Taking the first steps to a long-term benefits strategy

A common struggle for many companies that are searching for a cost-effective, successful employee benefits strategy is that HR professionals and finance professionals have conflicting objectives. Continue reading this blog post to learn more.

The quest for a cost-effective and successful employee benefits program can feel like a search for the Holy Grail. To most, it’s an elusive goal within the context of rising and unsustainable costs.

Unlike “Monty Python and the Holy Grail,” in which a comedy of errors made for a hilarious movie, nonsensical benefits strategies can have serious consequences.

One major challenge is that many HR and finance professionals have conflicting objectives. HR’s mission is to design a program that is competitive in the marketplace for human capital needs while supporting the organization’s culture. Finance, on the other hand, is charged with managing to a budget by controlling expenses to mitigate year-over-year increases. The result, in spite of best intentions, leaves organizations unable to commit to a multi-year plan and opt in favor of living year-to-year.

So, how do you overcome this challenge?

Step 1: Key HR and finance stakeholders need to align on goals and objectives. They also need to remain engaged in the process throughout the year (not just at renewal). Once you achieve alignment, these objectives should be memorialized into a benefits philosophy. Why? So the collective team has guiding principles for future decisions.

Step 2: Identify the cost drivers of the program. Many employers have little line of sight into how their plan is performing until it’s too late. Once you are staring down the barrel of a 25% increase, an organization may be forced to make swift changes to soften the blow to their bottom line rather than follow a strategic approach that comes with preparation. Unfortunately, this type of knee-jerk reaction only temporarily relieves the pressure and may create unintended consequences to the employee value proposition.

Step 3: Understand where you were, where you are and where you want to be. After 25 years in the consulting industry, one thing I know for certain is there are only so many levers you can pull to rein in escalating benefit costs. Identify the levers and how far you want to pull them.

Step 4: Determine success metrics. I’ve seen many organizations implement new tactics, such as a health savings account. When I ask them if it was successful, they can’t answer because they didn’t set an internal bar for success. That barometer will help you gauge success and determine what changes need to be made to your approach to achieve your goal.

Step 5: Commit the plan to writing and review it periodically. Just like your company’s overall business plan, you will need to make adjustments along the way as your business changes.

Regardless of strategy, I recommend employers take steps toward a self-funding benefits model. Historically, self-funding was for groups with 1,000 lives and above. But that’s no longer the case. Self-funding provides that all-important line of sight into cost drivers because of access to claims data. Having a deeper understanding of the “why” behind costs allows an organization to implement a data-driven approach to the overarching benefits strategy. Self-funding also provides more plan design flexibility and eliminates the internal costs that an insurance carrier builds into a plan for profit.

It’s more effective to create a benefits strategy that is sustainable over time, so when you inevitably endure a higher-than-normal renewal cycle, typically every three to five years, you are prepared to stay the course.

Consider timing. When you make changes to a benefit plan is just as important as what changes you make. Evaluate the timing of benefit changes, how they are implemented and how adjustments will impact your workforce now and in the future.

For example, if you plan to add new voluntary benefits, such as indemnity plans, it may make sense to run them “off cycle” from the core medical benefits open enrollment season. This gives employees more time to conduct research about the new product option and make an educated decision.

Strive for simplicity. I can’t stress this enough. The Affordable Care Act, an increase in voluntary benefit options, new funding models and benefit trends have created an enormous amount of noise in the insurance industry. Tune it out and simplify your process as much as you can. Your HR and Finance teams are overwhelmed and so are your employees. Instead of throwing new benefits at them each year, focus on educating them and making choices simple. In fact, any long-term benefits plan worth its weight always includes an education and communications component.

Benefit illiteracy is rampant, and confusion over options at open enrollment can have consequences for the employee throughout the plan year. If your employees choose their benefits online, spend the open enrollment meeting educating them on how to buy and consume insurance, rather than just what the benefit choices are for the plan year, or how to use the online enrollment tool. You should also communicate throughout the year, rather than just at open enrollment to support employees’ understanding of their benefits program.

Identify other areas where employees might struggle. One trend is to offer transparency tools to help them choose a doctor or specialist. But be aware that the sheer number of doctors in a given list can be overwhelming. Rather than offering employees a choice of 50 doctors, narrow it down to five providers with the best healthcare outcomes.

Making it simpler for employees to be better consumers of healthcare will help you cut costs and get on the right path to a long-term benefit strategy. Of course, you’ll have to check in each year and consider making small adjustments to the program, and data will help guide these changes. Adjustments should all be in service of a long-term plan. If you begin your long-term plan by asking the question, “Where were we, where are we now and where do we want to be in the future?” you’re halfway there. You may eventually find that your Holy Grail is within reach.

SOURCE: Bloom, A. (14 May 2019) "Taking the first steps to a long-term benefits strategy" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/taking-the-first-steps-to-a-long-term-benefits-strategy

Are you offering the right benefits? Look to benchmarking, surveys for answers

Are you offering the right employee benefits? With unemployment at historic lows, benefits have become a big differentiator for employers. Read this blog post for more on offering competitive benefits.

