What to consider before adding a genetic testing benefit

According to recent statistics from the Society of Human Resource Management (SHRM), 18 percent of employers provide health-related genetic testing benefits. Read this blog post for what employers should consider before adding a genetic testing benefit to their benefits package.

As employers look for new voluntary benefits to help attract and retain employees, a growing number are turning to direct-to-consumer genetic testing for all employees to their benefits plans. According to the latest statistics from the Society for Human Resource Management, 18% of employers provide a health-related genetic testing benefit, an increase of 6% over the previous year.

For the most part, it can be a smart move: Not only can the benefit differentiate one employer from others vying to hire from the same employee pool, genetic testing providers market the benefit as a way to potentially lower healthcare costs and increase employee wellness.

This type of testing can be valuable for employees at an increased risk for certain types of cancer, such as breast and ovarian cancer related to mutations of the BRCA1 and BRCA2 genes, those considering having a child who have risk factors for genetic conditions such as cystic fibrosis and Tay Sachs disease, those who have a family history of conditions like high cholesterol, and those who take medications such as blood thinners and anti-depressants. There also are tests that look for genes associated with conditions such as Parkinson’s disease, Alzheimer’s disease and celiac disease.

But employers also have to realize that genetic testing for all employees, regardless of family history and risk factors, comes with potential downsides. In fact, some physicians believe that widespread genetic testing of this type may even present a risk of harm. There’s also the issue of regulation and oversight of direct-to-consumer genetic testing. The industry is not currently regulated, which, some researchers have found, can lead to inaccurate or varying results. One study found that when the same genetic variant was provided to nine different labs for analysis, the answers provided were different 22% of the time, highlighting the risk of false positive and false negative results.

So for employers who offer — or are considering adding — a genetic benefit, make sure to think about the potential outcomes that can occur by doing so.

The potential for lower costs as well as unnecessary healthcare spending

If an employee’s genetic test is positive for a mutation that’s associated with cancer or another disease, he or she may be more proactive about screening for the disease and may make lifestyle changes that may lower the risk of developing the disease. There are potential healthcare cost savings to early detection of some conditions. For example, by some estimates, the cost for treating early-stage breast cancer is more than 50% less than the cost to treat the same cancer at an advanced stage.

For employees who undergo testing related to how effective a blood thinner or antidepressant will be, there can be better health outcomes as well as cost savings. One study found that when physicians prescribed the blood thinner Warfarin based on pharmacogenomic testing, adverse events decreased by 27%. Avoiding adverse events and making sure employees are taking the medications that can most effectively treat their conditions can help keep them healthy, out of the hospital and productively on the job, all of which has a positive financial impact.

But when you’re screening people who don’t have risk factors or a family history of these conditions, a positive test result can lead to unnecessary testing and medical procedures, potential complications from those procedures and the costs associated with that testing and care.

Before and after testing, education

Employers who offer genetic testing without a physician referral need to take steps to ensure that employees understand the risks and benefits of these tests upfront and that they know what a genetic test can and cannot tell them about their health now and in the future. The first step is for any employer offering genetic testing to provide education for employees.

Many employees don’t realize that having a gene mutation that’s associated with a disease does not mean that he or she will ever develop that disease. The risk associated with most genetic variations is, in fact, relatively small. Because of that misunderstanding, employees may experience needless worry or, if the test is negative for mutations related to a disease, may forgo screenings like mammograms, colonoscopies and cholesterol tests that can help detect health problems earlier when they are often more treatable. In the case of genetic testing for mutations associated with cancer, employees may not be aware that most cancers are not caused by a mutation in the single gene that the test screens for.

For some of the conditions that genetic tests screen for, like Alzheimer’s disease, there are currently no treatments. This can again cause anxiety for employees and their families. Genetic tests also have implications that reach beyond the specific employee who is tested. A positive test can affect siblings and children as well, opening the question of whether the employee wants or feels compelled to share the results with other family members who may also be at risk.

Employers who offer employees genetic testing should ensure that all employees who choose to undergo testing are guided by experienced genetic counselors who can help them interpret and understand the results of their test and can connect them with other healthcare providers for additional testing or treatment as needed.

SOURCE: Varn, M. (3 May 2019) "What to consider before adding a genetic testing benefit" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/what-to-consider-before-adding-a-genetic-testing-benefit

4 benefits messages to send employees in May

Tax season has come and gone, and summer is right around the corner, making it a great time of year for employers to beef up communications about certain employee benefits. Read this blog post for four benefits messages employers should send their employees this May.

With tax season behind us, summer right around the corner and the second half of the year coming up, now is a great time of year for employers to beef up communications about certain benefits.

That’s because there are a number of important messages that are specific to this time of year, including saving money for summer vacations and putting more money into a health savings account so employees can plan for healthcare expenses for the remainder of the year.

