ARPA: What Employers Need to Know

On March 10, 2021 Congress passed the American Rescue Plan Act (ARPA) of 2021, which was signed into law on March 11th. The ARPA attempts to address and help mitigate some of the far-reaching financial impacts of the COVID-19 pandemic. In addition to those provisions, the ARPA contains provisions that are of special interest to employers and employees.

into law on March 11th. The ARPA attempts to address and help mitigate some of the far-reaching financial impacts of the COVID-19 pandemic. In addition to those provisions, the ARPA contains provisions that are of special interest to employers and employees.

The ARPA Nitty Gritty

- COBRA Subsidy - A 100% premium subsidy is provided, funded through employer tax credits.

- FFCRA Leave - Employer tax credits have been extended through September 30, 2021.

- FFCRA Leave - Inclusion of testing and immunization as qualifying reasons for FFCRA leave.

- FFCRA Tax Credits - Definition of employee earnings eligible have been expanded.

- Unemployment - The $300 weekly increase has been extended and expanded.

- ACA - Exchange insurance subsidies are increased.

- DCAP - Contribution limits have been increased.

- Employee Retention Tax Credit - Extended and expanded eligibility for some businesses.

Let's Break It Down

COBRA Subsidy

What is it?

COBRA (Consolidated Omnibus Budget Reconciliation Act of 1986) allows employees who would lose employer-sponsored health insurance because of job loss (or reduction in working hours) to continue that insurance for 18 months. However, the employer can require the employee that elects COBRA coverage to pay the entire cost of the premium oftentimes creating a necessary, but an unexpected financial burden for the employee.

ARPA Provisions

- 100% subsidy of COBRA premiums from April 1, 2021, through September 30, 2021, for employees and their family members who lost health insurance due to involuntary termination or reduction in hours of their employment

- Allows employees who declined COBRA coverage, or elected it and dropped it, to elect subsidized COBRA

- Does not apply to employees who voluntarily terminated their employment or who qualify for another group health plan

Who Pays For It?

The subsidy is funded through the federal government through a refundable payroll tax credit.

Action Steps

- New employee notice requirements for plan administrators will be issued by the US Department of Labor

- Employees may elect subsidized COBRA starting April 1, 2021, through 60 days after receiving notice of the benefit

FFCRA Leave

What is it?

FFCRA (Families First Coronavirus Response Act) was passed in March 2020 and provided a tax credit for employers to fund two types of paid employee leave required by the law. These leave requirements expired in December 2020, but for employers that chose to continue providing FFCRA leave voluntarily, the tax credit was extended through March 2021.

ARPA Provisions

- Extends tax credit through September 30, 2021

- Adds a provision to include employee time off related to COVID-19 testing and immunization

- Increases the amount of wages eligible for the family leave credit from $10,000 to $12,000 per employee

- Provides an additional 10 days of voluntary emergency paid sick leave for employees beginning April 1, 2021

Unemployment

What is it?

Due to the COVID-19 pandemic, unemployment provisions were expanded under the previous administration to include three new federal unemployment programs. These programs were scheduled to end no later than April 2021.

- Pandemic Unemployment Assistance (PUA): Provided weekly benefits to independent contractors, self-employed individuals, and other workers that typically would not be eligible for unemployment benefits

- Pandemic Emergency Unemployment Compensation (PEUC): Provides weekly benefits to individuals who have exhausted their eligibility for all other unemployment benefits

- Federal Pandemic Unemployment Compensation: Provides an additional $300 weekly payment to individuals already receiving PUA, PEUC, or regular unemployment benefits

ARPA Provisions

- Previously established provisions that were set to expire have been extended through September 6, 2021

- Changes how unemployment benefits are taxed, exempting the first $10,200 from federal income tax for each spouse in households with under $150,000 in adjusted gross income.

ACA

What is it?

The ACA (Affordable Care Act) established health insurance exchanges for the purchase of individual health insurance coverage, as well as premium tax credits. These tax credits are not available to individuals with income at or above 400% of the federal poverty level.

ARPA Provisions

- Temporarily eliminates the income cap on subsidies for a period of two years

- Limits the total amount a household is required to pay for health coverage through the Exchanges to 8.5% of household income

- Increases federal subsidy amounts available for lower-income individuals, in some cases eliminating premium costs entirely

- Increases federal funding intended to encourage states to expand Medicaid programs (if they previously had not done so)

- All provisions are temporary and will expire in two years

DCAP

What is it?

A DCAP (Dependent Care Assistance Plan), also sometimes referred to as a dependent care flexible spending account (FSA), is an employee benefit plan that helps employees pay for the care of a qualifying dependent, such as a child or elder, as defined by Internal Revenue Service (IRS) regulations.

ARPA Provisions

- Increases annual contribution limit from $5,000 to $10,500 ($2,500 to $5,250 for married filing separately) for tax years beginning after December 31, 2020 and before January 1, 2022

- Employers meeting requirements can retroactively amend plans to incorporate the increase

Action Steps

- Employers with DCAPs can retroactively amend plans, if

- The amendment is adopted by the last day of the plan year in which it is effective; and

- The plan operates consistently with the terms of the amendment until it is adopted.

