CenterStage...Open Season for Open Enrollment

In this month’s CenterStage, we interviewed Rich Arnold for some in-depth information on Medicare plans and health coverage. Read the full article below.

Open Season for Open Enrollment: What does it mean for you?

There are 10,000 people turning 65 every single day. Medicare has a lot of options, causing the process to be extremely confusing. Rich – a Senior Solutions Advisor – works hard to provide you with the various options available to seniors in Ohio, Kentucky and Indiana and reduce them to an ideal, simple, and easy-to-follow plan.

“For me, this is all about helping people.”

– Rich Arnold, Senior Solutions Advisor

What does this call for?

To provide clients with top-notch Medicare guidance, Rich must analyze their current doctors and drugs for the best plan option and properly educate them to choose the best program for their situation and health. It’s a simple, free process of evaluation, education, and enrollment.

For this month’s CenterStage article, we asked Rich to break down Medicare for the senior population who are in desperate need of a break from the confusion.

Medicare Break Down

Part A. Hospitalization, Skilled Nursing, etc.

If you’ve worked for 40 quarters, you automatically obtain Part A coverage.

Part B. Medical Services: Doctors, Surgeries, Outpatient visits, etc.…

You must enroll and pay a monthly premium.

Part C. Medicare Advantage Plans:

Provides most of your hospital and medical expenses.

Part D.

Prescription drug plans available with Medicare.

Under Parts A & B there are two types of plans…

Supplement Plan or Medigap Plan

A Medicare Supplement Insurance (Medigap) policy can help pay some of the health care costs that Original Medicare doesn’t cover, like copayments, coinsurance, and deductibles, coverage anywhere in the US as well as travel outside of the country, pay a monthly amount, and usually coupled with a prescription drug plan.

Advantage Plan

A type of Medicare health plan that contracts with Medicare to provide you with all your Part A and Part B benefits generally through a HMO or PPO, pay a monthly amount from $0 and up, covers emergency services, and offers prescription drug plans.

How does this effect you?

Medicare starts at 65 years of age, but Rich advises anyone turning 63 or 64 years of age to reach out to an advisor, such as himself, for zero cost, to be put onto their calendar to follow up at the proper time to investigate the Medicare options. Some confusion exists about Medicare and Social Security which are separate entities. Social Security does not pay for the Supplement or Advantage plans.

Medicare Open Enrollment: Open Enrollment occurs between October 15th and December 7 – yes, right around the corner! However, don’t panic, Rich and his services can help you if you are turning 65 or if you haven’t reviewed your current plan in over a year – you should seek his guidance.

Your plan needs to be reviewed every year to best fit your needs. If you’re on the verge of 65, turning 65 in the next few months, or over 65, you should consult your Medicare advisor as soon as possible. For a no cost analysis of your needs contact Rich, Saxon Senior Solutions Advisor, rarnold@gosaxon.com, 513-808-4879.

The Medicare Part D Prescription Drug Benefit

Below we have an article from the Kaiser Family Foundation providing detailed information and graphics on the benefit of the Medicare Prescription Drug Plan.

You can read the original article here.

Medicare Part D is a voluntary outpatient prescription drug benefit for people on Medicare that went into effect in 2006. All 59 million people on Medicare, including those ages 65 and older and those under age 65 with permanent disabilities, have access to the Part D drug benefit through private plans approved by the federal government; in 2017, more than 42 million Medicare beneficiaries are enrolled in Medicare Part D plans. During the Medicare Part D open enrollment period, which runs from October 15 to December 7 each year, beneficiaries can choose to enroll in either stand-alone prescription drug plans (PDPs) to supplement traditional Medicare or Medicare Advantage prescription drug (MA-PD) plans (mainly HMOs and PPOs) that cover all Medicare benefits including drugs. Beneficiaries with low incomes and modest assets are eligible for assistance with Part D plan premiums and cost sharing. This fact sheet provides an overview of the Medicare Part D program and information about 2018 plan offerings, based on data from the Centers for Medicare & Medicaid Services (CMS) and other sources.

Medicare Prescription Drug Plan Availability in 2018

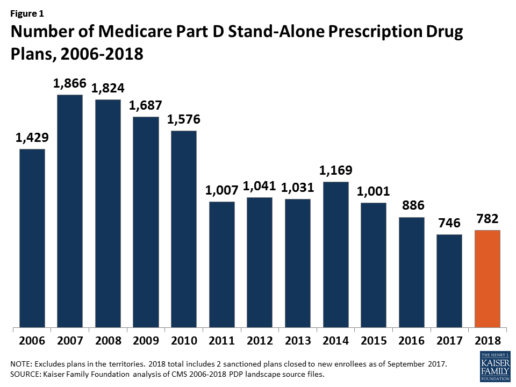

In 2018, 782 PDPs will be offered across the 34 PDP regions nationwide (excluding the territories). This represents an increase of 36 PDPs, or 5%, since 2017, but a reduction of 104 plans, or 12%, since 2016 (Figure 1).

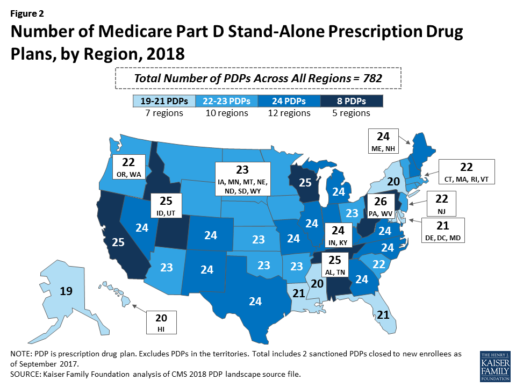

Beneficiaries in each state will continue to have a choice of multiple stand-alone PDPs in 2018, ranging from 19 PDPs in Alaska to 26 PDPs in Pennsylvania/West Virginia (in addition to multiple MA-PD plans offered at the local level) (Figure 2).

