Understanding the Intersection of Medicaid and Work

Sometimes, healthcare is confusing. We know this, which is why today we are focusing on Medicaid and work. Check out the snippet below, and check out the link for the full article.

Medicaid is the nation’s public health insurance program for people with low incomes. Overall, the Medicaid program covers one in five Americans, including many with complex and costly needs for care. Historically, nonelderly adults without disabilities accounted for a small share of Medicaid enrollees; however, the Affordable Care Act (ACA) expanded coverage to nonelderly adults with income up to 138% FPL, or $16,642 per year for an individual in 2017. As of December 2017, 32 states have implemented the ACA Medicaid expansion.1 By design, the expansion extended coverage to the working poor (both parents and childless adults), most of whom do not otherwise have access to affordable coverage. While many have gained coverage under the expansion, the majority of Medicaid enrollees are still the “traditional” populations of children, people with disabilities, and the elderly.

Some states and the Trump administration have stated that the ACA Medicaid expansion targets “able-bodied” adults and seek to make Medicaid eligibility contingent on work. Under current law, states cannot impose a work requirement as a condition of Medicaid eligibility, but some states are seeking waiver authority to do so. These types of waiver requests were denied by the Obama administration, but the Trump administration has indicated a willingness to approve such waivers. This issue brief provides data on the work status of the nearly 25 million non-elderly adults without SSI enrolled in Medicaid (referred to as “Medicaid adults” throughout this brief) to understand the potential implications of work requirement proposals in Medicaid. Key takeaways include the following:

- Among Medicaid adults (including parents and childless adults — the group targeted by the Medicaid expansion), nearly 8 in 10 live in working families, and a majority are working themselves. Nearly half of working Medicaid enrollees are employed by small firms, and many work in industries with low employer-sponsored insurance offer rates.

- Among the adult Medicaid enrollees who were not working, most report major impediments to their ability to work including illness or disability or care-giving responsibilities.

- While proponents of work requirements say such provisions aim to promote work for those who are not working, these policies could have negative implications on many who are working or exempt from the requirements. For example, coverage for working or exempt enrollees may be at risk if enrollees face administrative obstacles in verifying their work status or documenting an exemption.

Get the full report and findings.

SOURCE: Kaiser Family Foundation (5 January 2018). "Understanding the Intersection of Medicaid and Work" [Web Blog Post]. Retrieved from address https://www.kff.org/medicaid/issue-brief/understanding-the-intersection-of-medicaid-and-work/

Personalizing health plans with technology

Technology offers advanced opportunities to make your health plan customized to your employees. Check out this article from Employee Benefit Advisor by Cort Olsen for more information.

Many advisers are using digital monitoring to evaluate the status of wellbeing within a given employer’s employee population.

Craig Schmidt, senior wellness consultant for EPIC, says one of the ways he is able to identify the companies that are offering strong digital wellness plans is through their ability to integrate such programs with claims data. He utilizes a push style notification to a mobile device to inform individual employees about specific plans that can coordinate well with their conditions as a further enhancement.

Samantha Gardiner, director of product management at Health Advocate, says her company has combined wellness, chronic condition management and client outreach all into one program to improve the health of employees and reduce claims and pharmaceutical costs for employer-provided health plans.

“We take the data and provide alerts via our website, email or mobile push notifications to keep employees informed about their personal health conditions,” Gardiner says. “If we have the data, we can really target and personalize the program toward company goals and members’ personal goals.”

In order to identify the best in class among the programs offered by wellness providers, Schmidt says he looks at the number and quality of interfaces and outcomes from the program as well as success stories that employees can share that can flesh out an employer’s return on investment.

“We can look at results six months or even a year after an employee has participated in the program to see if behavior changes have taken place,” Schmidt says. “If the plan integrates and reacts to the systems the employer has in place for his or her employees, then we will know if the program is a right match.”

Integration

Monica Majors, vice president of marketing and communications of health plan products at Sutter Health, says a digital wellness program needs to integrate with a multitude of personal devices.

“The site must be responsive to all technology, such as a mobile device, a tablet, or for those who are deskbound, from their computer,” Majors says. “The flexibility of offering individual trackers as well as key based activity challenges through a wide range of activities will keep retention.”

The program can then offer a health assessment that can be aggregated into an overall employer report, which can then serve as a basis for customization for that specific workforce.

Marcia Otto, vice president of product strategy at Health Advocate, says her company offers biometric screenings that can be done onsite, which can then factor into an employee’s health risk assessment to further customize the personal health program.

“If we get biometric data from our biometric data collection or if the employee sends us the data from a third party, that is another data source we can look at to determine if they need further attention for diabetes, hyper tension or so on,” Otto says. “We can also collect data on what their last blood test reported, right down to how many fruits or vegetables they eat, which is then prioritized based on how sick the employee is.”

Incentivizing

To influence employees to remain on the wellness plan, employers have offered incentives. These incentives can range from gift cards and cash rewards to funding a HSA or a HRA.

Paul Sterling, vice president of emerging products at UnitedHealthcare, says users who are enrolled in the UnitedHealthcare Motion program – an app programmed to encourage employees to remain active throughout the workday using a smart phone or smart watch – rewards employees by funding money into an HSA or HRA as a way to retain users.

