As Daylight-Saving Time Ends, Wages & Hour Problems Begin

On November 3 this year, daylight saving time will end in most states. This change presents challenges for employers who have nonexempt employees working at 2 a.m. when the clocks are set back one hour. Read this blog post from SHRM for wage and hour implications that stem from the end of daylight savings time and how to prepare to "spring forward".

On Sunday, Nov. 3, 2019, at 2:00 a.m., daylight saving time will end and in most states clocks will be set back one hour. As it does every year, this change presents a challenge for employers whose nonexempt employees are working during that time.

This wage and hour issue will affect all employers that employ nonexempt employees with the exception of those working in Arizona and Hawaii, both of which do not observe daylight savings time.

Below are some of the wage and hour implications stemming from the end of daylight savings time:

- Employers are required to pay employees for all hours worked. However, employers whose nonexempt employees are working at 2:00 a.m. on Sunday, Nov. 3, must pay them one additional hour of pay unless the start/end times of their shifts are adjusted in anticipation of the time change. In essence, such an employee will have worked the hour from 1:00 a.m. to 2:00 a.m. twice.

- Employers whose nonexempt employees are working at that time might owe those employees overtime compensation as a result of the time change. That is, employers must include the additional hour of work in determining the employee's overtime compensation for the week.

- In addition, employers must take this additional hour of work into account when computing the employee's regular rate of pay for purposes of calculating the employee's overtime rate.

Preparing to 'Spring Forward'

Employers also should be aware of their pay obligations at the beginning of daylight savings time in the spring. Nonexempt employees who are working on Sunday, March 8, 2020, at 2:00 a.m.—when clocks will spring forward to 3:00 a.m.—are entitled to one less hour of pay than they otherwise would have been. So, an employee scheduled to work an eight-hour shift from 11:00 p.m. to 7:00 a.m. will only have worked seven hours because essentially the employee did not work from 2:00 a.m. to 3:00 a.m.

Employers that decide to pay such workers for a full eight-hour shift are not required under the Fair Labor Standards Act (FLSA) to include that extra hour of pay in calculating employees' regular rate of pay for overtime purposes. In addition, the FLSA prohibits employers from crediting that extra hour of pay towards any overtime compensation due to the employee.

Employers, however, should ensure that they do not have any additional obligations under a collective bargaining agreement or state law.

Hera Arsen, J.D., Ph.D., is managing editor of Ogletree Deakins' publications in Torrance, Calif. Ogletree Deakins is a national labor and employment law firm. © Ogletree Deakins. All rights reserved. Reposted with permission. Updated from an article originally posted on 11/1/2017.

SOURCE: Arsen, H. ( 2 October 2019) "As Daylight-Saving Time Ends, Wages & Hour Problems Begin" (Web Blog Post) https://www.shrm.org/resourcesandtools/hr-topics/compensation/pages/daylight-saving-time-wage-hour-problems.aspx

The Open Enrollment Checklist: Are You Poised for a Successful Season

Are you prepared for open enrollment? According to a recent survey, 56 percent of U.S. adults with employer-sponsored health benefits said health coverage satisfaction is a key factor in deciding whether they should leave their current job. Read this blog post from Employee Benefit News to learn more.

It’s here… the moment we’ve all been waiting for — or, in the case of HR, preparing for (at least we’d hope). That’s right, open enrollment season has arrived.

Open enrollment is a major opportunity for HR to contribute to their company’s performance — both in terms of healthcare savings and employee productivity. The better employees understand their benefits, the more likely they are to make cost-conscious decisions about their plan choices and their healthcare — saving themselves, and their employers, money. Not only that, but a recent survey found that 56% of U.S. adults with employer-sponsored health benefits said that whether or not they like their health coverage is a key factor in deciding to stay at their current job. And, interestingly, satisfaction with benefits and benefits communications have a tremendous impact on job satisfaction and engagement.

Not sure you’ve done everything you could to turn this annual necessity into a true financial, educational game-changer for your organizations? Ask yourself, did you:

Take stock of last year’s enrollment? Before diving into enrollment for 2020, employers should have taken stock of how the company fared last year. Post-mortem meetings with the enrollment team (along with key internal and external stakeholders) to assess what went well (or didn’t) can ensure the coming enrollment season runs smoothly.

In particular, identify the most time-consuming tasks and discuss how they could be streamlined in the future. Second, determine what questions employees asked the most about last year — and be prepared to answer them again this year. Third, consider whether the company achieved its overall open enrollment goals, and what contributed to those results. By addressing the peaks and pitfalls of last year’s season, HR should have a head start on planning for 2020.

Plan your communications strategy?With a defined approach to open enrollment in place, HR at this point should have developed an organized, well-communicated strategy to keep employees informed about their plan options at enrollment and throughout the year. Have you:

· Defined corporate objectives and how to measure success? · Assessed what messages to share with employees, especially anything that is changing — such as adding or eliminating plans or changing vendors? · Determined what information is best delivered in print (e.g. newsletters, posters, postcards, enrollment guides), online or in person through managers or one-on-one enrollment support? Adopting a multi-channel engagement strategy will ensure key messages reach the intended audience(s).

Make sure employees understand the deadline and process for enrolling — and the implications of missing the enrollment window. They must understand whether their existing coverage will roll over, if they’ll default to a specific plan and/or level of coverage (perhaps different from what they currently have), or end up with no coverage at all.