- It is recommended that you speak with your benefits advisor to ensure plans meet the requirements and stay in compliance

Employee Retention Tax Credit

What is it?

The Employee Retention Tax Credit was originally enacted with the CARES (Coronavirus Aid, Relief and Economic Security) Act. The credit was tended to encourage employers to retain employees on their payroll who were unable to work due to COVID-19 related reasons. This credit was set to expire in June of 2021.

ARPA Provisions

- Extends the credit through the end of 2021

- Expands eligibility to some small startups that began operating after February 15, 2020. Qualifying businesses will be eligible for a maximum credit of up to $50,000 per quarter even if they do not experience an eligible decline in gross receipts or a full or partial suspension

- Creates a new provision for 'severely financially distressed' employers which beginning in the third quarter of 2021 allows employers of any size to count all wages toward the $10,000 cap.

IRS: Added FSA / Dependent Care Flexibility for Employee Benefit Plans

On February 18th, due to the pandemic, the IRS provided greater flexibility to employee benefit plans offering health flexible spending arrangements (FSA) and/or dependent care assistance programs.

On February 18th, due to the pandemic, the IRS provided greater flexibility to employee benefit plans offering health flexible spending arrangements (FSA) and/or dependent care assistance programs.

Generally, under these plans, an employer allows its employees to set aside a certain amount of pre-tax wages to pay for medical care and dependent care expenses. Amounts spent by the employee are then reimbursed from their designated health FSAs or dependent care assistance programs.

The added flexibility with Notice 2021-15, is in addition to the changes enacted under the COVID-related Taxpayer Certainty and Disaster Tax Relief Act of 2020, which enabled plans to have additional discretion in 2021 and 2020 to adjust their programs to help employees during the pandemic.

Take a quick read of the overview below to ensure you are aware of these changes that may offer a positive impact for your employees.

Moving the Carry Over Goalpost

Resource: Notice 2021-15

As a result of COVID-19, many regular-use medical or dependent care services were lacking accessibility resulting in participating employees being more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and 2021.

Notice 2021-15 provides added (FSA / Dependent Care) flexibility for employers to:

- Handle carryover of unused amounts from 2020 and 2021 plan years;

- Extend the permissible period for incurring claims (2020 and 2021 plan years);

- Adopt a special rule regarding post-termination health FSA reimbursements;

- Incorporate a special claims period and carryover rule for dependent care assistance programs when a dependent "ages out" during the COVID-19 public health emergency; and

- Allow certain mid-year election changes for health FSAs and dependent care assistance programs for plan years ending in 2021.

Prior Guidance (FSA & Dependent Care)

Previously adopted changes provided flexibility with cafeteria plans through the end of calendar year 2020, during which employers could permit employees to apply unused health FSA amounts and dependent care assistance program amounts to pay for or reimburse medical care or dependent care expenses. The Taxpayer Certainty and Disaster Tax Relief Act of 2020, signed into law on December 27, 2020, extends and expands flexibility for these arrangements in 2021 and 2022.

Next Steps

The decision to adjust these employee benefit programs is at the discretion of the employer that sponsors the plan.

Notice 2021-15 gives employers the option to amend their plans to provide greater flexibility for employees to elect and use these programs during the pandemic without risking the forfeiture of the amounts they have set aside.

If you need help in understanding if making these adjustments is right for you, contact one of our Consultants for a more detailed analysis of your current plan offerings.

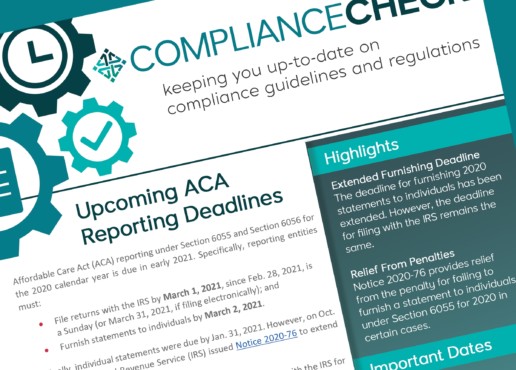

ACA Reporting Deadlines Quickly Approaching

Affordable Care Act (ACA) reporting under Section 6055 and Section 6056 for the 2020 calendar year is due in early 2021. Specifically, reporting entities must:

- File returns with the IRS by March 1, 2021, since Feb. 28, 2021, is a Sunday (or March 31, 2021, if filing electronically); and

- Furnish statements to individuals by March 2, 2021.

Originally, individual statements were due by Jan. 31, 2021. However, on Oct. 2, 2020, the Internal Revenue Service (IRS) issued Notice 2020-76 to extend the furnishing deadline.