“We have three daily walking objectives through our FIT criteria – frequency, intensity and tenacity – that each of our members try to achieve,” Sterling says. “Each one of those objectives is tied to or associated with an incentive amount.”

For each objective the employee completes, UnitedHealthcare deposits $1 into the user’s HSA or HRA, depending what they have.

Each day, the employee can complete each of the objectives. It resets daily, allowing the employee to continue to receive up to $3 per day.

Over the course of one year, Sterling says participation in the Motion program has held at a steady 67%. “If you think about other products in the health and wellness space, that’s arguably 10 times the level of engagement achieved over that period of time others would achieve,” Sterling says.

While Gardiner says she cannot pin point the number of employees engaged in her program for an extended period of time yet, she thinks incentives do drive continued engagement for some employees who need the extra push to be active or engage in a healthier lifestyle.

“An incentive program that provides at least a $300 incentive to participate is where we see our most engagement,” Gardiner says. “It all depends on the goals of the employer.”

Read more.

SOURCE: Olsen C. (4 February 2018). "Personalizing health plans with technology" [Web Blog Post]. Retrieved from address https://www.employeebenefitadviser.com/news/personalizing-health-plans-with-technology?feed=00000152-175f-d933-a573-ff5f3f230000

SaveSave

SaveSave

Health Care Lags As Hot-Button Issue

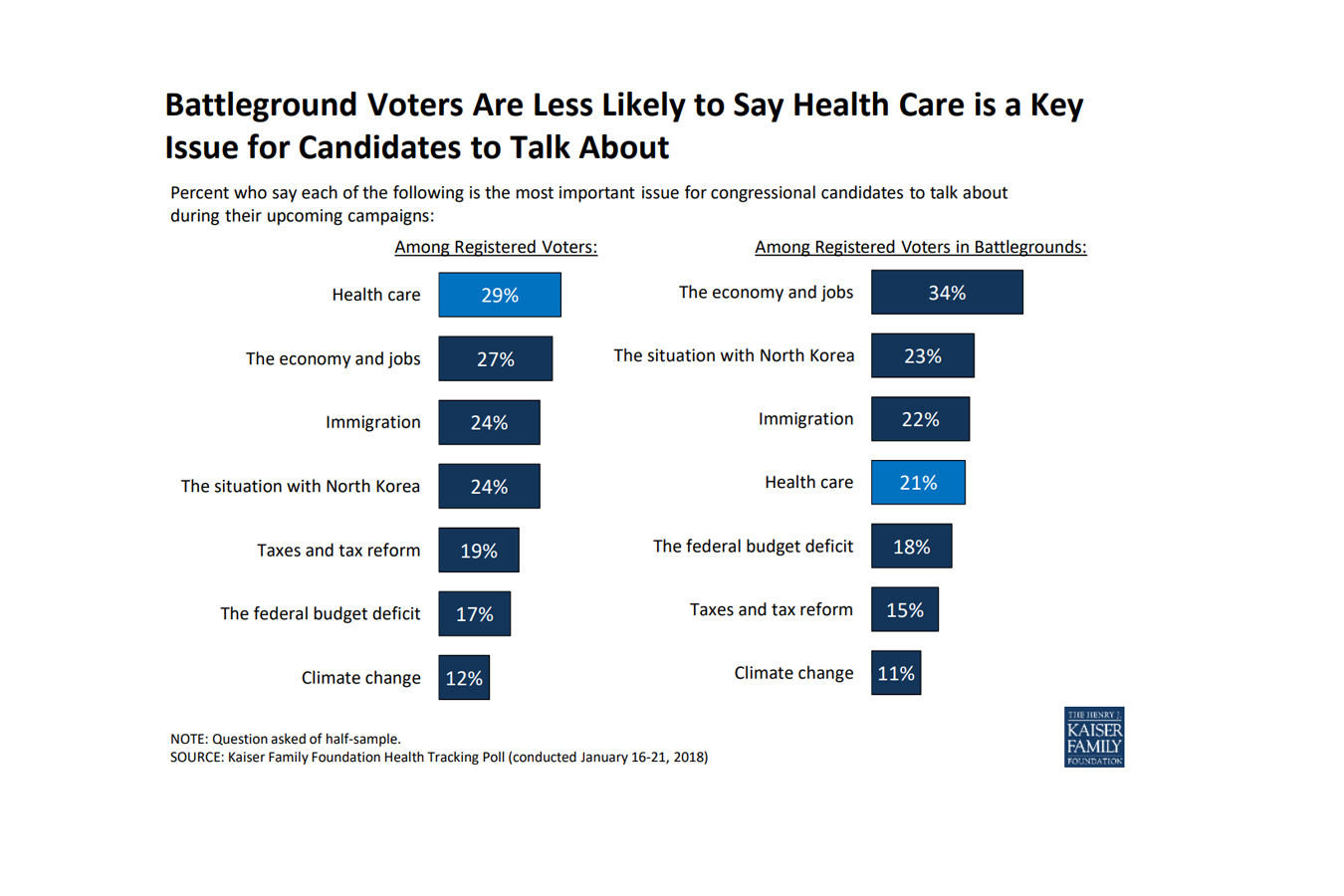

As it turns out - according to this poll conducted by Kaiser Health News - health care is not a key issue battleground voters wish to discuss. Instead, a large number of voters are more interested in dealing with issues regarding our economy and jobs.