Take a pro-active approach to open enrollment? Ninety percent of employees report that they roll over their same health plan year over year — though this doesn’t indicate overwhelming plan satisfaction. More typically, it’s because they’re intimidated about what they don’t know, are confused about their choices or just don’t care. Employees don’t have the information they need, and aren’t likely to seek it out on their own.

Offering — or even requiring — one-on-one meetings with benefit experts during open enrollment provides a forum for employees to discuss their individual needs and ensure they are selecting the right coverage. These services — often available through brokers or outside engagement firms — provide employees with a safe space to ask specific questions about their health conditions, family history and potential life changes that could affect their insurance needs. This is the ideal time to remind employees that there is no one-size-fits-all plan, and that the least expensive plan on paper may not, ultimately, be the most cost-effective plan over time.

Revisit your SPD? The document we all love to hate, summary plan descriptions (SPDs) remain the best source for information about how each plan works, what it covers and the participant’s rights and responsibilities under that plan.

Having an SPD that is current, appealing (or at least not off-putting) and easy to access can answer many employee questions before they find their way to HR. Simple fixes like adding charts, callout boxes or icons can make your SPDs easier to navigate. Many employers are taking it a step further and offering interactive SPDs, which include robust search functionality and links to definitions, important forms, modeling tools and calculators, vendor sites and even short video clips. By making SPDs digital and interactive, employers can provide employees access to important information about their coverage 24/7 via any device. And, by adding a data analytics component, HR can track which sections employees visit most and pinpoint knowledge gaps about their benefit options to enhance understanding and drive increased benefits usage.

Account for all demographics? With all the focus on today’s multigenerational workforce, it’s important to remember that there’s more to “demographics” than age and gender. Worksite (office vs. shop floor vs. construction site vs. road warrior) can have a tremendous impact on the communications channels you use and when you use them.

And while some “generational generalizations” hold true — many older workers prefer paper, and most young people prefer mobile communication channels — it’s more important to look at employee cohorts from the perspective of differing priorities (planning for retirement vs. retiring student debt), different levels of education and healthcare literacy, and experience with choosing and using benefits. Employees just starting their careers are likely to need more support and different information than a more seasoned worker who’s had years of experience with the enrollment process. Consider the most effective ways to engage the different demographics of your population to gain their attention and interest in choosing the right plan for them.

Equip employees for smart healthcare choices year-round? For most employees, becoming an educated healthcare consumer is a work in progress — which is why many employers offer year-round resources to support smart healthcare choices. That said, these resources are often under-utilized because employees don’t know they exist.

Open enrollment is the perfect time to spread the word about these programs and address the key question for employees: “What’s in it for me?” For example, many employers offer transparency services, which enable employees to research the potential cost of care and compare prices across several providers in their area.

Other resources, such as benefits advocates, can answer questions from employees in real time — including where to get care, how to get a second opinion and what the doctor’s instructions really mean. When used in conjunction, transparency and advocacy services can lower out-of-pocket spending for the employee and reduce costs for the employer. Does your open enrollment communications strategy highlight that these resources exist, outline how they work and explain how they benefit the employee?

What if open enrollment is only a week away and you haven’t taken most, if any, of these steps? It’s not too early to start your to-do list for next year — perhaps by first tackling your SPD and drafting that communications plan. Most importantly, get that post-mortem meeting on the schedule now, while the lessons learned from this year’s open enrollment are still fresh.

SOURCE: Buckey, K. (3 October 2019) "The Open enrollment checklist: Are you Poised for a successful season" (Web Blog Post) https://www.benefitnews.com/list/the-employers-open-enrollment-checklist

Why 24/7 Work Culture is Causing Workers to Burn Out

According to Dr. Michael Klein, workplace cultures that encourage employees to be available 24/7 may be causing burnout and other mental health issues like anxiety and depression. Read this blog post from Employee Benefit Advisor to learn more.

Workplace culture that encourages employees to be available 24/7 may be causing burnout and other mental health issues like anxiety and depression.

That’s according to business psychologist and workplace adviser Dr. Michael Klein, who says companies that encourage employees to work anytime and anywhere is making it more likely that burnout will occur.

“The problem now is when you have the ability to work from wherever you want,” he says. “It’s so important for general wellness to make time to exercise, time for family and to not check work email.”

In May, the World Health Organization classified burnout as an “occupational phenomenon” that is characterized by chronic work stress that is not successfully managed. Research shows that continued stress at work can lead to more serious mental health conditions like depression and anxiety.

As a result, Klein predicts the next few years will see an increased need for on-site mental healthcare which could be offered through employee assistance programs. Offering EAPs, flexible work options and family-friendly benefits like onsite childcare are just some of the ways employers can reduce stress for workers.

And HR may need to take the lead. Misty Guinn, director of benefits and wellness at Benefitfocus, says finding HR professionals that can handle difficult conversations around mental health may be key to addressing the problem. But many are not comfortable enough to have those kinds of conversations.

“Most have yet to achieve that level of comfort with conversations around mental health,” she says, noting that younger generations are often more comfortable talking about mental health issues. “We’ve got to enable people, especially within HR, benefits, and management to have those conversations and be comfortable with them.”

Guinn also says that EAPs alone may not be enough to address mental health issues for workers because these programs are often scarcely utilized. Subsidizing mental health co-pays, work-life balance and PTO policies are benefit options for employers to create a meaningful difference for worker's mental health, she adds.

