Open Enrollment Tips Under Health Care Reform

Originally posted September 6, 2013 on https://www.thestreet.com

This year's open enrollment season for selecting workplace benefits comes just before some of the biggest changes of health care reform go into effect.

Never before has it been more important to pay attention as you choose a health plan for you and your family.

"You really need to do your homework this year," says Carol Taylor, an employee benefit adviser with D & S Agency Inc. in Roanoke, Va.

Here are 5 tips for open enrollment this fall.

1. Understand the health care reform individual mandate: You must have coverage.

Starting in 2014, federal law will require virtually everyone to have health insurance or face a tax penalty. So if your employer doesn't offer health insurance for next year or your company's health plan doesn't meet certain minimum standards, you'll need to shop for health insurance on your own. Your employer must let you know by Oct. 1 whether its health plan meets "minimum standards," says Taylor, a member of the National Association of Health Underwriters National Legislative Council.

To meet the minimum standards under health reform, employers must offer coverage at the "bronze level," which is one of the four levels of coverage defined under health reform provisions. The other three are silver, gold and platinum. They are based on actuarial value, which measures the amount of financial protection the policy offers, or the percentage of health costs a plan would pay for an average person. For a bronze plan, the insurance would cover 60 percent of all health care costs for an average person. Enrollees, on average, would be responsible for paying 40 percent of the costs.

If you're shopping for an individual health plan, you can buy one from an insurance company directly or through your state's new health insurance marketplace. The online health insurance marketplaces, sometimes called exchanges, are scheduled to open for business Oct. 1. Coverage can begin Jan. 1.

If you're not eligible for coverage through an employer or your employer's plan doesn't meet government standards, then you might qualify for a tax credit to save money on premiums when you buy a marketplace plan. People who earn up to 400 percent of the federal poverty level -- that's $94,200 for a family of four in 2013 -- will be eligible for premium subsidies in the form of tax credits. People who earn up to 250 percent of the federal poverty level will be eligible for lower deductibles and copayments.

2. Don't assume your family will qualify to save money in the new marketplaces.

Think you can get a better deal in the new marketplace than what your employer is offering? Maybe not. If you and your family have access to affordable employer-sponsored health insurance that meets minimum standards, then you and your dependents are not eligible for premium tax credits or help with cost-sharing - which includes aid in paying deductibles, copayments or co-insurance -- in the new marketplaces. You can shop there, but you'll pay full price.

"Affordable" means you pay no more than 9.5 percent of your household income toward the coverage for yourself. The amount you pay for your dependents to be covered on the employer-sponsored plan isn't factored into the equation. So even if you have to pay a bundle to keep your dependents on the employer plan, they're still not eligible for subsidies in the marketplace if the portion you pay to cover yourself is deemed affordable and they have access to the employer plan.

That could put a lot of moderate-income families with a sole breadwinner in a financial bind, says Mindy Anderson-Wallis, president of Employee Benefit Solutions of Indiana in Lafayette, Ind.

3. Compare benefits and health insurance plan networks.

Check out the provider networks of the plans you're offered to make sure your doctors and preferred hospital system are included, especially if you have a serious or chronic condition and are undergoing treatment. Given all the standards that must be met, one way health plans may cut costs is to cut the provider networks, Taylor warns.

You pay substantially more out of pocket to see providers outside the network with a preferred provider organization (PPO) plan. Except in special circumstances, you typically pay for the full cost of services for providers outside the network with a health maintenance organization (HMO) plan.

4. Understand that your employer doesn't have to offer coverage in 2014, and it won't have to offer coverage to your spouse.

Starting in 2015, the Patient Protection and Affordable Care Act will require employers with at least 50 workers to provide affordable health insurance for workers and their dependents or pay a penalty. The so-called employer mandate was supposed to go into effect in 2014, but the Obama administration delayed implementation for a year.

Still, most employers are gearing up for the mandate, and there's one tricky technicality you should know. The federal government will define dependents as children, not spouses. So even when the employer mandate goes into effect, your workplace won't have to offer coverage to your spouse.

Nobody knows yet how this will play out, but Anderson-Wallis says she doesn't think the definition of "dependent" will have much impact.

"I don't think we'll see large employers not continue to cover spouses," she says. "Benefits are seen as a way to attract and retain employees."

If your spouse isn't eligible for employer-sponsored coverage, then he or she will qualify for a tax credit to save money on a health plan in the new marketplace if your household income is less than 400 percent of the federal poverty level.

5. Crunch the numbers and pick the health insurance plan with the best value.

Compare the out-of-pocket costs of each health plan if your employer offers a choice of plans. Your costs include:

- Deductible.

- Doctor visits, urgent care and emergency room copayments.

- Co-insurance -- the percentage the health plan pays after you satisfy the deductible.

- Prescription drug copayments or co-insurance.

- Your portion of the premium.

Consider how often you go to the doctor, the medicines you take and what services you might need in the next year. Run some scenarios to see how much each health plan would cost, and choose one that meets your unique needs.

"Don't just roll the dice without calculating," Anderson-Wallis says.

Cost savings attributed to self-funding, wellness

Originally published September 6, 2013 by Tristan Lejeune on https://ebn.benefitnews.com

Dianne Howard has understandably made a number of changes during her tenure as director of risk and benefits management with the School District of Palm Beach County, Fla. - after all, she's been there for 18 years. One change in particular six years ago paved the way for many other beneficial ones: The district went self-funded. It's a shift that may not be an option for many employers, but Howard - winner of the 2013 Benny Award for Benefits Leadership in Health Care - says it allowed her to be more hands-on with internal policies and institute real, lasting improvements.