With unemployment at a 50-year low, benefits have become a big differentiator for employers, which means they need to be competitive to attract and retain employees. What are competitive benefits? Ask 100 employers and you’ll get 100 answers.

It’s no longer affordable to offer Cadillac plans with low employee contributions. How do employers offer attractive yet affordable benefits that will draw potential employees in? They turn to benchmarking and employee surveys to build and validate benefit plans.

“High cost” has become so synonymous with “healthcare benefits” that it’s hard to separate one from the other. As benefits become more costly, they also become more complicated to manage. Add today’s shift to the need for competitive programs and the whole thing begins to look like a slog through quicksand.

Here’s the thing: The employer must strike a balance between what employees want and what they’ll use. That means zeroing in on what they find valuable. While it may be tempting to follow benefit trends by offering pet insurance or creating in-office perks like beer and pizza, research suggests that most employees value more traditional coverages and benefits. What gets them in the door — and keeps them engaged — is likely going to be paid leave, flexible/remote work options and professional development.

To determine what your employees want and what peer employers are offering in your industry, look to benchmarking and employee surveys as two of the sharpest arrows in your plan design quiver.

Benchmarking tells you what you’re competing against. While certain employee benefits are more popular in some industries than others, it’s vital to know who you’re competing against to attract and retain employees. For example, nonprofit organizations historically provide modest employee salaries but rich benefits. While that benefits model may work for most of your workforce, it’s important not to overlook other industry standards. A large nonprofit hiring employees for its IT department is not only competing against other nonprofits for talent, but they’re also competing against tech-industry talent, which may put more of a focus on salary and bonuses than rich benefits.

The best way to identify who you’re competing against and what types of benefits they’re offering is to undertake a benchmarking study. Benchmarking your benefits package can provide insight into what your competition offers across industries, regions and company size so you can ensure your plan design stands up against the competition. Benchmarking studies yield details like:

- Medical plan type

- Employee premium cost

- Employee premium contribution

- Medical copay

- Prescription drug copay

- Office visit copay

- Emergency room copay

- Voluntary benefits offerings

- Salary ranges

- Paid sick leave

Armed with that data, you can decide where you should aim your focus and whether you’re offering a competitive benefits package.

Surveys tell you what employees value. The best way to understand what your employees value is to ask them. Employee surveys can help you find out which benefits your employees love, which ones they don’t like and where you can make improvements.

When developing an employee benefits survey, pay close attention to how questions are written in order to elicit the best responses from employees. It might make sense to reach out to a survey organization to ensure it’s done right. Benefit brokers often have experience with surveys, too.

When the survey is complete, put together a communications plan so you can get the highest number of responses about what your employees love and what needs improvement. It’s a best practice to survey employees every plan year to stay on top of changes across the workforce. (Just not at open enrollment time).

It’s an inexpensive undertaking that could lead to serious cost savings from changes to the plan and increased employee retention. So basically, a survey is worth the time and effort.

Benchmarking and surveys are important components of a benefits strategy. They can put you on a more direct path to a plan design with options that are right for your culture and workforce.

SOURCE: Newman, H. (17 May 2019) "Are you offering the right benefits? Look to benchmarking, surveys for answers" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/hr-review-surveys-for-employee-benefits-trends

Motivating employees to higher performance

Building and sustaining an energized, motivated workforce take initiative and requires that employers develop an inspiring workplace culture. Continue reading this blog post for more on motivating employees to increase performance.

Building and sustaining an energized workforce that takes initiative requires creating an inspiring atmosphere.

Some of the key features of such a workplace are:

- A creative work environment where employees are able to express themselves openly.

- A work environment not stifled by unnecessary process and policy hurdles.

- A challenging and constructive work environment featuring constant feedback.

- Leadership that listens and responds to employees.

- A collaborative and cross-functional workforce where diversity is cherished.

Employees recognize the difference between empty slogans and real commitment and will respond to an organization that walks the walk in creating a great place to work.

Happiness equals productivity

A recent study found that employees who are happy are 12 percent more productive than those who aren’t.

Whether or not the specific percentage is totally accurate, we can all confirm the general point from our own work experiences.

Happy employees get to work on time, work hard, and take responsibility.

So how to keep a happy workplace? Here are some ideas:

- Make humor part of the agenda – work is stressful. Find ways to lighten things up occasionally

- Within the constraints of your particular process, don’t insist on rigid schedules. Give employees some control over how they use their time during the day.

- Respect, and encourage respect for, differences

- Fewer managers and official leaders

- Make fitness and physical activity part of a normal day

- Create a bright atmosphere and encourage interaction

SOURCE: McElgunn, T. (2 May 2019) "Motivating employees to higher performance" (Web Blog Post). Retrieved from https://www.hrmorning.com/performance-management-motivating-employees/

Boost employee engagement with these key people skills

Employers most likely won't be able to get every single employee to give their best every day, but with the right amount of effort, they could get the majority of employees to give their best. Continue reading for key people skills employers can use to boost employee engagement.

