DOL Says No Fine for Failing to Provide Exchange Notices in 2013

Originally posted by Stephen Miller on September 13, 2013 on https://www.shrm.org

U.S. employers were again surprised by another unexpected suspension of a provision of the Patient Protection and Affordable Care Act (PPACA or ACA) when, on Sept. 11, 2013, the Department of Labor (DOL) announced there will be no penalty imposed on employers that fail to distribute to workers a notice about available coverage under state- and federal-government-run health insurance exchanges (collectively referred to by the government as the "health insurance marketplace"), scheduled to launch in October 2013.

Fair Labor Standards Act (FLSA) Section 18B, added to the labor statute by the PPACA, requires employers that are subject to the FLSA to provide all their employees by Oct. 1 of each year (the traditional start of the annual open enrollment season for employee health plans), and all new employees at the time of hiring, a written notice informing them of the following:

- The existence of the government-run health care exchanges/the marketplace, including a description of the services provided and the manner in which employees may contact an exchange to request assistance.

- If the employer plan’s share of the total allowed costs of benefits provided under the plan is less than 60 percent of such costs, workers may be eligible for a premium tax credit under Section 36B of the Internal Revenue Code if they purchase a qualified health plan through an exchange.

- Employees who purchase a qualified health plan through an exchange may lose their employer’s contribution to any health benefits plan the organization offers. All or a portion of this contribution may be excluded from income for federal income tax purposes.

According to the PPACA and subsequent guidance, the notice must be provided to each employee, regardless of plan-enrollment status or part-time or full-time status. Employers are not required to provide a separate notice to dependents or retirees, but an employer's obligation to provide notice may extend to its independent contractors and leased workers, depending on the nature of their relationship with the employer as determined under the FLSA's "economic reality" test.

The PPACA has a $100-a-day penalty for noncompliance with its provisions (unless otherwise specified in the statute), and it had generally been assumed this penalty would apply to employers that fail to distribute the exchange notice, possibly with additional penalties for failure to comply with a provision of the FLSA. However, the penalty provision had not been made explicit in any previous guidance, nor had the regulators described how the penalty would be implemented and enforced.

Then, on Sept. 11, 2013, the DOL posted on its website a new FAQ on Notice of Coverage Options, which states:

Q: Can an employer be fined for failing to provide employees with notice about the Affordable Care Act’s new Health Insurance Marketplace?

A: No. If your company is covered by the Fair Labor Standards Act, it should provide a written notice to its employees about the Health Insurance Marketplace by Oct. 1, 2013, but there is no fine or penalty under the law for failing to provide the notice.

DOL Encourages Compliance

Keith R. McMurdy, a partner at law firm Fox Rothschild LLP, commented in a posting on his firm’s Employee Benefits Legal Blog that Section 18B of the FLSA clearly states that any employer subject to the FLSA “shall provide” written notice to current and future employees and that the DOL’s Technical Release No. 2013-02, issued in May 2013, states that Section 18B of the FLSA generally provides that an applicable employer “must provide” each employee with a notice. McMurdy wrote:

My experience with the federal laws and the enforcement of said laws by federal agencies is that when things say “shall” and “must,” there are penalties when you don’t do them. So when the DOL now takes the position that it is not a “shall” or “must” scenario, but rather only a “should” and “even if you don’t we won’t punish you” proposition, I get suspicious. But I also think this confirms what I have said since the beginning about PPACA compliance for employers. It is all about your risk tolerance.” …

So, if you don’t want to send the Oct. 1, 2013 Notice, apparently the DOL “FAQ” says you have no penalties and thus no risk. Me? My risk tolerance is a little lower than that and my experience with regulatory agencies is such that I don’t trust informal “FAQs” posted on the web as much as I trust the clear language of the statutes and prior technical releases. Words like “shall” and “must” usually mean that if I don’t do it I get burned. So I am still recommending that employers comply with the notice requirement. Why? I can almost guarantee that if you send the notice, you won’t face a penalty for not sending it. But if you don’t send one, well, I still say all bets are off.

Christine P. Roberts, a benefits attorney at law firm Mullen & Henzell LLP,commented on her “E is for ERISA” blog, “This information, at this late date, is more confusing than it is helpful to employers who have already invested significant resources in preparing to deliver the Notice of Exchange.” She added this cautionary note:

“Particularly for employers with pre-existing group health plans, the Notice of Exchange potentially could be viewed by the DOL as within the scope of the employer’s required disclosures to participants and thus within the scope of an ERISA audit, or separate penalties could be imposed through amendment to the FLSA or the ACA.”

