Health Care Lags As Hot-Button Issue

As it turns out - according to this poll conducted by Kaiser Health News - health care is not a key issue battleground voters wish to discuss. Instead, a large number of voters are more interested in dealing with issues regarding our economy and jobs.

Read further in this article below.

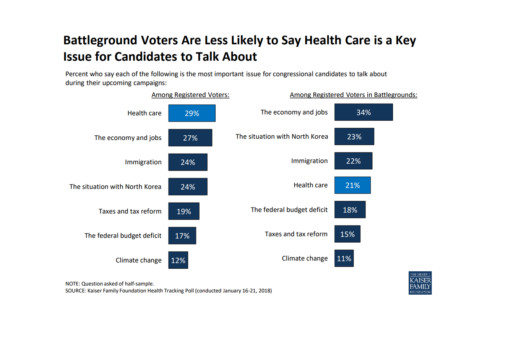

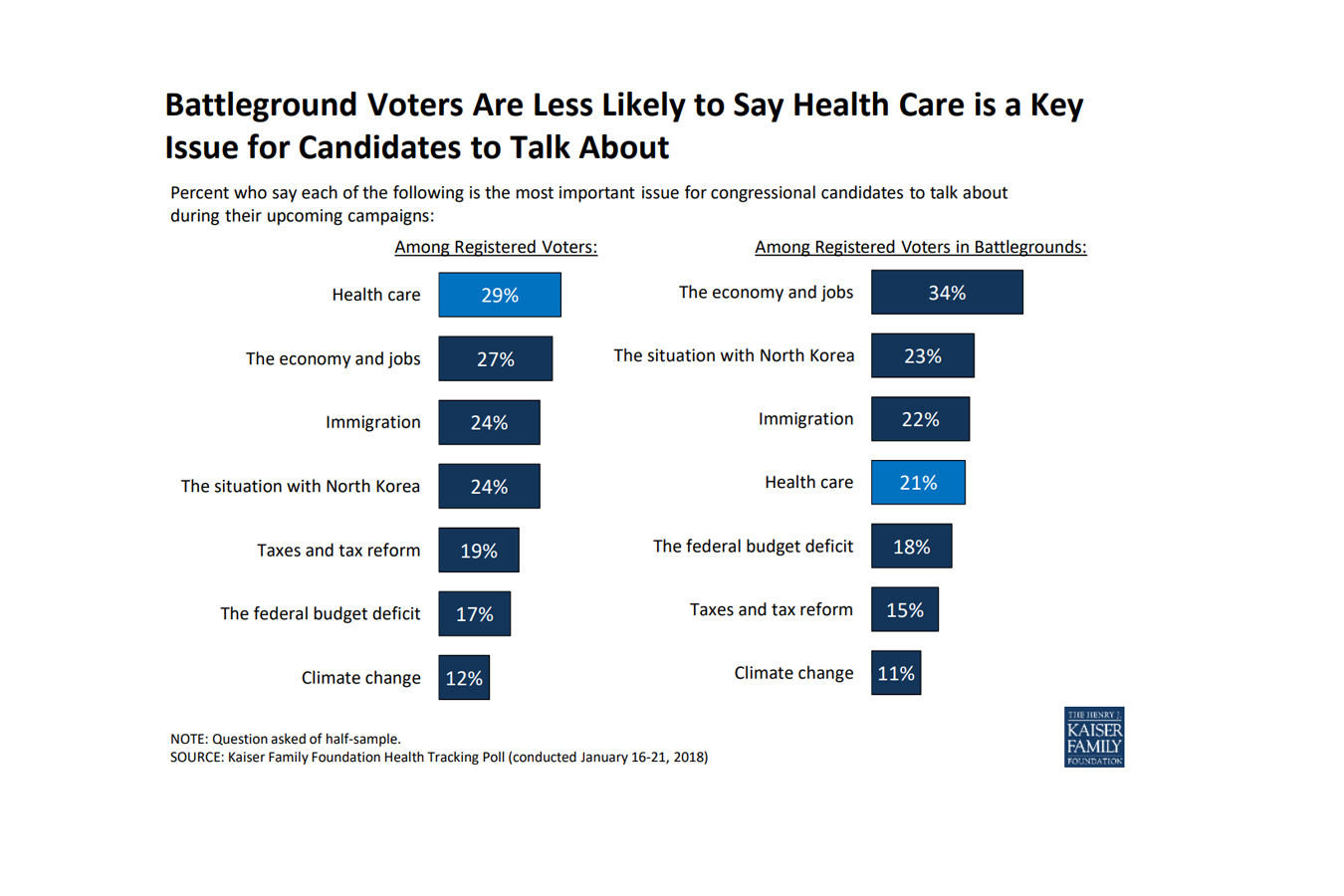

As the midterm elections approach, health care ranks as the top issue, mentioned more frequently among voters nationwide than among those living in areas with competitive races, a new poll finds.

As the midterm elections approach, health care ranks as the top issue, mentioned more frequently among voters nationwide than among those living in areas with competitive races, a new poll finds.

In areas with competitive congressional or gubernatorial races, the economy and jobs ranked as the top issue for candidates to discuss, with 34 percent of registered voters listing it as No. 1, according to the poll from the Kaiser Family Foundation. (Kaiser Health News is an editorially independent program of the foundation.) Following economics was the conflict with North Korea (23 percent), immigration (22 percent) and health care (21 percent). The competitive areas are 13 states with statewide races and 19 House districts judged as toss-ups by the nonpartisan Cook Political Report.

