IRS updates rules on retirement plan hardship distributions

Recently, the Internal Revenue Service (IRS) finalized updates to the hardship distribution regulations. These new regulations make the requirements more flexible and participant friendly. Read this blog post to learn more about these updated regulations.

Employers who allow for hardship distributions from their 401(k) or 403(b) plans should be aware that the Internal Revenue Service recently finalized updates to the hardship distribution regulations to reflect legislative changes. The new rules make the hardship distribution requirements more flexible and participant-friendly.

Hardship distributions are in-service distributions from 401(k) or 403(b) plans that are available only to participants with an immediate and heavy financial need. Plans are not required to offer hardship distributions. But there are certain requirements if a plan does offer hardship distributions. Generally, a hardship distribution may be made to a participant only if the participant has an immediate and heavy financial need, and the distribution is necessary and not in excess of the amount needed (plus related taxes or penalties) to satisfy that financial need.

An administrator of a 401(k) or 403(b) plan can determine whether a participant satisfies these requirements based on all of the facts and circumstances, or the administrator may rely on certain tests that the IRS has established, called safe harbors.

Over the last fifteen years, Congress has changed the laws that apply to hardship distributions. The new rules align existing IRS regulations with Congress’s legislative changes. Some of the changes are mandatory and some are optional. The new rules make the following changes. The following changes are required.

Elimination of six-month suspension.

Employers may no longer impose a six-month suspension of employee elective deferrals following the receipt of a hardship distribution.

Required certification of financial need.

Employers must now require participants to certify in writing or by other electronic means that they do not have sufficient cash or liquid assets reasonably available, in order to satisfy the financial need and qualify for a hardship distribution.

There were also some optional changes made to hardship distributions.

Removal of the requirement to take a plan loan.

Employers have the option, but are not mandated, to eliminate the requirement that participants take a plan loan before qualifying for a hardship distribution. In order to qualify for a hardship distribution, participants are still required to first take all available distributions from all of the employer’s tax-qualified and nonqualified deferred compensation plans to satisfy the participant’s immediate and heavy financial need. The optional elimination of the plan loan requirement may first apply beginning January 1, 2019.

Expanded safe harbor expenses to qualify for hardship.

The new hardship distribution regulations expand the existing list of pre-approved expenses that are deemed to be an immediate and heavy financial need. Prior to the new regulations, the list included the following expenses:

- Expenses for deductible medical care under Section 213(d) of the Internal Revenue Code;

- Costs related to the purchase of a principal residence;

- Payment of tuition and related expenses for a spouse, child, or dependent;

- Payment of amounts to prevent eviction or foreclosure related to the participant’s principal residence;

- Payments for burial or funeral expenses for a spouse, child, or dependent; and

- Expenses for repair of damage to a principal residence that would qualify for a casualty loss deduction under Section 165 of the Internal Revenue Code.

The new regulations expand this list of permissible expenses by adding a participant’s primary beneficiary under the plan as a person for whom medical, tuition and burial expenses can be incurred. The new regulations also clarify that the immediate and heavy financial need for principal residence repair and casualty loss expenses is not affected by recent changes to Section 165 of the Internal Revenue Code, which allows for a deduction of such expenses only if the principal residence is located in a federally declared disaster zone. Finally, the new regulations add an additional permissible financial need to the list above for expenses incurred due to federally declared disasters.

New contribution sources for hardships.

The law and regulations provide that employers may now elect to allow participants to obtain hardship distributions from safe harbor contributions that employers use to satisfy nondiscrimination requirements, qualified nonelective elective contributions (QNECS), qualified matching contributions (QMACs) and earnings on elective deferral contributions. However, 403(b) plans are not permitted to make hardship distributions from earnings on elective deferrals, and QNECS and QMACs are distributable as hardship distributions only from 403(b) plans not held in a custodial account.

As this list indicates, the new regulations make substantial changes to the hardship distribution rules.

The deadline for adopting this amendment depends on the type of plan the employer maintains and when the employer elects to apply the changes. Plan sponsors should work with their document providers and legal counsel to determine the specific deadlines for making amendments.

SOURCE: Tavares, L. (01 November 2019) "IRS updates rules on retirement plan hardship distributions" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/irs-updates-rules-on-401k-403b-plan-hardship-distributions

DOL proposes rule on digital 401(k) disclosures

A new rule has been proposed by the Department of Labor (DOL) that is meant to encourage employers to issue retirement plan disclosures electronically. This rule would allow plan sponsors of 401(k)s and other defined-contribution plans to default participants with a valid email address to receive plan disclosures electronically. Read the following blog post to learn more.

The Department of Labor proposed a rule Tuesday that's meant to encourage more employers to issue retirement plan disclosures electronically to plan participants.

The rule would allow sponsors of 401(k)s and other defined-contribution plans to default participants with valid email addresses into receiving all their retirement plan disclosures — such as fee disclosure statements and summary plan descriptions — digitally instead of on paper, as has been the traditional route.

Participants can opt-out of e-delivery if they prefer paper notices. The proposed rule covers the roughly 700,000 retirement plans subject to the Employee Retirement Income Security Act of 1974.

"DOL rules have largely relied on a paper default," said Will Hansen, chief government affairs officer for the American Retirement Association. "Everything had to be paper, unless they opted into electronic default. This rule is changing the current standing."

Proponents of digital delivery believe it will save employers money and increase participants' retirement savings. The DOL also believes digital delivery will increase the effectiveness of the disclosures.

Plan sponsors are responsible for the costs associated with furnishing participant notices, and many small and large plans pass those costs on to plan participants, Mr. Hansen said. The DOL estimates its proposal will save retirement plans $2.4 billion over the next 10 years through the reduction of materials, printing and mailing costs for paper disclosures.

