‘Eye’ spy a savings opportunity for health and vision benefits

The National Eye Institute reported that 61 million adults are at high risk for serious vision loss. Conventionally, vision benefits were offered as an elective, with coverage is focusing on vision tests or discounts for corrective eyewear. Read the following blog post to learn more about vision benefits.

Sixty-one million adults are at high risk for serious vision loss, according to the National Eye Institute, but most U.S. employers don’t include eye care as part of their benefits package. Vision benefits have traditionally been offered as an elective, where coverage is focused on vision tests or discounts for corrective eyewear.

This often results in inadequate coverage for employees and dependents, which can result in unrecognized and untreated issues that impact employee health and productivity, as well as an employer’s bottom line.

Comprehensive eye exams are recommended for adults under the age of 65 at least every two years, according to the American Optometric Association (AOA). These exams are the only way a doctor can detect signs and symptoms of serious conditions without cutting into or scanning body parts.

The total economic burden of eye disorders and vision loss in the U.S. was $139 billion in 2013, which includes $65 billion in direct medical costs strictly due to eye disorders and low vision. Loss of vision among workers results in $48 billion in lost productivity per year.

When it comes to benefit management priorities employers often focus more on chronic condition management. Yet, eye health is often linked to common chronic conditions including diabetes and hypertension. Without early detection of eye and vision health issues, employees cannot properly manage these conditions. Delaying medical treatment can lead to increased absenteeism and reduced productivity, eventually resulting in treatment that comes too late, and at a much higher price tag for employers, employees and family members.

About 68% of Americans with diabetes have been diagnosed with eye complications, many of which could have been prevented through a comprehensive eye exam. Diabetes is the leading cause of blindness among adults, according to the National Institutes of Health. Its prevalence is increasing as one in 10 people worldwide may be affected by 2040, according to research from the International Diabetes Federation.

Nearly half of Americans don’t know that diabetic eye diseases have visible symptoms, according to a 2018 AOA survey. More than one-third of respondents didn’t know a comprehensive eye exam is the only way to determine if a person’s diabetes will cause blindness. These exams, considered the gold standard in clinical vision care, should be covered under the employees’ medical benefits.

Three years ago the Midwest Business Group on Health began a collaboration with the AOA to better understand how employers think about and implement eye health and vision benefits. As part of this partnership, a no-cost eye care benefits toolkit was developed to support employers in evaluating their current eye health and vision care benefits to:

- Understand the importance of early detection so that employees can effectively manage chronic and more serious conditions

- Recognize how to integrate primary and preventive eye care into an overall medical benefit design

- Educate employees on the importance of periodic eye examinations

It’s important that employers better understand the impact of vision care benefits, including lower costs, better employee health, improved job satisfaction, better employee quality of life, and work productivity.

SOURCE: Larson, C. (20 September 2019) "‘Eye’ spy a savings opportunity for health and vision benefits" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/vision-loss-resulting-in-billions-in-lost-productivity

6 voluntary benefits your employees want

Multigenerational workforces are no longer finding the run-of-the-mill benefits plans adequate. This is making voluntary benefits more important than ever in this age of the multigenerational workforce and a tight labor market. Read this blog post from for six voluntary benefits employees want.

In this age of the multigenerational workforce and a tight labor market, a one-size-fits-all group benefits model with medical, prescription, dental, vision and a retirement plan just doesn’t cut it. A workforce with Baby Boomers, Gen X’ers, Millennials and Generation Z means that employees are going to find the run-of-the-mill benefits plan inadequate. Ditto for job seekers.

What follows is that voluntary benefits are more important than ever. Offering a range of voluntary benefits can help meet the needs of employees at all life stages.

Voluntary benefits add value to benefit plans and are typically easy to administer. They’re low-to-no-cost because employees pay for them, and maintenance is often handled through a payroll deduction. Many voluntary benefits also offer guaranteed acceptance at a lower rate than medical benefits, so even if a small group within your company chooses a particular benefit, they’ll be covered.

This landscape is changing quickly. Here are six trending voluntary benefits your employees want.

Student loan debt repayment assistance

Debt among college graduates has grown to nearly $1.6 trillion. It’s preventing the largest employee segment at most companies from buying houses or cars, saving for retirement, having kids and getting married. To help employees repay their student loan debt, some employers are helping employees pay down student loan debt through a direct payroll deduction.