Here are four messages employers should share with their employers this month.

1. Think about putting more money in your HSA.

May is a great time for your employees to take stock of their healthcare costs from January to April, and plan ahead for the second half of the year. Here’s a breakdown you can send to help them save money and have more cash available through December to pay their bills.

- Add up this year’s out-of-pocket health care costs thus far.

- Make a new estimate of your upcoming expenses (padding that estimate for unexpected expenses that may pop up.).

- Add your estimated costs to what you’ve already spent.

- Compare that total with how much you’ll have in your HSA account at the end of the year as it is now.

- If there’s a gap, you can increase your contribution rate now to make up the difference.

2. Adjust your W-4s.

Tax season has passed, which means it’s an excellent time to…think a little more about taxes.

The tax law changes that went into effect at the start of 2018 might have made your employees’ existing W-4s less accurate. If they didn’t update their withholding amount last year, they might have been surprised by a smaller refund, a balance due, or even by a penalty owed — and chances are, they don’t feel too happy about it.

Let your employees know that they can prevent unexpected surprises like this next tax season with a visit to this IRS tax withholding calculator. There, they can estimate their 2019 taxes and get instructions on how to update their W-4 withholdings to try and avoid any surprises next year. If they can update their W-4 online, send them the link along with clear step-by-step instructions. And if they need to fill out a paper form, explain where to find it and how to submit it.

3. Revisit your budgeting tools.

Summer is almost here, and your employees are likely starting to think about hitting the beach, road-tripping across the country or eating their weight in ice cream. Since having fun costs money, May is a good time to serve up some ideas on how to squirrel away a little extra cash in the next few months.

Employers should share tips for saving money on benefits-related expenses, like encouraging high-deductible health plan employees to use sites like GoodRx.com for cheaper prescription costs, or visiting urgent care instead of the emergency room for non-life-threatening issues. Also, consider making employees aware of apps like Acorns, Robinhood, Stash, Digits and Tally, which round up credit or bank card expenses to the next dollar, and automatically deposit the extra money into different types of savings accounts.

4. Double-check out-of-network coverage.

While you’re on the subject of summer fun, remind your employees to take a quick peek at their health plan’s out-of-network care policies before they head out of town. If they need a doctor (or ice cream headache cure) while they’re away, they’ll know where to go, how to pay, and how to get reimbursed.

Employers should remind employees that their HSA funds never expire, and they’re theirs for life. So if they put in more than they need this year, it will be there for them next year.

SOURCE: Calvin, H. (1 May 2019) "4 benefits messages to send employees in May" (Web Blog Post). Retrieved from https://www.benefitnews.com/list/4-benefits-messages-to-send-employees-in-may

Changes are coming to paid leave. Here’s what employers should know

Many states and local governments are enacting their own paid leave policies, making it difficult for employers to navigate employee paid leave. Read this blog post for what employers should know about the coming changes for paid leave.

A growing number of states and local governments are enacting their own paid leave policies. These new changes can be difficult for employers to navigate if they don’t understand the changes that are happening.

Adding to the confusion among employers, paid sick leave and paid family leave are often used interchangeably, when in fact there are some important distinctions. Paid sick leave is for a shorter time frame than paid family leave and allows eligible employees to care for their own or a family member’s health or preventative care. Paid family leave is more extensive and allows eligible employees to care for their own or a family member’s serious health condition, bond with a new child or to relieve family pressures when someone is called to military service.

The best-known type of employee leave is job-protected leave under the Family Medical Leave Act, where employees can request to take family medical leave for their own or a loved one’s illness, or for military caregiver leave. However, leave under FMLA is unpaid, and in most cases, employees may use available PTO or paid leave time in conjunction with family medical leave.

Rules vary by state, which makes it more difficult for multi-state employers to comply. The following is an overview of some new and changing state and local paid leave laws.

Paid sick leave

The states that currently have paid sick leave laws in place are Arizona, California, Connecticut, Maryland, Massachusetts, New Jersey, Oregon, Rhode Island, Vermont and Washington. There are also numerous local and city laws coming into effect across the country.

In New Jersey, the Paid Sick Leave Act was enacted late last year. It applies to all New Jersey businesses regardless of size; however, public employees, per diem healthcare employees and construction workers employed pursuant to a collective bargaining agreement are exempt. As of February 26, New Jersey employees could begin using accrued leave time, and employees who started after the law was enacted are eligible to begin using accrued leave 120 days after their hire dates.

Michigan’s Paid Medical Leave Act requires employers with 50 or more employees to provide paid leave for personal or family needs as of March.

Under Vermont’s paid sick leave law, this January, the number of paid sick leave hours employees may accrue rose from 24 to 40 hours per year.

In San Antonio, a local paid sick leave ordinance passed last year, but it may not take effect this August. The ordinance mirrors one passed in Austin that has been derailed by legal challenges from the state. Employers in these cities should watch these, closely.