Opponents of digital delivery maintain that paper delivery should remain the default option. They have noted that participants are more likely to receive and open disclosures if they come by mail, and claim that print is a more readable medium for financial disclosures that helps participants better retain the information.

"We are reviewing the proposal carefully and look forward to providing comments to the Department of Labor, but we already know that in a world of information overload, many people prefer to get important financial information delivered on paper, not electronically," said Cristina Martin Firvida, vice president of financial security and consumer affairs at AARP. "The reality is missed emails, misplaced passwords and difficulties reading complex information on a screen mean that most people do not visit their retirement plan website on a regular basis."

President Donald J. Trump issued an executive order on August 2018 calling on the federal government to strengthen U.S. retirement security. In that order, Mr. Trump directed the Labor secretary to examine how the agency could improve the effectiveness of plan notices and disclosures and reduce their cost.

The DOL proposal, called Default Electronic Disclosure by Employee Pension Benefit Plans under ERISA, is structured as a safe harbor, which offers legal protections to employers that follow the guidelines laid out in the rule.

Retirement plans would satisfy their obligation by making the disclosure information available online and sending participants and beneficiaries a notice of internet availability of the disclosures. That notice must be sent each time a plan disclosure is posted to the website.

A digital default can't occur without first notifying participants by paper that disclosures will be sent electronically to the participant's email address.

The 30-day comment period on the proposal starts Wednesday. In addition, the DOL issued a request for information on other measures it could take to improve the effectiveness of ERISA disclosures.

SOURCE: Lacurci, G. (22 October 2019) "DOL proposes rule on digital 401(k) disclosures" (Web Blog Post). Retrieved from https://www.investmentnews.com/article/20191022/FREE/191029985/dol-proposes-rule-on-digital-401-k-disclosures

Putting Humanity into HR Compliance: 3 Steps to Active Listening

How is your HR department communicating with your employees? One of the most common complaints people hear about HR professionals is that they don't listen. Read this blog post from SHRM for three practices of active listening.

When I work with executives and managers, a common complaint I hear about HR professionals is "They don't listen. They just tell."

So when I work with HR professionals, I encourage them to adopt three practices of active listening:

- The period-to-question-mark ratio.

- The EAAR listening method.

- Confront, then question.

The Period-to-Question-Mark Ratio

When you're engaged in a conversation, what's the ratio of your sentences that end with periods to those that end with question marks? If you're like most people, the ratio is overwhelmingly tilted toward sentences that end with periods. This could show that you are telling people what to do more often than you are looking for consensus on how to solve a problem. When you engage in a discussion with an executive, manager or employee, keep the ratio in mind. Strive to correct the imbalance by making yourself ask questions. The fact that you ask matters more than what the question is.

People I've coached have found that keeping the ratio in mind acts as a self-regulating device to ask more questions.

The EAAR Listening Method

E: Explore

A: Acknowledge

A: Apply

R: Response

It's a sequence. Begin the discussion with an exploratory, open-ended question: "Ms. Manager, what are the reasons that led you to conclude Mr. Employee should be fired?" "Tell me more." "Please share some examples." "Help me understand."

Once you've explored the other person's position and reasons for it, move to acknowledgment. Get the person to acknowledge that you understand his or her point. "So, Ms. Manager, if I understand you correctly, you believe Mr. Employee should be terminated because of the following reasons… Is that correct?

Although critical, the acknowledge step is often overlooked. Instead of confirming the understanding, the listener makes an assumption, which often proves erroneous and leads to unnecessary conflict. The EAAR method eliminates this possibility. If the person says, "No, that's not my position," simply go back to the exploration step: "I'm sorry. Please explain what I missed."

In your response, apply portions of what the person said, even actual words the person used. Even if your response isn't substantively what the person originally sought, this approach creates optimal conditions for acceptance.

"Ms. Manager, I agree with you that Mr. Employee's behavior is unacceptable. What you described [list the employee's actions] makes a compelling case. However, because of the following reasons, I think termination now would be premature and present undue legal risk.

"Nevertheless, I'm happy to work with you on an intervention strategy. If Mr. Employee is willing and able to close the gap in your legitimate management expectations, he will do so. If not, we will be in a much stronger position to terminate his employment, and I will support you."

Many HR professionals have told me that when they've used the EAAR method, conversations they feared would turn ugly became positive. Instead of a clash of wills and arguments, the discussion became collaborative and solution-oriented.

Confront, Then Question

What if you are the bearer of bad news? You must deliver a message you know won't make the recipient happy.

The approach here is to confront, then question. Make a short opening statement. State your position succinctly and without elaboration. Next, switch to question mode.

You can think of this approach as beginning the EAAR method with a short opening response to frame the conversation.

"Mr. Executive, based on our investigation, we found that Mr. Employee in your department engaged in actions that violate our anti-harassment policy. Although we understand he has been with the company for a long time and is one of your best performers, given the seriousness of the misconduct, we believe the appropriate action is termination of his employment."

Next, go to question mode: "What do you think?" "What questions do you have?" "How do you see things at this point?"

Assuming the executive doesn't respond by saying "Great idea! Go for it!" and wants to argue his or her point, pivot to exploration and start the EAAR process at that point. "I want to make sure I understand you, so please tell me what you agree with, what you disagree with and your reasons."

After that comes your acknowledgment: "Let me make sure I understand you. You agree that Mr. Employee's behavior was unacceptable and violated policy. However, you disagree that the proper remedy is termination. Instead, you recommend a suspension and written warning for these reasons. [List the reasons.] Is that accurate?"

Now you're ready to apply. From what the executive said, extract what you can use in your response.

"I appreciate the fact that you support our investigation and finding of misconduct. Our only disagreement is the appropriate remedy. Your points about Mr. Employee's long service and stellar performance are valid. Yet for these reasons [list them], I still believe termination is called for. How do you suggest we resolve our differing views? For example, should we present them to the CEO and let her decide?"

