Employees are stressed caring for aging parents. How can employers help?

As many employees are caring for parents and close relatives, a balancing act on both physical and mental well being has impacted their work productivity. Read this blog post to learn more.

A growing number of employees are caring for aging parents, parents-in-law and relatives while working full time. One report puts the number of employees caring for aging family members at one in six, while other sources put the number even higher — 73% of employees caring for older family members, with 80% of those employees reporting that they struggle to balance their work and caregiving responsibilities.

This balancing act not only has an impact on employees’ physical and mental wellbeing, it also has a significant impact on their employers. But researchers at Harvard Business School found that many employers are not aware of the extent to which caregiving responsibilities are affecting employee performance, productivity and costs.

Support strategies for employee caregivers

Employers can offer several resources and benefits to help reduce the stress and physical and mental health impact on employees who are caring for aging family members. These strategies can also decrease the negative effect that caregiving can have on productivity and costs.

- Flexible schedules and remote work options: Offering flexible schedules and the option to work from home can help employees fit caregiving responsibilities, like taking family members to doctor’s appointments, preparing meals and helping with other activities of daily living into their day with less stress and less missed work time.

- Eldercare information and referral resources: These services can help employees find eldercare in their community, connect with other caregivers for support and advice, and learn about financial, health, legal and housing issues they may face as they provide care for aging family members and plan for the future.

- Self-care resources for caregivers: The stress of caregiving can increase the risk of health problems including heart disease, diabetes, migraine headache, gastrointestinal problems, substance misuse, anxiety and depression. Employers can help employees better manage stress by offering access to free stress management resources including exercise and meditation classes, caregiver support groups and referrals to online and in-person mental health providers.

- Medical second opinions: Managing the healthcare for an aging family member living with complex or serious medical problems such as dementia, cancer and heart failure can be especially difficult, stressful and time-consuming for employees. Access to second opinions can help employees make informed choices about their family member’s care and provide peace of mind about their decisions.

- Specialist guidance and support: Employers can offer access to navigators and advisors who can help employees ensure that their aging family members’ healthcare is coordinated to lower the risk of medical errors, inappropriate care and missed follow-up care. These services can also ensure that their medical records are reviewed and consolidated, which is especially important when people see several physicians. Navigation and advisory services can help employees research medical treatments for their family member, find and connect with experienced specialists and build a plan to address the potential progression of their family member’s health issues. Advisors can also help with appointment scheduling, insurance issues and problems with medical bills, all of which can be exceptionally time-consuming and frustrating tasks.

- Expand telehealth access: By expanding employees’ telehealth benefits to include aging parents and parents-in-law, employers can make it easier for employees to be involved in their family member’s care, even if they don’t live nearby. Telehealth can also make getting care easier for family members because they don’t need to arrange transportation to appointments.

- Subsidize back-up care: Consider providing employees with subsidies to help pay for in-home back-up care for aging family members. With this safety net in place, employers can decrease the number of hours employees are absent from work due to caregiving responsibilities.

SOURCE: Varn, M. (28 October 2020) "Employees are stressed caring for aging parents. How can employers help?" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/opinion/employees-are-stressed-caring-for-aging-parents-how-can-employers-help

Offices struggle with COVID-19 social distancing measures

Across the nation, many are beginning, if they have not already, are allowed to work from their offices, instead of having to work remotely. Now, due to the coronavirus pandemic, there are several new protocols that many may struggle to maintain. Read this blog post to learn more.

Millions of workers in recent months have returned to offices outfitted with new pandemic protocols meant to keep them healthy and safe. But temperature checks and plexiglass barriers between desks can't prevent one of the most dangerous workplace behaviors for the spread of COVID-19 — the irresistible desire to mingle.

“If you have people coming into the office, it’s very rare for them consistently to be six feet apart,” said Kanav Dhir, the head of product at VergeSense, a company that has 30,000 object-recognition sensors deployed in office buildings around the world tracking worker whereabouts.

Since the worldwide coronavirus outbreak, the company has found that 60% of interactions among North American workers violate the U.S. Centers for Disease Control and Prevention’s six-foot distancing guidelines, as do an even higher share in Asia, where offices usually are smaller.

Most people who can work at home still are and likely will be until at least mid-2021. But as some white-collar workers begin a cautious return, it’s becoming clear how hard it is to make the workplace safe. A bevy of sophisticated sensors and data are being used to develop detailed plans; even IBM’s vaunted Watson artificial intelligence is weighing in. In many cases the data can only verify what should be evident: The modern office, designed to pack in as many workers as possible, was never meant to enforce social distancing.

