Medicare Advantage payments to see 3.4 percent increase next year

The U.S. agency that oversees Medicare said it will increase payments to privately run health plans for the elderly by an average of 3.4 percent next year, almost double the amount it had previously estimated.

That’ll be a boon for insurers such as UnitedHealth Group Inc. and Humana Inc. that have big businesses selling the private plans, known as Medicare Advantage. Including changes based on how sick or healthy people are, the total increase in payments to insurers is estimated to be about 6.5 percent, on average, the Centers for Medicare and Medicaid Services said in a statement Monday.

Medicare Advantage is an important source of growth for health insurers as the U.S. population ages and more people opt for the private plans, rather than the traditional Medicare program. About 21.4 million people are enrolled in the private plans, while 37.7 million rely on standard Medicare.

Medicare Advantage has drawn plenty of interest from both startups and established firms. Walmart Inc. may be seeking a broader partnership with Humana Inc. in part to benefit from growing enrollment in the plans, Bloomberg reported late last week. CVS Health Corp. agreed to acquire Aetna Inc. late last year in a bet in part on providing better care for seniors.

Source: Tracer Z. (3 April 2018). "Medicare Advantage payments to see 3.4 percent increase next year" [Web Blog Post]. Retrieved from Benefits Pro.

Summarized Report of The Kaiser Health Tracking Poll March 2018 for Non-Group Enrollees

Kaiser Health Tracking Poll – March 2018: Non-Group Enrollees

Key Findings: As part of the Republican tax reform plan signed into law at the end of 2017, lawmakers eliminated the ACA’s individual mandate penalty starting in 2019. About one-fifth of non-group enrollees (19 percent) are aware the mandate penalty has been repealed but is still in effect for this year. Regardless of the lack of awareness, nine in ten non-group enrollees say they intend to continue to buy their own insurance even with the repeal of the individual mandate. About one-third (34 percent) say the mandate was a “major reason” why they chose to buy insurance.

Survey: 9 in 10 people with non-group health insurance plan to continue buying insurance despite the repeal of the individual mandate penalty About half the public overall believes the ACA marketplaces are “collapsing,” including six in ten of those with coverage purchased through these marketplaces. In fact, across party identification and insurance type, more say the marketplaces are “collapsing” than say the marketplaces are not collapsing. Overall, the population who buy their insurance through the ACA marketplace report being satisfied with the insurance options available to them during the most recent open enrollment period and more than half give the value of their insurance a positive rating. Yet, some (32 percent) experienced problems while trying to renew or buy their coverage and six in ten marketplace enrollees say they are worried about the possible lack of health insurance coverage in their areas.

In 2017, President Trump issued an executive order directing his administration to expand the availability of non-renewable short-term insurance plans, and regulations have been proposed to implement the order. When asked whether non-group enrollees would prefer to purchase such a plan or prefer to keep the plan they have now, the vast majority (84 percent) say they would keep the plan they have now while 12 percent say they would want to purchase a short-term plan. The most common response offered by people who are uninsured when asked the reason why they don’t have health insurance is that it is too expensive and they can’t afford it (36 percent), followed by job-related issues such as unemployment or their employer doesn’t offer health insurance (20 percent).

Who Are Non-Group Enrollees?

This report examines people’s experiences with the current health insurance market focusing on individuals who currently have health insurance they purchased themselves (referred to as “non-group enrollees” throughout the report). This is comprised of individuals who purchase their own insurance through an Affordable Care Act (ACA) marketplace (“marketplace enrollees”) as well as those who purchase their insurance outside of the ACA markets. 1 In the first half of 2017, 10.1 million people had health insurance that they purchased through the ACA exchanges or marketplaces. 2 For comparison, the report also examines individuals ages 18-64 without health insurance (“uninsured”) as well as those who get their insurance through their employer (“employer-sponsored insurance”).

These extended interviews were conducted as part of the February and March Kaiser Health Tracking Polls and were completed after the close of the law’s fifth open enrollment period, which ended earlier this year. The Individual Mandate as part of the Republican tax reform plan signed into law at the end of 2017, lawmakers eliminated the ACA’s individual mandate penalty. The tax plan reduced the individual penalty for not having health insurance to zero beginning in 2019, effectively repealing the least favorable provision of the ACA (according to polling conducted by Kaiser Family Foundation). There is still uncertainty among the public as well as among the groups most directly affected by the individual mandate (non-group enrollees and the uninsured) on the status of the mandate.

—kff.org

The Results Are In: These Are the Companies With the Most Influence Over Washington

Poll: Americans Aghast Over Drug Costs But Aren’t Holding Their Breath For A Fix

The recent school shootings in Florida and Maryland have focused attention on the National Rifle Association’s clout in state and federal lobbying activities. Yet more than the NRA or even Wall Street, it’s the pharmaceutical industry that Americans think has the most muscle when it comes to policymaking. A poll from the Kaiser Family Foundation found that 72 percent of people think the drug industry has too much influence in Washington —outweighing the 69 percent who feel that way about Wall Street or the 52 percent who think the NRA has too much power. Only the large-business community outranked drugmakers. (Kaiser Health News is an editorially independent program of the foundation.)