Model Notices

The DOL’s Sept. 11 FAQ reiterated that the department has two model notices to help employers comply with the Oct. 1 exchange/marketplace notice deadline (which they are strongly encouraged to meet):

- Model Notice for employers who offer a health plan to some or all employees.

- Model Notice for employers who do not offer a health plan.

Employers may use one of these models, as applicable, or a modified version. The model notices are also available in Spanish and MS Word format at www.dol.gov/ebsa/healthreform.

Can Happiness Heal? How a positive attitude might save your life

Originally posted by Julia Perla Huisman on https://www.nwitimes.com

Health and happiness. Are the two linked? We can assume that those with good health are generally happy to be well. But what about the other way around? If someone is sick, can happiness make them feel better physically?

The answer is a resounding yes, according to recent research. Multiple studies have shown that a positive outlook on life reaps many tangible benefits: “‘Happy’ people cope better with stress and trauma, are more resilient, have stronger immune systems, and live longer,” says Barbara Santay, therapist for Franciscan Alliance’s Employee Assistance Program.

The statistics are staggering: according to Santay, two-thirds of female breast cancer survivors who attend support groups report that their lives were altered for the better after developing the disease. Women who have strong social connections live an average of 18 months longer than those who have little to no connections. Bereavement has been associated with stress hormones, and friendly social contact has been proven to decrease those hormones.

“One of the big ways we see [the correlation] clinically is with chronic pain,” says Michael Mirochna, M.D., a family medicine physician with Lake Porter Primary Care and Porter Physician Group of Porter Regional Hospital. “When a patient’s mood is good, they’ll be in less pain. If they start to feel worse and you dig into their psychosocial history, you find that something happened (their dog died, relationship problems, etc.). There’s a close correlation with mood and pain in that regard.”

It’s clear to see that happiness fosters good—or at least improved—physical health. But what, exactly, is happiness?

“I think we need to differentiate between happiness and joy,” says Tanaz Bamboat, certified laughter yoga instructor from Munster. “Happiness depends on things. Joy is unconditional.”

Santay adds, “People think they would be happy if only they were to get married, have a baby, get plastic surgery, win the lottery… These things do provide a temporary boost in happiness but after a certain time has passed, people return to their happiness set point.”

Experts agree that what leads to a continual state of happiness has nothing to do with circumstances or material possessions, which can be fleeting. Rather, it comes from one’s outlook on life.

Fortunately, such an outlook can be cultivated and exercised, so that even the biggest curmudgeon on the block can take control of his or her mental and emotional—and therefore physical—health.

We’ve outlined five ways to develop a positive perspective:

Be physically active. There is bountiful research backing the premise that exercise improves mood. “We strongly encourage physical activity with our patients diagnosed with depression,” says Mirochna. “If their depression is so bad that they don’t feel like doing anything at all, we encourage them to at least do some physical activity, and it immediately makes them feel better.” In fact, according to Santay, aerobic exercise is shown to be just as effective as depression medications.

Dawn Wood, certified therapeutic recreation specialist and instructor of the Benefits of Exercise class at Methodist Hospitals, says, “One of the emotional benefits of exercise is that you are doing good for your body and yourself. When you feel good about yourself, it gives you confidence to meet daily challenges, meet goals, and communicate with others.”

Meditate/Focus. Santay lists meditation, avoiding overthinking, and increasing “flow experiences” (activities that engage you, cause you to lose track of time) as ways to get the mind right. She also encourages two minutes of writing every day. “The immune system works better when we write,” she says. According to a study by the University of Missouri and Columbia, the psychological and physical benefits of two minutes of journaling are greater than those that come from writing in longer time segments.

Wood suggests “true relaxation… allow yourself to take a mental and physical break from your responsibilities from time to time, so when you return, you have a better frame of mind.”

Laugh. The phrase “laughter is the best medicine” isn’t just a euphemism. Laughter is proven to prevent heart disease, lower stress hormones, strengthen the immune system, and reduce food cravings. It also has anti-aging benefits.

While a comedy show or YouTube video provides a temporary laugh, the greater health benefit comes from intentional, continuous laughter that can be learned in a class like laughter yoga. In this practice, participants are taught to laugh from the belly, and for no reason, so they learn to laugh despite their circumstances. They’re also instructed to breathe properly, which improves blood flow.

