The Saxon Advisor - July 2020

Compliance Check

what you need to know

SF HSCO Expenditures. The last day to submit SF HSCO expenditures, if applicable*, for Q2 is July 30, 2020. *Applicable for employers with 20+ employees doing business in SF and Non-Profits with 50+ employees.

Form 5500 and Form 5558. The deadline for the 2019 plan year’s Form 5500 and Form 5558 is July 31, 2020 (unless otherwise extended by Form 5558 or automatically with an extended corporate income tax return).

Form 8955-SSA. Unless extended by Form 5558, Form 8955-SSA and the terminated vested participant statements for the plan year of 2019 are due July 31, 2020.

Form 5558. Unless there is an automatic extension due to corporate income tax returns, a single Form 5558 and 8955-SSA is due by 2½ months for the 2019 plan year.

Form 5330. For failed ADP/ACP tests regarding excise tax, Form 5330 must be filed by July 31, 2020.

401(k) Plans. For ADP/ACP testing, the recommended Interim is due August 1, 2020.

In this Issue

- Upcoming Compliance Deadlines:

- Eligible Automatic Contribution Arrangement (EACA)

- The deadline for the 2019 plan year’s Form 5500 and Form 5558 is July 31, 2020.

-

Medicare 101: A Quick Guide For Employers

- Fresh Brew Featuring Saxon’s Holiday Favorites

- This month’s Saxon U: The Steps Of An Internal Investigation

- #CommunityStrong: Pick your Own Charity! One of our Own, Deborah Raines, made a meal for a family in need at her temple!

COVID and the ADA and EEOC

Join us for this interactive and educational Saxon U seminar with Pandy Pridemore, The Human Resources USA, LLC, as we discuss COVID and the Americans with Disabilities Act (ADA) and Equal Employment Opportunity Commission (EEOC).

Medicare 101: A Quick Guide For Employers

Bringing the knowledge of our in-house advisors right to you...

Medicare is a government-funded health insurance program for those aged 65 and above, those under 65 with certain disabilities, and those with End State Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS). Employers that offer group health insurance plans to their employees have an interest in learning how employees’ entitlement to Medicare benefits can affect the administration of those plans.

“Ask a licensed agent for assistance. Advertisements can be confusing, and everyone wants to make the right choice. Using my expertise, I take the fear out of the decision making, so my clients can make an informed decision concerning their healthcare.”

Fresh Brew Featuring Saxon's Holiday Favorites

In celebration of Independence Day this past month, the Saxon crew has decided to share one of our favorite summer recipes for this month’s Fresh Brew! We hope you all have a safe and happy holiday!

This Month's #CommunityStrong:Each member of Saxon will be choosing their own charity that they want to make a positive impact on!

This May, June & July, the Saxon team and their families will be choosing their own charity that they would like to make a positive impact towards!

Are you prepared for retirement?

Saxon creates strategies that are built around you and your vision for the future. The key is to take the first step of reaching out to a professional and then let us guide you along the path to a confident future.

Monthly compliance alerts, educational articles and events

- courtesy of Saxon Financial Advisors.

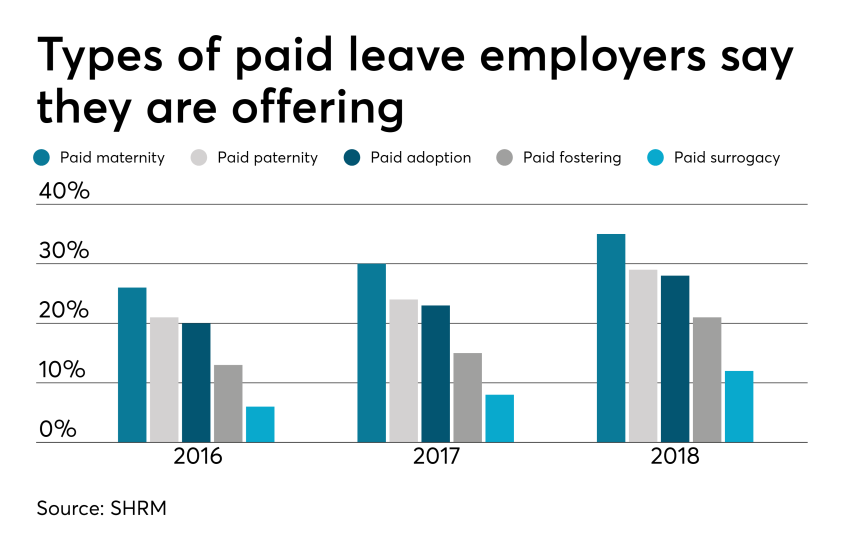

How employers can prevent a new parent penalty in the workplace

The new parent penalty, a bias against new parents, often occurs when employees return from parental leave. The penalty presents itself in managers and colleagues who assume individuals are no longer interested in the upward growth of the company. Read this blog post from Employee Benefit News for ways employers can prevent a new parent penalty in the workplace.

Returning to work after parental leave is a rigorous experience for many employees. It can be a difficult time filled with adjustment pain points and career growth setbacks, all stemming from a surprising cause: the new parent penalty.