These types of conversations can go in all sorts of directions, including ones you don't anticipate. That's OK, so long as you don't lose sight of the value of questions during a dispute.

Avoid cross-examination questions, such as "Isn't it true that … ?" Your questions should not state or imply your view. They should be curiosity-based, as you're genuinely trying to find out what the other person thinks.

The confront-then-question approach allows you to go directly to the heart of the matter. Even if you sense rising tension and hostility, the negative emotions will soon be arrested by your open-ended, exploratory questions.

When HR professionals make a commitment to active listening, executives, managers and employees become their biggest fans instead of being their biggest critics.

SOURCE: Janove, J. (9 October 2019) "Putting Humanity into HR Compliance: 3 Steps to Active Listening" (Web Blog Post). Retrieved from https://www.shrm.org/resourcesandtools/hr-topics/employee-relations/pages/putting-humanity-into-hr-compliance-active-listening-.aspx

As Daylight-Saving Time Ends, Wages & Hour Problems Begin

On November 3 this year, daylight saving time will end in most states. This change presents challenges for employers who have nonexempt employees working at 2 a.m. when the clocks are set back one hour. Read this blog post from SHRM for wage and hour implications that stem from the end of daylight savings time and how to prepare to "spring forward".

On Sunday, Nov. 3, 2019, at 2:00 a.m., daylight saving time will end and in most states clocks will be set back one hour. As it does every year, this change presents a challenge for employers whose nonexempt employees are working during that time.

This wage and hour issue will affect all employers that employ nonexempt employees with the exception of those working in Arizona and Hawaii, both of which do not observe daylight savings time.

Below are some of the wage and hour implications stemming from the end of daylight savings time:

- Employers are required to pay employees for all hours worked. However, employers whose nonexempt employees are working at 2:00 a.m. on Sunday, Nov. 3, must pay them one additional hour of pay unless the start/end times of their shifts are adjusted in anticipation of the time change. In essence, such an employee will have worked the hour from 1:00 a.m. to 2:00 a.m. twice.

- Employers whose nonexempt employees are working at that time might owe those employees overtime compensation as a result of the time change. That is, employers must include the additional hour of work in determining the employee's overtime compensation for the week.

- In addition, employers must take this additional hour of work into account when computing the employee's regular rate of pay for purposes of calculating the employee's overtime rate.

Preparing to 'Spring Forward'

Employers also should be aware of their pay obligations at the beginning of daylight savings time in the spring. Nonexempt employees who are working on Sunday, March 8, 2020, at 2:00 a.m.—when clocks will spring forward to 3:00 a.m.—are entitled to one less hour of pay than they otherwise would have been. So, an employee scheduled to work an eight-hour shift from 11:00 p.m. to 7:00 a.m. will only have worked seven hours because essentially the employee did not work from 2:00 a.m. to 3:00 a.m.

Employers that decide to pay such workers for a full eight-hour shift are not required under the Fair Labor Standards Act (FLSA) to include that extra hour of pay in calculating employees' regular rate of pay for overtime purposes. In addition, the FLSA prohibits employers from crediting that extra hour of pay towards any overtime compensation due to the employee.

Employers, however, should ensure that they do not have any additional obligations under a collective bargaining agreement or state law.

Hera Arsen, J.D., Ph.D., is managing editor of Ogletree Deakins' publications in Torrance, Calif. Ogletree Deakins is a national labor and employment law firm. © Ogletree Deakins. All rights reserved. Reposted with permission. Updated from an article originally posted on 11/1/2017.

SOURCE: Arsen, H. ( 2 October 2019) "As Daylight-Saving Time Ends, Wages & Hour Problems Begin" (Web Blog Post) https://www.shrm.org/resourcesandtools/hr-topics/compensation/pages/daylight-saving-time-wage-hour-problems.aspx

DOL issues finalized overtime regulation

The DOL recently released their finalized overtime rule. This new rule raises the minimum salary level to $35,568 per year for a full-year worker to earn overtime wages. Read this blog post from Employee Benefit News to learn more about this new rule.

The DOL on Tuesday released its highly anticipated finalized overtime rule, raising the minimum salary level to $35,568 per year for a full-year worker to earn overtime wages.

“Today’s rule is a thoughtful product informed by public comment, listening sessions and long-standing calculations,” Wage and Hour Division Administrator Cheryl Stanton says in a statement. “The DOL’s wage and hour division now turns to help employers comply and ensure that workers will be receiving their overtime pay.”

The final rule, effective Jan. 1, 2020, updates the earnings thresholds necessary to exempt executive, administrative or professional employees from the FLSA’s minimum wage and overtime pay requirements, and allows employers to count a portion of certain bonuses (and commissions) toward meeting the salary level.

The new thresholds account for growth in employee earnings since the currently enforced thresholds were set in 2004. In the final rule, the department is:

- Raising the standard salary level from the currently enforced level of $455 to $684 per week (equivalent to $35,568 per year for a full-year worker);

- Raising the total annual compensation level for highly compensated employees from the currently-enforced level of $100,000 to $107,432 per year;

- Allowing employers to use nondiscretionary bonuses and incentive payments (including commissions) that are paid at least annually to satisfy up to 10% of the standard salary level, in recognition of evolving pay practices; and

- Revising the special salary levels for workers in U.S. territories and in the motion picture industry.

This finalized rule is a shift from the previous administration's proposed rule, which would have doubled the salary threshold.

Under the Obama administration, the Labor Department in 2016 raised the minimum salary to roughly $47,000, extending mandatory overtime pay to nearly 4 million U.S. employees. But the following year, a federal judge in Texas ruled that the ceiling was set so high that it could sweep in some management workers who are supposed to be exempt from overtime pay protections. Business groups and 21 Republican-led states then sued, challenging the rule.