Read further in this article below.

As the midterm elections approach, health care ranks as the top issue, mentioned more frequently among voters nationwide than among those living in areas with competitive races, a new poll finds.

As the midterm elections approach, health care ranks as the top issue, mentioned more frequently among voters nationwide than among those living in areas with competitive races, a new poll finds.

In areas with competitive congressional or gubernatorial races, the economy and jobs ranked as the top issue for candidates to discuss, with 34 percent of registered voters listing it as No. 1, according to the poll from the Kaiser Family Foundation. (Kaiser Health News is an editorially independent program of the foundation.) Following economics was the conflict with North Korea (23 percent), immigration (22 percent) and health care (21 percent). The competitive areas are 13 states with statewide races and 19 House districts judged as toss-ups by the nonpartisan Cook Political Report.

Nationwide, 29 percent of registered voters ranked health care as the most important issue for electoral discussion — though it was far more important for Democrats than Republicans. Economy and jobs were close behind with 27 percent of voters rating it most important, and then immigration, with 24 percent listing it.

The poll found that nearly half of Americans believed there is still a federal requirement for everyone to obtain health insurance, even though Congress’ tax bill last year repealed the penalties for that requirement in the Affordable Care Act, known as the individual mandate. Only a third of the public was sure that those penalties had been repealed.

Fifty percent of the public expressed a favorable view of the health law, while 42 percent disliked it. Six in 10 people said that since President Donald Trump and the Republicans in Congress have altered the law, they are responsible for any problems. Like other opinions about the law, there was a strong partisan split: Only 38 percent of Republicans thought their party is now responsible, while 77 percent of Democrats thought so. Half of Republicans still listed repealing the health law as a top priority.

There was less of a partisan split over the importance that the president and Congress address the epidemic of prescription painkiller addiction. Among Republicans, 43 percent rated it a top priority; 54 percent of Democrats agreed.

There was no such comity over whether lawmakers should allow people brought illegally to this country by their parents — the so-called Dreamers — to stay in the country legally: 21 percent of Republicans called that a top priority, while 66 percent of Democrats did. And while 43 percent of Republicans said they wanted lawmakers to focus on passing federal funding for a border wall with Mexico, only 5 percent of Democrats and 19 percent of independents did.

The poll was conducted Jan. 16-21 among 1,215 adults. The margin of error was +/-3 percentage points. The poll included 298 people who said they were registered to vote in one of the areas the Cook Report identified as a battleground in the fall elections. The margin of error for results for this group was +/-7 percentage points.

Read the original article.

Source: Rau J. (26 January 2018). "In Battleground Races, Health Care Lags As Hot-Button Issue, Poll Finds" [Web Blog Post]. Retrieved from address https://khn.org/news/in-battleground-races-health-care-lags-as-hot-button-issue-poll-finds/

Tax Bill Provision Designed To Spur Paid Family Leave To Lower-Wage Workers

Tucked into the new tax law is a provision that offers companies a tax credit if they provide paid family and medical leave for lower-wage workers.

Many people support a national strategy for paid parental and family leave, especially for workers who are not in management and are less likely to get that benefit on the job. But consultants, scholars and consumer advocates alike say the new tax credit will encourage few companies to take the plunge.

The tax credit, proposed by Sen. Deb Fischer (R-Neb.), is available to companies that offer at least two weeks of paid family or medical leave annually to workers, but two key criteria must be met. The workers must earn less than $72,000 a year and the leave must cover at least 50 percent of their wages.

If contributing at the half-wage level, a company receives a tax credit equal to 12.5 percent of the amount it pays to the worker. The tax credit will increase on a sliding scale if the company pays more than 50 percent of wages. It could go up to a maximum credit of 25 percent of the amount the employer paid for up to 12 weeks of leave.

Payments to full- and part-time workers taking family leave who’ve been employed for at least a year would be eligible for the employer’s tax break. But the program, which is designed to test whether this approach works well, is set to last just two years, ending after 2019.

Aparna Mathur, a resident scholar in economic policy studies at the American Enterprise Institute, says the new tax credit sidesteps a pitfall for Republicans. They are wary of any legislation mandating that employers provide paid leave. The tax credit also is appropriately aimed at lower-wage workers who are most likely to lack access to paid leave, said Mathur, who co-authored a recent report on paid family leave.

But it’s not a big enticement.

“Providing this benefit is a huge cost for employers,” Mathur said. “It’s unlikely that any new companies will jump on board just because they have a 12.5 to 25 percent offset.”

That view is shared by Vicki Shabo, vice president for workplace policies and strategies at the National Partnership for Women & Families, an advocacy group, who said it will primarily benefit workers at companies already offering paid family leave. The new tax credit “just perpetuates the boss lottery,” she added.

Heather Whaling said her 22-person public relations company probably qualifies for the new tax credit, but she doesn’t think it’s the right approach. Whaling, the president of Geben Communication in Columbus, Ohio, already offers paid leave. The company provides up to 10 weeks of paid leave at full pay for new parents. Four employees have taken leave, and by divvying up their work to other team members and hiring freelancers they’ve been able to get by.

“It is an expense, but if you plan and budget carefully it’s not cost-prohibitive,” she said.

