Health insurance surpass $20,000 per year, hitting a record

According to an annual survey of employers, the cost of family health coverage has now surpassed $20,000, a record high. The survey also revealed that while most employers pay most of the costs of coverage, workers' average contribution for a family plan is now $6,000. Read this blog post from Employee Benefit News to learn more.

The cost of family health coverage in the U.S. now tops $20,000, an annual survey of employers found, a record high that has pushed an increasing number of American workers into plans that cover less or cost more, or force them out of the insurance market entirely.

“It’s as much as buying a basic economy car,” said Drew Altman, chief executive officer of the Kaiser Family Foundation, “but buying it every year.” The nonprofit health research group conducts the yearly survey of coverage that people get through work, the main source of insurance in the U.S. for people under age 65.

While employers pay most of the costs of coverage, according to the survey, workers’ average contribution is now $6,000 for a family plan. That’s just their share of upfront premiums, and doesn’t include co-payments, deductibles and other forms of cost-sharing once they need care.

The seemingly inexorable rise of costs has led to deep frustration with U.S. healthcare, prompting questions about whether a system where coverage is tied to a job can survive. As premiums and deductibles have increased in the last two decades, the percentage of workers covered has slipped as employers dropped coverage and some workers chose not to enroll. Fewer Americans under 65 had employer coverage in 2017 than in 1999, according to a separate Kaiser Family Foundation analysis of federal data. That’s despite the fact that the U.S. economy employed 17 million more people in 2017 than in 1999.

“What we’ve been seeing is a slow, slow kind of drip-drip erosion in employer coverage,” Altman said.

Employees’ costs for healthcare are rising more quickly than wages or overall economy-wide prices, and the working poor have been particularly hard-hit. In firms where more than 35% of employees earn less than $25,000 a year, workers would have to contribute more than $7,000 for a family health plan. It’s an expense that Altman calls “just flat-out not affordable.” Only one-third of employees at such firms are on their employer’s health plans, compared with 63% at higher-wage firms, according to the Kaiser Family Foundation’s data.

The survey is based on responses from more than 2,000 randomly selected employers with at least three workers, including private firms and non-federal public employers.

Deductibles are rising even faster than premiums, meaning that patients are on the hook for more of their medical costs upfront. For a single person, the average deductible in 2019 was $1,396, up from $533 in 2009. A typical household with employer health coverage spends about $800 a year in out-of-pocket costs, not counting premiums, according to research from the Commonwealth Fund. At the high end of the range, those costs can top $5,000 a year.

While raising deductibles can moderate premiums, it also increases costs for people with an illness or who gets hurt. “Cost-sharing is a tax on the sick,” said Mark Fendrick, director of the Center for Value-Based Insurance Design at the University of Michigan.

Under the Affordable Care Act, insurance plans must cover certain preventive services such as immunizations and annual wellness visits without patient cost-sharing. But patients still have to pay out-of-pocket for other essential care, such as medication for chronic conditions like diabetes or high blood pressure, until they meet their deductibles.

Many Americans aren’t prepared for the risks that deductibles transfer to patients. Almost 40% of adults can’t pay an unexpected $400 expense without borrowing or selling an asset, according to a Federal Reserve survey from May.

That’s a problem, Fendrick said. “My patient should not have to have a bake sale to afford her insulin,” he said.

After years of pushing healthcare costs onto workers, some employers are pressing pause. Delta Air Lines Inc. recently froze employees’ contributions to premiums for two years, Chief Executive Officer Ed Bastian said in an interview at Bloomberg’s headquarters in New York last week.

“We said we’re not going to raise them. We're going to absorb the cost because we need to make certain people know that their benefits structure is real important,” Bastian said. He said the company’s healthcare costs are growing by double-digits. The Atlanta-based company has more than 80,000 employees around the globe.

Some large employers have reversed course on asking workers to take on more costs, according to a separate survey from the National Business Group on Health. In 2020, fewer companies will limit employees to so-called “consumer-directed health plans,” which pair high-deductible coverage with savings accounts for medical spending funded by workers and employers, according to the survey. That will be the only plan available at 25% of large employers in the survey, down from 39% in 2018.