Paid family leave

The five states that currently have paid family leave policies are California, New Jersey, Rhode Island, New York, Washington and the District of Columbia.

New York, Washington and D.C. all have updates coming to their existing legislation, and Massachusetts will launch a new paid family program for employers in that state. In New York, the state’s paid family leave program went into effect in 2018 and included up to eight weeks of paid family leave for covered employees. This year, the paid leave time jumps to 10 weeks. Payroll deductions to fund the program also increased.

Washington’s paid family leave program will begin on January 1, 2020, but withholding for the program started on January 1 of this year. The program will include 12 weeks of paid family leave, 12 weeks of paid medical leave. If employees face multiple events in a year, they may be receive up to 16 weeks, and up to 18 weeks if they experience complications during pregnancy.

The paid family leave program in Massachusetts launches on January 1, 2021, with up to 12 weeks of paid leave to care for a family member or new child, 20 weeks of paid leave for personal medical issues and 26 weeks of leave for an emergency related to a family member’s military deployment. Payroll deductions for the program start on July 1.

The Paid Leave Act of Washington, D.C. will launch next year with eight weeks of parental leave to bond with a new child, six weeks of leave to care for an ill family member with a serious health condition and two weeks of medical leave to care for one’s own serious health condition. On July 1, the district will begin collecting taxes from employers, and paid leave benefits will be administered as of July 1, 2020.

Challenging times ahead

An employer must comply with all state and local sick and family leave laws, and ignorance of a law is not a defense. Employers must navigate different state guidelines and requirements for eligibility no matter how complex, including multi-state employers and companies with employees working remotely in different jurisdictions.

These state paid leave programs are funded by taxes, but employers must cover the costs of managing the work of employees who are out on leave. While generous paid leave policies can help employers attract talent, they simply don’t make sense for all companies. For example, it can be difficult for low-margin businesses to manage their workforces effectively when employees can take an extended paid leave.

Not only must employers ensure compliance with state and local rules, but they also must make sure that their sick time, family and parental leave policies are non-discriminatory and consistent with federal laws and regulations. That’s a lot to administer.

Employers should expect to see the changes in paid sick leave and family leave laws to continue. In the meantime, companies should make sure they have the people and internal processes in place right now to track these changes and ensure compliance across the board.

SOURCE: Starkman, J.; Johnson, D. (2 May 2019) "Changes are coming to paid leave. Here’s what employers should know" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/what-employers-need-to-know-about-changing-paid-leave-laws?brief=00000152-14a7-d1cc-a5fa-7cffccf00000

Employers Must Report 2017 and 2018 EEO-1 Pay Data

The Equal Employment Opportunity Commission (EEOC) is requiring that all employers report their pay data, broken down by race, sex and ethnicity, from 2017 and 2018 by September 30. Continue reading this post from the SHRM to learn more.

The Equal Employment Opportunity Commission (EEOC) has announced that employers must report pay data, broken down by race, sex and ethnicity, from 2017 and 2018 payrolls. The pay data reports are due Sept. 30.

Employers had been waiting to learn what pay data they would need to file—if any at all—as litigation on the matter ensued. A federal judge initially ordered the EEOC to collect employee pay data for 2018. The National Women's Law Center (NWLC) and other plaintiffs wanted the EEOC to collect two years of data, as the agency was supposed to under a new regulation before the government halted the collection in 2017.

Judge Tanya Chutkan of the U.S. District Court for the District of Columbia sided with the plaintiffs and gave the EEOC the option of collecting 2017 pay data along with the 2018 information by the Sept. 30 deadline or collecting 2019 pay data during the 2020 reporting period. The EEOC opted to collect the 2017 data.

The agency said it could make the collection portal available to employers by mid-July and would provide information and training to employers prior to that date.

Immediate Steps

"We are awaiting confirmation from the EEOC or the contractor it is hiring to facilitate the pay-data collection on how to lay out the data file for a batch upload," said Alissa Horvitz, an attorney with Roffman Horvitz in McLean, Va.

But employers should take some steps immediately. They should reach out to their subject-matter and technical experts and pull together resources to ensure that the required data components can be captured, analyzed and reported by Sept. 30, said Annette Tyman, an attorney with Seyfarth Shaw in Chicago.

Filing the additional reports will impose unanticipated burdens for HR, IT and legal departments, as well as third-party consultants, she noted. "It is unclear whether any further litigation options will impact the Sept. 30 deadline, and we are instructing employers to assume they must comply."

Employers should keep in mind that they still must submit their 2018 data for Component 1 of the EEO-1 form by May 31, unless they request an extension. Note that the EEOC recently shortened the extension period for employers to report Component 1 data from 30 days to two weeks. So the extension deadline is now June 14.