The overturning of the 2016 rule that increased the salary level from the 2004 level has created a lot of uncertainty, says Susan Harthill, a partner with Morgan Lewis. The best way to create certainty is to issue a new regulation, which is what the administration's done, Harthill adds.

While the final rule largely tracks the draft, there are two changes that should be noted: the salary level is $5 higher and the highly compensated employee salary level is dramatically reduced from the proposed level, she says.

“This is an effort to find a middle ground, and while it may be challenged by either or maybe both sides, the DOL’s salary test sets a clear dividing line between employees who must be paid overtime if they work more than 40 hours per week and employees whose eligibility for overtime varies based on their job duties,” Harthill adds.

The DOL estimates 1.3 million employees could now be eligible for overtime pay under this rule (employees who earn between $23,600 and $35,368 no longer qualify for the exemption).

A majority of business groups were critical of Obama’s overtime rule, citing the burdens it placed particularly on small businesses that would be forced to roll out new systems for tracking hours, recordkeeping and reporting.

SHRM, for example, expressed it's opposition to the rule, noting it would have fundamentally changed the rules for employee classification, dramatically increased the salary under which employees are eligible for overtime and provided for automatic increases in the salary level without employer input.

“Today’s announcement finalizing DOL’s overtime rule provides much-needed clarity for workplaces," SHRM says in a statement. "This rule marks the first increase to the salary threshold since 2004 and gives employers more flexibility to plan for the future. We appreciate DOL’s willingness to work with SHRM, other organizations and America’s workers to enact an overtime rule that benefits both employers and their employees.”

But the finalized rule still will have implications for employers.

“Education and health services, wholesale and retail trade, and professional and business services, are the most impacted industries, according to DOL, but all industries are potentially impacted,” Harthill, also former DOL deputy solicitor of labor for national operations, adds. “Also often overlooked is the impact on nonprofits and state and local governments, which are subject to the FLSA and often have lower salaries.”

All companies should be taking a close look at their employees to make sure workers are properly classified, but what they do after that will depend entirely on individual business needs, she says. “Some will hire additional employees to reduce the amount of overtime, while others will just pay overtime if their workers in this salary bracket spend more than 40 hours a week on the job.”

Employers who haven’t already reviewed their exempt workforce should do so now, before the Jan. 1 effective date, Harthill advises.

“They can opt to pay overtime, raise salary levels above $35,368, or review and tighten policies to ensure employees do not work more than 40 hours per week,” she says. “There could be job positions that need to be reclassified and that might have a knock-on effect for employees who earn above the new salary level.”

Many employers increased their salaries when DOL issued the 2016 rule, and some states have higher salary levels, so not all businesses will need to make an adjustment. “But even those employers should review their highly compensated employees — they may still be exempt even if they earn less than $107,432 but the analysis will be more complicated,” she adds.

“We did not hear any objections from employers when these rules were initially proposed," adds Jason Hammersla, vice president of communications at the American Benefits Council. "That said, aside from the obvious compensation and payroll tax implications, this rulemaking is significant for employers who include overtime compensation in the formula for retirement plan contributions as it could increase any required employer contributions."

"The change could also affect plans that exclude overtime pay from the plan’s definition of compensation if the new overtime pay causes the plan to become discriminatory in favor of highly compensated employees," he adds.

SOURCE: Otto, N. (24 September 2019) "DOL issues finalized overtime regulation" (Web Blog Post). Retrieved from https://www.benefitnews.com/news/dol-issues-finalized-overtime-regulation

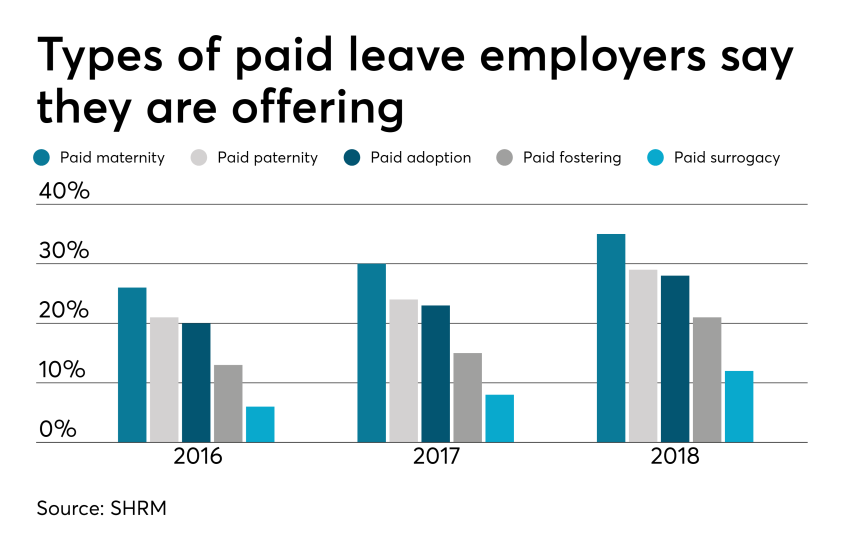

4 pitfalls of paid leave and how clients can avoid them

Employers are using paid leave options to help boost their employee benefits packages in efforts to better attract and retain talent. Read the following blog post from Employee Benefit Advisor for 4 common pitfalls of paid leave and how employers can avoid them.

Smart employers are boosting their benefits packages with paid family leave — the most coveted work perk among all generations. In today’s low unemployment environment, paid leave benefits can be a huge differentiator in attracting and retaining talent.

Smart employers are boosting their benefits packages with paid family leave — the most coveted work perk among all generations. In today’s low unemployment environment, paid leave benefits can be a huge differentiator in attracting and retaining talent.

But some employers are getting themselves into trouble in the process, facing accusations of gender discrimination or improper use of leave.

Here are four potential pitfalls of paid leave, and how employers can avoid them.