The tax credit isn’t big enough to provide a strong incentive to provide paid leave, said Whaling, 37. Besides, “having access to paid family leave shouldn’t be luck of the draw, it should be available to every employee in the country.”

Still, the tax credit may be appealing to companies that have been considering adding a paid family and medical leave benefit, said Rich Fuerstenberg, a senior partner at benefits consultant Mercer.

By defraying some of the cost, the tax credit could help “tip them over” into offering paid leave, he said. But “I’m not even sure I’d call it the icing on the cake,” Fuerstenberg said. “It’s like the cherry on the icing.”

Only 15 percent of private-sector and state and local government workers had access to paid family and medical leave in 2017, according to the Bureau of Labor Statistics’ National Compensation Survey. Eighty-eight percent had access to unpaid leave, however.

Under the federal Family and Medical Leave Act, employers with 50 or more workers generally must allow eligible employees to take unpaid leave for up to 12 weeks annually for specified reasons. These include the birth or adoption of a child, caring for your own or a family member’s serious health condition, or leave for military caregiving or deployment. An individual’s job is protected during such leaves.

A tax credit that can be claimed at the end of the year is unlikely to encourage small businesses to offer paid family and medical leave, said Erik Rettig, an expert on family leave policies at the Small Business Majority, which advocates for those firms on national policy.

“It isn’t going to help the family business that has to absorb the costs of this employee while they’re gone,” Rettig said.

A better solution, according to Shabo and others, is to provide a paid family leave benefit that’s funded by employer and/or employee payroll contributions. Sen. Kirsten Gillibrand (D-N.Y.) and Rep. Rosa DeLauro (D-Conn.) last year reintroduced such legislation. Their bill would guarantee workers, including those who are self-employed, up to 12 weeks of family and medical leave with as much as two-thirds of their pay.

A handful of mostly Democratic states — including California, New Jersey, Rhode Island and New York — have similar laws in place, and a program in the District of Columbia and Washington state will begin in 2020.

“We know from states that this approach works for both employees and their bosses,” Shabo said.

Read the original article.

Source: Andrews M. (23 January 2018). "Tax Bill Provision Designed To Spur Paid Family Leave To Lower-Wage Workers" [Web blog post]. Retrieved from address https://khn.org/news/tax-bill-provision-designed-to-spur-paid-family-leave-to-lower-wage-workers/

SaveSave

CHIP Renewed For Six Years As Congress Votes To Reopen Federal Government

A brief, partial shutdown of the federal government ended Monday, as the Senate and House approved legislation that would keep federal dollars flowing until Feb. 8, as well as fund the Children’s Health Insurance Program for the next six years.

President Donald Trump signed the bill Monday evening.

The CHIP program, which provides coverage to children in families who earn too much to qualify for Medicaid but not enough to afford private insurance, has been bipartisan since its inception in 1997. But its renewal became a partisan bargaining chip over the past several months.

Funding for CHIP technically expired Oct. 1, although a temporary spending bill in December gave the program $2.85 billion. That was supposed to carry states through March to maintain coverage for an estimated 9 million children, but some states began to run short almost as soon as that bill passed.

The Georgetown University Center for Children and Families estimated that 24 states could face CHIP funding shortfalls by the end of January, putting an estimated 1.7 million children’s coverage at risk in 21 of those states.

Meanwhile, both houses of Congress had been at loggerheads over how to put the program on firmer financial footing.

In October, just days after the program’s funding expired, the Senate Finance Committee approved a bipartisan five-year extension of funding by voice vote. But that bill did not include a way to pay the cost, then estimated at $8.2 billion.

In November, the House passed its own five-year funding bill for the program, but it was largely opposed by Democrats because it would have offset the CHIP funding by making cuts to Medicare and the Affordable Care Act (ACA).

The reason, explained CBO, is that the landmark tax bill passed in December eliminated the ACA’s individual mandate, which would likely drive up premiums in the individual market. Those higher premiums, in turn, would increase the federal premium subsidies for those with qualifying incomes. As a result, if kids were to lose their CHIP coverage and go onto the individual exchanges instead, the federal premium subsidies would cost more than their CHIP coverage.

Driving that point home, on Jan. 11, CBO Director Keith Hall wrote to Rep. Frank Pallone (D-N.J.) that renewing CHIP funding for 10 years rather than five would save the federal government money. “The agencies estimate that enacting such legislation would decrease the deficit by $6.0 billion over the 2018-2027 period,” the letter said.

That made it easier for Republicans to include the CHIP funding in the latest spending bill. But it infuriated Democrats, who had vowed not to vote for another short-term spending bill until Congress dealt with the issue of immigrant children brought to the country illegally by their parents.

Republicans, said Senate Minority Leader Chuck Schumer (D-N.Y.) on Sunday, “were using the 10 million kids on CHIP, holding them as hostage for the 800,000 kids who were Dreamers. Kids against kids. Innocent kids against innocent kids. That’s no way to operate in this country.”

Republicans, however, said it was the opposite — that Democrats were holding CHIP hostage by not voting for the spending bill. “There is no reason for my colleagues to pit their righteous crusade on immigration against their righteous crusade for CHIP,” said Hatch. “This is simply a matter of priorities.”

The CHIP renewal was not the only health-related change in the temporary spending bill. The measure also delays the collection of several unpopular taxes that raise revenues to pay for the ACA’s benefits. The taxes being delayed include ones on medical device makers, health insurers and high-benefit “Cadillac” health plans.