Drug prices are among the few areas of health policy where Americans seem to find consensus. Eighty percent of people said they think drug prices are too high, and both Democrats (65 percent) and Republicans (74 percent) agreed the industry has too much sway over lawmakers. Democrats were far more likely than Republicans — 73 vs. 21 percent — to say the NRA had too much influence. The monthly poll also looked at views about health care. Americans may be warming to the idea of a national health plan, such as the Medicare-for-all idea advocated by Sen. Bernie Sanders (I-Vt.). Overall, 59 percent said they supported it, and even more, 75 percent, said they would support it if it were one option among an array for Americans to choose.

Americans are far more concerned with lowering prescription drug prices, though they don’t trust the current administration to fix the problem. Fifty-two percent said lowering drug costs should be the top priority for President Donald Trump and Congress, but only 39 percent said they were confident that a solution would be delivered. “There’s more action happening on the state level; what we are finding is they’re not seeing the same action on the federal level,” said Ashley Kirzinger, a senior survey analyst for KFF’s public opinion and survey research team. “They’re holding the president accountable as well as leaders of their own party.”

Overall, at least three-quarters of people don’t think Democrats and Republicans in Congress, as well as the Trump administration, are doing enough to bring costs down. Twenty-one percent reported that they didn’t trust either party to lower prices, up from 12 percent in 2016. And, unlike other health-related policy questions such as repealing the Affordable Care Act or creating a national health plan, the poll does not find a partisan divide on this perception.

Passing legislation to lower drug prices was at the top of the list of the public’s priorities, making it more important than infrastructure, solving the opioid epidemic, immigration reform, repealing the ACA or building a border wall. Looking ahead to the 2018 midterm elections, 7 percent reported that creating a national health plan was the “single most important factor” for how they would vote in 2018. However, 7 in 10 said it is an important consideration, and 22 percent said it is not an important factor at all.

The poll found that support for the federal health law fell this month, from February’s all-time high of 54 percent to 50 percent in March. Opposition moved up slightly from 42 to 43 percent. The poll was conducted March 8-13 among 1,212 adults. The margin of sampling error is +/-3 percentage points. KHN’s coverage of prescription drug development, costs and pricing is supported by the Laura and John Arnold Foundation .

