18% of the U.S. population is projected to be 65 and older.

As world populations grow and age, certain diseases are expected to have a greater prevalence than others and a large portion of health care spending is likely to go towards them. By 2020, Deloitte projects that 50% of global health care expenditures, about $4 trillion, will be spent on cardiovascular diseases, cancer and respiratory diseases.

These trends could be a tailwind for healthcare companies, but at the same time a lot could change in the regulatory environment as well as with the treatments available in the years ahead.

Looking Ahead to Earnings

The first major company in the sector to report earnings is Johnson & Johnson, which will release results before market open on Tuesday, October 17. The following companies report later in the month: Eli Lilly & Co. before market open on Tuesday, October 24, Gilead Sciences after market close on Thursday, October 26, Merck before market open on Friday, October 27 and Pfizer before market open on Tuesday, October 31.

You can read the original article here.

Source:

Kinahan J. (10 October 2017). "Health Care Sector Earnings: Major Companies Open The Books On Q3 Results In Weeks Ahead" [Web Blog Post]. Retrieved from address https://www.forbes.com/sites/jjkinahan/2017/10/10/health-care-sector-earnings-major-companies-open-the-books-on-q3-results-in-weeks-ahead/#417bef6a44bb

Saxon Welcomes a New Senior Solutions Specialist

Saxon is excited and proud to announce a new employee added to our team, Leigh Rathje!

Leigh’s background in group health insurance has led her to a new path with Saxon as a Senior Advisor. She helps her clients in the day to day needs when it comes to Medicare questions, enrollments, claims issues, and billing concerns.

Self funded health care – a big business advantage

Check out this article from Business Insurance by one of their staff writers. In this article, Business Insurance dives into the awesome advantages of self-funding for big businesses.

You can read the original article here.

Health insurance benefits are expensive. The rising costs of health care has driven up insurance premiums to levels where many businesses have been forced to reduce these benefits or drop them altogether. There is, however another option that is less regulated, taxed less and typically results in cost savings: self funded health insurance. The problem is, it's not always the best option for all employers, particularly the smaller ones. And there's a number of reasons for this:

What is self funded health care a.k.a. self-insurance?

Self-insurance is a method of providing health care to employees by taking on the financial liabilities of the care instead of paying premiums to an insurance agency to do the same. In other words: when a person covered under a self-funded plan needs medical care, the company is financially responsible for paying the medical bill (minus deductibles). It's an alternative risk transfer strategy that assumes the risk and liability of medical bills for those covered instead of outsourcing it to a third party. It's a surprisingly common practice:

In 2008, 55% of workers with health benefits were covered by a self-insured plan….and 89% of workers in firms of 5,000 or more employees.

Most (but not all) self-insurance plans are administered by a third party, usually a health insurance company, in order to process claims. The bills are simply paid for by the employer. Health insurance companies act as a third party administrators in what are called ASO contracts (Administrative Services Only)

Another common component of self insurance plans is stop-loss insurance. This is a separate insurance plan that the employer can purchase to reduce the overall liability of claims. With this type of insurance, if claims exceed a certain dollar amount, stop-loss kicks in paying the rest. There are two kinds of stop-loss insurance:

Specific – covers the excess costs from larger claims made by individuals in the group

Aggregate – kicks in when total claims by the group exceed a set amount

For example, a company who self-insures their $1000 employees projects $100,000 in medical care claims for the year. If they purchase aggregate stop-loss insurance for claims that exceed 120% of the expected amount or $120,000, the insurance will pick up the bill for the remaining claims. If the company purchases specific stop-loss insurance at 200%, if any single claim exceeds $2,000, the stop-loss pays the remainder.

Typically, self-funded insurance providers will purchase both specific and aggregate stop-loss insurance unless the conditions are such that specific stop-loss provides enough financial protection.

Benefits of self-insurance

There are a number of financial and administrative advantages to using self-funded health insurance plans for employers. According to the Self-Insurance Institute of America (SIIA) these include:

- The employer can customize the plan to meet the specific health care needs of its workforce, as opposed to purchasing a 'one-size-fits-all' insurance policy.

- The employer maintains control over the health plan reserves, enabling maximization of interest income – income that would be otherwise generated by an insurance carrier through the investment of premium dollars.

- The employer does not have to pre-pay for coverage, thereby providing for improved cash flow.

- The employer is not subject to conflicting state health insurance regulations/benefit mandates, as self-insured health plans are regulated under federal law (ERISA).

- The employer is not subject to state health insurance premium taxes, which are generally 2-3 percent of the premium's dollar value.

- The employer is free to contract with the providers or provider network best suited to meet the health care needs of its employees.

There are, however, some drawbacks to self-insurance policies:

Health care can be costly, so heavy claims years can be extremely expensive

Self insurance isn't tax deductible the same way the costs of providing health insurance is.

Financial benefits are long-term, particularly with an investment component.

Small businesses at a disadvantage

Self insurance is much more prevalent for larger companies mostly because it is easier to predict health care costs from a larger group. The more people in the group, the less potentially damaging a single expensive claim will be to the plan overall. That's why less than 10% of companies with less than 50 employees use self-insurance.

Because risk is more difficult to predict with smaller groups, stop-loss insurance is also more expensive for smaller businesses. The practice of “lasering”, or increasing deductibles for specific higher risk employees can also be much tougher on small firms. As a result, self-insurance tends to be a less cost effective option than it is for larger companies.

Another roadblock for small businesses is a lack of cash-flow that is necessary to finance self-insurance. This doesn't mean, however, that small businesses can't benefit from a self-insurance plan. In fact, an increasing number of small businesses still are. But fully understanding the risks and rewards for doing so can sometimes be difficult.

Regulations

Because the only 3rd party administration of insurance (stop-loss) is between the employer and the insurance company directly, it is not subject to state level regulation the way traditional insurance policies are. Instead, they're regulated by the department of labor under the Employee Retirement Income Security Act – ERISA. Benefit administrators must still comply with federal standards despite the lack of state regulation.