This penalty — or bias against new parents — presents itself by way of managers and colleagues assuming these individuals are no longer interested in or dedicated to upward growth in the company in the same way they were prior to taking time off. Unfortunately, this is an all-too-common hurdle. This bias often has a negative impact on the morale and career potential of employees who experience it.

Yet there are several actionable steps that HR leaders and employers, in general, should keep in mind to help new parents get back into the swing of things at work.

Evaluate your current leave options. The first step to ensuring a smooth re-entry to the workplace is implementing a leave policy that allows employees enough time to adjust to their new roles as parents. Only 14% of Americans have access to any paid family leave for the birth of a child, according to Pew Research Center. Even more, 23% of mothers are back on the job within 10 days of giving birth whether they're physically ready or not, according to the Department of Labor. This often results in mothers leaving the workforce, even if though they want to stay. Paid family leave is critical — it improves health outcomes for recovering mothers and new babies and improves retention of new parents.

Set the entire team up to succeed. One thing I often hear from clients at Maven who struggle with returning to work is that there is pressure from managers to resume a business as usual mindset, ignoring the significant shift in their lives. Managers should be trained to help mitigate this by providing better re-entry support. Employers can no longer expect parents to work at all hours or travel at the drop of the hat without some flexibility. Providing a transition or ramp time can be extremely successful in helping parents juggle their often competing work priorities and the needs of their children. Transition time also helps set expectations for other team members who may feel frustrated and overworked when parents come back to work unable to operate in the same capacity that they once did — enter parental bias.

Support career advancement with individualized plans. A client who recently returned to work after maternity leave was surprised to learn during a progress meeting that her manager had placed her on a so-called mommy track. She had requested a flexible work schedule upon her return from leave. Her manager assumed that meant she was no longer interested in opportunities for growth at the company.

This mother is not alone, many new parents face similar roadblocks in career advancement as a result of employers scaling back on assigning them responsibilities that would keep them on the leadership track. Instead of assuming what the new parents are looking for, employers should offer individualized paths for success. This ensures that new parents can continue to grow their careers even if they choose more flexible schedules.

Create a support system. Implementing employee resource groups can be an invaluable tool for new parents looking to connect and receive advice from their colleagues, who have been in their positions. Connecting employees with peers who can speak first hand about the pain points of new working parenthood, and how to make the transition easier can go a long way. Having easy access to a network like this lets employees feel like their concerns are heard and their needs are being met. These employees are in turn more likely to confidently stay in their careers rather than dropping out.

Employers are understanding that there are significant benefits to supporting their employees’ transition back to the workforce, including an increase in retention, culture improvements, and positive impact on their bottom lines. In short: paid family leave is a good thing, and when combined with individualized support from managers and team members, a parent’s return to work is smoother. By understanding the needs of their employees, employers are better equipped and more prepared to anticipate and prevent parental bias that hinders employee and company growth.

SOURCE: Ferrante, M. (5 November 2019) "How employers can prevent a new parent penalty in the workplace" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/how-employers-can-prevent-a-new-parent-penalty-in-the-workplace

DOL issues finalized overtime regulation

The DOL recently released their finalized overtime rule. This new rule raises the minimum salary level to $35,568 per year for a full-year worker to earn overtime wages. Read this blog post from Employee Benefit News to learn more about this new rule.

The DOL on Tuesday released its highly anticipated finalized overtime rule, raising the minimum salary level to $35,568 per year for a full-year worker to earn overtime wages.

“Today’s rule is a thoughtful product informed by public comment, listening sessions and long-standing calculations,” Wage and Hour Division Administrator Cheryl Stanton says in a statement. “The DOL’s wage and hour division now turns to help employers comply and ensure that workers will be receiving their overtime pay.”

The final rule, effective Jan. 1, 2020, updates the earnings thresholds necessary to exempt executive, administrative or professional employees from the FLSA’s minimum wage and overtime pay requirements, and allows employers to count a portion of certain bonuses (and commissions) toward meeting the salary level.

The new thresholds account for growth in employee earnings since the currently enforced thresholds were set in 2004. In the final rule, the department is:

- Raising the standard salary level from the currently enforced level of $455 to $684 per week (equivalent to $35,568 per year for a full-year worker);

- Raising the total annual compensation level for highly compensated employees from the currently-enforced level of $100,000 to $107,432 per year;

- Allowing employers to use nondiscretionary bonuses and incentive payments (including commissions) that are paid at least annually to satisfy up to 10% of the standard salary level, in recognition of evolving pay practices; and

- Revising the special salary levels for workers in U.S. territories and in the motion picture industry.

This finalized rule is a shift from the previous administration's proposed rule, which would have doubled the salary threshold.

Under the Obama administration, the Labor Department in 2016 raised the minimum salary to roughly $47,000, extending mandatory overtime pay to nearly 4 million U.S. employees. But the following year, a federal judge in Texas ruled that the ceiling was set so high that it could sweep in some management workers who are supposed to be exempt from overtime pay protections. Business groups and 21 Republican-led states then sued, challenging the rule.

The overturning of the 2016 rule that increased the salary level from the 2004 level has created a lot of uncertainty, says Susan Harthill, a partner with Morgan Lewis. The best way to create certainty is to issue a new regulation, which is what the administration's done, Harthill adds.