—khn.org

Health Care Lags As Hot-Button Issue

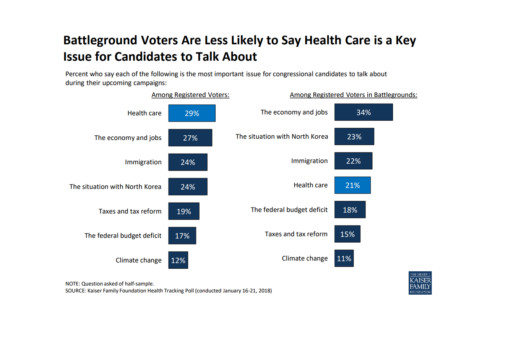

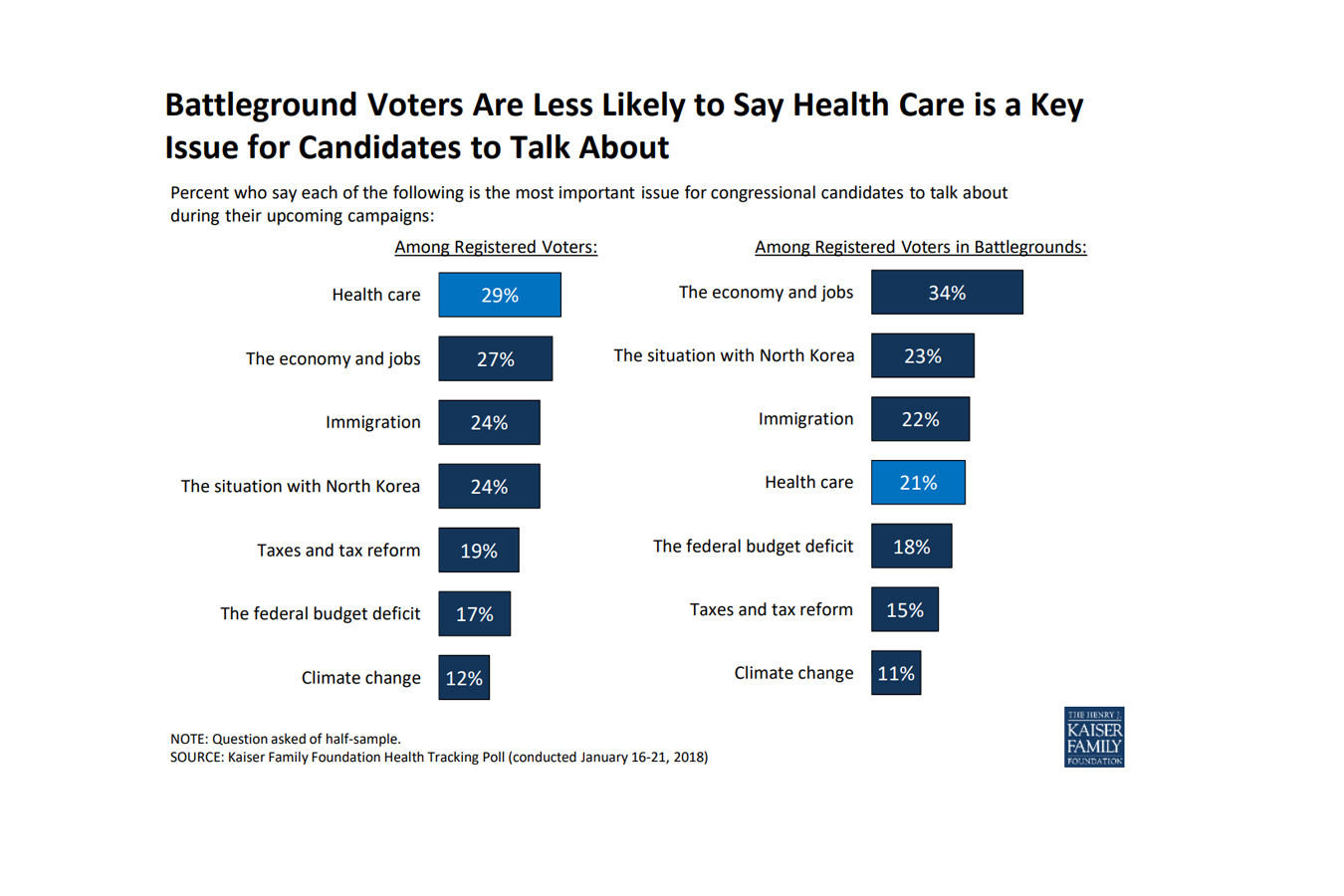

As it turns out - according to this poll conducted by Kaiser Health News - health care is not a key issue battleground voters wish to discuss. Instead, a large number of voters are more interested in dealing with issues regarding our economy and jobs.

Read further in this article below.

As the midterm elections approach, health care ranks as the top issue, mentioned more frequently among voters nationwide than among those living in areas with competitive races, a new poll finds.

As the midterm elections approach, health care ranks as the top issue, mentioned more frequently among voters nationwide than among those living in areas with competitive races, a new poll finds.

In areas with competitive congressional or gubernatorial races, the economy and jobs ranked as the top issue for candidates to discuss, with 34 percent of registered voters listing it as No. 1, according to the poll from the Kaiser Family Foundation. (Kaiser Health News is an editorially independent program of the foundation.) Following economics was the conflict with North Korea (23 percent), immigration (22 percent) and health care (21 percent). The competitive areas are 13 states with statewide races and 19 House districts judged as toss-ups by the nonpartisan Cook Political Report.

Nationwide, 29 percent of registered voters ranked health care as the most important issue for electoral discussion — though it was far more important for Democrats than Republicans. Economy and jobs were close behind with 27 percent of voters rating it most important, and then immigration, with 24 percent listing it.

The poll found that nearly half of Americans believed there is still a federal requirement for everyone to obtain health insurance, even though Congress’ tax bill last year repealed the penalties for that requirement in the Affordable Care Act, known as the individual mandate. Only a third of the public was sure that those penalties had been repealed.

Fifty percent of the public expressed a favorable view of the health law, while 42 percent disliked it. Six in 10 people said that since President Donald Trump and the Republicans in Congress have altered the law, they are responsible for any problems. Like other opinions about the law, there was a strong partisan split: Only 38 percent of Republicans thought their party is now responsible, while 77 percent of Democrats thought so. Half of Republicans still listed repealing the health law as a top priority.

There was less of a partisan split over the importance that the president and Congress address the epidemic of prescription painkiller addiction. Among Republicans, 43 percent rated it a top priority; 54 percent of Democrats agreed.

There was no such comity over whether lawmakers should allow people brought illegally to this country by their parents — the so-called Dreamers — to stay in the country legally: 21 percent of Republicans called that a top priority, while 66 percent of Democrats did. And while 43 percent of Republicans said they wanted lawmakers to focus on passing federal funding for a border wall with Mexico, only 5 percent of Democrats and 19 percent of independents did.