"I'm a big believer in self-insurance," Howard says. "I think you can buy excess insurance to protect yourself, you know, specific and aggregate. You can't be too small, but for groups of 1,000 or more, it's the way to go. You can control things, you can subcontract, you can get in there and say, 'Well, why is this costing us so much money?'"

She recalls an incident where MRIs - hundreds of them in total - were being paid for without having the deductible applied. Providers never informed them of this until the district took the reins themselves; they had just assumed that hospital stays were involved.

"And it was just a mistake - I'm not trying to throw anybody under the bus - but because we looked at it, we could fix it and change it so that the design as we negotiated [it] was in there, and we're getting the savings that we thought we would get," she says.

After going self-insured, the district used a data warehouse to analyze its claims and find ways to control costs. Estimated savings? At least $4 million. It also added a tobacco surcharge to insurance plans and helped write the Florida law banning smoking on school property. But the initiative Howard is most eager to talk about is one that has been widely embraced even as its financial efficacy has been increasingly questioned: wellness.

Not an easy sell

Many who have tried it will tell you that initiating a wellness program is not the easiest sell to an employee population. Just ask Howard: "People don't like being told what to do," she says, and she saw quite a bit of resistance. That's normal enough for a private company, but Howard's position comes with extra challenges.

"We're a public entity, so noise gathers," she says. "It doesn't just come to me and my staff. It goes to me, to my boss and maybe to our school board. You just want to be able to defend your position, get it well-communicated and get the unions on board to help you communicate. We told them, 'If it works and we keep our rates down, maybe we won't need rate increases every year.' And for 2014, we're not going to need a rate increase."

Marilyn Boursiquot, benefits manager for the district, agrees that wellness was not exactly a welcome change for employees, but she says the work is paying off.

"Our culture is slow, and some folks are still being dragged along kicking and screaming, but we can truly say that we're starting to see the light of creating a culture of wellness, which is really exciting," Boursiqout says.

Howard's "tenacity" and her "willingness to be on the edge" has helped steward the district through year after year of change, Boursiquot says. And she thinks that's what makes Howard worthy of her Benny Award.

"When we look at other school districts, and just other employers in general, they're willing to go to a point, but then when the rubber hits the road ... it's not always easy to introduce programs like this," Boursiquot says. "You take flak for it. And to actually keep moving forward in spite of all that - that's what I really admire about her."

Medical trends

The School District of Palm Beach County boasts an average five-year medical trend of 6% - 4% below the industry median of 10%. It also shed 1,000 dependents (estimated long-term savings: $4.4 million) after an audit found them ineligible - one of many reviews made possible through self-insurance.

Howard, however, believes the wellness program has been helping keep costs down for the district, which has 20,000 full-time employees. It was a slow road, she says, and the program "evolved" from weak to strong.

"We started out by saying, 'Here's a health assessment you could do.' In a district our size, we got 25 people to do it, and we gave gift cards at the time," she says. "And that really was poor. So about four or five years ago, we started talking with the unions, and we found a different way to negotiate with them and said, 'Let's bargain something two years out,' and that gave them time to think and to plan.

"We wanted to get to the point where employees have to get blood work, so they know their condition, and get a physical. ... More than half our employees never saw a doctor. So we said, 'OK, preventive stuff is what we should do,' so we had talks with our carrier about what's important, and we figured the health assessment was very important."

The district upped the reward for HRA completion substantially to a $50 premium reduction per month. "And that number," Howard says, "really was motivating to our employees." In its first year, the new program saw 85% compliance. And now, as she says, health insurance costs won't rise for workers next year. This, too, is a bigger deal for a public entity.

"We're government employees," Howard points out. "We haven't had raises in a few years."

Of course, even wellness programs' biggest proponents will admit they can only get you so far; the district has had to do its share of belt-tightening. Copays and premiums have risen in recent years, and there are newly designed pharmacy tiers, too.

Estimating in 2010 that diabetes accounted for 20% of its health claims, the district implemented a diabetes health plan. In its first year, the plan reduced total net costs by 9%, or around $2.9 million.

In another "self-funded only" gain, the district now gets 100% of its pharmacy rebates, which not only helps its coffers but also future plan design.

"Our rebates are approaching $5 million a year, and that's money that goes right back into the health plan," Howard says. "We had no idea it was so much money - only self-insured employers do."

Schools run mini-programs

But Howard again credits the district's wellness plans for starting long-term change. Schools, she says, can be excellent incubators for mini-programs that could work just as well at businesses with multiple locations. In addition to administrative offices, the Palm Beach County district runs some 180 locations, serving approximately 176,000 students.

"We had what we called 'wellness champions' at each school," Howard says. "What we said we would do is give them some resources so that they could run a program for their school - if they wanted to run a class on exercise or Weight Watchers or whatever. We have two big meetings a year with them, we give them a $500 stipend out of our health budget and for that they have to do a certain number of programs at their school. ... We went from 30 to 170 [wellness champions] in four years. And each of those people can [reach out] to the 200 to 400 people at their school and they know them."

Employees might be more amenable to such programs when they're initiated by a friendly co-worker and not some distant HR office. Making it personal and fun helps, too: In a different effort, called the Apple-a-Day Program, participants can submit photos of themselves eating apples while walking, reading medical care info or doing other healthy things. Howard says vendors donated prizes for the best photos, and local orchards even donated some apples. It's definitely a program she plans to repeat.

Kimberly Sandmaier, Palm Beach County wellness coordinator, admires Howard for her dedication and knows the district health plan is in good hands. "She's worked so hard with all our programs," Sandmaier says, and positive results are coming in on all fronts.

"I've always looked up to her and seen her as a leader. Whether it's meeting with a vendor or the unions, she gets a lot of respect from them. I think she does a great job, and she handles everything with grace."