With all the talk about “employee engagement,” it’s only fair to ask, “Can I really get all the people in my organization to give their best – every day?”

The short answer is probably not “all.” But with the right amount of effort you can get “most” of them to give their best … most of the time. And that’s a lot better than where most companies are right now.

Boiled down to its simplest parts, employee engagement is about connecting with employees and getting them focused. It requires an ongoing and consistent effort by managers to bring out the best in people.

Employee engagement takes practice

You don’t need to be good friends with every employee – but it does help to build cordial relationships. That makes working with people more productive and cohesive.

People get more engaged in their work when the work means something to them, when they understand their role in the organization, and when they can see and appreciate the results of their own efforts.

Here are some “hands on” ways leaders can work to improve interactions and create a deeper connection with employees and colleagues:

- Make it personal. Use people’s names when talking to them – from the janitor to the CEO. Even better, use the names of their significant others – spouses, kids, parents – when possible.

- Say more than hello. Sometimes it’s necessary to cut to the chase and get to the business at hand – a project, deadline, important question, etc. But in other circumstances, there’s time to show interest in employees’ and colleagues’ lives. Instead of a generic “How are you?” ask about something that affects them.

- Talk about their interests. People surround themselves with hints of what interests them outside of work (for instance, sports ticket stubs, photos of beach trips, logo T-shirts from local events, race medals, certificates of appreciation from philanthropic groups, etc.). Look for those hints and ask about them. Once you know a little about what they do outside work, you have a starter for other conversations: “How did your son’s soccer game turn out?” “Where did you volunteer this weekend?” “Planning any vacations?”

- Show appreciation. Avoid waiting for the end of a project or annual reviews to thank employees and coworkers for their contributions. And it’s OK to say thanks for the little things they bring to the table – a good sense of humor, a sharp eye for errors, an impeccable work station, a positive attitude.

- Make others feel important. Feeling important is slightly different than feeling appreciated. Employees need to know they’re relevant. Let them know you recognize their contributions by referring to past successes when you talk to them personally and to others in meetings. Explain why their work was important.

- Recognize emotions. Work and life are roller coasters of emotions. Leaders don’t have to react to every peak and valley, but they’ll want to address the highs and lows they see. For instance, “You seem frustrated and anxious lately. Is something wrong that I can help with?” Or, “I can sense you’re very excited and proud. You deserve to be.”

Building morale

The best morale exists when you never hear the word mentioned. If you have employees, you’ll have morale problems. No matter how thorough a company’s hiring process is, at some point leaders will have to handle morale issues because employees get stressed, are overworked and deal with difficult people.

The good news: Most of the time, employees won’t be down if their managers build and maintain morale. To stay ahead of morale issues:

- Communicate. Employees left in the dark will become fearful and anxious and likely make up negative news to fill the gap. This can be avoided by regularly reporting information, changes and company news.

- Listen. While sharing information is a must, employees must also be heard. Give them different options to share their concerns and ideas. Offer the floor at department meetings, have regular one-on-one meetings, put up a suggestion box or anonymous e-mail account for submissions, invite executives to come in and listen, etc.

- Appreciate. People who aren’t recognized for their contributions may assume they’re not doing well. Leaders should take the time to thank employees for their everyday efforts that keep the operations running smoothly. In addition, extra effort should be recognized and rewarded.

- Be fair. Nothing hurts morale like unfair treatment. Leaders can’t turn their backs on poor performances, and they can’t play favorites. It’s best to document what’s done in response to good and bad behaviors so leaders can do the exact same thing when the situation arises again – and have a record of it.

- Provide opportunities to grow. Growth is often equated with moving up the career ladder. But it doesn’t have to be. Many employees are motivated by learning and creating a larger role for themselves. So if people can’t move up a career ladder (because there aren’t positions available), encourage them to learn more about the company, industry or business through in-house or outside training. Or give them opportunities to grow socially by allowing them time to volunteer.

- Create a friendly environment. Research shows people who have friends at work are more motivated and loyal to their employer. While this can’t be forced, opportunities to build friendships can be provided through potluck lunches, team-building activities and requesting staff to help in the recruiting process.

- Paint the picture. Employees who know their purpose have higher morale than those who are “just doing the job.” Regularly explain to employees how their roles fit into the company’s mission and how they affect the department and the company.

Praise what you want to see repeated

Handing out recognition takes a little more skill than just saying “Good job” and giving a pat on the back, though that’s a good start.

Giving recognition well is a skill all leaders could improve upon to keep their employees encouraged and productive.

Here are five guidelines for recognizing good work:

- Make it a policy, not a perk. Set rules for different types of recognition. For instance, recognize people for tenure and meeting goals – things everyone can accomplish.