The poll was conducted Jan. 16-21 among 1,215 adults. The margin of error was +/-3 percentage points. The poll included 298 people who said they were registered to vote in one of the areas the Cook Report identified as a battleground in the fall elections. The margin of error for results for this group was +/-7 percentage points.

Read the original article.

Source: Rau J. (26 January 2018). "In Battleground Races, Health Care Lags As Hot-Button Issue, Poll Finds" [Web Blog Post]. Retrieved from address https://khn.org/news/in-battleground-races-health-care-lags-as-hot-button-issue-poll-finds/

Poll: Majority Sees GOP Health Bill as Step Backward

Have you wondered how other Americans feel about the repealing of the ACA? Check out in this great article by Jonathan Easley from The Hill about a poll taken from Harvard detailing how people across the country really feel about the passing of the AHCA.

A majority of voters see the GOP healthcare bill as a step backward and want to see the Senate make significant changes to it.

According to data from the latest Harvard-Harris Poll survey, provided exclusively to The Hill, 55 percent view the House-passed bill as a step backward, compared to 45 percent who described it as a step forward.

Seventy-seven percent of Republicans view the bill as a step forward, while 77 percent of Democrats and 61 percent of independents view it as a step back.

Fifty-seven percent of voters said they want to see the Senate make significant changes to the bill if it is to be passed into law, including 64 percent of Republicans and 66 percent of independents.

Sixty percent of voters want the Senate bill to ensure people with preexisting conditions can get affordable healthcare.

An amendment to the House bill offers state waivers that would allow carriers to charge people more based on their health.

“The voters want to neither go back to ObamaCare nor to the House bill,” said Harvard-Harris co-director Mark Penn.

“The Senate is going to have to thread the needle here and craft a new compromise. The voters are mostly concerned with pre-existing conditions and are against any penalty for not having insurance. Solve the preconditions dilemma and they might have something that could get public support.”

The Harvard-Harris online survey of 2,006 registered voters was conducted May 17–20. The partisan breakdown is 36 percent Democrat, 32 percent Republican, 29 percent independent and 3 percent other. The poll uses a methodology that doesn't produce a traditional margin of error.

The Harvard–Harris Poll is a collaboration of the Harvard Center for American Political Studies and The Harris Poll. The Hill will be working with Harvard-Harris throughout 2017. Full poll results will be posted online later this week.

Satisfaction with the bill cut sharply along partisan lines.

See the original article Here.

Source:

Easley J. (2017 May 24). Poll: majority sees GOP health bill as step backward[Web blog post]. Retrieved from address https://thehill.com/policy/healthcare/335003-poll-majority-sees-gop-health-bill-as-step-backward

HR Pros Were Relieved When Obamacare Replacement Bill Got Pulled

Find out how HR professionals really felt about the fall of the AHCA in this great article from HR Morning by Tim Gould.

Everybody knows that the GOP’s attempt to repeal and replace Obamacare came to a rather ignominious end. But how did the HR community feel about that outcome?

HR powerhouse Mercer addressed that question in a recent webcast, and the results were eye-opening.

Here are some stats from the webcast, which asked a couple key questions of 509 benefits pros.

On how they felt about the American Health Care Act being pulled:

- Very relieved it didn’t pass — 24%

- Relieved it didn’t pass — 32%

- Very disappointed it didn’t pass — 5%

- Disappointed it didn’t pass — 16%, and

- No opinion — 23%.

So (utilizing our super-sharp math skills here) considerably more than half of the participants were not in favor of the AHCA, while just slightly more than one in five were disappointed it was shot down. Looks like Obamacare isn’t as deeply disliked as we’ve been led to believe — at least with benefits pros.

Mercer also asked participants to rate priorities for improving current healthcare law — using 5 as the top rating and 1 as the lowest. Those results:

- Reduce pharmacy costs — 4.4

- Improve price transparency for medical services/devices — 4.1

- Stabilize individual market — 4.0

- Maintain Medicaid funding — 4.0, and

- Invest more in population health and health education — 3.7.

Perspective? As Beth Umland wrote on the Mercer blog, “Policymakers should view this health reform ‘reboot’ as an opportunity to partner with American businesses to drive higher quality, lower costs, and better outcomes for all Americans.”

A glance back

In case you’ve been hiding in a cave somewhere for the past several months, here’s a quick recap of the fate of the American Health Care Act.

Why did the AHCA fail, despite Republicans controlling the House, Senate and White House?

The answer starts with the fact that the GOP didn’t have the 60 seats in the Senate to avoid a filibuster by the Democrats. In other words, despite being the majority party, it didn’t have enough votes to pass a broad ACA repeal bill outright.

As a result, Senate Republicans had to use a process known as reconciliation to attempt to reshape the ACA. Reconciliation is a process that allows for the passage of budget bills with 51 votes instead of 60. So the GOP could vote on budgetary pieces of the health law, without giving the Democrats a chance to filibuster.

