7 wellness program ideas you may want to steal

Need more energy and excitement in your office? Keep your employees healthy and motivated with these fun wellness program ideas.

Building your own workplace wellness program takes work–and time–but it’s worth it.

“It’s an investment we need to make,” Jennifer Bartlett, HR director at Griffin Communication, told a group of benefits managers during a session at the Human Resource Executive Health and Benefits Leadership Conference. “We want [employees] to be healthy and happy, and if they’re healthy and happy they’ll be more productive.”

Bartlett shared her experiences building, and (continually) tweaking, a wellness program at her company–a multimedia company running TV outlets across Oklahoma –over the last seven years. “If there was a contest or challenge we’ve done it,” she said, noting there have been some failed ventures.

“We got into wellness because we wanted to reduce health costs, but that’s not why we do it today,” she said. “We do it today because employees like it and it increases morale and engagement.”

Though Griffin Communication's wellness program is extensive and covers more than this list, here are some components of it that's working out well that your company might want to steal:

- Fitbit challenge.Yes, fit bits can make a difference, Bartlett said. The way she implemented a program was to have a handful of goals and different levels as not everyone is at the same pace-some might walk 20,000 steps in a day, while someone else might strive for 5,000. There are also competition and rewards attached. At Griffin Communications, the company purchased a number of Fitbits, then sold them to its employees for half the cost.

- Race entry.Griffin tries to get its employees moving by being supportive of their fitness goals. If an employee wants to participate in a race-whether walking or running a 5k or even a marathon, it will reimburse them up to $50 one time.

- Wellness pantry.This idea, Bartlett said, was "more popular than I ever could have imagined." Bartlett stocks up the fridge and pantry in the company's kitchen with healthy food options. Employees then pay whole sale the price of the food, so it's a cheap option for them to instead of hitting the vending machine. "Employees can pay 25 cents for a bottled water or $1.50 for a soda from the machine."

- Gym membership."We don't have an onsite workout facility, but we offer 50 percent reimbursement of (employees') gym membership cost up to a max of 200 per year," she said. The company also reimburses employees for fitness classes, such as yoga.

- Biggest Loser contest.Though this contest isn't always popular among companies, a Biggest Loser-type competition- in which employees compete to lose the most weight-worked out well at Griffin. Plus, Bartlett said, "this doesn't cost us anything because the employee buys in $10 to do it." She also insisted the company is sensitive to employees. For example, they only share percentages of weight loss instead of sharing how much each worker weights.

- "Project Zero" contest.This is a program pretty much everyone can use: Its aim is to avoid gaining the dreaded holiday wights. The contest runs from early to mid- November through the first of the year. "Participants will weigh in the first and last day of the contest," Bartlett said. "The goal is to not gain weight during the holidays-we're not trying to get people to lose weight but we're just to not get them to not eat that third piece of pie."

- Corporate challenges.Nothing both builds camaraderie and encourages fitness like a team sports or company field day. Bartlett said that employees have basically taken this idea and run with it themselves- coming up with fun ideas throughout the year.

SOURCE:

Mayer K (14 June 2018) "7 wellness program ideas you may want to steal" [Web Blog Post]. Retrieved from https://www.benefitspro.com/2015/10/10/7-wellness-program-ideas-you-may-want-to-steal/

Viewpoint: Coaching Your Employees to Finish Strong as They Near Retirement

10,000 people a day are retiring. Help your employees transition into retirement with these important strategies.

Baby Boomers are beginning to retire in large numbers. AARP says 10,000 people a day are retiring from work. Most companies have no formal program to aid these employees in this transition. Although we often have extensive onboarding programs, little to nothing is done when an employee is ending his or her career, except a goodbye party.

For many people, upcoming retirement means coasting until the day they are done. Dave was a senior-level manager who announced his retirement one year in advance. The problem was that Dave then became "retired on the job." He stopped innovating. He stopped moving new ideas forward. He avoided conflict by ignoring problems. He no longer aggressively led his team.

Dave had been very successful in his career but he ended poorly, so that was how everyone remembered him. His team suffered poor morale because its members felt they were stuck until Dave left his position. That is a problem for the whole company.