To date, the coronavirus has infected more than 8 million Americans and is blamed for 220,000 U.S. deaths. So far, efforts to get large numbers of workers into the office haven’t worked out very well. Some workers at Goldman Sachs Group and JPMorgan Chase tested positive after they returned to work and were sent home. With infection rates rising again nationwide, many companies have told most employees to work from home until next year, or even forever. Michigan’s governor approved new rules last week that bar employers from forcing workers back to the office if they can do their job at home.

For those employers pushing ahead with a return to the office, sensors that measure room occupancy are proving to be a necessity, said Doug Stewart, co-head of digital buildings at the technology unit Cushman & Wakefield, which manages about 785-million-square feet of commercial space in North and South America. Most offices are already fitted with sensors of some kind, even if it’s just a badging system or security cameras. Those lagging on such capabilities are now scrambling to add more, he said.

The systems were used before the pandemic to jam as many people together in the most cost-effective way, not limit workplace crowding or keep employees away from each other, Stewart said. With that in mind, companies can analyze the data all they want, but changing human behavior — we’re social creatures, after all — is harder, he said.

“Just because technology identifies it, and the analytics is flagging it, doesn’t mean the behavior will change,” Stewart said.

Because office crowding can show up in air quality, proper ventilation has replaced comfort as the focus for building managers, said Aaron Lapsley, who directs Cushman’s digital building operations with Stewart. Measuring the amount of carbon dioxide or the concentration of aerial particles can determine if airflow needs to be adjusted — or whether some people need to be told to leave a specific area. Employees are now more likely to use smartphone apps to receive alerts and keep tabs on the health and safety of the building, he said.

Something even as trivial as a trip to the bathroom or coffee machine has to be re-examined, said Mike Sandridge, executive director of client success at the technology unit of Jones Lang LaSalle, which oversees about 5-billion-square feet of property globally. Some restrooms have had to be limited to one person, and a red light will come on to let others know whether it’s occupied, based on stepping on a switch. When it’s free, the light turns green. Companies can also monitor whether the snack area is getting crowded, he said.

To help get some of its 350,000 employees back to its 150 offices around the world, International Business Machines is using its problem-solving Watson AI to analyze data from WiFi usage to help design and adjust office occupancy, said Joanne Wright, vice president of enterprise operations.

Understanding worker habits is more useful if you have a way to nudge them into new patterns. Since the pandemic began, Radiant RFID has sold 10,000 wristbands that vibrate when co-workers are too close to each other. The technology was originally designed to warn workers away from dangerous machinery, not other people. So far, the wristbands are responsible for reducing unsafe contacts by about 65%, said Kenneth Ratton, chief executive of the company, which makes radio-communication devices. At this point, the data on more than 3 billion encounters shows the average worker has had about 300 interactions closer than six feet lasting 10 minutes or more.

“The biggest problem is we as Americans haven't really been socially distanced, ever,” Ratton said.

Nadia Diwas is using another kind of technology: a wireless key fob she carries in her pocket made by her employer, Semtech, which tracks her movements and interactions, making it useful for contact tracing if someone gets sick, which is as important as warning people they are too close. The technology originally was developed by Semtech to help devices such as thermostats communicate on the so-called internet of things.

The reality is that people still need to work together, and if you’re back in the office, that means face-to-face interaction, said Diwas, who works in an electronics lab with two and sometimes three other people. She said she comes in contact with more people at the grocery store than in the office.

“It does make me more aware and more careful,” Diwas said in an interview. “The way I picture it in my head is that if both of us stretch our arms out, we should not touch each other.”

For most office workers, the best way to keep a safe distance from colleagues for the foreseeable future will still be on Zoom.

SOURCE: Green, J. (26 October 2020) "Offices struggle with COVID-19 social distancing measures" (Web Blog Post). Retrieved from employeebenefitadviser.com/articles/offices-struggle-with-covid-19-social-distancing-measures

How to bridge the health insurance knowledge gap for younger employees

More often times than not, when younger employees are searching for their own health insurance plans, they make common and costly mistakes due to the lack of education in regards to health care plans. Proper education could help the young generation of employees for their health, wellness, and future. Read this blog post to learn more.

With the passage of the Affordable Care Act, young adults were able to stay on their parents health insurance plans until the age of 26. But once they get their own health insurance, many young employees make common and costly mistakes because they don’t have the proper education when choosing their own programs.

This information gap could result in employees being hesitant to seek care, resulting in higher medical expenses for employees and reduced productivity from sick leave.

“It’s a challenge— there’s a fair number of employees that will come off of their parent's insurance at the age of 26,” says Amanda Baethke, director of corporate development at Aeroflow Healthcare. “There's not a lesson that you go through in order to understand insurance.”