Others are offering a new, IRS-allowable retirement plan match swap where an employer can opt to increase its defined contribution match, enabling employees to reduce their retirement match and contribute funds to repaying student loans instead.

Interest in this benefit continues to grow. Employers looking to offer student loan debt repayment should be aware that not all platforms are created equal. Look out for high per-employee, per-month fees.

Individual long-term care

A growing number of people are beginning to understand the value of long-term care insurance because they have taken care of or currently care for a friend or relative who needs round-the-clock care. Long-term care insurance covers home or institutional care if a person is no longer able to perform at least two activities of daily living--eating, bathing, dressing, moving from a bed to a chair or using a toilet.

Employees are interested in buying long-term care insurance through their employer because they can offer better rates for simplified issue plans. If you plan to offer long-term care as an employer-sponsored benefit, I recommended rolling it out with a strategic project plan and a benefit counselor or a technology platform capable of providing decision-making tools for a smooth application process.

Executive reimbursement plans

Employee retention — especially executive retention — is on the minds of many employers in the midst of this thriving economy. Filling gaps in medical and prescription coverage is one way to provide executive teams with premium benefits they may be looking for.

Executive reimbursement plans provide reimbursement for out-of-pocket expenses, access to facilities and level of service not normally covered under most group health plans. Rather than simply increasing compensation to help cover out-of-pocket expenses, premiums for these plans are tax-deductible for the employer, and benefits are non-taxable for employees.

Executive individual disability insurance

Traditional employer-sponsored long-term disability (LTD) is likely not enough coverage for highly-compensated employees or some sales staff who depends heavily on commission and bonuses. Normally, LTD pays employees 50-70% of their salary up to a certain amount.

Employers can carve out additional coverage for employees based on their management level, performance or tenure. Individual disability insurance plans can protect employees until they turn 65; they can also protect job titles or levels until employees are well enough to return to work. Executive individual disability insurance, like executive reimbursement, can be offered as a form of compensation, or a form of financial asset protection for higher incomes.

Telemedicine

The rise of consumer-driven health plans has led to the need for telemedicine. Telemedicine provides a way for employees to see a physician or provider by video and get a diagnosis and/or prescription quickly. The success of telemedicine is leading some carriers to integrate it within their plan. However, standalones still exist and can provide employees with an easy way to get care faster and cheaper than before.

Pet Insurance

Pet parents spend nearly $70 billion on veterinarian costs for their pets, but just 10% of dogs and 5% of cats are covered by medical insurance. As pets begin to play a larger role in our lives, more employers are offering pet insurance to their employees to help defray the cost of unexpected medical expenses.

There are a number of plan options, and setting up a plan for employees’ pets is simple. However, it’s vital that employers do their research to ensure the veterinarian network includes the best vets.

As part of a voluntary benefit offering, be sure to develop a rollout strategy and communications plan so employees are thoroughly educated and you meet group minimums.

SOURCE: Park, N. (25 September 2019) "6 voluntary benefits your employees want" (Web Blog Post). Retrieved from https://www.benefitnews.com/list/6-voluntary-benefits-your-employees-want

4 pitfalls of paid leave and how clients can avoid them

Employers are using paid leave options to help boost their employee benefits packages in efforts to better attract and retain talent. Read the following blog post from Employee Benefit Advisor for 4 common pitfalls of paid leave and how employers can avoid them.