“Too often employers make the mistake of believing that offering an employee assistance program sufficiently checks off the mental health box in a complete benefits package,” she says. “In reality, these programs generally have low utilization because employees don’t have confidence in how confidential they are.”

Klein and Guinn agree that employers should consider more ways to support the total well-being of employees. Companies who prioritize their people will do better in the long term, Guinn adds.

“Employers need to take purposeful actions within their policies and programs to reinforce their support of total well-being for employees and their families,” she says.

SOURCE: Hroncich, Caroline. (10 June 2019) "Why 24/7 Work Culture is Causing Workers to Burn Out" (Web Blog Post) https://www.employeebenefitadviser.com/news/24-7-work-culture-is-causing-workers-to-burn-out

SIMPLE IRA vs. 401(k): How to Pick the Right Plan

Should you choose a SIMPLE IRA or a 401(k) for retirement saving? There are pros and cons to both types for employers. Read this blog post from NerdWallet for more on these two plan types and how to choose the right one for you.

The decision between a SIMPLE IRA and a 401(k) is, at its core, a choice between simplicity and flexibility for employers.

The aptly named SIMPLE IRA, which stands for Savings Incentive Match Plan for Employees, is the more straightforward of the two options. It’s quick to set up, and ongoing maintenance is easy and inexpensive. But if you have employees, you are required to provide contributions to their accounts. (See our SIMPLE IRA explainer.)

Although a 401(k) plan can be more complex to establish and maintain, it provides higher contribution limits and gives you more flexibility to decide if and how you want to contribute to employee accounts. Another big difference is that you can opt for a Roth version of the plan, whereas the SIMPLE IRA allows no Roth provision.

SIMPLE IRA vs. 401(k)

Here are the need-to-know differences between SIMPLE IRAs and 401(k)s:

SIMPLE IRA |

401(k) |

|

| Employer eligibility | Employers with 100 or fewer employees | Any employer with one or more employees |

| Employee eligibility | All employees who have compensation of at least $5,000 in any prior 2 years, and are reasonably expected to earn at least $5,000 in the current year |

All employees at least 21 years old who worked at least 1,000 hours in a previous year |

| Employer contribution rules |

|

|

| Contribution limits |

|

|

| Administrative responsibilities | No annual tax filing requirements; annual plan details must be sent to employees | Subject to annual compliance testing to ensure plan does not favor highly compensated employees |

| Fees | Minimal account fees | Varies by plan |

| Investment options | Any investments available through the financial institution that holds accounts | Investment selection curated by employer and plan administrator |

| Pros |

|

|

| Cons |

|

|

| More details | What Is a SIMPLE IRA? | What Is a 401(k)? |

SOURCE: IRS.gov

SIMPLE IRA or 401(k): How to decide

Startup costs and ease of setup often dictate the choice between retirement savings plans. But there are other factors to consider as well. To help decide which plan is best, answer the following questions:

Why are you setting up a retirement plan?

For many small-business owners, the answer is that they’re trying to maximize their own retirement savings dollars. If that’s the case, contribution limits should weigh heavily in your decision. For high earners especially, the higher contribution limit of the 401(k) makes it a more attractive choice than a SIMPLE IRA.

How important is it to offer the Roth option?

As mentioned earlier, the IRS allows employers to offer a Roth 401(k). (Quick reminder: A Roth 401(k) is funded with after-tax contributions in exchange for tax-free distributions in retirement.) There is no Roth version of the SIMPLE IRA. The account is subject to many of the same rules as a traditional IRA: Contributions reduce your taxable income for the year, but distributions in retirement are taxed as ordinary income. That said, the IRS allows participants to save in both a SIMPLE IRA and a Roth IRA at the same time.

Will you need to adjust employer contributions?

Although a nice perk to attract potential employees, employer contributions are not required of companies that offer 401(k) plans. You also have the freedom to set vesting terms, which allows you to require employees remain employed by you for a set time before taking ownership of your contributions to their accounts. Employer contributions to employee SIMPLE IRA accounts are mandatory, though you can choose between two matching arrangements dictated by the IRS. Contributions to a SIMPLE IRA are immediately 100% vested.

You have other choices

If you are self-employed or a small-business owner, SIMPLE IRAs and 401(k) plans aren’t your only options. There are a variety of retirement plans at your disposal.

For example, if you run a business with no employees, a solo 401(k) is worth considering. As the employer and (your own) employee, you’re allowed to contribute a total of up to $56,000 in 2019 (or $62,000 if you’re age 50 or older).

A SEP IRA also has a high contribution limit for business owners and self-employed individuals, though there is no catch-up contribution for savers 50 or older. The drawbacks: Like the SIMPLE IRA, a SEP requires employers to contribute to eligible employee accounts, and no Roth version is allowed.

We’ve laid out the pros and cons for these and other retirement plan options for the self-employed.

SOURCE: Yochim, D. (8 June 2019) "SIMPLE IRA vs. 401(k): How to Pick the Right Plan" (Web Blog Post). Retrieved from https://www.nerdwallet.com/blog/investing/simple-ira-vs-401k-comparison-how-to-pick-the-right-plan/

Simple Open-Enrollment Tips That Can Make a Big Difference

Many employees associate fear, anxiety or apprehension with open enrollment, the annual period when they select which employer-sponsored benefits they will have the coming year. Read this blog post from SHRM For a few simple tips to help out with this open enrollment season.