The bill does not, however, extend funding for Community Health Centers, another bipartisan program whose funding is running out. That will have to wait for another bill.

Read the original article.

Source: Rovner J. (22 January 2018). "CHIP Renewed For Six Years As Congress Votes To Reopen Federal Government" [Web blog post]. Retrieved from address https://khn.org/news/chip-renewed-for-six-years-as-congress-votes-to-reopen-federal-government/

SaveSave

What’s ahead for HR technology?

As technology modernizes business, HR has worked hard to keep up. In 2017, there were numerous innovations, so we can't wait to see what 2018 brings! Check out this article from Employee Benefit Advisor on some trends in HR Technology this year.

The past year saw a number of HR technology innovations and significant product introductions — and 2018 promises to bring about even bigger changes.

“The whole field of HRIS is really exciting right now,” says Vanessa DiMauro, CEO of consulting firm Leader Networks and a Columbia University faculty member. “There is so much change and innovation happening.”

Indeed, experts contend, innovations in artificial intelligence and analytics, along with development in cloud, social and mobile technologies, are making HR systems more intelligent and more engaging.

So what will smarter, friendlier HR systems do?

To begin with, they’ll provide more targeted support for employees by helping them gain access to the benefits and services they need. Employees with a new baby, for instance, would not only have their benefits packages updated automatically, but would also receive alerts and recommendations for store discounts, childcare facilities and other products and services geared toward helping them better manage their new family responsibilities.

Smarter HR systems also will deliver the type of workforce analytics that employers need to make better staffing decisions. The manager of a chain of convenience stores, for example, might want to schedule employees who have demonstrated a higher level of job performance for the late shift, because they can be counted on to close a store. The supervisor at a large hospital, on the other hand, might look to assign the facility’s most reliable employees — those who are more likely to show up for work on time — to care units that need to remain in compliance with their government-mandated staffing requirements.

But automatic updates and more efficient workforce scheduling are only two ways in which the latest digital advances will enhance human capital management. There are many others, including:

- Increased employee retention and more effective recruitment.

- Less biased performance management and KPIs.

- Improved knowledge sharing and employee collaboration.

- Greater workforce diversity and inclusion.

To illustrate this, DiMauro points to a new set of talent acquisition tools aimed at helping employers take advantage of underutilized labor pools by increasing the diversity of their workforce. These include applications to help improve outreach efforts to military veterans and people with disabilities, among other populations.

Offering another example, she cites an emerging category of applications designed to minimize gender, ethnic and other forms of bias, when it comes to performance reviews and considering employees for raises and promotions.

Building a smart system

What gives these new applications their power and joins them together, as part of an integrated HR information system (HRIS), is their ability to feed and draw from the same set of employee records. Building this smart HR system — and setting forth on the employer’s digital “journey,” of which it is a part — is likely to begin with the deployment of an employee-collaboration or knowledge-management platform that serves as the hub for all of the employer’s future HR tech endeavors.

The knowledge platform is linked through a single sign-on to the organization’s employee records database. HR staffers and other employees can organize the information into groups, which employees can join. A new hire might begin by logging into the “new employee orientation” group, which might auto-join the employee into a “benefits” group or a “training” group.

Over time, employees can continue to be auto-joined to different groups and auto-fed applicable content, as they experience different life events (such as a home purchase) or reach various milestones (such as a promotion) in their careers. Each of the groups might be built around a corresponding app — some of which might be designed for a mobile device.

Utilizing a hub and spoke model, different HR applications can be added to the system and tied into the employee database. In this way, employers are able to incrementally build out a 360-degree HRIS “wheel” that eventually includes performance reviews, employee engagement portals and talent acquisition tools that auto-reward employees for successful referrals.

The auto-classification and auto-taxonomy features embedded in the collaboration platform and corresponding apps, DiMauro explains, eliminate many of the purely rote administrative tasks that HR is saddled with today.

Meeting employee needs

Citing consumer research, the consultant notes that most customers — including most employees — want to self-serve. “Who wants to wait until morning, if you have a middle-of-the-night problem?” she asks. “When employees can readily find their own answers to less complex questions, that is a win-win for both the employee and the HR rep who would’ve had to handle the request.”

Behind all these innovations are a number of new technologies that will continue to gain steam in 2018. The most important of these is the cloud.

“From a technology standpoint, this is the biggest trend in HRIS,” says Lisa Rowan, vice president for HCM and talent management at market researcher International Data Corp.

Cloud-based HRIS solutions, which are hosted at remote facilities and maintained by the service provider, offer employers many advantages over traditional on-premise solutions that they had to maintain themselves. Chief among these are lower maintenance costs, faster transaction times, a more streamlined and easier-to-use interface, and software that is always up to date.

Human resource execs are embracing applicant tracking, training management, performance management and other software applications.

Keeping HRIS software current is important, if the employer wants to take advantage of other leading-edge technologies as they become available, including more graphically-oriented, intuitive applications for complex undertakings like a benefits enrollment. But it does require certain tradeoffs.