1. Be careful what you call “maternity leave.”

Employers have long been granting leave for new moms in the form of disability coverage. In fact, the top cause of short term disability is pregnancy. Disability insurance usually grants new moms six to eight weeks of paid leave to recover from childbirth.

Because this coverage applies to the medical condition of recovering from childbirth, it shouldn’t be lumped in with bonding leave.

Guidance from the Equal Employment Opportunity Commission says leave granted for new moms for bonding must also be extended to new dads, so separating disability leave from bonding leave is crucial to avoiding gender discrimination.

2. Don’t make gender assumptions.

The amount of bonding time for new parents after birth, adoption or fostering must be granted equally for men and women. Companies that don’t provide the same amount of paid leave for men and women may find themselves in a discrimination lawsuit.

It’s not just the time away from work that matters, but also the return-to-work support provided. If new moms are granted temporary or modified work schedules to ease the transition back to work, new dads must also have access to this.

Some companies may choose to differentiate the amount of leave and return-to-work support for primary or secondary caregivers. That’s compliant as long as assumptions aren’t made on which gender is the primary or secondary caregiver.

The best way to avoid potential gender discrimination pitfalls is to keep all parental bonding and related return-to-work policies gender neutral.

3. Avoid assuming the length of disability.

Be careful about assuming the length of time a new mom is disabled, or recovering medically, after birth. Typical coverage policies allot six to eight weeks of recovery for a normal pregnancy, so assuming a new mom may be out for 10 weeks might be overestimating the medical recovery time, and under-representing the bonding time, which must be gender neutral.

4. Keep up with federal, state and local laws.

Mandated leave laws are ever-evolving, so employers should consistently cross-check their policies with state and local laws. For instance, do local paid leave laws treat adoption the same as birth? Are multistate employers compliant? What if an employee lives in one state but works in another: Which state’s leave policies take precedence?

Partnering with a paid leave service provider can mitigate the risk of improperly administering leave. Paid leave experts can help answer questions, review guidelines and provide information regarding job-protecting medical or family leave.

They can also help flag potential pitfalls, ensuring leave requests from all areas of your company are managed uniformly and in accordance with state and federal laws, including the EEOC.

SOURCE: Bennett, A. (12 September 2019) "4 pitfalls of paid leave and how clients can avoid them" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/list/4-pitfalls-of-paid-leave-and-how-clients-can-avoid-them

A 401(k) plan administrators’ guide to the recent IRS revenue ruling

The IRS recently released a new revenue ruling that provides 401(k) plan administrators with helpful guidance on reporting and withholding from 401(k) plan distributions. Read the blog post below to learn more about this new ruling.

The IRS recently issued revenue ruling 2019-19. The revenue ruling provides 401(k) plan administrators with helpful guidance on how to report and withhold from 401(k) plan distributions when a plan participant actually receives the distribution but for some reason, does not cash the check.

Unfortunately, this new guidance does not provide answers to the complex issues that 401(k) plan administrators face when the plan must make a distribution, but the plan participant is missing.

Let’s hope revenue ruling 2019-19 is just the first in a series of much-needed guidance from the IRS and the Department of Labor about how 401(k) plan administrators should handle the increasingly common administrative issues related to uncashed checks and missing plan participants.

There are many situations in which a 401(k) plan must make a distribution to a plan participant. For example, plans must distribute small benefit cash outs (e.g., account balances that are $1,000 or less) or required minimum distributions to plan participants who reach age 70 and a half. This may come as a surprise, but plan participants fail to actually cash these checks with some regularity.

In the ruling, the IRS confirmed that 401(k) plan administrators should withhold taxes on a 401(k) plan distribution and report the distribution on a Form 1099-R in the year the check is distributed to the participant, even if the participant does not cash the check until a later year.

Similarly, the participant needs to include the plan distribution as taxable income in the year in which the plan makes the distribution even if the participant fails to cash the check until a later year. While this guidance is not surprising, it does provide clarity to 401(k) plan administrators as to how they must withhold and report normal course and required plan distributions. In particular, 401(k) plan administrators should not reverse the tax withholding or reporting of the distribution when the participant receives the distribution and simply does not cash the check until a later year.

Unfortunately, this new IRS guidance has limited use because the ruling uses an example that specifically concedes that the plan participant actually received the plan distribution check, but simply failed to cash it. What should 401(k) plan administrators do when the participant may not have received the distribution check at all (e.g., a check is returned for an invalid address) or the plan itself does not have current contact information for the participant?

Retirement plan administrators have an ERISA fiduciary obligation to implement a diligent and prudent process to find missing plan participants and to take additional steps to make sure participants actually receive plan distributions. Uncashed 401(k) plan distribution checks are still retirement plan assets which means the 401(k) plan administrator is still subject to ERISA fiduciary standards of care, prudence and diligence related to those amounts. As a result, the IRS and DOL have increased their focus on uncashed checks and missing participants in retirement plan audits.

Plan administrators would be well-served by establishing and implementing a consistent process to stay on top of any missing plan participants or uncashed checks and taking steps to locate those participants and properly address uncashed checks. Plan administrators should also carefully document the steps that they take in this regard. The IRS and DOL have currently provided limited guidance on the steps a 401(k) plan administrator can take to locate missing participants, but more guidance is needed — let’s hope revenue ruling 2019-19 is just the beginning.

This article originally appeared on the Foley & Lardner website. The information in this legal alert is for educational purposes only and should not be taken as specific legal advice.

SOURCE: Dreyfus Bardunias, K. (6 September 2019) "A 401(k) plan administrators’ guide to the recent IRS revenue ruling" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/401k-administrators-guide-to-the-irs-revenue-ruling-2019-19

PCORI Fee Is Due by July 31 for Self-Insured Health Plans

The annual fee for the federal Patient-Centered Outcomes Research Institute (PCORI) is due July 31, 2019. Plans with terms ending after September 30, 2012, and before October 1, 2019, are required to pay an annual PCORI fee. Read this article from SHRM to learn more.