Low-Income Subsidy Plan Availability in 2018

Through the Part D Low-Income Subsidy (LIS) program, additional premium and cost-sharing assistance is available for Part D enrollees with low incomes (less than 150% of poverty, or $18,090 for individuals/$24,360 for married couples in 2017) and modest assets (less than $13,820 for individuals/$27,600 for couples in 2017).1

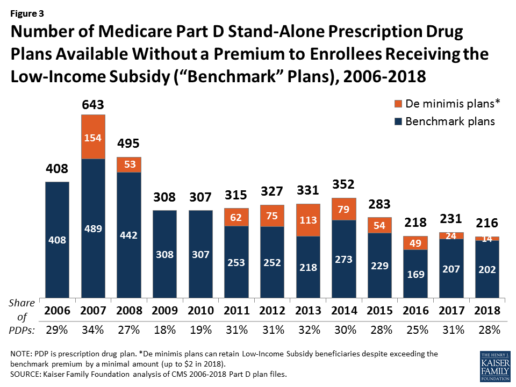

In 2018, 216 plans will be available for enrollment of LIS beneficiaries for no premium, a 6% decrease in premium-free (“benchmark”) plans from 2017 and the lowest number of benchmark plans available since the start of the Part D program in 2006. Roughly 3 in 10 PDPs in 2018 (28%) are benchmark plans (Figure 3).

Low-Income Subsidy Plan Availability in 2018

Through the Part D Low-Income Subsidy (LIS) program, additional premium and cost-sharing assistance is available for Part D enrollees with low incomes (less than 150% of poverty, or $18,090 for individuals/$24,360 for married couples in 2017) and modest assets (less than $13,820 for individuals/$27,600 for couples in 2017).1

In 2018, 216 plans will be available for enrollment of LIS beneficiaries for no premium, a 6% decrease in premium-free (“benchmark”) plans from 2017 and the lowest number of benchmark plans available since the start of the Part D program in 2006. Roughly 3 in 10 PDPs in 2018 (28%) are benchmark plans (Figure 3).

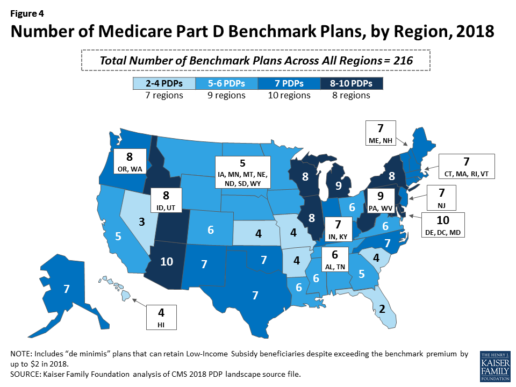

Benchmark plan availability varies at the Part D region level, with most regions seeing a reduction of 1 benchmark plan for 2018 (Figure 4). The number of premium-free plans in 2018 ranges from a low of 2 plans in Florida to 10 plans in Arizona and Delaware/Maryland/Washington D.C.

Part D Plan Premiums and Benefits in 2018

Premiums. According to CMS, the 2018 Part D base beneficiary premium is $35.02, a modest decline of 2% from 2017.2 Actual (unweighted) PDP monthly premiums for 2018 vary across plans and regions, ranging from a low of $12.60 for a PDP available in 12 out of 34 regions to a high of $197 for a PDP in Texas.

Part D enrollees with higher incomes ($85,000/individual; $170,000/couple) pay an income-related monthly premium surcharge, ranging from $13.00 to $74.80 in 2018 (depending on their income level), in addition to the monthly premium for their specific plan.3 According to CMS projections, an estimated 3.3 million Part D enrollees (7%) will pay income-related Part D premiums in 2018.

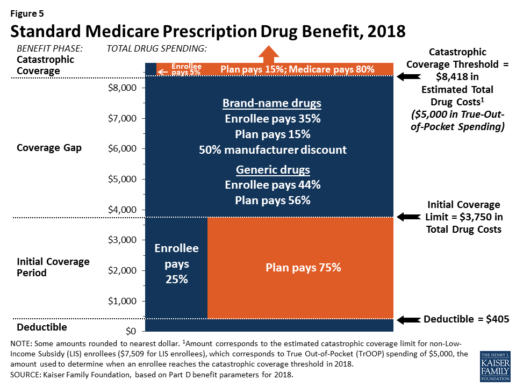

Benefits. In 2018, the Part D standard benefit has a $405 deductible and 25% coinsurance up to an initial coverage limit of $3,750 in total drug costs, followed by a coverage gap. During the gap, enrollees are responsible for a larger share of their total drug costs than in the initial coverage period, until their total out-of-pocket spending in 2018 reaches $5,000 (Figure 5).

After enrollees reach the catastrophic coverage threshold, Medicare pays for most (80%) of their drug costs, plans pay 15%, and enrollees pay either 5% of total drug costs or $3.35/$8.35 for each generic and brand-name drug, respectively.

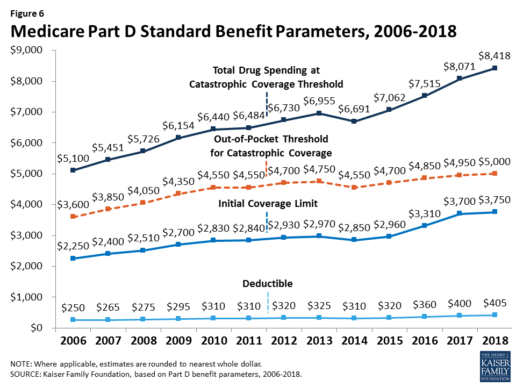

The standard benefit amounts are indexed to change annually by rate of Part D per capita spending growth, and, with the exception of 2014, have increased each year since 2006 (Figure 6).

Part D plans must offer either the defined standard benefit or an alternative equal in value (“actuarially equivalent”), and can also provide enhanced benefits. But plans can (and do) vary in terms of their specific benefit design, cost-sharing amounts, utilization management tools (i.e., prior authorization, quantity limits, and step therapy), and formularies (i.e., covered drugs). Plan formularies must include drug classes covering all disease states, and a minimum of two chemically distinct drugs in each class. Part D plans are required to cover all drugs in six so-called “protected” classes: immunosuppressants, antidepressants, antipsychotics, anticonvulsants, antiretrovirals, and antineoplastics.

In 2018, almost half (46%) of plans will offer basic Part D benefits (although no plans will offer the defined standard benefit), while 54% will offer enhanced benefits, similar to 2017. Most PDPs (63%) will charge a deductible, with 52% of all PDPs charging the full amount ($405). Most plans have shifted to charging tiered copayments or varying coinsurance amounts for covered drugs rather than a uniform 25% coinsurance rate, and a substantial majority of PDPs use specialty tiers for high-cost medications. Two-thirds of PDPs (65%) will not offer additional gap coverage in 2018 beyond what is required under the standard benefit. Additional gap coverage, when offered, has been typically limited to generic drugs only (not brands).