As for what lies ahead, Sandmaier says, "We're trying to be proactive. We're trying to figure out the best thing out there to reduce our health care costs, especially in light of everything that's happening with health care reform and some of the additional charges that we may see in the future."

In the next phase of evolution, Howard plans to make her wellness programs results-based. Though she concedes it "may be not quite as successful," she remains optimistic.

"I think people are going to do it. I mean, you're taking the blood work anyways," she says. "Ideally people will say 'I've been doing the blood work for three years, I've had high blood pressure for three years - why don't I do something about it?' But that might not happen."

Whether self-insured or not, whether public or private, Howard recommends employers commit to wellness. "I really believe that you need a wellness component and work toward having your population having a little accountability in your health care," Howard says. "Don't give up when the noise gets a little loud. Use your data to show people, 'Look, this is what happening.' I just really believe in it; it's been good for us."

The numbers

Here are just a few of the results achieved by the School District of Palm Beach County under Dianne Howard's leadership:

2007: Switch to self-funded plan.

0: Cost increase in 2014 for self-funded medical plan.

6%: Average five-year medical trend.

100: Percentage of pharmacy rebates now received.

$4 million: Savings achieved from using a data warehouse to dig into claims to see where the school district was spending the most money and analyze what could be done to control those costs.

1,000: Number of dependents moved off the health plan thanks to a dependent eligibility audit.

$4.4 million: Estimated savings from dependent eligibility audit.

80%: Average participation rate in the wellness program.

$2.9 million: Estimated savings from the implementation of a diabetes health management program.

$600: Annual tobacco surcharge.

195: Number of wellness champions, up from 16 a few years ago.

IRS struggles to combine PPACA reports

Originally posted September 6, 2013 by Allison Bell on https://www.benefitspro.com

The Internal Revenue Service is still trying to figure out how to combine two new Patient Protection and Affordable Care Act reporting programs.

One of the new programs requires a carrier to tell the IRS and consumers whether it’s providing minimum essential coverage.

The other requires a large employer to tell the IRS whether it’s meeting the “shared responsibility” requirements -- the employer mandate -- by offering full-time workers affordable coverage with a minimum value. An employer that violates the mandate rules could have to pay a penalty of $2,000 per affected worker.

The IRS will publish the PPACA Section 6055 MEC reporting requirement and PPACA Section 6056 shared responsibility reporting requirement draft regulations in the Federal Register on Monday.

It’s been suggested before that the IRS combine the two programs. But doing so would be complicated, because the programs apply to different entities and will generate different types of information, IRS officials said.

In some cases, the IRS may let large employers use information reported on Form W-2 and information reported to meet the Section 6055 MEC reporting requirements to meet the Section 6056 shared responsibility requirements, officials said.

The IRS is considering letting employers meet the Section 6056 shared responsibility reporting requirements by using a code on the W-2.

Also in the draft, officials:

- Declined to let employers with fiscal years other than the ordinary calendar year to base Section 6055 or Section 6056 reporting on the fiscal year. Consumers need the coverage information early in the calendar year, officials said.

- Declined to create a safe harbor from penalties for coverage issuers or employers that violate reporting rules because other parties cause problems. Another provision already offers issuers and employers relief for any errors that are corrected in a timely manner, officials said.

- Said that the insurer that insures a group health plan, not the group plan sponsor, is responsible for meeting the Section 6055 MEC reporting requirements for the group plan members.

9 items to tackle ahead of the Oct. 1 deadline

Originally posted September 6, 2013 by Dan Cook on https://www.benefitspro.com

Enrolling employees for the 2014 company health plan will put plan managers to a test like they’ve never seen before. Those that haven’t already immersed themselves in the details are going to be working some very late nights in the next couple of weeks.

John Haslinger, vice president for strategic advisory services at ADP, helped BenefitsPro.com compile a list of the essentials that must be executed in order to comply with the law and avoid sanctions.

Haslinger strongly advises that companies take these requirements seriously. He said the government’s decision to delay the corporate plan sanctions piece of the PPACA until 2015 doesn’t let anyone off the hook as far as meeting all the other requirements by Jan. 1. And many items must be completed by Oct. 1.

Here, then, are nine items you need to check off your 2014 checklist to stay out of the PPACA’s woodshed.

1. Notice of coverage or exchange notification: It’s up to employers to notify every employee, covered by a company health plan or not, of the health care options available to them through the insurance exchanges created by the Patient Protection and Affordable Care Act. This notification must be in an employee’s hands no later than Oct. 1. Employers hired after Oct. 1 have to be notified within 14 days.

Suggestion: If you haven’t started this process, hire a third-party administrator with knowledge of the process to do it for you.

2. The Transitional Reinsurance Fee: This is the $63-per-covered-employee fee that plan sponsors and insurers must pay. The money goes to fund insurance for high-risk individuals. Employers and insurers have to report their enrollment numbers to the feds by Nov. 15. You’ll get an invoice back in a month, if all goes as planned, and the bill will come due a month later.

Suggestion: Set aside a good chunk of dough now to cover the cost.

3. Essential health benefits: This section of the PPACA requires non-grandfathered health plans to cover 10 essential health benefits as follows:

(1) ambulatory patient services; (2) emergency services; (3) hospitalization; (4) maternity and newborn care; (5) mental health and substance use disorder services including behavioral health treatment; (6) prescription drugs; (7) rehabilitative and habilitative services and devices; (8) laboratory services;(9) preventive and wellness services and chronic disease management; and (10) pediatric services, including oral and vision care.

For newly hired full-time employees who come on board after Jan. 1, coverage must be made available no longer than 90 days after hire.