The problem for Republicans was reconciliation severely limited the extent to which they could reshape the law — and it’s a big reason the why American Health Care Act looked, at least to some, like “Obamacare Lite.”

Ultimately, what caused Trump and Ryan to decide to pull the bill before the House had a chance to vote on it was that so many House Republicans voiced displeasure with the bill and said they wouldn’t vote for it.

Specifically, here are some of what conservatives didn’t like about the American Health Care Act:

- it largely left a lot of the ACA’s “entitlements” intact — like government aid for purchasing insurance

- it didn’t do enough to curtail the ACA’s expansion of Medicaid

- too many of the ACA’s insurance coverage mandates would remain in place

- the Congressional Budget Office estimated that the bill would result in some 24 million Americans losing insurance within the next decade, and

- it didn’t do enough to drive down the cost of insurance coverage in general.

See the original article Here.

Source:

Gould T. (2017 April 14). Hr pros were relieved when obamacare replacement bill got pulled Ob[Web blog post]. Retrieved from address https://www.hrmorning.com/hr-pros-were-relieved-when-obamacare-replacement-bill-got-pulled-off-the-table/

Employees Want Money More than Perks

Have you been trying to leverage your employee benefits as a way to attract and retain talent? Take a look at this great article from Benefits Pro about how employees still value money over the perks of employee benefits Marlene Y. Satter.

There’s plenty of talk these days about all sorts of employee benefits that might help to attract and retain top talent — but when push comes to shove, it’s the dollar sign that has the most influence.

That’s according to a Paychex.com survey, which finds that in the employment conversation, money still talks the loudest. It’s not that people don’t want or like other benefits, such as health insurance, vacations and 401(k)s, but what they really want, what they really, really want is cold hard cash in the form of bonuses and raises. Regular bonuses, they say, are the most important job incentive.

However, asked about the benefits they do receive, survey respondents list a range of benefits, including health care, dental insurance, 401(k)s, casual dress days and free snacks, but bonuses only come in at eighth place. Least important to them of all are “nomadic days” — days on which they can work away from the office at the location of their choice.

Asked their salaries and which benefits they’d gladly give up in exchange for more money, there are quite a few — with low-cost benefits the most disposable. Millennials, perhaps unsurprisingly, make the least money at less than $47,000 a year, while boomers come in second (despite their longevity on the job) at just over $49,000 annually; GenXers are the best paid, at an average of more than $53,000.

And they all know the value of a buck. The top five most expendable benefits named are free coffee or snacks; casual dress days; company events or outings; discounts on company products; and discounts on other products. In fact, such “benefits” may actually backfire if companies think offering them instead of merit-based compensation or bonuses to induce greater productivity.

There’s certainly a disconnect between what employees say they value most and what employers believe are the most valuable options, with employees saying the most important to them are monetary bonuses, additional paid vacation time, and health and dental insurance.

Bosses, on the other hand, think employee morale benefits more from paid vacations, bonuses and finally paid maternity leave and vision and dental insurance.

To show how out of touch employers can be, employers rate health care just above lunch breaks in terms of morale-boosting importance, despite its value to employees.

Considering that low-wage jobs are associated with higher rates of employee turnover, the study points out that providing employees with a salary increase could cut the costs associated with recruitment and training.

Of course, smaller companies tend to offer fewer, and less expansive, benefits than larger companies, with employers of fewer than 100 more likely to offer employees casual dress days or free snacks than they are to provide them with the considerably more important benefit of health insurance. But on the flip side, smaller companies are also more likely to offer bonuses than are larger companies, and indeed employees rank those bonuses above health care, dental insurance, and 401(k) plans in importance.

And the benefits on offer could depend on the age of the boss, with millennials more willing to offer employees commission and sales bonuses, paid gym memberships and student loan reimbursement while Gen Xers hit on all cylinders in offering bonuses, paid maternity leave and on-site health and wellness services.

Boomers, alas, seem stuck in the dark ages when it comes to modern benefit offerings, reluctant to see the benefit of such perks as bonuses, nomadic days and paid maternity leave; in addition, they’re really resistant to such things as student loan reimbursement and paid professional development.

See the original article Here.

Source:

Satter M. (2017 April 28). Employees want money more than perks [Web blog post]. Retrieved from address https://www.benefitspro.com/2017/04/28/employees-want-money-more-than-perks?ref=hp-news&page_all=1

FIVE TRENDS IN TALENT

Do you know what is needed to attract new talent to your company? Here's a great article from SHRM about 5 trends that new hires are looking for in 2017 by Shonna Waters & Alex Alonso

See the original article Here.