While the final rule largely tracks the draft, there are two changes that should be noted: the salary level is $5 higher and the highly compensated employee salary level is dramatically reduced from the proposed level, she says.

“This is an effort to find a middle ground, and while it may be challenged by either or maybe both sides, the DOL’s salary test sets a clear dividing line between employees who must be paid overtime if they work more than 40 hours per week and employees whose eligibility for overtime varies based on their job duties,” Harthill adds.

The DOL estimates 1.3 million employees could now be eligible for overtime pay under this rule (employees who earn between $23,600 and $35,368 no longer qualify for the exemption).

A majority of business groups were critical of Obama’s overtime rule, citing the burdens it placed particularly on small businesses that would be forced to roll out new systems for tracking hours, recordkeeping and reporting.

SHRM, for example, expressed it's opposition to the rule, noting it would have fundamentally changed the rules for employee classification, dramatically increased the salary under which employees are eligible for overtime and provided for automatic increases in the salary level without employer input.

“Today’s announcement finalizing DOL’s overtime rule provides much-needed clarity for workplaces," SHRM says in a statement. "This rule marks the first increase to the salary threshold since 2004 and gives employers more flexibility to plan for the future. We appreciate DOL’s willingness to work with SHRM, other organizations and America’s workers to enact an overtime rule that benefits both employers and their employees.”

But the finalized rule still will have implications for employers.

“Education and health services, wholesale and retail trade, and professional and business services, are the most impacted industries, according to DOL, but all industries are potentially impacted,” Harthill, also former DOL deputy solicitor of labor for national operations, adds. “Also often overlooked is the impact on nonprofits and state and local governments, which are subject to the FLSA and often have lower salaries.”

All companies should be taking a close look at their employees to make sure workers are properly classified, but what they do after that will depend entirely on individual business needs, she says. “Some will hire additional employees to reduce the amount of overtime, while others will just pay overtime if their workers in this salary bracket spend more than 40 hours a week on the job.”

Employers who haven’t already reviewed their exempt workforce should do so now, before the Jan. 1 effective date, Harthill advises.

“They can opt to pay overtime, raise salary levels above $35,368, or review and tighten policies to ensure employees do not work more than 40 hours per week,” she says. “There could be job positions that need to be reclassified and that might have a knock-on effect for employees who earn above the new salary level.”

Many employers increased their salaries when DOL issued the 2016 rule, and some states have higher salary levels, so not all businesses will need to make an adjustment. “But even those employers should review their highly compensated employees — they may still be exempt even if they earn less than $107,432 but the analysis will be more complicated,” she adds.

“We did not hear any objections from employers when these rules were initially proposed," adds Jason Hammersla, vice president of communications at the American Benefits Council. "That said, aside from the obvious compensation and payroll tax implications, this rulemaking is significant for employers who include overtime compensation in the formula for retirement plan contributions as it could increase any required employer contributions."

"The change could also affect plans that exclude overtime pay from the plan’s definition of compensation if the new overtime pay causes the plan to become discriminatory in favor of highly compensated employees," he adds.

SOURCE: Otto, N. (24 September 2019) "DOL issues finalized overtime regulation" (Web Blog Post). Retrieved from https://www.benefitnews.com/news/dol-issues-finalized-overtime-regulation

4 pitfalls of paid leave and how clients can avoid them

Employers are using paid leave options to help boost their employee benefits packages in efforts to better attract and retain talent. Read the following blog post from Employee Benefit Advisor for 4 common pitfalls of paid leave and how employers can avoid them.

Smart employers are boosting their benefits packages with paid family leave — the most coveted work perk among all generations. In today’s low unemployment environment, paid leave benefits can be a huge differentiator in attracting and retaining talent.

Smart employers are boosting their benefits packages with paid family leave — the most coveted work perk among all generations. In today’s low unemployment environment, paid leave benefits can be a huge differentiator in attracting and retaining talent.

But some employers are getting themselves into trouble in the process, facing accusations of gender discrimination or improper use of leave.

Here are four potential pitfalls of paid leave, and how employers can avoid them.

1. Be careful what you call “maternity leave.”

Employers have long been granting leave for new moms in the form of disability coverage. In fact, the top cause of short term disability is pregnancy. Disability insurance usually grants new moms six to eight weeks of paid leave to recover from childbirth.

Because this coverage applies to the medical condition of recovering from childbirth, it shouldn’t be lumped in with bonding leave.

Guidance from the Equal Employment Opportunity Commission says leave granted for new moms for bonding must also be extended to new dads, so separating disability leave from bonding leave is crucial to avoiding gender discrimination.

2. Don’t make gender assumptions.

The amount of bonding time for new parents after birth, adoption or fostering must be granted equally for men and women. Companies that don’t provide the same amount of paid leave for men and women may find themselves in a discrimination lawsuit.

It’s not just the time away from work that matters, but also the return-to-work support provided. If new moms are granted temporary or modified work schedules to ease the transition back to work, new dads must also have access to this.

Some companies may choose to differentiate the amount of leave and return-to-work support for primary or secondary caregivers. That’s compliant as long as assumptions aren’t made on which gender is the primary or secondary caregiver.