Employers can help bridge this gap through proper training and communication strategies. In a recent interview, Baethke shared her thoughts on how employers can provide this extra education and what they can gain from it.

How can employers help younger workers avoid health insurance mistakes?

It's beneficial for HR to do a training where they're going over what co-pays, premiums, deductibles and coinsurance are. When signing up for insurance, employees are trying to decide which insurance to pick and may not understand the full impact of that decision. Employees could pick the cheapest one because they want less out of their paycheck. There's just not a lot of discussions happening and employees are left blind.

What mistakes do young workers make when it comes to health insurance?

I’ll get a lot of questions from my team like ‘What’s an HSA and what’s the benefit?’ It's truly a lack of understanding, because nobody teaches it. A lot of mistakes will happen with out-of-network providers. They don't realize that there are insurance networks and then within those networks, there are more narrow networks underneath.

For example, an employee can call a doctor's office and ask if that office is in-network and the receptionist may respond that they are — especially for the national brands like UHC, Aetna, Cigna, Humana. However, many of those plans have narrow networks under them that allow them to better control cost. So the employee would want to ensure their particular group/plan is in-network.

Another thing is making sure employees know that even though they have a deductible, some preventative care is likely covered under their insurance. This will help them choose the right physician so if they do get sick later on, they can see that physician, rather than going to a hospital which would be more costly for them.

What specific role should HR take when it comes to educating younger employees about health insurance?

HR is responsible for making sure that employees understand the benefits that they're offering. HR works incredibly hard to deliver the best benefits possible and advocate for each and every employee. So why not just go the extra step and have a consultation with the insurance company to explain what the benefits mean, what is covered, what may not be covered, how to really navigate through the insurance company and work back with them.

SOURCE: Schiavo, A. (19 October 2020) "How to bridge the health insurance knowledge gap for younger employees" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/news/how-to-bridge-the-health-insurance-knowledge-gap-for-younger-employees

Just 28% of Americans expect to return to the workplace before 2021

According to a recent study from a Conference Board Survey, only 28 percent of Americans expect that they can return to the workplace before the year 2021. Although that percentage has increased, many are still uneasy about the idea of returning to public spaces. Read this blog post to learn more.

Just 28% of Americans say they already have or expect to return to workplaces before the end of the year, indicating the coronavirus pandemic is making remote work more mainstream, a Conference Board survey showed Thursday.

Nearly one-third of respondents said they would be uncomfortable getting back to offices, shops and factories, while half said their greatest concern was contracting the disease at work, according to the Sept. 16-25 online survey of more than 1,100 workers. Only 17% of employees said they were very comfortable or even wanted to return.

The coronavirus continues to spread across the U.S., with 34 states recording higher seven-day averages of new cases compared with a month ago. While progress is being made on a vaccine, it will be months before it’s available to the general public. Even when it is ready, the Conference Board’s survey showed just 7% expect a return to their workplace.

“For knowledge workers and others where remote working is an option, you’re going to see more of a remote or hybrid working arrangement become the standard way,” said Rebecca Ray, executive vice president of human capital at the Conference Board.

A cultural shift to working from home and the pause or stop in business reopenings have upended the commercial real estate market. Federal Reserve Bank of Boston President Eric Rosengren warned that a resurgence in the virus could lead to troubles in the financial sector via commerical real estate.

The “commercial real estate sector is going to be impacted in the long term as we now need much less space for offices, retail, and probably higher education,” said Gad Levanon, head of the Conference Board Labor Markets Institute.

The Conference Board’s survey echoed with a recent poll of company executives by Cisco Systems. More than half plan to downsize their offices as remote working will become commonplace after the pandemic subsides, according to the Cisco survey.

The Conference Board survey also showed that lower-ranking employees are more concerned about returning. Some 20% of rank-and-file workers and 21% of front-line managers indicated they feel pressure to return in order to keep their jobs, compared with just 4% of executives. Individual contributors are also the least comfortable coming back to job sites.

Some 29% of respondents said they had little faith that their colleagues would adhere to safety protocols and guidelines upon return. One-third questioned the wisdom of going back to workplaces because they said productivity has remained high when working remotely, the survey showed.

SOURCE: Ren, H. (15 October 2020) "Just 28% of Americans expect to return to the workplace before 2021" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/articles/just-28-of-americans-expect-to-return-to-the-workplace-before-2021

Every dollar counts in today’s zero-interest-rate environment

It’s no secret that interest rates have been at historically low levels for quite some time, but the recent announcement by Federal Reserve Chairman Jerome Powell indicates that rates will stay near zero for the foreseeable future. Chairman Powell stated in his address last month that the Fed would tolerate above-2% inflation instead of attempting to preemptively control inflation by raising interest rates.