California SB 1431

California is considering a proposed legislation to regulate the sale of stop-loss policies to smaller businesses. On the surface, the regulation looks as though it is an attempt to prevent small businesses from taking on too much risk. But the true intentions of the legislation may be to prevent cherry-picking of generally healthier small businesses (effectively removing them from the health insurance pool). This cherry-picking would theoretically cause traditional insurance premiums to become more expensive.

According to the SIIA, SB 1431 would prohibit the sale of stop-loss policies to employers with fewer than 50 employees that does any of the following:

- Contains a specific attachment point that is lower than $95,000;

- Contains an aggregate attachment point that is lower than the greater of one of the following:

- $19,000 times the total number of covered employees and dependents;

- 120% of expected claims;

- $95,000

This legislation would effectively limit the options of small businesses as it would force them to purchase a more expensive low deductible stop-loss policies. And according to the SIIA, with this legislation, almost no small business under 50 employees would (nor should they) consider self-insurance as an option.

If the legislation is passed in California, it has been suggested that it is only time before other states follow suit and/or enact even stricter regulations on small businesses. The SIIA even has a facebook page dedicated to defeating the bill they say is:

“…unnecessary and will only exasperate the problem that small employers in California face in being able to afford the rising cost of providing quality health benefits to their employees.”

So while self insurance can be a relatively risky option for small businesses, with legislation like this, it could no longer be a realistic option at all… And, in effect: another competitive advantage big businesses will have over their smaller counterparts.

You can read the original article here.

Source:

Staff Writer. (Date Unlisted). "Self funded health care – a big business advantage" [Web Blog Post]. Retrieved from address https://www.businessinsurance.org/self-funded-health-care-a-big-business-advantage/

The Medicare Part D Prescription Drug Benefit

Below we have an article from the Kaiser Family Foundation providing detailed information and graphics on the benefit of the Medicare Prescription Drug Plan.

You can read the original article here.

Medicare Part D is a voluntary outpatient prescription drug benefit for people on Medicare that went into effect in 2006. All 59 million people on Medicare, including those ages 65 and older and those under age 65 with permanent disabilities, have access to the Part D drug benefit through private plans approved by the federal government; in 2017, more than 42 million Medicare beneficiaries are enrolled in Medicare Part D plans. During the Medicare Part D open enrollment period, which runs from October 15 to December 7 each year, beneficiaries can choose to enroll in either stand-alone prescription drug plans (PDPs) to supplement traditional Medicare or Medicare Advantage prescription drug (MA-PD) plans (mainly HMOs and PPOs) that cover all Medicare benefits including drugs. Beneficiaries with low incomes and modest assets are eligible for assistance with Part D plan premiums and cost sharing. This fact sheet provides an overview of the Medicare Part D program and information about 2018 plan offerings, based on data from the Centers for Medicare & Medicaid Services (CMS) and other sources.

Medicare Prescription Drug Plan Availability in 2018

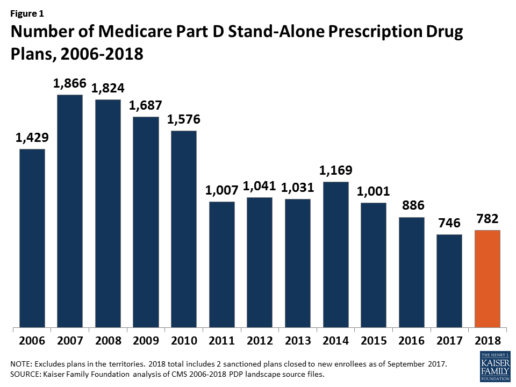

In 2018, 782 PDPs will be offered across the 34 PDP regions nationwide (excluding the territories). This represents an increase of 36 PDPs, or 5%, since 2017, but a reduction of 104 plans, or 12%, since 2016 (Figure 1).

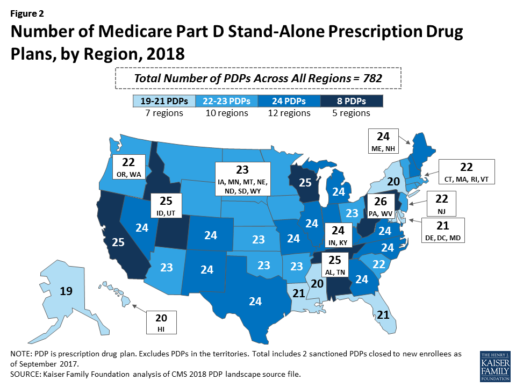

Beneficiaries in each state will continue to have a choice of multiple stand-alone PDPs in 2018, ranging from 19 PDPs in Alaska to 26 PDPs in Pennsylvania/West Virginia (in addition to multiple MA-PD plans offered at the local level) (Figure 2).

Low-Income Subsidy Plan Availability in 2018

Through the Part D Low-Income Subsidy (LIS) program, additional premium and cost-sharing assistance is available for Part D enrollees with low incomes (less than 150% of poverty, or $18,090 for individuals/$24,360 for married couples in 2017) and modest assets (less than $13,820 for individuals/$27,600 for couples in 2017).1

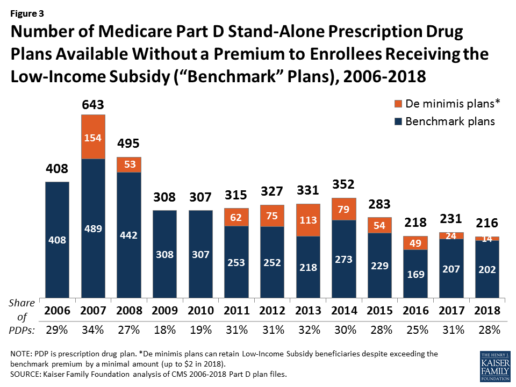

In 2018, 216 plans will be available for enrollment of LIS beneficiaries for no premium, a 6% decrease in premium-free (“benchmark”) plans from 2017 and the lowest number of benchmark plans available since the start of the Part D program in 2006. Roughly 3 in 10 PDPs in 2018 (28%) are benchmark plans (Figure 3).