Suggestion: State EHBs may vary, so make sure you know the requirements where you live.

4. Defining and counting your eligible full-time employees: The PPACA has redefined full-time employees for purposes of healthcare coverage. Now, employers must offer coverage to anyone who works an average of 30 hours a week. Calculating the 30 hours can be tricky, so you need to know the details. For instance, hours an employee is paid to work aren’t the only ones you count. You need to include the hours you pay someone not to work, such as vacation time, and hours of unpaid leave, such as jury duty. Having a good fix on who your eligible employees will be come Jan. 1 is critical to meeting the requirements of the law. To provide good data to the feds when they ask for it in 2015, employers will have to start tracking hours beginning this Oct. 1.

Suggestion: If you have put this exercise off because of the delay for sanctions until 2015, start counting now. You’ll need data from 10/1/13. Just because you don’t face sanctions doesn’t mean it isn’t essential to have a handle on this number.

5. 90-day waiting period: Under the PPACA, a group health plan or health insurance issuer offering group health insurance coverage must offer health coverage to new employees within 90 days of their hiring. No more “we’ll get you covered if you survive six months here.”

Suggestion: You might want to test potential hires out as contractors to make sure they’re a fit before you’re committed to coverage after 90 days.

6. Preventive services must be offered without cost-sharing: This requires group health plans to cover recommended preventive services without charging a deductible or co-pay/coinsurance. Grandfathered plans are generally excluded from complying with this provision. Among these services are immunization, well-woman visits, screening for gestational diabetes, screening for sexually transmitted diseases, well baby visits, and others.

Suggestion: If your benefits package includes a wellness program, you’ve got more assignments to complete before Oct.1. The idea behind these new rules is that all employees, regardless of their physical condition, should be able to meet the incentives built into wellness programs. Among the requirements:

7. Reasonable accommodations: Some employees, for various reasons, cannot meet the requirements established by wellness programs, so there must be options available for them built into the system.

8. The program must be designed to promote health or prevent disease: Wellness program goals must be tied to direct health benefits. Also, the goals established must not be “overly burdensome.”

9. Rewards must be available to all similarly situated employees: Again, because employees present a range of medical conditions, including some that may thwart them from achieving a reward, the conditions present in a given workplace have to be considered when designing the incentives and goals. Notice must be given to these employees of the options available to them.

Suggestion: Have a wellness program professional review your program to make sure that it is fair to all, truly promotes better health and includes incentives that any employee making a reasonable effort can hope to enjoy.

DOL Says No Fine for Failing to Provide Exchange Notices in 2013

Originally posted by Stephen Miller on September 13, 2013 on https://www.shrm.org

U.S. employers were again surprised by another unexpected suspension of a provision of the Patient Protection and Affordable Care Act (PPACA or ACA) when, on Sept. 11, 2013, the Department of Labor (DOL) announced there will be no penalty imposed on employers that fail to distribute to workers a notice about available coverage under state- and federal-government-run health insurance exchanges (collectively referred to by the government as the "health insurance marketplace"), scheduled to launch in October 2013.

Fair Labor Standards Act (FLSA) Section 18B, added to the labor statute by the PPACA, requires employers that are subject to the FLSA to provide all their employees by Oct. 1 of each year (the traditional start of the annual open enrollment season for employee health plans), and all new employees at the time of hiring, a written notice informing them of the following:

- The existence of the government-run health care exchanges/the marketplace, including a description of the services provided and the manner in which employees may contact an exchange to request assistance.

- If the employer plan’s share of the total allowed costs of benefits provided under the plan is less than 60 percent of such costs, workers may be eligible for a premium tax credit under Section 36B of the Internal Revenue Code if they purchase a qualified health plan through an exchange.

- Employees who purchase a qualified health plan through an exchange may lose their employer’s contribution to any health benefits plan the organization offers. All or a portion of this contribution may be excluded from income for federal income tax purposes.

According to the PPACA and subsequent guidance, the notice must be provided to each employee, regardless of plan-enrollment status or part-time or full-time status. Employers are not required to provide a separate notice to dependents or retirees, but an employer's obligation to provide notice may extend to its independent contractors and leased workers, depending on the nature of their relationship with the employer as determined under the FLSA's "economic reality" test.

The PPACA has a $100-a-day penalty for noncompliance with its provisions (unless otherwise specified in the statute), and it had generally been assumed this penalty would apply to employers that fail to distribute the exchange notice, possibly with additional penalties for failure to comply with a provision of the FLSA. However, the penalty provision had not been made explicit in any previous guidance, nor had the regulators described how the penalty would be implemented and enforced.

Then, on Sept. 11, 2013, the DOL posted on its website a new FAQ on Notice of Coverage Options, which states:

Q: Can an employer be fined for failing to provide employees with notice about the Affordable Care Act’s new Health Insurance Marketplace?

A: No. If your company is covered by the Fair Labor Standards Act, it should provide a written notice to its employees about the Health Insurance Marketplace by Oct. 1, 2013, but there is no fine or penalty under the law for failing to provide the notice.