Help retiring employees to end strong at your company. Instead of letting employees coast and drain the company coffers, HR can support retiring workers as they end their careers in the best way possible, fully contributing up until the last day.

Some key strategies include:

- Creating a planning-to-retire educational program.HR should develop a workshop to show employees how to plan out their future, paying special consideration to how they will handle all the free time they will have once they leave the company. The course can cover financial planning, too. The employee will be grateful for this assistance.

- Coaching the employee's manager.Managers of departing employees need instruction on how to support someone leaving the group. The formal coaching should offer proven strategies to keep the employee engaged until his or her last day. The supervisor should encourage the employee to complete as many key projects as possible and accept the responsibility to not let the employee become retired on the job.

- Documenting their knowledge.As many Baby Boomers walk out the door, their depth of experience and insight depart with them. Companies should have these employees document their knowledge by creating a training manual or by adding pages to the organization's intranet so other employees can learn from these folks.

- Training a new employee.Ideally, the organization should promote or hire a replacement and have the departing employee train the new person. Having a two- to three-week training period helps the new employee get up to speed and be more productive, more quickly.

- Offering a "bridge job."Finding talented workers to replace departing Baby Boomers will become harder to do in our tight labor market. Developing a transitional or bridge job where the employee remains at work on a part-time basis may allow the company to avoid the quest for talent that is often not available. Baby Boomers want more flexibility and fewer work hours at the end of their career. In fact, 72 percent say they plan to work in their retirement. Annette was an IT specialist who wanted to leave the energy utility she worked for. The HR department was under the gun to deliver a new human resource information system and asked her to continue working three days a week with the ability to take more unpaid vacations. This new bridge job kept her in her role for 18 months until the big project was completed.

Final days may be a bittersweet time for employees to say goodbye to their co-workers, friends and the company itself. Having a supportive send-off is a great policy to ensure that everyone leaves on a positive note and will speak highly of your organization after the departure.

SOURCE:

Ryan R (4 June 2018) "Viewpoint: Coaching Your Employees to Finish Strong as They Near Retirement" [Web Blog Post]. Retrieved from https://www.shrm.org/ResourcesAndTools/hr-topics/benefits/Pages/Viewpoint-Coaching-Your-Employees-on-Finishing-Strong-As-They-Retire-.aspx?_ga=2.37756515.1310386699.1527610160-238825258.1527610159

Employee benefit satisfaction has direct relation to job fulfillment

New reports say that employees would sacrifice pay increases for better benefits. Heres some tips on how to keep your employees satisfied.

A link between the satisfaction workers feel about their benefits — both employment based and voluntary — has a direct relation with retention opportunities for employers.

Eight in 10 employees who ranked their benefits satisfaction as extremely or very high also ranked job satisfaction as extremely or very high, according to Employee Benefit Research Institute’s recent 2017 Health and Workplace Benefits Survey. Additionally, nearly two-thirds of respondents who ranked benefits satisfaction as extremely or very high ranked their morel as excellent or very good.

“It is important for employers to understand that benefits continue to be valued by employees,” says Paul Fronstin, director of the health research and education program at EBRI. “Health insurance, retirement plans, dental, vision and life insurance continue to be highly important when making job change decisions.”

In fact, the survey finds that more than four in 10 respondents say they would forgo a wage increase to receive an increase in their work-life balance benefits, and nearly two in 10 state a preference for more health benefits and lower wages.

Employees continue to indicate benefits play a key role in whether to remain at a job or choose a new job. Since 2013, health insurance consistently remains one of the top benefits that employees consider in assessing a job change.

Last year, 83% say health insurance is very or extremely important in deciding whether to stay in or change jobs. A retirement savings plan is also one of the critical benefits, with 73% indicating it is extremely or very important in determining whether to stay in or switch jobs.

Although employees say they are generally satisfied with the employee benefits provide today, there is a growing concern benefit programs might start to dwindle. When asked, only 19% of respondents say they are extremely confident in what will be provided will be similar to what they have now in three years.