The 2010 Affordable Care Act gradually lowers out-of-pocket costs in the coverage gap by providing enrollees with a 50% manufacturer discount on the total cost of their brand-name drugs filled in the gap and additional plan payments for brands and generics. In 2018, Part D enrollees in plans with no additional gap coverage will pay 35% of the total cost of brands and 44% of the total cost of generics in the gap until they reach the catastrophic coverage threshold. Medicare will phase in additional subsidies for brands and generic drugs, ultimately reducing the beneficiary coinsurance rate in the gap to 25% by 2020.

Part D and Low-Income Subsidy Enrollment

Enrollment in Medicare drug plans is voluntary, with the exception of beneficiaries who are dually eligible for both Medicare and Medicaid and certain other low-income beneficiaries who are automatically enrolled in a PDP if they do not choose a plan on their own. Unless beneficiaries have drug coverage from another source that is at least as good as standard Part D coverage (“creditable coverage”), they face a penalty equal to 1% of the national average premium for each month they delay enrollment.

In 2017, more than 42 million Medicare beneficiaries are enrolled in Medicare Part D plans, including employer-only group plans.4 Of this total, 6 in 10 (60%) are enrolled in stand-alone PDPs and 4 in 10 (40%) are enrolled in Medicare Advantage drug plans. Medicare’s actuaries estimate that around 2 million other beneficiaries in 2017 have drug coverage through employer-sponsored retiree plans where the employer receives subsidies equal to 28% of drug expenses between $405 and $8,350 per retiree in 2018 (up from $400 and $8,250 in 2017).5 Several million beneficiaries are estimated to have other sources of drug coverage, including employer plans for active workers, FEHBP, TRICARE, and Veterans Affairs (VA). Yet an estimated 12% of Medicare beneficiaries lack creditable drug coverage.

Twelve million Part D enrollees are currently receiving the Low-Income Subsidy. Beneficiaries who are dually eligible, QMBs, SLMBs, QIs, and SSI-onlys automatically qualify for the additional assistance, and Medicare automatically enrolls them into PDPs with premiums at or below the regional average (the Low-Income Subsidy benchmark) if they do not choose a plan on their own. Other beneficiaries are subject to both an income and asset test and need to apply for the Low-Income Subsidy through either the Social Security Administration or Medicaid.

Part D Spending and Financing in 2018

The Congressional Budget Office (CBO) estimates that spending on Part D benefits will total $92 billion in 2018, representing 15.5% of net Medicare outlays in 2018 (net of offsetting receipts from premiums and state transfers). Part D spending depends on several factors, including the number of Part D enrollees, their health status and drug use, the number of enrollees receiving the Low-Income Subsidy, and plans’ ability to negotiate discounts (rebates) with drug companies and preferred pricing arrangements with pharmacies, and manage use (e.g., promoting use of generic drugs, prior authorization, step therapy, quantity limits, and mail order). Federal law prohibits the Secretary of Health and Human Services from interfering in drug price negotiations between Part D plan sponsors and drug manufacturers.6

Financing for Part D comes from general revenues (78%), beneficiary premiums (13%), and state contributions (9%). The monthly premium paid by enrollees is set to cover 25.5% of the cost of standard drug coverage. Medicare subsidizes the remaining 74.5%, based on bids submitted by plans for their expected benefit payments. Part D enrollees with higher incomes ($85,000/individual; $170,000/couple) pay a greater share of standard Part D costs, ranging from 35% to 80%, depending on income.

According to Medicare’s actuaries, in 2018, Part D plans are projected to receive average annual direct subsidy payments of $353 per enrollee overall and $2,353 for enrollees receiving the LIS; employers are expected to receive, on average, $623 for retirees in employer-subsidy plans.7 Part D plans’ potential total losses or gains are limited by risk-sharing arrangements with the federal government (“risk corridors”). Plans also receive additional risk-adjusted payments based on the health status of their enrollees and reinsurance payments for very high-cost enrollees.

Under reinsurance, Medicare subsidizes 80% of drug spending incurred by Part D enrollees above the catastrophic coverage threshold. In 2018, average reinsurance payments per enrollee are estimated to be $941; this represents a 7% increase from 2017. Medicare’s reinsurance payments to plans have represented a growing share of total Part D spending, increasing from 16% in 2007 to an estimated 41% in 2018.8 This is due in part to a growing number of Part D enrollees with spending above the catastrophic threshold, resulting from several factors, including the introduction of high-cost specialty drugs, increases in the cost of prescriptions, and a change made by the ACA to count the 50% manufacturer discount in enrollees’ out-of-pocket spending that qualifies them for catastrophic coverage. Analysis from MedPAC also suggests that in recent years, plans have underestimated their enrollees’ expected costs above the catastrophic coverage threshold, resulting in higher reinsurance payments from Medicare to plans over time.

Issues for the Future

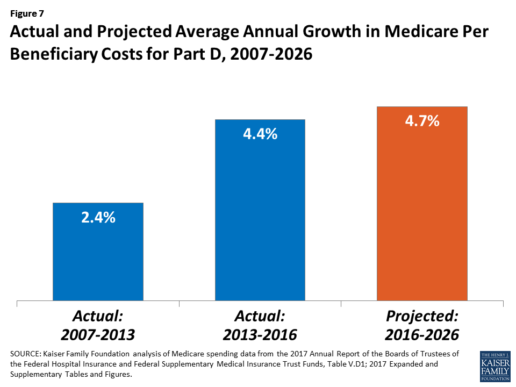

After several years of relatively low growth in prescription drug spending, spending has risen more steeply since 2013. The average annual rate of growth in Part D costs per beneficiary was 2.4% between 2007 and 2013, but it increased to 4.4% between 2013 and 2016, and is projected to increase by 4.7% between 2016 and 2026

(Figure 7).9

Medicare’s actuaries have projected that the Part D per capita growth rate will be comparatively higher in the coming years than in the program’s initial years due to higher costs associated with expensive specialty drugs, which is expected to be reflected in higher reinsurance payments to plans. Between 2017 and 2027, spending on Part D benefits is projected to increase from 15.9% to 17.5% of total Medicare spending (net of offsetting receipts).10 Understanding whether and to what extent private plans are able to negotiate price discounts and rebates will be an important part of ongoing efforts to assess how well plans are able to contain rising drug costs. However, drug-specific rebate information is not disclosed by CMS.

