Ready for the sounds of office sniffles?

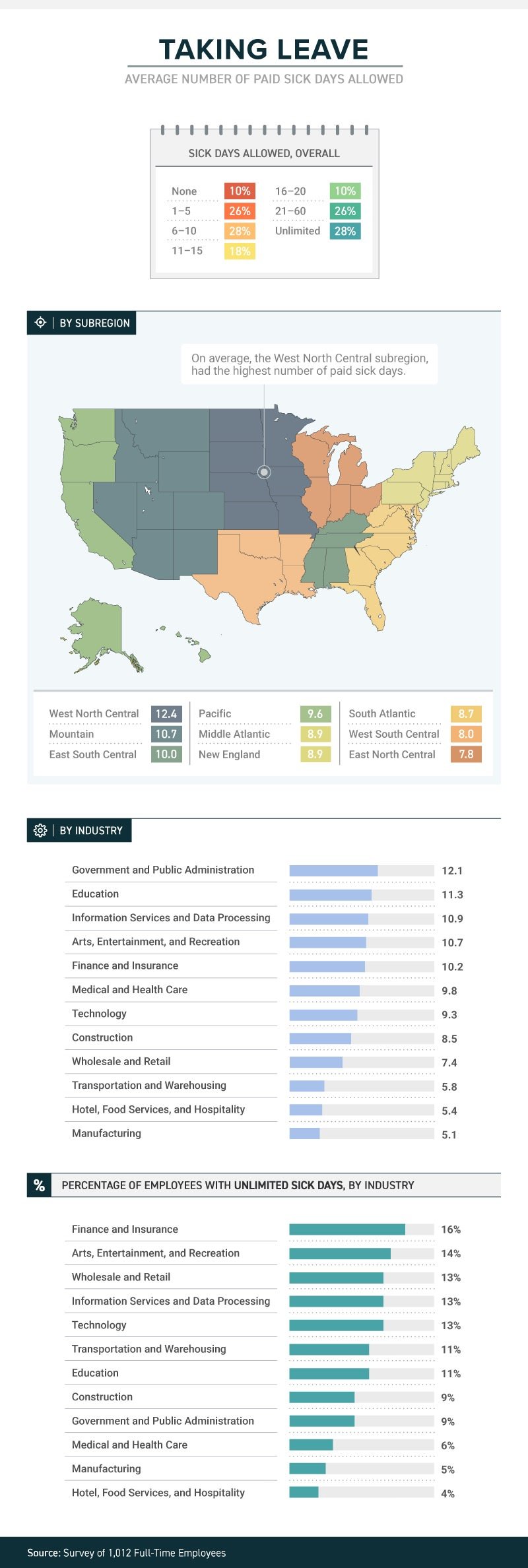

A recent study by law firm, Farah and Farah, states that one in four full-time workers receive between 1 and 5 sick days. Continue reading to learn more.

It’s not just a matter of whether they feel well enough to work, or whether they have sick days. The boss’s attitude about whether workers should take sick days or not can determine whether they actually do stay home when they’re sick, or instead come to work to spread their germs to all and sundry.

A new study from law firm Farah & Farah finds that even though it can take a person some 10 days to fully recover from a cold, approximately 10 percent of full-time workers in the U.S. get no sick days at all (part-timers don’t usually get them either), while more than 1 in 4 have to make do with between 1 and 5 sick days. Just 18 percent get enough sick time to actually recover from that cold—between 11 and 15 days.

The amount (or presence) of sick time varies from industry to industry, with government and public administration providing the most (an average of 12.1) and both hotel, food services and hospitality and manufacturing providing the least (an average of 5.4 for the hospitality industry and 5.1 for manufacturing). Some lucky souls actually get unlimited sick days, although even then they don’t always use them.

Regardless of industry, or quantity, just because workers get sick days it doesn’t mean they use them. Workers often worry that they’ll be discouraged from using them, with employers who may provide them but not encourage employees to stay home when ill. In fact, 38 percent of workers show up to work whether they’re contagious or not. Sadly for the people they encounter at work, the most likely to do so are in hospitality, medical and healthcare and transportation. Plenty of germ-spreading to be done in those professions!

And their employers’ attitudes play a role in how satisfied they are with their jobs. Among those who work for the 34 percent of bosses who encourage sick employees to stay home, 43 percent said they’re satisfied with their jobs in general. Among those who work for the 47 percent of bosses who are neutral about the use of sick days, that drops to 21 percent—and among the unfortunate workers who work for the 19 percent of bosses who actually discourage workers from staying home while ill, just 12 percent were satisfied with their jobs.

When it comes to mental health days (no, not that kind; the ones people really need to deal with diagnosed mental health conditions), fewer than 1 in 10 men and women were willing to call in sick. Taking “mental health days” when physically healthy, however, either to play hooky or simply have a vacation from the office, is something that 15 percent of respondents admitted to.