Bamboat, who teaches laughter yoga classes throughout Northwest Indiana, works often with cancer patients. “Laughter brings movement up into the lymph nodes,” which play a big role in cancer care.

“Laughter brings you back to a childlike state,” Bamboat says. “We were born with a spirit of laughter but have forgotten it because of stress. If you condition your body to laugh unconditionally, you will relieve your social, medical and physical stress.”

Be social. When we’re not feeling well, we tend to isolate ourselves. In reality, that’s the worse thing we can do. Having social connections and a strong support system can greatly improve one’s health.

“We tell our patients it’s important to have a sense of community,” says Mirochna. “What kind of social support structure do they have in place? If they are elderly, we ask if they have kids or a family.” Mirochna points out that Porter Hospital has a group for senior citizens in which they can participate in lectures and trips and develop friendships with other people in their stage of life.

Santay also urges her clients to nurture social relationships, learn to forgive, and practice acts of random kindness. Wood adds that helping others has been “the biggest factor I have noticed with patients’ happiness. It helps them feel worthwhile, capable.”

Be spiritual. Getting in touch with your spiritual side can do wonders to your physical health. Those active in religion live longer, use drugs less often, have longer marriages, and are healthier in general, according to Santay.

Father Tony Janik of Franciscan St. Anthony Health-Crown Point explains spirituality’s medicinal qualities: “Those with a spiritual outlook can face the difficult parts of life by having a greater sense of value. They have a source of perspective and hope… They find strength in that hope and have better coping mechanisms.”

This is especially valuable for those going through the end of life. “Not everyone gets cured, but they can be healed, from a spiritual perspective,” Janik adds. “We believe that everyone is made in the image of God and that they can have a life beyond here. That gives our patients hope.”

Tools to Better Understand Your 401(k)

Originally posted September 11, 2013 by Philip Moeller on https://money.usnews.com

The Lifetime Income Disclosure Act proposed in May seems to have a reasonable objective: help people determine how much retirement income would be produced by their 401(k). For years, financial experts have touted the benefits of helping consumers understand their retirement trajectories. Otherwise, how will they know if they're on the right track to a successful retirement?

Reasonable or not, the legislation has become a perennial in the garden of consumer finance proposals. It gets introduced. Consumer groups applaud it. Investment firms say the goal has merit. Then they raise a host of operational problems in implementing such a law. Leading the list is their opposition to pretty much any government mandate. They prefer voluntary compliance.

[Read: How to Take Control of Your 401(k).]

Fidelity, the biggest provider of retirement accounts, responded last month to U.S. Department of Labor proposals to implement lifetime income disclosure rules: "Information provided in a static format does not promote participant engagement," Fidelity wrote in a letter to the labor department. "As an equally important consideration, the disclosures that would need to accompany the projections and illustrations would greatly add to both the length and complexity of participant statements, increasing the risk of reader disengagement from any of the information provided on the statement."

Please raise your hand along with me if you aren't really sure what this means. In Fidelity's defense, adding any additional required materials to customer statements may produce diminishing returns. Consumers have greeted recent expansions in 401(k) statements – aimed to provide more transparency to account fees and performance – with disinterest.

Many other investment firms also weighed in with their own objections. More fundamentally, exactly what assumptions about future investment returns and rates of inflation should be used in calculating lifetime income projections? What is the ideal or "right" rate of withdrawing assets from a plan during retirement? Even Nobel Prize winners wouldn't agree on such numbers.

What does Washington say? Here is the description provided by the Congressional Research Service of the current version of the proposed law:

"[The Lifetime Income Disclosure Act] requires such lifetime income disclosure to set forth the lifetime income stream equivalent of the participant's or beneficiary's total benefits accrued. Defines a lifetime income stream equivalent of the total benefits accrued as the monthly annuity payment the participant or beneficiary would receive if those total accrued benefits were used to provide lifetime income streams to a qualified joint and survivor annuitant.

"Directs the Secretary of Labor to: (1) issue a model lifetime income disclosure, written in a manner which can be understood by the average plan participant; and (2) prescribe assumptions that plan administrators may use in converting total accrued benefits into lifetime income stream equivalents."

[Read: 3 Highly Personal Threats to Your Retirement.]

Are we all clear on this?

In the interest of plain language – whether driven by government mandate or voluntary industry compliance – employees and retirees with 401(k)s and individual retirement accounts would be better off with clear answers to practical questions. Here are 10 basic retirement plan questions that merit clear and helpful answers, and some tips about trends and where to find answers.