DOL Encourages Compliance

Keith R. McMurdy, a partner at law firm Fox Rothschild LLP, commented in a posting on his firm’s Employee Benefits Legal Blog that Section 18B of the FLSA clearly states that any employer subject to the FLSA “shall provide” written notice to current and future employees and that the DOL’s Technical Release No. 2013-02, issued in May 2013, states that Section 18B of the FLSA generally provides that an applicable employer “must provide” each employee with a notice. McMurdy wrote:

My experience with the federal laws and the enforcement of said laws by federal agencies is that when things say “shall” and “must,” there are penalties when you don’t do them. So when the DOL now takes the position that it is not a “shall” or “must” scenario, but rather only a “should” and “even if you don’t we won’t punish you” proposition, I get suspicious. But I also think this confirms what I have said since the beginning about PPACA compliance for employers. It is all about your risk tolerance.” …

So, if you don’t want to send the Oct. 1, 2013 Notice, apparently the DOL “FAQ” says you have no penalties and thus no risk. Me? My risk tolerance is a little lower than that and my experience with regulatory agencies is such that I don’t trust informal “FAQs” posted on the web as much as I trust the clear language of the statutes and prior technical releases. Words like “shall” and “must” usually mean that if I don’t do it I get burned. So I am still recommending that employers comply with the notice requirement. Why? I can almost guarantee that if you send the notice, you won’t face a penalty for not sending it. But if you don’t send one, well, I still say all bets are off.

Christine P. Roberts, a benefits attorney at law firm Mullen & Henzell LLP,commented on her “E is for ERISA” blog, “This information, at this late date, is more confusing than it is helpful to employers who have already invested significant resources in preparing to deliver the Notice of Exchange.” She added this cautionary note:

“Particularly for employers with pre-existing group health plans, the Notice of Exchange potentially could be viewed by the DOL as within the scope of the employer’s required disclosures to participants and thus within the scope of an ERISA audit, or separate penalties could be imposed through amendment to the FLSA or the ACA.”

Model Notices

The DOL’s Sept. 11 FAQ reiterated that the department has two model notices to help employers comply with the Oct. 1 exchange/marketplace notice deadline (which they are strongly encouraged to meet):

- Model Notice for employers who offer a health plan to some or all employees.

- Model Notice for employers who do not offer a health plan.

Employers may use one of these models, as applicable, or a modified version. The model notices are also available in Spanish and MS Word format at www.dol.gov/ebsa/healthreform.

Can Happiness Heal? How a positive attitude might save your life

Originally posted by Julia Perla Huisman on https://www.nwitimes.com

Health and happiness. Are the two linked? We can assume that those with good health are generally happy to be well. But what about the other way around? If someone is sick, can happiness make them feel better physically?

The answer is a resounding yes, according to recent research. Multiple studies have shown that a positive outlook on life reaps many tangible benefits: “‘Happy’ people cope better with stress and trauma, are more resilient, have stronger immune systems, and live longer,” says Barbara Santay, therapist for Franciscan Alliance’s Employee Assistance Program.

The statistics are staggering: according to Santay, two-thirds of female breast cancer survivors who attend support groups report that their lives were altered for the better after developing the disease. Women who have strong social connections live an average of 18 months longer than those who have little to no connections. Bereavement has been associated with stress hormones, and friendly social contact has been proven to decrease those hormones.

“One of the big ways we see [the correlation] clinically is with chronic pain,” says Michael Mirochna, M.D., a family medicine physician with Lake Porter Primary Care and Porter Physician Group of Porter Regional Hospital. “When a patient’s mood is good, they’ll be in less pain. If they start to feel worse and you dig into their psychosocial history, you find that something happened (their dog died, relationship problems, etc.). There’s a close correlation with mood and pain in that regard.”

It’s clear to see that happiness fosters good—or at least improved—physical health. But what, exactly, is happiness?

“I think we need to differentiate between happiness and joy,” says Tanaz Bamboat, certified laughter yoga instructor from Munster. “Happiness depends on things. Joy is unconditional.”

Santay adds, “People think they would be happy if only they were to get married, have a baby, get plastic surgery, win the lottery… These things do provide a temporary boost in happiness but after a certain time has passed, people return to their happiness set point.”

Experts agree that what leads to a continual state of happiness has nothing to do with circumstances or material possessions, which can be fleeting. Rather, it comes from one’s outlook on life.

Fortunately, such an outlook can be cultivated and exercised, so that even the biggest curmudgeon on the block can take control of his or her mental and emotional—and therefore physical—health.

We’ve outlined five ways to develop a positive perspective:

Be physically active. There is bountiful research backing the premise that exercise improves mood. “We strongly encourage physical activity with our patients diagnosed with depression,” says Mirochna. “If their depression is so bad that they don’t feel like doing anything at all, we encourage them to at least do some physical activity, and it immediately makes them feel better.” In fact, according to Santay, aerobic exercise is shown to be just as effective as depression medications.

Dawn Wood, certified therapeutic recreation specialist and instructor of the Benefits of Exercise class at Methodist Hospitals, says, “One of the emotional benefits of exercise is that you are doing good for your body and yourself. When you feel good about yourself, it gives you confidence to meet daily challenges, meet goals, and communicate with others.”

Meditate/Focus. Santay lists meditation, avoiding overthinking, and increasing “flow experiences” (activities that engage you, cause you to lose track of time) as ways to get the mind right. She also encourages two minutes of writing every day. “The immune system works better when we write,” she says. According to a study by the University of Missouri and Columbia, the psychological and physical benefits of two minutes of journaling are greater than those that come from writing in longer time segments.

Wood suggests “true relaxation… allow yourself to take a mental and physical break from your responsibilities from time to time, so when you return, you have a better frame of mind.”

Laugh. The phrase “laughter is the best medicine” isn’t just a euphemism. Laughter is proven to prevent heart disease, lower stress hormones, strengthen the immune system, and reduce food cravings. It also has anti-aging benefits.

While a comedy show or YouTube video provides a temporary laugh, the greater health benefit comes from intentional, continuous laughter that can be learned in a class like laughter yoga. In this practice, participants are taught to laugh from the belly, and for no reason, so they learn to laugh despite their circumstances. They’re also instructed to breathe properly, which improves blood flow.

Bamboat, who teaches laughter yoga classes throughout Northwest Indiana, works often with cancer patients. “Laughter brings movement up into the lymph nodes,” which play a big role in cancer care.