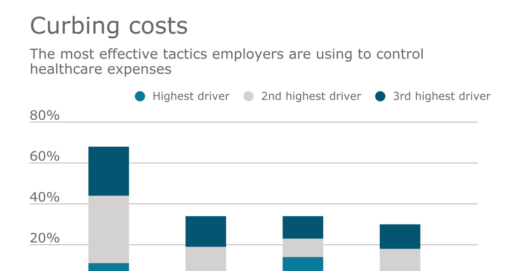

Other challenges remain

“The challenge is how employers can continue to provide the strong employee benefits package that employees want and need, while still controlling the costs of these benefits, particularly healthcare,” Fronstin notes.

Employee education on benefit offerings could use some beefing up. According to the study a little more than one-half (52%) of employees say they understand their health benefits and 43% indicate they understand their non-health benefits very/extremely well.

Some of this limited understanding of benefits may come from the lack — or perceived lack — of benefit educational opportunities that employees are receiving from their employer, according to the study.

Nearly one-third (31%) of employees indicate that their employer or benefits company provides no education or advice on benefits. Only 39% state that their employer provides education on how health insurance works, 24% say that their employer provides education on how a health savings account works, and 28% confirm that their employer offers education on how to invest money in their retirement plan.

In any case, Fronstin adds, “as employers weigh the future of benefits, they should consider that health insurance consistently remains one of the top benefits that employees consider in assessing a job change, with retirement savings plan also viewed as a critical benefit.”

SOURCE:

Otto N (4 June 2018) "Employee benefit satisfaction has direct relation to job fulfillment" [Web Blog Post]. Retrieved from https://www.benefitnews.com/news/employee-benefit-satisfaction-has-direct-relation-to-job-fulfillment

Five Practical Ways to Support Mental Well-being at Work

Mental well-being impacts engagement, absenteeism and productivity. Discover how help make the workplace atmosphere and environment more pleasant with these tricks.

The American Institute of Stress reports that stress is the nation’s top health problem. This makes sense, as mental capacity is highly valued in the workplace but can also be highly vulnerable. Today’s workplace, with technology, fast-paced growth and decreased resources, can contribute to increased stress.

Companies should value the mental health of their employees as a top asset and fiercely protect it. Mental well-being impacts engagement, presenteeism, absenteeism and productivity — all of which impact businesses bottom lines. More importantly, supporting and protecting the mental health of your employees is the right thing to do.

Here are five best practices to support mental health in the workplace.

- Normalize the conversation.

Top-down support of mental health is crucial in creating an open dialogue, as is an open-door policy. Senior leaders should participate in the conversation about mental wellbeing to show buy in. Normalizing the occurrence of a grief reaction or stress disorder can insure that your employees seek help when it happens to them.

Establishing mental health champions within your organization is another way to encourage a healthy dialogue. People with mental health conditions who want to help others are great candidates for this role.

Use awareness days that focus on stress and mental health as external nudges to educate staff about these important issues. Importantly, remind staff that a diversity of perspectives, including those with lived mental health experiences, are valued and encouraged in inclusive environments.

- Implement strong policies and procedures.

Disclosure can help an employee seek the appropriate resources and care before conditions worsen, so having proper policies and procedures in place are important in removing barriers to disclose.

This includes protection against discrimination, which is usually a top concern for employees, as well as providing appropriate workplace accommodations. Ensure managers are aware of key resources, like employee assistance programs, and maintain confidentiality when an employee discloses information.

Beyond this, educate employees on policies, procedures and proper protocols to increase employee awareness. Here’s a tip: Repeat key messages and tailor your communications to better reach your staff.

- Prevention is better than cure.

It’s essential to remember that anyone is susceptible to stress and a resulting decline in their mental health, whether a preexisting condition exists or not. Big life events like having a baby or losing a loved one and every day struggles like money worries, relationship issues or work-related stress can cause or aggravate mental health conditions to the point of interfering with work.

Mental wellness sessions or work/life balance programs can help. Bring in an expert and talk to your staff about how to safeguard their own mental health, build resilience and recognize signs of distress in others.