Source:

Waters S., Alonso A. (2017 January 5). Five trends in talent [Web blog post]. Retrieved from address https://blog.shrm.org/blog/five-trends-in-talent

Kaiser Health Tracking Poll: Health Care Priorities for 2017

Great article from the Kaiser Family Foundation about Americans thoughts on ACA repeal by Ashley Kirzinger, Bryan Wu, and Mollyann Brodie

KEY FINDINGS:

- The latest Kaiser Health Tracking Poll finds that health care is among the top issues, with the economy and jobs and immigration, Americans want President-elect Donald Trump and the next Congress to address in 2017. When asked about a series of health care priorities for President-elect Trump and the next Congress to act on, repealing the ACA falls behind other health care priorities including lowering the amount individuals pay for health care, lowering the cost of prescription drugs, and dealing with the prescription painkiller addiction epidemic.

- When presented with two general approaches to the future of health care in the U.S., six in ten (62 percent) Americans prefer “guaranteeing a certain level of health coverage and financial help for seniors and lower-income Americans, even if it means more federal health spending and a larger role for the federal government” while three in ten (31 percent) prefer the approach of “limiting federal health spending, decreasing the federal government’s role, and giving state governments and individuals more control over health insurance, even if this means some seniors and lower-income Americans would get less financial help than they do today.”

- As Congressional lawmakers make plans for the future of the ACA, the latest survey finds the public is divided on what they would like lawmakers to do when it comes to the 2010 health care law. Forty-nine percent of the public think the next Congress should vote to repeal the law compared to 47 percent who say they should not vote to repeal it. Of those who want to see Congress vote to repeal the law, a larger share say they want lawmakers to wait to vote to repeal the law until the details of a replacement plan have been announced (28 percent) than say Congress should vote to repeal the law immediately and work out the details of a replacement plan later (20 percent). However, the survey also finds malleability of attitudes towards Congress repealing the health care law with both supporters and opponents being persuaded after hearing counter-messages.

Top Issues for President-elect Trump and Congress

The latest Kaiser Health Tracking Poll finds health care among the top issues Americans want President-elect Donald Trump and the next Congress to address in 2017. When asked which issue they would most like the next administration to act on in 2017, one-fourth of the public mention the economy and jobs (24 percent), followed by immigration (20 percent), and health care (19 percent). Among Democrats and independents, the economy and jobs is the top issue (23 percent and 24 percent, respectively) while the top issues for Republicans are immigration (30 percent) and economy and jobs (29 percent). Among all partisans, health care ranks among the top three issues that the public wants the next administration to act on in 2017.

The top issue for voters who supported President-elect Donald Trump are similar to those among Republicans: economy and jobs (31 percent) and immigration (31 percent), followed closely by health care (27 percent).

When asked to mention which health care issue they would most like President-elect Trump and the next Congress to act on in 2017, about one-third of the public mention the Affordable Care Act (ACA) but attitudes are mixed between wanting the next administration to act on repealing the 2010 health care law (14 percent), improving/fixing the law (11 percent), or keeping/expanding the law (8 percent).

LOWERING OUT-OF-POCKET COSTS IS A TOP PRIORITY FOR AMERICANS

When asked about a series of health care priorities for President-elect Trump and the next Congress to act on, repealing the ACA falls behind other health care priorities. Two-thirds of the public (67 percent) say lowering the amount individuals pay for health care should be a “top priority” for President-elect Trump and the next Congress. This is followed by six in ten (61 percent) who say lowering the cost of prescription drugs should be a “top priority,” and nearly half (45 percent) who say dealing with the prescription pain killer addiction epidemic should be a “top priority.”

Smaller shares say repealing the 2010 health care law (37 percent), decreasing how much the federal government spends on health care over time (35 percent), and decreasing the role of the federal government in health care (35 percent) should be top priorities.

LOWERING OUT-OF-POCKET COSTS TOPS PRIORITIES REGARDLESS OF PARTISANSHIP

While about two-thirds of Democrats, Republicans, and independents say lowering the amount individuals pay for health care should be a “top priority,” partisans differ in how they prioritize other health care issues. Most notably, while 63 percent of Republicans say repealing the 2010 health care law should be a top priority – this view is shared by much smaller shares of independents (32 percent) and Democrats (21 percent). Similarly, Republicans (50 percent) are more likely than independents (34 percent) or Democrats (26 percent) to place a top priority on decreasing the role of the federal government in health care. By contrast, Democrats and independents are somewhat more likely than Republicans to place a top priority on lowering the cost of prescription drugs (67 percent, 61 percent, and 55 percent, respectively) and on dealing with the epidemic of prescription painkiller addiction (51 percent, 46 percent, and 39 percent, respectively).

CONFIDENCE IN PRESIDENT-ELECT TRUMP’S ABILITY TO REDUCE HEALTH CARE COSTS

Lowering out-of-pocket health care costs is a top priority for Americans, and this was also a campaign promise from Donald Trump during his 2016 presidential campaign. When asked how confident they are in President-elect Trump’s ability to deliver on this campaign promise that Americans will get better health care at a lower cost than they pay now, Americans are split with similar shares saying they are either “not too confident” or “not at all confident” (51 percent) as saying they are “very confident” or “somewhat confident” (47 percent).