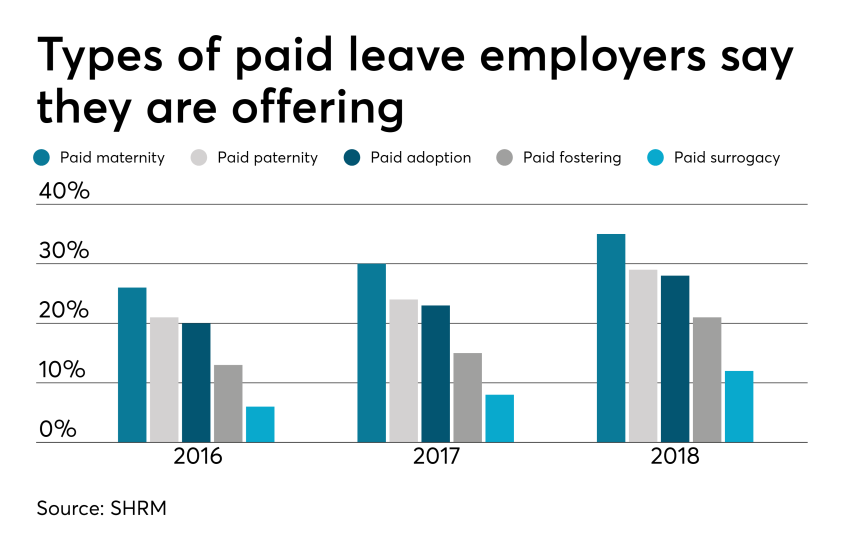

Smart employers are boosting their benefits packages with paid family leave — the most coveted work perk among all generations. In today’s low unemployment environment, paid leave benefits can be a huge differentiator in attracting and retaining talent.

Smart employers are boosting their benefits packages with paid family leave — the most coveted work perk among all generations. In today’s low unemployment environment, paid leave benefits can be a huge differentiator in attracting and retaining talent.

But some employers are getting themselves into trouble in the process, facing accusations of gender discrimination or improper use of leave.

Here are four potential pitfalls of paid leave, and how employers can avoid them.

1. Be careful what you call “maternity leave.”

Employers have long been granting leave for new moms in the form of disability coverage. In fact, the top cause of short term disability is pregnancy. Disability insurance usually grants new moms six to eight weeks of paid leave to recover from childbirth.

Because this coverage applies to the medical condition of recovering from childbirth, it shouldn’t be lumped in with bonding leave.

Guidance from the Equal Employment Opportunity Commission says leave granted for new moms for bonding must also be extended to new dads, so separating disability leave from bonding leave is crucial to avoiding gender discrimination.

2. Don’t make gender assumptions.

The amount of bonding time for new parents after birth, adoption or fostering must be granted equally for men and women. Companies that don’t provide the same amount of paid leave for men and women may find themselves in a discrimination lawsuit.

It’s not just the time away from work that matters, but also the return-to-work support provided. If new moms are granted temporary or modified work schedules to ease the transition back to work, new dads must also have access to this.

Some companies may choose to differentiate the amount of leave and return-to-work support for primary or secondary caregivers. That’s compliant as long as assumptions aren’t made on which gender is the primary or secondary caregiver.

The best way to avoid potential gender discrimination pitfalls is to keep all parental bonding and related return-to-work policies gender neutral.

3. Avoid assuming the length of disability.

Be careful about assuming the length of time a new mom is disabled, or recovering medically, after birth. Typical coverage policies allot six to eight weeks of recovery for a normal pregnancy, so assuming a new mom may be out for 10 weeks might be overestimating the medical recovery time, and under-representing the bonding time, which must be gender neutral.

4. Keep up with federal, state and local laws.

Mandated leave laws are ever-evolving, so employers should consistently cross-check their policies with state and local laws. For instance, do local paid leave laws treat adoption the same as birth? Are multistate employers compliant? What if an employee lives in one state but works in another: Which state’s leave policies take precedence?

Partnering with a paid leave service provider can mitigate the risk of improperly administering leave. Paid leave experts can help answer questions, review guidelines and provide information regarding job-protecting medical or family leave.

They can also help flag potential pitfalls, ensuring leave requests from all areas of your company are managed uniformly and in accordance with state and federal laws, including the EEOC.

SOURCE: Bennett, A. (12 September 2019) "4 pitfalls of paid leave and how clients can avoid them" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/list/4-pitfalls-of-paid-leave-and-how-clients-can-avoid-them

A 401(k) plan administrators’ guide to the recent IRS revenue ruling

The IRS recently released a new revenue ruling that provides 401(k) plan administrators with helpful guidance on reporting and withholding from 401(k) plan distributions. Read the blog post below to learn more about this new ruling.

The IRS recently issued revenue ruling 2019-19. The revenue ruling provides 401(k) plan administrators with helpful guidance on how to report and withhold from 401(k) plan distributions when a plan participant actually receives the distribution but for some reason, does not cash the check.

Unfortunately, this new guidance does not provide answers to the complex issues that 401(k) plan administrators face when the plan must make a distribution, but the plan participant is missing.