The best way to avoid potential gender discrimination pitfalls is to keep all parental bonding and related return-to-work policies gender neutral.

3. Avoid assuming the length of disability.

Be careful about assuming the length of time a new mom is disabled, or recovering medically, after birth. Typical coverage policies allot six to eight weeks of recovery for a normal pregnancy, so assuming a new mom may be out for 10 weeks might be overestimating the medical recovery time, and under-representing the bonding time, which must be gender neutral.

4. Keep up with federal, state and local laws.

Mandated leave laws are ever-evolving, so employers should consistently cross-check their policies with state and local laws. For instance, do local paid leave laws treat adoption the same as birth? Are multistate employers compliant? What if an employee lives in one state but works in another: Which state’s leave policies take precedence?

Partnering with a paid leave service provider can mitigate the risk of improperly administering leave. Paid leave experts can help answer questions, review guidelines and provide information regarding job-protecting medical or family leave.

They can also help flag potential pitfalls, ensuring leave requests from all areas of your company are managed uniformly and in accordance with state and federal laws, including the EEOC.

SOURCE: Bennett, A. (12 September 2019) "4 pitfalls of paid leave and how clients can avoid them" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/list/4-pitfalls-of-paid-leave-and-how-clients-can-avoid-them

Changes are coming to paid leave. Here’s what employers should know

Many states and local governments are enacting their own paid leave policies, making it difficult for employers to navigate employee paid leave. Read this blog post for what employers should know about the coming changes for paid leave.

A growing number of states and local governments are enacting their own paid leave policies. These new changes can be difficult for employers to navigate if they don’t understand the changes that are happening.

Adding to the confusion among employers, paid sick leave and paid family leave are often used interchangeably, when in fact there are some important distinctions. Paid sick leave is for a shorter time frame than paid family leave and allows eligible employees to care for their own or a family member’s health or preventative care. Paid family leave is more extensive and allows eligible employees to care for their own or a family member’s serious health condition, bond with a new child or to relieve family pressures when someone is called to military service.

The best-known type of employee leave is job-protected leave under the Family Medical Leave Act, where employees can request to take family medical leave for their own or a loved one’s illness, or for military caregiver leave. However, leave under FMLA is unpaid, and in most cases, employees may use available PTO or paid leave time in conjunction with family medical leave.

Rules vary by state, which makes it more difficult for multi-state employers to comply. The following is an overview of some new and changing state and local paid leave laws.

Paid sick leave

The states that currently have paid sick leave laws in place are Arizona, California, Connecticut, Maryland, Massachusetts, New Jersey, Oregon, Rhode Island, Vermont and Washington. There are also numerous local and city laws coming into effect across the country.

In New Jersey, the Paid Sick Leave Act was enacted late last year. It applies to all New Jersey businesses regardless of size; however, public employees, per diem healthcare employees and construction workers employed pursuant to a collective bargaining agreement are exempt. As of February 26, New Jersey employees could begin using accrued leave time, and employees who started after the law was enacted are eligible to begin using accrued leave 120 days after their hire dates.

Michigan’s Paid Medical Leave Act requires employers with 50 or more employees to provide paid leave for personal or family needs as of March.

Under Vermont’s paid sick leave law, this January, the number of paid sick leave hours employees may accrue rose from 24 to 40 hours per year.

In San Antonio, a local paid sick leave ordinance passed last year, but it may not take effect this August. The ordinance mirrors one passed in Austin that has been derailed by legal challenges from the state. Employers in these cities should watch these, closely.

Paid family leave

The five states that currently have paid family leave policies are California, New Jersey, Rhode Island, New York, Washington and the District of Columbia.

New York, Washington and D.C. all have updates coming to their existing legislation, and Massachusetts will launch a new paid family program for employers in that state. In New York, the state’s paid family leave program went into effect in 2018 and included up to eight weeks of paid family leave for covered employees. This year, the paid leave time jumps to 10 weeks. Payroll deductions to fund the program also increased.

Washington’s paid family leave program will begin on January 1, 2020, but withholding for the program started on January 1 of this year. The program will include 12 weeks of paid family leave, 12 weeks of paid medical leave. If employees face multiple events in a year, they may be receive up to 16 weeks, and up to 18 weeks if they experience complications during pregnancy.

The paid family leave program in Massachusetts launches on January 1, 2021, with up to 12 weeks of paid leave to care for a family member or new child, 20 weeks of paid leave for personal medical issues and 26 weeks of leave for an emergency related to a family member’s military deployment. Payroll deductions for the program start on July 1.

The Paid Leave Act of Washington, D.C. will launch next year with eight weeks of parental leave to bond with a new child, six weeks of leave to care for an ill family member with a serious health condition and two weeks of medical leave to care for one’s own serious health condition. On July 1, the district will begin collecting taxes from employers, and paid leave benefits will be administered as of July 1, 2020.

Challenging times ahead

An employer must comply with all state and local sick and family leave laws, and ignorance of a law is not a defense. Employers must navigate different state guidelines and requirements for eligibility no matter how complex, including multi-state employers and companies with employees working remotely in different jurisdictions.

These state paid leave programs are funded by taxes, but employers must cover the costs of managing the work of employees who are out on leave. While generous paid leave policies can help employers attract talent, they simply don’t make sense for all companies. For example, it can be difficult for low-margin businesses to manage their workforces effectively when employees can take an extended paid leave.