- Tailor your benefits package to support mental wellbeing.

Choose a major medical plan that gives employees access to quality mental health specialists in network, as these costs can add up significantly. Helping employees have access to and triage the right specialist support is crucial in managing conditions.

EAPs can act as a first line of defense for a wide range of problems – from money and relationship worries to support for working caregivers. They provide both practical and emotional support for employees through confidential counseling and can help prevent issues from escalating and impacting productivity. These programs are often offered as part of a major medical or disability plan, so your company may already have access to them.

Money worries can also take an emotional toll on wellbeing. In fact, financial concerns were the leading cause of stress across all generations in a recent consumer study conducted by my company, Unum.

Help your employees establish a strong financial foundation by offering financially-focused benefits, like life and disability insurance, retirement savings options and supplemental health benefits that can close the rising financial gap in medical plans.

If your budget doesn’t cover these benefits, consider offering them on a voluntary basis. Access to financial protection benefits are more affordable when offered through the workplace, even if the employee picks up the cost.

Flexible hours or remote working options can also help employees schedule their work days when they’re feeling most productive. This can help reduce presenteeism for mental ill-health, and it also signals to employees that you’re supportive of a healthy work/life balance.

- Encourage self-care.

Self-care plays a critical role in overall wellbeing. Encourage employees to do small tasks that’ll help them build resilience over time.

The basics like getting plenty of sleep, eating healthy, drinking water, and exercising are foundational in overall wellbeing.

Beyond these staples, developing appropriate time management and work/life balance skills are also important. Delegating and collaborating are also key to ensure healthy work behaviors which also decrease stress.

While technology and our always-on culture make it hard to disconnect, encourage employees to set device off-times so they can fully recharge before the next day. And most important, model this behavior to your staff and limit after hours work and emails.

Having a holistic mental well-being strategy that includes prevention, intervention and protection is essential for unlocking a workforce’s true potential.

SOURCE:

Jackson M (4 June 2018) "Five Practical Ways to Support Mental Well-being at Work" [Web Blog Post]. Retrieved from https://www.workforce.com/2018/05/18/five-practical-ways-support-mental-well-work/

The Business Case for Providing Health Insurance to Low-Income Employees

Low income employees without health insurance could be detrimental for a business. This study explains why providing health insurance for low income employees is crucial for successful performance in the workplace.

After the failed negotiations over the repeal of Obamacare earlier in March, the Trump administration appears to be on the brink of proposing a new health care bill. While the details are still sketchy, it seems likely that the new bill will leave many lower-income Americans without access to health insurance.

I believe there is a case to be made that, should this take effect, the private sector has a strong incentive to step in. The provision of health insurance by organizations is a sensible business decision—especially for low-income individuals. In fact, a number of studies—including one that I co-authored—highlight that health insurance coverage can be beneficial to the bottom line of businesses, and should be endorsed by managers as good corporate strategy if they seek to increase their productivity.

Health insurance for low-income employees is good business for at least three reasons: it is linked with reduced levels of stress, more long-term decision-making, and increased cognitive ability, as well as (perhaps somewhat obviously) increased physical health — all of which are crucial components of higher organizational performance.

Health Insurance Can Reduce Stress

Among other positive outcomes, health insurance significantly decreases the level of stress employees experience, as a study described in a recent working paper shows. Johannes Haushofer of Princeton University and several colleagues worked with an organization in Nairobi, Kenya — the metalworkers of the Kamukunji Jua Kali Association (JKA) — and randomly allocated some employees to receive health insurance free of cost for one year. In other words, the researchers sponsored a health care plan for a proportion of JKAs’ employees, whereas others continued working for JKA as usual.

In addition to collecting data through surveys — for example on the employees’ self-reported health and well-being, and their household characteristics — the researchers did something rather unusual: they collected saliva samples from all respondents, which were later tested for the stress hormone cortisol. These measurements occurred at two time points, at the start of the study and at the end.

The researcher’s results were striking. Not only did employees who received free health insurance report feeling less stressed, but this decline correlated with a reduction in the cortisol measured in the saliva sample. The decrease in cortisol was comparable to roughly 60% of the difference between people who are depressed, and people who are not.