The Medicare drug benefit helps to reduce out-of-pocket drug spending for enrollees, which is especially important to those with modest incomes or very high drug costs. Closing the coverage gap by 2020 will bring additional relief to millions of enrollees with high costs. But with drug spending on the rise and more plans charging coinsurance rather than flat copayments for covered brand-name drugs, enrollees could face higher out-of-pocket costs for their Part D coverage. These trends highlight the importance of comparing plans during the annual enrollment period. Research shows, however, that relatively few people on Medicare have used the annual opportunity to switch Part D plans voluntarily—even though those who do switch often lower their out-of-pocket costs as a result of changing plans.

Understanding how well Part D is working and how well it is meeting the needs of people on Medicare will be informed by ongoing monitoring of the Part D plan marketplace and plan enrollment; assessing coverage and costs for high-cost biologics and other specialty drugs; exploring the relationship between Part D spending and spending on other Medicare-covered services; and evaluating the impact of the drug benefit on Medicare beneficiaries’ out-of-pocket spending and health outcomes.

Endnotes

- Poverty and resource levels for 2018 are not yet available (as of September 2017).

- The base beneficiary premium is equal to the product of the beneficiary premium percentage and the national average monthly bid amount (which is an enrollment-weighted average of bids submitted by both PDPs and MA-PD plans). Centers for Medicare & Medicaid Services, “Annual Release of Part D National Average Bid Amount and Other Part C & D Bid Information,” July 31, 2017, available at https://www.cms.gov/Medicare/Health-Plans/MedicareAdvtgSpecRateStats/Downloads/PartDandMABenchmarks2018.pdf.

- Higher-income Part D enrollees also pay higher monthly Part B premiums.

- Centers for Medicare & Medicaid Services, Medicare Advantage, Cost, PACE, Demo, and Prescription Drug Plan Contract Report – Monthly Summary Report (Data as of August 2017).

- Board of Trustees, 2017 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, Table IV.B7, available at https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/ReportsTrustFunds/Downloads/TR2017.pdf.

- Social Security Act, Section 1860D-11(i).

- 2017 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds; Table IV.B9.

- Kaiser Family Foundation analysis of aggregate Part D reimbursement amounts from Table IV.B10, 2017 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds.

- Kaiser Family Foundation analysis of Part D average per beneficiary costs from Table V.D1, 2017 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds.

- Kaiser Family Foundation analysis of Part D benefits spending as a share of net Medicare outlays (total mandatory and discretionary outlays minus offsetting receipts) from CBO, Medicare-Congressional Budget Office’s June 2017 Baseline.

Read the full article here.

Source:

Kaiser Family Foundation (2 October 2017). “The Medicare Part D Prescription Drug Benefit” [Web Blog Post]. Retrieved from address https://www.kff.org/medicare/fact-sheet/the-medicare-prescription-drug-benefit-fact-sheet/#26740

Bill Would Allow Medicare-Eligible Retirees to Keep HSA Contributions

Original post businessinsurance.com

Health savings accounts are surging in popularity — and that can lead to some complications for older workers who enroll in Medicare.

Health Savings Accounts (HSAs) are offered to workers enrolled in high-deductible health insurance plans. The accounts are used primarily to meet deductible costs; employers often contribute and workers can make pretax contributions up to $3,350 for individuals, and $5,640 for families; the dollars can be invested and later spent tax-free to meet healthcare expenses.

Twenty-four percent of U.S. workers were enrolled in high-deductible health plans last year, according to the Kaiser Family Foundation - and 15% of them were in plans coupled with an HSA. That compares with 6% using HSA-linked plans as recently as 2010. Assets in HSA accounts rose 25% last year, and the number of accounts rose 22%, according to a report by Devenir, an HSA investment adviser and consulting firm.

But as more employees work past traditional retirement age, some sticky issues arise for HSA account holders tied to enrollment in Medicare. The key issue: HSAs can only be used alongside qualified high-deductible health insurance plans. The minimum deductible allowed for HSA-qualified accounts this year is $1,300 for individual coverage ($2,600 for family coverage). Medicare is not considered a high-deductible plan, although the Part A deductible this year is $1,288 (for Part B, it is $166).

That means that if a worker - or a spouse covered on the employer's plan - signs up for Medicare coverage, the worker must stop contributing to the HSA, although withdrawals can continue.

The normal enrollment age for Medicare is 65, but people who are still working at that point often stay on the health plans of their employers (more on that below). In certain situations, the worker or a retired spouse might enroll for some Medicare benefits. Moreover, if the worker or spouse claims Social Security, that can trigger an automatic enrollment in Medicare Part A and B.

That would require the worker to stop contributing to the HSA - and the contributions actually would need to stop six months before that Social Security claim occurs. That is because Medicare Part A is retroactive for up to six months, assuming the enrollee was eligible for coverage during those months. Failing to do that can lead to a tax penalty.

"The Medicare problem is a basic flaw in the way HSAs are designed," said Jody Dietel, chief compliance officer of WageWorks Inc, a provider of HSA and other consumer-directed benefit plans to employers.

Recognizing the problem, U.S. Senator Orrin Hatch and Representative Erik Paulsen proposed legislation last month that would allow HSA-eligible seniors enrolled in Medicare Part A (only) to continue to contribute to their HSAs.

The HSA complication is bound to arise more often as the huge baby boom generation retires, and as high-deductible insurance linked to HSA accounts continues to gain popularity among employers. High-deductible plans come with lower premiums - the average premium for individual coverage in a high-deductible health plan coupled with a savings option last year was $5,567 (the employee share was $868), KFF reports. By contrast, the comparable average premium for a preferred provider organization was $6,575 (with workers contributing $1,145).

Some experts also pitch HSAs as a tax-advantaged way to save to meet healthcare costs in retirement - although the HSA's main purpose is to help people meet current-year deductible costs, and employers often make an annual contribution for that purpose.

So far, there is not much evidence that large accumulations are building in the accounts. The average account total balance last year was $14,035, according to Devenir. The limits on contributions are one reason for that.

Deciding to delay a Medicare enrollment depends on your individual circumstances.