1. Based on your current 401(k) contribution level and investment results, what kind of retirement is in store for you?

The Employment Benefit Research Institute does an annual retirement confidence survey that contains troubling conclusions about the state of retirement prospects for many Americans. The 2013 survey results can be found at https://www.ebri.org/surveys/rcs/2013/.

2. Do you know what your Social Security benefits would be for different claiming ages?

The Social Security Administration has a tool to provide you access to your earnings history and projected benefits at www.ssa.gov/myaccount.

3. Are you saving enough?

Most people should be saving 10 to 15 percent of their salaries, with higher levels needed for those who wait until their 40s to get serious about retirement savings. Yet most people are saving far less.

4. How much money do you have?

Make a date with yourself to spend an hour with your latest plan statement. It may be time very well spent.

5. What are you paying in fees?

Investment management companies have been steadily lowering retirement plan fees in response to sustained criticism and competition from Vanguard and other low-fee investment firms. The Department of Labor has a primer on retirement plan fees at www.dol.gov/ebsa/publications/undrstndgrtrmnt.html.

6. How has your account performed?

See the advice for question #4.

7. How does your 401(k) performance compare with other investment choices you can make within your plan?

This will require more work on your part, but your plan statement and usually your plan's website will include tools to let you look at investment returns of the various funds and other investment choices offered by the plan.

[See: 10 Things to Watch When Interest Rates Go Up.]

8. How does your performance compare with investment results in the plans of other companies?

Check out BrightScope at www.brightscope.com or Morningstar at www.morningstar.com/Cover/Funds.aspx.

9. What is your employer's match policy, how does it compare with industry standards and are you taking full advantage of the match?

Smart401k provides a helpful discussion of employer matches at https://www.smart401k.com/Content/retail/resource-center/retirement-investing-basics/company-match.

10. If you change jobs, what are you going to do with your current employer's 401(k)?

Many people cash in their retirement plans when they change jobs instead of rolling them over into new plans or IRAs. Most of them are making a mistake.

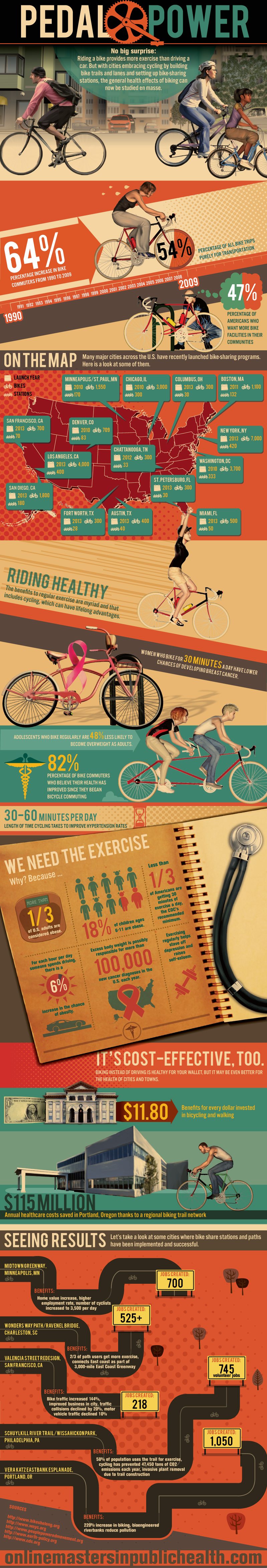

Pedal Power - Wellness Infographic

Originally posted on https://onlinemastersinpublichealth.com/pedal-power/

No big surprise: Riding a bike provides more exercise than driving a car. But with cities embracing cycling by building bike trails and lanes and setting up bike-sharing stations, the general health effects of biking can now be studied en masse.

64%

Percentage increase in bike commuters from 1990 to 2009

54%

Percentage of all bike trips purely for transportation

47%

Percentage of Americans who want more bike facilities in their communities

Riding Healthy

The benefits to regular exercise are myriad and that includes cycling, which can have lifelong advantages.

Women who bike for 30 minutes a day have lower chances of developing breast cancer.

Adolescents who bike regularly are 48% less likely to become overweight as adults.

82%

Percentage of bike commuters who believe their health has improved since they began bicycle commuting

30-60 minutes per day

Length of time cycling takes to improve hypertension rates

We Need the Exercise

Why? Because …

- More than 1/3 of U.S. adults are considered obese.

- 18% of children ages 6-11 are obese.