Component 1 asks for the number of employees who work for the business by job category, race, ethnicity and sex. Component 2 data—which includes hours worked and pay information from employees' W-2 forms by race, ethnicity and sex—is the subject of the legal dispute.

Data Collection

Businesses with at least 100 employees and federal contractors with at least 50 employees and a contract with the federal government of $50,000 or more must file the EEO-1 form. The EEOC uses information about the number of women and minorities companies employ to support civil rights enforcement and analyze employment patterns, according to the agency.

The revised EEO-1 form will require employers to report wage information from Box 1 of the W-2 form and total hours worked for all employees by race, ethnicity and sex within 12 proposed pay bands.

The reported hours worked should show actual hours worked by nonexempt employees and an estimated 20 hours per week for part-time exempt employees and 40 hours per week for full-time exempt employees.

"Filling out the added data in the EEO-1 form will present a large amount of work, especially as there's great potential for human error when populating the significantly expanded form," said Arthur Tacchino, J.D., chief innovation officer at SyncStream Solutions, which provides workplace compliance solutions.

Employers should start looking at their data now and conduct an initial assessment of their systems, said Camille Olson, an attorney with Seyfarth Shaw in Chicago. Identify the systems that house the relevant demographic, pay and hours-worked data and determine how to pull the information together, she said.

Pulling EEO-1 data is much simpler for Component 1, she noted, because it only involves reporting the employer's headcount by race, ethnicity and sex—whereas collecting pay information involves more data points. Additionally, employers may use different vendor systems at different locations, some employees may have only worked for part of the year, and other employees may have been reclassified to exempt or nonexempt.

"Employers may want to inquire with their current vendors—payroll or otherwise—or look for outside vendors that may be able to assist them with this reporting requirement," Tacchino said.

Under some circumstances, employers may be able to seek an exemption (at the EEOC's discretion) if filing the information would cause an undue burden. "Mega employers" may not be able to show an undue burden, but this could be an option for smaller businesses, said Jim Paretti, an attorney with Littler in Washington, D.C. But that will depend on how the parties decide to move forward.

The Court Battle

The EEO-1 form was revised during President Barack Obama's administration to add the Component 2 data, but the pay-data provisions were suspended in 2017 by President Donald Trump's administration. The NWLC challenged the Trump administration's hold on the pay-data collection provisions, and on March 4, Chutkan lifted the stay—meaning the federal government needed to start collecting the information.

On March 18, however, the EEOC opened the portal for employers to submit EEO-1 reports without including the pay-data questions. Chutkan subsequently told the government to come up with a plan.

The EEOC proposed the Sept. 30 deadline for employers to submit Component 2 data, claiming that the agency needed more time to address the associated collection challenges. Furthermore, the EEOC's chief data officer warned that rushing the data collection may yield poor quality data. Even with the additional time, the agency said it would need to spend more than $3 million to hire a contractor to provide the appropriate procedures and systems.

Robin Thurston, an attorney with Democracy Forward and counsel for the plaintiffs, said at an April 16 hearing that the plaintiffs don't want the agency to compromise quality. But they also wanted "sufficient assurances" that the EEOC will collect the data by Sept. 30.

On April 25, Chutkan ordered the government to provide the court and the plaintiffs with periodic updates on the EEOC's progress and to continue collection efforts until a certain threshold of employer responses has been received.

SOURCE: Nagele-Piazza, L. (2 May 2019) "Employers Must Report 2017 and 2018 EEO-1 Pay Data" (Web Blog Post). Retrieved from https://www.shrm.org/resourcesandtools/legal-and-compliance/employment-law/pages/eeo-1-pay-data-report-2017-2018.aspx

Can Employers Require Measles Vaccines?

Can employers require that their employees get the measles vaccine? The recent measles outbreak is raising the question of whether employers can require that their workers get the vaccine. Read this blog post from SHRM to learn more.

The recent measles outbreak, resulting in mandatory vaccinations in parts of New York City, raises the question of whether employers can require that workers get the vaccine to protect against measles, mumps and rubella (MMR) or prove immunity from the illness.

The answer generally is no, but there are exceptions.

Offices and manufacturers probably can't require vaccination or proof of immunity because the Americans with Disabilities Act (ADA) generally prohibits medical examinations—unless the employer is in a location like Williamsburg, the neighborhood in Brooklyn where vaccinations are now mandatory. Health care providers, schools and nursing homes, however, probably can require them because their employees work with patients, children and people with weak immune systems who risk health complications from measles.

But even these employers must try to find accommodations for workers who object to vaccines for a religious reason or because of a disability that puts them at risk if they're vaccinated, such as having a weak immune system.

Proof of Immunity

Proof of immunity includes one of the following:

- Written documentation of adequate vaccination.

- Laboratory evidence of immunity.