Traditionally, if an HRIS system didn’t support the precise way an HR organization handled a given task or function, custom software code would be written to adapt the system to the process. This was expensive and time-consuming, and forced companies to delay adopting new versions of the software, since every upgrade required complex rewrites of their customized code. Cloud-based systems eliminate these requirements and are much easier to deploy, but the HR department must adapt to the workflow prescribed by the system — and not the other way around.

As cloud-based systems become prevalent, says Rowan, “HR professionals will have to face the fact that they will have to do things a little differently to fit within the scope of a configurable, but not customizable, system.”

The cost efficiencies and operational advantages associated with a cloud-based system pave the way for other break-through HRIS technologies as well. Chief among them are:

- Social media, which offers employees new ways to share work and collaborate, and provides employers with new tools for disseminating their message and attracting job candidates.

- Mobile devices, which let employers tailor their outreach to select groups of employees, and allow employees to clock-in, enroll for benefits and handle many other tasks remotely, at a time and place of their choosing.

- Artificial intelligence, which is paving the way for new and different ways to respond to employee demands. Chat boxes, for instance, will soon replace human operators at HR call centers. Employees who phone or text in will still feel as though they are dealing with a person, but it will be a computer algorithm at the other end of the line.

- Data analytics, which give HR pros tools to gauge and influence employee behaviors, improve open enrollment outcomes and deepen employee engagement. But data analytics can also be utilized in a more strategic manner: By correlating workforce composition and activity with specific business outcomes, employers can systematically reshape their workforce to improve those outcomes.

“Analytics allow employers to identify useful trends by asking simple questions,” explains Bob DelPonte, general manager for the workforce ready group at Kronos, a provider of human capital management products and services. “For example, what’s the turnover rate for employees who live more than 20 miles away from work, compared with those who live less?”

The answer, he says, can inform the employer’s hiring and scheduling decisions. “Why risk losing a hard-to-replace employee because you’re forcing her to travel farther than she needs to, if you have the option of transferring her to a closer facility?”

Proceeding with caution

While technologies like artificial intelligence can be a boon to HR, they can also pose challenges. By increasing automation, AI will free HR staff from many repetitive tasks, allowing them to focus on more strategic concerns. But analysts like Rowan are not demure about the fact that some HR staffers will also be replaced by the software.

“How does that play out?” she asks. “You have HR personnel today who are geared toward answering phone calls, and when there are fewer calls, they may no longer be needed. There’s no point to sugar-coating that reality. There are HR professionals that need to think about re-skilling themselves.”

DiMauro also offers a word of caution. “It’s important that HR executives don’t get drunk at the bar of tools. There are so many new applications,” she says, “that they need to keep their wits about them and determine what they really need. Look for the right tool to solve the problem. Don’t just collect and decorate because it’s all out there and available.”

Read the original article.

Source: Kass E. (17 January 2018). "What’s ahead for HR technology?" [Web Blog Post]. Retrieved from address https://www.employeebenefitadviser.com/news/whats-ahead-for-hr-technology?feed=00000152-175f-d933-a573-ff5f3f230000

Employers prefer paper-based approach for open enrollment

Sure, technology is great, but can it ever live up to a face-to-face sit down? Let's take a look at the facts from Employee Benefit Advisor.

Fewer than half of businesses use technology to handle annual enrollment or manage time off, Affordable Care Act reporting or benefits changes during the year, according to a recent white paper by one of the nation’s leading ancillary benefits providers.

Citing a 2017 LIMRA report entitled “Convenient and Connected: Employers and Benefits,” Colonial Life highlighted several reasons why employers are resisting the digital age. They believe their organization isn’t big enough (32%), a technology solution is too expensive (24%), they don’t have enough staff (16%), in-person meetings are more engaging, or it’s the preference of their broker or plan administrator (tied at 15%).

In fact, Colonial Life post-enrollment surveys from 2009 to 2016 show that 98% of employees understand their benefits better through 1-to-1 benefits counseling and 95% describe the personalized attention they received as valuable.

Steven Johnson, vice president in premier markets and enrollment solutions at Colonial Life, was surprised by the prevalence of “manual and outdated ways.” However, he also understands the tendency to resist change— noting, for example, how some people still maintain landlines in spite of a reliance on smartphones for calls, text, e-mail, social media and GPS directions.

“Slow adoption of technology can be especially true in the workplace,” he says. “Heavy dependence of the fax machine at many workplaces still baffles me with so much advanced technology available to perform the job better, faster and cheaper.”

For those employers looking to add capabilities to their benefits technology programs, the report noted that LIMRA found most cited cost reduction (36%) or control of benefit data (35%). Rounding out the list was reduced staff time (32%), improved benefits communications (29%) and better employee experience (27%).

Among the features most sought after for either benefits administration systems, enrollment technology or both, LIMRA said low cost led the way (87%), followed by data security (86%), ease of use for employees (85%), it’s accessible all year (80%), employees re-enrolled annually or all insurance benefits are on the same platform (77% apiece).

Colonial Life stressed the importance of providing personalized resource materials, such as web content, e-mails and one-to-one meetings, as well as ample time for employees to make wise choices for themselves and dependents. Another recommendation was that insurance carriers make available benefits counselors to help guide employees through their decisions.

Johnson urged benefit brokers and advisers to help educate their clients on affordable enrollment technology solutions that will greatly enhance the experience for their employees while also reducing administrative burdens and challenges for employers and plan administrators.