- Less than 1/3 of Americans are getting 30 minutes of exercise a day, the CDC’s recommended minimum.

- For each hour per day someone spends driving, there is a 6% increase in the chance of obesity.

- Excess body weight is possibly responsible for more than 100,000 new cancer diagnoses in the U.S. each year.

- Exercising regularly helps stave off depression and raises self-esteem.

It’s Cost-Effective, Too.

Biking instead of driving is healthy for your wallet, but it may be even better for the health of cities and towns.

$11.80

Benefits for every dollar invested in bicycling and walking

$115 million

Annual healthcare costs saved in Portland, Oregon thanks to a regional biking trail network

Seeing Results

Let’s take a look at some cities where bike share stations and paths have been implemented and successful.

Midtown Greenway, Minneapolis, MN

Benefits: Home value increase, higher employment rate, number of cyclists increased to 3,500 per day

Jobs created: 700

Wonders Way Path/Ravenel Bridge, Charleston, SC

Benefits: 2/3 of path users get more exercise, connects East coast as part of 3,000-mile East Coast Greenway

Jobs created: 525+

Valencia Street Redesign, San Francisco, CA

Benefits: Bike traffic increased 144%, improved business in city, traffic collisions declined by 20%, motor vehicle traffic declined 10%

Jobs created: 218

Schuylkill River Trail/Wissahickon Park, Philadelphia, PA

Benefits: 58% of population uses the trail for exercise, cycling has prevented 47,450 tons of CO2 emissions each year, invasive plant removal due to trail construction

Jobs created: 745 volunteer jobs

Vera Katz Eastbank Esplanade, Portland, OR

Benefits: 220% increase in biking, bioengineered riverbanks reduce pollution

Jobs created: 1,050

Employees say companies have yet to communicate benefit changes

Originally posted August 27, 2013 by Andrea Davis on https://ebn.benefitnews.com

The October 1 deadline for employers to notify employees of their health coverage options is looming yet the majority of employees say their company has yet to communicate any changes, according to a survey released this morning by Aflac.

Sixty-nine percent of employees surveyed say their employer hasn’t communicated changes coming to their benefits package due to health care reform, despite the October 1 deadline.

In a separate Aflac survey, meanwhile, only 9% of companies indicate they are very prepared to implement required changes to their business based on the health care reform law at this time. Some employers (41%) believe more gaps in coverage will be created and 69% believe costs to employees will increase as a result of health care reform.

“At the heart of this issue is the fact that many workers will be blindsided this open enrollment season because we know they already struggle with understanding their insurance policies today, and in covering the high out-of-pocket costs from gaps in their current coverage,” says Michael Zuna, Aflac’s executive vice president and chief marketing officer.

Other statistics from the open enrollment survey of employees include:

- 74% of workers sometimes or never understand everything that is covered by their insurance policy today.

- 37% of workers think it will be more difficult to understand everything in their health care policy with the changes dictated by health care reform.

- 28% of employees are confused, worried or simply unsure about the change their employer is making to their health care coverage or benefits options due to health care reform.

- 60% of workers have not begun to educate themselves about coming changes to their benefits package due to health care reform.

A faster, cheaper way to wellness programs that work

Originally posted September 6, 2013 by Vlad Gyster on https://ebn.benefitnews.com

The debate over whether wellness programs "work" is becoming increasingly heated. Many question the validity of research demonstrating that wellness programs reduce health care costs. At the same time, others swear by their wellness provider. So, who's the liar?

As with most things, the truth is in the eye of the beholder. Wellness is a business, and it would serve us well - no pun intended - to consider this business formula as we attempt to determine where the truth lies and understand why this debate is so heated: Value = Benefits/Cost.

To begin with, we don't truly know the value of a wellness program. This formula helps quantify the importance of knowing value. When making a purchase, all of us have some understanding of a product's benefits, and in return we pay a cost. Together, those two factors create a value. If the benefits and costs are generally understood, then value is pretty predictable. But if there's a lack of agreement about the benefits, it's tough to come to consensus on value and cost. The result is very different calculations and a big debate about whether something is really worth it. This is what we're experiencing with wellness programs. The reality is that we don't really know all the benefits a wellness program provides, and, as a result, their value is up for debate.