If you work for an employer with fewer than 20 workers, Medicare usually is the primary insurer at age 65, so failing to sign up would mean losing much of your coverage - hardly worth the tax advantage of continued HSA contributions. If you work for a larger employer, Medicare coverage is secondary, so a delayed Medicare filing is more feasible - so long as you or a spouse are not enrolled in Social Security. (Also make sure that the account in question is an HSA and not a Health Reimbursement Account - the latter is not a savings account and does not bring the Medicare enrollment problem into play.)

"We usually advise people to talk it over with a tax expert - it's more of a tax issue than a health insurance question," said Casey Schwarz, senior counsel for education and federal policy at the Medicare Rights Center, a nonprofit advocacy and consumer rights group.

Pay attention to Medicare Part D Coverage and 5 other things you should know during open enrollment

Once a year Medicare beneficiaries get the chance once a year to make a change. Open enrollment runs from Oct. 15 through Dec. 7.

Medicare beneficiaries can choose from original Medicare which is provided by the government or Medicare Advantage which is offered by private health insurance companies.

Beneficiaries can also change their Part D plans which provides prescription drug coverage.

Part B Premiums May Be Increasing for Some People

A report this month in the AARP Bulletin, based on data from the Medicare Boards of Trustees, finds 1 in 7 Medicare beneficiaries could see their Part B premiums increase as much as 52 percent next year.

The increase will go into effect if there is no cost-of-living adjustment for Social Security in 2016, but it will apply mainly to those already paying higher premiums because of their income and affect those who pay premiums directly to the government. Most people making direct payments are doing so because they are delaying Social Security benefits, a strategy that can increase their future monthly payments.

“Should folks in the latter situation sign up for Social Security now?” asks Patricia Barry, a features editor for AARP Publications who wrote the AARP report and author of "Medicare For Dummies.” Under the law, those who have their Part B premiums deducted from Social Security cannot be subject to a premium increase.

Barry says applying for Social Security in October may allow people to save money on premiums in the short run but could cost them more in the future. “They might be giving up higher [Social Security] payments for the rest of their lives for the sake of what could well turn out to be just one year of inflated Part B premiums.”

Pay Special Attention to Your Part D Coverage

Although it’s a smart idea to review your health insurance options each open enrollment period, experts say most plans stay largely the same each year. Instead, most people will find changes in Part D plans.

“It’s something [consumers] want to check into every single year,” says Kristin Romel, a health and life agent with Alpine North Insurance Agency in Alpena, Michigan.

Romel explains that many companies use a claims-based system for determining prescription drug costs and coverage. A medication for which they had a large number of claims may end up moving into a tier with higher copays. However, other insurers may not have had the same number of claims for those drugs, and the out-of-pocket costs for those prescriptions might remain lower in other plans.

Barry’s research supports this finding. In the last few years, she has analyzed what different Part D plans in the same state charge as copays for the same drug. “Those copays vary enormously, often by more than $100 for a 30-day supply, and sometimes by a lot more,” she says.

The Network May Be More Important Than the Price

Those shopping for a Medicare Advantage plan may gravitate toward the option with the lowest premium. However, there is more than price to consider.

“Patients should be scrutinizing the providers [in a plan’s network],” says Colin LeClair, senior vice president of business and product development for ConcertoHealth, a health care provider for dual-eligible Medicare and Medicaid patients. “The quality of providers is far more important than cost.”

While it may hard to gauge the quality of unknown physicians, Medicare beneficiaries should at least check a plan’s network to see if their preferred doctors and facilities participate. “You’ve got to be careful with little, fly-by-night companies,” Romel says. “Are hospitals actually going to take that insurance?”

Your Mailbox Is Full, but the Best Help May be Found Elsewhere

Barry has a simple piece of advice when it comes to all those brochures you’ve received: “Ignore that avalanche of mailings from Medicare plans that are coming through the door.”

Instead, use the plan finder at Medicare.gov to look over your options. Your State Health Insurance Assistance Program may also be able to help you navigate your choices. LeClair says he finds a lot of his company’s clients bring their stack of mailings to the doctor’s office.

“Physicians should not be advising patients on which plan to use,” LeClair says, “but they can help [patients] understand them.”

65-Year-Olds Need to Enroll Even If They Delay Social Security

Open enrollment is only for those who are already enrolled in Medicare, but John Piershale, a certified financial planner and wealth advisor with Piershale Financial Group in Crystal Lake, Illinois, says now is a good time to remind 65-year-olds that they need to enroll in Medicare, or they will face penalties.

For those filing for Social Security by age 65, enrollment in Medicare is typically automatic. However, those waiting to claim Social Security until a later age will need to be proactive about enrolling. The initial enrollment period runs for seven months and includes the three months before your birthday month, your birthday month and the three months after it.

Failing to enroll in Medicare during this period results in a 10 percent increase in Part B premiums for every year you delay enrolling. “A lot of people don’t know about [the penalty], and there is no way to fix it,” Piershale says.

The Biggest Change to Medicare Is One You Can't See

One of the biggest changes coming to Medicare is one that won’t be immediately obvious to patients, LeClair says. Many insurance companies are moving toward outcome-based contracts with providers, which could change how patients are seen by doctors. These contracts are intended to reward physicians who are, for example, successfully managing chronic conditions and reducing hospital admissions.

“Historically, [insurers] paid physicians on a fee-for-service model,” LeClair says. That system encouraged physicians to move through patients quickly and possibly order unnecessary testing and other services. “Now you have providers focused on doing less and providing better outcomes,” LeClair says.

From a patient perspective, an emphasis on positive outcomes may mean shorter wait times to get in to see a doctor and more time spent with a physician once you’re in the office.

Until outcome-based care becomes standard, Medicare beneficiaries can use the annual open enrollment period to switch to a new plan with different providers if they are unhappy with their options. However, to make the most of the opportunity, you’ll need to compare more than just the price. “Don’t go cheap on your health insurance,” Romel advises. “Don’t put a price tag on your health.”

Medicare Part D Notices Due October 15

The Creditable Coverage notification requirements for Medicare eligible employees are required by the Centers for Medicare and Medicaid Services (CMS) on October, 15th of each year.

This is a friendly reminder that all plan sponsors are required to notify their employees about their creditable coverage status. For your convenience, the model notification letters for both credible and non-credible coverage provided by CMS for this year can be found below and are in Word document format.