SOURCE: Satter, M (5 October 2018) "Ready for the sounds of office sniffles?" (Web Blog Post). Retrieved from https://www.benefitspro.com/2018/10/05/ready-for-the-sounds-of-office-sniffles/

Original report retrieved from https://farahandfarah.com/studies/sick-days-in-america

U.S. Unemployment Drops to Lowest Rate in 50 Years

Last month the U.S. unemployment rate fell to 3.7 percent, the lowest it’s been in 50 years. Continue reading to learn how the low jobless rate is affecting the U.S. labor market.

Unemployment in the U.S. fell to 3.7 percent in September—the lowest since 1969, according to the Bureau of Labor Statistics (BLS).

The low jobless rate, down from 3.9 percent in August, is further evidence of a strong economy—employers added 134,000 new jobs in September, extending the longest continuous jobs expansion on record at 96 months. The continued gains run counter to economists' expectations for a significant slowdown in hiring as the labor market tightens. Through the first nine months of the year, employers added an average of 211,000 workers to payrolls each month, well outpacing 2017's average monthly growth of 182,000.

"This morning's jobs report marked a new milestone for the U.S. economy," said Andrew Chamberlain, chief economist at Glassdoor. "With good news in most economic indicators today, it's likely the economy will continue its march forward through the remainder of 2018."

Cathy Barrera, chief economist at online employment marketplace ZipRecruiter, pointed out that the jobless rate ticked down for all education levels. "Anecdotal evidence has suggested that employers have experienced labor shortages for entry-level positions, and the decline in unemployment for these groups reflects that," she said. "More of those joining or rejoining the labor force are moving directly into jobs, reflecting the high demand for workers."

The sectors showing the strongest jobs gains in September include:

- Professional and business services (54,000 new jobs).

- Healthcare (26,000).

- Transportation and warehousing (24,000).

- Construction (23,000).

- Manufacturing (18,000).

"Retail job losses—20,000 jobs—were widespread, and the leisure and hospitality sector lost 17,000 jobs, largely confined to restaurants," said Josh Wright, chief economist for recruitment software firm iCIMS, based in Holmdel, N.J.

"We can clearly point to a slowdown in retail trade for the dip in [overall] payroll numbers in September," said Martha Gimbel, research director for Indeed's Hiring Lab, the labor market research arm of the global job search engine. "Retail trade had a strong first half of the year but has slowed down in recent months. In addition, recent Hiring Lab research saw a slight dip in the number of holiday retail postings, suggesting that the sector may struggle in months to come."

Prior to September, employment in leisure and hospitality had been on a modest upward trend and the losses last month may reflect the impact of Hurricane Florence.

The Department of Labor said it's possible that employment in some industries was affected by Hurricane Florence which struck the Carolinas in September. Nearly 300,000 workers nationwide told the BLS that bad weather kept them away from their jobs last month.

"That's far below the level in September 2017 amid hurricanes Harvey and Irma, but significantly above the average of about 200,000 over the prior 13 years," Wright said. Upward revisions are likely, he added.

Wages Stubborn but Rising

In September, average hourly earnings for private-sector workers rose 8 cents to $27.24. Over the year, average hourly earnings have increased by 73 cents, or 2.8 percent.

"That's down slightly from the 2.9 percent pace last month, but consistent with a steady upward trend in wage growth we've seen as the job market tightens and more employers face labor shortages," Chamberlain said. "We expect to see that pace continue to rise throughout the holiday season, likely topping 3 percent within the next six months."

Glassdoor has recorded strong wage growth in tech-heavy metropolitan areas such as San Francisco, New York and Los Angeles.

"If the true wage growth rate is at or below 2.8 percent year-over-year, it is disappointing that it is not growing faster," Barrera said. "Given how tight the labor market has been not only with overall unemployment below 4 percent, but particularly so at the entry level, we would expect wage growth to be higher. The labor turnover numbers suggest that mobility is lower than it historically has been in periods where unemployment is very low. This is one reason wages may not be rising as quickly as we'd expect."

Labor Force Participation Stalled?

The nation's labor force participation rate held at 62.7 percent.

"Looking at the labor flows data, the rate of movement of the civilian population into the labor force hasn't moved much in the last couple of years, however, more of those folks are moving directly into employment rather than into unemployment," Barrera said.

Wright noted that the number of new labor force entrants and reentrants going directly to unemployment was just 33,000. "This raises interesting questions—whenever we get a recession, how long will these reentrants and new entrants continue searching for jobs before leaving the labor force?" he asked.

The percentage of the population in their prime working years with a job also held around 79 percent, where it's been for about eight months, Gimbel said, adding that the measure suggests that the number of workers remaining to pull into the labor force may be exhausted.

"The share of the labor force working part-time but who wants a full-time job unfortunately ticked up," she said. "Any remaining slack in the economy may be concentrated in part-time workers who want more hours."