Trepidation is what comes to mind for many employees when asked their feelings about open enrollment, the annual period when they select employer-provided benefits for the coming year.

According to a nationally representative sample of 1,000 employees polled earlier this year, 33 percent cited "annoyance" or "dread" as their primary emotions when they thought about open enrollment and just 10 percent of workers said they were "confident" in the benefits choices they made when the enrollment process was over, according to VSP Vision Care's annual Open Talk about Open Enrollment survey.

In another survey, HR software company Namely found that 31 percent of employees give their employer a "C" or lower when it comes to open enrollment.

Here are some tips from benefits experts that will help you raise your grade this open-enrollment season.

What to Do, and Not to Do

Jennifer Benz, national practice leader at benefits communications firm Segal Benz, shared three bad HR practices that undermine open enrollment and three best practices for doing open enrollment the right way.

- Don't hide vital information from employees. Benz recalls how one company sent out its benefits materials but didn't include monthly costs. "A group of enterprising employees crunched the numbers and came up with estimates and circulated a rogue spreadsheet. Dealing with this communications fiasco took more work" than being upfront about costs, she noted.

Best practice: Be transparent and share the reasons you are making benefits changes. Break down the details and do the work for the employees. Provide scenarios so employees can better understand their options and cost breakdowns for different life situations.

- Don't cram in every benefit at once. Some companies hand out pages and pages of text, jamming a year's worth of communications into a few weeks, and figure they have done what they need to do. "What they have done is confused their employees," Benz said.

Best practices: Communicate the technical details of your various benefits over time. "Don't assume employees will weed through all your materials to make sense of the benefits offered to them," Benz said. Also make full use of visual aids. "Photos, icons, infographics, memes, charts, graphics and more—they all help to attract, and more importantly hold, people's attention," noted Amber Riley, a communications consultant to Segal Benz. "Whether you're driving an open-enrollment campaign, creating a new benefits guide or promoting a wellness program, when you increase the visual pleasure of what you are communicating, your people are more likely to engage, learn, understand and ultimately take action."

- Don't give employees too little time to process their open-enrollment choices. While many people wait until the last day to fill out the health care selection forms, they may have been considering their options with family members for weeks, so giving them just a few days to make decisions is not going to be enough.

Best practice: Build in a time frame that gives HR staff and employees the time they need. Benz recommended three weeks.

"People are always talking about learning from the best practices and success stories, but you can also learn a lot from other companies' mistakes," she noted. "When you prepare for enrollment in advance and anticipate issues—including those you and others have experienced in the past—you are better-equipped to avoid missteps. Your employees will notice and appreciate the extra effort."

Help Employees Ace Open Enrollment

"Open enrollment is often time-consuming and confusing for employees, but these choices can make a huge financial impact," said Julie Stich, CEBS, vice president of content at the International Foundation of Employee Benefit Plans, an association of benefit plan sponsors. She suggested that HR share the following advice with employees to help prepare them for the upcoming enrollment season:

- Take your time. Take time to really read through the enrollment materials you receive. If you are invited to a face-to-face meeting, make time to attend. It's possible you'll be offered different plan options and coverages this year. The better you understand the changes, the better decisions you'll make.

-

Take a trip down memory lane. Think back to what happened in your life this year. How often did you and your family members need medical services? What kind? Are any treatments ongoing? Think about any life changes that could affect the benefits you need, like a marriage or divorce, a child going off to college, or a spouse changing jobs.

- Look ahead. Consider what the next year will look like for you and your family. Are you planning to have a baby? Knee replacement surgery? A root canal? Does someone need braces? New glasses? Keep this in mind as you look at your coverage options.

- Dive into the details. It's important to note whether the plans' provider networks have changed. Make sure your doctors are still in-network. Is your chiropractor also covered? Does the plan cover orthodontics? Is your spouse's daily prescription drug covered, and did the coverage change? Also consider areas of need like access to specialists, mental health care, therapies, complementary and alternative medicine, and chronic care. Look at the options offered in all plans, including health, dental, vision and disability.

- Get out your calculator. Add up the amount you'll need to pay toward your health premium plus deductibles, co-payments (flat-dollar amounts) for prescriptions and doctor office visits, and co-insurance (a percentage of the cost you'll pay) for services. Understand what you'll be asked to pay if you seek care outside your network. This will give you a clearer picture of how much you're likely to spend. The plan that looks to be the cheapest option may not really be the cheapest for you.

- Determine what's right for you. Consider your comfort level with risk. If you want your family to be covered for every eventuality, a more traditional plan, if one is offered, might be right for you. If you're comfortable taking on some upfront costs, a high-deductible plan with a lower premium ight be your plan of choice.

- Take advantage of extras. Your employer may offer the option to reduce your health premiums in exchange for your participation in a wellness program or health-risk assessment. It may match some or all of the money you save in your 401(k) plan. It might let you set aside tax-deferred money into a health savings account or flexible spending account. Also, check with your employer to see if it offers voluntary insurance with a group discount and payroll deduction for premiums—like critical-illness, pet, auto and homeowners coverage. If these options work for your situation, sign up.

- Ask questions. Don't be shy about asking your HR or benefits department to explain something if you're not sure. They're there to help and want you to make the best decisions for your situation.