This debate will eventually be resolved in one of two ways:

1. We come to a consensus that wellness programs deliver the stated benefits and continue to pay the current cost; or

2. We conclude the benefits are lower than initially thought, and adjust the cost accordingly.

I've got my money on option 2. Here's why:

Gartner - a research advisory firm that's been evaluating technology for more than 30 years - discovered a funny pattern: Every few years, a new technology emerges that gets a lot of people really excited. There's a lot of enthusiasm and promises, but, given limited use, no real data about the technology's actual benefits. This is the "peak of inflated expectations"; i.e., when we make statements like "This is going to change the world."

After a while, though, people realize that their perception of the technology's benefits are unrealistic; they feel they received bad value, get disgruntled and criticize the technology as worthless. This is the "trough of disillusionment." It occurs when the benefits are lower than originally assumed, and the cost is experienced as too high relative to the perceived lesser value.

It's reasonable to assume we are in the midst of a sober re-evaluation of the benefits of wellness programs, somewhere in the "trough of disillusionment." The good news is, as history has proven, that over time, the market comes to understand the technology's actual benefits, accepts them and broad adoption can occur. For this to happen, there needs to be a consensus about the benefits (aka ROI) and the price adjusted accordingly. This doesn't mean wellness programs are worthless, just that they may be worth less than the benefits declared during the "peak of inflated expectations."

Minimize cost

In a scenario where the value of something is unclear, it's wise to minimize - rather than wait for the market to drive down - cost, as cost is the variable you have control over. Traditional approaches to launching wellness initiatives come with huge overhead - strategy, vendor selection, implementation and vendor fees can easily run into the hundreds of thousands of dollars - and can take years before having any real impact on even a single employee. Cut as much of this overhead as possible. Vendor selections should come in the form of free trials with groups of employees. Vendor fees should be contract-free and have monthly options for easy exit. Strategy work should turn into small experiments with employees to identify what works and what doesn't.

In other words, spend less. But how do you drive a high level of engagement in wellness with limited resources? We suggest using the Lean Startup methodology used by startups to drive engagement in new products using limited resources. This approach advocates using small, inexpensive steps that lead to quick wins and continuous improvement. Its use could help HR quickly and cheaply differentiate what works from what doesn't, so HR can focus time and dollars on what's actually effective.

Four steps

Here's our version of the Lean Startup methodology adapted for HR:

Step 1: Think in terms of a "Minimum Viable Product". MVP is the smallest thing you can do to learn how to make progress toward your objective. For most employers, the objective of their wellness programs will be somehow tied to employee participation. Instead of spending limited resources on building business cases and other costly activities, pick something to do that is small and will help you learn what works to gain employee participation.

Step 2: Build something that's "good enough". Start with something easy, like an employee video testimonial about a benefit that's already available (but likely underappreciated), such as gym reimbursement. Upload the video to a video hosting tool for businesses so you can track how many people click the link and view your video. Send an email to employees inviting them to watch the video. Explain that this is a "beta" and you're testing concepts for a potential wellness initiative. Distribute it to a small group first to ensure everything is working.

Step 3: Measure. Measuring is essential. If you don't measure results you can't test your assumption about how a particular strategy will work or learn from it. Once the email is sent, you'll know how many people clicked the link and how many people viewed the video and for how long. These key performance indicators - KPIs - provide a baseline for identifying progress and future improvements.

Step 4: Learn. This is the most important step. By this point, you should have gained some idea of what's working well and what's not, and the data necessary to improve key metrics. These are the types of tangible outcomes necessary to propel any wellness initiative forward. What can you do to increase those numbers? The faster you can repeat this process and improve your KPIs, the more momentum you'll gain - and the sooner you can determine the potential effectiveness of wellness initiatives without a huge expenditure of scarce resources.

Debate will continue

Whether the results achieved with wellness programs are worth their cost is a debate that will likely continue. That said, there's little doubt that a key ingredient to achieving ROI on wellness programs - or any HR initiative - is employee participation. The HR-adapted Lean Startup approach lets you know whether you've got this key ingredient - before you've spent a lot of time and money hoping to get it.

IRS loosens employer mandate reporting requirements

Originally posted September 9, 2013 by Gillian Roberts on https://eba.benefitnews.com

In a follow-up to the Obama administration’s July 2 employer mandate delay, the U.S. Department of the Treasury and Internal Revenue Service issued a proposed rule late last week that would make certain reporting requirements in the provision of the Affordable Care Act voluntary. According to a statement by the department, “The regulatory proposals reflect an ongoing dialogue with representatives of employers, insurers, other reporting entities, and individual taxpayers.”

The changes include:

- “Eliminating the need to determine whether particular employees are full-time if adequate coverage is offered to all potentially full-time employees.”