“A trusted benefits adviser can share case study examples from companies of similar size and industry to illustrate the benefits of adopting a benefits admin solution for enrollment,” he says. In addition, he suggests that employee survey feedback can be shared to help advance the argument that “the overall experience is far better for those who’ve used technology to help them make their important benefits decisions.”

Source:

Shutan B. (13 November 2017). "Employers prefer paper-based approach for open enrollment" [Web blog post]. Retrieved from address https://www.employeebenefitadviser.com/news/employers-prefer-paper-based-approach-for-open-enrollment?brief=00000152-1443-d1cc-a5fa-7cfba3c60000

SaveSave

SaveSave

IRS to reject returns lacking health coverage disclosure

Where does the IRS stand on ACA (Affordable Care Act)? It's time to know. Check out this article from Benefits Pro for more information.

The Internal Revenue Service has announced that for the first time, tax returns filed electronically in 2018 will be rejected if they do not contain the information about whether the filer has coverage, including whether the filer is exempt from the individual mandate or will pay the tax penalty imposed by the law on those who don’t buy coverage.

Tax returns filed on paper could have processing suspended and thus any possible refund delayed.

The New York Times reports that the IRS appears to be acting in contradiction to the first executive order issued by the Trump White House on inauguration day, in which Trump instructed agencies to “scale back” enforcement of regulations governing the ACA.

The move by the IRS reminds people that they can’t just ignore the ACA, despite the EO. Although only those lacking coverage have to pay the penalty, everyone has to indicate their insurance coverage status on their filing.

While the uninsured rate for all Americans dipped to a historic low of 8.6 percent in the first three months...5 states with lowest, highest uninsured rates

According to legal experts cited in the report, the IRS is indicating that although the administration may have leeway in how aggressively it enforces the mandate provision, it’s still in effect unless and until Congress specifically repeals it.

While many people thought they didn’t have to bother with reporting, and many insurers have raised rates anticipating that the lack of a mandate would lead to lower enrollments and higher costs for them, that’s not the case. Initially the IRS did not reject returns because the law was new.

The penalty is pretty steep; for those who don’t have coverage, it can range from $695 for an individual to a maximum of $2,085 for a family or 2.5 percent of AGI, whichever is higher. Not everyone without coverage would be penalized, though; if their income is too low or if the lowest-priced coverage costs more than 8.16 percent of their income, they’ll avoid the penalty.

That said, it’s not known how stringently the IRS will be in enforcing the mandate. But at least taxpayers will know whether they’re exempt from the penalty or whether they’re obligated to buy coverage.

5 Health Care Terms You Need to Know

We talk about health care A TON, but sometimes it's good to refer back to the basics of it all. Do you understand the meaning of deductible, premium or HSA? If so, give yourself a pat on the back. If not, don't worry! This blog post has got you covered.

Health care is confusing, but one thing's for certain: It's expensive. And health insurance companies don't always make it easy to understand what's covered, what's not, and how much you'll be on the hook for paying.

Deductible: The amount you pay before your insurance coverage kicks in. It resets annually.

Copay: The amount you pay after you have met your deductible. It's a fixed price for services and medications, and can vary by the type of physician you visit, the class of medication you're taking, and other factors.

Out-of-pocket maximum: The top limit of what you'll spend in a year out of pocket for deductibles and copays.

Premium: Your monthly fee for health insurance. If your employer provides you coverage, then you probably pay a portion of the premium, while your employer pays the rest. A higher premium may mean a lower deductible; on the other hand, a lower premium may mean a higher deductible.

Health savings account (HSA): A type of pre-tax savings account for health expenses. Funds roll over year to year, and some accounts even gain interest.

You can read the original article here.

Source:

Health.com (4 April 2017). "5 Health Care Terms You Need to Know" [Web blog post]. Retrieved from address https://www.health.com/mind-body/healthcare-terms-coinage

Health-Care Cost Expert Kathryn Votava on Buying Long-Term-Care Insurance

Health care can be an expensive matter, especially when seeking long-term solutions. We thought it'd be beneficial to find an article from the perspective of an expert on long-term insurance, enabling those looking into the solution to have a better idea of what they're getting into. From Health.com, here is an interview from Kathryn Votava.

You can read the original article here.

"The earlier you purchase a policy, the healthier you are and the more likely you are to qualify for insurance."(KATHRYN VOTAVA)

"The earlier you purchase a policy, the healthier you are and the more likely you are to qualify for insurance."(KATHRYN VOTAVA)

Many people rely on family and friends to provide care for them when they can no longer do it themselves. But at some point, the care required can be too much for these informal networks to handle. That's where long-term-care insurance comes in. Caregiving expenses are usually not covered by health insurance, and they can be staggeringa semi-private room in a nursing home, for instance, can run about $70,000 a year, and in-home care can reach as high as $350,000 for round-the-clock help. We asked Kathryn Votava, PhD, assistant professor of clinical nursing at the University of Rochester in New York and president of Goodcare.com, a company that analyzes health-care costs, for advice on how to shop for the best long-term insurance policy.

Q: What does long-term-care insurance cover?