An earlier version of this article was posted on November 6, 2018

The next annual fee that sponsors of self-insured health plans must pay to fund the federal Patient-Centered Outcomes Research Institute (PCORI) is due July 31, 2019.

The Affordable Care Act mandated payment of an annual PCORI fee by plans with terms ending after Sept. 30, 2012, and before Oct. 1, 2019, to provide initial funding for the Washington, D.C.-based institute, which funds research on the comparative effectiveness of medical treatments. Self-insured plans pay the fee themselves, while insurance companies pay the fee for fully insured plans but may pass the cost along to employers through higher premiums.

The IRS treats the fee like an excise tax.

The PCORI fee is due by the July 31 following the last day of the plan year. The final PCORI payment for sponsors of 2018 calendar-year plans is due by July 31, 2019. The final PCORI fee for plan years ending from Jan. 1, 2019 to Sept. 30, 2019, will be due by July 31, 2020.

In Notice 2018-85, the IRS set the amount used to calculate the PCORI fee at $2.45 per person covered by plan years ending Oct. 1, 2018, through Sept. 30, 2019.

The chart below shows the fees to be paid in 2019, which are slightly higher than the fees owed in 2018. The per-enrollee amount depends on when the plan year ended, as in previous years.

| Fee per Plan Enrollee for Payment Due July 31, 2019 |

|

| Plan years ending from Oct. 1, 2018, through Sept. 30, 2019. | $2.45 |

| Fee per Plan Enrollee for Payment Due July 31, 2018 |

|

| Plan years ending from Oct. 1, 2017, through Dec. 31, 2017, including calendar-year plans. | $2.39 |

| Plan years ending from Jan. 1, 2017, through Sept. 30, 2017 | $2.26 |

| Source: IRS. |

Nearing the End

The PCORI fee will not be assessed for plan years ending after Sept. 30, 2019, "which means that for a calendar-year plan, the last year for assessment is the 2018 calendar year," wrote Richard Stover, a New York City-based principal at HR consultancy Buck Global, and Amy Dunn, a principal in Buck's Knowledge Resource Center.

For noncalendar-year plans that end between Jan. 1, 2019 and Sept. 30, 3019, however, there will be one last PCORI payment due by July 31, 2020.

"There will not be any PCORI fee for plan years that end on October 1, 2019 or later," according to 360 Corporate Benefit Advisors.

The PCORI fee was first assessed for plan years ending after Sept. 30, 2012. The fee for the first plan year was $1 per plan enrollee, which increased to $2 per enrollee in the second year and was then indexed in subsequent years based on the increase in national health expenditures.

FSAs and HRAs

In addition to self-insured medical plans, health flexible spending accounts (health FSAs) and health reimbursement arrangements (HRAs) that fail to qualify as “excepted benefits” would be required to pay the per-enrollee fee, wrote Gary Kushner, president and CEO of Kushner & Co., a benefits advisory firm based in Portage, Mich.

As set forth in the Department of Labor's Technical Release 2013-03:

- A health FSA is an excepted benefit if the employer does not contribute more than $500 a year to any employee accounts and also offers a group health plan with nonexcepted benefits.

- An HRA is an excepted benefit if it only reimburses for limited-scope dental and vision expenses or long-term care coverage and is not integrated with a group health plan.

Kushner explained that:

- If the employer sponsors a fully insured group health plan for which the insurance carrier is filing and paying the PCORI fee and the same employer sponsors an employer-funded health care FSA or an HRA not exempted from the fee, employers should only count the employees participating in the FSA or HRA, and not spouses or dependents, when paying the fee.

- If the employer sponsors a self-funded group health plan, then the employer needs to file the form and pay the PCORI fee only on the number of individuals enrolled in the group health plan, and not in the employer-funded health care FSA or HRA.

An employer that sponsors a self-insured HRA along with a fully insured medical plan "must pay PCORI fees based on the number of employees (dependents are not included in this count) participating in the HRA, while the insurer pays the PCORI fee on the individuals (including dependents) covered under the insured plan," wrote Mark Holloway, senior vice president and director of compliance services at Lockton Companies, a benefits broker and services firm based in Kansas City, Mo. Where an employer maintains an HRA along with a self-funded medical plan and both have the same plan year, "the employer pays a single PCORI fee based on the number of covered lives in the self-funded medical plan (the HRA is disregarded)."

Paying PCORI Fees

Self-insured employers are responsible for submitting the fee and accompanying paperwork to the IRS, as "third-party reporting and payment of the fee is not permitted for self-funded plans," Holloway noted.

For the coming year, self-insured health plan sponsors should use Form 720 for the second calendar quarter to report and pay the PCORI fee by July 31, 2019.

"On p. 2 of Form 720, under Part II, the employer needs to designate the average number of covered lives under its applicable self-insured plan," Holloway explained. The number of covered lives will be multiplied by $2.45 for plan years ending on or after Oct. 1, 2018, to determine the total fee owed to the IRS next July.

To calculate "the average number of lives covered" or plan enrollees, employers should use one of three methods listed on pages 8 and 9 of the Instructions for Form 720. A white paper by Keller Benefit Services describes these methods in greater detail.

Although the fee is paid annually, employers should indicate on the Payment Voucher (720-V), located at the end of Form 720, that the tax period for the fee is the second quarter of the year. "Failure to properly designate 'second quarter' on the voucher will result in the IRS's software generating a tardy filing notice, with all the incumbent aggravation on the employer to correct the matter with the IRS," Holloway warned.