Not only must employers ensure compliance with state and local rules, but they also must make sure that their sick time, family and parental leave policies are non-discriminatory and consistent with federal laws and regulations. That’s a lot to administer.

Employers should expect to see the changes in paid sick leave and family leave laws to continue. In the meantime, companies should make sure they have the people and internal processes in place right now to track these changes and ensure compliance across the board.

SOURCE: Starkman, J.; Johnson, D. (2 May 2019) "Changes are coming to paid leave. Here’s what employers should know" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/what-employers-need-to-know-about-changing-paid-leave-laws?brief=00000152-14a7-d1cc-a5fa-7cffccf00000

DOL proposes new rule clarifying, updating regular rate of pay

The Department of Labor (DOL) recently released a proposal that defines and updates what forms of payment employers can include and exclude in the time-and-one-half calculation when determining overtime rates. Read this blog post to learn more.

For the first time in 50 years, the Department of Labor has proposed changing the definition of the regular rate of pay.

The proposal, announced Thursday, “defines and updates” what forms of payment employers include and exclude in the time-and-one-half calculation when determining workers’ overtime rates, according to the DOL.

The regulations the DOL is proposing to revise govern how employers must calculate the regular rate and overtime pay rate, including the types of compensation that must be included and may be excluded from the overtime pay calculation, says Tammy McCutchen, a principal at Littler Mendelson and former administrator of the Department of Labor’s Wage and Hour Division.

The regular rate of pay is not just an employee’s hourly rate, she says, but rather includes “all remuneration for employment” — unless specifically excluded by section 7(e) of the FLSA.

Under current rules, employers are discouraged from offering more perks to their employees as it may be unclear whether those perks must be included in the calculation of an employees’ regular rate of pay, the DOL says. The proposed rule focuses primarily on clarifying whether certain kinds of perks, benefits or other miscellaneous items must be included in the regular rate.

The DOL proposes that employers may exclude the following from an employee’s regular rate of pay:

- The cost of providing wellness programs, onsite specialist treatment, gym access and fitness classes and employee discounts on retail goods and services;

- Payments for unused paid leave, including paid sick leave;

- Reimbursed expenses, even if not incurred solely for the employer’s benefit;

- Reimbursed travel expenses that do not exceed the maximum travel reimbursement permitted under the Federal Travel Regulation System regulations and that satisfy other regulatory requirements;

- Discretionary bonuses;

- Benefit plans, including accident, unemployment, and legal services; and

- Tuition programs, such as reimbursement programs or repayment of educational debt.

The proposed rule also includes additional clarification about other forms of compensation, including payment for meal periods and call back pay.

The regulations will benefit employees, primarily, ensuring that employers can continue to provide benefits that employees’ value — tuition reimbursements, student loan repayment, employee discounts, payout of unused paid leave and gym memberships, McCutchen says.

“Remember, there is no law that employers must provide employees these types of benefits,” she adds. “Employers will not provide such benefits if doing so creates risk of massive overtime liability.”

Knowing when employers must pay overtime on these types of benefits, how to calculate the value of those benefits and overtime pay are all difficult questions, she adds. “Unintentional mistakes by good faith employers providing valued benefits to employees is easy. With this proposed rule, the DOL is embracing the philosophy that good deeds should not be punished.”

She notes the proposal does not include any specific examples of what reimbursements may be excluded from the regular rate.

“One big open question is whether employers must pay overtime when they provide employees with subsidies to take public transportation to work — as the federal government does for many of its own employees — I think around $260 per month in the DC Metro area,” she adds.

The DOL earlier this month proposed to increase the salary threshold for overtime eligibility to $35,308 up from the current $23,660. If finalized, the rule would expand overtime eligibility to more than a million additional U.S. workers, far fewer than an Obama administration rule that was struck down by a federal judge in 2017.

Employers are expected to challenge the new rule as well, based on similar complaints of administrative burdens, but a legal challenge might be more difficult to pass this time around.

SOURCE: Otto, N. (28 March 2019) "DOL proposes new rule clarifying, updating regular rate of pay" (Web Blog Post). Retrieved from https://www.benefitnews.com/news/dol-proposes-new-rule-on-regular-rate-of-pay-calculation?brief=00000152-14a5-d1cc-a5fa-7cff48fe0001

Compliance: Yearly Deadlines for Health Plans

Do you offer group health plans coverage to your employees? Employers that provide coverage are subject to multiple compliance requirements throughout the year. Certain requirements have been around for many years, while others have been recently added by the Affordable Care Act (ACA).

Continue reading for a summary of the many compliance requirements and their associated deadlines that health plan providers should be aware of throughout the year. Certain deadlines for non-calendar year plans may vary from what is outlined in this summary. This summary only covers recurring calendar year compliance deadlines. Other requirements that are not based on the calendar year are not included below.

January

| Deadline | Requirement | Description |

|

January 31 |

Form W-2 | Deadline for providing Forms W-2 to employees. The ACA requires employers to report the aggregate cost of employer-sponsored group health plan coverage on their employees’ Forms W-2. The purpose is to provide employees with information on how much their health coverage costs. Certain types of coverage are not required to be reported on Form W-2.