This is important for organizations because employees who experience higher levels of stress are more prone to burning out, and less likely to attain high levels of performance. Stressed employees hurt the bottom-line — and interventions that reduce stress benefit it.

Health Insurance Can Lead to More Long-Term Decision-Making

But health insurance can do more, too. A paper I co-authored with Elke Weber of Princeton University and Jaideep Prabhu of Cambridge University that was recently published in the Proceedings of the National Academy of Sciencesfocuses on one reason why low-income individuals have difficulties escaping their destitute situation. As research has found, we show that poor people are more likely to make decisions that favor the short term, even when these decisions involve smaller payoffs than larger payouts they might receive in the future.

In our study, we find that this is partially the case because low-income individuals experience more pressing financial needs than their richer counterparts. Because they are so pre-occupied with making ends meet, they are unable to even consider a possible larger payout in the future. This way, they remain captured in what Johannes Haushofer and Ernst Fehr of the University of Zurich so aptly call the “vicious cycle of poverty.”

However, we also find that interventions that serve to reduce levels of financial need that low-income individuals experience can make them more likely to make more long-term-oriented decisions. One such intervention may be the provision of health insurance. With a safety net they can draw on when health problems arise, poor people may be less likely to experience their financial needs as pressing — and as a result, make more long-term-oriented decisions.

This can lead to significant improvements for organizations as well. Companies require their employees to make many long-term decisions. In many cases, a more long-term orientation is necessary for companies to thrive.

Not Having Health Insurance Can Hinder Cognitive Ability

Finally, health insurance can give low-income individuals peace of mind. A seminal study led by Anandi Mani of the University of Warwick investigated the cognitive consequences of poverty. The researchers found — in concordance with an increasing body of evidence — that lack of money saps people’s attention. While they did not specifically study health insurance, it is easy to extrapolate their research to this question. Given that everyone’s attention is limited, the more people’s concerns weigh on their mind, the less attention they can pay to any one concern.

To illustrate this finding, imagine a case where a low-income employee uses her car to come to work every day. She lives paycheck to paycheck and depends on her steady stream of income. Every day, even when she isn’t driving, she worries about what she would do if her car broke down. Such thoughts circle in her mind incessantly — they are always there, no matter what else she tries to focus her attention on.

Obviously, such worrying thoughts have detrimental consequences for her performance. Constant ruminations make it more difficult to focus on tasks that matter in the moment. Now replace the car in the above scenario with her health; let’s assume she has a chronic condition that requires medical attention when it breaks out. This is not an uncommon case: over 34% of employees have chronic medical conditions, which are even more widespread amongst low-income individuals.

Although many of these physical ailments cannot be cured, their accompanying cognitive detriments can be. Thoughts such as, “How will I pay for the doctor? How can I afford my medication?” could be eradicated with the provision of health insurance. This is especially important for low-income individuals who are more likely to have such worries. And with an increased ability to focus on their work, employees are also more likely to be productive members of the organization.

It is unclear what will happen in Washington D.C. in the next few months. Will Obamacare be repealed? Will millions of low-income individuals lose their health insurance? In the absence of a resolution, managers may have to step up. There is a business case to be made for providing employees with health insurance, which may make them less stressed, improve their long-term decisions, and lead to increased attention on the task at hand — and the case is especially strong for low-income employees.

SOURCE:

Jachimowicz J (29 May 2018). [Web Blog Post]. Retrieved from address https://hbr.org/2017/04/the-business-case-for-providing-health-insurance-to-low-income-employees

Could These 3 Reasons Be Behind Your Failing Employee Engagement?

Encouraging employee engagement with health benefits

In a competitive economy, a robust package of employee health benefits is one of the key elements that employers need to attract and to retain a skilled, experienced workforce. In fact, according to statistics gathered by Collective Health and Harris Poll, 78% of adults in the U.S. say healthcare benefits strongly factor into their decision on where to accept a job. However, once employees have these benefits, most do not take full advantage of the complete range of services and support available. Only 25% of employees questioned in one survey said they have used all the preventive care benefits offered by their employer.