A: Depending on what kind of policy you choose, it will pay for a nursing home, assisted-living facility, community programs, or for someone to come to your home to care for you. It can offset some of the costsnotice I said some. Most people think that if they have a long-term-care insurance policy, they're covered completely. Not only is the average policy not enough to cover the cost of this type of care, but people don't take health-care inflation into account. And you will still need to pay for your Medicare Part B, Medigap plan, prescription drugs, and doctor visits just as before. Those expenses don't go away and long-term-care insurance doesn't cover them.

Q: How much coverage should I get?

A: The average policy covers $149 a day. Now, if you live in some parts of Texas or Louisiana, that might cover your long-term-care needs. But in a place like New York City, the average is more than twice that. Get an understanding of what the costs are in your area. The two big surveys of nursing-home prices are from Genworth Financial and MetLife Financial. That will give you a ballpark figure, but even those underestimate how much it actually costs. I'd call a good nursing home or home health-care agency that you might like to use eventually. Find out what the daily cost might be, for example $300 a day, and buy the coverage that's closest to that daily cost. When it comes to 24-hour care at home, you will find that a long-term-care insurance benefit will not come close to covering that level of cost, because extensive in-home care is costly. Remember that once you have exceeded two to four hours a day, seven days per week of in-home care, you will probably be paying more for long-term-care than if you were in a nursing home. Therefore, if you need more than two to four hours per day of in-home care, your long-term insurance benefit may provide more long-term-care if you are in a nursing home.

Q: How long should my coverage last?

A: You can purchase a policy that pays a set dollar amount per day for either some period of time or as a continuous lifetime benefit. I advise people that the most economical choice is to purchase a plan that provides benefits for five years. Only about 20% of people stay in a nursing home for five years or more. That's the minimum coverage you should have. If you have more money to spend, then certainly buy coverage for a longer time period or a bigger benefit so that if you're certain that you want in-home care, you will have more money to pay for it. Take the money you'll save on the shorter coverage period and buy a shorter waiting period, benefit for home care (as many policies pay out only 50 cents on the dollar for long-term-care at home), and compound-inflation protection riders. Don't give up coverage on the front end for something you are much less likely to collect on the back end. Once you have the minimum coverage, if you have more money to spend, then you can buy coverage for a longer time period.

Q: What additional features are worth paying for?

A: Get a compounded inflation rider. A "simple" inflation rider does not keep up with inflation nearly as well. One basic problem is that health-care inflation runs at 8.1% a year; the maximum inflation protection you can usually get in a long-term-care insurance policy is 5%thats the best you can do. While that 5% rate will not keep up entirely with health-care inflation, it will give you a better chance of being able to afford your long-term-care when the policy pays out. I also like to see people have a 30-day waiting period or lessthats the amount of time from when the insurance company determines that a person is eligible to use their long-term-care benefit to when the company begins to actually pay out for the benefit. All policies have some waiting period. People often get a 90-day or a 100-day waiting period because it lowers their premium, but you could end up paying thousands of dollars during the time you're waiting for coverage to start. Finally, I recommend a nonforfeiture-of-benefit rider. Typically, you're only eligible for the insurance benefits as long as you pay your premium. But the nonforfeiture rider lets you maintain some value in a policy even if you decide not to continue paying for it. That could be very important if the insurance company you're with decides to go out of this business and sells your policy to someone else who jacks up your premium so much you can't afford it anymore. The non-forfeiture rider means you will get some amount of the policy benefitnot all, but somedepending what you paid in over time. One last thing: Make sure the insurance company you choose has a solid track record. Call the National Association of Insurance Commissioners at (866)-470-6246 and get the phone number for your state health-insurance department. Then contact your state insurance department to find out if there are any reported problems with an insurance company you are considering.

Q: When should you buy the insurance?

A: At the latest, I'd say late 40s or early 50s. It's still affordable then. The premium is based on your heath status first, then your age. Generally speaking, the earlier you purchase a policy, the healthier you are and the more likely you are to qualify for insurance. People who have serious, chronic conditions may find their rates to be really high or they may even be uninsurable. The costs vary greatly from policy to policy, state to state, and person to person. Usually someone in his or her late 40s or early 50s will pay about $3,000 to $6,000 a year. That's for a very good policy. Someone in his 60s could pay several thousand dollars a year more for the same policy.

Q: When does the coverage start?

A: In order for the policy to kick in, you must have a certain level of need. Most providers define that as not being able to perform at least two of what are called "activities of daily living," in insurance-speak. Those are: bathing, eating, dressing, toileting, and transferring from bed to chair. So, you might have a hard time giving yourself a bath, and it might take you all day to do and then you're completely exhausted, but to the insurance company you're not compromised enough to use the insurance for that. The exception to that rule is folks with dementia. They may be able to perform those tasks, but they need supervision, so the insurance company will often pay out for their care.

Q: Can you run into problems collecting your insurance?

A: It's gotten better. Some of the companies that were the most difficult to deal with were on shaky financial ground, and they've gone out of business. Remember, the person who comes to do the assessment of whether you're able to perform the activities of daily living works for the insurance company, not for you. They'll be looking at your case through that lens. If you run into trouble getting them to pay benefits, you might want to enlist an advocate, like a geriatric care manager, if more than a simple follow-up phone call is necessary.

You can read the original article here.

Source:

Polyak I. (25 January 2011). "Health-Care Cost Expert Kathryn Votava on Buying Long-Term-Care Insurance" [Web blog post]. Retrieved from address https://www.health.com/health/article/0,,20456208,00.html