Notice 2020-76 does not extend the due date for filing forms with the IRS for 2020. Notice 2020-76 also provides additional penalty relief related to furnishing forms to individuals under Section 6055.

Action Steps

Despite the delay, the IRS is encouraging reporting entities to furnish statements as soon as they are able. No request or other documentation is required to take advantage of the extended deadline.

Section 6055 and 6056 Reporting

- Section 6055 applies to providers of minimum essential coverage (MEC), such as health insurance issuers and employers with self-insured health plans. These entities generally use Forms 1094-B and 1095-B to report information about the coverage they provided during the previous year.

- Section 6056 applies to applicable large employers (ALEs)—generally, those employers with 50 or more full-time employees, including full-time equivalents, in the previous year. ALEs use Forms 1094-C and 1095-C to report information relating to the health coverage that they offer (or do not offer) to their full-time employees.

The ACA’s individual mandate penalty was reduced to zero beginning in 2019. As a result, the IRS has been studying whether and how the Section 6055 reporting requirements should change, if at all, for future years. Despite the elimination of the individual mandate penalty, Section 6055 reporting continues to be required, although transition relief from penalties is available in some situations, as described below. Under this relief, individual statements do not have to be furnished if certain requirements are met.

Standard Deadlines

Generally, forms must be filed with the IRS annually, no later than Feb. 28 (March 31, if filed electronically) of the year following the calendar year to which the return relates. In addition, reporting entities must also furnish statements annually to each individual who is provided MEC (under Section 6055), and each of the ALE’s full-time employees (under Section 6056). Individual statements are generally due on or before Jan. 31 of the year immediately following the calendar year to which the statements relate.

As noted above, individual statements do not have to be provided under Section 6055 if certain requirements are met.

However, filing with the IRS is still required, and this relief does not apply to Section 6056.

Extended Furnishing Deadline

The IRS has again determined that some employers, insurers and other providers of MEC need additional time to gather and analyze the information, and prepare 2020 Forms 1095-B and 1095-C to be furnished to individuals. For 2020, the furnishing deadline was Feb. 1, 2021, since Jan. 31, 2021, is a Sunday. Notice 2020-76 provides an additional 30 days for furnishing the 2020 Form 1095-B and Form 1095-C, extending the due date from Feb. 1, 2021, to March 2, 2021.

Despite the delay, employers and other coverage providers are encouraged to furnish 2020 statements to individuals as soon as they are able.

Filers are not required to submit any request or other documentation to the IRS to take advantage of the extended furnishing due date provided by Notice 2020-76. Because this extended furnishing deadline applies automatically to all reporting entities, the IRS will not grant additional extensions of time of up to 30 days to furnish Forms 1095-B and 1095-C. As a result, the IRS will not formally respond to any requests that have already been submitted for 30-day extensions of time to furnish statements for 2020.

Impact on the Filing Deadline

The IRS has determined that there is no need for additional time for employers, insurers and other providers of MEC to file 2020 forms with the IRS. Therefore, Notice 2020-76 does not extend the due date for filing Forms 1094-B, 1095-B, 1094-C or 1095-C with the IRS for 2020.

This due date remains:

- March 1, 2021, if filing on paper (since Feb. 28, 2021, is a Sunday); or

- March 31, 2021, if filing electronically.

Because the due dates are unchanged, potential automatic extensions of time for filing information returns are still available under the normal rules by submitting a Form 8809. The notice also does not affect the rules regarding additional extensions of time to file under certain hardship conditions.

Penalty Relief Regarding the Furnishing Requirement Under Section 6055 for 2020

The individual mandate penalty has been reduced to zero, beginning in 2019. As a result, an individual does not need the information on Form 1095-B in order to calculate his or her federal tax liability or file a federal income tax return. However, reporting entities required to furnish Form 1095-B to individuals must continue to expend resources to do so.

Therefore, Notice 2020-76 provides relief from the penalty for failing to furnish a statement to individuals as required under Section 6055 for 2020 in certain cases. Specifically, the IRS will not assess a penalty under Section 6722 against reporting entities for failing to furnish a Form 1095-B to responsible individuals in cases where the following two conditions are met:

- The reporting entity prominently posts a notice on its website stating that responsible individuals may receive a copy of their 2020 Form 1095-B upon request, accompanied by an email address and a physical address to which a request may be sent, as well as a telephone number that responsible individuals can use to contact the reporting entity with any questions; and

- The reporting entity furnishes a 2020 Form 1095-B to any responsible individual upon request within 30 days of the date the request is received. The reporting entity may furnish these statements electronically if it meets the requirements for electronic furnishing.

ALEs that offer self-insured health plans are generally required to use Form 1095-C, Part III, to meet the Section 6055 reporting requirements, instead of Form 1095-B. This 2020 Section 6055 furnishing penalty relief does not extend to the requirement to furnish Forms 1095-C to full-time employees. As a result, for full-time employees enrolled in self-insured health plans, penalties will continue to be assessed consistent with prior enforcement policies for any failure by ALEs to furnish Form 1095-C, including Part III, according to the applicable instructions. However, the 2020 Section 6055 furnishing penalty relief does extend to the requirement to furnish the Form 1095-C to any non-full-time employees enrolled in an ALE’s self-insured health plan, subject to the requirements of the 2020 Section 6055 furnishing penalty relief.