Low-Income Subsidy Plan Availability in 2018

Through the Part D Low-Income Subsidy (LIS) program, additional premium and cost-sharing assistance is available for Part D enrollees with low incomes (less than 150% of poverty, or $18,090 for individuals/$24,360 for married couples in 2017) and modest assets (less than $13,820 for individuals/$27,600 for couples in 2017).1

In 2018, 216 plans will be available for enrollment of LIS beneficiaries for no premium, a 6% decrease in premium-free (“benchmark”) plans from 2017 and the lowest number of benchmark plans available since the start of the Part D program in 2006. Roughly 3 in 10 PDPs in 2018 (28%) are benchmark plans (Figure 3).

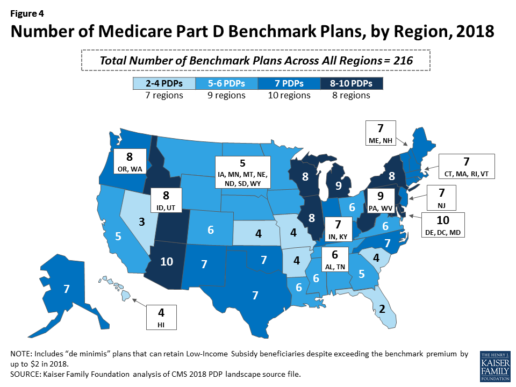

Benchmark plan availability varies at the Part D region level, with most regions seeing a reduction of 1 benchmark plan for 2018 (Figure 4). The number of premium-free plans in 2018 ranges from a low of 2 plans in Florida to 10 plans in Arizona and Delaware/Maryland/Washington D.C.

Part D Plan Premiums and Benefits in 2018

Premiums. According to CMS, the 2018 Part D base beneficiary premium is $35.02, a modest decline of 2% from 2017.2 Actual (unweighted) PDP monthly premiums for 2018 vary across plans and regions, ranging from a low of $12.60 for a PDP available in 12 out of 34 regions to a high of $197 for a PDP in Texas.

Part D enrollees with higher incomes ($85,000/individual; $170,000/couple) pay an income-related monthly premium surcharge, ranging from $13.00 to $74.80 in 2018 (depending on their income level), in addition to the monthly premium for their specific plan.3 According to CMS projections, an estimated 3.3 million Part D enrollees (7%) will pay income-related Part D premiums in 2018.

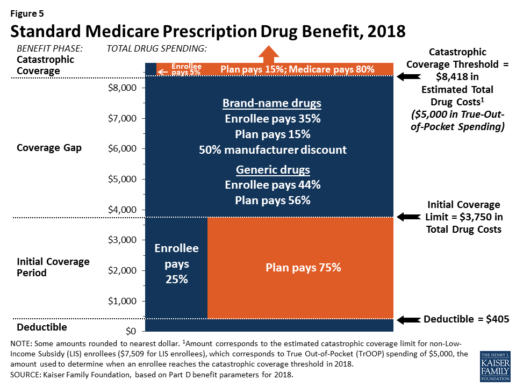

Benefits. In 2018, the Part D standard benefit has a $405 deductible and 25% coinsurance up to an initial coverage limit of $3,750 in total drug costs, followed by a coverage gap. During the gap, enrollees are responsible for a larger share of their total drug costs than in the initial coverage period, until their total out-of-pocket spending in 2018 reaches $5,000 (Figure 5).

After enrollees reach the catastrophic coverage threshold, Medicare pays for most (80%) of their drug costs, plans pay 15%, and enrollees pay either 5% of total drug costs or $3.35/$8.35 for each generic and brand-name drug, respectively.

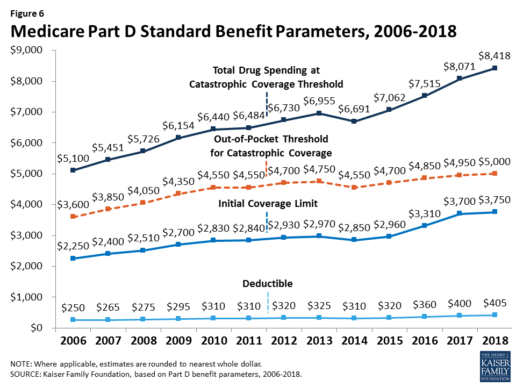

The standard benefit amounts are indexed to change annually by rate of Part D per capita spending growth, and, with the exception of 2014, have increased each year since 2006 (Figure 6).

Part D plans must offer either the defined standard benefit or an alternative equal in value (“actuarially equivalent”), and can also provide enhanced benefits. But plans can (and do) vary in terms of their specific benefit design, cost-sharing amounts, utilization management tools (i.e., prior authorization, quantity limits, and step therapy), and formularies (i.e., covered drugs). Plan formularies must include drug classes covering all disease states, and a minimum of two chemically distinct drugs in each class. Part D plans are required to cover all drugs in six so-called “protected” classes: immunosuppressants, antidepressants, antipsychotics, anticonvulsants, antiretrovirals, and antineoplastics.

In 2018, almost half (46%) of plans will offer basic Part D benefits (although no plans will offer the defined standard benefit), while 54% will offer enhanced benefits, similar to 2017. Most PDPs (63%) will charge a deductible, with 52% of all PDPs charging the full amount ($405). Most plans have shifted to charging tiered copayments or varying coinsurance amounts for covered drugs rather than a uniform 25% coinsurance rate, and a substantial majority of PDPs use specialty tiers for high-cost medications. Two-thirds of PDPs (65%) will not offer additional gap coverage in 2018 beyond what is required under the standard benefit. Additional gap coverage, when offered, has been typically limited to generic drugs only (not brands).