Nationwide, 29 percent of registered voters ranked health care as the most important issue for electoral discussion — though it was far more important for Democrats than Republicans. Economy and jobs were close behind with 27 percent of voters rating it most important, and then immigration, with 24 percent listing it.

The poll found that nearly half of Americans believed there is still a federal requirement for everyone to obtain health insurance, even though Congress’ tax bill last year repealed the penalties for that requirement in the Affordable Care Act, known as the individual mandate. Only a third of the public was sure that those penalties had been repealed.

Fifty percent of the public expressed a favorable view of the health law, while 42 percent disliked it. Six in 10 people said that since President Donald Trump and the Republicans in Congress have altered the law, they are responsible for any problems. Like other opinions about the law, there was a strong partisan split: Only 38 percent of Republicans thought their party is now responsible, while 77 percent of Democrats thought so. Half of Republicans still listed repealing the health law as a top priority.

There was less of a partisan split over the importance that the president and Congress address the epidemic of prescription painkiller addiction. Among Republicans, 43 percent rated it a top priority; 54 percent of Democrats agreed.

There was no such comity over whether lawmakers should allow people brought illegally to this country by their parents — the so-called Dreamers — to stay in the country legally: 21 percent of Republicans called that a top priority, while 66 percent of Democrats did. And while 43 percent of Republicans said they wanted lawmakers to focus on passing federal funding for a border wall with Mexico, only 5 percent of Democrats and 19 percent of independents did.

The poll was conducted Jan. 16-21 among 1,215 adults. The margin of error was +/-3 percentage points. The poll included 298 people who said they were registered to vote in one of the areas the Cook Report identified as a battleground in the fall elections. The margin of error for results for this group was +/-7 percentage points.

Read the original article.

Source: Rau J. (26 January 2018). "In Battleground Races, Health Care Lags As Hot-Button Issue, Poll Finds" [Web Blog Post]. Retrieved from address https://khn.org/news/in-battleground-races-health-care-lags-as-hot-button-issue-poll-finds/

5 things to know about this year’s flu

The nation is having a Terrible, Horrible, No Good, Very Bad flu season.

Flu is widespread in 46 states, according to reports to the U.S. Centers for Disease Control and Prevention (CDC).

Nationally, as of mid-December, at least 106 people had died from the infectious disease.

In addition, states across the country are reporting higher-than-average flu-related hospitalizations and emergency room visits. Hospitalization rates are highest among people older than 50 and children younger than 5.

In California, which is among the hardest-hit states, the virus struck surprisingly early this season. The state’s warmer temperatures typically mean people are less confined indoors during the winter months. As a result, flu season usually strikes later than in other regions.

Health experts aren’t sure why this season is different.

“We’re seeing the worst of it right now,” said Dr. Randy Bergen, a pediatrician who is leading Kaiser Permanente-Northern California’s anti-flu effort. “We’re really in historic territory, and I just don’t know when it’s going to stop.” (Kaiser Health News, which produces California Healthline, is not affiliated with Kaiser Permanente.)

Here are five things you should know about this flu season:

1. It’s shaping up to be one of the worst in recent years.

The H3N2 influenza A subtype that appears to be most prevalent this year is particularly nasty, with more severe symptoms including fever and body aches. Australia, which U.S. public health officials follow closely in their flu forecasting — in part because their winter is our summer — reported a record-high number of confirmed flu cases in 2017. Another influenza B virus subtype also is circulating, “and that’s no fun, either,” Bergen said.

Flu season in the U.S. typically starts in October and ends in May, peaking between December and February.

2. This season’s flu vaccine is likely to be less effective than in previous years.

U.S. flu experts say they won’t fully know how effective this season’s vaccine is until the it’s over. But Australia’s experience suggests effectiveness was only about 10 percent. In the U.S., it is 40 to 60 percent effective in an average season. Vaccines are less protective if strains are different than predicted and unexpected mutations occur.

3. You should get the flu shot anyway.

Even if it is not a good match to the virus now circulating, the vaccine helps to ease the severity and duration of symptoms if you come down with the flu.

Children are considered highly vulnerable to the disease. Studies show that for children a shot can significantly reduce the risk of dying.

High-dose vaccines are recommended for older people, who also are exceptionally vulnerable to illness, hospitalization and death related to the flu, according to the CDC.

“Some protection is better than no protection,” Bergen said, “but it’s certainly disappointing to have a vaccine that’s just not as effective as we’d like it to be.

Shots may still be available from your doctor or local health clinic, as well as at some chain drugstores. Check the Vaccine Finder website for a location near you.

4. Basic precautions may spare you and your family from days in bed.

As much as possible, avoid people who are sick. Wash your hands frequently and avoid touching your mouth, nose and eyes.

Masks aren’t particularly effective in keeping you from catching the flu, although they may help keep sick people who wear them from spreading their germs further.

If you are sick, cover your cough and stay home from work if you can, Bergen said. Remaining hydrated, eating nutritious foods and exercising can also help strengthen your immune system.

Because elderly people are so vulnerable to the flu, some nursing homes and assisted living facilities may limit visitors and resident activities, depending on the level of illness.

5. Don’t mistake flu symptoms for those of a common cold.

The hallmarks of flu are fever and body aches that accompany cough and congestion, Bergen said.

If you feel as if you’re having trouble breathing, or if your fever can’t be controlled with medication like Tylenol, check with your doctor. It’s even more important for patients to see a doctor if they have a chronic medical condition like diabetes or heart disease, or if they are young or elderly.