Another survey, conducted by the American Psychological Association, found that only 33% of employees report participating in employer-provided health promotion programs. The failure to engage with and use the benefits available can have an especially significant impact when employees or their family members face serious or complex medical issues, such as a cancer diagnosis or recommendation for surgery. When employees don’t use the full spectrum of benefits available to them, such as second opinions and case management, the risk of poorer health outcomes and higher employer and employee healthcare costs increases, with more than $210 billion a year spent on inappropriate and unnecessary treatment according to an Institute of Medicine report. Several factors contribute to employees’ failure to use all the health benefits available to them:

Problems with the benefits selection process: Although the choice of benefits can have wide ranging effects on both physical and financial health, 77% of employees spend 60 minutes or less choosing benefits, while 46% spend 30 minutes or less on this important decision, according to an Aflac poll. Another survey noted the high stress levels associated with making benefit decisions, finding that 49% of employees say making benefits decisions is always stressful.

Not understanding the options: A survey by the International Foundation of Employee Benefits Plans found that approximately 80% of organizations reported that employees do not have a high level of understanding of their benefits. This lack of understanding comes at a financial cost. According to 42% of employees in the Aflac survey, the estimated cost of errors employees make understanding and choosing benefits can cost them up to $750 per year.

Complexity of benefits: When faced with multiple benefit providers and contact points, employees often do not know where to find the information they need to understand the benefits available to them and how to access them. As a result, employees fail to access the information, resources and support that can help them make informed medical decisions. This can have a negative impact on health outcomes and healthcare costs.

—benefitnews.com

Strengthening the Relationship between Education and Employers: Johnny C. Taylor, Jr., Appointed Chair of President’s Board of Advisors on HBCUs

From the SHRM CEO, here is his opinion on the newly appointed Chair of President’s Board of Advisors on HBCUs.

Johnny C. Taylor, Jr., SHRM-SCP, president and chief executive officer of the Society for Human Resource Management, was appointed chair of the President’s Board of Advisors on Historically Black Colleges and Universities (HBCUs) at a White House ceremony today.

In accepting the volunteer advisory appointment to the White House Initiative on HBCUs by President Donald Trump, Taylor gave these remarks:

Thank you, President Trump and Secretary DeVos.

I appreciate the trust you have placed in me to chair the President’s Board of Advisors on HBCUs. It has been my life’s work to unleash talent — in all its forms, from wherever it originates.

As CEO of the Society for Human Resource Management (SHRM), I work with employers across the country. No matter their industry, size or longevity, today’s organizations all share the same challenge — closing the skills gap while building diverse, inclusive, engaged workforces.

For each of them, the “War for Talent” will never end and, thanks to this incredibly strong economy we’re experiencing, it is now a way of life. And today, people are an organization’s only competitive edge.

Employers depend on our country’s educational institutions as a reliable source of the multi-faceted talent they need. HBCUs are a critical conduit for this talent. Every year, over 300,000 students turn to these institutions for their education and to prepare them for their careers.

This President’s Advisory Board can be the nexus between higher education institutions and employers. As a CEO (in both non-profit and for-profit businesses), a former Fortune 500 chief HR executive, and someone with over 7½ years of experience in the HBCU space, I am up for this very challenge.

At SHRM, we are the experts on people and work and on building powerfully diverse organizational cultures that drive success. SHRM’s 300,000 members impact the lives of over 100 million people in the American workforce. SHRM is also an experienced academic partner, currently providing human resources curricula through 465 programs on 354 college campuses.

By working together, across all sectors, the HR profession, HBCUs and this Advisory Board can strengthen the relationship between education and employers. This Advisory Board can facilitate this critical relationship and support innovations in work-based learning opportunities for HBCU students. And as the world’s largest human resources association, SHRM can work with CEOs to connect industry to the diverse talent at these institutions.

This Board has an incredible opportunity to highlight HBCUs as wellsprings of the diverse talent American employers want and need today. HR and education, along with the support of this administration, must move together, forward.

Read the article.