- Stay small. Handshakes and sincere appreciation are always welcome (especially since 65% of employees say they haven’t been recognized in the past year, according to a Gallup Poll). Leaders need to look their employees in the eye, thank them for specific work and explain why it made a difference.

- Add some fanfare. Recognize people at meetings when others can congratulate them.

- Include the team. In addition to praising individuals, recognize a whole group for coming through during an unexpected hard time, meeting a goal, working together, etc.

- Make it personal. When recognizing employees, match the reward and praise to the person. One person may like a quiet thank-you and a gift card to a favorite store. Someone else might thrive on applause and a certificate given at a group lunch. Find out what people like and cater to them when possible.

SOURCE: Henson, R. (7 May 2019) "Boost employee engagement with these key people skills" (Web Blog Post). Retrieved from https://www.hrmorning.com/boost-employee-engagement-with-people-skills/

How do you know when learning programs are working?

How do employers measure the success of employee learning programs? The demand for employee learning programs is increasing, as well as the spend that employers are allocating for these programs. Continue reading to learn more.

Demand for learning is up and the spend that employers allocate to it is climbing — but as employers spend more money, they may also need to increase expectations for learning's success.

What outcomes do employers expect from learning programs? Whenever a company initiates training, that company must also ensure it has clear, definable results in mind, experts told HR Dive. Training to increase practical knowledge — how to utilize equipment, for example — should be task-oriented and measurable. Other training goals, like developing soft skills, may be more intangible, but success metrics can still be necessary.

Quantifying learning and finding success

The classic Kirkpatrick Model to evaluate training is widely used, Tom Griffiths, CEO and co-founder of Hone, explained to HR Dive. It covers four measurements:

- Reaction. Were workers actively engaged and participating in the program? Observation and reaction surveys can help with this metric.

- Actual learning. Did they come away from the session knowing more than they went in knowing? Baseline quizzes before and after give a snapshot of whether or not the session met objectives.

- Behavioral change. Are you seeing a change in the way people perform their work? If training isn't directly relatable and usable, this might be more difficult to quantify.

- Results. What is the final impact on the business overall following the training? Have errors decreased? Has productivity increased? Is customer satisfaction up? These measurements may take longer to quantify, but they're worthwhile metrics to obtain.

Ultimately, employers should keep an eye out for true measures of performance improvement, Anna Robinson, CEO of Ceresa, told HR Dive in an email. Sales growth, unit cost reductions and improved throughput are all examples of potential results. "If business performance improves, that means the right person is receiving the right content, and it is having an impact on their performance," she added.

But there are other ways to measure success, Ujjwal Gupta, co-founder and COO of BenchPrep, told HR Dive in an email. A learner getting that long-sought promotion or spreading knowledge in their department are key ways to witness a development program's success, Gupta said.

Changing minds and habits

What is the goal of training — changing minds or changing behaviors? Griffiths believes both are needed for a growth mindset, but one can lead to another.

"We can inspire change by giving learners the mental models, evidence and ways of thinking to start shifting their mindset, which can have a huge effect on behavior," he said. "For example, how differently do I behave if I believe I know everything and have nothing to learn from others, versus the mindset that I have something to learn from everyone?"

Employers should do more than just encourage learning, but should aspire to have a culture of learning, which enables employees to actively look for growth because learning is readily available and development is rewarded. For Griffiths, a successful learning culture is one that is open, aware and flexible. Ideally, there is a balance between dictating what the organization wants people to learn and giving the learners choice and control over what they learn to foster an employee-driven culture of learning, he noted.

Robinson said to look for engagement and buy-in. To gauge success of their mentoring program, for example, Ceresa looks at the number of women who are interested in continuing the relationship as well as the number who begin to mentor others. "This both extends and expands the learning culture," she said.

Has it made an impact?

Employees may be participating in learning exercises, but that doesn't necessarily translate to impact, experts warned. Knowledge can keep employees on track for what they need to be doing today, but it isn't enough on its own to ready them for new challenges or spark innovation. Seeing strong numbers on employee engagement surveys and significant changes in the way people work are key indicators, but the real goal is for employees to be hungry for more. Experts have noted that offering training outside workers' current areas of expertise and comfort zones can help push them further. Training that regards growth as the goal, whether or not it's of use at work today, can have the most impact on the employee and organization.

For Gupta, the numbers are important; evaluating retention and growth are leading indicators for those seemingly outside opportunities. "Seeing that you are not only keeping your employees happy, but that you are also expanding the business leads to a win-win situation by having a great learning culture that drives ROI," he said.

SOURCE: O'Donnell, R. (7 May 2019) "How do you know when learning programs are working?" (Web Blog Post). Retrieved from https://www.hrdive.com/news/how-do-you-know-when-learning-programs-are-working/554099/

Workforce Planning Will Help You Understand the Needs of Your Organization

How are you managing your workforce? Workforce planning is one of HR's most important priorities, but many HR professionals shy away from the task. Continue reading this post from SHRM to learn how workforce planning will help HR departments understand the needs of their organization.