Kaiser Permanente doctors now are being advised to prescribe antiviral drugs like Tamiflu — given as a pill or, for kids, an oral suspension — even without a lab test for influenza, Bergen said. According to a report in the Los Angeles Times, however, Tamiflu supplies are running low.

And Bergen cautioned that these medications are only partly effective, reducing the time of illness by just a day or two.

Read the original article.

Source: Kaiser Health News (22 January 2018). "5 things to know about this year’s flu" [Web blog post]. Retrieved from address https://workwell.unum.com/2018/01/5-things-know-years-flu/

Tax Bill Provision Designed To Spur Paid Family Leave To Lower-Wage Workers

Tucked into the new tax law is a provision that offers companies a tax credit if they provide paid family and medical leave for lower-wage workers.

Many people support a national strategy for paid parental and family leave, especially for workers who are not in management and are less likely to get that benefit on the job. But consultants, scholars and consumer advocates alike say the new tax credit will encourage few companies to take the plunge.

The tax credit, proposed by Sen. Deb Fischer (R-Neb.), is available to companies that offer at least two weeks of paid family or medical leave annually to workers, but two key criteria must be met. The workers must earn less than $72,000 a year and the leave must cover at least 50 percent of their wages.

If contributing at the half-wage level, a company receives a tax credit equal to 12.5 percent of the amount it pays to the worker. The tax credit will increase on a sliding scale if the company pays more than 50 percent of wages. It could go up to a maximum credit of 25 percent of the amount the employer paid for up to 12 weeks of leave.

Payments to full- and part-time workers taking family leave who’ve been employed for at least a year would be eligible for the employer’s tax break. But the program, which is designed to test whether this approach works well, is set to last just two years, ending after 2019.

Aparna Mathur, a resident scholar in economic policy studies at the American Enterprise Institute, says the new tax credit sidesteps a pitfall for Republicans. They are wary of any legislation mandating that employers provide paid leave. The tax credit also is appropriately aimed at lower-wage workers who are most likely to lack access to paid leave, said Mathur, who co-authored a recent report on paid family leave.

But it’s not a big enticement.

“Providing this benefit is a huge cost for employers,” Mathur said. “It’s unlikely that any new companies will jump on board just because they have a 12.5 to 25 percent offset.”

That view is shared by Vicki Shabo, vice president for workplace policies and strategies at the National Partnership for Women & Families, an advocacy group, who said it will primarily benefit workers at companies already offering paid family leave. The new tax credit “just perpetuates the boss lottery,” she added.

Heather Whaling said her 22-person public relations company probably qualifies for the new tax credit, but she doesn’t think it’s the right approach. Whaling, the president of Geben Communication in Columbus, Ohio, already offers paid leave. The company provides up to 10 weeks of paid leave at full pay for new parents. Four employees have taken leave, and by divvying up their work to other team members and hiring freelancers they’ve been able to get by.

“It is an expense, but if you plan and budget carefully it’s not cost-prohibitive,” she said.

The tax credit isn’t big enough to provide a strong incentive to provide paid leave, said Whaling, 37. Besides, “having access to paid family leave shouldn’t be luck of the draw, it should be available to every employee in the country.”

Still, the tax credit may be appealing to companies that have been considering adding a paid family and medical leave benefit, said Rich Fuerstenberg, a senior partner at benefits consultant Mercer.

By defraying some of the cost, the tax credit could help “tip them over” into offering paid leave, he said. But “I’m not even sure I’d call it the icing on the cake,” Fuerstenberg said. “It’s like the cherry on the icing.”

Only 15 percent of private-sector and state and local government workers had access to paid family and medical leave in 2017, according to the Bureau of Labor Statistics’ National Compensation Survey. Eighty-eight percent had access to unpaid leave, however.

Under the federal Family and Medical Leave Act, employers with 50 or more workers generally must allow eligible employees to take unpaid leave for up to 12 weeks annually for specified reasons. These include the birth or adoption of a child, caring for your own or a family member’s serious health condition, or leave for military caregiving or deployment. An individual’s job is protected during such leaves.

A tax credit that can be claimed at the end of the year is unlikely to encourage small businesses to offer paid family and medical leave, said Erik Rettig, an expert on family leave policies at the Small Business Majority, which advocates for those firms on national policy.

“It isn’t going to help the family business that has to absorb the costs of this employee while they’re gone,” Rettig said.

A better solution, according to Shabo and others, is to provide a paid family leave benefit that’s funded by employer and/or employee payroll contributions. Sen. Kirsten Gillibrand (D-N.Y.) and Rep. Rosa DeLauro (D-Conn.) last year reintroduced such legislation. Their bill would guarantee workers, including those who are self-employed, up to 12 weeks of family and medical leave with as much as two-thirds of their pay.

A handful of mostly Democratic states — including California, New Jersey, Rhode Island and New York — have similar laws in place, and a program in the District of Columbia and Washington state will begin in 2020.

“We know from states that this approach works for both employees and their bosses,” Shabo said.

Read the original article.

Source: Andrews M. (23 January 2018). "Tax Bill Provision Designed To Spur Paid Family Leave To Lower-Wage Workers" [Web blog post]. Retrieved from address https://khn.org/news/tax-bill-provision-designed-to-spur-paid-family-leave-to-lower-wage-workers/

SaveSave

CHIP Renewed For Six Years As Congress Votes To Reopen Federal Government

A brief, partial shutdown of the federal government ended Monday, as the Senate and House approved legislation that would keep federal dollars flowing until Feb. 8, as well as fund the Children’s Health Insurance Program for the next six years.