- Laboratory confirmation of measles.

- Birth before 1957. The measles vaccine first became available in 1963, so those who were children before the late 1950s are presumed to have been exposed to measles and be immune.

Measles, which is contagious, typically causes a high fever, cough and watery eyes, and then spreads as a rash. Measles can lead to serious health complications, especially among children younger than age 5. One or two out of 1,000 people who contract measles die, according to the U.S. Centers for Disease Control and Prevention.

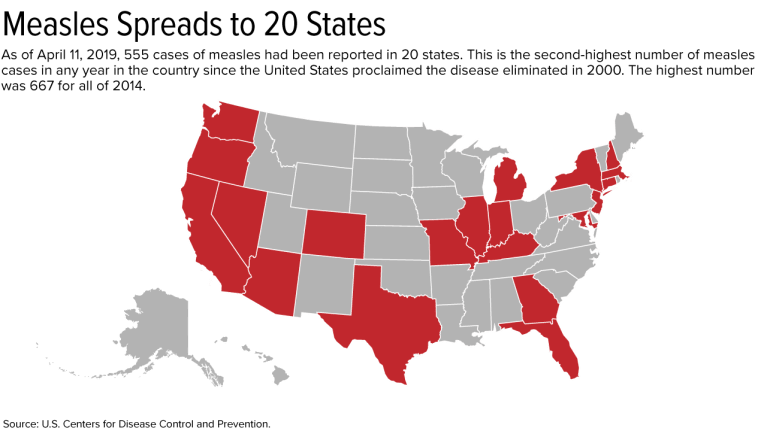

Outbreak Has Spread to 20 States

As of April 11, 555 cases have been reported in the United States this year. This is the second-greatest number in any year since the United States proclaimed measles eliminated in 2000; 667 cases were reported in all of 2014.

On April 9, New York City Mayor Bill de Blasio declared a public health emergency in Williamsburg, requiring the MMR vaccine in that neighborhood. Those who have not received the MMR vaccine or do not have evidence of immunity may be fined $1,000.

Since the outbreak started, 285 cases have been confirmed in Williamsburg, including 21 hospitalizations and five admissions to intensive care units.

If a city requires vaccinations, an employer's case for requiring them is much stronger, said Robin Shea, an attorney with Constangy, Brooks, Smith & Prophete in Winston-Salem, N.C. But employers usually should not involve themselves in employees' health care unless they are making an inquiry related to a voluntary wellness program, or the health issue is job-related, she cautioned.

The measles outbreak has spread this year to 20 states—outbreaks linked to travelers who brought measles to the U.S. from other countries, such as Israel, Ukraine and the Philippines, where there have been large outbreaks.

Strike the Right Balance

Health care employers typically require vaccinations or proof of immunity as a condition of employment, said Howard Mavity, an attorney with Fisher Phillips in Atlanta. He noted that most schoolchildren must be immunized, so many employees can show proof of immunity years later.

If an employee provides current vaccination records when an employer asks, the ADA requires that those records be kept in separate, confidential medical files, noted Meredith Shoop, an attorney with Littler in Cleveland.

All employers must balance their health and safety concerns with the right of employees with disabilities to reasonable accommodations under the ADA and the duty to accommodate religious workers under Title VII of the Civil Rights Act of 1964.

Under the ADA, a reasonable accommodation is required unless it would result in an undue hardship or direct threat to the safety of the employee or the public. The direct-threat analysis will be different for a registered nurse than for someone in a health care provider's billing department, for example, who might not work around patients.

Even if the ADA permitted mandatory vaccines in a manufacturing setting in limited circumstances, such as in Williamsburg now, any vaccination orders may need to be the subject of collective bargaining if the factory is unionized. Shoop has seen manufacturers shut down because employees were reluctant to come to work when their co-workers were sick on the job.

An employer does not have to accommodate someone who objects to a vaccine merely because he or she thinks it might do more harm than good but doesn't have an ADA disability or religious objection, said Kara Shea, an attorney with Butler Snow in Nashville, Tenn.

If someone claims to have a health condition that makes getting vaccinated a health risk, the employer does not have to take the person's word for it. The employer instead should ask the person to sign a consent form allowing the employer to learn about the condition and get documentation from the employee's doctor, she said. Before accommodating someone without an obvious impairment, the ADA allows employers to require medical documentation of the disability.

Courts don't closely scrutinize religious objections to immunizations, Mavity remarked.

"Some people have extremely strong beliefs that they don't want a vaccine in their body," said Kathy Dudley Helms, an attorney with Ogletree Deakins in Columbia, S.C. If the employer works with vulnerable people but can't find an accommodation for a worker who refuses vaccination, the employee may have to work elsewhere, she said.