Supreme Court debates future of Affordable Care Act

Originally posted on March 5, 2015 by Ariane de Vogue on www.wqad.com.

WASHINGTON (CNN) — The future of health care in America is on the table — and in serious jeopardy — Wednesday morning in the Supreme Court.

After more than an hour of arguments, the Supreme Court seemed divided in a case concerning what Congress meant in one very specific four-word clause of the Affordable Care Act with respect to who is eligible for subsidies provided by the federal government to help people buy health insurance.

If the Court ultimately rules against the Obama administration, more than 5 million individuals will no longer be eligible for the subsidies, shaking up the insurance market and potentially dealing the law a fatal blow. A decision likely will not be announced by the Supreme Court until May or June.

All eyes were on Chief Justice John Roberts — who surprised many in 2012 when he voted to uphold the law — he said next to nothing, in a clear strategy not to tip his hand either way.

“Roberts, who’s usually a very active participant in oral arguments, said almost nothing for an hour and a half,” said CNN’s Supreme Court analyst Jeffrey Toobin, who attended the arguments. “(Roberts) was so much a focus of attention because of his vote in the first Obamacare case in 2012 that he somehow didn’t want to give people a preview of how he was thinking in this case. … He said barely a word.”

The liberal justices came out of the gate with tough questions for Michael Carvin, the lawyer challenging the Obama administration’s interpretation of the law, which is that in states that choose not to set up their own insurance exchanges, the federal government can step in, run the exchanges and distribute subsidies.

Carvin argued it was clear from the text of the law that Congress authorized subsidies for middle and low income individuals living only in exchanges “established by the states.” Just 16 states have established their own exchanges, but millions of Americans living in the 34 states are receiving subsidies through federally facilitated exchanges.

But Justice Elena Kagan, suggested the law should be interpreted in its “whole context” and not in the one snippet of the law that is the focus of the challengers.

“We look at the whole text. We don’t look at four words,” she said. Kagan also referred to the legal challenges to the law as the “never-ending saga.”

Justice Sonia Sotomayor was concerned that in the states where the individuals may not be able to receive subsidies, “We’re going to have the death spiral that this system was created to avoid.”

And Sotomayor wondered why the four words that so bother the challengers did not appear more prominently in the law. She said it was like hiding “a huge thing in a mousetrap.”

“Do you really believe that states fully understood?” she asked, Carvin, that those with federally run exchanges “were not going to get subsidies?”

Justice Ruth Bader Ginsburg suggested the four words at issue were buried and “not in the body of the legislation where you would expect to find” them.

Justice Anthony Kennedy asked questions that could be interpreted for both sides, but he was clearly concerned with the federalism aspects of the case.

“Let me say that from the standpoint of the dynamics of Federalism,” he said to Carvin. “It does seem to me that there is something very powerful to the point that if your argument is accepted, the states are being told either create your own exchange, or we’ll send your insurance market into a death spiral.”

He grilled Carvin on the “serious” consequences for those states that had set up federally-facilitated exchanges.

“It seems to me that under your argument, perhaps you will prevail in the plain words of the statute, there’s a serious constitutional problem if we adopt your argument,” Kennedy said.

The IRS — which is charged with implementing the law — interprets the subsidies as being available for all eligible individuals in the health exchanges nationwide, in both exchanges set up by the states and the federal government. In Court , Solicitor General Donald B. Verrilli, Jr. defended that position. He ridiculed the challengers argument saying it “revokes the promise of affordable care for millions of Americans — that cannot be the statute that Congress intended.”

But he was immediately challenged by Justice Antonin Scalia.

“It may not mean the statute they intended, the question is whether it’s the statute they wrote,” he said.

Although as usual, Justice Clarence Thomas said nothing, Justice Samuel Alito was also critical of Verrilli’s argument. He said if it were true that some of the states were caught off guard that the subsidies were only available to those in state run exchanges, why didn’t more of them sign amicus briefs. And he refuted the notion that the sky might fall if the challengers were to prevail by saying the Court could stay any decision until the end of the tax season.

On that point Scalia suggested Congress could act.

“You really think Congress is just going to sit there while all of these disastrous consequences ensue?” he asked.

Verrilli paused and to laughter said, “Well, this Congress? ”

Kennedy did ask Verrilli a question that could go to the heart of the case wondering if it was reasonable that the IRS would have been charged with interpreting a part of the law concerning “billions of dollars” in subsidies.

Only Ginsburg brought up the issue of standing — whether those bringing the lawsuit have the legal right to be in Court which suggested that the Court will almost certainly reach the mandates of the case.

President Barack Obama has expressed confidence in the legal underpinning of the law in recent days.

“There is, in our view, not a plausible legal basis for striking it down,” he told Reuters this week.

Wednesday’s hearing marks the third time that parts of the health care law have been challenged at the Supreme Court.

In this case — King v. Burwell — the challengers say that Congress always meant to limit the subsidies to encourage states to set up their own exchanges. But when only 16 states acted, they argue the IRS tried to move in and interpret the law differently.

Republican critics of the law, such as Texas Sen. Ted Cruz, filed briefs warning that the executive was encroaching on Congress’ “law-making function” and that the IRS interpretation “opens the door to hundreds of billions of dollars of additional government spending.”

In a recent Washington Post op-ed, Orrin Hatch, R-Utah, and two other Republicans in Congress said that if the Court rules in their favor, “Republicans have a plan to protect Americans harmed by the administration’s actions.”

Hatch said Republicans would work with the states and give them the “freedom and flexibility to create better, more competitive health insurance markets offering more options and different choices.”

In Court, Verrilli stressed that four words — “established by the state” — found in one section of the law were a term of art meant to include both state run and federally facilitated exchanges.

He argued the justices need only read the entire statute to understand Congress meant to issue subsidies to all eligible individuals enrolled in all of the exchanges.

Democratic congressmen involved in the crafting of the legislation filed briefs on behalf of the government arguing that Congress’ intent was to provide insurance to as many people as possible and that the challengers’ position is not consistent with the text and history of the statute.

Last week, Health and Human Services Secretary Sylvia Mathews Burwell warned that if the government loses it has prepared no back up plan to “undo the massive damage.”

IRS Clarifies Prior Guidance on Premium Reimbursement Arrangements; Provides Limited Relief

Originally posted February 24, 2015 by Daimon Myers, Proskauer - ERISA Practice Center on www.jdsupra.com.