President Donald Trump signed the bill Monday evening.

The CHIP program, which provides coverage to children in families who earn too much to qualify for Medicaid but not enough to afford private insurance, has been bipartisan since its inception in 1997. But its renewal became a partisan bargaining chip over the past several months.

Funding for CHIP technically expired Oct. 1, although a temporary spending bill in December gave the program $2.85 billion. That was supposed to carry states through March to maintain coverage for an estimated 9 million children, but some states began to run short almost as soon as that bill passed.

The Georgetown University Center for Children and Families estimated that 24 states could face CHIP funding shortfalls by the end of January, putting an estimated 1.7 million children’s coverage at risk in 21 of those states.

Meanwhile, both houses of Congress had been at loggerheads over how to put the program on firmer financial footing.

In October, just days after the program’s funding expired, the Senate Finance Committee approved a bipartisan five-year extension of funding by voice vote. But that bill did not include a way to pay the cost, then estimated at $8.2 billion.

In November, the House passed its own five-year funding bill for the program, but it was largely opposed by Democrats because it would have offset the CHIP funding by making cuts to Medicare and the Affordable Care Act (ACA).

The reason, explained CBO, is that the landmark tax bill passed in December eliminated the ACA’s individual mandate, which would likely drive up premiums in the individual market. Those higher premiums, in turn, would increase the federal premium subsidies for those with qualifying incomes. As a result, if kids were to lose their CHIP coverage and go onto the individual exchanges instead, the federal premium subsidies would cost more than their CHIP coverage.

Driving that point home, on Jan. 11, CBO Director Keith Hall wrote to Rep. Frank Pallone (D-N.J.) that renewing CHIP funding for 10 years rather than five would save the federal government money. “The agencies estimate that enacting such legislation would decrease the deficit by $6.0 billion over the 2018-2027 period,” the letter said.

That made it easier for Republicans to include the CHIP funding in the latest spending bill. But it infuriated Democrats, who had vowed not to vote for another short-term spending bill until Congress dealt with the issue of immigrant children brought to the country illegally by their parents.

Republicans, said Senate Minority Leader Chuck Schumer (D-N.Y.) on Sunday, “were using the 10 million kids on CHIP, holding them as hostage for the 800,000 kids who were Dreamers. Kids against kids. Innocent kids against innocent kids. That’s no way to operate in this country.”

Republicans, however, said it was the opposite — that Democrats were holding CHIP hostage by not voting for the spending bill. “There is no reason for my colleagues to pit their righteous crusade on immigration against their righteous crusade for CHIP,” said Hatch. “This is simply a matter of priorities.”

The CHIP renewal was not the only health-related change in the temporary spending bill. The measure also delays the collection of several unpopular taxes that raise revenues to pay for the ACA’s benefits. The taxes being delayed include ones on medical device makers, health insurers and high-benefit “Cadillac” health plans.

The bill does not, however, extend funding for Community Health Centers, another bipartisan program whose funding is running out. That will have to wait for another bill.

Read the original article.

Source: Rovner J. (22 January 2018). "CHIP Renewed For Six Years As Congress Votes To Reopen Federal Government" [Web blog post]. Retrieved from address https://khn.org/news/chip-renewed-for-six-years-as-congress-votes-to-reopen-federal-government/

SaveSave

What’s ahead for HR technology?

As technology modernizes business, HR has worked hard to keep up. In 2017, there were numerous innovations, so we can't wait to see what 2018 brings! Check out this article from Employee Benefit Advisor on some trends in HR Technology this year.

The past year saw a number of HR technology innovations and significant product introductions — and 2018 promises to bring about even bigger changes.

“The whole field of HRIS is really exciting right now,” says Vanessa DiMauro, CEO of consulting firm Leader Networks and a Columbia University faculty member. “There is so much change and innovation happening.”

Indeed, experts contend, innovations in artificial intelligence and analytics, along with development in cloud, social and mobile technologies, are making HR systems more intelligent and more engaging.

So what will smarter, friendlier HR systems do?

To begin with, they’ll provide more targeted support for employees by helping them gain access to the benefits and services they need. Employees with a new baby, for instance, would not only have their benefits packages updated automatically, but would also receive alerts and recommendations for store discounts, childcare facilities and other products and services geared toward helping them better manage their new family responsibilities.

Smarter HR systems also will deliver the type of workforce analytics that employers need to make better staffing decisions. The manager of a chain of convenience stores, for example, might want to schedule employees who have demonstrated a higher level of job performance for the late shift, because they can be counted on to close a store. The supervisor at a large hospital, on the other hand, might look to assign the facility’s most reliable employees — those who are more likely to show up for work on time — to care units that need to remain in compliance with their government-mandated staffing requirements.

But automatic updates and more efficient workforce scheduling are only two ways in which the latest digital advances will enhance human capital management. There are many others, including:

- Increased employee retention and more effective recruitment.

- Less biased performance management and KPIs.

- Improved knowledge sharing and employee collaboration.

- Greater workforce diversity and inclusion.

To illustrate this, DiMauro points to a new set of talent acquisition tools aimed at helping employers take advantage of underutilized labor pools by increasing the diversity of their workforce. These include applications to help improve outreach efforts to military veterans and people with disabilities, among other populations.

Offering another example, she cites an emerging category of applications designed to minimize gender, ethnic and other forms of bias, when it comes to performance reviews and considering employees for raises and promotions.