The 2020 Section 6055 furnishing penalty relief also does not affect the requirement or the deadline to file the 2020 Forms 1094-B, 1095-B, 1094-C or 1095-C, as applicable, with the IRS.

Judge strikes down parts of DOL's emergency paid leave regs

Dive Brief:

- Several features of the U.S. Department of Labor (DOL)'s regulations implementing the paid-leave provisions of the Families First Coronavirus Response Act (FFCRA) exceeded the agency's authority under federal law, a federal judge has ruled (State of New York v. U.S. Department of Labor, et al., No. 20-CV-3020 (S.D.N.Y. Aug. 3, 2020)).

- Among the struck-down DOL regulations are: the final rule's work-availability requirement; its definition of "health care provider" for the purposes of excluding certain healthcare sector employees from emergency leave benefits; its requirement that an employee secure employer consent for intermittent FFCRA leave; and its requirement that documentation be provided by an employee before taking FFCRA leave.

- The federal judge permitted the outright ban on intermittent leave for certain qualifying reasons — specifically, intermittent leave based on qualifying conditions that correspond with an increased risk of infection — as well as the substance of the final rule's documentation requirement to stand. The court, the judge said, "sees no reason that the remainder of the Rule cannot operate as promulgated in the absence of the invalid provisions."

The ruling is an important one for the nation's first-ever federal paid leave law for private-sector workers. New York originally filed the suit in April following the release of DOL's FFCRA implementation guidance earlier in the month. Shortly before the lawsuit's filing, Congressional Democrats criticized DOL's final rule in a letter to Secretary of Labor Eugene Scalia that said the agency's guidance either deviated from the FFCRA's statute or did not have a basis in it.

Asked about the letter, a DOL spokesperson told HR Dive in April that the agency took "quick action to implement paid sick leave and expanded paid family and medical leave provides necessary support for America's workforce in uncertain times."

The federal judge said in the ruling that DOL faced "considerable pressure" in promulgating its final rule. "This extraordinary crisis has required public and private entities alike to act decisively and swiftly in the face of massive uncertainty, and often with grave consequence," the judge noted. "But as much as this moment calls for flexibility and ingenuity, it also calls for renewed attention to the guardrails of our government. Here, DOL jumped the rail."

Management-side attorneys expect the ruling to be appealed, Bloomberg Law reported. The decision applies nationally, creates uncertainty for employers who experienced pandemic-related shutdowns or reductions in force and requires healthcare employers to "re-examine whether they must provide paid leave" to certain employees, Sami Assad, partner at FordHarrison LLP and chair of the firm's Home Healthcare Practice Group, wrote in an article.

The FFCRA applies to U.S. employers with fewer than 500 employees, but those with fewer than 50 employees may be exempt from two of the law's paid-leave requirements. An authorized officer of the business must use a three-prong test to determine whether the employer may claim an exemption. Also, the IRS has published guidance detailing how small businesses can receive 100% reimbursement for paid leave pursuant to the FFCRA.

SOURCE: Golden, R. (04 August 2020) "Judge strikes down parts of DOL's emergency paid leave regs" (Web Blog Post). Retrieved from https://www.hrdive.com/news/new-york-judge-strikes-down-dol-emergency-paid-leave-reg/582856/

The Saxon Advisor - June 2020

Compliance Check

what you need to know

Eligible Automatic Contribution Arrangement (EACA). For failed ADP/ACP tests, corrective distributions must be made towards participants within 6 months after the plan year ends – June 30, 2020.

SF HSCO Expenditures. The last day to submit SF HSCO expenditures, if applicable*, for Q2 is July 30, 2020. *Applicable for employers with 20+ employees doing business in SF and Non-Profits with 50+ employees.

Form 5500 and Form 5558. The deadline for the 2019 plan year’s Form 5500 and Form 5558 is July 31, 2020 (unless otherwise extended by Form 5558 or automatically with an extended corporate income tax return).

Form 8955-SSA. Unless extended by Form 5558, Form 8955-SSA and the terminated vested participant statements for the plan year of 2019 are due July 31, 2020.

Form 5558. Unless there is an automatic extension due to corporate income tax returns, a single Form 5558 and 8955-SSA is due by 2½ months for the 2019 plan year.

Form 5330. For failed ADP/ACP tests regarding excise tax, Form 5330 must be filed by July 31, 2020.

401(k) Plans. For ADP/ACP testing, the recommended Interim is due August 1, 2020.

In this Issue

- Upcoming Compliance Deadlines:

- Eligible Automatic Contribution Arrangement (EACA)

- The deadline for the 2019 plan year’s Form 5500 and Form 5558 is July 31, 2020.