The 2010 Affordable Care Act gradually lowers out-of-pocket costs in the coverage gap by providing enrollees with a 50% manufacturer discount on the total cost of their brand-name drugs filled in the gap and additional plan payments for brands and generics. In 2018, Part D enrollees in plans with no additional gap coverage will pay 35% of the total cost of brands and 44% of the total cost of generics in the gap until they reach the catastrophic coverage threshold. Medicare will phase in additional subsidies for brands and generic drugs, ultimately reducing the beneficiary coinsurance rate in the gap to 25% by 2020.

Part D and Low-Income Subsidy Enrollment

Enrollment in Medicare drug plans is voluntary, with the exception of beneficiaries who are dually eligible for both Medicare and Medicaid and certain other low-income beneficiaries who are automatically enrolled in a PDP if they do not choose a plan on their own. Unless beneficiaries have drug coverage from another source that is at least as good as standard Part D coverage (“creditable coverage”), they face a penalty equal to 1% of the national average premium for each month they delay enrollment.

In 2017, more than 42 million Medicare beneficiaries are enrolled in Medicare Part D plans, including employer-only group plans.4 Of this total, 6 in 10 (60%) are enrolled in stand-alone PDPs and 4 in 10 (40%) are enrolled in Medicare Advantage drug plans. Medicare’s actuaries estimate that around 2 million other beneficiaries in 2017 have drug coverage through employer-sponsored retiree plans where the employer receives subsidies equal to 28% of drug expenses between $405 and $8,350 per retiree in 2018 (up from $400 and $8,250 in 2017).5 Several million beneficiaries are estimated to have other sources of drug coverage, including employer plans for active workers, FEHBP, TRICARE, and Veterans Affairs (VA). Yet an estimated 12% of Medicare beneficiaries lack creditable drug coverage.

Twelve million Part D enrollees are currently receiving the Low-Income Subsidy. Beneficiaries who are dually eligible, QMBs, SLMBs, QIs, and SSI-onlys automatically qualify for the additional assistance, and Medicare automatically enrolls them into PDPs with premiums at or below the regional average (the Low-Income Subsidy benchmark) if they do not choose a plan on their own. Other beneficiaries are subject to both an income and asset test and need to apply for the Low-Income Subsidy through either the Social Security Administration or Medicaid.

Part D Spending and Financing in 2018

The Congressional Budget Office (CBO) estimates that spending on Part D benefits will total $92 billion in 2018, representing 15.5% of net Medicare outlays in 2018 (net of offsetting receipts from premiums and state transfers). Part D spending depends on several factors, including the number of Part D enrollees, their health status and drug use, the number of enrollees receiving the Low-Income Subsidy, and plans’ ability to negotiate discounts (rebates) with drug companies and preferred pricing arrangements with pharmacies, and manage use (e.g., promoting use of generic drugs, prior authorization, step therapy, quantity limits, and mail order). Federal law prohibits the Secretary of Health and Human Services from interfering in drug price negotiations between Part D plan sponsors and drug manufacturers.6

Financing for Part D comes from general revenues (78%), beneficiary premiums (13%), and state contributions (9%). The monthly premium paid by enrollees is set to cover 25.5% of the cost of standard drug coverage. Medicare subsidizes the remaining 74.5%, based on bids submitted by plans for their expected benefit payments. Part D enrollees with higher incomes ($85,000/individual; $170,000/couple) pay a greater share of standard Part D costs, ranging from 35% to 80%, depending on income.

According to Medicare’s actuaries, in 2018, Part D plans are projected to receive average annual direct subsidy payments of $353 per enrollee overall and $2,353 for enrollees receiving the LIS; employers are expected to receive, on average, $623 for retirees in employer-subsidy plans.7 Part D plans’ potential total losses or gains are limited by risk-sharing arrangements with the federal government (“risk corridors”). Plans also receive additional risk-adjusted payments based on the health status of their enrollees and reinsurance payments for very high-cost enrollees.

Under reinsurance, Medicare subsidizes 80% of drug spending incurred by Part D enrollees above the catastrophic coverage threshold. In 2018, average reinsurance payments per enrollee are estimated to be $941; this represents a 7% increase from 2017. Medicare’s reinsurance payments to plans have represented a growing share of total Part D spending, increasing from 16% in 2007 to an estimated 41% in 2018.8 This is due in part to a growing number of Part D enrollees with spending above the catastrophic threshold, resulting from several factors, including the introduction of high-cost specialty drugs, increases in the cost of prescriptions, and a change made by the ACA to count the 50% manufacturer discount in enrollees’ out-of-pocket spending that qualifies them for catastrophic coverage. Analysis from MedPAC also suggests that in recent years, plans have underestimated their enrollees’ expected costs above the catastrophic coverage threshold, resulting in higher reinsurance payments from Medicare to plans over time.

Issues for the Future

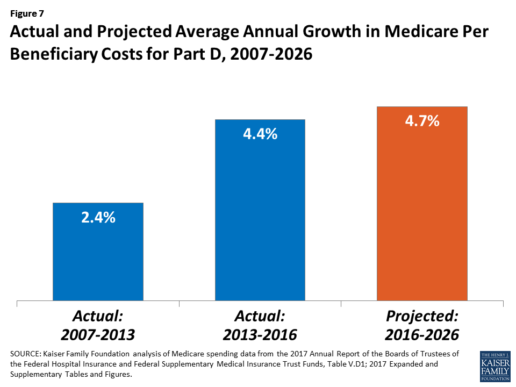

After several years of relatively low growth in prescription drug spending, spending has risen more steeply since 2013. The average annual rate of growth in Part D costs per beneficiary was 2.4% between 2007 and 2013, but it increased to 4.4% between 2013 and 2016, and is projected to increase by 4.7% between 2016 and 2026

(Figure 7).9

Medicare’s actuaries have projected that the Part D per capita growth rate will be comparatively higher in the coming years than in the program’s initial years due to higher costs associated with expensive specialty drugs, which is expected to be reflected in higher reinsurance payments to plans. Between 2017 and 2027, spending on Part D benefits is projected to increase from 15.9% to 17.5% of total Medicare spending (net of offsetting receipts).10 Understanding whether and to what extent private plans are able to negotiate price discounts and rebates will be an important part of ongoing efforts to assess how well plans are able to contain rising drug costs. However, drug-specific rebate information is not disclosed by CMS.