With rates likely to remain low, investors, and especially participants in sponsored 401(k) plans in the U.S. retirement system, need every dollar they can save to achieve their goals in retirement. This is particularly true this year, with the COVID-19 pandemic having inflicted significant disruption, uncertainty, and volatility on our nation’s workforce as well as the financial markets.

Even before the pandemic, low interest rates were already hitting Americans enjoying or nearing retirement very hard, because lower rates for annuities and money market accounts require people to save more when trying to convert savings into income. The indexing of Social Security benefits at lower rates also decreases income in retirement.

Stop automatically cashing out terminated participants’ small-account balances!

Since every dollar counts for plan participants in our pandemic-disrupted, zero-interest-rate environment, why are sponsors (who have a duty to adhere to the fiduciary standard) continuing to cash out small, stranded accounts with less than $1,000?

The Employee Benefit Research Institute (EBRI) estimates that a total of $92 billion in hard-earned savings leaks out of the U.S. retirement system every year because 401(k) plan participants prematurely cash out their accounts when they switch jobs. Conducting automatic cash-outs for terminated participants adds to the already sizable leakage of assets from our nation’s retirement system.

As we have noted in previous articles in this space, the primary driver of cash-out leakage is the lack of seamless plan-to-plan asset portability for participants at the point of job-change — and the resultant costly and time-consuming nature of DIY portability.

Boston College’s Center for Retirement Research has reported that, on average, premature cash-outs decrease participants’ total 401(k) assets for retirement by 25%. Cashing out 401(k) savings early is perhaps the worst blunder that a retirement-saver can make. But when sponsors automatically cash out small accounts, they potentially open themselves up to new fiduciary liability down the road.

After all, if a terminated participant has moved to a new house or apartment in the years since working for a former employer, and the new mailing address has not been updated in the files of the plan sponsor’s recordkeeper, then the check for the cashed-out small balance may not reach the accountholder. If that occurs, and the accountholder finds out the assets in their former-employer 401(k) account were lost, the employer could be sued, or the plan could be the focus of a regulatory inquiry.

Auto portability can eliminate the need for automatic cash-outs and rollovers

By adopting the technology solutions which enable auto portability, sponsors can potentially avoid having to conduct automatic cash-outs and automatic rollovers to keep their average account balances and related metrics at healthy levels.

Auto portability — the routine, standardized, and automated movement of a retirement plan participant’s 401(k) savings account from their former employer’s plan to an active account in their current employer’s plan — is powered by “locate” technology and a “match” algorithm. Together, these innovations locate lost and missing participants, and kick-off the process of moving their savings into 401(k) accounts in their current-employer plans.

Auto portability also has the power to make automatic rollovers of small accounts into safe-harbor IRAs a redundant practice. Placing terminated participants’ assets for retirement into safe-harbor IRAs in a low-interest-rate environment isn’t exactly benefiting them, since the only default investment options allowed in safe-harbor IRAs are principal-protected products. The combination of low yields and high fees in too many safe-harbor IRAs can deplete accountholders’ assets over the long term.

The capability to begin the movement and consolidation of 401(k) assets as participants change jobs, as well as reunite lost and missing participants with their 401(k) savings, can help decrease cash-out leakage — and savings depletion — at a time when every dollar in the U.S. retirement system counts more than ever.

EBRI estimates that the widespread adoption of auto portability by sponsors and recordkeepers would preserve up to $1.5 trillion (measured in today’s dollars) in our nation’s retirement system over the course of a 40-year period, primarily for the benefit of low-income workers. Based on EBRI data, Retirement Clearinghouse estimates that widespread adoption of auto portability would preserve $619 billion in savings for 67 million minority participants in the U.S. retirement system — including $191 billion for 21 million African-Americans.

Fortunately, auto portability has been live for more than three years, and it’s available to help sponsors make every dollar count for participants during these extraordinary times.

SOURCE: Williams, S. (07 October 2020) "Every dollar counts in today’s zero-interest-rate environment" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/every-dollar-counts-in-todays-zero-interest-rate-environment

Here's your employee checklist for open enrollment

The COVID-19 pandemic has focused consumer attention on health care, germs and the impact a single illness can have on their lives, livelihoods and loved ones. With the fall open enrollment season almost here, you have the opportunity to think more critically about the specific plans you choose for yourself and your family, as well as any voluntary benefits that may be available to you, including childcare, elder care and critical illness. In a world where it feels like health is out of the individual’s control, we all want, at the very least, to feel control over our coverage.