Building a smart system

What gives these new applications their power and joins them together, as part of an integrated HR information system (HRIS), is their ability to feed and draw from the same set of employee records. Building this smart HR system — and setting forth on the employer’s digital “journey,” of which it is a part — is likely to begin with the deployment of an employee-collaboration or knowledge-management platform that serves as the hub for all of the employer’s future HR tech endeavors.

The knowledge platform is linked through a single sign-on to the organization’s employee records database. HR staffers and other employees can organize the information into groups, which employees can join. A new hire might begin by logging into the “new employee orientation” group, which might auto-join the employee into a “benefits” group or a “training” group.

Over time, employees can continue to be auto-joined to different groups and auto-fed applicable content, as they experience different life events (such as a home purchase) or reach various milestones (such as a promotion) in their careers. Each of the groups might be built around a corresponding app — some of which might be designed for a mobile device.

Utilizing a hub and spoke model, different HR applications can be added to the system and tied into the employee database. In this way, employers are able to incrementally build out a 360-degree HRIS “wheel” that eventually includes performance reviews, employee engagement portals and talent acquisition tools that auto-reward employees for successful referrals.

The auto-classification and auto-taxonomy features embedded in the collaboration platform and corresponding apps, DiMauro explains, eliminate many of the purely rote administrative tasks that HR is saddled with today.

Meeting employee needs

Citing consumer research, the consultant notes that most customers — including most employees — want to self-serve. “Who wants to wait until morning, if you have a middle-of-the-night problem?” she asks. “When employees can readily find their own answers to less complex questions, that is a win-win for both the employee and the HR rep who would’ve had to handle the request.”

Behind all these innovations are a number of new technologies that will continue to gain steam in 2018. The most important of these is the cloud.

“From a technology standpoint, this is the biggest trend in HRIS,” says Lisa Rowan, vice president for HCM and talent management at market researcher International Data Corp.

Cloud-based HRIS solutions, which are hosted at remote facilities and maintained by the service provider, offer employers many advantages over traditional on-premise solutions that they had to maintain themselves. Chief among these are lower maintenance costs, faster transaction times, a more streamlined and easier-to-use interface, and software that is always up to date.

Human resource execs are embracing applicant tracking, training management, performance management and other software applications.

Keeping HRIS software current is important, if the employer wants to take advantage of other leading-edge technologies as they become available, including more graphically-oriented, intuitive applications for complex undertakings like a benefits enrollment. But it does require certain tradeoffs.

Traditionally, if an HRIS system didn’t support the precise way an HR organization handled a given task or function, custom software code would be written to adapt the system to the process. This was expensive and time-consuming, and forced companies to delay adopting new versions of the software, since every upgrade required complex rewrites of their customized code. Cloud-based systems eliminate these requirements and are much easier to deploy, but the HR department must adapt to the workflow prescribed by the system — and not the other way around.

As cloud-based systems become prevalent, says Rowan, “HR professionals will have to face the fact that they will have to do things a little differently to fit within the scope of a configurable, but not customizable, system.”

The cost efficiencies and operational advantages associated with a cloud-based system pave the way for other break-through HRIS technologies as well. Chief among them are:

- Social media, which offers employees new ways to share work and collaborate, and provides employers with new tools for disseminating their message and attracting job candidates.

- Mobile devices, which let employers tailor their outreach to select groups of employees, and allow employees to clock-in, enroll for benefits and handle many other tasks remotely, at a time and place of their choosing.

- Artificial intelligence, which is paving the way for new and different ways to respond to employee demands. Chat boxes, for instance, will soon replace human operators at HR call centers. Employees who phone or text in will still feel as though they are dealing with a person, but it will be a computer algorithm at the other end of the line.

- Data analytics, which give HR pros tools to gauge and influence employee behaviors, improve open enrollment outcomes and deepen employee engagement. But data analytics can also be utilized in a more strategic manner: By correlating workforce composition and activity with specific business outcomes, employers can systematically reshape their workforce to improve those outcomes.

“Analytics allow employers to identify useful trends by asking simple questions,” explains Bob DelPonte, general manager for the workforce ready group at Kronos, a provider of human capital management products and services. “For example, what’s the turnover rate for employees who live more than 20 miles away from work, compared with those who live less?”

The answer, he says, can inform the employer’s hiring and scheduling decisions. “Why risk losing a hard-to-replace employee because you’re forcing her to travel farther than she needs to, if you have the option of transferring her to a closer facility?”

Proceeding with caution

While technologies like artificial intelligence can be a boon to HR, they can also pose challenges. By increasing automation, AI will free HR staff from many repetitive tasks, allowing them to focus on more strategic concerns. But analysts like Rowan are not demure about the fact that some HR staffers will also be replaced by the software.

“How does that play out?” she asks. “You have HR personnel today who are geared toward answering phone calls, and when there are fewer calls, they may no longer be needed. There’s no point to sugar-coating that reality. There are HR professionals that need to think about re-skilling themselves.”

DiMauro also offers a word of caution. “It’s important that HR executives don’t get drunk at the bar of tools. There are so many new applications,” she says, “that they need to keep their wits about them and determine what they really need. Look for the right tool to solve the problem. Don’t just collect and decorate because it’s all out there and available.”

Read the original article.

Source: Kass E. (17 January 2018). "What’s ahead for HR technology?" [Web Blog Post]. Retrieved from address https://www.employeebenefitadviser.com/news/whats-ahead-for-hr-technology?feed=00000152-175f-d933-a573-ff5f3f230000

The Importance of Effective Employer and Employee Relations

Before investing in multiple employee benefit options, it's best to get to know your employees first. Understanding what they need and communicating effectively with them will discontinue money and time waste.