Employers have to balance their desire to control costs with their need to attract and keep workers, said Kaiser’s Altman. That leaves them less inclined to make aggressive moves to tackle underlying medical costs, such as by cutting high-cost hospitals out of their networks. In recent years employers’ healthcare costs have remained steady as a share of their total compensation expenses.

“There’s a lot of gnashing of teeth,” Altman said, “but if you look at what they do, not what they say, it’s reasonably vanilla.”

SOURCE: Tozzi, J. (25 September 2019) "Health insurance surpass $20,000 per year, hitting a record" (Web Blog Post). Retrieved from https://www.benefitnews.com/articles/health-insurance-costs-surpass-20-000-per-year

The unpaid caregiver crisis is landing on employers’ doorsteps

According to new data, 43 million Americans currently are tending to a family member in need, which can be both physically and emotionally taxing on the caregiver. Read this blog post for more on the unpaid caregiver crisis.

Scott Williams knows firsthand what it is like to support a sick relative. But even after spending 20 years tending to his ailing mother, he didn’t consider himself a caregiver.

“She suffered from multiple chronic conditions, but I never considered myself a caregiver,” he says. “I just thought I was a son who loved his mom.”

Williams, who is vice president and head of global patient advocacy and strategic partnerships at the biopharmaceutical company EMD Serono, realized that because he didn’t think of himself as a caregiver, he wasn’t able to take advantage of the benefit offerings his company had in place for these workers.

“Until I really started to think about it, I didn’t realize how burned out I really was,” Williams says. “I was in that sandwich generation, which is a situation that many caregivers find themselves in sometimes.”

Williams dilemma is not uncommon. There are 43 million Americans currently tending to a family member in need, according to data from LIMRA. AARP estimates that caring for a loved one can cost close to $7,000 out of pocket.

"I never considered myself a caregiver, I just thought I was a son who loved his mom.” Scott Williams

It is also both physically and emotionally taxing — 57% of caregivers need medical care or support for a mental health condition, according to an Embracing Carers survey. About 55% of caregivers say their own physical health has diminished, 54% say they don’t have time to tend to their own medical needs and 47% report feeling depressed.

The caregiving crisis puts employers in a unique position to offer benefits, policies and resources that can ease some of this stress. Indeed, there are some employers that already stepped up. For example, Starbucks launched a new caregiver benefit last year. Amgen and Brinker International, use digital tools to offer caregiving benefits to their workers.

Regardless, the need for employer-provided backup child, adult and senior care options is still largely unmet. Only 4% of employers offer backup childcare services and only 2% offer backup elder care, according to data from the Society for Human Resource Management.

The breakdown of communication between the company and the worker may be keeping the majority of employees from accessing the assistance they need. If employers ignore this issue or simply fail to communicate with employees, it can end up becoming a burden that costs the company money or result in the loss of a worker.

But there are some steps employers can take. The first is to identify the responsibilities of the family caregiver so that employers can better address their needs. One of the biggest responsibilities caregivers face is the amount of time they have to spend transporting loved ones, says Ellen Kelsay, chief strategy officer for the National Business Group on Health citing recent data on the subject. These employees often have to leave work early, come in late or take off to get an ill family member to their doctor’s appointments.

“The financial impact is considerable, many of these employees are paying out of their own pocket to support the medical care of a loved one. So there is financial assistance that they need,” Kelsay says. “When you think about the impact on the employee, they [struggle from a] physical, mental and emotional wellbeing perspective.”

About half of unpaid caregivers work full time outside of their home and many have to take leaves of absence or cut back their work hours due to the demands of caring for a family member, LIMRA research shows. A significant portion of employees had to stop working in order to better care for their loved one — about 22% say they voluntarily quit their jobs, 18% had their employment terminated and 13% chose to retire early.