Let’s hope revenue ruling 2019-19 is just the first in a series of much-needed guidance from the IRS and the Department of Labor about how 401(k) plan administrators should handle the increasingly common administrative issues related to uncashed checks and missing plan participants.

There are many situations in which a 401(k) plan must make a distribution to a plan participant. For example, plans must distribute small benefit cash outs (e.g., account balances that are $1,000 or less) or required minimum distributions to plan participants who reach age 70 and a half. This may come as a surprise, but plan participants fail to actually cash these checks with some regularity.

In the ruling, the IRS confirmed that 401(k) plan administrators should withhold taxes on a 401(k) plan distribution and report the distribution on a Form 1099-R in the year the check is distributed to the participant, even if the participant does not cash the check until a later year.

Similarly, the participant needs to include the plan distribution as taxable income in the year in which the plan makes the distribution even if the participant fails to cash the check until a later year. While this guidance is not surprising, it does provide clarity to 401(k) plan administrators as to how they must withhold and report normal course and required plan distributions. In particular, 401(k) plan administrators should not reverse the tax withholding or reporting of the distribution when the participant receives the distribution and simply does not cash the check until a later year.

Unfortunately, this new IRS guidance has limited use because the ruling uses an example that specifically concedes that the plan participant actually received the plan distribution check, but simply failed to cash it. What should 401(k) plan administrators do when the participant may not have received the distribution check at all (e.g., a check is returned for an invalid address) or the plan itself does not have current contact information for the participant?

Retirement plan administrators have an ERISA fiduciary obligation to implement a diligent and prudent process to find missing plan participants and to take additional steps to make sure participants actually receive plan distributions. Uncashed 401(k) plan distribution checks are still retirement plan assets which means the 401(k) plan administrator is still subject to ERISA fiduciary standards of care, prudence and diligence related to those amounts. As a result, the IRS and DOL have increased their focus on uncashed checks and missing participants in retirement plan audits.

Plan administrators would be well-served by establishing and implementing a consistent process to stay on top of any missing plan participants or uncashed checks and taking steps to locate those participants and properly address uncashed checks. Plan administrators should also carefully document the steps that they take in this regard. The IRS and DOL have currently provided limited guidance on the steps a 401(k) plan administrator can take to locate missing participants, but more guidance is needed — let’s hope revenue ruling 2019-19 is just the beginning.

This article originally appeared on the Foley & Lardner website. The information in this legal alert is for educational purposes only and should not be taken as specific legal advice.

SOURCE: Dreyfus Bardunias, K. (6 September 2019) "A 401(k) plan administrators’ guide to the recent IRS revenue ruling" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/401k-administrators-guide-to-the-irs-revenue-ruling-2019-19

Employers look to virtual services to curb rising health costs

Employers are looking for ways to stem the rising costs of healthcare and find ways to better engage employees. According to the National Business Group on Health, 64 percent of employers believe virtual care will play a significant role in healthcare delivery. Read this blog post to learn more about virtual services.

WASHINGTON — With the continued cost of healthcare benefits expected to increase by another 5%, topping $15,000 per employee, employers are looking for ways to stem the increase and better engage employees in holistic well-being.

One of those ways is through virtual care. The number of employers who believe virtual care will play a significant role in how healthcare is delivered in the future continues to grow, up to 64% going into 2020 from 52% in 2019, according to the National Business Group on Health’s annual healthcare strategy survey.

“Virtual care solutions bring healthcare to the consumer rather than the consumer to healthcare,” Brian Marcotte, president and CEO of NBGH said at a press briefing Tuesday. “They continue to gain momentum as employers seek different ways to deliver cost-effective, quality healthcare while improving access and the consumer experience. Of particular note is the growing interest among employers to offer virtual care for mental health as well as musculoskeletal conditions.”

The majority of respondents (51%) will offer more virtual care programs next year, according to the survey. Nearly all employers will offer telehealth for minor, acute services while 82% will offer virtual mental health services — a figure that’s expected to grow to 95% by 2022.

Virtual care for musculoskeletal management shows the greatest potential for growth, the study noted. While 23% of employers will offer musculoskeletal management virtual services next year, another 38% are considering it by 2022. Physical therapy is the best way to address musculoskeletal conditions and help avoid surgery, but it can be inconvenient and costly, said Ellen Kelsay, chief strategy officer at NBGH.