"Taking the time upfront to carefully choose the best options will help employees better manage their finances throughout the year, alleviating stress and promoting productivity," Stich said.

SOURCE: Miller, S. (24 September 2019) "Simple Open-Enrollment Tips That Can Make a Big Difference" (Web Blog Post). Retrieved from https://www.shrm.org/ResourcesAndTools/hr-topics/benefits/Pages/simple-open-enrollment-tips-make-a-big-difference.aspx

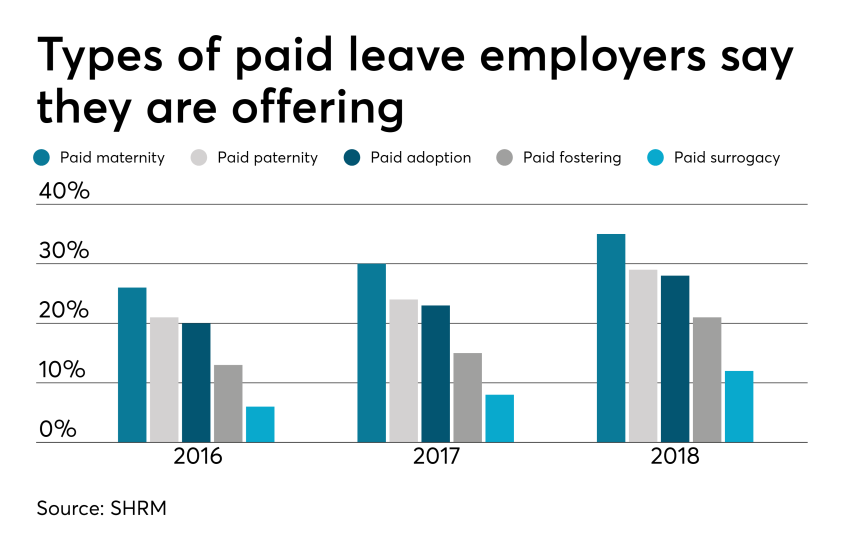

4 pitfalls of paid leave and how clients can avoid them

Employers are using paid leave options to help boost their employee benefits packages in efforts to better attract and retain talent. Read the following blog post from Employee Benefit Advisor for 4 common pitfalls of paid leave and how employers can avoid them.

Smart employers are boosting their benefits packages with paid family leave — the most coveted work perk among all generations. In today’s low unemployment environment, paid leave benefits can be a huge differentiator in attracting and retaining talent.

Smart employers are boosting their benefits packages with paid family leave — the most coveted work perk among all generations. In today’s low unemployment environment, paid leave benefits can be a huge differentiator in attracting and retaining talent.

But some employers are getting themselves into trouble in the process, facing accusations of gender discrimination or improper use of leave.

Here are four potential pitfalls of paid leave, and how employers can avoid them.

1. Be careful what you call “maternity leave.”

Employers have long been granting leave for new moms in the form of disability coverage. In fact, the top cause of short term disability is pregnancy. Disability insurance usually grants new moms six to eight weeks of paid leave to recover from childbirth.

Because this coverage applies to the medical condition of recovering from childbirth, it shouldn’t be lumped in with bonding leave.

Guidance from the Equal Employment Opportunity Commission says leave granted for new moms for bonding must also be extended to new dads, so separating disability leave from bonding leave is crucial to avoiding gender discrimination.

2. Don’t make gender assumptions.

The amount of bonding time for new parents after birth, adoption or fostering must be granted equally for men and women. Companies that don’t provide the same amount of paid leave for men and women may find themselves in a discrimination lawsuit.

It’s not just the time away from work that matters, but also the return-to-work support provided. If new moms are granted temporary or modified work schedules to ease the transition back to work, new dads must also have access to this.

Some companies may choose to differentiate the amount of leave and return-to-work support for primary or secondary caregivers. That’s compliant as long as assumptions aren’t made on which gender is the primary or secondary caregiver.

The best way to avoid potential gender discrimination pitfalls is to keep all parental bonding and related return-to-work policies gender neutral.

3. Avoid assuming the length of disability.

Be careful about assuming the length of time a new mom is disabled, or recovering medically, after birth. Typical coverage policies allot six to eight weeks of recovery for a normal pregnancy, so assuming a new mom may be out for 10 weeks might be overestimating the medical recovery time, and under-representing the bonding time, which must be gender neutral.

4. Keep up with federal, state and local laws.

Mandated leave laws are ever-evolving, so employers should consistently cross-check their policies with state and local laws. For instance, do local paid leave laws treat adoption the same as birth? Are multistate employers compliant? What if an employee lives in one state but works in another: Which state’s leave policies take precedence?

Partnering with a paid leave service provider can mitigate the risk of improperly administering leave. Paid leave experts can help answer questions, review guidelines and provide information regarding job-protecting medical or family leave.

They can also help flag potential pitfalls, ensuring leave requests from all areas of your company are managed uniformly and in accordance with state and federal laws, including the EEOC.

SOURCE: Bennett, A. (12 September 2019) "4 pitfalls of paid leave and how clients can avoid them" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/list/4-pitfalls-of-paid-leave-and-how-clients-can-avoid-them

What would change if your employees were CEO for a day?