Unlimited PTO, remote work, shared sick time and an employee resource group are just a few offerings employers can offer staff, Williams says. For instance, EMD Serono created an employee resource group for caregivers, a peer to peer network where employers can find dedicated resources, while also having an exchange with colleagues who are going through similar situations.

But there is still more that can be done, Williams says. Training managers to be more understanding of an employee’s needs can go a long way toward bridging the gap. Another option companies should consider is enhancing employee assistance programs to include caregivers, he adds.

“One of the things we see employers doing that can really help is being able to raise the visibility of [the available] resources,” Williams says. “To really ensure that whether you’re a new employee or an established employee in an unpaid caregiving situation that you have access to them.”

SOURCE: Schiavo, A. (11 July 2019) "The unpaid caregiver crisis is landing on employers’ doorsteps" (Web Blog Post). Retrieved from https://www.benefitnews.com/news/improving-caregiving-challenges-through-the-workplace

Hospital pricing transparency: More information, more confusion?

As of January 1, a new rule that requires hospitals to list the prices of all their services and medications they provide is in effect. Read this blog post to learn more about this ruling.

As of the first of this year, a new rule is in effect that requires hospitals to list the price for all the services they provide and medications they prescribe for patients while they’re in the hospital. In theory, this should give patients more information that can help them decide where it makes the most economic sense to receive hospital care. In actuality, while there’s a wealth of new data available, it can be difficult to find — and nearly impossible for people outside the healthcare industry to understand.

The document that aggregates the price information is called a chargemaster, and it can contain tens of thousands of entries. The new rule doesn’t require that the information be written in plain language, only that it be machine readable, so much of the data reads like it’s in a yet-to-be-discovered language. For example, if you download Memorial Sloan Kettering’s chargemaster, you’ll find an Excel spreadsheet that contains 13,088 entries such as “CAP MALE/FEMALE RAIL, $765” and “BX SUBCUT SKIN/INC, $1,771.” Even if a patient puzzles out the meaning of these abbreviations, the prices listed are different from the lower fees that insurers negotiate, so estimating how much you would pay for care is complicated at best and impossible at worst.

The goal of the hospital pricing transparency rule is to help patients understand the cost of their care and choose more wisely when deciding where to receive that care. Unfortunately, the information that is now available adds to the confusion and doesn’t help patients make one-to-one price comparisons when choosing where to receive care. In addition, the rule only covers care delivered by a hospital, so patients don’t have the information they need to make price comparisons for services performed in doctor’s offices, urgent care facilities, diagnostic test sites and outpatient surgical centers.

Though the new rule generally doesn’t help employees, employers can.

Even if price transparency doesn’t help workers better understand the cost of care and choose where to receive that care, there are strategies and resources that employers can provide to help their employees make more informed decisions about healthcare. Here are some of them.

Second opinions. Wrong diagnoses, inappropriate treatments (treatments that don’t meet the evidenced-based standard of care) and medical errors all drive up healthcare costs for both employers and employees and can lead to poorer health outcomes. One strategy to lower the risk of these types of problems is providing employees with streamlined access to second opinions from experienced physicians.

A second opinion can confirm or change an employee’s diagnosis, suggest other treatment options and pinpoint misdiagnoses, especially in the case of serious and complex conditions like cancer, autoimmune disease and back and joint problems. In fact, a Mayo Clinic study found that 88% of people who sought a second opinion from the hospital’s physicians for a complex medical condition received a new or refined diagnosis. Employers can make second opinions available to employees through several channels, including a health insurance plan or as a standalone benefit.

Care coordination. Duplicate testing and medical care is another source of wasted healthcare dollars. When communication between healthcare providers is inconsistent or medical records aren’t updated and shared among all treating physicians, employees may undergo repeat testing — for example, when a primary care physician and a cardiologist both order a cardiac stress test for a patient with shortness of breath. Employers can offer care coordination through a case manager for employees who are living with multiple health conditions.