“Where we’ve seen a lot of development in areas of virtual solutions is to provide remote physical therapy treatments,” she said. “Employees can access treatment through their virtual app wherever it’s convenient for them.”

Regardless, employee utilization of virtual services still remains low. For example, while roughly 70% of large companies provide telemedicine coverage, only 3% of employees use it, according to prior NBGH data.

But many resources are out of sight and out of mind, Kelsay said. However, employers are focusing on offering high-touch concierge services to help workers better navigate the healthcare system.

Employers are reaching a point of saturation with the number of solutions that are available, but from the employee’s perspective, they just don’t know where to start, she added. “These concierge and navigator services really help point employees in the direction to the solution at the point in time they need it.”

In addition, the use of predictive analytics and claims data is also an opportunity to help employers get the right programs in front of employees in the moment, Marcotte added.

“Some of these engagement platforms are getting at personal messaging and predictive analytics. It’s not where we want it to be yet, but as that continues to get better, I think you’ll see utilization go up,” he said.

15 states where $1 million in retirement savings will last the longest

How much do you have saved for retirement? According to GOBankingRates data, employees who have $1 million in retirement savings can make it last for more than 20 years in Mississippi, Arkansas, Oklahoma and Missouri. In this article, Paola Peralta writes on the importance of understanding what better retirement choices can do for your future.

Employees with $1 million in retirement savings can make it stretch for more than 20 years in Mississippi, Arkansas, Oklahoma and Missouri, according to GOBankingRates data in an article from Business Insider. Retirees in New Mexico, Tennessee, Michigan and Kansas can also live on a similar amount of savings, data shows. Retirees with $1 million can expect their savings to last in average span of 19 years, GOBankingRates estimates.

Less choice could mean better retirement outcomes

The amount of income that seniors can replace in retirement is a good measure to determine whether there is a looming retirement crisis in the U.S., according to retirement expert Mark Miller in this article from Morningstar. However, it is hard to make generalizations, he explains. “I think it varies tremendously, depending which demographic group you’re looking at, you can do it generationally or otherwise,” Miller says.

Retirement requires a shift in thinking

As retirees needs change, they should be ready to adjust their mindset and modify their investment strategies, an expert in Kiplinger writes. Retirees should focus more on preservation and distribution after the accumulation phase, the expert writes. “In retirement, it’s important to think of your savings as income rather than a lump sum. It’s not all about achieving maximum return on investment anymore," the expert says. "It’s about how you can get the maximum return from your portfolio and into your pocket."

Employees nearing retirement? 12 features to look for in their next home

Seniors who intend to move to a new home in retirement should consider a property that offers low yard maintenance, a single-story open floor plan and easy access to loved ones and essential amenities, according to a Forbes article. They should ensure that the new house is cheap to maintain and won’t trigger a hefty tax bill, says one expert. “If those costs are low, it can be a great investment.”

SOURCE: Peralta, P. (15 August, 2019) "15 states where $1M in retirement savings lasts the longest"(Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/news/states-where-retirement-savings-will-last-the-longest

The case for expanding wellness beyond the physical

Can addressing mental health, financial wellness and substance abuse in the workplace help employees feel fulfilled both personally and professionally? Newly released data shows that employees who have access to wellness programs that address most or all of the five aspects of well-being are more likely to say their job performance is excellent. Read this blog post to learn more about expanding wellness programs.

Client's wellness programs that only focus on physical fitness may need to rethink their approach.

By expanding wellness offerings to include programs that support workers’ mental and financial wellness, employer clients can increase the overall wellbeing of their workforce. Newly released data from Optum and the National Business Group on Health shows that employees who are offered programs that address most or all of the five aspects of wellbeing — physical, mental, financial, social and community — are significantly more likely to say their job performance is excellent, have a positive impression of their employer, and recommend their company as a place to work.

Over the last decade, workplace wellness initiatives have evolved beyond health risk assessments, physical fitness and nutrition programs. Many programs now include resources to address mental health, financial wellness and substance abuse.