Managing headcount—and workforce planning overall—is one of HR's most important priorities, yet so many HR and talent acquisition (TA) leaders shy away from it.

"Very few TA organizations do it, because it's a very analytical process that scares HR," said Jeremy Eskenazi, SHRM-SCP, managing principal of Riviera Advisors, a Long Beach, Calif.-based talent acquisition consulting and training company. "It's perceived to be outside of HR's expertise, and it involves inputs that come from outside HR's ownership."

In many organizations, headcount forecasting is understood to be a financial and budgeting exercise owned by finance, Eskenazi said. "But because the function of headcount is not perceived to be owned by HR, and finance doesn't make it a priority, nobody owns it in the end."

The TA function's failure to successfully predict talent gaps and prepare for hiring needs can be chalked up to a lack of experience with workforce planning, a lack of capacity to undertake it and not understanding its benefits, said John Vlastelica, founder and managing director of Recruiting Toolbox, a global management consulting and training firm in Seattle.

"Most TA leaders operate in a transactional environment and unfortunately see their jobs as purely a fulfillment function," he said. "TA is dealing with so much need that it can't help but be reactive. There's not enough time spent with the business, outlining hiring goals, conducting quarterly business reviews, updating turnover forecasts, reviewing talent composition, going over succession planning, or starting proactive sourcing conversations."

The organizations that win at talent acquisition are those that have a pipeline of talent ready to choose from when they need it, Eskenazi said. "The only way to have that ability is to know what is coming up. If you don't know what's coming up, you're operating on assumptions."

Workforce planning connects recruiting, hiring, employee development and talent management by identifying needed skills, helping recruiters target the right candidates with those skills and assisting managers in charting the internal pathways for employee growth.

"Workforce planning is not just about hiring new people; it's [also] about the gaps between what you currently have and what you need," Eskenazi said. "If you do it right, you can discover who is capable of stepping into new roles with training and development, and who may not be able to stay on in a job because the required skill sets are changing. Workforce planning is about all movement—up, down, in, out or across the organization."

Creating a Workforce Plan

The process begins with information gathering. "You simply need to interview managers of individual workgroups inside your organization and then consolidate and analyze that data," Eskenazi said. HR should be the facilitator of the process and everyone who leads people should participate, he said.

Vlastelica outlined a top-to-bottom approach to collect the information. He advised HR to sit in on executive-level discussions on overall growth and industry challenges. "At the middle level there is a lot of work to be done on forecasting for expected growth and backfills and which job families and roles are most critical," he said. To represent the bottom, "HR should talk with individual hiring managers and department leaders about their talent priorities and workforce composition," he said.

Eskenazi explained that HR should ask department heads a series of standard questions:

- How will the business impact you over the next six months? Twelve months? Twenty-four months?

- What skills do you need to meet your goals and how does current staff meet that need?

- Who is expected to be let go? Who is expected to remain? Who is getting promoted?

After gathering and tracking information about each department's talent inventory and their future talent requirements—using a spreadsheet or a workforce planning platform—it's time to conduct a gap analysis. Estimate what types of positions, people and competencies will be needed in the future to help the organization address talent gaps and then align necessary resources.

When presenting a final analysis to leadership, don't just repeat what you heard. Categorize the findings in a way that makes sense for talent acquisition, Vlastelica said.

"Forecasting is a little bit of science and a lot of art," he added. "It's a good opportunity to teach the business about how to think about talent acquisition, the ramp up time and resource cost to meet business need."

Be Flexible

Organizations looking to be more agile in a rapidly changing environment should engage in regular workforce planning updates, Eskenazi said. "All you have to do is create the framework once, then update it every six months. Once you do it one time in a comprehensive way, it's far easier than having to start from scratch."

The workforce planning team should reach out routinely for insights from department and business line leaders to update and modify the plan based on hiring needs.

"It needs to be very flexible, because oftentimes the business's priorities change, even in a short time," Eskenazi said. "The business is constantly resetting—and faster than ever before."

SOURCE: Maurer, R. (13 May 2019) "Workforce Planning Will Help You Understand the Needs of Your Organization" (Web Blog Post). Retrieved from https://www.shrm.org/resourcesandtools/hr-topics/talent-acquisition/pages/workforce-planning-will-help-you-understand-organization-need.aspx