This support can lower the risk of duplicative testing as well as duplicate prescriptions or medications that can result in interactions, which can put an employee’s health needlessly at risk. Another piece of this equation is the review and coordination of medical records, which is especially important when employees see multiple physicians. A medical records management service should include a review of the employee’s records by an RN or physician, consolidation of a comprehensive medical record, and the creation of a secure electronic medical record that can be shared with the employee’s permission with all treating physicians.

Guidance on where to receive care. While you can undergo a colonoscopy, medication infusion or a range of common surgical procedures at a hospital, that may not always be the most appropriate or cost-effective place to receive care. By offering employees the ability to talk with a care manager or adviser about the procedure they need and the options for where they can receive that care (a hospital, outpatient surgery center or doctor’s office), employers can help them receive the care they need and lower both claims costs and employee out-of-pocket costs.

Medical bill review. Another resource employers can offer to make sure healthcare costs are carefully managed is a medical bill review. Experts estimate that between 30% and 80% of medical bills contain errors that increase costs. There are many different causes of these errors, including the use of the incorrect billing codes and use of out-of-network healthcare providers. In addition to offering employees the services of a medical billing review and negotiation firm, they can provide education that lets employees know what types of errors are commonly made and how to spot them on their own bills.

SOURCE: Varn, M. (13 February 2019) "Hospital pricing transparency: More information, more confusion?" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/hospital-pricing-transparency-more-information-more-confusion?brief=00000152-14a5-d1cc-a5fa-7cff48fe0001

Top 10 health conditions costing employers the most

As healthcare costs continue to rise, employers continue to look for ways to target those costs. Read this blog post to learn more.

As healthcare costs continue to rise, more employers are looking at ways to target those costs. One step they are taking is looking at what health conditions are hitting their pocketbooks the hardest.

“About half of employers use disease management programs to help manage the costs of these very expensive chronic conditions,” says Julie Stich, associate vice president of content at the International Foundation of Employee Benefits Plans. “In addition, about three in five employers use health screenings and health risk assessments to help employees identify and monitor these conditions so that they can be managed more effectively. Early identification helps the employer and the employee.”

What conditions are costly for employers to cover? In IFEPB’s Workplace Wellness Trends 2017 Survey, more than 500 employers were asked to select the top three conditions impacting plan costs. The following 10 topped the list.

10. High-risk pregnancy

9. Smoking

8. High cholesterol

7. Depression/mental illness

6. Hypertension/high blood pressure

5. Heart disease

4. Arthritis/back/musculoskeletal

3. Obesity

2. Cancer (all kinds)

1. Diabetes

New rule pushes for hospital price transparency

The Centers for Medicare & Medicaid Services is pushing for a new rule that will force hospitals to provide patients with a list of the cost of all their charges. Continue reading to learn more.

The Centers for Medicare & Medicaid Services announced a proposed rule aimed at providing patients with a clear price listing of the cost of their hospital charges. In an effort to fulfill the proposed rule’s objective, CMS suggested an amendment to the requirements previously established by Section 2718(e) of the Affordable Care Act.

CMS issued the final rule (CMS-1694-F), which included the suggested amendment discussed in the April 24, 2018 proposed rule. Currently, under Section 2718(e), hospitals are given the option to either (i) make public a list of the hospital’s standard charges or (ii) implement policies for allowing the public to view a list of the hospital’s standard charges in response to an individual request.

Beginning January 1, 2019, however, hospitals will be required to make available a list of their current standard charges via the Internet in a machine readable format and to update this information at least annually, or more often as appropriate.

This could be in the form of the chargemaster itself of another form of the hospital’s choice, as long as the information is in machine readable format. CMS believes that this update will further promote price transparency by improving public accessibility of hospital charge information.

In the final rule, CMS explains that it is aware of the challenges that continue to exist because the chargemaster data may not accurately reflect what any given individual is likely to pay for a particular service or visit.

Additionally, the comments received in response to the proposed rule argue that the chargemaster data would not be useful to patients because it is confusing as to the amount of the actual out-of-pocket costs imposed on a particular patient.