“[Employers] must commit to looking beyond clinical health outcomes,” says Chuck Gillespie, CEO of the National Wellness Institute, speaking at a webcast from the International Foundation of Employee Benefit Plans. “You want employees to be fulfilled both personally and professionally.”

Even though some clients address financial, social and community health, most still focus on physical and mental health.

However, there are benefit trends that address wellness beyond physical fitness. The emergence of financial wellness benefits — such as early pay access, student loan assistance and retirement saving plans — may help employees feel less stressed and more financially secure, which has shown to improve overall health.

But having a good wellness program in place isn’t enough — employers also have to make sure that the offerings are inclusive and personalized, and that the programs have successful participation and engagement rates.

“These programs need to be adapted to who you are,” Gillespie says. “Customization has to be a key factor of what you’re looking at, because everybody is not going to fit inside your box.”

Effective wellness programs use both health and wellness data points and best practices, while keeping an eye on developing trends. Multi-dimensional wellness — looking at aspects such as social and community — can help companies understand the needs of their employees better.

“Employers need to better recognize personal choices, and if the employees are in an environment where they are functioning optimally,” Gillespie says. “Smokers hang out with smokers; the cultural foods that you eat with family may not be nutritious; is there social isolation; do you contribute to your community. [Most benefits] are work-oriented, but for most people, their life is their home life. It’s important to look at the degrees of which you feel positive and enthusiastic about your work and life.”

SOURCE: Nedlund, E. (15 August 2019) "The case for expanding wellness beyond the physical" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/news/the-case-for-expanding-wellness-beyond-the-physical

Specific Plans for Your Employees

Most plans are created to fit every employee but not specifically each employee's specific needs. However, employers now are looking at adding more customized packages for their employees. In turn, this is helping with new hires. Keep reading this blog to learn about additional benefits.

Research shows that benefits drive the attraction and retention of employees even more than compensation. When implemented in the correct way, these perks can help draw diverse groups of workers. So if this is the case, why are so many packages not tailored to diversified workforces?

The short answer is because it’s easier to administer a one-size-fits-all plan. The burden of building customized plans means that packages are updated only once a year. As a result, modern workers needs go unmet, because life circumstances and coverage requirements can change at any given moment.

These packages need to go beyond baseline benefits such as medical, dental and vision. Employers should realize that adding more customized benefits could help the needle in the talent war.

For example, two new employees at opposite ends of the spectrum may require different kinds of benefits to meet their needs, but few packages are set up to accommodate these differences. While millennial workers may view offerings like pet insurance or tuition reimbursement as must-haves, these may not be relevant for everyone.

Blanketing all employees with the same benefits package risks failing to engage those prospects who have something amazing to bring to your business. An employee who has a baby mid-year, for example, might have to wait to get her life insurance adjusted or open a college fund because it’s not on the schedule.

But in some sectors, things are starting to change. Larger enterprise employers are now more likely to offer at least five kinds of benefits, including life insurance, pet insurance and disability coverage plus legal shield, identity protection, loan repayment, financial literacy and paid sabbaticals with more added all the time. We’re also seeing an uptick in new offerings such as workplace education and vacation planning or payment.

Now the same approach needs to be adopted in the mid-market. Employers need to make a concerted effort to understand their workforce. To learn and drive benefits package curation to consider a survey or evaluation exercise. HR leaders should also institute more frequent touchpoints, for example, every quarter, to assess the utilization rates of a benefits package.

Looking ahead, the workplace of the future will become even more diverse. As more workers continue to choose to work remotely, companies will need to accept hiring talent outside of the U.S. Which also means hiring managers will have to address perks and benefits that may fall outside of a company’s home state, or even satisfy alternative healthcare or benefits packages in countries with different requirements altogether.

Every employee’s situation is different and the industry needs to be ready to offer benefits and workplace perks that match key talent’s most important needs.

SOURCE: Lyubovitzky, Rachel. (2 August 2019). "It's time to put an end to one-size-fits-all employee benefits plans" (Web Blog Post). Retrieved from: https://www.employeebenefitadviser.com/opinion/the-case-for-personalized-employee-benefits-plans

Deepfakes in HR

Blame Forrest Gump. The 1994 movie used new technology to edit Gump's character into scenes to make it seem like he talked with John F. Kennedy or sat next to John Lennon — an editing magician's trick that won the film accolades.