SOURCE: SHRM (17 April 2019) "Can Employers Require Measles Vaccines?" (Web Blog Post). Retrieved from https://www.shrm.org/resourcesandtools/legal-and-compliance/employment-law/pages/measles-outbreak-2019-vaccinations.aspx

Getting employees up to speed with health literacy

Do your employees know how much sugar is in a granola bar or how much radiation is in a CT scan? If not, it's most likely because no one is teaching them. Continue reading to learn more on getting your employees up to speed with health literacy.

Your employees probably don’t know how much sugar is in a granola bar or how much radiation is in a CT scan. They may not even know how to reach your employee assistance program.

That’s because no one is teaching them. Which is what happens when wellness program education ends at eat more fruits and vegetables and avoid added sugar.

Sometimes the advice is even wrong. For example, below is a clipping from a popular health risk assessment. Focus on the lower right quadrant.

It isn’t entirely true that low-fat and nonfat dairy is healthier. In fact, full fat dairy does have health benefits, for example some studies suggest it could help protect against diabetes. By comparison, low-fat or nonfat yogurt could be a significant source of sugar.

This is why employee health literacy is so important. With easy access to mis-information, employees need to learn to sift through the noise to determine what is actually good for them.

Plus, there is plenty to learn. Spanning from everyday health, employee medical education and health benefits literacy. I’ve outlined just a few of the ways to employers can better educate their population.

Everyday health education

Sugar is one place where health education could be more impactful — but it should go beyond just telling workers to avoid added sugars. Education starts at work. Chances are your break room is stocked with granola bars, maybe Clif Bars. The first ingredient in a Clif Bar is organic brown rice syrup. That may sound healthy, but it’s really just sugar. In fact, there are almost 60 different sugars disguised with fancy names like turbinado or malted barley extract.

Another example is sleep. We all want employees to get enough of it, but do they know how? They may not know little bits of information that could help them get more shuteye, like there is a night shift setting on their iPhone or that energy-efficient light bulbs contribute to insomnia.

But teaching everyday health is just the beginning of health literacy. The real impact comes with employee medical education.

Employee medical education

U.S. consumers are voracious purchasers of healthcare services and yet our outcomes remain poor. Americans have about 240 CT scans per 1,000 people. To put that in perspective, only about 1 in 1,000 covered people in your employee population was hospitalized for diabetes last year. So 240 times more employees are getting scans than uncontrolled diabetes.

CT scans have risks. They have about 500 times the radiation of an x-ray and are especially concerning for children because their cells are dividing more rapidly than adults and are more sensitive to radiation exposure. The dye used intravenously also carries a risk.

But many employees don’t know about these risks. So it may be important to educate your workforce about these common medical procedures and how to decide whether or not it is right for them.

Health benefit education

Here’s a wild guess: your employees don’t appreciate the health benefits you provide for them. If so, you’ve got company. Most large organizations face the same issue.

Consider the employee assistance program. Do workers know you offer one? Do they know it’s confidential? They know their emails aren’t confidential, so don’t assume they know this. Do they know the URL, username and password? How many free sessions do they get?

Repeat a similar set of questions for all your benefits. You can’t expect that some memos and a website will implant your benefits firmly in their mind.

SOURCE: Lewis, A. (25 April 2019) "Getting employees up to speed with health literacy" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/educating-employees-through-health-literacy

Fresh Brew with Dave Smetana

Welcome to our monthly segment, Fresh Brew, where we will be exploring the delicious coffees, teas, and snacks of some of our employees! You can look forward to our Fresh Brew blog post on the first Friday of every month.

“There has to come a point where the research stops, and the decision gets made! It is too easy sometimes to stay in the ‘searching out all possibilities mode’ out of fear of making the ‘wrong decision.'”

Dave Smetana is the CFO at Saxon Financial Services.

Dave and his wife, Terry have 2 children, whom they vacation with whenever possible to places they have never been. A recent trip was out West to see the Grand Canyon, Hoover Dam, and other amazing sites. For an upcoming trip, Dave will travel to Colorado.

Caffe Verona Dark Roast or Whole Bean Dark Roast

Dave enjoys sipping on a Starbucks Caffe Verona Dark Roast while at work or any Costco whole bean dark roast when he’s at home.

Banana Nut Muffins

Dave’s favorite mid-morning snack to enjoy with a freshly brewed cup of coffee is a Paleo Banana Nut Muffin recipe he got from fellow employee, Amy.

Think your employee is faking sickness? Here’s what you can do

Have your employees misused their FMLA leave before? Navigating FMLA can be tricky, leading to costly lawsuits if a wrong move is taken. Continue reading this blog post to learn more about handling FMLA misuse.

Your employee’s gout flared up, so they took the day off using intermittent medical leave. Later on, a photo of the same employee sliding into home base surfaces on social media that day. How do you find out if the employee was misusing FMLA leave?