-

Medicare 101: A Quick Guide For Employers

- Fresh Brew Featuring Abby Graham

- This month’s Saxon U: The Steps Of An Internal Investigation

- #CommunityStrong: Pick your Own Charity! One of our Own, Deborah Raines, made a meal for a family in need at her temple!

The Steps Of An Internal Investigation

Join us for this interactive and educational Saxon U seminar with Pandy Pridemore, The Human Resources USA, LLC, as we discuss the steps of an internal investigation.

Medicare 101: A Quick Guide For Employers

Bringing the knowledge of our in-house advisors right to you...

Medicare is a governmentfunded health insurance program for those aged 65 and above, those under 65 with certain disabilities, and those with End State Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS). Employers that offer group health insurance plans to their employees have an interest in learning how employees’ entitlement to Medicare benefits can affect the administration of those plans.

“Ask a licensed agent for assistance. Advertisements can be confusing, and everyone wants to make the right choice. Using my expertise, I take the fear out of the decision making, so my clients can make an informed decision concerning their healthcare.”

Fresh Brew Featuring Abby Graham

"It’s not that hard to be well!"

This month’s Fresh Brew features Abby Graham, Wellness Director at Saxon.

Abby’s favorite brew is Coffee. Her favorite local spot to grab her favorite brew is Coffee Emporium.

Scott’s favorite snack to enjoy with his brew is Reese’s Pieces Cookies.

This Month's #CommunityStrong:Each member of Saxon will be choosing their own charity that they want to make a positive impact on!

This May, June & July, the Saxon team and their families will be choosing their own charity that they would like to make a positive impact towards!

Are you prepared for retirement?

Saxon creates strategies that are built around you and your vision for the future. The key is to take the first step of reaching out to a professional and then let us guide you along the path to a confident future.

Monthly compliance alerts, educational articles and events

- courtesy of Saxon Financial Advisors.

The Saxon Advisor - May 2020

Compliance Check

what you need to know

Eligible Automatic Contribution Arrangement (EACA). For failed ADP/ACP tests, corrective distributions must be made towards participants within 6 months after the plan year ends – June 30, 2020.

SF HSCO Expenditures. The last day to submit SF HSCO expenditures, if applicable*, for Q2 is July 30, 2020. *Applicable for employers with 20+ employees doing business in SF and Non-Profits with 50+ employees.

Form 5500 and Form 5558. The deadline for the 2019 plan year’s Form 5500 and Form 5558 is July 31, 2020 (unless otherwise extended by Form 5558 or automatically with an extended corporate income tax return).

Form 8955-SSA. Unless extended by Form 5558, Form 8955-SSA and the terminated vested participant statements for the plan year of 2019 are due July 31, 2020.

Form 5558. Unless there is an automatic extension due to corporate income tax returns, a single Form 5558 and 8955-SSA is due by 2½ months for the 2019 plan year.

Form 5330. For failed ADP/ACP tests regarding excise tax, Form 5330 must be filed by July 31, 2020.

401(k) Plans. For ADP/ACP testing, the recommended Interim is due August 1, 2020.

In this Issue

- Upcoming Compliance Deadlines:

- Eligible Automatic Contribution Arrangement (EACA)

- The deadline for the 2019 plan year’s Form 5500 and Form 5558 is July 31, 2020.

- Providing an HSA, FSA, or HRA Health Plan for your Employees

- Fresh Brew Featuring Lexi Kofron

- This month’s Saxon U: How To Legally Work With Gig And Contract Workers

- #CommunityStrong: Families Forward Donation Drive

How To Legally Work With Gig And Contract Workers

Join us for this interactive and educational Saxon U seminar with Pandy Pridemore, The Human Resources USA, LLC, as we discuss how to legally work with Gig and Contract Workers.

Providing an HSA, FSA, or HRA Health Plan for your Employees

Bringing the knowledge of our in-house advisors right to you...

When open enrollment hits annually, it is not uncommon for employers to feel exasperated when staring down a list of acronyms such as HSA, FSA and HRA. As it should go without saying, the most common first thought is, “What does any of this mean?” Even the most seasoned experts have difficulty with understanding the complexities of various care options.

““It is your account; yours if you leave the employer and can contribute as long as you have an HDHP and can use the funds until they are gone, even if you are no longer in an HDHP.” said Kelley Bell, a Group Health Benefits Consultant at Saxon Financial.

Fresh Brew Featuring Lexi Kofron

"Stay calm and collected on phone calls, and stay organized!"

This month’s Fresh Brew features Lexi Kofron, a Client Service Specialist at Saxon.

Lexi’s favorite brew is a Cinnamon Dolce Latte. Her favorite local spot to grab his favorite brew is at Starbucks

Scott’s favorite snack to enjoy is Pretzels and Hummus.