Internal communication is vital to a successful company. The communication that occurs between the employer and its employees directly effects the company’s overall productivity.

No matter what kind of business it is, communicating with employees is essential to people management. Establishing and maintaining effective lines of communication with employees can help a business enormously in many ways. Good communication from an employer can help motivate their staff, help deliver quality customer service and help cultivate a strong team of workers.

Every business deals with both planned and unplanned change. The ability of the business to navigate change successfully relies heavily on whether employees know employer expectations and understand the business and its goals.

Communication promotes employee dedication to the company. Employees are more motivated. Regular talks among employers and employees lets them know they are a valued part of a team. If employers can demonstrate to their employees that the company depends on their input, they will feel a sense of responsibility for the company’s goals and success.

Good, effective communication can help prevent certain detrimental effects that arise when employees feel uninformed. Employees who feel that information is being kept from them will have negative perceptions. Not communicating with employees will only enhance feelings of mistrust towards the employer. The employer should make their staff feel involved with business decisions so that they feel well informed and valued. This promotes a trusting relationship among employees and their employer.

Employers can often times overlook the value of their employees. Open lines of communication allow employees to provide potentially useful information they have to employers. Because employees do a lot of the “field work,” they have a better idea of customer trends and changes. Any bit of feedback can have a significant difference in the success or failure of a business.

Communication between employers and their employees can come in many forms. Some forms of communication are internal newsletters, bulletin boards, intranet and email. The most important thing for an employer to keep in mind is that communication works both ways.

Communication is a full-time responsibility for an employer in order to have a healthy and well orchestrated business team. As a result the overall company will be much more structurally sound. Therefore, effective, positive, and frequent communication with the employees should be the main focus of any successful business.

Source:

tylertalkstruth (17 November 2012). "The Importance of Effective Employer and Employe Relations" [web blog post]. Retrieved from address https://tylertalkstruth.wordpress.com/2012/11/17/employer-and-employee-relations/

Despite Compressed Sign-Up Period, ACA Enrollment Nearly Matches Last Year’s

President Trump decided to take away ACA, but that didn’t stop people from signing up. Read this article for the shocking numbers of enrollment.

A day after President Donald Trump said the Affordable Care Act “has been repealed,” officials reported that 8.8 million Americans have signed up for coverage on the federal insurance exchange in 2018 — nearly reaching 2017’s number in half the sign-up time.

That total is far from complete. Enrollment is still open in parts of seven states, including Florida and Texas, that use the federal healthcare.gov exchange but were affected by hurricanes earlier this year. The numbers released Thursday by the Department of Health and Human Services also did not include those who signed up between midnight Dec. 15 and 3 a.m. ET on Dec. 16, the final deadline for 2018 coverage, as well as those who could not finish enrolling before the deadline and left their phone number for a call back.

And enrollment has not yet closed in 11 states — including California and New York — plus Washington, D.C., that run their own insurance exchanges. Those states are expected to add several million more enrollees.

The robust numbers for sign-ups on the federal exchange — 96 percent of last year’s total — surprised both supporters and opponents of the health law, who almost universally thought the numbers would be lower. Not only was the sign-up period reduced by half, but the Trump administration dramatically cut funding for advertising and enrollment aid. Republicans in Congress spent much of the year trying to repeal and replace the law, while Trump repeatedly declared the health law dead, leading to widespread confusion.

On the other hand, a Trump decision aimed at hurting the exchanges may have backfired. When he canceled federal subsidies to help insurers offer discounts to their lowest-income customers, it produced some surprising bargains for those who qualify for federal premium help. That may have boosted enrollment.

“Enrollment defied expectations and the Trump administration’s efforts to undermine it,” said Lori Lodes, a former Obama administration health official who joined with other Obama alumni to try to promote enrollment in the absence of federal outreach efforts. “The demand for affordable coverage speaks volumes — proving, yet again, the staying power of the marketplaces.”

“The ACA is not repealed and not going away,” tweeted Andy Slavitt, who oversaw the ACA under President Barack Obama.

The tax bill passed by Congress this week repeals the fines for those who fail to obtain health coverage, but those fines do not go away until 2019. Still, that has added to the confusion for 2018 coverage.

And it remains unclear whether Congress will make another attempt to repeal the law in 2018.

“I think we’ll probably move on to other issues,” Senate Majority Leader Mitch McConnell (R-Ky.) said in an interview Friday with NPR.

Read further.

Source: Rovner J. (21 December 2017). "Despite Compressed Sign-Up Period, ACA Enrollment Nearly Matches Last Year’s" [Web Blog Post]. Retrieved from address https://khn.org/news/despite-compressed-sign-up-period-aca-enrollment-nearly-matches-last-years/view/republish/

HHS Nominee Vows To Tackle High Drug Costs, Despite His Ties To Industry

What is President Trump’s solution for fighting high drug prices? From Kaiser Health News, check out this article on the new Department of Health and Human Services (HHS) nominee.

Senate Democrats on Tuesday pressed President Donald Trump’s nominee for the top health post to explain how he would fight skyrocketing drug prices — demanding to know why they should trust him to lower costs since he did not do so while running a major pharmaceutical company.

Alex M. Azar II, the former president of the U.S. division of Eli Lilly and Trump’s pick to run the Department of Health and Human Services, presented himself as a “problem solver” eager to fix a poorly structured health care system during his confirmation hearing before the Senate Finance Committee. Azar said addressing drug costs would be among his top priorities.