How is your workplace culture? New data shows that employees are 4.6 times more likely to contribute their best work when they feel like their voices are being heard. Read this blog post from Employee Benefits News to learn more about building a strong workplace culture.

When employees feel like their voices are being heard, they are reportedly 4.6 times more likely to contribute their best work, according to SalesForce data. Ultimately, knowing that the company is interested in what employees have to say builds trust and encourages loyalty among members of the workforce.

Respect is the most important leadership behavior, according to a Georgetown University survey of nearly 20,000 employees. More than merely listening, making employees a part of a two-way conversation shows that the company values their opinions.

With this in mind, we set out to develop a process to help Nearmap increase workplace communication. Along the way, we found that creating opportunities for interaction, encouraging honest participation and involving executive participation were all keys to building a stronger corporate culture.

Invite employee interaction

We recognized that we needed a conversation starter to open the lines of communication and spark a little enthusiasm. We discovered that engagement surveys work the best for our circumstances because they’re quick and easy to take, which results in high completion rates.

We like to include thought-provoking questions like “if you were CEO for a day, what is the one thing you would change?” to keep the employees engaged. At first, that particular question provided some of our most entertaining suggestions, including “free umbrellas for all,” “I would like the CEO’s paycheck,” “change my LinkedIn profile,” and “put margarita slushy machines in the kitchen.” When employees saw that the CEO responded to every answer, they realized that we were taking the feedback seriously, and that changed the tone of their responses.

Anonymity invites honest responses

It was essential to Nearmap that we collect unfiltered, honest feedback from our employees. This meant reassuring participants that their responses were completely anonymous. We believe this confidentiality encouraged authentic and candid submissions from employees that otherwise would have remained silent for fear of reprimand or judgment.

For instance, we’ve received excellent insights about driving the strategy and growth of the business, giving Nearmap valuable concepts that we’ve been able to embed into the business.

In addition, we present the survey results back to the employees so they can see how their thoughts align with those of their co-workers. We believe this commitment to being open is an excellent way to motivate honest dialog.

Executive participation leads by example

When the survey concludes, we group all of the responses under different headings, such as collaboration and communication, marketing, mission, planning, product, compensation, recognition, and general. Then, our CEO, Rob Newman, gets together with other executives to provide answers and comments on many of the submissions. In turn, those responses are shared with the employees via the HR newsletter and on our company collaboration app.

In reply to an inquiry about creating a green initiative for the company, our CEO shared a list of active programs that Nearmap was involved in to reduce not only our carbon footprint but also that of our customers as well.

While we may not know what we would change if we were the CEO for a day, we are convinced that employee interaction, honest responses and executive participation are reliable and important ways to make impactful connections with our employees and build a stronger corporate culture in our company.

SOURCE: Steel, S. (13 September 2019) "What would change if your employees were CEO for a day?" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/what-would-change-if-your-employees-were-ceo-for-a-day

8 renewal considerations for 2020

Are you prepared for open enrollment 2020? With renewal season quickly approaching, plan administrators have a lot of considerations to make regarding employee health plans. Read the following blog post from Employee Benefit News for eight things to consider this year.

The triumphant return of the Affordable Care Act premium tax (the health insurer provider fee).

This tax of about 4% is under Congressional moratorium for 2019 and returns for 2020. Thus, fully insured January 2020 medical, dental and vision renewals will be about 4% higher than they would have been otherwise. Of note, this tax does not apply to most self-funded contracts, including so-called level-funded arrangements. Thus, if your plans are presently fully insured, now may be a good time to re-evaluate the pricing of self-funded plans.

Ensure your renewal timeline includes all vendor decision deadlines.

As the benefits landscape continues to shift and more companies are carving out certain plan components, including the pharmacy benefit manager, you may be surprised with how early these vendors need decisions in order to accommodate benefit changes and plan amendments. Check your contracts and ask your consultant. Further, it seems that our HRIS and benefit administration platforms are ironically asking for earlier and earlier decisions, even with the technology seemingly improving.

Amending your health plan for the new HSA-eligible expenses.

In July of this year, the U.S. Treasury loosened the definition of preventive care expenses for individuals with certain conditions.

While these regulations took effect immediately, they won’t impact your health plan until your health plan documents are amended. Has your insurer or third-party administrator automatically already made this amendment? Or, will it occur automatically with your renewal? Or is it optional? If your answer begins with “I would assume…,” double-check.

Amending your health plan for the new prescription drug coupon regulations.

As we discussed in July of this year, these regulations go into effect when plans renew in 2020. In short, plans can only prevent coupons from discounting plan accumulators (e.g., deductible, out-of-pocket maximum) if there is a “medically advisable” generic equivalent.

If your plan is fully insured, what action is your insurer taking? Does it seem compliant? If your plan is self-funded, what are your options? If you can keep the accumulator program and make it compliant, is there enough projected program savings to justify keeping this program?

Is your group life plan in compliance with the Section 79 nondiscrimination rules?

A benefit myth that floats around from time to time is that the first $50,000 in group term life insurance benefits is always non-taxable. But, that’s only true if the plan passes the Section 79 nondiscrimination rules. Generally, as long as there isn’t discrimination in eligibility terms and the benefit is either a flat benefit or a salary multiple (e.g., $100,000 flat, 1 x salary to $250,000), the plan passes testing. Ask your attorney, accountant, and benefits consultant about this testing. If you have two or more classes for life insurance, the benefit is probably discriminatory. If you fail the testing, it’s not the end of the world. It just means that you’ll likely need to tax your Section 79-defined “key employees” on the entire benefit, not just the amount in excess of $50,000.