As we know all too well, there’s a lot to consider when it comes to choosing and using health care benefits. The most important piece of becoming an informed health care consumer is ensuring you have access to — and understand — the benefits information you need to make smart health care choices.

While open enrollment may seem daunting, devoting an hour or two to reviewing your plan options, the programs available to support you and your family physically, mentally and financially, and how to get the most from the coverages you do elect, can go a long way towards providing peace of mind as we face the unknowns of 2021. Here are five tips to keep in mind as you prepare for and participate in open enrollment.

Don’t forget that preventive care is covered by most plans at 100% in-network regardless of where that care is received. Schedule your appointments as soon as possible (and permissible in their area), and research other venues for receiving care, such as pharmacies, retail clinics and urgent care facilities. Most are equipped to provide standard vaccinations and/or routine physicals.

Unfortunately, there are also the long-term implications of COVID-19 to consider. Research suggests that there are serious health impacts that emerge in survivors of COVID-19, such as the onset of diabetes and liver, heart and lung problems. And many who were able to ride out the virus at home are finding it’s taking months, not weeks, to fully recover. As a result, you should prepre for the possibility that you, or a loved one, may be ill and possibly out of work for an extended period of time. Be sure to evaluate all of the plans and programs your employer offers to ensure your family has the financial protections you need. For some, a richer health plan with a lower deductible, voluntary plans such as critical illness or hospital indemnity insurance, and buy-up life and disability insurance may be worth investigating for the first time.

As hospitals reopen, it may be difficult to schedule a procedure due to scheduling requirements and pent up demand. A second opinion may be in order if your condition stabilized, improved or worsened during the delay; there may be other treatment options available.

A delay in scheduling also provides an opportunity to “shop around” for a facility that will provide needed care at an appropriate price — especially if you are choosing to go out-of-network or have a plan without a network. Researching cost is the best way to find the most affordable providers and facilities with the best quality, based on your specific needs.

Many medical plans offer second opinion and transparency services, and there are independent organizations who provide “white glove,” personalized support in these areas. Read over your enrollment materials carefully, or check your plan’s summary plan description, to see what your employer offers. If nothing is available, ask your employer to look into it, and don’t hesitate to do some research on your own. Doing so can often result in substantial cost savings, without compromising on quality of care.

Be sure to check up on your preferred health care providers — especially those you might not see regularly — to confirm they are still in business and still in network (if applicable). If you live in a rural area, you may have to travel farther to reach in-network facilities. If you’re currently covered by an HMO or EPO, you may want to evaluate whether that option still makes sense, if your preferred in-network providers are no longer available.

When was the last time you changed your medical plan? If you’ve been keeping the same coverage for years, it might be time to look at what else is available. Your employer may have introduced new plans, or you may find that a different plan makes more sense financially based on how often you need health care. Don’t forget — the cheapest plan isn’t always the one with the lowest premiums.

You may also want to consider setting aside funds in a health savings account or health care flexible spending account (if available). If your employer offers a wellness program, this might be an opportunity to start adopting better health habits to ensure you’re better equipped physically and mentally to deal with whatever lies ahead.

3 tips to boost your healthcare literacy with technology

Historically, the relationship between consumers and their health plan providers has been a distant and somewhat bumpy one. Some health plan providers get a bad rap for poor communications, leaving consumers on their own to navigate a health care system wrought with confusing language, red tape, and unpredictable costs.

The events of a global pandemic have compounded the complexity of dealing with the healthcare system. A recent J.D. Power Survey found that more than 60% of privately insured U.S. health plan members did not receive any guidance about COVID-19 from their providers. The lack of healthcare literacy — knowing what questions to ask and where to get care — has also created a bigger gap between everyday people and their providers. But the good news is technology can help us get more out of our benefits, making our relationship with health plan providers more connected.

The COVID-19 pandemic has exposed the need for more TLC and attention when it comes to benefits. But technology can help us get the most out of our benefits — strengthening our consumer relationship with health plan providers. By engaging with technology, we can improve our healthcare literacy, identify cost-saving opportunities and be more prepared for the unexpected.

If consumers are going to make an informed decision during open enrollment, they’ll need information about the number of visits they paid to the doctor and the costs of their claims to determine if they should change plans. Maybe they’re paying a lot more in premiums, or perhaps they didn’t meet their deductible. Being engaged with your benefits is key to getting the most out of them.

Tip: Avoid going on autopilot with your benefits. Benefits offerings are always changing, and health providers often offer programs that you can opt-in to free. Make sure you’re set up to receive notifications from your benefits administrators and health plan providers. Then take action. Use the preventative care offerings, likes annual wellness check-ups, and enroll in the programs that will serve you now and in the future.