Continuing its focus on so-called “premium reimbursement” or “employer payment plans”, the Internal Revenue Service (IRS) released IRS Notice 2015-17 on February 18, 2015. In this Notice, which was previewed and approved by both the Department of Labor (DOL) and Department of Health and Human Services (collectively with the IRS, the “Agencies”) clarifies the Agencies’ perspective on the limits of certain employer payment plans and offers some limited relief for small employers.

Prior guidance, released as DOL FAQs Part XXII and described in our November 7, 2014 Practice Center Blog entry, established that premium reimbursement arrangements are group health plans subject to the Affordable Care Act’s (ACA’s) market reforms. Because these premium reimbursement arrangements are unlikely to satisfy the market reform requirements, particularly with respect to preventive services and annual dollar limits, employers using these arrangements would be required to self-report their use and then be subject to ACA penalties, including an excise tax of $100 per employee per day.

Since DOL FAQs Part XXII was released, the Agencies’ stance has been the subject of frequent commentary and requests for clarification. With Notice 2015-17, it appears that the Agencies have elected to expand on the prior guidance on a piecemeal basis, with IRS Notice 2015-17 being the first in what may be a series of guidance. The following are the key aspects of Notice 2015-17:

- Wage Increases In Lieu of Health Coverage. The IRS confirmed the widely-held understanding that providing increased wages in lieu of employer-sponsored health benefits does not create a group health plan subject to market reforms, provided that receipt of the additional wages is not conditioned on the purchase of health coverage. Quelling concerns that any communication regarding individual insurance options could create a group health plan, the IRS stated that merely providing employees with information regarding the health exchange marketplaces and availability of premium credits is not an endorsement of a particular insurance policy. Although this practice may be attractive for a small employer, an employer with more than 50 full-time employees (i.e., an “applicable large employer” or “ALE”) should be mindful of the ACA’s employer shared responsibility requirements if it adopts this approach. ALEs are required to offer group health coverage meeting certain requirements to at least 95% (70% in 2015) of its full-time employees or potentially pay penalties under the ACA. Increasing wages in lieu of benefits will not shield ALEs from those penalties.

- Treatment of Employer Payment Plans as Taxable Compensation. Some employers and commentators have tried to argue that “after-tax” premium reimbursement arrangements should not be treated as group health plans. In Notice 2015-17, the IRS confirmed its disagreement. In the Notice, the IRS acknowledges that its long-standing guidance excluded from an employee’s gross income premium payment reimbursements for non-employer provided medical coverage, regardless of whether an employer treated the premium reimbursements as taxable wage payments. However, in Notice 2015-17, the IRS provides a reminder that the ACA, in the Agencies’ view, has significantly changed the law, including, among other things, by implementing substantial market reforms that were not in place when prior guidance had been released. The result: the Agencies have reiterated and clarified their view that premium reimbursement arrangements tied directly to the purchase of individual insurance policies are employer group health plans that are subject to, and fail to meet, the ACA’s market reforms (such as the preventive services and annual limits requirements). This is the case whether or not the reimbursements or payments are treated by an employer as pre-tax or after-tax to employees. (This is in contrast to simply providing employees with additional taxable compensation not tied to the purchase of insurance coverage, as described above.)

- Integration of Medicare and TRICARE Premium Reimbursement Arrangements. On the other hand, although the Notice confirms that arrangements that reimburse employees for Medicare or TRICARE premiums may be group health plans subject to market place reforms, the Agencies also provide for a bit of a safe harbor relief from that result. As long as those employees enrolled in Medicare Part B or Part D or TRICARE coverage are offered coverage that is minimum value and not solely excepted benefits, they can also be offered a premium reimbursement arrangement to assist them with the payment of the Medicare or TRICARE premiums. (The IRS appropriately cautions employers to consider restrictions on financial incentives for employees to obtain Medicare or TRICARE coverage.)

- Transition Relief for Small Employers and S Corporations. Although many comments on the prior guidance concerning employer payment plans requested an exclusion for small employers (those with fewer than 50 full-time equivalent employees), the IRS refused to provide blanket relief. The IRS notes that the SHOP Marketplace should address the small employers’ concerns. However, because the SHOP Marketplace has not been fully implemented, no excise tax will be incurred by a small employer offering an employer payment plan for 2014 or for the first half of 2015 (i.e., until June 30, 2015). (This relief does not cover stand-alone health reimbursement arrangements or other arrangements to reimburse employees for expenses other than insurance premiums.) This is welcome relief to small employers who adopted these arrangements notwithstanding the Agencies’ prior guidance that they violated certain ACA marketplace provisions.

- In addition to granting temporary relief to small employers, the IRS also provided relief through 2015 for S corporations with premium reimbursement arrangements benefiting 2% shareholders. In general, reimbursements paid to 2% shareholders must be included in income, but the underlying premiums are deductible by the 2% shareholder. The IRS indicated that additional guidance for S corporations is likely forthcoming.

The circumstances under which premium reimbursement arrangements are permitted appears to be rapidly dwindling, and the IRS indicated that more guidance will be released in the near future. Employers offering these arrangements should consult with qualified counsel to ensure continuing compliance with applicable laws.

3 Takeaways From the Medicare Trustees Report

Originally posted at 9:41 am EST, August 1, 2014 by Drew Altman on https://blogs.wsj.com.

The annual report from the Social Security and Medicare trustees predicted that Medicare will be solvent until 2030, four years later than the trustees predicted last year. That’s thanks to the recent slowdown in Medicare spending and a stronger economy that yields higher revenue through payroll tax contributions to the Medicare trust fund.

The administration and congressional Democrats are taking credit for elements of the Affordable Care Act that have helped to slow the growth in Medicare spending, and they warn against changes to Medicare that they fear would shift costs to seniors and undermine the program.

Republicans, however, see little good in the trustees’ report. “Don’t be fooled by the news that Medicare has a few more years of solvency,” Rep. Kevin Brady, chairman of the House Ways and Means subcommittee on health, said in a statement. More fundamental changes to Medicare are needed, many Republicans argue, such as transforming the program to a premium-support or voucher model.