Confidence in President-elect Trump’s promise that Americans will get better health care at a lower cost is largely divided by party identification and 2016 vote choice with nearly nine in ten Republicans (85 percent) and Trump voters (86 percent) saying they are either “very” or “somewhat” confident in the next administration’s ability to deliver on this campaign promise. This is compared to 81 percent of Democrats and 86 percent of Clinton voters who say they are either “not too confident” or “not at all confident” that the next president will deliver on this promise.

Americans’ Attitudes on the Future of Health Care in the U.S.

Throughout the 2016 presidential election, it became clear that the two major political parties in the U.S. have competing views on the future of health care. When given two competing approaches to the future of health care, six in ten Americans (62 percent) prefer “guaranteeing a certain level of health coverage and financial help for seniors and lower-income Americans, even if it means more federal health spending and a larger role for the federal government” while about one-third (31 percent) prefer “limiting federal health spending, decreasing the federal government’s role, and giving state governments and individuals more control over health insurance, even if this means some seniors and lower-income Americans would get less financial help than they do today.”

There are also partisan differences, with about half of Republicans (53 percent) preferring the approach that Republican leaders have coalesced around – limiting federal health spending, decreasing the federal government’s role, and giving states and individuals more control; this approach is preferred by much smaller shares of independents (27 percent) and Democrats (15 percent). The majority of Democrats (79 percent) and independents (65 percent) prefer guaranteeing a certain level of coverage for seniors and lower-income Americans – even if it means a larger role for the federal government and increased federal spending.

ATTITUDES TOWARDS THE FUTURE OF THE AFFORDABLE CARE ACT

The future of the Affordable Care Act has been at the forefront of the political agenda since the 2016 election with President-elect Trump and Republican lawmakers in Congress saying they will quickly move to repeal the health care law in 2017. The latest survey finds public opinion towards the law is divided with similar shares of the public saying they have an unfavorable opinion (46 percent) as say they have a favorable opinion (43 percent) of the law, which is largely stable from previous months.

REPEALING AND REPLACING THE AFFORDABLE CARE ACT

As Congressional lawmakers make plans for the future of the ACA, the latest Kaiser Health Tracking survey finds that – similar to overall attitudes towards the law – the public is also divided on what they would like lawmakers to do when it comes to the 2010 health care law.

Overall, 49 percent of the public think the next Congress should vote to repeal the law and 47 percent say they should not vote to repeal it. Of those who want to see Congress vote to repeal the law, a larger share say they want lawmakers to wait to vote on repeal until the details of a replacement plan have been announced (28 percent) than say Congress should vote to repeal the law immediately and work out the details of a replacement plan later (20 percent).

HOW FLEXIBLE ARE AMERICANS’ OPINIONS OF REPEALING THE ACA?

The survey examines the malleability of attitudes towards Congress repealing the health care law and finds that both supporters and opponents of Congress voting to repeal the law can be persuaded after hearing counter-messages. After hearing pro-repeal arguments, the share of the public supporting repeal can grow to as large as 60 percent, while counter-messages against repeal can decrease support to 27 percent.

Among those who originally said Congress should not vote to repeal the 2010 health care law, about one-fifth (22 percent) change their opinion after hearing that some consumers around the country have seen large increases in the cost of their health insurance – which is similar to the share who shifted their opinion after hearing that the country cannot afford the cost of providing financial help to individuals to purchase health insurance.

On the other side of the debate, some of those who originally said they support Congress voting to repeal the health care law are also persuaded by hearing arguments often made by opponents of the repeal efforts. The survey finds that a share shifts their opinion after hearing that some people with pre-existing conditions would no longer be able to get health coverage and after hearing that some of the roughly 20 million Americans who got health insurance as a result of the law would lose their coverage.

PERCEIVED EFFECTS OF CHANGES TO HEALTH CARE SYSTEM

Overall, large shares of Americans say their own health care will “stay about the same” if lawmakers vote to repeal the 2010 health care law. More than half of Americans say the quality of their own health care (57 percent) and their own ability to get and keep health insurance (55 percent) will stay about the same if the law is repealed. Fewer (43 percent) say the cost of health care for them and their family will stay about the same if the law is repealed. In each of these cases, about equal shares believe their own situation will get better as say it will get worse.

INDIVIDUALS WITH A PRE-EXISTING CONDITION

After being read a definition of “pre-existing condition,” just over half (56 percent) of U.S. adults say that they or someone in their household would be considered to have such a condition. Overall, these individuals are more likely than those without a pre-existing condition to say their access, quality, and cost of health care will get “worse” if the ACA is repealed. However, about one in five of these individuals say their access, quality, and cost of health care will get “better” if the ACA is repealed.