“Laughter brings you back to a childlike state,” Bamboat says. “We were born with a spirit of laughter but have forgotten it because of stress. If you condition your body to laugh unconditionally, you will relieve your social, medical and physical stress.”

Be social. When we’re not feeling well, we tend to isolate ourselves. In reality, that’s the worse thing we can do. Having social connections and a strong support system can greatly improve one’s health.

“We tell our patients it’s important to have a sense of community,” says Mirochna. “What kind of social support structure do they have in place? If they are elderly, we ask if they have kids or a family.” Mirochna points out that Porter Hospital has a group for senior citizens in which they can participate in lectures and trips and develop friendships with other people in their stage of life.

Santay also urges her clients to nurture social relationships, learn to forgive, and practice acts of random kindness. Wood adds that helping others has been “the biggest factor I have noticed with patients’ happiness. It helps them feel worthwhile, capable.”

Be spiritual. Getting in touch with your spiritual side can do wonders to your physical health. Those active in religion live longer, use drugs less often, have longer marriages, and are healthier in general, according to Santay.

Father Tony Janik of Franciscan St. Anthony Health-Crown Point explains spirituality’s medicinal qualities: “Those with a spiritual outlook can face the difficult parts of life by having a greater sense of value. They have a source of perspective and hope… They find strength in that hope and have better coping mechanisms.”

This is especially valuable for those going through the end of life. “Not everyone gets cured, but they can be healed, from a spiritual perspective,” Janik adds. “We believe that everyone is made in the image of God and that they can have a life beyond here. That gives our patients hope.”

Tools to Better Understand Your 401(k)

Originally posted September 11, 2013 by Philip Moeller on https://money.usnews.com

The Lifetime Income Disclosure Act proposed in May seems to have a reasonable objective: help people determine how much retirement income would be produced by their 401(k). For years, financial experts have touted the benefits of helping consumers understand their retirement trajectories. Otherwise, how will they know if they're on the right track to a successful retirement?

Reasonable or not, the legislation has become a perennial in the garden of consumer finance proposals. It gets introduced. Consumer groups applaud it. Investment firms say the goal has merit. Then they raise a host of operational problems in implementing such a law. Leading the list is their opposition to pretty much any government mandate. They prefer voluntary compliance.

[Read: How to Take Control of Your 401(k).]

Fidelity, the biggest provider of retirement accounts, responded last month to U.S. Department of Labor proposals to implement lifetime income disclosure rules: "Information provided in a static format does not promote participant engagement," Fidelity wrote in a letter to the labor department. "As an equally important consideration, the disclosures that would need to accompany the projections and illustrations would greatly add to both the length and complexity of participant statements, increasing the risk of reader disengagement from any of the information provided on the statement."

Please raise your hand along with me if you aren't really sure what this means. In Fidelity's defense, adding any additional required materials to customer statements may produce diminishing returns. Consumers have greeted recent expansions in 401(k) statements – aimed to provide more transparency to account fees and performance – with disinterest.

Many other investment firms also weighed in with their own objections. More fundamentally, exactly what assumptions about future investment returns and rates of inflation should be used in calculating lifetime income projections? What is the ideal or "right" rate of withdrawing assets from a plan during retirement? Even Nobel Prize winners wouldn't agree on such numbers.

What does Washington say? Here is the description provided by the Congressional Research Service of the current version of the proposed law:

"[The Lifetime Income Disclosure Act] requires such lifetime income disclosure to set forth the lifetime income stream equivalent of the participant's or beneficiary's total benefits accrued. Defines a lifetime income stream equivalent of the total benefits accrued as the monthly annuity payment the participant or beneficiary would receive if those total accrued benefits were used to provide lifetime income streams to a qualified joint and survivor annuitant.

"Directs the Secretary of Labor to: (1) issue a model lifetime income disclosure, written in a manner which can be understood by the average plan participant; and (2) prescribe assumptions that plan administrators may use in converting total accrued benefits into lifetime income stream equivalents."

[Read: 3 Highly Personal Threats to Your Retirement.]

Are we all clear on this?

In the interest of plain language – whether driven by government mandate or voluntary industry compliance – employees and retirees with 401(k)s and individual retirement accounts would be better off with clear answers to practical questions. Here are 10 basic retirement plan questions that merit clear and helpful answers, and some tips about trends and where to find answers.

1. Based on your current 401(k) contribution level and investment results, what kind of retirement is in store for you?

The Employment Benefit Research Institute does an annual retirement confidence survey that contains troubling conclusions about the state of retirement prospects for many Americans. The 2013 survey results can be found at https://www.ebri.org/surveys/rcs/2013/.

2. Do you know what your Social Security benefits would be for different claiming ages?

The Social Security Administration has a tool to provide you access to your earnings history and projected benefits at www.ssa.gov/myaccount.

3. Are you saving enough?

Most people should be saving 10 to 15 percent of their salaries, with higher levels needed for those who wait until their 40s to get serious about retirement savings. Yet most people are saving far less.

4. How much money do you have?

Make a date with yourself to spend an hour with your latest plan statement. It may be time very well spent.

5. What are you paying in fees?

Investment management companies have been steadily lowering retirement plan fees in response to sustained criticism and competition from Vanguard and other low-fee investment firms. The Department of Labor has a primer on retirement plan fees at www.dol.gov/ebsa/publications/undrstndgrtrmnt.html.

6. How has your account performed?

See the advice for question #4.

7. How does your 401(k) performance compare with other investment choices you can make within your plan?

This will require more work on your part, but your plan statement and usually your plan's website will include tools to let you look at investment returns of the various funds and other investment choices offered by the plan.