A few other points to keep in mind: "The U.S. Department of Labor believes the fee cannot be paid from plan assets," he said. In other words, for self-insured health plans, "the PCORI fee must be paid by the plan sponsor. It is not a permissible expense of a self-funded plan and cannot be paid in whole or part by participant contributions."

In addition, PCORI fees "should not be included in the plan's cost when computing the plan's COBRA premium," Holloway noted. But "the IRS has indicated the fee is, however, a tax-deductible business expense for employers with self-funded plans," he added, citing a May 2013 IRS memorandum.

SOURCE: Miller, S. (2 July 2019) "PCORI Fee Is Due by July 31 for Self-Insured Health Plans" (Web Blog Post). Retrieved from https://www.shrm.org/resourcesandtools/hr-topics/benefits/pages/2019-pcori-fees.aspx

DOL Offers Wage and Hour Compliance Tips in Three Opinion Letters

On July 1, the U.S. Department of Labor (DOL) released three opinion letters that address how to comply with the Fair Labor Standards Act (FLSA) regarding wage and hour issues. Continue reading this blog post to learn how the agency would enforce statutes and regulations specific to these situations.

The U.S. Department of Labor (DOL) issued three new opinion letters addressing how to comply with the Fair Labor Standards Act (FLSA) when rounding employee work hours and other wage and hour issues.

Opinion letters describe how the agency would enforce statutes and regulations in specific circumstances presented by an employer, worker or other party who requests the opinion. Opinion letters are not binding, but there may be a safe harbor for employers that show they relied on one.

The DOL Wage and Hour Division's July 1 letters covered:

- Permissible rounding practices for calculating an employee's hours worked.

- How to apply the "highly compensated employee" exemption from overtime pay to paralegals who are employed by a trade organization.

- How to calculate overtime pay for nondiscretionary bonuses that are paid on a quarterly and annual basis.

Here are the key takeaways for employers.

Rounding Practices

One letter reviewed whether an organization's rounding practices are permissible under the Service Contract Act (SCA), which requires government contractors and subcontractors to pay prevailing wages and benefits and applies FLSA principles to calculate hours worked.

The employer's payroll software extended employees' clocked time to six decimal points and then rounded that number to two decimal points. When the third decimal was less than .005, the second decimal was not adjusted, but when the third decimal was .005 or greater, the second decimal was rounded up by 0.01. Then the software calculated daily pay by multiplying the rounded daily hours by the SCA's prevailing wage.

Employers may round workers' time if doing so "will not result, over a period of time, in failure to compensate the employees properly for all the time they have actually worked," according to the FLSA.

"It has been our policy to accept rounding to the nearest five minutes, one-tenth of an hour, one-quarter of an hour, or one-half hour as long as the rounding averages out so that the employees are compensated for all the time they actually work," the opinion letter said.

Based on the facts provided, the DOL concluded that the employer's rounding practice complied with the FLSA and the SCA. The rounding practice was "neutral on its face" and appeared to average out so that employees were paid for all the hours they actually worked.

For employers, the letter provides two significant details, said Marty Heller, an attorney with Fisher Phillips in Atlanta. First, it confirms that the DOL applies the FLSA's rounding practices to the SCA. Second, it confirms the DOL's position that computer rounding is permissible, at least when the rounding involves a practice that appears to be neutral and does not result in the failure to compensate employees fully over a period of time, he said.

Patrick Hulla, an attorney with Ogletree Deakins in Kansas City, Mo., noted that the employer's rounding practice in this case differed from many employers' application of the principle. Specifically, the employer was rounding time entries to six decimal places. Most employers round using larger periods of time—in as many as 15-minute increments, he said.

"Employers taking advantage of permissible rounding should periodically confirm that their practices are neutral, which can be a costly and time-consuming exercise," he suggested.

Exempt Paralegals

Another letter analyzed whether a trade organization's paralegals were exempt from the FLSA's minimum wage and overtime requirements. Under the FLSA's white-collar exemptions, employees must earn at least $23,660 and perform certain duties. However, employees whose total compensation is at least $100,000 a year are considered highly compensated employees and are eligible for exempt status if they meet a reduced duties test, as follows:

- The employee's primary duty must be office or nonmanual work.

- The employee must "customarily and regularly" perform at least one of the bona fide exempt duties of an executive, administrative or professional employee.

Employers should note that the DOL's proposed changes to the overtime rule would raise the regular salary threshold to $35,308 and the highly compensated salary threshold to $147,414.

Because "a high level of compensation is a strong indicator of an employee's exempt status," the highly compensated employee exemption "eliminates the need for a detailed analysis of the employee's job duties," the opinion letter explained.

The paralegals described in the letter appeared to qualify for the highly compensated employee exemption because all their duties were nonmanual, they were paid at least $100,000 a year, and they "customarily and regularly" perform at least one duty under the administrative exemption.

The letter cited "a litany of the paralegals' job duties and responsibilities—including keeping and maintaining corporate and official records, assisting the finance department with bank account matters, and budgeting—that are directly related to management or general business operations," the DOL said.

The DOL noted that some paralegals don't qualify for the administrative exemption because their primary duties don't include exercising discretion and independent judgment on significant matters. But the "discretion and independent judgment" factor doesn't have to be satisfied under the highly compensated employee exception.

Calculating Bonuses

The third letter discussed whether the FLSA requires an employer to include a nondiscretionary bonus that is a fixed percentage of an employee's straight-time wages received over multiple workweeks in the calculation of the employee's regular rate of pay at the end of each workweek.

Under the FLSA, nonexempt employees must be paid at least 1 1/2 times their regular rate of pay for hours worked beyond 40 in a workweek, unless they are covered by an exemption—but the regular rate is based on more than just the employee's hourly wage. It includes all remuneration for employment unless the compensation falls within one of eight statutory exclusions. Nondiscretionary bonuses count as remuneration and must be included in the calculation.