CMS further explains that it is currently reviewing the concerns addressed in the comments, and is considering ways to further improve the accessibility and usability of the information disclosed by the hospitals.

SOURCE: Goldman, M; Grushkin, J; Fierro, C (16 August 2018) "New rule pushes for hospital price transparency" (Web Blog Post). Retrieved by https://www.employeebenefitadviser.com/opinion/cms-rule-pushes-for-hospital-price-transparency

Reference-based pricing is gaining momentum — here’s why

Healthcare and pharmacy costs are constantly on the rise. In this article, Kern talks about reference-based pricing and explains why it’s gaining momentum.

In my 25 years in the insurance business I’ve seen many changes. But there’s always been one constant: Healthcare and pharmacy costs continue to accelerate and no regulatory action has been able to slow this runaway train. The problem is that we have focused on the wrong end of the spectrum. We don’t have a healthcare issue; we have a billing issue.

At the root of this national crisis is a lack of cost transparency, which is driven by people who are motivated to keep benefit plan sponsors and healthcare consumers in the dark. Part of the problem is that most cost-reduction strategies are developed by independent players in the healthcare food chain. This siloed approach fails to address the entire ecosystem, and that’s why we continue to lament that nothing seems to be working.

But that could change with reference-based pricing, a method that’s slowly gaining momentum.

Here’s how it works.

Reference-based pricing attacks the problem from all angles and targets billing — which is at the heart of the crisis.

Typically, a preferred provider organization network achieves a 50-60% discount on billable charges. However, after this 50-60% discount, the cost of care is still double or triple what Medicare pays for the same service. For example, the same cholesterol blood test can range from $10 to $400 at the same lab. The same hospitalization for chest pain can range anywhere from $3,000 to $25,000.

Reference-based pricing allows employers to pay for medical services based on a percentage of CMS reimbursements (i.e. Medicare + 30%), rather than a percentage discount of billable charges. This model ensures that the above-mentioned hospitalization cost an employer $3,000 rather than $25,000.

“Negotiating” like Medicare

Reference-based pricing is becoming increasingly popular as more organizations consider the move to correct cost transparency issues as they transition from fully-insured to self-funded insurance plans.

One well-known and considerable example is Montana’s state employee health plan. The state employee health plan administrator received a notice from legislators in 2014 urging the state to gain control of healthcare costs. Instead of beginning with hospitals’ prices and negotiating down, they turned to reference-based pricing based on Medicare. Instead of negotiating with hospitals, Medicare sets prices for every procedure, which has allowed it to control costs. Typically, Medicare increases its payments to hospitals by just 1-3% each year.

The state of Montana set a reference price that was a generous 243% of Medicare — which allowed hospitals to provide high-quality healthcare and profit, while providing price transparency and consistency across hospitals. So far, hospitals have agreed to pay the reference price.

Of course, there is still the risk that a healthcare provider working with the state of Montana health plan, or any other health plan using reference-based pricing, could “balance bill” the member. But a fair payment and plenty of employee education about what to do if that happens could help you curb costs.

If balance billing does occur, many solutions include a law and auditing firm to resolve the dispute. In one recent example, a patient was balance billed almost $230,000 for a back procedure after her health plan had paid just under $75,000. An auditing firm found that the total charges should have been around $70,000, and a jury agreed. The hospital was awarded an additional $766.

Reference-based pricing is a forward-thinking way to manage costs while providing high-quality benefits to your employees. It’s one way to improve cost transparency, which may eventually transform the way that we buy healthcare.

Kern, J. (18 July 2018) "Reference-based pricing is gaining momentum — here’s why" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/opinion/reference-based-pricing-health-insurance-gaining-momentum?utm_campaign=intraday-c-Jul%2018%202018&utm_medium=email&utm_source=newsletter&eid=1e52d1873f9d2e8d6bd477da3e7f49a3

Ahead of the Midterms, Voters across Parties See Costs as their Top Health Care Concern

From Kaiser Health News is this poll deciphering where the public sits ahead of Midterms. What is there top healthcare concern? Costs. Get all the information in this article.