This Month's #CommunityStrong:

Families Forward Donation Drive

This May the Saxon family donated a bunch of household items and outdoor activities to Families Forward. Their staff goes out each week in masks and gloves to hand out these donations to the families in need through their program. Here are some pictures they provided when they passed out the donations and our trunk load of donations!

Are you prepared for retirement?

Saxon creates strategies that are built around you and your vision for the future. The key is to take the first step of reaching out to a professional and then let us guide you along the path to a confident future.

Monthly compliance alerts, educational articles and events

- courtesy of Saxon Financial Advisors.

The Saxon Advisor - March 2020

Compliance Check

what you need to know

Section 6055/6056 Reporting (Electronic Filing Deadline). Applicable large employers (ALEs) that sponsor self-insured health plans are required by Internal Revenue Code Sections 6055 and 6056 to report information about the coverage to the IRS yearly. IRS Forms 1094-C and 1095-C are used to report coverage information. March 31, 2020, is the deadline to submit these forms if employers are filing electronically.

COBRA General Notice. Employers who provide group health plans must provide a written General Notice of COBRA rights to all covered employees and spouses (if applicable). This notice must be provided 90 days after health plan coverage begins.

Summary Plan Description (SPD). Employers who offer group health plans that are subject to ERISA must provide Summary Plan Descriptions (SPD) to employees who newly enrolled at the beginning of the plan year by March 31, 2020.

Form 1099-R (Electronic Filing Deadline). Employers must file Form 1099-R with the IRS by March 31, 2020, if they are filed electronically.

Form 5330 Excise Tax Return. The Form 5330 excise tax return and payment for excess 2018 ADP/ACP contributions are due March 31, 2020.

Excess Contribution Refunds (over IRS limit). April 15, 2020 is the deadline to return excess retirement plan contributions for elective deferrals exceeding the 402(g) limits.

In this Issue

- Upcoming Compliance Deadlines

- Paving the Road to a Successful Portfolio Featuring Brian Bushman

- Upcoming Saxon U Webinar: Employee Navigator Workshop with Jake Meyer

- Fresh Brew Featuring Jake Meyer

- #CommunityStrong: American Heart Association Heart Mini Fundraising & School Donation Drive

Employee Navigator Workshop

Join us for this interactive and educational Saxon U webinar with Jake Meyer, Saxon Financial Services, as we walk you through certain aspects of Navigator and teach you how to use the most common features.

Paving the Road to a Successful Portfolio

Bringing the knowledge of our in-house advisors right to you...

Determining a proper asset allocation is an important first step in creating your portfolio and planning how it will grow in the future. Asset allocation is the process of diversifying your investments into different asset classes based on the investor’s time horizon, their goals and how much risk they can tolerate.

“People always ask me what they can invest in that will make them a lot of money without the chance of losing any,” said Brian Bushman, Saxon Financial Advisor.

Fresh Brew Featuring Jake Meyer

“Educate your employees about their benefits. The more they understand them, the more they will realize how big of a benefit they are.”

This month’s Fresh Brew features Jake Meyer, an Account Executive at Saxon.

Scott’s favorite brew is Rhinegeist Truth, a local Indian Pale Ale from the Rhinegeist Brewery in Cincinnati, Ohio.

Jake doesn’t have a particular snack that he eats when sipping on his favorite brew. He instead likes to enjoy the hops in his favorite IPA.

This Month's #CommunityStrong:

American Heart Association Heart Mini Fundraising

This March, the Saxon team and their families teamed up to raise money for the American Heart Association Heart Mini!

Do you have a strategic approach to the totality of your financial picture?

Saxon creates innovative strategies that will help you figure out how to get there, plan for the risks along the way, navigate complex tax code and understand the steps you need to take to protect and secure your future.

Monthly compliance alerts, educational articles and events

- courtesy of Saxon Financial Advisors.

The Saxon Advisor - February 2020

Compliance Check

what you need to know

Section 6055/6056 Reporting. Employers must file Forms 1094-B and 1095-B, and Forms 1094-C and 1095-C with the IRS by February 28, 2020 if they are filed on paper.

Form 1099-R Paper Filing. Employers must file Form 1099-R with the IRS by February 28, 2020 if they are filed on paper.

CMS Medicare Part D Disclosure. Employers that provide prescription drug coverage must disclose to the CMS whether the plan’s prescription drug coverage is creditable or non-creditable.

Summary of Material Modifications Distribution. Employers who offer a group health plan that is subject to ERISA must distribute a SMM for plan changes that were adopted at the beginning of the year that are material reductions in plan benefits or services.

Section 6055/6056 Individual Statements (2019 EXTENDED DEADLINE). Applicable large employers (ALEs) that sponsor self-insured health plans must disclose information about plan coverage to covered employees each year. This deadline was extended from January 31, 2020, to March 2, 2020, this year by the IRS.

ADP/ACP Refunds. Corrective refunds for a failed ADP/ACP test must be made by March 15, 2020, to avoid 10 percent excise tax penalties.