SOURCE: Maurer, R. (5 October 2018) "U.S. Unemployment Drops to Lowest Rate in 50 Years" (Web Blog Post). Retrieved from https://www.shrm.org/resourcesandtools/hr-topics/talent-acquisition/pages/us-unemployment-drops-lowest-50-years-bls-jobs.aspx/

Are you ready for self-funding? Three tools to help you decide

Are you ready for a self-funded health plan? Self-funding and other alternative funding options may seem risky to many HR professionals. Continue reading for three tools to help you decide if you’re ready to switch.

When your health plan is fully insured, it’s easy for your finance department to budget for the cost — you just pass on the health insurer’s annual renewal premium amount to them and that becomes the annual budget number. But you and your broker may have come to suspect that you are leaving money on the table by continuing on a fully insured basis, and you may want to test the self-funded waters.

By now, you may already know there are significant benefits to self-funding, but actually making the switch is a scary prospect for HR directors.

Before you can transition to a self-funded plan, you need to be financially stable and willing to take a bit of a risk. As a safeguard, you also need to familiarize yourself with the two forms of stop-loss insurance. One caps the impact on any one covered member’s claims (individual or specific stop loss), and the other caps your total annual claim liability (aggregate stop loss). Your broker can guide you on which stop loss levels and which stop-loss coverage periods are right for your population when transitioning from fully insured to self-funding.

Beyond these stop-loss safeguards, size will dictate how you pay. If you have fewer than 100 covered employees, you may be able to pay the same amount monthly, just as you do with your fully insured premium. This monthly payment equals projected claims plus an aggregate margin, a monthly administration fee and the stop loss charge. This eliminates unpredictable monthly payments for a small self-funded group.

However, for larger groups of over 100 employees, moving to self-funding will mean paying claims as they are processed (which means uneven claim payments), plus stop loss and administration.

To help you determine if you’re ready for self-funding, you may want to analyze your plan in a few different ways.

1. Look back: A look back analysis is just what it sounds like — a view of how your plan would have performed over the last couple years had you been self-funded, compared to how it did perform under a fully insured model. This should be an easy enough task for your broker to take on, especially if they have sought out self-funded quotes from claim administrators and stop-loss carriers on your behalf. In addition, they should know what your actual claims costs were. The result is that you’ll know whether you would have saved money or not.

2. Look forward: You may already know what your upcoming fully insured renewal looks like. But even if you don’t have hard numbers yet, you can work with your broker to determine a strong estimate of what your proposed premiums will be. Then, your broker should get a self-funded quote, which includes the expected and maximum claims, plus the administrative fees and stop-loss premiums. This is your expected self-funded costs for the upcoming policy period. Compare that estimate to your fully insured renewal costs. (Make sure the self-funded costs are on the same “incurred claims with runout” basis that the fully insured costs would be, for a fair apples-to-apples comparison.)

3. Probability. While the “look forward” analysis compares your fully insured costs to your expected self-funded costs, it is based on “expected” claims. The risky part of self-funding is that your actual claims will not ultimately materialize exactly as expected. There are some more sophisticated tools that combine group-specific data (such as your claims history, demographics and the proposed fixed costs) with a fairly large actuarial database to come up with thousands of possible outcomes.

By charting all of these outcomes, you can produce likelihood percentages of where your actual claims will come in at — versus the “expected” level, and versus the fully insured renewal rate. Not all brokers have this tool on hand, and as a result, there may be a cost associated with producing one. The output from this tool may appeal to your colleagues in the finance department.

Other considerations

During your analysis, you may want to set your self-funded policy year liability based on incurred claims (plus fixed costs), even though your actual paid claims within that policy year may be less due to the lag between when provider services occur and when you actually fund them. The lag is a cash-flow advantage but it does not represent a reduced claim liability.

Finally, don’t lose sight of the cost of high claimants, an important part of planning if you choose the self-funding route. Will your past high claimants continue into your renewal period? Are you aware of new high claimants on the horizon? Stop-loss carriers generally insure only “unknown risks,” not “known risks.” If a plan member has an expensive chronic condition, such as kidney failure, a stop loss carrier may “laser” that individual and set a higher individual stop-loss threshold. It’s important that you know what’s excluded and factor in any uncovered catastrophic claimants into your analysis.

In the end, it may turn out that self-funding is not a good fit, or possibly that this year is just not the year for it. But whether it is, or it isn’t, it is comforting to know that you’ve done your due diligence and have documentation supporting the decision you’ve reached.

SOURCE: DePaola, Raymond (5 October 2018) "Are you ready for self-funding? Three tools to help you decide" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/ready-for-self-funding-three-tools-to-help-you-decide

4 best practices for implementing a gamification-based compliance training system

Many employees may dislike and even disengage when their employer mentions implementing training sessions. Continue reading to learn how implementing a gamification-based training system can help improve employee engagement.