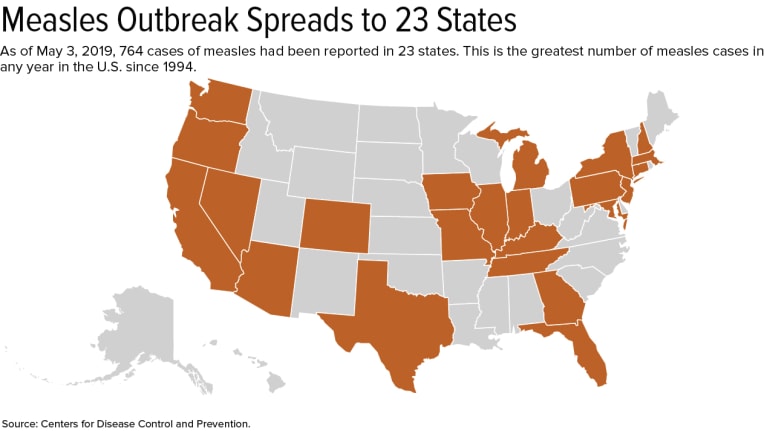

How to Respond to the Spread of Measles in the Workplace

How should employers respond to the spread of measles? With measles now at its highest number of cases in one year since 1994, employers are having to cooperate with health departments to fight the spread. Read this blog post from SHRM to learn more.

Employers and educators are cooperating with health departments to fight the spread of measles, now at its highest number of cases in one year since 1994: 764.

Two California universities—California State University, Los Angeles (Cal State LA) and the University of California, Los Angeles (UCLA)—recently quarantined staff and students at the request of local health departments.

In April at Cal State LA, the health department told more than 600 students and employees to stay home after a student with measles entered a university library.

Also last month, UCLA identified and notified more than 500 students, faculty and staff who may have crossed paths with a student who attended class when contagious. The county health department quarantined 119 students and eight faculty members until their immunity was established.

The quarantines ended April 30 at UCLA and May 2 at Cal State LA.

Measles is one of the most contagious viruses; one measles-infected person can give the virus to 18 others. In fact, 90 percent of unvaccinated people exposed to the virus become infected, the U.S. Centers for Disease Control and Prevention (CDC) notes.

Action Steps for Employers

Once an employer learns someone in the workplace has measles, it should immediately send the worker home and tell him or her not to return until cleared by a physician or other qualified health care provider, said Robin Shea, an attorney with Constangy, Brooks, Smith & Prophete in Winston-Salem, N.C.

The employer should then notify the local health department and follow its recommended actions, said Howard Mavity, an attorney with Fisher Phillips in Atlanta. The company may want to inform workers where and when employees might have been exposed. If employees were possibly exposed, the employer may wish to encourage them to verify vaccination or past-exposure status, directing those who are pregnant or immunocompromised to consult with their physicians, he said.

Do not name the person who has measles, cautioned Katherine Dudley Helms, an attorney with Ogletree Deakins in Columbia, S.C. "Even if it is not a disability—and we cannot assume that, as a general rule, it is not—I believe the ADA [Americans with Disabilities Act] confidentiality provisions cover these medical situations, or there are situations where individuals would be covered by HIPAA [Health Insurance Portability and Accountability Act]."

The employer shouldn't identify the person even if he or she has self-identified as having measles, Mavity noted.

Shea said that once the person is at home, the employer should:

- Inform workers about measles, such as symptoms (e.g., dry cough, inflamed eyes, tiny white spots with bluish-white centers on a red background in the mouth, and a skin rash) and incubation period—usually 10 to 12 days, but sometimes as short as seven days or as long as 21 days, according to the CDC.

- Inform employees about how and where to get vaccinations.

- Remind workers that relatives may have been indirectly exposed.

- Explain that measles exposure to employees who are pregnant or who might be pregnant can be harmful or even fatal to an unborn child.

- Explain that anyone born before 1957 is not at risk. The measles vaccine first became available in 1963, so those who were children before the late 1950s are presumed to have been exposed to measles and be immune.

Employers may also want to bring a health care provider onsite to administer vaccines to employees who want or need them, Shea said.

"Be compassionate to the sick employee by offering FMLA [Family and Medical Leave Act] leave and paid-leave benefit options as applicable," she said.

When a Sick Employee Comes to Work Anyway

What if an employee insists on returning to work despite still having the measles?

Mavity said an employer should inform the worker as soon as it learns he or she has the measles to not return until cleared by a physician, and violating this directive could result in discipline, including discharge. A business nevertheless may be reluctant to discipline someone who is overly conscientious, he said. It may opt instead to send the employee home if he or she returns before being given a medical clearance.

The employer shouldn't make someone stay out longer than is required, Helms said. Rely instead on the health care provider's release.

SOURCE: Smith, A. (9 May 2019) "How to Respond to the Spread of Measles in the Workplace" (Web Blog Post). Retrieved from https://www.shrm.org/resourcesandtools/legal-and-compliance/employment-law/pages/how-to-respond-spread-measles-workplace.aspx

4 Simple Reasons Why Texting Can Lead to Better Hires

Are your recruiters continually getting “ghosted” by job candidates? The way they communicate with job recruits may have something to do with why they are getting “ghosted” by candidates. Continue reading for four reasons texting can lead to better hires.