Section 6055/6056 Reporting (Electronic Filing Deadline). Applicable large employers (ALEs) that sponsor self-insured health plans are required by Internal Revenue Code Sections 6055 and 6056 to report information about the coverage to the IRS yearly. IRS Forms 1094-C and 1095-C are used to report coverage information. March 31, 2020, is the deadline to submit these forms if employers are filing electronically.

COBRA General Notice. Employers who provide group health plans must provide a written General Notice of COBRA rights to all covered employees and spouses (if applicable). This notice must be provided 90 days after health plan coverage begins.

Summary Plan Description (SPD). Employers who offer group health plans that are subject to ERISA must provide Summary Plan Descriptions (SPD) to employees who newly enrolled at the beginning of the plan year.

Form 1099-R (Electronic Filing Deadline). Employers must file Form 1099-R with the IRS by March 31, 2020, if they are filed electronically.

Form 5330. The Form 5330 excise tax return and payment for excess 2018 ADP/ACP contributions are due March 31, 2020.

In this Issue

- Upcoming Compliance Deadlines

- How to Speak to Your Employees About Their Intimidating Benefits – Featuring Jamie Charlton

- Fresh Brew Featuring Nat Gustafson

- This month’s Saxon U: What Employers Should Know About the SECURE Act

- March’s Saxon U: Saxon’s Humana GO365 Annual Wellness Clinic

- #CommunityStrong: American Heart Association Heart Mini Fundraising

What Employers Should Know About the SECURE Act

Join us for this interactive and educational Saxon U seminar with Todd Yawit, Director of Employer-Sponsored Retirement Plans at Saxon Financial Services, as we discuss what the SECURE Act is and how it impacts your employer-sponsored retirement plan.

How to Speak to Your Employees About Their Intimidating Benefits

Bringing the knowledge of our in-house advisors right to you...

Employers spend thousands annually to secure and offer benefits to their employees. However, a small amount of time and money are devoted to ensuring employees understand and appreciate their benefits. Properly communicating – what you say, how you say it and to whom you say it to – can make a tremendous difference in how employees think, feel and react to their benefits, employer and fellow co-workers.

In this installment of CenterStage, Jamie Charlton, founding partner and CEO of Saxon Financial Services, discusses the importance of offering sound education of benefits to employees, as well as how to effectively communicate their benefits in a clear, concise manner.

Fresh Brew Featuring Nat Gustafson

“Always be prepared.”

This month’s Fresh Brew features Nat Gustafson, an Account Manager at Saxon.

In his free time, Nat enjoys snowboarding. When thinking about his greatest adventure, he remembers traveling around Italy. He lives by the catchphrase of, “Roll up your sleeves.”

Nat’s favorite brew is Rhinegeist Truth. His favorite local spot to grab his favorite brew is Mount Lookout Tavern on Linwood Avenue.

Nat’s favorite snack to enjoy with his brew is Chicken wings.

This Month's #CommunityStrong:

American Heart Association Heart Mini Fundraising

This January, February & March, the Saxon team and their families will be teaming up to raise money for the American Heart Association Heart Mini!

Saxon’s Humana GO365 Annual Wellness Clinic

Learn what Go365 is, how it works, how to create engaged employees and how to maximize the 15% wellness incentive credit from the program.

Monthly compliance alerts, educational articles and events

- courtesy of Saxon Financial Advisors.

The Saxon Advisor - January 2020

Compliance Check

what you need to know

Form W-2s are due January 31, 2020. January 31 is the deadline for employers to distribute Form W-2s to employees. Large employers – employers who have more than 250 W-2s – must include the aggregate cost of health coverage.

Form 1099-Rs are due January 31, 2020. Employers must distribute Form 1099-Rs to recipients of 2019 distributions.

Form 945 Distributions. Form 945s must be distributed to plan participants by January 31, 2020, for 2019 non payroll withholding of deposits if they were not made on time and in full to pay all taxes that are due.

Section 6055/6056 Reporting. Employers must file Forms 1094-B and 1095-B, and Forms 1094-C and 1095-C with the IRS by February 28, 2020 if they are filed on paper.

Form 1099-R Paper Filing. Employers must file Form 1099-R with the IRS by February 28, 2020 if they are filed on paper.

CMS Medicare Part D Disclosure. Employers that provide prescription drug coverage must disclose to the CMS whether the plan’s prescription drug coverage is creditable or non-creditable.

Summary of Material Modifications Distribution. Employers who offer a group health plan that is subject to ERISA must distribute a SMM for plan changes that were adopted at the beginning of the year that are material reductions in plan benefits or services

In this Issue

- Upcoming Compliance Deadlines

- Traditional IRA, Roth IRA, 401(k), 403(b): What’s the Difference?

- Fresh Brew Featuring Scott Langhorne

- This month’s Saxon U: What Employers Should Know About the SECURE Act

- #CommunityStrong: American Heart Association Heart Mini Fundraising

What Employers Should Know About the SECURE Act

Join us for this interactive and educational Saxon U seminar with Todd Yawit, Director of Employer-Sponsored Retirement Plans at Saxon Financial Services, as we discuss what the SECURE Act is and how it impacts your employer-sponsored retirement plan.