During the pandemic, there has also been an increase in the use of AI to improve communication across the healthcare ecosystem. For example, patient care in the emergency room (ER) is traditionally delivered numerically — first come, first serve. However, AI can help doctors and caregivers at hospitals prioritize the needs of waiting patients. This can lead to a decrease in wait times in crowded hospitals — especially important during the pandemic. In the same vein, AI can help an individual decide if they truly need to visit the ER or if a telehealth option would be more effective and affordable.

Caregiver support platforms, like Cariloop, are using cloud-base technology to improve communication between providers, consumers and their families. This employer-sponsored benefit offers tailored caregiving plans and coaching for families looking for pediatric and senior care. Cariloop, and other caregiver support platforms, use technology to tap into a system of trusted providers and build caregiving scenarios with planning and calculator tools. Users can adjust for different scenarios, review whatresources are available, and receive personal coaching throughout the caregiving journey.

Tip: Viewing benefits as an item to check off a list once a year means you might be overpaying or leaving benefits on the table. Using claims integrations and decision support tools, like planning calculators, can help you and your family fully engage with your benefits and improve your healthcare literacy.

Benefits administrators and health plan providers are beginning to see the importance of supporting the whole person — through mental wellbeing initiatives or by offering online tutoring discounts, streaming virtual fitness programs, and food delivery services.

Tip: Look to the different options that providers use to deliver holistic and preventative care options. For example, year-long access to audio-guided meditation apps like Headspace or programs built around the use of wearable technology that rewards users who meet personalized activity goals. These initiatives go beyond regular patient care and give you tools to support your wellbeing — not just when you’re feeling under the weather.

3 tactics to navigate company culture in a remote world

In many respects, COVID-19 reframed our thinking about worklife balance. While this was already a fatigued concept, the pandemic and resulting quarantine fully demolished the fourth wall that stood between work and the personal lives of our team members.

In the early weeks, given our technology enablement already in place, a near immediate shift to fully virtual didn’t seem like a huge shift for many. As the weeks wore on, working parents and those with different challenges at home felt the effects almost immediately. As a working mom myself, I have first-hand experience around what it means to be a mom and an employee at the same time and in the same space, along with my partner also working from home. In fact, my daughter may or may not have “Zoom bombed” a session with our board. Of course, none of them were bothered by it and it probably embarassed me more personally than anything.

As the chief people officer of SailPoint, I’ve seen how balancing continuing to educate our children from home while working full time has taken a toll on many. Half of our workforce have children under the age of 18 living at home. To move forward as a distributed workforce in a way that is sustainable and productive, HR teams need actionable steps to empower today’s working parents.

By implementing specific guidelines that help employees navigate these waters, HR teams can better instill confidence in their employees and provide them with the resources required to drive successful and productive engagement. Small changes, simply starting with an acknowledgement of this issue, helps teams to get their work done on the terms they’re able to design to best fit their needs.

Give employees the formal gift of time

When the pandemic began earlier this year, SailPoint’s approach was centered on “returning to normal.” It’s clear now that a return to normal is not in the cards, and organizations should look at this time as an opportunity to rebuild and create lasting culture changes through new programs and initiatives.

One strategy we’ve found successful at SailPoint is implementing a 2-hour block twice a week when employees have no meetings and can focus on what is most important to them individually. This could range from taking care of their children to getting a presentation done that they haven’t had time for, or even scheduling personal appointments. Whatever it may be, this block we call ‘Free2Focus’ is about giving our crew space to balance the personal demands with the work demands. So far, the response to this time block has been very positive and it allows SailPoint crew members to use their time during the day how they wish in a flexible but formal way. Some crew members are using this time to focus on helping their children with school work, others have used it to have lunch with loved ones. Given that much of schooling from home may fall to women, we also look at this as an inclusion initiative to ensure that part of our workforce isn’t faced with a choice of one or the other.

Restructure your physical office

One aspect of corporate culture that was long overdue for restructuring is the use of the physical office space. At SailPoint, we’ve always offered our crew members flexibility, and this extends to trusting them to decide where they work. We believe that work is our identity, not our cubicle, and COVID-19 has presented us all an opportunity to rethink the office space.

As of September, we have allowed crew members to voluntarily return to the office if they wish at 25% capacity. Moving forward, we’re asking the crew to think of our offices like they would a college library. In college, you would likely go to the library for a place to focus or a place to meet with otehrs. This is how we want the SailPoint offices to operate because we know our crew makes the most impact when they have the autonomy to make their own decisions that work for the individual, their family and their work. There is not a one-size-fits-all when it comes to working styles and personal situations, which is why we want our physical office space to be as flexible as our remote office space.