It’s no secret that recruiters spend the majority of their time researching to find the right candidates for the right job, and even more time reaching out to talk to these potential candidates. So it’s natural that they become frustrated when candidates ignore communications like emails and LinkedIn InMail messages from recruiters. While these communication methods can work for some, they definitely aren’t preferred for all — especially these days.

With people busier than ever before, especially passive millennial candidates, recruiters are seeing more and more recruits “ghosting” them. If you are continually getting no responses to your outreach, it likely has something to do with the other 100-plus emails that are hitting candidates’ inboxes every day. Reaching out via SMS (text messaging) can help you break through the noise and make it easy for potential candidates to take the next step.

Here are four simple ways to use text messages to make better hires:

Texting is quicker

In a highly competitive market, speed matters more than ever. How quickly you can secure the talent you need impacts how quickly your business is moving forward. Seventy-three percent of U.S. millennials and Gen Zers interact with each other digitally more than they do in real life. If you want a fast answer, texting is the way to go.

Scheduling via text is also quicker

Nothing good ever comes from never-ending email chains, especially when the topic is as dull as “Are you available Wednesday morning between 9 am and 11 am?” Sending your candidate a link to your favorite scheduling client via SMS puts an end to group-email fatigue and gets the interview on the books in a matter of minutes.

Don’t forget reminders

There’s nothing worse than a candidate showing up late or missing an interview.

A quick text message is a perfect way to give your candidates a quick heads-up, give them an extra tip, a quick pat on the back and send them in ready to win. No one likes tardiness and no-shows. A quick reminder ensures everyone’s on the same page.

Accelerate the hiring process

Text messages make the candidate experience way more enjoyable by simply shortening the hiring process. Hiring typically involves emails, scheduling, and so much admin. A great SMS can make hiring human again, not to mention faster. By communicating directly with someone at a time that works best for them, especially in a way that they’re much more likely to respond quickly, it will help shorten the overall hiring timeline.

When used alongside other awesome tools, such as a chatbot, text messaging could even help qualify leads more quickly and immediately put you in touch with the best candidates.

The bottom line: utilizing text for recruiting can help you revitalize your talent pipeline and create a more engaging candidate experience.

SOURCE: Bounds, D. (25 April 2019) "4 Simple Reasons Why Texting Can Lead to Better Hires" (Web Blog Post). Retrieved from https://hrexecutive.com/4-simple-reasons-why-texting-can-lead-to-better-hires/

What to consider before adding a genetic testing benefit

According to recent statistics from the Society of Human Resource Management (SHRM), 18 percent of employers provide health-related genetic testing benefits. Read this blog post for what employers should consider before adding a genetic testing benefit to their benefits package.

As employers look for new voluntary benefits to help attract and retain employees, a growing number are turning to direct-to-consumer genetic testing for all employees to their benefits plans. According to the latest statistics from the Society for Human Resource Management, 18% of employers provide a health-related genetic testing benefit, an increase of 6% over the previous year.

For the most part, it can be a smart move: Not only can the benefit differentiate one employer from others vying to hire from the same employee pool, genetic testing providers market the benefit as a way to potentially lower healthcare costs and increase employee wellness.

This type of testing can be valuable for employees at an increased risk for certain types of cancer, such as breast and ovarian cancer related to mutations of the BRCA1 and BRCA2 genes, those considering having a child who have risk factors for genetic conditions such as cystic fibrosis and Tay Sachs disease, those who have a family history of conditions like high cholesterol, and those who take medications such as blood thinners and anti-depressants. There also are tests that look for genes associated with conditions such as Parkinson’s disease, Alzheimer’s disease and celiac disease.

But employers also have to realize that genetic testing for all employees, regardless of family history and risk factors, comes with potential downsides. In fact, some physicians believe that widespread genetic testing of this type may even present a risk of harm. There’s also the issue of regulation and oversight of direct-to-consumer genetic testing. The industry is not currently regulated, which, some researchers have found, can lead to inaccurate or varying results. One study found that when the same genetic variant was provided to nine different labs for analysis, the answers provided were different 22% of the time, highlighting the risk of false positive and false negative results.

So for employers who offer — or are considering adding — a genetic benefit, make sure to think about the potential outcomes that can occur by doing so.

The potential for lower costs as well as unnecessary healthcare spending

If an employee’s genetic test is positive for a mutation that’s associated with cancer or another disease, he or she may be more proactive about screening for the disease and may make lifestyle changes that may lower the risk of developing the disease. There are potential healthcare cost savings to early detection of some conditions. For example, by some estimates, the cost for treating early-stage breast cancer is more than 50% less than the cost to treat the same cancer at an advanced stage.

For employees who undergo testing related to how effective a blood thinner or antidepressant will be, there can be better health outcomes as well as cost savings. One study found that when physicians prescribed the blood thinner Warfarin based on pharmacogenomic testing, adverse events decreased by 27%. Avoiding adverse events and making sure employees are taking the medications that can most effectively treat their conditions can help keep them healthy, out of the hospital and productively on the job, all of which has a positive financial impact.