The Medicare drug benefit helps to reduce out-of-pocket drug spending for enrollees, which is especially important to those with modest incomes or very high drug costs. Closing the coverage gap by 2020 will bring additional relief to millions of enrollees with high costs. But with drug spending on the rise and more plans charging coinsurance rather than flat copayments for covered brand-name drugs, enrollees could face higher out-of-pocket costs for their Part D coverage. These trends highlight the importance of comparing plans during the annual enrollment period. Research shows, however, that relatively few people on Medicare have used the annual opportunity to switch Part D plans voluntarily—even though those who do switch often lower their out-of-pocket costs as a result of changing plans.

Understanding how well Part D is working and how well it is meeting the needs of people on Medicare will be informed by ongoing monitoring of the Part D plan marketplace and plan enrollment; assessing coverage and costs for high-cost biologics and other specialty drugs; exploring the relationship between Part D spending and spending on other Medicare-covered services; and evaluating the impact of the drug benefit on Medicare beneficiaries’ out-of-pocket spending and health outcomes.

Endnotes

- Poverty and resource levels for 2018 are not yet available (as of September 2017).

- The base beneficiary premium is equal to the product of the beneficiary premium percentage and the national average monthly bid amount (which is an enrollment-weighted average of bids submitted by both PDPs and MA-PD plans). Centers for Medicare & Medicaid Services, “Annual Release of Part D National Average Bid Amount and Other Part C & D Bid Information,” July 31, 2017, available at https://www.cms.gov/Medicare/Health-Plans/MedicareAdvtgSpecRateStats/Downloads/PartDandMABenchmarks2018.pdf.

- Higher-income Part D enrollees also pay higher monthly Part B premiums.

- Centers for Medicare & Medicaid Services, Medicare Advantage, Cost, PACE, Demo, and Prescription Drug Plan Contract Report – Monthly Summary Report (Data as of August 2017).

- Board of Trustees, 2017 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, Table IV.B7, available at https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/ReportsTrustFunds/Downloads/TR2017.pdf.

- Social Security Act, Section 1860D-11(i).

- 2017 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds; Table IV.B9.

- Kaiser Family Foundation analysis of aggregate Part D reimbursement amounts from Table IV.B10, 2017 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds.

- Kaiser Family Foundation analysis of Part D average per beneficiary costs from Table V.D1, 2017 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds.

- Kaiser Family Foundation analysis of Part D benefits spending as a share of net Medicare outlays (total mandatory and discretionary outlays minus offsetting receipts) from CBO, Medicare-Congressional Budget Office’s June 2017 Baseline.

Read the full article here.

Source:

Kaiser Family Foundation (2 October 2017). “The Medicare Part D Prescription Drug Benefit” [Web Blog Post]. Retrieved from address https://www.kff.org/medicare/fact-sheet/the-medicare-prescription-drug-benefit-fact-sheet/#26740

Apple, Fitbit to join FDA program to speed health tech

Wondering how technology can speed the process of developing health tech? In this article from BenefitsPro written by Anna Edney, gain a close insight on how Apple and Fitbit are working together with the FDA to make your health of vital importance.

You can read the original article here.

A federal agency that regulates apples wants to make regulations on Apple Inc. a little easier.

The Food and Drug Administration, which oversees new drugs, medical devices and much of the U.S. food supply, said Tuesday that it had selected nine major tech companies for a pilot program that may let them avoid some regulations that have tied up developers working on health software and products.

“We need to modernize our regulatory framework so that it matches the kind of innovation we’re being asked to evaluate,” FDA Commissioner Scott Gottlieb said in a statement.

The program is meant to let the companies get products pre-cleared rather than going through the agency’s standard application and approval process that can take months. Along with Apple, Fitbit Inc., Samsung Electronics Co., Verily Life Sciences, Johnson & Johnson and Roche Holding AG will participate.

A new report and video from the Health Enhancement Research Organization (HERO) identifies six promising practices for effectively integrating wearables...

The FDA program is meant to help the companies more rapidly develop new products while maintaining some government oversight of technology that may be used by patients or their doctors to prevent, diagnose and treat conditions.

Apple is studying whether its watch can detect heart abnormalities. The process it will go through to make sure it’s using sound quality metrics and other measures won’t be as costly and time-consuming as when the government clears a new pacemaker, for example. Verily, the life sciences arm of Google parent Alphabet Inc., is working with Novartis AG to develop a contact lens that could continuously monitor the body’s blood sugar.

Faster Pace

“Historically, health care has been slow to implement disruptive technology tools that have transformed other areas of commerce and daily life,” Gottlieb said in July when he announced that digital health manufacturers could apply for the pilot program.

Officially dubbed the Pre-Cert for Software Pilot, Gottlieb at the time called it “a new and pragmatic approach to digital health technology.”

The other companies included in the pilot are Pear Therapeutics Inc., Phosphorus Inc. and Tidepool.

The program is part of a broader move at the FDA, particularly since Gottlieb took over in May, to streamline regulation and get medical products to patients faster. The commissioner said last week the agency will clarify how drugmakers might use data from treatments already approved in some disease to gain approvals for more conditions. In July, he delayed oversight of electronic cigarettes while the agency decides what information it will need from makers of the products.