For most employees, compliance training is the Brussels sprouts on the kid’s plate of working life. Everyone knows it’s good for you — one mistake could lead to violations, accidents, reputation issues and maybe a not-so-friendly visit from regulatory body officials — but most workers turn up their noses and disengage when it’s time to dig in.

Considering that merely a third of American workers report feeling engaged at work as it stands, anything that makes matters worse is dangerous. Why risk inflaming indifference — not to mention spending money for on-site instructors — with dull-as-dry-toast workshops?

A far better bet is to embrace technology and go virtual. Of course, online-based compliance training won’t guarantee heightened participation or enthusiasm unless they have one specific aspect: gamification.

Gaming elements can turn any virtual compliance training learning management system (LMS) into an immersive experience. ELearning compliance training participants can enjoy customization and flexibility while getting up to speed on the latest rules, guidelines and protocols. With LMS gamification, HR managers and chief learning officers can cultivate and retain top talent. Best of all, it’s far easier to get buy-in for a robust LMS system with badges, bells and whistles than it is to make a pile of Brussels sprouts disappear from a toddler’s tray.

What exactly is so exciting about game-based learning? In essence, the process prompts active and immediate participation because of extra motivation in the form of rewards. Whether it’s badges or points, these features make eLearning interesting and enjoyable.

In one study, workers who enjoyed themselves retained concepts 40% better than those who weren’t having fun. As you might guess, this is what game-based learning is all about. Engaged employees who rapidly earn rewards are less likely to make errors, so they naturally increase a company’s bottom line and lower the likelihood of compliance fees and penalties. Plus, according to research from TalentLMS, 87% of employees report that gamification makes them more productive.

Merging gamification with training makes plenty of sense. It’s also easy to build a gamification-based compliance training LMS by following a straightforward LMS implementation checklist.

1. Identify your training goals and gaps. Before you can find the best LMS for your needs and move forward with an implementation project plan, you need to spot the inefficiencies of your existing compliance training program. For example, your strategy might not facilitate real-world applications. Knowing this, you would want a compliance training LMS that bridges gaps and imparts practical experience.

2. Discover what motivates and drives employees. Employee gamification only works when employees are properly incentivized, so find out what motivates your team based on their backgrounds and experience levels. Whether a task is challenging or boring, people respond better when they are internally driven to succeed.

Do you need an intuitive LMS with a personalized dashboard? Are the introverts on your team more driven by badges and points than by a sense of competition? Conduct surveys to gauge expectations, and try to follow a 70:20:10 model of training amplified by gaming to foster experimentation and collaboration.

3. Choose the right rewards for desired outcomes. With the plethora of LMS choices on the market, you can select from rewards and mechanics that lead to the exact behaviors and criteria you desire. Want employees to achieve safety online training certifications? Reward “graduates” with points after they have displayed their proficiency. Reinforce favorable behaviors without punishing workers who lag behind. Carrots are far more effective than sticks.

4. Invest in a feature-rich, gamification-supported LMS. Your LMS should not only be user-friendly, but it should also be a portal to game-based learning support and an online asset library. Ideally, your gamified learning platform should include themes and templates that allow you to design visually appealing rewards without reinventing the wheel. Just make sure you have game-based reporting on your side, which makes it simple to track employee performance, completion rates, and other LMS metrics.

Implementing a gamification-based compliance training strategy requires careful budgeting, planning, and analysis. Once you find an LMS platform that delivers the features you need within your price range, you’ll be on your way to mitigating risks and retaining superstar employees. And thanks to gamification, everyone can have a little fun along the way.

SOURCE: Pappas, C. (10 October 2018) "4 best practices for implementing a gamification-based compliance training system" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/4-best-practices-for-implementing-a-gamification-based-compliance-training-system?brief=00000152-14a5-d1cc-a5fa-7cff48fe0001

IRS updates required tax notice to address plan loan offsets

The model notices that all plan sponsors are required to send to plan participants before they receive an eligible rollover distribution from qualified plans were recently updated by the IRS. Continue reading to learn more.

The IRS has updated the model notice that is required to be provided to participants before they receive an “eligible rollover distribution” from a qualified 401(a) plan, a 403(b) tax-sheltered annuity, or a governmental 457(b) plan.

Notice 2018-74, which was published on September 18, 2018, modifies the prior safe-harbor explanations (model notices) that were published in 2014. Like the 2014 guidance, the 2018 Notice — sometimes referred to as the “402(f) Notice” or “Special Tax Notice” — includes two separate “model” notices that are deemed to satisfy the requirements of Code Section 402(f): one for distributions that are not from a designated Roth account, and one for distributions from a designated Roth account. The 2018 Notice also includes an appendix that can be used to modify (rather than replace) existing safe-harbor 402(f) notices.