But armed with charts showing how some of Eli Lilly’s drug prices had doubled on Azar’s watch, Democrats argued Azar was part of the problem. Sen. Ron Wyden of Oregon, the committee’s top Democrat, said Azar had never authorized a decrease in a drug price as a pharmaceutical executive.

“The system is broken,” Wyden said. “Mr. Azar was a part of that system.”

Azar countered that the nation’s pharmaceutical drug system is structured to encourage companies to raise prices, a problem he said he would work to fix as head of HHS.

“I don’t know that there is any drug price of a brand-new product that has ever gone down from any company on any drug in the United States, because every incentive in this system is towards higher prices, and that is where we can do things together, working as the government to get at this,” he said. “No one company is going to fix that system.”

Azar’s confirmation hearing Tuesday was his second appearance before senators as the nominee to lead HHS. In November, he faced similar questions from the Senate Health, Education, Labor and Pensions Committee during a courtesy hearing.

If confirmed, Azar would succeed Tom Price, Trump’s first health secretary, who resigned in September amid criticism over his frequent use of taxpayer-paid charter flights. A former Republican congressman who was a dedicated opponent of President Barack Obama’s signature health care law, Price had a frosty relationship with Democrats in Congress as he worked with Republicans to try to undo the law.

Price and the Trump administration often turned to regulations and executive orders to undermine the Affordable Care Act, since Republicans in Congress repeatedly failed to enact a repeal. “Repeal and replace” has been the president’s mantra.

But at the hearing, Azar was circumspect about his approach, noting that his job would be to work under existing law. “The Affordable Care Act is there,” he said, adding that it would fall to him to make it work “as best as it possibly can.”

Senate Republicans touted Azar’s nearly six years working for the department under President George W. Bush, including two years as a deputy secretary. Committee Chairman Orrin Hatch (R-Utah) praised Azar’s “extraordinary résumé,” adding that, among HHS nominees, he was “probably the most qualified I’ve seen in my whole term in the United States Senate.” Hatch, who is the longest-serving Republican senator in history, has been a senator for more than 40 years.

In addition to drug costs, Azar vowed to focus on the nation’s growing opioid crisis, calling for “aggressive prevention, education, regulatory and enforcement efforts to stop overprescribing and overuse,” as well as “compassionate treatment” for those suffering from addiction.

Pressed about Republican plans to cut entitlement spending to compensate for budget shortfalls, Azar said he was “not aware” of support within the Trump administration for such cuts.

“The president has stated his opposition to cuts to Medicaid, Medicare or Social Security,” Azar said. “He said that in the campaign, and I believe he has remained steadfast in his views on that.”

But Democrats pushed back, pointing out that Trump had proposed Medicaid cuts in his budget request last year. Sen. Sherrod Brown (D-Ohio) said such cuts would hurt those receiving treatment for opioid addiction.

“What happens to these people?” he said.

Despite such Democratic criticism, Azar is likely to be confirmed when the full Senate votes on his nomination. An HHS spokesman Tuesday pointed reporters to an editorial in STAT supporting Azar, written by former Senate majority leaders Bill Frist and Tom Daschle — a Republican and a Democrat. “We need a person of integrity and competence at the helm of the Department of Health and Human Services,” they wrote. “The good news is that President Trump has nominated just such a person, Alex Azar.”

Read further.

Source:

Huetteman E. (9 January 2018). "HHS Nominee Vows To Tackle High Drug Costs, Despite His Ties To Industry" [Web blog post]. Retrieved from address https://khn.org/news/hhs-nominee-vows-to-tackle-high-drug-costs-despite-his-ties-to-industry/view/republish/

Level-funded plan uptake trickling down market

What are level-funded plans, and why are they becoming so popular? Allow this article to break down the facts for you.

A brighter light is being cast on level-funded group health plans as benefits decision-makers tackle open-enrollment season. Several industry observers say the trend is more pronounced given that the Affordable Care Act remains largely intact — for now.

There has been an ebb and flow to these self-insured underwritten plans over the past 18 months, says Michael Levin, CEO and co-founder of the healthcare data services firm Vericred. But with a fixed monthly rate for more predictability, he says they can drive 25% to 35% savings relative to fully-insured ACA plans that must comply with the medical loss ratio for a certain segment of the market.

Level funding typically leverages an aggregate and/or specific stop-loss product to cap exposure to catastrophic claims. These plans are offered by an independent third-party administrator or health insurance carrier through an administrative-services-only contract.

It’s best suited for companies with a very low risk profile comprised of young or healthy populations, according to Levin. And with low attachment, stop-loss coverage in most states, he explains that the plans have “very little downside risk from the group’s perspective.” Two exceptions are California and New York whose constraints on the stop-loss attachment point “essentially preclude level-funded plans from being offered” there, he adds.

The arrangement is trickling down market. “We’ve heard from carriers that will go down to seven employees, plus dependents, while others cut it off at 20 or 25,” he says.

David Reid, CEO of EaseCentral, sees a “resurgence of level funding” across more than 38,000 employers with less than 500 lives that his SaaS platform targets through about 6,000 health insurance brokers and 1,000 agencies. His average group is about 30 employees.

He’s also seeing more customers using individual-market plans rather than group coverage through Hixme’s digital healthcare benefits consulting platform. Under this approach, health plans are bundled with other specific types of insurance and financing as a line of credit to fill coverage gaps. Employer contributions are earmarked for individual-market plans, which are purchased through payroll deduction.

Read further.

Source: Shutan B. (17 November 2017). "Level-funded plan uptake trickling down market" [Web Blog Post]. Retrieved from address https://www.employeebenefitadviser.com/news/level-funded-plan-uptake-trickling-down-market?feed=00000152-175e-d933-a573-ff5ef1df0000

Miserable Modern Workers: Why Are They So Unhappy?