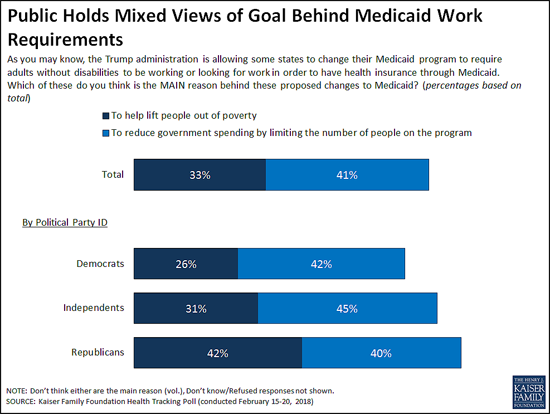

At a time when the Trump Administration is encouraging state efforts to revamp their Medicaid programs through waivers, the latest Kaiser Family Foundation tracking poll finds the public splits on whether the reason behind proposals to impose work requirements on some low-income Medicaid beneficiaries is to lift people out of poverty or to reduce spending.

The Centers for Medicare and Medicaid Services in January provided new guidance to states and has since approved such waivers in two states (Kentucky and Indiana). Eight other states have pending requests

When asked the goal of work requirements, four in 10 (41%) say it is to reduce government spending by limiting the people enrolled in the program, while a third (33%) say it is to lift people out of poverty as proponents say.

While larger shares of Democrats and independents say the reason is to cut costs, Republicans are more divided, with roughly equal shares saying it is to lift people out of poverty (42%) as to reduce government spending (40%). People living in the 10 states that have approved or pending work requirement waivers are similarly divided, with near-equal shares saying the goal is to lift people out of poverty (37%) as to reduce government spending (36%). This holds true even when controlling for other demographic variables including party identification and income.

In addition to work requirements, five states are currently seeking Medicaid waivers to impose lifetime limits on the benefits that non-disabled adults could receive under the Medicaid program. The poll finds the public skeptical of such a shift, with two thirds (66%) saying Medicaid should be available to low-income people as long as they qualify, twice the share (33%) as say it should only provide temporary help for a limited time.

Substantial majorities of Democrats (84%) and independents (64%) say Medicaid should be available without lifetime limits, while Republicans are divided with similar shares favoring time limits (51%) and opposing them (47%).

These views may reflect people’s personal experiences with Medicaid and the generally positive views the public has toward the current program, which provides health coverage and long-term care to tens of millions of low-income adults and children nationally.

Seven in 10 Americans report a personal connection to Medicaid at some point in their lives – either directly through their own health insurance coverage (32%) or their child being covered (9%), or indirectly through a friend or other family member (29%).

Three in four (74%) hold favorable views of Medicaid, including significant majorities of Democrats (83%), independents (74%) and Republicans (65%). About half (52%) of the public say the current Medicaid program is working well for low-income enrollees, while about a third (32%) say it is not working well.

Most Residents of Non-Expansion States Favor Medicaid Expansion to Cover More Low-Income People

Under the Affordable Care Act, most states expanded their Medicaid programs to cover more low-income adults. In the 18 states that have not done so, a majority (56%) say that their state should expand Medicaid to cover more low-income adults, while nearly four in 10 (37%) say their state should keep Medicaid as it is today.

Slightly more than half of Republicans living in the 18 non-expansion states (all of which have either Republican governors, Republican-controlled legislatures or both) say their state should keep Medicaid as it is today (54%) while four in 10 (39%) say their state should expand their Medicaid program.