The model notices were updated to take into consideration certain legislation that has been enacted, and other IRS guidance that has been published, since 2014. They include:

- changes related to qualified plan loan offsets under the Tax Cuts and Jobs Act of 2017;

- changes in the rules for phased retirement under the Moving Ahead for Progress in the 21st Century Act (“MAP-21”);

- changes in the exceptions to the 10% penalty for early distributions from governmental plans under the Defending Public Safety Employees’ Retirement Act; and

- IRS guidance (in Revenue Procedure 2016-47) regarding a self-certification procedure for waivers of the 60-day rollover deadline.

The model notices also make some “clarifying” changes to the 2014 notices, including:

- clarification that the 10% additional tax on early distributions applies only to amounts includible in income;

- an explanation of how the rollover rules apply to governmental 457(b) plans that include designated Roth accounts;

- clarification that certain exceptions to the 10% tax on early distributions do not apply to IRAs; and

- recognizing that taxpayers affected by federally declared disasters and other events may have an extended deadline for making rollovers.

The updated model 402(f) notices should be particularly useful in communicating to participants the extension, under the Tax Cuts and Jobs Act, of the time to roll over a “qualified plan loan offset amount.”

Inside the plan load offset

By way of background, Notice 2018-74 reminds us that distribution of a “plan loan offset amount” is an eligible rollover distribution, and that a “plan loan offset” occurs when, under the plan terms governing a plan loan, the participant’s accrued benefit is reduced, or offset, in order to repay the loan. According to the Notice, this can occur when, for example, the terms of the plan loan require that, in the event of an employee’s termination of employment or request for a distribution, the loan is to be repaid immediately or treated as in default.

The Notice also indicates that a plan loan offset may occur when, under the terms of the plan loan, the loan is canceled, accelerated, or treated as if it were in default (for example, when the plan treats a loan as in default upon an employee’s termination of employment or within a specified period thereafter). The Notice also reminds us, however, that a plan loan offset cannot occur prior to a distributable event.

This is helpful guidance for distinguishing between a “deemed distribution” of a defaulted loan (a taxable event which is not eligible for rollover) and a “plan loan offset amount,” which is an eligible rollover distribution.

Generally, if a default occurs before the participant has a distributable event (such as termination of employment, or attainment of age 59½), and the default is not cured by the last day of the cure period, it must be treated as a “deemed distribution” and reported on Form 1099. Such defaulted amounts are not eligible for rollover.

However, if the default occurs at or after a distribution event, and the plan terms require that the participant’s account be offset to pay off the loan, then the reduction of the account may be treated as a plan loan offset, which is an eligible rollover distribution.

Notice 2018-74 (and the new model notices) also reflect that, prior to the Tax Cuts and Jobs Act of 2017, participants who incurred a “plan loan offset” only had 60 days to “roll” an equivalent amount of money to an IRA or another employer plan (to avoid the offset being treated as a taxable distribution). However, for plan loan offsets that occur after December 31, 2017, if the plan loan offset is a “qualified plan loan offset” (meaning it occurs in connection with termination of employment or termination of the plan), then the participant has significantly more time (until the extended due date of the participant’s tax return for the year of the offset) in which to roll an amount equal to the loan offset amount to an IRA or another employer plan.

SOURCE: Browning, R (4 October 2018) "IRS updates required tax notice to address plan loan offsets" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/opinion/irs-updates-required-tax-notice-to-address-plan-loan-offsets?brief=00000152-146e-d1cc-a5fa-7cff8fee0000

8 keys to developing a successful return to work program

What does your return to work program look like? Read this blog post for 8 tips to developing a successful return to work program at your organization.

No matter the size of your organization, there’s about a 99% chance at some point dealing with employees going on leave. Most HR professionals are well-versed on the logistics of what to do when an employee is on short- or long-term disability — but what sort of culture do you have in place that encourages and supports them with a return to work (RTW)? Developing a positive and open RTW culture benefits not only the organization but the employee and their teams as well.

An effective RTW program helps an injured or disabled employee maintain productivity while recuperating, protecting their earning power and boosting an organization’s output. There also are more intangible benefits including the mental health of the employee (helping them feel valued), and the perception by other team members that the organization values everyone’s work.

See also: 7 Ways Employers Can Support Older Workers And Job Seekers

Some other benefits of an RTW program can include improvement of short-term disability claims, improvement of compliance and reduction of employer costs (replacing a team member can cost anywhere from half to twice that employee’s salary, so doing everything you can to keep them is a wise investment).

Some of these may seem like common sense, but I’m continually surprised how many (even large) organizations don’t have an established RTW program. Here are eight critical elements of a successful program.

1. Support from company leadership.

2. Have a written policy and process.

3. Establish a return to work culture.

4. Train your team members.

5. Establish an RTW coordinator.

6. Create detailed job descriptions.

7. Create modified duty options.

8. Establish evaluation metrics.

Severance plans: How savvy employers can stay ERISA compliant

How can employers’ severance plans stay ERISA compliant? There are significant advantages associated with ERISA severance plans. Continue reading to learn more.