One-third of individuals who have someone in their household with a pre-existing condition say the cost of health care for them and their family will get worse if the ACA is repealed, compared to about one in five of those living in a household without someone with a pre-existing condition. Larger shares of those with a pre-existing condition also say their ability to get and keep health insurance will get worse than those without a pre-existing condition (24 percent vs. 17 percent), and the quality of their own health care will get worse (21 percent vs. 15 percent).

In addition, individuals with a pre-existing condition in their household also report being more worried about health-care related issues than those without a pre-existing condition. Slightly more than half (54 percent) of those with a pre-existing condition say they are either “very worried” or “somewhat worried” about not being able to afford the health care services they need, compared to 43 percent of those without a pre-existing condition. Similarly, 43 percent of those with a pre-existing condition are worried (either “very” or “somewhat”) about losing their health insurance compared to 30 percent of those without a pre-existing condition.

Kaiser Health Policy News Index

The latest Kaiser Health Tracking Poll finds President-elect Donald Trump’s transition and cabinet appointments was the most closely followed news story during the past month with seven in ten (68 percent) Americans closely following news about his transition. Other stories that captured the attention of Americans include the conflict involving ISIS in Mosul, Iraq (64 percent), the CIA’s report of Russia interfering in the 2016 presidential election (64 percent), and the top health policy story this month – Republican plans to repeal the ACA (63 percent). Other health policy stories followed by Americans this month include the ongoing heroin and prescription painkiller addiction epidemic in the U.S. (57 percent), Republican plans for the future of Medicare (51 percent), and the passing of the 21st Century Cures Act (37 percent).

See the original article and charts Here.

Source:

Krizinger A., Wu B., Brodie M. (2017 January 06). Kaiser health tracking poll: health care priorities [Web blog post]. Retrieved from address https://kff.org/health-costs/poll-finding/kaiser-health-tracking-poll-health-care-priorities-for-2017/

Financial wellness: Here’s what employees want, need in 2017

Great article from our partner, United Benefit Advisors (UBA) by

Recent research into individuals’ financial resolutions for 2017 can tell you whether your financial wellness initiatives are giving employees what they want. It can also tell you whether to expect employees to increase their retirement contributions next year.

Personal finance company LendEDU recently asked 1,001 Americans about their financial goals for 2017, as well as what their biggest concerns are. The results were published in LendEDU’s “Financial Resolution Survey & Report 2017,” which can help employers determine if their financial programs are on point.

Here are some of the more interesting Q&A’s from the research:

What’s your most important financial resolution in 2017?

- Save more money — 52.85% of respondents selected this

- Pay off debt — 35.56%

- Spend less money — 11.59%

Takeaway for employers: Improving savings should be front and center in any financial wellness strategy.

What’s your top financial resolution?

- Make and stick to a budget — 21.38%

- Save for a large purchase like a down payment, household upgrade, or car, etc. — 19.28%

- Pay down credit card debt — 18.88%

- Place money aside for an emergency — 16.58%

- Save for retirement — 13.69%

- Pay down student loan debt — 7.29%

- Save for college — 2.90%

Takeaway for employers: Employees need the most help creating a budget they can stick to.

What’s your top financial concern?

- Unexpected expenses — 53.25%

- Healthcare costs — 23.98%

- Higher interest rates — 9.69%

- The labor market — 7.79%

- Stock market fluctuations — 5.29%

Takeaway for employers: Helping employees manage healthcare costs can be a key add-on to any financial education program.

Do you think you’re better off financially in 2017 than in 2016?

- Yes — 78.32%

- No — 21.68%

Takeaway for employers: Employees’ financial state of mind is on the upswing, which is good. But it could make increasing participation in wellness initiatives more challenging.

Do you make financial resolutions with your spouse or significant other?

- Yes — 84.83%

- No — 15.17%

Takeaway for employers: When it comes to finances, very few people go it alone, so invite spouses to be a part of your wellness offerings.

What would make you stick to a financial resolution?

- Having a reward for reaching the goal — 37.56%

- Segmenting a longer term goal into smaller bit sized pieces — 20.08%

- Technology that helps you save money or monitor goals in real-time — 19.38%

- The encouragement of family and friends — 13.99%

- Having a consequence for not reaching the goal — 8.99%

Takeaway for employers: Incremental rewards and incentives, can help drive participation and success in 2017 financial wellness initiatives.

Do you think you’ll increase your retirement savings contributions this year?

- Yes — 63.24%

- No — 36.76%

Takeaway for employers: This could be a good year to really push employees to bump up retirement plan contributions.

See the original article Here.

Source:

Author (Date). Title [Web blog post]. Retrieved from address https://www.hrmorning.com/financial-wellness-heres-what-employees-want-need-in-2017/