Is your group life maximum benefit higher than the guaranteed issue amount?

Surprisingly, I still routinely see plans where the employer-paid benefit maximum exceeds the guaranteed issue amount. Thus, certain highly compensated employees must undergo and pass medical underwriting in order to secure the full employer-paid benefit. What often happens is that, as benefit managers turnover, this nuance is lost and new hires are not told they need to go through underwriting in order to secure the promised benefit. Thus, for example, an employee may think he or she has $650,000 in benefit, while he or she only contractually has $450,000. What this means is the employer is unknowingly self-funding the delta — in this example, $200,000. See the problem?

Please pick up your group life insurance certificate and confirm that the entire employer-paid benefit is guaranteed issue. If it is not, negotiate, change carriers, or lower the benefit.

Double-check that you haven’t unintentionally disqualified participant health savings accounts (HSAs).

As we discussed last December, unintentional disqualification is not difficult.

First, ensure that the deductibles are equal to or greater than the 2020 IRS HSA statutory minimums and the out-of-pocket maximums are equal to or less than the 2020 IRS HSA statutory maximums. Remember that the IRS HSA maximum out-of-pocket limits are not the same as the Affordable Care Act (ACA) out-of-pocket maximum limits. (Note to Congress – can we please align these limits?)

Also, remember that in order for a family deductible to have a compliantly embedded single deductible, the embedded single deductible must be equal to or greater than the statutory minimum family deductible.

Complicating matters, also ensure that no individual in the family plan can be subject to an out-of-pocket maximum greater than the ACA statutory individual out-of-pocket maximum.

Finally, did you generously introduce any new standalone benefits for 2020, like a telemedicine program, that Treasury would consider “other health coverage”? If yes, there’s still time to reverse course before 2020. Talk with your tax advisor, attorney, and benefits consultant.

Once all decisions are made, spend some time with your existing Wrap Document and Wrap Summary Plan Description.

For employers using these documents, it’s easy to forget to make annual amendments. And, it’s easy to forget, depending on the preparer, how much detail is often in these documents. For example, if your vision vendor changes or even if your vision vendor’s address changes, an amendment is likely in order. Ask your attorney, benefits consultant, and third party administrators for help.

SOURCE: Pace, Z. (Accessed 9 September 2019) "8 renewal considerations for 2020" (Web Blog Post). Retrieved from https://www.benefitnews.com/list/healthcare-renewal-considerations-for-2020

Putting Humanity into HR Compliance: Stop Tolerating Toxicity

HR departments who have a detox mission and address toxic workplace relationships can prove incredibly valuable to their organizations. Not only are employees and their well-being impacted by toxic workplace relationships, but also the organizational success and the well-being of employees' family members. Continue reading this blog post to learn more.

In my prior career as an employment attorney and in my current one as an organizational consultant and coach, I have encountered numerous toxic workplace relationships. The cost of these relationships—to organizational success, employee well-being and the well-being of employees' family members—is astronomical.

And the greatest tragedy is this: Almost all of this loss, pain and suffering is preventable.

Why are toxic workplace relationships so common? And why are they tolerated?

The answer to the first question is that good people make bad decisions. Typically, employee relationships start out fine. Employees cooperate and collaborate in their relationships with their bosses and peers.

But then something goes awry. A trust gap opens. The employee does not address the problem promptly, directly and constructively, but the employees' avoidance instinct kicks in. Nothing constructive is done to close the trust gap. As a result, the problem festers and grows. Eventually, any remaining trust evaporates, and the relationship degenerates into aggression, passive aggression or both.

Note that I'm not talking about the incorrigible "work jerk," whose behavior should never be tolerated. Rather, I'm talking about people stuck in toxic work relationships producing jerkish and other negative behavior.

Managers and HR practitioners succumb to the avoidance instinct, too. Although aware of the toxicity, they don't intervene and are wary of wading into others' dysfunctional relationships.

What are the costs of tolerating toxicity?

- Personal suffering. The immediate parties may think they have nothing in common, but they do: They're equally disengaged and miserable.

- Work loss. Toxic relationships do nothing to improve the quantity or quality of work, customer service or on-the-job innovation. There is increased absenteeism and what Colleen McManus, SHRM-SCP, an HR executive with the state of Arizona, calls "presenteeism," in which people are at work but not focused on work, dwelling on negativity instead of doing their jobs properly.

- Secondhand anxiety. Co-workers who witness the toxic behavior suffer, as does their contribution to the organization. They are the truly innocent victims.

- Collateral damage. Employees affected by workplace toxicity typically bring their stress home. This doesn't reduce their stress; rather, it elevates their loved ones' stress. "So true! In the most serious situations," McManus said, "I have seen greater instances of alcoholism and domestic violence due to problems at work."

How HR Can Help

HR departments with a detox mission can prove incredibly valuable to their organizations and the people in them. It's not hard to identify toxic relationships. The challenge is taking action.

I can say with confidence that intervention is always better than tolerating toxicity. You'd be surprised how easily many toxic relationships can be reset when a skilled third party steps in. HR professionals are ideally positioned to help employees stuck in toxic relationships get back on track. Or, if there's too much baggage, HR professionals can facilitate a respectful relocation of the parties to different positions in the organization. This method is a good way to start.