That technology has evolved into what is now referred to as "deepfake" technology: a mix of AI and machine learning that allows users to alter videos, audios, and photos in powerful ways.

One deepfake example: A widely-shared video of Speaker of the House Nancy Pelosi that was doctored to slow down the speed of her speech, creating the impression Pelosi was impaired. Deepfakes can make it seem that someone is saying something or doing something they may never have — and that can create a new kind of security woe for employers of all types.

Just because deepfakes haven't showed up at your company doesn't mean they'll stay away forever, Randy Barr, chief information security officer for Topia, a global mobility management software company, told HR Dive; "We're going to start to see a lot more than this as soon as technology is readily available for people to use and try."

What can HR do now to ensure employees are safe?

It's all fun and photoshop until someone gets hurt

Deepfake technology can have positive purposes, such as in the creation of digital voices for those who have lost the ability to speak, or the David Beckham video that shows him explaining how people can protect themselves from malaria, using deepfake tech to look like he's speaking in nine different languages.

But unlike the altered content from Forrest Gump and Instagram filters, the audience isn't supposed to know that the deepfakes are manipulated pieces.

On top of that, the technology is often used explicitly to create trouble, Niraj Swami, CEO of SCAD AI, an AI consultancy, told HR Dive. "It stems from leveraging controversial material…offensive content or offensive perspectives," he said. When this material pops up in social media, it creates media confusion, he said, and many viewers react emotionally to the false information.

Some deepfake videos can be identified relatively easily, Barr said. "One of the simple ways of detecting it is if you look at the video, see how often that individual blinks, because [with] the current AI technology and deepfake, it's hard to impose the face over a body if the eyes are closed," he said. Other tips are to look for a mismatch in skin tone, and placement of the eyebrows and chin, he added.

Just as deepfake technology is becoming more sophisticated, so is the technology used to identify altered media, with improvements on both sides expected to continue.

How deepfakes can harm employers

Although most deepfakes thus far have targeted politicians and celebrities, the technology has been seen in the work environment — and it may be used with increasing frequency, experts said.

Imagine a CEO placing an urgent call to a senior financial officer requesting an emergency money transfer — except the CEO's voice was deepfaked by criminals, as Axios reported happening to a number of companies already. Deepfakes could be used to attack a company, Barr said; "[It] could be the evolution of how ransomware takes place."

Remote employees could use deepfake tech to disguise their identities and hand off work to subcontractors, Swami said. This could be concerning if the subcontractor is not supposed to be offshore or if the initial employee had a security clearance, but the subcontractor does not, he said.

For HR leaders, deepfakes could lead to tricky situations, Forman said. What happens if an employee finds an altered photo or video of them on social media that uses their company ID or picture? What obligation does the organization have to investigate? "It's becoming more difficult. You have workplace morale issues, compliance issues with your policy and procedures that all jump up because of deepfakes," he said.

Guarding against deepfakes

HR leaders are used to discerning fake information, from exaggerations on a resume to doctored emails, but as technology improves, it becomes more challenging to anticipate potential issues. While HR is not expected to analyze media for alterations, leaders can take steps to protect employees and the company from being manipulated by deepfakes.

Review company technology policies, said Forman. New technologies up the ante for the workplace and the employer and employee relationships because of the increased risk for misconduct, he said. An employer may want to take an existing policy regarding anti-harassment, anti-retaliation, and anti-discrimination, and make sure the guidelines address the new technology, he added.

Companies should decide how they would respond if a deepfake incident occurred, Forman advised. Although there may be no one right or wrong answer, being prepared to react to the threat is necessary.

"The biggest thing is awareness," Swami said. If employers see an incendiary video, they can't have a knee jerk reaction if it is presented as evidence of wrong-doing, he said. Managers might not be able to believe their eyes, so employers may need to ensure its managers gather more information. "You can't have a single source of truth."

SOURCE: DeLoatch, Pamela. (5 August 2019). "Keeping it real: What HR leaders need to know about deepfakes" (Web Blog Post). Retrieved from: https://www.hrdive.com/news/keeping-it-real-what-hr-leaders-need-to-know-about-deepfakes/559475/

Summer Hours

Should employees have different hours in the summer? Will this make them work less or more? Continue reading today's blog to answer these questions! Read more