Rules Uncertainty

As Silicon Valley developers have pushed into health care, the industry has been at times uncertain about when it needed the FDA’s approval. In 2013, the consumer gene-testing company 23andMe Inc. was ordered by the agency to temporarily stop selling its health analysis product until it was cleared by regulators, for example.

Under the pilot, the FDA will scrutinize digital health companies’ software and will inspect their facilities to ensure they meet quality standards and can adequately track their products once they’re on the market. If they pass the agency’s audits, the companies would be pre-certified and may face a less stringent approval process or not have to go through FDA approval at all.

More than 100 companies were interested in the pilot, according to the FDA. The agency plans to hold a public workshop on the program in January to help developers not in the pilot understand the process and four months of initial findings.

You can read the original article here.

Source:

Edeny A. (27 September 2017). "Apple, Fitbit to join FDA program to speed health tech" [Web Blog Post]. Retrieved from address https://www.benefitspro.com/2017/09/27/apple-fitbit-to-join-fda-program-to-speed-health-t

Absent federal action, states take the lead on curbing drug costs

What's your state's stance on the cost of prescription drugs? See how Maryland has moved forward in their decision making for drug prices, giving themselves the ability to say "no" in this article from Benefits Pro written by Shefali Luthra.

You can read the original article here.

Lawmakers in Maryland are daring to legislate where their federal counterparts have not: As of Oct. 1, the state will be able to say “no” to some pharmaceutical price spikes.

A new law, which focuses on generic and off-patent drugs, empowers the state’s attorney general to step in if a drug’s price climbs 50 percent or more in a single year. The company must justify the hike. If the attorney general still finds the increase unwarranted, he or she can file suit in state court. Manufacturers face a fine of up to $10,000 for price gouging.

As Congress stalls on what voters say is a top health concern — high pharmaceutical costs — states increasingly are tackling the issue. Despite often-fierce industry opposition, a variety of bills are working their way through state governments. California, Nevada and New York are among those joining Maryland in passing legislation meant to undercut skyrocketing drug prices.

Maryland, though, is the first to penalize drugmakers for price hikes. Its law passed May 26 without the governor’s signature.

The state-level momentum raises the possibility that — as happened with hot-button issues such as gay marriage and smoke-free buildings — a patchwork of bills across the country could pave the way for more comprehensive national action. States feel the squeeze of these steep price tags in Medicaid and state employee benefit programs, and that applies pressure to find solutions.

“There is a noticeable uptick among state legislatures and state governments in terms of what kind of role states can play in addressing the cost of prescription drugs and access,” said Richard Cauchi, health program director at the National Conference of State Legislatures.

Many experts frame Maryland’s law as a test case that could help define what powers states have and what limits they face in doing battle with the pharmaceutical industry.

The generic-drug industry has already filed a lawsuit to block the law, arguing it’s unconstitutionally vague and an overreach of state powers. A district court is expected to rule soon.

The state-level actions focus on a variety of tactics:

“Transparency bills” would require pharmaceutical companies to detail a drug’s production and advertising costs when they raise prices over certain thresholds. Cost-limit measures would cap drug prices charged by drugmakers to Medicaid or other state-run programs, or limit what the state will pay for drugs. Supply-chain restrictions include regulating the roles of pharmacy benefit managers or limiting a consumer’s out-of-pocket costs.

A New York law on the books since spring allows officials to cap what its Medicaid program will pay for medications. If companies don’t sufficiently discount a drug, a state review will assess whether the price is out of step with medical value.

Maryland’s measure goes further — treating price gouging as a civil offense and taking alleged violators to court.

“It’s a really innovative approach. States are looking at how to replicate it, and how to expand on it,” said Ellen Albritton, a senior policy analyst at the left-leaning Families USA, which has consulted with states including Maryland on such policies.

Lawmakers have introduced similar legislation in states such as Massachusetts, Rhode Island, Tennessee and Montana. And in Ohio voters are weighing a ballot initiative in November that would limit what the state pays for prescription drugs in its Medicaid program and other state health plans.

Meanwhile, the California legislature passed a bill earlier in September that would require drugmakers to disclose when they are about to raise a price more than 16 percent over two years and justify the hike. It awaits Democratic Gov. Jerry Brown’s signature.

In June, Nevada lawmakers approved a law similar to California’s but limited to insulin prices. Vermont passed a transparency law in 2016 that would scrutinize up to 15 drugs for which the state spends “significant health care dollars” and prices had climbed by set amounts in recent years.

But states face a steep uphill climb in passing pricing legislation given the deep-pocketed pharmaceutical industry, which can finance strong opposition, whether through lobbying, legal action or advertising campaigns.

Last fall, voters rejected a California initiative that would have capped what the state pays for drugs — much like the Ohio measure under consideration. Industry groups spent more than $100 million to defeat it, putting it among California’s all-time most expensive ballot fights. Ohio’s measure is attracting similar heat, with drug companies outspending opponents about 5-to-1.

States also face policy challenges and limits to their statutory authority, which is why several have focused their efforts on specific parts of the drug-pricing pipeline.

Critics see these tailored initiatives as falling short or opening other loopholes. Requiring companies to report prices past a certain threshold, for example, might encourage them to consistently set prices just below that level.

Maryland’s law is noteworthy because it includes a fine for drugmakers if price increases are deemed excessive — though in the industry that $10,000 fine is likely nominal, suggested Rachel Sachs, an associate law professor at Washington University in St. Louis who researches drug regulations.

This law also doesn’t address the trickier policy question: a drug’s initial price tag, noted Rena Conti, an assistant professor in the University of Chicago who studies pharmaceutical economics.

And its focus on generics means that branded drugs, such as Mylan’s Epi-Pen or Kaleo’s overdose-reversing Evzio, wouldn’t be affected.