This Form W-2 reporting requirement is currently optional for small employers (those who file fewer than 250 Forms W-2). Employers that file 250 or more Forms W-2 are required to comply with the ACA’s reporting requirement. |

| January 31 | Form 1095-C or Form 1095-B—Annual Statement to Individuals | Applicable large employers (ALEs) subject to the ACA’s employer shared responsibility rules must furnish Form 1095-C (Section 6056 statements) annually to their full-time employees. Employers with self-insured health plans that are not ALEs must furnish Form 1095-B (Section 6055 statements) annually to covered employees.

The Forms 1095-B and 1095-C are due on or before Jan. 31 of the year immediately following the calendar year to which the statements relate. Extensions may be available in certain limited circumstances. However, an alternate deadline generally is not available for ALEs that sponsor non-calendar year plans.

Update: The IRS extended the deadline for furnishing the 2018 employee statements, from Jan. 31, 2019, to March 4, 2019. |

February

| Deadline | Requirement | Description |

|

February 28 (March 31, if filing electronically) |

Section 6055 and 6056 Reporting | Under Section 6056, ALEs subject to the ACA’s employer shared responsibility rules are required to report information to the IRS about the health coverage they offer (or do not offer) to their full-time employees. ALEs must file Form 1094-C and Form 1095-C with the IRS annually.

Under Section 6055, self-insured plan sponsors are required to report information about the health coverage they provided during the year. Self-insured plan sponsors must generally file Form 1094-B and Form 1095-B with the IRS annually. ALEs that sponsor self-insured plans are required to report information to the IRS under Section 6055 about health coverage provided, as well as information under Section 6056 about offers of health coverage. ALEs that sponsor self-insured plans will generally use a combined reporting method on Form 1094-C and Form 1095-C to report information under both Sections 6055 and 6056. All forms must be filed with the IRS annually, no later than Feb. 28 (March 31, if filed electronically) of the year following the calendar year to which the return relates. Reporting entities that are filing 250 or more returns must file electronically. There is no alternate filing date for employers with non-calendar year plans. |

March

| Deadline | Requirement | Description |

|

March 1 (calendar year plans) |

Medicare Part D Disclosure to CMS | Group health plan sponsors that provide prescription drug coverage to Medicare Part D eligible individuals must disclose to the Centers for Medicare & Medicaid Services (CMS) whether prescription drug coverage is creditable or not. In general, a plan’s prescription drug coverage is considered creditable if its actuarial value equals or exceeds the actuarial value of the Medicare Part D prescription drug coverage. Disclosure is due:

Plan sponsors must use the online disclosure form on the CMS Creditable Coverage webpage. |

July

| Deadline | Requirement | Description |

|

July 31 |

PCORI Fee | Deadline for filing IRS Form 720 and paying Patient-Centered Outcomes Research Institute (PCORI) fees for the previous year. For insured health plans, the issuer of the health insurance policy is responsible for the PCORI fee payment. For self-insured plans, the PCORI fee is paid by the plan sponsor.

The PCORI fees are temporary—the fees do not apply to plan years ending on or after Oct. 1, 2019. This means that, for calendar year plans, the PCORI fees do not apply for the 2019 plan year. |

|

July 31 |

Form 5500 | Plan administrators of ERISA employee benefit plans must file Form 5500 by the last day of the seventh month following the end of the plan year, unless an extension has been granted. Form 5500 reports information on a plan’s financial condition, investments and operations. Form 5558 is used to apply for an extension of two and one-half months to file Form 5500.

Small health plans (fewer than 100 participants) that are fully insured, unfunded or a combination of insured/unfunded, are generally exempt from the Form 5500 filing requirement. The Department of Labor’s (DOL) website and the latest Form 5500 instructions provide information on who is required to file and detailed information on filing. |

September

| Deadline | Requirement | Description |

|

September 30 |

Medical Loss Ratio (MLR) Rebates | The deadline for issuers to pay medical loss ratio (MLR) rebates for the 2014 reporting year and beyond is Sept. 30. The ACA requires health insurance issuers to spend at least 80 to 85 percent of their premiums on health care claims and health care quality improvement activities. Issuers that do not meet the applicable MLR percentage must pay rebates to consumers.

Also, if the rebate is a “plan asset” under ERISA, the rebate should, as a general rule, be used within three months of when it is received by the plan sponsor. Thus, employers who decide to distribute the rebate to participants should make the distributions within this three-month time limit. |

|

September 30 |

Summary Annual Report | Plan administrators must automatically provide participants with the summary annual report (SAR) within nine months after the end of the plan year, or two months after the due date for filing Form 5500 (with approved extension).

Plans that are exempt from the annual 5500 filing requirement are not required to provide an SAR. Large, completely unfunded health plans are also generally exempt from the SAR requirement. |

October

| Deadline | Requirement | Description |

|

October 15 |

Medicare Part D – Creditable Coverage Notices | Group health plan sponsors that provide prescription drug coverage to Medicare Part D eligible individuals must disclose whether the prescription drug coverage is creditable or not. Medicare Part D creditable coverage disclosure notices must be provided to participants before the start of the annual coordinated election period, which runs from Oct. 15-Dec. 7 of each year. Coverage is creditable if the actuarial value of the coverage equals or exceeds the actuarial value of coverage under Medicare Part D. This disclosure notice helps participants make informed and timely enrollment decisions.