[See: 10 Things to Watch When Interest Rates Go Up.]

8. How does your performance compare with investment results in the plans of other companies?

Check out BrightScope at www.brightscope.com or Morningstar at www.morningstar.com/Cover/Funds.aspx.

9. What is your employer's match policy, how does it compare with industry standards and are you taking full advantage of the match?

Smart401k provides a helpful discussion of employer matches at https://www.smart401k.com/Content/retail/resource-center/retirement-investing-basics/company-match.

10. If you change jobs, what are you going to do with your current employer's 401(k)?

Many people cash in their retirement plans when they change jobs instead of rolling them over into new plans or IRAs. Most of them are making a mistake.

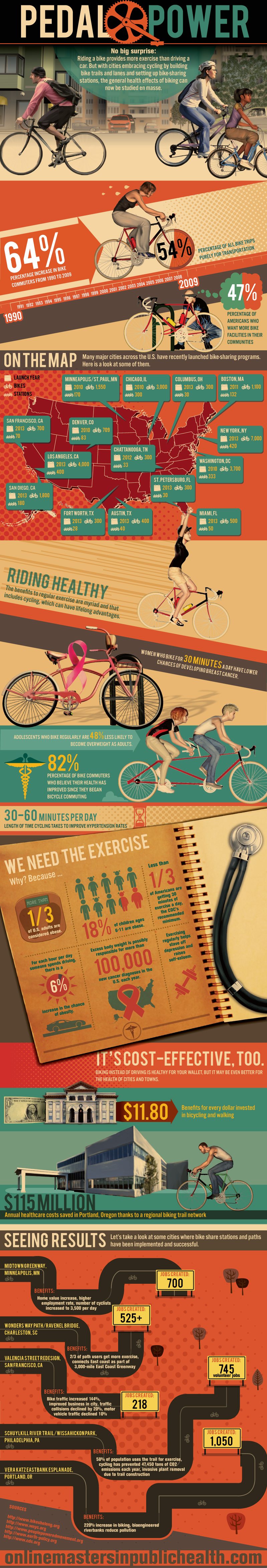

Pedal Power - Wellness Infographic

Originally posted on https://onlinemastersinpublichealth.com/pedal-power/

No big surprise: Riding a bike provides more exercise than driving a car. But with cities embracing cycling by building bike trails and lanes and setting up bike-sharing stations, the general health effects of biking can now be studied en masse.

64%

Percentage increase in bike commuters from 1990 to 2009

54%

Percentage of all bike trips purely for transportation

47%

Percentage of Americans who want more bike facilities in their communities

Riding Healthy

The benefits to regular exercise are myriad and that includes cycling, which can have lifelong advantages.

Women who bike for 30 minutes a day have lower chances of developing breast cancer.

Adolescents who bike regularly are 48% less likely to become overweight as adults.

82%

Percentage of bike commuters who believe their health has improved since they began bicycle commuting

30-60 minutes per day

Length of time cycling takes to improve hypertension rates

We Need the Exercise

Why? Because …

- More than 1/3 of U.S. adults are considered obese.

- 18% of children ages 6-11 are obese.

- Less than 1/3 of Americans are getting 30 minutes of exercise a day, the CDC’s recommended minimum.

- For each hour per day someone spends driving, there is a 6% increase in the chance of obesity.

- Excess body weight is possibly responsible for more than 100,000 new cancer diagnoses in the U.S. each year.

- Exercising regularly helps stave off depression and raises self-esteem.

It’s Cost-Effective, Too.

Biking instead of driving is healthy for your wallet, but it may be even better for the health of cities and towns.

$11.80

Benefits for every dollar invested in bicycling and walking

$115 million

Annual healthcare costs saved in Portland, Oregon thanks to a regional biking trail network

Seeing Results

Let’s take a look at some cities where bike share stations and paths have been implemented and successful.

Midtown Greenway, Minneapolis, MN

Benefits: Home value increase, higher employment rate, number of cyclists increased to 3,500 per day

Jobs created: 700

Wonders Way Path/Ravenel Bridge, Charleston, SC

Benefits: 2/3 of path users get more exercise, connects East coast as part of 3,000-mile East Coast Greenway

Jobs created: 525+

Valencia Street Redesign, San Francisco, CA

Benefits: Bike traffic increased 144%, improved business in city, traffic collisions declined by 20%, motor vehicle traffic declined 10%

Jobs created: 218

Schuylkill River Trail/Wissahickon Park, Philadelphia, PA

Benefits: 58% of population uses the trail for exercise, cycling has prevented 47,450 tons of CO2 emissions each year, invasive plant removal due to trail construction

Jobs created: 745 volunteer jobs

Vera Katz Eastbank Esplanade, Portland, OR

Benefits: 220% increase in biking, bioengineered riverbanks reduce pollution

Jobs created: 1,050

Employees say companies have yet to communicate benefit changes

Originally posted August 27, 2013 by Andrea Davis on https://ebn.benefitnews.com

The October 1 deadline for employers to notify employees of their health coverage options is looming yet the majority of employees say their company has yet to communicate any changes, according to a survey released this morning by Aflac.

Sixty-nine percent of employees surveyed say their employer hasn’t communicated changes coming to their benefits package due to health care reform, despite the October 1 deadline.

In a separate Aflac survey, meanwhile, only 9% of companies indicate they are very prepared to implement required changes to their business based on the health care reform law at this time. Some employers (41%) believe more gaps in coverage will be created and 69% believe costs to employees will increase as a result of health care reform.

“At the heart of this issue is the fact that many workers will be blindsided this open enrollment season because we know they already struggle with understanding their insurance policies today, and in covering the high out-of-pocket costs from gaps in their current coverage,” says Michael Zuna, Aflac’s executive vice president and chief marketing officer.