"An employer may base a nondiscretionary bonus on work performed during multiple workweeks and pay the bonus at the end of the bonus period," according to the opinion letter. "An employer, however, is not required to retrospectively recalculate the regular rate if the employer pays a fixed percentage bonus that simultaneously pays overtime compensation due on the bonus."

The annual bonus, in this case, was not tied to straight-time or overtime hours. Based on the facts provided by an employee, the DOL said that after the employer pays the annual bonus, it must recalculate the regular rate for each workweek in the bonus period and pay any overtime compensation that is due on the annual bonus.

For the quarterly bonuses, the employee received 15 percent of his straight-time and overtime wages so they "simultaneously include all overtime compensation due on the bonus as an arithmetic fact," the DOL said.

SOURCE: Nagele-Piazza, L.(2 July 2019) "DOL Offers Wage and Hour Compliance Tips in Three Opinion Letters" (Web Blog Post). Retrieved from https://www.shrm.org/ResourcesAndTools/legal-and-compliance/employment-law/Pages/DOL-Offers-Wage-and-Hour-Compliance-Tips-in-Three-Opinion-Letters.aspx

IRS Seeks Comments on Form W-4 Overhaul for 2020

A draft of the 2020 Form W-4 was released on May 31, by the IRS. This new version includes included major revisions that were designed to make accurate income-tax withholding easier for employees. Continue reading this blog post to learn more.

On May 31, the IRS released a draft 2020 Form W-4 with major revisions designed to make accurate income-tax withholding easier for employees, starting next year. The IRS also posted FAQs about the new form and asked for comments on the changes by July 1.

The form is not for immediate use, the IRS emphasized, and employers should continue to use the current Form W-4 for 2019.

"The primary goals of the new design are to provide simplicity, accuracy and privacy for employees, while minimizing burden for employers and payroll processors," IRS Commissioner Charles Rettig said.

The new form reflects changes made by the Tax Cuts and Jobs Act, which took effect last year. For instance, the revised form eliminates the use of withholding allowances, which were tied to the personal exemption amount—$4,050 for 2017, now suspended. It also replaces complicated worksheets with more straightforward questions.

Addressing a key employer concern, the IRS said that employees who have submitted Form W-4 in any year before 2020 will not need to submit a new form because of the redesign. Employers can compute withholding based on information from employees' most recently submitted Form W-4, if employees choose not to adjust their withholding using the revised form.

Easier for Employees, More Complex for Employers

"Generally, the new Form W-4 is an improvement for employees," said Pete Isberg, vice president of government relations at payroll and HR services firm ADP. It shifts the burden of several calculations from employees to the employer, he noted. "For example, previously. employees would complete a difficult worksheet to convert expected deductions to a number of withholding allowances. With the new form, they'll just enter their full-year expected deductions over the standard deduction amount."

Because existing employees won't have to complete a new Form W-4, "employers must still observe their current Form W-4 withholding allowances," Isberg said. "However, for employees hired after 2019—and anyone that wants to adjust their withholding after 2019—the 2020 version will be the only valid Form W-4."

Not requiring employees to submit the new W-4 will ease HR's burden, but it also means that "payroll systems will need to accommodate the existing withholding allowance calculation, as well as the new method," which could make reprogramming payroll systems more arduous, said Mike Trabold, director of compliance at Paychex, an HR technology services and payroll provider.

In addition to supporting two distinct withholding systems, employers will need to accommodate three sets of withholding calculations, Isberg said:

- The old system based on withholding allowances.

- The 2020 system with a checkbox for optional higher withholding.

- The 2020 system that allows employees to input new data, listed below in the W-4 forms comparison chart.

| 2019 Form W-4 | 2020 Form W-4 (draft) |

| Number of withholding allowances. | Checkbox for multiple jobs or optional higher withholding. |

| Per-payroll additional amount to withhold. | Full-year child and dependent tax credits. |

| Full-year other (non-wage) income. | |

| Full-year deductions (over the standard deduction amount). | |

| Per-payroll additional amount to withhold. |

"One interesting question is how long employers might need to support the old and new systems simultaneously," Isberg said. "It will probably be many years before the last withholding allowances [used by current employees] drop off."

Addressing Privacy Concerns

In June 2018, the IRS issued an earlier revision of Form W-4 and instructions for 2019. But in September 2018, the IRS said it would delay major revisions until 2020 to respond to criticism about the form's release date and complexity.

"We anticipate this version will be better received than the prior draft," Trabold said. The earlier version "asked for much more specific information on other sources of income, such as second jobs, spousal income, non-earned income, etc., which was intended to increase withholding accuracy but which many taxpayers may have felt to be invasive and wouldn't necessarily want to share with their employer."

With the new version of the form, taxpayers can check a box "to indicate their desire to have more tax withheld, without having to share details with their employer," Trabold said. Although this may lead to too much withholding for some taxpayers, "it will help address concerns of those who prefer to get a refund check every year or who may have had to unexpectedly pay tax when filing this year," he explained.

While there will be a worksheet to help taxpayers with the new form, "it will not be provided to the employer, further assuring privacy," Trabold noted.

What's Next

The IRS said it plans to release a "close to final" version of the form in late July, after which employers and payroll administrators can start making programming changes to their systems. A final version, expected in November, will contain only minor adjustments.

The IRS also plans to release instructions for employers in the next few weeks for comment.

In the meantime, the IRS encouraged employees to use its online Paycheck Checkup tool to ensure they're having the right amount of tax withheld. While useful in its current form, the tool will be updated to reflect the new W-4 when it becomes final.

SOURCE: Miller, S. (6 June 2019) "IRS Seeks Comments on Form W-4 Overhaul for 2020" (Web Blog Post). Retrieved from https://www.shrm.org/ResourcesAndTools/hr-topics/compensation/Pages/IRS-seeks-comments-on-Form-W-4-overhaul-for-2020.aspx