Disclosure notices must be provided to all Part D eligible individuals who are covered under, or apply for, the plan’s prescription drug coverage, regardless of whether the prescription drug coverage is primary or secondary to Medicare Part D. Model disclosure notices are available on CMS’ website. |

Annual Notices

| Type of Notice | Description |

| WHCRA Notice | The Women’s Health and Cancer Rights Act (WHCRA) requires group health plans that provide medical and surgical benefits for mastectomies to also provide benefits for reconstructive surgery. Group health plans must provide a notice about the WHCRA’s coverage requirements at the time of enrollment and on an annual basis after enrollment. The initial enrollment notice requirement can be satisfied by including the information on WHCRA’s coverage requirements in the plan’s summary plan description (SPD). The annual WHCRA notice can be provided at any time during the year. Employers with open enrollment periods often include the annual notice with their open enrollment materials. Employers that redistribute their SPDs each year can satisfy the annual notice requirement by including the WHCRA notice in their SPDs.

Model language is available in the DOL’s compliance assistance guide. |

| CHIP Notice | If an employer’s group health plan covers residents in a state that provides a premium subsidy under a Medicaid plan or CHIP, the employer must send an annual notice about the available assistance to all employees residing in that state. the annual CHIP notice can be provided at any time during the year. Employers with annual enrollment periods often provide CHIP notice with their open enrollment materials.

The DOL has a model notice that employers may use. |

| Group health plans and health insurance issuers are required to provide an SBC to applicants and enrollees each year at open enrollment or renewal time. The purpose of the SBC is to allow individuals to easily compare their options when they are shopping for or enrolling in health plan coverage. Federal agencies have provided a template for the SBC, which health plans and issuers are required to use.

The issuer for fully insured plans usually prepares the SBC. If the issuer prepares the SBC, an employer is not also required to prepare an SBC for the health plan, although the employer may need to distribute the SBC prepared by the issuer. The SBC must be included in open enrollment materials. If renewal is automatic, the SBC must be provided no later than 30 days prior to the first day of the new plan year. However, for insured plans, if the new policy has not yet been issued 30 days prior to the beginning of the plan year, the SBC must be provided as soon as practicable, but no later than seven business days after the issuance of the policy. |

|

| Grandfathered Plan Notice | To maintain a plan’s grandfathered status, the plan sponsor or must include a statement of the plan’s grandfathered status in plan materials provided to participants describing the plan’s benefits (such as the summary plan description, insurance certificate and open enrollment materials). The DOL has provided a model notice for grandfathered plans. This notice only applies to plans that have grandfathered status under the ACA. |

| Notice of Patient Protections | If a non-grandfathered plan requires participants to designate a participating primary care provider, the plan or issuer must provide a notice of patient protections whenever the SPD or similar description of benefits is provided to a participant. This notice is often included in the SPD or insurance certificate provided by the issuer (or otherwise provided with enrollment materials).

The DOL provided a model notice of patient protections for plans and issuers to use. |

| HIPAA Privacy Notice | The HIPAA Privacy Rule requires self-insured health plans to maintain and provide their own privacy notices. Special rules, however, apply for fully insured plans. Under these rules, the health insurance issuer, and not the health plan itself, is primarily responsible for the privacy notice.

Self-insured health plans are required to send the privacy notice at certain times, including to new enrollees at the time of enrollment. Thus, the privacy notice should be provided with the plan’s open enrollment materials. Also, at least once every three years, health plans must either redistribute the privacy notice or notify participants that the privacy notice is available and explain how to obtain a copy. The Department of Health and Human Services (HHS) has model Privacy Notices for health plans to choose from. |

| HIPAA Special Enrollment Notice | At or prior to the time of enrollment, a group health plan must provide each eligible employee with a notice of his or her special enrollment rights under HIPAA. This notice should be included with the plan’s enrollment materials. It is often included in the health plan’s SPD or insurance booklet. Model language is available in the DOL’s compliance assistance guide. |

| Wellness Notice HIPAA | Employers with health-contingent wellness programs must provide a notice that informs employees that there is an alternative way to qualify for the program’s reward. This notice must be included in all plan materials that describe the terms of the wellness program. If wellness program materials are being distributed at open enrollment (or renewal time), this notice should be included with those materials. Sample language is available in the DOL’s compliance assistance guide. |

| Wellness Notice ADA | To comply with the Americans with Disabilities Act (ADA), wellness plans that collect health information or involve medical exams must provide a notice to employees that explains how the information will be used, collected and kept confidential. Employees must receive this notice before providing any health information and with enough time to decide whether to participate in the program. Employers that are implementing a wellness program for the upcoming plan year should include this notice in their open enrollment materials. The Equal Employment Opportunity Commission has provided a sample notice for employers to use. |