Other statistics from the open enrollment survey of employees include:

- 74% of workers sometimes or never understand everything that is covered by their insurance policy today.

- 37% of workers think it will be more difficult to understand everything in their health care policy with the changes dictated by health care reform.

- 28% of employees are confused, worried or simply unsure about the change their employer is making to their health care coverage or benefits options due to health care reform.

- 60% of workers have not begun to educate themselves about coming changes to their benefits package due to health care reform.

A faster, cheaper way to wellness programs that work

Originally posted September 6, 2013 by Vlad Gyster on https://ebn.benefitnews.com

The debate over whether wellness programs "work" is becoming increasingly heated. Many question the validity of research demonstrating that wellness programs reduce health care costs. At the same time, others swear by their wellness provider. So, who's the liar?

As with most things, the truth is in the eye of the beholder. Wellness is a business, and it would serve us well - no pun intended - to consider this business formula as we attempt to determine where the truth lies and understand why this debate is so heated: Value = Benefits/Cost.

To begin with, we don't truly know the value of a wellness program. This formula helps quantify the importance of knowing value. When making a purchase, all of us have some understanding of a product's benefits, and in return we pay a cost. Together, those two factors create a value. If the benefits and costs are generally understood, then value is pretty predictable. But if there's a lack of agreement about the benefits, it's tough to come to consensus on value and cost. The result is very different calculations and a big debate about whether something is really worth it. This is what we're experiencing with wellness programs. The reality is that we don't really know all the benefits a wellness program provides, and, as a result, their value is up for debate.

This debate will eventually be resolved in one of two ways:

1. We come to a consensus that wellness programs deliver the stated benefits and continue to pay the current cost; or

2. We conclude the benefits are lower than initially thought, and adjust the cost accordingly.

I've got my money on option 2. Here's why:

Gartner - a research advisory firm that's been evaluating technology for more than 30 years - discovered a funny pattern: Every few years, a new technology emerges that gets a lot of people really excited. There's a lot of enthusiasm and promises, but, given limited use, no real data about the technology's actual benefits. This is the "peak of inflated expectations"; i.e., when we make statements like "This is going to change the world."

After a while, though, people realize that their perception of the technology's benefits are unrealistic; they feel they received bad value, get disgruntled and criticize the technology as worthless. This is the "trough of disillusionment." It occurs when the benefits are lower than originally assumed, and the cost is experienced as too high relative to the perceived lesser value.

It's reasonable to assume we are in the midst of a sober re-evaluation of the benefits of wellness programs, somewhere in the "trough of disillusionment." The good news is, as history has proven, that over time, the market comes to understand the technology's actual benefits, accepts them and broad adoption can occur. For this to happen, there needs to be a consensus about the benefits (aka ROI) and the price adjusted accordingly. This doesn't mean wellness programs are worthless, just that they may be worth less than the benefits declared during the "peak of inflated expectations."

Minimize cost

In a scenario where the value of something is unclear, it's wise to minimize - rather than wait for the market to drive down - cost, as cost is the variable you have control over. Traditional approaches to launching wellness initiatives come with huge overhead - strategy, vendor selection, implementation and vendor fees can easily run into the hundreds of thousands of dollars - and can take years before having any real impact on even a single employee. Cut as much of this overhead as possible. Vendor selections should come in the form of free trials with groups of employees. Vendor fees should be contract-free and have monthly options for easy exit. Strategy work should turn into small experiments with employees to identify what works and what doesn't.

In other words, spend less. But how do you drive a high level of engagement in wellness with limited resources? We suggest using the Lean Startup methodology used by startups to drive engagement in new products using limited resources. This approach advocates using small, inexpensive steps that lead to quick wins and continuous improvement. Its use could help HR quickly and cheaply differentiate what works from what doesn't, so HR can focus time and dollars on what's actually effective.

Four steps

Here's our version of the Lean Startup methodology adapted for HR:

Step 1: Think in terms of a "Minimum Viable Product". MVP is the smallest thing you can do to learn how to make progress toward your objective. For most employers, the objective of their wellness programs will be somehow tied to employee participation. Instead of spending limited resources on building business cases and other costly activities, pick something to do that is small and will help you learn what works to gain employee participation.

Step 2: Build something that's "good enough". Start with something easy, like an employee video testimonial about a benefit that's already available (but likely underappreciated), such as gym reimbursement. Upload the video to a video hosting tool for businesses so you can track how many people click the link and view your video. Send an email to employees inviting them to watch the video. Explain that this is a "beta" and you're testing concepts for a potential wellness initiative. Distribute it to a small group first to ensure everything is working.

Step 3: Measure. Measuring is essential. If you don't measure results you can't test your assumption about how a particular strategy will work or learn from it. Once the email is sent, you'll know how many people clicked the link and how many people viewed the video and for how long. These key performance indicators - KPIs - provide a baseline for identifying progress and future improvements.

Step 4: Learn. This is the most important step. By this point, you should have gained some idea of what's working well and what's not, and the data necessary to improve key metrics. These are the types of tangible outcomes necessary to propel any wellness initiative forward. What can you do to increase those numbers? The faster you can repeat this process and improve your KPIs, the more momentum you'll gain - and the sooner you can determine the potential effectiveness of wellness initiatives without a huge expenditure of scarce resources.

Debate will continue

Whether the results achieved with wellness programs are worth their cost is a debate that will likely continue. That said, there's little doubt that a key ingredient to achieving ROI on wellness programs - or any HR initiative - is employee participation. The HR-adapted Lean Startup approach lets you know whether you've got this key ingredient - before you've spent a lot of time and money hoping to get it.