Traditional IRA, Roth IRA, 401(k), 403(b): What's the Difference?

Bringing the knowledge of our in-house advisors right to you...

If you haven’t begun saving for retirement yet, don’t be discouraged. Whether you begin through an employer sponsored plan like a 401(k) or 403(b) or you begin a Traditional or Roth IRA that will allow you to grow earnings from investments through tax deferral, it is never too late or too early to begin planning.

“A major trend we see is that if people don’t have an advisor to meet with, they tend to invest too conservatively, because they are afraid of making a mistake,” said Kevin Hagerty, a Financial Advisor at Saxon Financial.

Fresh Brew Featuring Scott Langhorne

“Pay close attention to detail.”

This month’s Fresh Brew features Scott Langhorne, an Account Manager at Saxon.

Scott’s favorite brew is Bud Light. His favorite local spot to grab his favorite brew is wherever his friends and family are.

Scott’s favorite snack to enjoy with his brew is wings.

This Month's #CommunityStrong:

American Heart Association Heart Mini Fundraising

This January, February & March, the Saxon team and their families will be teaming up to raise money for the American Heart Association Heart Mini! They will be hosting a Happy Hour at Fretboard Brewing Company Wednesday, January 29, from 4 p.m. - 7 p.m. to raise money.

Are you prepared for retirement?

Saxon creates strategies that are built around you and your vision for the future. The key is to take the first step of reaching out to a professional and then let us guide you along the path to a confident future.

Monthly compliance alerts, educational articles and events

- courtesy of Saxon Financial Advisors.

DOL updates FLSA regular rate rule

With the New Year right around the corner, it's important to know what rules are being updated. The U.S. Department of Labor has updated the "regular rate of pay" to calculate overtime pay. This standard is used to calculate overtime pay under the Fair Labor Standards Act (FLSA). Read this blog post for more information on this final rule.

The U.S. Department of Labor (DOL) has issued a final rule updating the "regular rate of pay" standard used to calculate overtime pay under the Fair Labor Standards Act (FLSA), according to a notice to be published in the Federal Register Dec. 13.

In the rule, DOL clarifies when certain employer benefits may be excluded when calculating overtime pay for a non-exempt employee, including bona fide meal periods, reimbursements, certain benefit plan contributions, state and local scheduling law payments and more. The rule also clarifies how employers may determine whether a bonus is discretionary or nondiscretionary.

The rule will take effect Jan. 12, 2020.

The rule will likely result in employers taking a closer look at their benefits packages, Susan Harthill, partner at Morgan Lewis, told HR Dive in an emailed statement.

A number of employer advocates that submitted comments on DOL’s Notice of Proposed Rulemaking (NPRM), including the Society for Human Resource Management, supported excluding employee benefits like gym memberships, tuition assistance and adoption and surrogacy services from regular rate calculations. Gym memberships and tuition assistance are generally excludable, according to DOL, but the agency said only some forms of adoption assistance would be excludable and that most surrogacy assistance payments would not be.

Employers also inquired about public transportation and childcare subsidies. In the final rule, DOL said public transportation benefits would not be excludable, noting that the agency "has long acknowledged that employer-provided parking spaces are excludable from the regular rate but commuter subsidies are not." But it did add clarifying language around childcare, saying that while "routinely-provided childcare" must be included in the regular rate, emergency childcare services — if those services are not provided as compensation for hours of employment and are not tied to the quantity or quality of work performed — may be excluded.

DOL also offered additional details about its treatment of tuition reimbursement and education-related benefits. As it stated in the NPRM, the agency said that as long as tuition programs are offered to employees regardless of hours worked or services rendered are "contingent merely on one’s being an employee," such programs qualify as "other similar payments" excludable from the regular rate. This includes payment for an employee's current coursework, online coursework, payment for an employee’s family member’s tuition and certain student-loan repayment plans, DOL said.

HR teams should respond by performing audits of the pay codes for benefits that would be impacted, Tammy McCutchen, shareholder at Littler Mendelson, told HR Dive in an interview: "This is a good time to get your calculations correct." McCutchen suggested that employers conduct audits first before deciding whether to expand benefits options in light of the rule. She added that it's an employer's responsibility to notify payroll providers of any changes to exemptions.

Employers also will need to check state laws and consult with counsel ahead of implementing changes to employees' regular rates, as those laws may differ from DOL's new rule, Harthill said. Moreover, "[t]his is an interpretive rule and it remains to be seen whether courts will defer to DOL's interpretation of the rule or if any resultant exclusions are challenged," she added.

SOURCE: Golden, R. (12 December 2019) "DOL updates FLSA regular rate rule" (Web Blog Post). Retrieved from https://www.hrdive.com/news/dol-updates-flsa-regular-rate-rule/568954/