Source: SHRM (27 February 2018). "Strengthening the Relationship between Education and Employers: Johnny C. Taylor, Jr., Appointed Chair of President’s Board of Advisors on HBCUs" [Web Blog Post]. Retrieved from address https://blog.shrm.org/blog/strengthening-the-relationship-between-education-and-employers-johnny-c-tay

Algorithmic Bias – What is the Role of HR?

How should HR professionals deal with the forthcoming algorithmic bias issue? Find out in this article.

Merriam-Webster defines ‘algorithm’ as step-by-step procedure for solving a problem…In an analog world, ask anyone to jot down a step-by-step procedure to solve a problem – and it will be subject to bias, perspective, tacit knowledge, and a diverse viewpoint. Computer algorithms, coded by humans, will obviously contain similar biases.

The challenge before us is that with Moore’s Law, cloud computing, big data, and machine learning, these algorithms are evolving, increasing in complexity, and these algorithmic biases are more difficult to detect – “the idea that artificially intelligent software…often turns out to perpetuate social bias.”

“Algorithmic bias is shaping up to be a major societal issue at a critical moment in the evolution of machine learning and AI. If the bias lurking inside the algorithms that make ever-more-important decisions goes unrecognized and unchecked, it could have serious negative consequences, especially for poorer communities and minorities.”What is the role of HR in reviewing these rules? What is the role of HR in reviewing algorithms and code? What questions to ask?

In December 2017, New York City passed a bill to address algorithmic discrimination.Some interesting text of the bill, “a procedure for addressing instances in which a person is harmed by an agency automated decision system if any such system is found to disproportionately impact persons;” and “making information publicly available that, for each agency automated decision system, will allow the public to meaningfully assess how such system functions and is used by the city, including making technical information about such system publicly available where appropriate;”

Big data, AI, and machine learning will put a new forward thinking ethical burden on the creators of this technology, and on the HR professionals that support them. Other examples include Google Photos incorrect labeling or Nikon’s facial detection. While none of these are intentional or malicious, they can be offensive, and the ethical standards need to be vetted and reviewed. This is a new area for HR professionals, and it’s not easy.

As Nicholas Diakopoulos suggests, “We’re now operating in a world where automated algorithms make impactful decisions that can and do amplify the power of business and government. As algorithms come to regulate society and perhaps even implement law directly, we should proceed with caution and think carefully about how we choose to regulate them back.”

The ethical landscape for HR professionals is changing rapidly.

Read more.

Source: Smith R. (15 February 2018). "Algorithmic Bias – What is the Role of HR?" [Web Blog Post]. Retrieved from address https://blog.shrm.org/blog/algorithmic-bias-what-is-the-role-of-hr

Miserable Modern Workers: Why Are They So Unhappy?

It's a new year, which means working to improve the bad. What's so bad about today's work environment? Employees are more disengaged than ever. So, how can employers fix that? Let's take a look at the basic facts and possible first steps.

Today's workers are disengaged. They lack motivation. They're bored. They're stressed. They're burned out.

Researchers at Gallup, Randstad and Mercer conducting survey after survey have come to these conclusions. In fact, these surveys seem to paint an increasingly bleak picture of life at work.

At a time when technology has arguably made the workplace more efficient than ever, laws are protecting employees better than ever, and companies are offering benefits perhaps more generous than ever, why would U.S. workers be so checked out?

"One could argue that today's employees are as equally stressed as their predecessors, but for different reasons," said Jodi Chavez, president of Atlanta-based Randstad Professionals, a segment of Randstad US, which provides finance, accounting, HR, sales, marketing, legal staffing and recruitment services. "They fear having their jobs outsourced to another country, have anxiety about how best to work alongside new technologies such as automation and robotics, have increased financial pressures with rising student loan debt and late retirement, and feel pressure to be 'on' and answering e-mails 24/7."