An employer’s promise to provide severance benefits may be written or oral, formal or informal, and individual or group. Determining whether an ERISA plan already exists, or whether an employer wants its severance arrangement to be subject to ERISA, is an important consideration in determining an employer’s obligation and liabilities associated with a severance arrangement.

There are significant advantages associated with a severance arrangement that is an ERISA plan as discussed in detail below. An employer, however, cannot unilaterally decide that the severance arrangement is an ERISA plan. Instead, an employer, when designing and administering a severance arrangement, can take definitive steps to ensure that the arrangement is treated as an ERISA plan.

Employers may assume that the first step to ensure the existence of an ERISA plan is to have a written plan document, which is required by ERISA. Surprisingly, this is not necessarily determinative as to whether an ERISA plan exists. Courts have held that ERISA plans can exist without a written plan document and vice versa.

Case law has provided the broad outlines of the nature of an ERISA-governed severance plan. An essential characteristic of ERISA severance plans is that, by their nature, they necessitate “an ongoing administrative scheme.” Courts have looked at the following indicators when determining what constitutes an ongoing administrative scheme:

- The employer’s discretion in determining (1) eligibility for benefits or (2) available plan benefits

- The form of payment such as lump sums versus periodic payments

- Any ongoing demand on the employer’s assets such that there is an ongoing scheme to coordinate and control the distribution of benefits

- Calculations based on certain factors such as job performance, length of service, reemployment prospects, and so forth.

Severance plans or arrangements that normally do not require an ongoing administrative scheme, and therefore, do not implicate ERISA, are plans that have lump-sum payments that are calculated under a formula and are mechanically triggered by a single event (such as termination). Where severance payments are made over time (through payroll, for example) and/or additional benefits (such as continuation of benefits or outplacement services) are provided, the severance arrangement is likely subject to ERISA.

As a practical matter, whether severance arrangements are ad hoc or recognized in a formal plan document, they may end up providing ERISA-covered benefits. In a dispute, an employer generally prefers that ERISA applies because of ERISA’s preemption of state laws. Preemption protects employers from state laws that may favor employees and generally limits the dispute to an ERISA claim for benefits, thereby avoiding the potential exposure to punitive, extra-contractual or special damages under state laws. In addition, ERISA’s claim procedure, which provides a pre-litigation administrative process for dispute resolution, will apply if proper plan language is provided. If employees with a severance claim fail to faithfully follow the ERISA claims procedure, their lawsuits may be dismissed for failure to exhaust administrative remedies.

Typically, the plan document gives the employer, in its capacity as plan administrator, the discretionary authority to interpret the plan’s language and make decisions about the plan. If the employee follows the claim procedures and the claim is denied, the decision-making process of the employer (or its designee) if done properly, is given deferential treatment by a reviewing court. Moreover, in many cases, judicial review is limited to only those matters addressed in the administrative record of the claim. In other words, many federal courts would decline to consider factual matters that were not raised by the employee in the claim procedure process.

Another consideration for the savvy employer is that severance benefits are almost always considered to be “welfare” benefits. Welfare benefits, as opposed to pension benefits, are afforded an extremely low level of protection under ERISA. Essentially, the employer’s exposure as to promised severance benefits is only as broad as its express contractual commitment to them. By appropriately documenting the benefits with “best practices” language (such as specifying that the amendment or termination of benefits may be done with or without advance notice), employers can take advantage of the opportunity afforded by the relatively thin protections provided by ERISA. On the other hand, poor or no documentation of a severance arrangement may leave an employer with difficult-to-prove assertions as to what severance commitments were actually made.

In summary, an ERISA-governed plan provides an employer with significant advantages in litigation. In addition, a severance arrangement subject to ERISA will enjoy the powerful benefits of ERISA preemption and the ERISA claims procedures.

SOURCE: Rothman, J.; Ninneman, S. (3 October 2018) "Severance plans, Part 1: How savvy employers can stay ERISA compliant" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/opinion/how-employers-can-stay-erisa-compliant-with-severance-plans

6 Books on the Future of Work That Every HR Professional Should Read

What do the next 50 or 100 years have in store for organizations and workers? Read this blog post for six books on the future of work that every HR professional should read.

As HR professionals and organizational leaders, it seems we are increasingly bombarded with messages about disruptive innovations and the changing nature of work. While calls to prepare strategically for the "future of work" might sometimes seem over-the-top, it doesn't change the fact that we've seen tremendous shifts in the global economy (including the labor economy) and technological innovation over the past 50 years that have had significant implications for the nature of work.

So what do the next 50 years have in store for organizations and workers? How will disruptive technologies like robotics, artificial intelligence/machine learning, pharmacogenetics, quantum entanglement, virtual presence/augmented reality, 3-D printing, and blockchain (among many others) influence future labor markets?