Commit to community

While this time may have brought us closer to our families, it can be isolating from an employee culture perspective. Some of us are lucky enough to have family support at home, but many do not. It’s crucial that those looking for companionship and emotional support are able to find it, within our community.

Having a strong culture in place is not only invaluable for the individual’s well-being but also vital in keeping employees engaged and motivated. One strategy to achieve this is taking advantage of the technology that connects us. At SailPoint, we have several Slack channels that aren’t related to work to keep our community connected. We have channels for parents, pet lovers, beauty gurus, Texas Longhorns and more, but we also have a channel called SAIL ON. This particular channel is a place for people to post supportive messages, or to just have fun and connect with their community of crew members. So far, this initiative take on a life of its own, as we’ve seen our crew organize fitness competitions, build standing desks for each other’s homes, share their thoughts on "Feel Good Fridays.”

SOURCE: Payne, A. (23 October 2020) "3 tactics to navigate company culture in a remote world" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/list/3-tactics-to-navigate-company-culture-in-a-remote-world

Clearing Up COVID Confusion

The Workplace Routine

For many, getting back to work is a long-awaited blessing. However, as we have seen COVID-19 cases spike across Ohio over the last several days, business-as-usual it is not. More employers and employees are working to meet the challenges of COVID-19 and are attempting to understand how to properly respond to COVID-19 incidents.

Although resources related to handling COVID-19 are vast, many employers continue to be unsure of what is necessary to minimize risk to employees and others. For that reason, we thought it may be helpful to bottom-line some workplace best practices, particularly for responding to situations where someone has been in “close contact” with a person or persons with COVID-19.

First of all, where did we get our information?

The Centers for Disease Control and Prevention (“CDC”) has developed a raft of guidelines to address responding to possible exposure to COVID-19. We additionally consulted the resources available to assist employers through the Ohio Department of Health dedicated Coronavirus website.

Who can you trust?

Unfortunately, we have a pandemic that has been politicized creating a lot of hyper-partisan back and forth. Ultimately, this has led to a confusing landscape with people unsure of what to listen to and who to trust. The State of Ohio has gone through great lengths to help employers and employees in every field understand how to implement and innovate under the threat of COVID-19.

What is “close contact” with COVID-19?

The CDC has issued guidance regarding the proper response to situations where an individual has been in “close contact” with a person with COVID-19, which they updated in late September 2020. “Close contact” is defined by both the CDC as spending at least 15 minutes within six feet of a person with a confirmed case of COVID-19, or a direct exposure to possibly infected droplets of saliva or nasal mucus (e.g., being sneezed or coughed on in the face).

“Close Contact” Bottom Line

- If a person does not have COVID-19 symptoms but has had “close contact”, the person should remain in self-quarantine at home for 14 days from the last exposure if the person has tested negative (or has not been tested);

- If the person has a positive test but no symptoms, he or she should stay home in quarantine for 10 days after the test.

- If a person has had both close contact and COVID-19 symptoms, the person (regardless of COVID-19 test results) should stay in self-isolation for at least 10 days since the onset of symptoms and until at least 24 hours have passed with no fever (without medications) and with the improvement of the other symptoms.

- In addition to the above, new therapeutics are hitting treatment facilities showing merit for shortening the cycle. If in doubt, trust your health professionals to provide guidance on when it is safe to return to work.

“But, I was wearing a mask”…

Just because an employee was wearing a mask when they came in “close contact” does not mean they can skip quarantine procedures. While wearing a mask aids in the fight to control COVID-19, the CDC guidance does not give one a “pass” from the quarantine requirements due to the fact that one was wearing a mask when in close contact with a person with COVID-19. The same quarantine requirements still apply.

“But, I tested negative”…

Many employers are asking that employees that have been in “close contact” to be tested before returning to work. While this is a good step, it has caused some confusion. Given that the virus can develop and symptoms may not appear for up to fourteen days post-exposure; being exposed and then testing negative the next day does not mean an employee is in the clear. Simply put, even if an employee tests negative for COVID-19 or feels healthy, they should quarantine if they have been in “close contact” with someone with COVID-19. Today’s negative test can become tomorrow’s positive test.

“I vacationed or traveled to a hot spot, now what?”

Hot spots are popping up in a variety of areas across the country. If an employee travels for personal or professional reasons to a COVID-19 hot spot (classified as such due to the high rate of spread in the area), a traveler is exempt from the self-quarantine requirement if he or she has had a negative COVID-19 test in the seventy-two (72) hours prior to arrival back in Ohio or since returning. However, if while visiting a hot spot a person was in “close contact” with someone with COVID-19, then it is recommended to follow the CDC guidelines for potential exposure.