It's a new year, which means working to improve the bad. What's so bad about today's work environment? Employees are more disengaged than ever. So, how can employers fix that? Let's take a look at the basic facts and possible first steps.

Today's workers are disengaged. They lack motivation. They're bored. They're stressed. They're burned out.

Researchers at Gallup, Randstad and Mercer conducting survey after survey have come to these conclusions. In fact, these surveys seem to paint an increasingly bleak picture of life at work.

At a time when technology has arguably made the workplace more efficient than ever, laws are protecting employees better than ever, and companies are offering benefits perhaps more generous than ever, why would U.S. workers be so checked out?

"One could argue that today's employees are as equally stressed as their predecessors, but for different reasons," said Jodi Chavez, president of Atlanta-based Randstad Professionals, a segment of Randstad US, which provides finance, accounting, HR, sales, marketing, legal staffing and recruitment services. "They fear having their jobs outsourced to another country, have anxiety about how best to work alongside new technologies such as automation and robotics, have increased financial pressures with rising student loan debt and late retirement, and feel pressure to be 'on' and answering e-mails 24/7."

Disengagement Can Lead to Bad Habits

Gallup has been measuring employee engagement in the United States since 2000 and finds that less than one-third of U.S. workers report that they are "engaged" in their jobs. Of the country's approximately 100 million full-time employees, 51 percent say they are "not engaged" at work—meaning they feel no real connection to their jobs and tend to do the bare minimum. Another 17.5 percent are "actively disengaged"— meaning they resent their jobs, tend to gripe to co-workers and drag down office morale. Altogether, that's a whopping 68.5 percent who aren't happy at work.

Recently, Randstad US found in its own survey that disengagement has led to some bad habits among the nation's workers: Unhappy workers admitted that while on the job, they drank alcohol (5 percent), took naps (15 percent), checked or posted on social media (60 percent), shopped online (55 percent), played pranks on co-workers (40 percent), and watched Netflix (11 percent).

"Some employers may see checking social media a few times a day as a small offense, while napping on the job or watching Netflix could be considered serious safety hazards for other employers," Chavez said. "Really, we found that these results are part of a bigger story—a trend of burnout and job dissatisfaction. Burnout is a natural human reaction to stressful environments, or long workdays, but it may also be a sign that an employee isn't the right fit for a position. It's important for employers to be aware of these habits, evaluate if they're a sign of a larger issue and identify what they can do to help employees feel appreciated."

Even if today's workers are no more disengaged than workers of decades past, three things may be making the "commentary on disengagement louder," said Ken Oehler, global culture and engagement practice leader with London-based Aon:

Scrutiny. "Management focus on people and talent is much greater now than in the past," he said. "Three or four decades ago, studies could not find a link between job satisfaction and performance, and the concept of engagement did not even exist. There are now many studies establishing the link between engaged employees and better performance. With this we have seen a great increase in the measurement and thirst for understanding [of] how to maximize the employee experience, employee engagement and employee performance. So when the rate of disengaged employees does not seem to change much, management becomes dissatisfied and wants to know what can be done."

Expectations of work. "Employee expectations about work are dramatically different than a few decades past," he said. "Few workers sign up thinking they will be employed by the same company for life and be rewarded with a nice pension. Most Millennials don't want that. They thirst for development, advancement, movement, impact and purpose. So, when that doesn't happen, [discontent] can get loud."

Rate of change. The constant technological demands and steep learning curves of many modern jobs can overwhelm the senses, he said. "I believe many workers are worried about keeping up with this rate of change and having the relevant skills required for the future. Companies and employees need to be smarter and faster, and the technology involved in work is largely unchanged or inadequate. This is really stressful when the need and rate of change increases and the technology, tools and processes do not support this."

Are Small 'Fixes' Enough?

The "fixes" that employee engagement experts often suggest to make workers happier on the job, however, may not be making much of a difference—at least not if recent surveys measuring employee satisfaction are to be believed.

"Will simple things like getting a good night's sleep, asking for help or finding a creative outlet transform every employee's attitude?" asked Chavez. "No. But these small fixes are easy, actionable things that people can try if they're truly stressed, exhausted or having external problems, as these changes can boost productivity and overall happiness at work. If not, then maybe the employee needs to do some deeper exploring as to whether the job, employer or even career are a good fit."

The pressures put on modern workers to "do more with less" may be the result of business shareholders who—having grown cautious following the Great Recession—aren't willing to expand budgets to hire more people at companies or better compensate those already there, Chavez and Oehler said. Worker pay has remained relatively flat since the recession, with nominal annual increases even though the economy and markets are said to be booming.

"Ensuring that you get pay right is critical," Oehler said. "Perceptions of pay inequity will erode trust and engagement."

Said Chavez: "It's true that wages have remained relatively flat for the last several years. At the same time, there's more competition for top, skilled talent, so employers are becoming more creative when it comes to benefits. These benefits can come in many different forms—student loan benefits, access to telemedicine, stipends for commuting, flexible hours and remote work arrangements. While some may prefer higher salary over increased vacation time, some value robust learning and development programs. As for what makes work gratifying, every employee is different."

Source:

Wilkie D. (2 November 2017). "Miserable Modern Workers: Why Are They So Unhappy?" [web blog post]. Retrieved from address https://www.shrm.org/resourcesandtools/hr-topics/employee-relations/pages/employee-engagement-.aspx