Here are six books I believe every HR professional and organizational leader should read to better understand these trends and the drivers influencing the shifting trajectories in the future of work.

1. The Future of the Professions: How Technology Will Transform the Work of Human Experts(Oxford University Press, 2017) by Richard Susskind and Daniel Susskind

The Future of the Professions closely examines the intersection of rapidly advancing innovative technologies and the shifting nature and transformation of work and the professions, providing theoretically grounding and ample examples of emerging technologies, organizations and work arrangements. It is intended for organizational leaders and policy practitioners of all stripes who are interested in the effects of disruptive technologies on the future of work.

2. The Future of Work: Robots, AI, and Automation (Brookings Institution Press, 2018) by Darrell M. West

In The Future of Work, West sees the U.S. and the world at a "major inflection point" where we have to grapple with the likely impact of an increasingly automated and technologically advanced society on work, education and public policy. The insights provided will be useful to those who manage others and to those who are managed in the workplace of the future.

3. Rise of the Robots: Technology and the Threat of a Jobless Future (Basic Books, 2016) by Martin Ford

Rise of the Robots is a somewhat unsettling vision of a future world dominated by artificial intelligence, machine learning and highly automated industries, where most members of the current workforce find themselves replaced by technology and machines; in other words, a jobless future. Based on recent economic and innovation trends, Ford argues that the rapid technological advancement will ultimately result in a fundamental restructuring of corporations, governments and even entire societies as middle-class jobs gradually disappear, economic mobility evaporates and wealth is increasingly concentrated among the elite super-rich.

4. Gigged: The End of the Job and the Future of Work (St. Martin's Press, 2018) by Sarah Kessler

Gigged examines the shifting psychological contract between organizations and workers, discusses trends in the organization of work, and documents the movement in recent decades away from traditional employment models and toward part-time work and contingent employment arrangements such as independent contracting and project-based "gig" work. While such work has always been a part of informal economies around the world, the trend is increasingly common in traditional organizations as well, bolstered by the success of companies like Uber and Airbnb.

5. The Future of Work: Attract New Talent, Build Better Leaders, and Create a Competitive Organization (Wiley, 2014) by Jacob Morgan

In The Future of Work, Morgan continues the argument that the world is changing at an accelerated pace. He demonstrates that the way we work today is fundamentally different from how previous generations worked (due to globalization, technological innovation and shifts in the composition of national economies) and suggests that the future of work will be drastically different from what we experience today (a shift from knowledge workers to learning workers), where employees can work anytime and anywhere and can use any devices.

6. Shaping the Future of Work: A Handbook for Action and a New Social Contract (MITxPress, 2017) by Thomas A. Kochan

Probably the most academic book on this list, Shaping the Future of Work acknowledges an increasingly digitized economy and examines the resulting shift in social contract with regard to work and the professions. Kochan provides a road map for what leaders across contexts need to do to create high-quality jobs and develop strong and successful businesses.

What Does All This Mean?

In the next 50 years, we will likely see:

-

A continually shifting geopolitical landscape.

-

Continued movement from linear organizations to a more latticed/connected framework.

-

The displacement of jobs and the hunt for talent in a more automated economy.

-

An increasingly mobile and flexible labor force, and a push toward a reskilling agenda within organizations to continually leverage human capital value.

-

Technological advancements that continue to disrupt traditional organizational models and shift the very nature of work and professions.

So what does this all mean for HR professionals and organizational leaders? What are the core competencies of organizations that are prepared for these technological disruptions? How does the shifting nature of work influence needed HR competencies?

Regardless of what the future holds, these are questions we need to be asking and discussions we need to be having so that we are prepared for the future of work.

SOURCE: Westover, J. (5 September 2018) "6 Books on the Future of Work That Every HR Professional Should Read" (Web Blog Post). Retrieved from https://www.shrm.org/hr-today/news/hr-magazine/book-blog/pages/6-books-on-the-future-of-work-that-every-hr-professional-should-read.aspx/

Business meal deductions likely here to stay after new IRS guidelines

Business meal deductions are expected to continue to qualify for deductions. After much confusion following the IRS’s decision to end deductions for client entertainment, they are expected to release guidance regarding business meal deductions. Read on to learn more.

Employers wondering whether they can still deduct business meals from their tax returns may soon be getting an answer from the Internal Revenue Service.

The agency is expected to release guidance saying that business meals will continue to be 50% deductible, according to an article in the Wall Street Journal.

The confusion over the deductibility of business meals stems from the IRS’s decision to end deductions for client entertainment, a move that was part of the government’s tax overhaul. Previously, the entertainment-related deduction was 50% of qualified expenses.

The elimination of deductions for client entertainment left many tax professionals wondering whether client meals might be considered entertainment and therefore no longer qualify for deductions.