More Resources Available

Ohio Department of Health, as mentioned at the top of this post, has assembled many resources for employers. With the September 14th law, HB 606, Ohio Governor Mike DeWine provided employers legal protections when it comes to their efforts to stem the spread of COVID-19, making Ohio one of a growing number of states granting similar civil immunity. However, it is important to note, HB 606 does not offer blanket protection for employers, as it additionally provides protections for employees who can prove “reckless disregard for consequences” by an employer.

One particularly useful area of resources on the Ohio Department of Health website is a section dedicated to common questions around COVID-19, as well as a number of downloadable checklists and employer resources. We would encourage you to check that out: COVID-19 Checklists

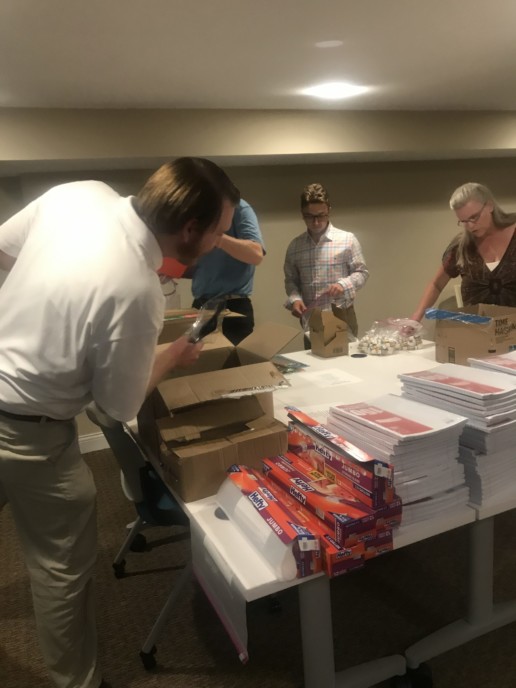

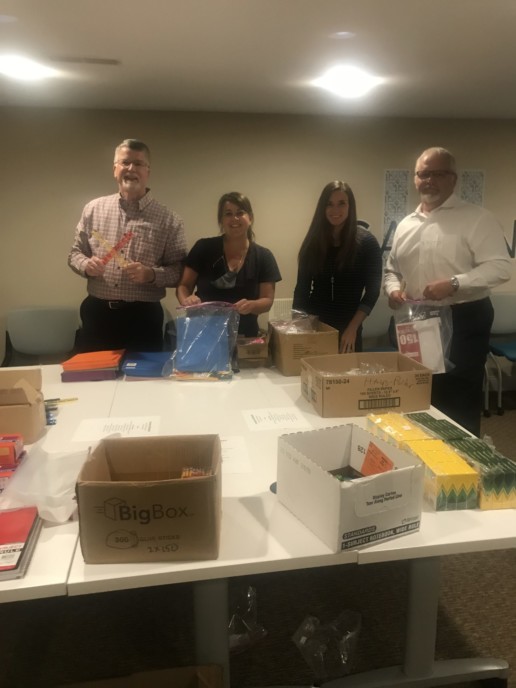

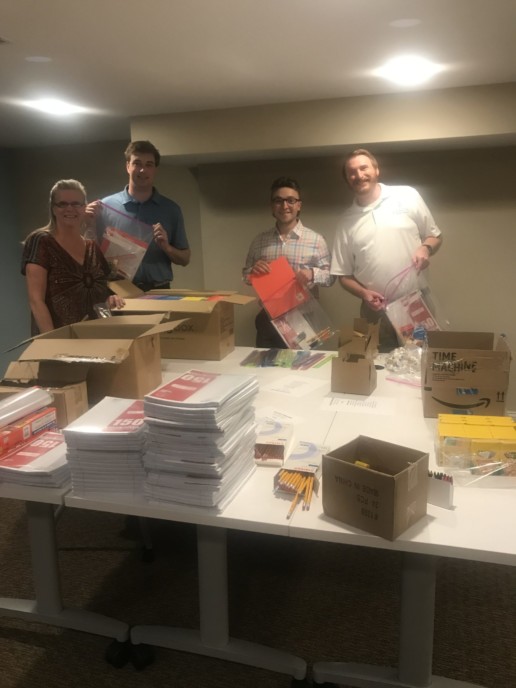

Saxon Gives Back

Community Strong: FamiliesFORWARD

Saxon took time out to give back by assembling school supply kits for FamiliesFORWARD.

FamiliesFORWARD is a neighborhood-based resource center devoted to helping children reach their full potential through many programs and partnerships within the community. We invite you to take a few moments to learn more about the FamiliesFORWARD mission and how you can get involved.