Yet there’s a good reason for this, noted Jeremy Greene, a professor of medicine and the history of medicine at Johns Hopkins University who is in favor of Maryland’s law.

Current interpretation of federal patent law suggests that the issues related to the development and affordability of on-patent drugs are under federal jurisdiction, outside the purview of states, he explained.

In Maryland, “the law was drafted narrowly to address specifically a problem we’ve only become aware of in recent years,” he said. That’s the high cost of older, off-patent drugs that face little market competition. “Here’s where the state of Maryland is trying to do something,” he said.

Still, a ruling against the state in the pending court case could have a chilling effect for other states, Sachs said, although it would be unlikely to quash their efforts.

“This is continuing to be a topic of discussion, and a problem for consumers,” said Sachs.

“At some point, some of these laws are going to go into effect — or the federal government is going to do something,” she added.

Kaiser Health News, a nonprofit health newsroom whose stories appear in news outlets nationwide, is an editorially independent part of the Kaiser Family Foundation. KHN’s coverage of prescription drug development, costs and pricing is supported in part by the Laura and John Arnold Foundation.

Source:

Luther S. (29 September 2017). "Absent federal action, states take the lead on curbing drug costs" [Web Blog Post]. Retrieved from address https://www.benefitspro.com/2017/09/29/absent-federal-action-states-take-the-lead-on-curb?page=2

Why Employee Engagement Matters – and 4 Ways to Build It Up

An engaged employee is a productive employee. Employee engagement is a very important piece of a company's operations. They are some of the best assets a company can have and without engaged employees, your company's operations could be negatively impacted. Take a look at this great article by Joe Wedgewood from The Happiness Index and check out some of the helpful tips on how you can boost engagement across your organization.

Organizations with high employee engagement levels outperform their low engagement counterparts in total shareholder returns and higher annual net income.” — Kenexa.

Your people are undoubtedly your greatest asset. You may have the best product in the world, but if you can’t keep them engaged and motivated — then it counts for very little.

By making efforts to keep your people engaged, you will maximize your human capital investment and witness your efforts being repaid exponentially.

The benefits of an engaged workforce

Increase in profitability:

“Increasing employee engagement investments by 10% can increase profits by $2,400 per employee, per year.” — Workplace Research Foundation.

There is a wealth of research to suggest that companies that focus on employee engagement will have an emotionally invested and committed workforce. This tends to result in higher profitability rates and shareholder returns. The more engaged your employees are the more efficient and productive they become. This will help lower operating costs and increase profit margins.

An engaged workforce will be more committed and driven to help your business succeed. By focusing on engagement and investing in your people’s future, you will create a workforce that will generate more income for your business.

Improved retention and recruitment rates:

“Replacing employees who leave can cost up to 150% of the departing employee’s salary. Highly engaged organizations have the potential to reduce staff turnover by 87%; the disengaged are four times more likely to leave the organization than the average employee.” — Corporate Leadership Council

Retaining good employees is vital for organizational success. Engaged employees are much less likely to leave, as they will be committed to their work and invested in the success of the company. They will have an increased chance of attracting more qualified people.

Ultimately the more engaged your people are, the higher their productivity and workplace satisfaction will be. This will significantly reduce costs around absences, recruitment, training and time lost for interviews and onboarding.

Boost in workplace happiness:

“Happy employees are 12%t more productive than the norm, and 22% more productive than their unhappy peers. Creating a pleasant workplace full of happy people contributes directly to the bottom line.” – Inc.

Engaged employees are happy employees, and happy employees are productive employees. A clear focus on workplace happiness, will help you to unlock everyone’s true potential. On top of this, an engaged and happy workforce can also become loyal advocates for your company. This is evidenced by the Corporate Leadership Council, “67% of engaged employees were happy to advocate their organizations compared to only 3% of the disengaged.”

Higher levels of productivity:

“Employees with the highest levels of commitment perform 20% better than employees with lower levels of commitment.” — The Society for Human Resource Management (SHRM).

Often your most engaged people will be the most dedicated and productive, which will give your bottom line a positive boost. Employees who are engaged with their role and align with the culture are more productive as they are looking beyond personal benefits. Put simply, they will work with the overall success of the organization in mind and performance will increase.

More innovation:

“Employee engagement plays a central role in translating additional job resources into innovative work behaviour.” — J.J. Hakanen.

Employee engagement and innovation are closely linked. Disengaged employees will not have the desire to work innovatively and think of new ways to improve your business; whereas an engaged workforce will perform at a higher level, due to increased levels of satisfaction and interest in their role. This often breeds creativity and innovation.

If your people are highly engaged they will be emotionally invested in your business. This can result in them making efforts to share ideas and innovations with you that can lead to the creation of new services and products — thus improving employee profitability.

Strategies to increase employee engagement

Communicate regularly:

Every member of your team will have valuable insights, feedback and suggestions. Many will have concerns and frustrations too. Failure to effectively listen and respond to everyone will lower their engagement and negatively affect the company culture.

Create open lines of communication and ensure everyone knows how to contact you. This will create a platform for your people to share ideas, innovations and concerns with you. It will also bridge gaps between senior management and the rest of the team.

An effective way to communicate and respond to everyone in real-time is by introducing pulse surveys — which will allow you to gather instant intelligence on your people to help you understand the sentiment of your organization. You can use this feedback to create relevant action plans to boost engagement and make smarter business decisions.

Take the time to respond and share action plans with everyone. This will ensure your people know that their feedback is being heard and can really make a difference.

Recognize achievements:

“The engagement level of employees who receive recognition is almost three times higher than the engagement level of those who do not.” — IBM Smarter Workforce Institute.

If your people feel undervalued or unappreciated then their performance and profitability will decrease. According to a survey conducted by technology company Badgeville, only 31% of employees are most motivated by monetary awards. The remaining 69% of employees are motivated by job satisfaction, recognition and learning opportunities.