Bryon Bass, senior vice president of workforce absence at Sedgwick — a business solution tech company — says navigating FMLA can be tricky, and the wrong move can provoke costly lawsuits. But if an employer has reason to believe the absence isn’t valid, Bass says there’s a process they can follow to investigate.

“I think [a social media photo] casts doubt on the reason for their absence,” Bass said during a recent webinar hosted by the Disability Management Employer Coalition. “It merits a second look, along with some potential code of conduct talks with HR.”

When a questionable situation arises, employers can ask for the worker’s approved medical condition to be recertified, Bass said. This involves having the employee resubmit their original FMLA application. Afterward, employers can send a list of absences to the employee’s healthcare provider to authenticate the dates as valid medical absences. Typically, employers can only request recertification after a 30 day period, unless there’s reason to believe the employee is taking advantage of the system.

“If, for example, you notice two employees — who happen to be dating — are taking off the same days for their different medical conditions, that’s a valid reason for asking for recertification,” Bass said. “Patterns of absence are a common reason to look into it.”

Instead of requesting recertification, some employers make the mistake of contacting the employee’s physician directly — a process called clarification. Employers are only allowed to use clarification during the initial FMLA application, and only after obtaining the employee’s permission. Clarification is used to answer employer questions about the amount of rest an employee’s condition merits.

Employers might not trust the opinion of their employee’s doctor, but they can’t ask for a second opinion until it’s time for the employee to re-submit their annual certification, Bass says. When that time comes, employers can appoint a physician to reexamine the employee at the company’s expense. If the employee objects to the second doctor’s report, a third opinion can be sought.

“With third opinions, both the employer and the employee have to agree on the provider because their decision is final,” Bass said. “Employers are also required to cover this expense.”

Although employers are within their right to file recertification, Bass says it should be done sparingly and in situations where evidence suggests misuse. An employee using slightly more time for recovery isn’t automatically abusing the policy, he said.

“FMLA does not permit healthcare providers to provide an exact schedule of leave, just an estimate of absences necessary for the employee’s treatment and recovery,” Bass said. “Treatments are more predictable, but it’s still only an estimate. If someone takes a little more time than estimated, it doesn’t mean you need to ask for recertification; in fact, the Department of Labor discourages that.”

SOURCE: Webster, K. (24 April 2019) "Think your employee is faking sickness? Here’s what you can do" (Web Blog Post). Retrieved from https://www.benefitnews.com/news/how-to-certify-medical-leave-and-handle-pto-requests?feed=00000152-a2fb-d118-ab57-b3ff6e310000

7 tips for keeping shift workers healthy

Most companies that are open for more than 10 hours a day have some sort of shift work or work pattern. Though shift work can have multiple positives for companies and their workers, it can also have numerous negative impacts on physical and mental health. Read this blog post for seven tips on keeping shift workers healthy.

For companies open for more than 10 hours a day, it’s likely that you have some sort of shift work, or a pattern of work involving rotation through different fixed periods across a working week or month. Employees who work in healthcare, call centers, manufacturing and in a warehouse all regularly work round-the-clock shifts, and these are some of the most common industries utilizing this type of model.

While shift work can have numerous positives for the company and even the workers, it also can have many negative impacts on health — both physical and mental. Beyond the most common health impact — sleep disruption — there are numerous other ways shift work can negatively impact a worker’s health including: mood disorders, gastrointestinal disorders, injuries and accidents, metabolic disorders, cancer, cardiovascular disorders, interference on family live and limited social life.

Shift workers also experience high levels of annual leave requests and short-term disability claims.

For employers in one of these industries, or any industry with non-regular shift hours, there are a few best practices that will help improve worker productivity and minimize leave.

Provide schedules that are as predictable at possible. Allowing an employee to settle into a regular schedule will allow them to establish a routine both at work and at home. Interference with home and social life can be a key trigger for a variety of negative health habits.

Limit the number of nights worked consecutively. Just like a traditional Monday-Friday, 9-5 worker, those working night hours need a weekend of their own, too. While this may not always be Saturday-Sunday, allowing them a couple of consecutive days off will give them time to disconnect and recharge.

Designate areas and times for employees to rest in the workplace. Whether a nurse in a busy ER department or a warehouse worker stocking shelves, everyone needs a break during their workday. Work with the shift manager to map out regular breaks and a calm and quiet place for employees to take a break.

Provide health and wellness programs that are accessible at night and on weekends. Since most HR professionals work office day jobs, they often forget about accessibility of services to employees working different hours. Assure your EAP provider is accessible 24/7 and if you have on-campus programs, be sure to offer them at different times for your shift workers. A factory employee working third shift should have the same level of access as a first-shift office worker.

Give employees more control over their schedules with shift-based hiring. This is an approach of hiring people for individual shifts rather than hiring employees, then scheduling them into shifts. Employees come to companies with a range of responsibilities outside of the workplace. Allowing them to match with the shift that best works with their personal lives will result in greater productivity and fewer health impacts.