But when you’re screening people who don’t have risk factors or a family history of these conditions, a positive test result can lead to unnecessary testing and medical procedures, potential complications from those procedures and the costs associated with that testing and care.

Before and after testing, education

Employers who offer genetic testing without a physician referral need to take steps to ensure that employees understand the risks and benefits of these tests upfront and that they know what a genetic test can and cannot tell them about their health now and in the future. The first step is for any employer offering genetic testing to provide education for employees.

Many employees don’t realize that having a gene mutation that’s associated with a disease does not mean that he or she will ever develop that disease. The risk associated with most genetic variations is, in fact, relatively small. Because of that misunderstanding, employees may experience needless worry or, if the test is negative for mutations related to a disease, may forgo screenings like mammograms, colonoscopies and cholesterol tests that can help detect health problems earlier when they are often more treatable. In the case of genetic testing for mutations associated with cancer, employees may not be aware that most cancers are not caused by a mutation in the single gene that the test screens for.

For some of the conditions that genetic tests screen for, like Alzheimer’s disease, there are currently no treatments. This can again cause anxiety for employees and their families. Genetic tests also have implications that reach beyond the specific employee who is tested. A positive test can affect siblings and children as well, opening the question of whether the employee wants or feels compelled to share the results with other family members who may also be at risk.

Employers who offer employees genetic testing should ensure that all employees who choose to undergo testing are guided by experienced genetic counselors who can help them interpret and understand the results of their test and can connect them with other healthcare providers for additional testing or treatment as needed.

SOURCE: Varn, M. (3 May 2019) "What to consider before adding a genetic testing benefit" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/what-to-consider-before-adding-a-genetic-testing-benefit

4 benefits messages to send employees in May

Tax season has come and gone, and summer is right around the corner, making it a great time of year for employers to beef up communications about certain employee benefits. Read this blog post for four benefits messages employers should send their employees this May.

With tax season behind us, summer right around the corner and the second half of the year coming up, now is a great time of year for employers to beef up communications about certain benefits.

That’s because there are a number of important messages that are specific to this time of year, including saving money for summer vacations and putting more money into a health savings account so employees can plan for healthcare expenses for the remainder of the year.

Here are four messages employers should share with their employers this month.

1. Think about putting more money in your HSA.

May is a great time for your employees to take stock of their healthcare costs from January to April, and plan ahead for the second half of the year. Here’s a breakdown you can send to help them save money and have more cash available through December to pay their bills.

- Add up this year’s out-of-pocket health care costs thus far.

- Make a new estimate of your upcoming expenses (padding that estimate for unexpected expenses that may pop up.).

- Add your estimated costs to what you’ve already spent.

- Compare that total with how much you’ll have in your HSA account at the end of the year as it is now.

- If there’s a gap, you can increase your contribution rate now to make up the difference.

2. Adjust your W-4s.

Tax season has passed, which means it’s an excellent time to…think a little more about taxes.

The tax law changes that went into effect at the start of 2018 might have made your employees’ existing W-4s less accurate. If they didn’t update their withholding amount last year, they might have been surprised by a smaller refund, a balance due, or even by a penalty owed — and chances are, they don’t feel too happy about it.

Let your employees know that they can prevent unexpected surprises like this next tax season with a visit to this IRS tax withholding calculator. There, they can estimate their 2019 taxes and get instructions on how to update their W-4 withholdings to try and avoid any surprises next year. If they can update their W-4 online, send them the link along with clear step-by-step instructions. And if they need to fill out a paper form, explain where to find it and how to submit it.

3. Revisit your budgeting tools.

Summer is almost here, and your employees are likely starting to think about hitting the beach, road-tripping across the country or eating their weight in ice cream. Since having fun costs money, May is a good time to serve up some ideas on how to squirrel away a little extra cash in the next few months.

Employers should share tips for saving money on benefits-related expenses, like encouraging high-deductible health plan employees to use sites like GoodRx.com for cheaper prescription costs, or visiting urgent care instead of the emergency room for non-life-threatening issues. Also, consider making employees aware of apps like Acorns, Robinhood, Stash, Digits and Tally, which round up credit or bank card expenses to the next dollar, and automatically deposit the extra money into different types of savings accounts.

4. Double-check out-of-network coverage.

While you’re on the subject of summer fun, remind your employees to take a quick peek at their health plan’s out-of-network care policies before they head out of town. If they need a doctor (or ice cream headache cure) while they’re away, they’ll know where to go, how to pay, and how to get reimbursed.

Employers should remind employees that their HSA funds never expire, and they’re theirs for life. So if they put in more than they need this year, it will be there for them next year.

SOURCE: Calvin, H. (1 May 2019) "4 benefits messages to send employees in May" (Web Blog Post). Retrieved from https://www.benefitnews.com/list/4-benefits-messages-to-send-employees-in-may