Make efforts to celebrate good work and recognize everyone’s input. Take the time to personally congratulate people and honor their achievements and hard work. You will likely be rewarded with an engaged and energized workforce, that will make efforts to impress you and have their efforts recognized.

Provide opportunities for growth:

Career development is key for employee engagement. If your people feel like their careers are stagnating, or their hard work and emotional investment aren’t being reciprocated — then you can be certain that engagement will drop.

By meeting with your people regularly, discussing agreed targets and time frames, and clearly highlighting how they fit into the organizations wider plans, you can build a “road map” for their future. This will show that their efforts and hard work aren’t going unnoticed.

Improve company culture:

“Customers will never love a company until the employees love it first.” — Simon Sinek.

Building a culture that reflects your brand and creates a fun and productive working environment is one of the most effective ways to keep your employees engaged. It’ll also boost retention and help recruitment efforts. If your culture motivates everyone to work hard, help each other, become brand ambassadors, and even keep the place clean — then you have won the battle.

An engaged and committed workforce is a huge contributor to any organization’s bottom line. The rightculture will be a catalyst to help you achieve this.

Here’s how you can improve the company culture within your organization:

- Empower your people: Empowered employees will take ownership of their responsibilities, solve problems and do whatever it takes to help your company succeed. This will drive your company culture forward. Demonstrate you have faith in your people and trust them to fulfill their duties to their best of their abilities. This will ensure they feel valued, which can lead to empowerment.

- Manage and communicate expectations: Your people may struggle to understand your cultural vision. By setting clear and regular expectations and communicating your vision via posters, emails, discussions and leading by example, you will prevent confusion and limit deviation from your desired vision.

- Be consistent: To sustain a consistent culture, you must show uniformity with your actions and communications. Make efforts to have consistent expectations and standards for all your workers, and communicate everything in the same way.

By focusing on employee engagement and investing in your people, they will repay your efforts with an increase in performance, productivity and — ultimately — profit.

See the original article Here.

Source:

Wedgewood J. (2017 June 8). Why employee engagement matters - and 4 ways to build it up [Web blog post]. Retrieved from address https://www.hrmorning.com/employee-engagement-ways-to-build-it-up/

How Health Coaching can Revitalize a Workforce

Do you need help revitalizing your workforce? Check out this great column by Paul Turner from Employee Benefit Advisor and see how health coaching can be a great way to increase engagement and productivity among your employees.

Nearly 50% of Americans live with at least one chronic illness, and millions more have lifestyle habits that increase their risk of health problems in the future, according to the Centers for Disease Control and Prevention. Type 2 diabetes, cardiovascular disease, cancer, pulmonary disease and other conditions account for more than 75% of the $2 trillion spent annually on medical care in the U.S.

Employers have a stake in improving on these discouraging statistics. People spend a good portion of their lives at work, where good health habits can be cultivated and then integrated into their personal lives. While chronic diseases often can’t be cured, many risk factors can be mitigated with good health behaviors, positive and consistent lifestyle habits and adherence to medication and treatment plans. Moreover, healthy behaviors — like smoking cessation, weight management, and exercise — can help prevent people from developing a chronic disease in the first place.

Companies that sponsor well-being programs realize the benefits of a healthier and more vital employee population, with lower rates of absenteeism and improved productivity. Investing in such programs can yield a significant return — particularly from condition management programs for costly chronic diseases.

Digitally-based well-being programs in particular are powerful motivators to adopt healthy behaviors. Yet for many employees, dealing with difficult health challenges can be daunting and digital wellness tools may not offer them sufficient support. Combining these health technologies with the skill and support of a health coach, however, can be a winning approach for greater workplace well-being. The benefits of coaching can also extend to employees that are currently healthy. People without a known condition may still struggle with stress, sleep issues, and lack of exercise, and the guidance of a coach can address risk factors and help prevent future health problems.

Choosing a health coach

Coaching is an investment, and the more rigor that employers put into the selection of a coaching team, the better the results. Coaches should be a credentialed Certified Health Education Specialist or a healthcare professional, such as a registered nurse or dietician, who is extensively trained in motivational interviewing. It also helps when a coach has a specialty accreditation in an area such as nutrition, exercise physiology, mental health or diabetes management. Such training allows the coach to respond effectively to highly individualized needs.

This sort of personalization is essential. A good coach will recognize that each wellness program participant is motivated by a different set of desires and rewards and is undermined by their own unique combination of doubts, fears and temptations. They build trust and confidence by helping employees identify the emotional triggers that may lead them to overeat, smoke or fail to stick with their treatment plans and healthy lifestyle behaviors.

What works for one employee, does not work for another. A 50-year-old trying to quit smoking may need the personal touch of a meeting or phone conversation to connect with her coach; a 30-year-old focused on stress management might prefer email or texting. It’s important for the coaching team to accommodate these preferences.

Working with our employer clients, WebMD has seen what rigorous coaching can achieve:

· A 54% quit rate for participants in a 12-week smoking-cessation program

· Successful weight loss for 68% of those who joined a weight-management program

· A nearly 33% reduction in known health risks for relatively healthy employees in a lifestyle coaching program

· A corresponding 28% health risk reduction for employees with a known condition who received condition management coaching.

Coaching is more likely to succeed when it is part of a comprehensive wellness program carried out in an environment where employee well-being is clearly emphasized by the employer and its managers. WebMD popularizes the saying that ‘When the coach is in, everybody wins.’ Qualified health coaching may be the missing ingredient that helps an employer achieve its well-being goals and energize its workforce.

See the original article Here.

Source:

Turner P. (2017 July 27). How health coaching can revitalize a workforce [Web blog post]. Retrieved from address https://www.employeebenefitadviser.com/opinion/how-health-coaching-can-revitalize-a-workforce?feed=00000152-1387-d1cc-a5fa-7fffaf8f0000