For those returning to work following a leave, keep the schedule as close to their normal schedule as possible. While it’s not always possible to perfectly align with their previous schedule, you’ll want to get those returning from a leave back into the routine of their previous shift work. While on leave, many will have transitioned into a different sleep routine, so getting them back to the previous patterns will help with the transition back to work.

Provide resources on good sleep health. For shift workers, a healthy sleep routine can be challenging. However, there are simple and well-proven approaches to establishing sleep patterns regardless of the time of day. Be sure to regularly promote resources in the workplace and through regular communications. The American Academy of Sleep Medicine is a good place to start.

SOURCE: Willett, S. (26 April 2019) "7 tips for keeping shift workers healthy" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/tips-for-keeping-hourly-employees-healthy?brief=00000152-14a5-d1cc-a5fa-7cff48fe0001

Concerned about cybersecurity? Here’s how to protect 401(k) plans

Do you offer a 401(k) retirement plan to your employees? A new emerging cybersecurity risk for plan sponsors is retirement plans. Continue reading this blog post for tips on protecting 401(k) plans from cyberattacks.

All companies that manage personal consumer data are already concerned — or should be concerned — about cybersecurity. The scope and scale of cyberattacks continue to rise worldwide, as demonstrated last year by a breach that compromised data of 50 million Facebook users.

Retirement plans pose a new risk. Lawmakers are keen to protect the personal information of defined contribution plan participants. Recently, Sen. Patty Murray (D.-Wash.) and Rep. Bobby Scott (D.-Va.) asked the U.S. Government Accountability Office to “examine the cybersecurity of the private retirement system.”

Fortunately for plan sponsors, record-keepers and other parties in the retirement services industry, the same solution designed to address the multiple problems stemming from the upsurge in small, stranded 401(k) accounts — auto-portability — can also augment existing practices that protect plan participants’ personal data.

Auto-portability is the routine, standardized and automated transfer of a retirement plan participant’s 401(k) savings account from their former employer’s plan to an active account associated with their current job. This solution is underpinned by paired “locate” and “match” algorithms which work together to locate participants with multiple 401(k) plan accounts, confirm their identities, obtain consent for rolling over their stranded accounts. These accounts can exist in former employer plans or rolled into safe-harbor IRAs before they're moved into active accounts in their current employers’ plans. In addition, consolidation can include a roll-in to the participant’s current employer plan.

The act of consolidating accounts reduces the number of small accounts in the 401(k) system through auto-portability, which makes plan participant data more secure. Consolidating a participant’s multiple 401(k) accounts reduces the number of systems that store a participant’s data, and also encourages participants, sponsors and record-keepers to become more engaged when it comes to keeping track of accounts.

Auto-portability meets cybersecurity best practices

While there is currently no central legal framework regulating cybersecurity in the retirement services industry, the SPARK Institute published a compilation of recommended cybersecurity best practices for retirement plan record-keepers in 2017. Auto-portability, which went live that same year, operates in conformance to the SPARK Institute’s cybersecurity recommendations.

For example, the SPARK Institute, a retirement policy center in Simsbury, Connecticut, issued 16 security control objectives, including the practice of encryption, which requires protection of both “data-in-motion and data at rest.” The institute suggests that the same data protection risk management standards be applied to suppliers. To address cybersecurity, the institute suggests these steps:

- Encrypt all sensitive information subject to auto-portability using Advanced Encryption Standard 256-bit encryption, an industry standard developed by the National Institute of Standards and Technology. There is no known type of cyberattack that can read AES-encrypted data without having the cryptographic key.

- Never combine a Social Security number with other personally identifiable information in any single file transfer. The objective should be to ensure there is never enough personal data in any single transmission for a hacker to use to steal an identity. In addition, any file with personal information should never include the identity of either the plan’s sponsor or the record keeper. That further thwarts a hacker from accessing an individual participant’s retirement account.

- Know that auto-portability supports multiple methods of exchanging secure data.

- Ensure that any information flagged during the locate-and-match process that doesn’t adhere to certain criteria requires additional verification to confirm an identity.

- Conduct full address-location searches to ensure that the correct participant is found and properly matched to multiple accounts.

When participants strand 401(k) savings accounts in former-employer plans, and nothing is done to transport them to active accounts in their present employers’ plans, there’s a strong chance that the worker may fall victim to a cybercrime. Plan sponsors can protect themselves and their participants from hackers, and strengthen their overall cybersecurity preparedness, by implementing auto-portability to cull small accounts and missing participants.

SOURCE: Williams, S. (25 April 2019) "Concerned about cybersecurity? Here’s how to protect 401(k) plans" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/how-to-protect-401k-plans-from-cybersecurity-risks