Many times, a toxic relationship is rooted in an unwitting and unaddressed offense one employee gave the other. As a result, the offended party started behaving differently toward the offender, which produced more offensive behavior, and so on. "I'm always surprised," McManus said, "when I ask the parties to the conflict what a resolution looks like. Often, it's simply an opportunity to be heard."

She adds that a sincere apology goes a long way toward rebuilding trust. "They feel validated, which is important to them."

Sometimes there's a structural misfit in the workers' roles that needs to be clarified, or how the jobs interact needs to be modified. HR can help figure out how the jobs can function without recurrent friction. "This is our profession's bread and butter!" McManus said.

There may be a personality conflict, in which case the parties need better understanding of how to interact with people whose styles differ from theirs. If that can't be achieved, though, there can be an agreement to disagree and respectfully move on—whether to a different position inside or outside the organization.

An HR team that makes a commitment to identify and resolve toxic relationships is empowered by the CEO, and is supported by the leadership team will prove to be incredibly valuable to its organization and the people in it. HR team members can directly coach others to resolve conflicts and show managers how to coach their employees who are stuck in toxic relationships.

There's also a risk management, compliance and claim-prevention component. In my employment lawyer days, most of my billable hours arose from conflict caused by toxic workplace relationships. An HR profession with a detox mission will become painfully costly to my former profession.

SOURCE: Janove, J. (Sept 06, 2019) "Putting Humanity into HR Compliance: Stop Tolerating Toxicity" (Web Blog Post) Retrieved from https://www.shrm.org/resourcesandtools/hr-topics/employee-relations/pages/putting-humanity-into-hr-compliance-stop-tolerating-toxicity-.aspx

5 Questions Expecting Moms Have About Life Insurance

Are you considering life insurance? If this is your first time looking for coverage, you most likely have questions. Read this blog post from Life Happens for five questions expecting mothers typically ask when looking at life insurance.

If you are expecting a child and are considering life insurance, the first thing I have to say is—smart move! But if this is your first time looking for coverage, you may have questions. Here are some typical ones I’ve heard over the years:

1. What type of life insurance coverage is best for new parents—term or permanent?

Before figuring out what kind of coverage you need, you first have to understand how much death benefit you need to protect your family. You can do an easy calculation online to get a working idea of how much you may need with this Life Happens Life Insurance Needs Calculator.

Then you can move on to what kind of coverage—term or permanent—meets your needs. An advantage of term life insurance is that it costs less than permanent, at least initially. This makes it affordable for young families that may not have a lot of disposable income, but have a large need for coverage. Permanent insurance provides both lifelong coverage and a cash accumulation feature, which can be a valuable source of money that you can tap in the future.

Often, the best solution can be a combination of term and permanent life insurance. The term policy can give you extra coverage during the years when the children are at home, with the permanent policy offering lifelong coverage.

2. Should you consider different types of coverage if you are working mom versus a stay-at-home mom?

Both working and stay-at-home moms need protection because what they do for their families is so valuable. While a stay-at-home mom isn’t compensated for her work, if something were to happen to her, it would be expensive to replace all those things she does—from childcare to home care to ensuring the family gets where they need to go when they have to be there.

The difference between the two is that a working mother also contributes an income, which may be critical to the family financially. That means she needs to think about replacing that income when considering how much life insurance coverage she may need.

3. The company where I work offers life insurance, is that enough?

Group insurance is a great benefit to have, but it’s limited in a number of ways. First, the coverage is often a lump sum, such as $50,000, or it may be one to two times your salary. That may sound like a lot of money, but my question to you is: Honestly, how long would that money last? And what would happen to your family financially after that was gone?

Second, when you leave that job, you generally lose that coverage. If you don’t have an individual policy that you own, you’ll be leaving your family at risk. Think of how many times people change jobs, and you’ll quickly realize that group coverage, which is limited in scope and amount, is not a proper life insurance plan.

4. Are there any restrictions I have to consider now that I’m pregnant?

If it’s early in your pregnancy, and there are no medical complications, you should be able to get life insurance. If you’re farther along and there are medical issues, it may difficult to obtain. The life insurance company may want to wait until after your child is born. That’s why I advise those that are planning to have children to get the coverage as soon as possible.

5. What can I expect to pay for life insurance?

How much you pay for life insurance is based on a number of things but most importantly age and health. So, it depends on how old and how healthy you are! But here’s an example: A healthy 30-year-old woman could get $250,000 in life insurance coverage (for a 20-year level term policy for a nonsmoker) for about $13 a month. That’s certainly a lot of peace of mind for $13.

And don’t forget about your spouse or partner. The two of you could get $500,000 of combined coverage (using the example of two 30-year-olds that each get a $250,000 20-year level term policy) for right around $26 a month.

And my last piece of advice: talking with a life insurance agent at this stage can be very valuable. They can do a needs assessment and come up with the right type and amount of life insurance that works for your family budget. And what many people don’t realize is that an agent will sit down and offer this advice free of charge, with no strings attached. If you’d like help finding a life insurance professional, you can start here.

SOURCE: Feldman, M. (23 August 2019) "5 Questions Expecting Moms Have About Life Insurance" (Web Blog Post). Retrieved from https://lifehappens.org/blog/5-questions-expecting-moms-have-about-life-insurance/