The anticipated IRS guidance — which comes at the urging of the American Institute of Certified Public Accountants and other groups — is expected to preserve the 50% deduction for the cost of meals with clients and elaborate on how the 50% meal write-off meshes with entertainment expenses, the Wall Street Journal said.

If a business owner or employee, for example, takes a client to a ballgame, the cost of the tickets is not deductible because the expense is for entertainment. Hots dogs and drinks purchased at the event, however, could still be 50% deductible, the IRS is expected to say, according to the Wall Street Journal.

The IRS, which did not respond to a request for comment, is not likely to change the normal requirements corporate executives must meet to take deductions for client meals.

They must discuss business with the client before, during and after the meal, and the meal must not be “lavish or extravagant,” the Wall Street Journal said.

SOURCE: Correia, M. (28 September 2018) "Business meal deductions likely here to stay after new IRS guidelines" (Web Blog Post). Retrieved from https://www.benefitnews.com/news/business-meal-deductions-likely-here-to-stay-after-new-irs-guidelines?brief=00000152-14a5-d1cc-a5fa-7cff48fe0001

5 ways benefits educators can ease the open enrollment process

Are you prepared for open enrollment? HR professionals are responsible for effectively communicating plan options and changes to employees so they make informed decisions regarding their coverage and healthcare. Continue reading to learn more.

Open enrollment season is on its way, which means that HR’s already full plate just got a bit fuller. In addition to developing competitive health plans that attract and retain top talent – talent of all ages and with varying needs – HR pros are also responsible for effectively communicating plan options to employees to ensure that individuals make informed, cost-conscious decisions about their coverage and care.

See also: Here’s how HR pros can breeze through open enrollment

As the healthcare landscape becomes more complex, so do employee questions around their health care benefits. Many healthcare consumers today don’t feel comfortable navigating the health care system – which is why most roll over the same plan year after year. While HR teams want to manage the influx of employee questions around their benefits options, they struggle to provide the necessary guidance given their current bandwidth. Covering health plans in a large townhall meeting won’t provide the personalized information that employees need to make educated decisions. To deliver a more personal, empowering experience, organizations can look to benefits educators to supplement strapped HR teams.

Benefits educators can help individuals better understand the plan options available to them and select the package that offers the coverage they need at the price that best fits their budget. To ensure that benefits educators are aligned with the organization’s strategy, HR teams should arrange for educators well in advance of open enrollment so they are equipped to best explain the employer’s benefits plan options. Once up to speed, benefits educators can hold one-on-one conversations with employees to:

1. Define healthcare terms that employees don’t understand. With low healthcare literacy rampant across the U.S., disturbingly few employees are comfortable defining basic health terms such as “deductible,” “copay” or “coinsurance.” benefits educators cannot only explain these important terms but also help employees understand their significance in their coverage selection process.

2. Compare different plans to suit each employee’s needs. Benefits educators will work to understand the specific needs of each employee they meet. By taking the time to sit and get to know each employee, the benefits educator can recommend options that provide the coverage that best meets the needs of the employee and his or her family.

See also: Avoid these 12 Common Open Enrollment Mistakes

Third-party, independent benefits educators can be particularly valuable for employees who do not feel comfortable posing personal questions to their coworkers. By meeting one-on-one with an outsider who understands both benefits in general and company options in particular, employees are often more inclined to raise specific health or personal details that should guide their benefits selection. In fact, 45 percent of employees say they would prefer to speak to a benefits expert when choosing their coverage.

3. Equip employees with the information they need to choose their coverage. Left to their own devices, 83 percent of employees spend less than an hour reviewing their plan options before open enrollment – a lack of preparation that does not bode well for educated benefits selection. benefits educators can focus on the details that matter – saving the employee time and effort.

4. Explain voluntary benefits. Despite the increasing popularity of voluntary benefits, many employees are still confused about what they are, how they work and why they might be helpful. In reality, certain voluntary benefits can help control health costs and bridge the gap between medical coverage and out-of-pocket costs – added expenses that concern 61 percent of employees. In today’s multigenerational workforce – where employees have very different priorities when it comes to their health and financial wellness – benefits educators can dispel some of the mystery and suggest options that might meet individual needs.

5. Empower employees to make the most of their benefits year-round. Benefits educators can lay the groundwork for more educated health care consumers by directing employees to resources where they can find more information about their coverage and how their plans work after the open enrollment ends.

See also: 5 tips to make this the best open enrollment ever

More informed employees not only make smarter choices about their coverage and care but also better appreciate their employers – which has the potential to help with retention and business productivity. Ultimately, organizations see a win-win-win: happier employees who save on care, happier HR teams who save on time and happier executives, who see a significant return on their health care investments.

SOURCE: Murdock, G (21 September 2018) "5 ways benefits educators can ease the open enrollment process" (Web Blog Post). Retrieved from https://www.benefitspro.com/2018/09/21/5-ways-benefits-educators-can-ease-the-open-enroll/