- “Replacing section 6056 employee statements with Form W-2 reporting on offers of employer-sponsored coverage to employees, spouses, and dependents.”

- “Limited reporting for certain self-insured employers offering no-cost coverage to employees and their families.”

“Today’s proposed rules enable us to continue engaging on how best to implement the ACA reporting requirements in a more streamlined and focused manner,” said Assistant Secretary for Tax Policy Mark J. Mazur in the statement. “We will continue to consider ways, consistent with the law, to simplify the new information reporting process and bring about a smooth implementation of those new rules.”

The full statement can be found here and the full rule, with details to provide comments, can be found here.

Proposed rules would ease employers' health plan reporting burden

Originally posted September 6, 2013 by Jerry Geisel on https://www.businessinsurance.com

Newly proposed Internal Revenue Service and Treasury Department health care reform regulations would ease the amount of employee plan coverage information employers would have to report to federal regulators.

Under the proposed rules, released Thursday, employers would not be required to report cost information related to family coverage.

In addition, employers would have to report how much of the premium employees will have to pay for single coverage only.

Limiting that reporting requirement to single coverage is appropriate, the IRS and the Treasury Department said because a health care reform law affordability test applies only to single coverage — not family coverage.

Under that test, if the premium paid by employees for single coverage exceeds 9.5% of household income, the employee is eligible for a federal premium subsidy to purchase coverage in a public insurance exchange. If the employee uses the subsidy, the employer may be liable for a $3,000 penalty.

No penalty is assessed regardless of how much the employer charges for family coverage, making the need to collect such information unnecessary, regulators said.

“Because only the lowest-cost option of self-only coverage offered under any of the enrollment categories for which the employee is eligible is relevant to the determination of whether coverage is affordable — and thus to the administration of the premium tax credit and employer shared responsibility provisions — that is the only cost information proposed to be requested,” according to the proposed regulation, which is scheduled to be published in the Sept. 9 Federal Register.

While regulators have reduced the amount of information to be reported, “it is only limited relief. There still will be a massive amount of work to meet the reporting requirements,” said Rich Stover, a principal with Buck Consultants L.L.C. in Secaucus, N.J.

The proposed rules, though, could pose problems in other areas. For example, employers would be required to report tax identification numbers of employees' dependents.

Employers do not always have such information for every dependent, said Amy Bergner, managing director of human resources in Washington for PricewaterhouseCoopers L.L.P.

White House proposes new employer mandate rules

Originally posted September 6, 2013 by Ricardo Alonso-Zaldivar on https://www.benefitspro.com

WASHINGTON (AP) — The Obama administration on Thursday released new proposals for carrying out a major requirement of the federal health care law that was postponed earlier this summer.

At issue is how to gather information that would allow the government to enforce a requirement that companies with 50 or more workers provide affordable health insurance to their full-time employees. Companies that don't comply would risk fines.

The mandate was supposed to take effect Jan. 1, but in July the White House unexpectedly announced a one-year delay until 2015. Officials said more time was needed to work out information reporting requirements so they would not be too burdensome for businesses. Delaying the mandate also defused a potential political problem for Democrats in next year's congressional elections.

The new proposal from the Treasury Department seeks comment on options to reduce or streamline reporting by employers, insurers and health plan administrators. In some instances, the administration is proposing to eliminate duplicative reports and in other cases, it's asking for less detail.

Business groups said it will take time to sort through the technicalities but praised the administration's effort to find common ground.

"Retailers are not interested in being overly burdened by bureaucratic red tape or time-wasting, duplicative reporting requirements," Neil Trautwein, the top health policy official for the National Retail Federation, said in a statement.

The information reported by employers and insurers is also critical in enforcing the law's central requirement that virtually all Americans carry health insurance starting Jan. 1. That so-called individual mandate has not been delayed and remains in full force.

The Treasury Department said it will be soliciting feedback on its proposals through early November, and will use the comments to develop final rules.

Although the one-year delay of the employer coverage requirement remains in effect, the administration says it hopes employers will voluntarily begin reporting information next year to smooth the transition in 2015.

IRS Issues Proposed PPACA Rules on Employer-Information Reporting

Originally posted September 6, 2013 by Stephen Miller on https://www.shrm.org

On Sept. 5, 2013, the U.S. Department of the Treasury and the Internal Revenue Service issued two proposed rules intended to streamline the information-reporting requirements for certain employers and insurers under the Patient Protection and Affordable Care Act (PPACA or ACA).