Here are three points that might have been lost in the back and forth over the report by those on the left and the right:

* Contrary to conventional wisdom, Medicare appears to be outperforming the private sector. Medicare spending per capita rose at a 6.1% annual clip between 2000 and 2012 vs. a 6.5% growth rate for private health insurance. And Medicare spending is projected to rise at a 4% per capita rate between 2013 and 2022 vs. 4.9% for private insurance. (The bad news is that GDP per capita is projected to rise more slowly, at 3.7% per year.) Medicare’s problem is less poor performance and more the challenge of meeting the needs of an aging society and seniors who have modest incomes to pay for their health care.

* The ACA is projected to cut $716 billion in expected increases to providers and insurers between 2013 and 2022. Despite claims that cutting payments to providers and private plans could make the sky fall, there is no evidence so far that the industry or beneficiaries have been adversely affected by the reductions. In fact, enrollment has been growing in the private Medicare Advantage plans, which were hit by the most severe and controversial reductions, and the gains are projected to continue. So far, complex schemes to reform the way Medicare pays doctors and hospitals, which many believe hold promise, have produced mixed results in the effort to cut costs. But as $716 billion in Medicare savings demonstrates, the tried-and-true way to save money continues to be shaving a little off payment increases each year, as long as the health-care industry is still in the black and can absorb it.

* Perhaps the best news from the 2014 trustees report is that the country has a bit more time to hope for a more functional Congress that can figure out how best to finance Medicare for an aging population. It is almost impossible to envision the current Congress and administration working together on these long-term challenges.

With liberals and conservatives at odds over Medicare’s future direction and seniors such a strong voting group, it will be difficult to shift Medicare quickly in any direction. But there is good news for now in the trustees report.

Include health care cost in plans

Originally posted August 3, 2014 by Redding Edition on https://www.ifebp.org

The possibility of having to pay major health care costs in the future is a primary concern of planning for retirement these days. Is there some way to plan for these expenses years in advance?

Just how great might those expenses be? There’s no rote answer, but recent surveys from AARP and Fidelity Investments reveal that too many baby boomers might be taking this subject too lightly.

For the last eight years, Fidelity has projected average retirement health care expenses for a couple — assuming that retirement begins at age 65 and that one spouse or partner lives about seven years longer than the other. In 2013, Fidelity estimated that a couple retiring at age 65 would require about $220,000 just to absorb those future health care costs.

When it asked Americans ages 55 to 64 how much money they thought they would spend on health care in retirement, 48 percent of the respondents figured they would only need about $50,000 each, or about $100,000 per couple. That pales next to Fidelity’s projection and it also falls short of the estimates made in 2010 by the Employee Benefit Research Institute. EBRI figured that a couple with median prescription drug expenses would pay $151,000 of their own retirement health care costs.

AARP posed this question to Americans ages 50 to 64 in the fall of 2013. The results were 16 percent of those polled thought their out-of-pocket retirement health care expenses would run less than $50,000 and 42 percent figured needing less than $100,000.

Another 15 percent admitted they had no idea how much they might eventually spend for health care. Not surprising, just 52 percent of those surveyed felt confident that they could financially handle such expenses.

Prescription drugs may be your No. 1 cost. EBRI currently says that a 65-year-old couple with median drug costs would need $227,000 to have a 75 percent probability of paying off 100 percent of their medical bills in retirement. That figure is in line with Fidelity’s big-picture estimate.

What might happen if you don’t save enough for these expenses? As Medicare premiums come out of Social Security benefits, your monthly Social Security payments could grow smaller. The greater your reliance on Social Security, the bigger the ensuing financial strain.

The main message is save more and save now. Do you have about $200,000 after tax saved for future health care costs? If you don’t, you have yet another compelling reason to save more money for retirement.

Medicare, after all, will not pay for everything. In 2010, EBRI analyzed how much it did pay for, and it found that Medicare only covered about 62 percent of retiree health care expenses. While private insurance picked up another 13 percent and military benefits or similar programs another 13 percent, that still left retirees on the hook for 12 percent out of pocket.

Consider what Medicare doesn’t cover, and budget accordingly. Medicare pays for much, but it doesn’t cover things like glasses and contacts, dentures and hearing aids — and it certainly doesn’t pay for extended long-term care.

Medicare’s yearly Part B deductible is $147 for 2014. Once you exceed it, you will have to pick up 20 percent of the Medicare-approved amount for most medical services. That’s a good argument for a Medigap or Medicare Advantage plan, even considering the potentially high premiums. The standard monthly Part B premium is at $104.90 this year, which comes out of your Social Security. If you are retired and earn income of more than $85,000, your monthly Part B premium will be larger. The threshold for a couple is $170,000. Part D premiums for drug coverage can also vary greatly. The greater your income, the larger they get. Reviewing your Part D coverage vis-à-vis your premiums each year is only wise.

Takeaway: Staying healthy may save you a good deal of money. EBRI projects that someone retiring from an $80,000 job in poor health may need to live on as much as 96 percent of that end salary annually, or roughly $76,800. If that retiree is in excellent health instead, EBRI estimates that he or she may need only 77 percent of that end salary — about $61,600 — to cover 100 percent of annual retirement expenses.

Reminder: CMS Online Disclosure Due by March 1, 2014

This requirement is nothing new. In the past health plan sponsors have been required to complete an annual online disclosure form with the Centers for Medicare and Medicaid Services (CMS), to show whether the prescription drug coverage offered under the sponsor's plan/plans are "creditable" (at least as good as Medicare Part D's prescription drug benefit) or "noncreditable" (not as good). The plan sponsor must complete the disclosure within 60 days after the beginning of the plan year.

Who Is Exempt From this Process?

As an employer if you do not offer drug coverage to any Medicare-enrolled employee, retiree or dependent at the beginning of the plan year are exempt from filing. Similarly, employers who qualified for the Medicare Part D retiree drug subsidy are exempt from filing with CMS, but only with respect to the individuals and plan options for which they claimed the subsidy. If an employer offers prescription drug coverage to any Medicare-enrolled retirees or dependents not claimed under the subsidy, the employer must complete an online disclosure for plan options covering such individuals.

Filing with CMS is due by March 1, 2014.

A CMS filing is also required within 30 days of termination of a prescription drug plan and for any change in a plan's creditable coverage status. As described above some plans are exempt from the filing requirement.

Instructions related to the online filing discuss the types of information that are required, including the total number of Part D eligible individuals, the number of prescription drug options and which options are creditable and noncreditable. Click to access the instructions. Please save any documentation of this filing for your records.

Click to access the online portal that is used to complete the submission.