Resources: https://www.ada.gov/; https://www.dol.gov/; https://www.hhs.gov/hipaa/for-professionals/privacy/guidance/model-notices-privacy-practices/index.html; https://www.cms.gov/Medicare/Prescription-Drug-Coverage/CreditableCoverage/Model-Notice-Letters.html; https://www.irs.gov/retirement-plans/retirement-plan-participant-notices-when-the-end-of-the-plan-year-has-passed; https://www.cms.gov/cciio/programs-and-initiatives/health-insurance-market-reforms/medical-loss-ratio.html; https://www.dol.gov/sites/default/files/ebsa/about-ebsa/our-activities/resource-center/publications/compliance-assistance-guide.pdf; https://www.dol.gov/agencies/ebsa/laws-and-regulations/laws/affordable-care-act/for-employers-and-advisers/preexisting-condition-exclusions; https://www.dol.gov/agencies/ebsa/laws-and-regulations/laws/affordable-care-act/for-employers-and-advisers/summary-of-benefits; https://www.dol.gov/agencies/ebsa/laws-and-regulations/laws/chipra/working-group; https://www.dol.gov/agencies/ebsa/laws-and-regulations/laws/whcra; https://www.dol.gov/agencies/ebsa/employers-and-advisers/plan-administration-and-compliance/reporting-and-filing/forms; https://www.irs.gov/newsroom/patient-centered-outcomes-research-institute-fee; https://www.irs.gov/affordable-care-act/individuals-and-families/form-1095-b-what-you-need-to-do-with-this-form; https://www.irs.gov/affordable-care-act/individuals-and-families/form-1095-c-what-you-need-to-do-with-this-form; https://www.cms.gov/Medicare/Prescription-Drug-Coverage/CreditableCoverage/index.html?redirect=/CreditableCoverage/; https://www.irs.gov/affordable-care-act/questions-and-answers-on-information-reporting-by-health-coverage-providers-section-6055; https://www.irs.gov/affordable-care-act/employers/questions-and-answers-on-reporting-of-offers-of-health-insurance-coverage-by-employers-section-6056; https://www.irs.gov/forms-pubs/about-form-w-2;

5 Things Employers Need to Know About Overtime Rules

Original post benefitsnews.com

With compensation taking up the biggest slice of the benefits pie, employers are paying close attention to the Department of Labor’s proposed changes to the overtime rules – expected to be released as early as this month – under the Fair Labor Standards Act.

The proposed rules bump the salary threshold for overtime from $23,600/year to $50,440/year. If the final rules stay the same as the proposed rules, employees currently working in salaried positions who make less than $50,440 will now be entitled to overtime pay. That’s a 113% increase, which is “incredibly dramatic,” says Lisa Horn, spokesperson for the Partnership to Protect Workplace Opportunity.

“Not only does it raise it that high, but what many have failed to hone in on is the fact that this is an annual increase,” she adds. “That’s quite impactful on top of that huge initial jump in the salary increase.”

Horn says some research predicts that because of that annual increase, which is tied to the 40th percentile of all full-time salaried workers in the country, the minimum salary threshold for overtime could rise as high as $90,000 within five to seven years.

It’s possible the final rules could include a lower salary threshold – Horn says she’s heard it could be $47,000/year instead of $50,440 – but even if that’s the case, it will still mean a big jump. Employers will have to decide whether to increase workers’ salaries to make them exempt from overtime or reclassify them as non-exempt.

And since many employers have different benefit structures for hourly and salaried workers, if some employees need to be reclassified as non-exempt they could see their benefits affected.

Moreover, in the eyes of employees, being reclassified as non-exempt is “seen as a demotion,” says Horn, who also works as SHRM’s director of Congressional affairs. “Because you’re continually trying to climb most employees from that non-exempt hourly status to the more professional exempt status.”

Here are five things employers need to know about the proposed rules from the PPWO, a group of more than 70 employer organizations and companies created to respond to the overtime rule changes:

1. This proposal represents a 113% immediate increase plus an annual increase. The proposed overtime rule would initially raise the salary threshold defining which employees must be paid overtime by 113%, from $23,600 to $50,440. In addition, the DOL has proposed increasing this minimum salary on an annual basis.

2. The proposal will impact millions of workers and cost billions to businesses.According to the DOL, the rule will affect over 10 million workers – workers who may see their workplace flexibility diminished or a loss in other benefits they rely on, says the PPWO. The National Retail Federation estimates retail and restaurant businesses will see an increase of more than $8.4 billion per year in costs.

3. The implementation window is very short. As proposed, the implementation timeline for this rule is only 60 days, which will place a massive burden on HR departments and organizations scrambling to comply, according to the PPWO. “That 60 days is just completely unworkable from an organization’s standpoint and having to implement these changes in such a short time frame,” says Horn. “These are, for some organizations, really massive changes.”

4. Many employees will need to be demoted. This change could force employers to reclassify professional employees from salaried to hourly – including many managers and those with advanced degrees – resulting in a loss in benefits, bonuses, and flexibility, and a reduction in professional opportunities.

5. This is a blanket increase that disproportionally impacts lower cost areas. A one-size-fits-all approach is inappropriate for the different industries and various regions of the country. While the threshold of $50,440 may be reasonable in New York City, a comparable cost of living in Birmingham, Alabama, for example, is only about $21,000 – making the threshold unattainable and unrealistic for many small businesses in lower cost of living areas, according to the PPWO.