The PPACA requires information reporting under Internal Revenue Code (IRC) Section 6055 by self-insuring employers and other health coverage providers. And under IRC Section 6056, information reporting is required of employers subject to the employer "shared responsibility" provisions, also known as the employer mandate—meaning those with 50 or more full-time equivalent workers, who must provide coverage for employees working an average of at least 130 hours per month (or 30 or more hours per week) looking back at a standard measurement period of not less than three but not more than 12 consecutive months—or pay a $2,000 penalty for each full-time worker above a 30-employee threshold. The shared-responsibility mandate, which was set to take effect in January 2014, has been delayed until January 2015.

One proposed rule, “Information Reporting of Minimum Essential Coverage,” pertains to IRC Section 6055, while the other proposed rule, “Information Reporting by Applicable Large Employers on Health Insurance Coverage Offered Under Employer-Sponsored Plans,” pertains to IRC Section 6056.

“These reporting requirements serve distinct purposes under the ACA,” Timothy Jost, a professor at the Washington and Lee University School of Law in Virginia, explained in a commentary about the proposed rules posted on the journal Health Affairs’ blog. “The large-employer reporting requirement is necessary to determine whether large employers are complying with the employer-responsibility provisions of the ACA and will also help identify individuals who are ineligible for premium tax credits because they have been offered coverage by their employer. The minimum-essential-coverage reporting requirement will assist the IRS in determining whether individuals are complying with the ACA’s individual-responsibility requirement and also whether they are eligible for premium tax credits because they lack minimum essential coverage.”

Once the final rules have been published, employers and insurers will be encouraged to report the specified information in 2014 (when reporting will be optional), in preparation for the full application of the reporting provisions in 2015.

“The absence of these rules was the reason given by the IRS for delaying the employer mandate until 2015,” Jost noted. “The IRS is encouraging voluntary reporting by employers and insurers, subject to the requirements for 2014, and should have no trouble getting the final rules in place for mandatory reporting in 2015.”

Statutory Requirements

Specifically, the PPACA calls for employers, insurers and other reporting entities to report under IRC Section 6055:

- Information about the entity providing coverage, including contact information.

- A list of individuals with identifying information and the months they were covered.

And under IRC Section 6056:

- Information about the applicable large employer offering coverage (including contact information for the company and the number of full-time employees).

- A list of full-time employees and information about the coverage offered to each, by month, including the cost of self-only coverage.

Proposed Reporting Options

The proposed rules describe a variety of options to potentially reduce or streamline information reporting, such as:

- Replacing Section 6056 employee statements with Form W-2 reporting on offers of employer-sponsored coverage to employees, spouses and dependents.

- Eliminating the need to determine whether particular employees are full time if adequate coverage is offered to all potentially full-time workers.

- Allowing organizations to report the specific cost to an employee of purchasing employer-sponsored coverage only if the cost is above a specified dollar amount.

- Allowing self-insured group health plans to avoid providing employee statements under Sections 6055 and 6056 by furnishing a single substitute statement.

- Allowing limited reporting by certain self-insured employers that offer no-cost coverage to employees and their families.

- Permitting health insurance issuers to forgo reporting, under Section 6055, on individual coverage offered through a government-run health care exchange, or marketplace (set to launch in October 2013), because that information will be provided by the marketplace.

- Permitting health insurance issuers, employers and other reporting entities, under Section 6055, to forgo reporting the specific dates of coverage (instead reporting only the months of coverage), the amount of any cost-sharing reductions, or the portion of the premium paid by an employer.

According to Jost, the IRS is attempting to avoid duplication and collecting unnecessary information. “Large employers need only report the employee’s share of the lowest-cost monthly premium for self-only coverage, since a determination as to whether employer coverage is affordable for adjudicating eligibility for premium tax credits is based on the cost of self-only, rather than family, coverage,” he wrote. “Entities that must report minimum essential coverage can report birthdates, rather than Social Security numbers, for dependents if they are unable to secure the Social Security numbers after reasonable efforts.”

The IRS is soliciting comments on the Section 6055 and 6056 proposed rules through Nov. 8, 2013. The agency will take the public comments into account when developing final reporting rules on further simplifications.

Separately, the process to challenge an insurance exchange's finding that an employer's plans are unaffordable or fail to provide minimum essential coverage (thereby triggering penalties against the employer) is presented in a final rule published in the Federal Register on Aug. 30, 2013, by the U.S. Department of Health and Human Services.