Disengagement Can Lead to Bad Habits

Gallup has been measuring employee engagement in the United States since 2000 and finds that less than one-third of U.S. workers report that they are "engaged" in their jobs. Of the country's approximately 100 million full-time employees, 51 percent say they are "not engaged" at work—meaning they feel no real connection to their jobs and tend to do the bare minimum. Another 17.5 percent are "actively disengaged"— meaning they resent their jobs, tend to gripe to co-workers and drag down office morale. Altogether, that's a whopping 68.5 percent who aren't happy at work.

Recently, Randstad US found in its own survey that disengagement has led to some bad habits among the nation's workers: Unhappy workers admitted that while on the job, they drank alcohol (5 percent), took naps (15 percent), checked or posted on social media (60 percent), shopped online (55 percent), played pranks on co-workers (40 percent), and watched Netflix (11 percent).

"Some employers may see checking social media a few times a day as a small offense, while napping on the job or watching Netflix could be considered serious safety hazards for other employers," Chavez said. "Really, we found that these results are part of a bigger story—a trend of burnout and job dissatisfaction. Burnout is a natural human reaction to stressful environments, or long workdays, but it may also be a sign that an employee isn't the right fit for a position. It's important for employers to be aware of these habits, evaluate if they're a sign of a larger issue and identify what they can do to help employees feel appreciated."

Even if today's workers are no more disengaged than workers of decades past, three things may be making the "commentary on disengagement louder," said Ken Oehler, global culture and engagement practice leader with London-based Aon:

Scrutiny. "Management focus on people and talent is much greater now than in the past," he said. "Three or four decades ago, studies could not find a link between job satisfaction and performance, and the concept of engagement did not even exist. There are now many studies establishing the link between engaged employees and better performance. With this we have seen a great increase in the measurement and thirst for understanding [of] how to maximize the employee experience, employee engagement and employee performance. So when the rate of disengaged employees does not seem to change much, management becomes dissatisfied and wants to know what can be done."

Expectations of work. "Employee expectations about work are dramatically different than a few decades past," he said. "Few workers sign up thinking they will be employed by the same company for life and be rewarded with a nice pension. Most Millennials don't want that. They thirst for development, advancement, movement, impact and purpose. So, when that doesn't happen, [discontent] can get loud."

Rate of change. The constant technological demands and steep learning curves of many modern jobs can overwhelm the senses, he said. "I believe many workers are worried about keeping up with this rate of change and having the relevant skills required for the future. Companies and employees need to be smarter and faster, and the technology involved in work is largely unchanged or inadequate. This is really stressful when the need and rate of change increases and the technology, tools and processes do not support this."

Are Small 'Fixes' Enough?

The "fixes" that employee engagement experts often suggest to make workers happier on the job, however, may not be making much of a difference—at least not if recent surveys measuring employee satisfaction are to be believed.

"Will simple things like getting a good night's sleep, asking for help or finding a creative outlet transform every employee's attitude?" asked Chavez. "No. But these small fixes are easy, actionable things that people can try if they're truly stressed, exhausted or having external problems, as these changes can boost productivity and overall happiness at work. If not, then maybe the employee needs to do some deeper exploring as to whether the job, employer or even career are a good fit."

The pressures put on modern workers to "do more with less" may be the result of business shareholders who—having grown cautious following the Great Recession—aren't willing to expand budgets to hire more people at companies or better compensate those already there, Chavez and Oehler said. Worker pay has remained relatively flat since the recession, with nominal annual increases even though the economy and markets are said to be booming.

"Ensuring that you get pay right is critical," Oehler said. "Perceptions of pay inequity will erode trust and engagement."

Said Chavez: "It's true that wages have remained relatively flat for the last several years. At the same time, there's more competition for top, skilled talent, so employers are becoming more creative when it comes to benefits. These benefits can come in many different forms—student loan benefits, access to telemedicine, stipends for commuting, flexible hours and remote work arrangements. While some may prefer higher salary over increased vacation time, some value robust learning and development programs. As for what makes work gratifying, every employee is different."

Source:

Wilkie D. (2 November 2017). "Miserable Modern Workers: Why Are They So Unhappy?" [web blog post]. Retrieved from address https://www.shrm.org/resourcesandtools/hr-topics/employee-relations/pages/employee-engagement-.aspx