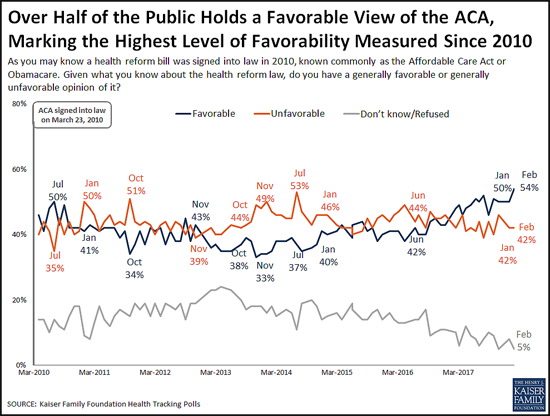

Favorable Views of the ACA Reach New High in More Than 80 KFF Polls

The poll finds 54 percent of the public now holds a favorable view of the Affordable Care Act, the highest share recorded in more than 80 KFF polls since the law’s enactment in 2010. This reflects a slight increase in favorable views since January (50%), while unfavorable views held steady at 42 percent.

The shift toward more positive views comes primarily from independents (55% view the ACA favorably this month, up slightly from 48% in January).

Public Remains Confused about Repeal of the ACA’s Individual Mandate

The poll also probes the public’s awareness about the repeal of the ACA’s requirement that nearly all Americans have health insurance or pay a fine, commonly known as the individual mandate. The tax legislation enacted in December 2017 eliminated this requirement beginning in 2019.

About four in 10 people (41%) are aware that Congress repealed the individual mandate, a slight increase from January, when 36 percent were aware of the provision’s repeal.

However, misunderstandings persist. Most (61%) of the public is either unaware that the requirement has been repealed (40%) or is aware of its repeal but mistakenly believes the requirement will not be in effect during 2018 (21%). Few (13%) are both aware that it has been repealed and that it remains in effect for this year.

Costs are Voters’ Top Health Care Concern ahead of the 2018 Midterm Elections

Looking ahead to this year’s midterm elections, the poll finds Democratic, Republican and independent voters most often cite costs as the health care issue that they most want candidates to address.

When asked to say in their own words what health care issue that they most want candidates to discuss, more than twice as many voters mention health care costs (22%) as any other issue, including repealing or opposing the Affordable Care Act (7%). Costs are the clear top issue for Democrats (16%) and independents (25%), and one of the top issues for Republicans (22%) followed by repealing or opposing the ACA (17%).

Designed and analyzed by public opinion researchers at the Kaiser Family Foundation, the poll was conducted from February 15-20, 2018 among a nationally representative random digit dial telephone sample of 1,193 adults. Interviews were conducted in English and Spanish by landline (422) and cell phone (771). The margin of sampling error is plus or minus 3 percentage points for the full sample. For results based on subgroups, the margin of sampling error may be higher.

Read the article.

Source: Kaiser Family Foundation (1 March 2018). "Poll: Public Mixed on Whether Medicaid Work Requirements Are More to Cut Spending or to Lift People Up; Most Do Not Support Lifetime Limits on Benefits" [Web Poll Post]. Retrieved from address https://www.kff.org/medicaid/press-release/poll-public-mixed-medicaid-work-requirements-more-to-cut-spending-lift-people-up-most-do-not-support-lifetime-limits/

Overcoming Financial Illiteracy

May 9, 2012

Source: Benefitspro.com

We’ve all too often heard these assertions: Insurance is not bought, it’s sold. People don’t plan to fail, they fail to plan. We have a financially illiterate society.

The upshot of these familiar sayings is that in the financial services world, individuals need to be practically forced into understanding even simple concepts. This is an implicit put down of consumers, and in reality, it’s an explicit indictment of us.

We know consumers will go to great lengths to research buying a cell phone, a coffee pot or a microwave oven, but they avoid researching financial products like the plague. Imagine how few consumers spend time researching a critical illness product, a health insurance plan, disability plan or life plan. And yet the coffee pot or cell phone costs a fraction of the amount entrusted to the financial products we sell.

Perhaps it all starts with our desire to be entertained and pampered. Financial products don’t offer instant gratification. In fact, they generally only deliver value in situations that are either boring or disturbing. Who wants to think about disturbing events such as poor health, critical illnesses, disabilities and premature death? And saving money for the future is boring—you have to save for years and years to have enough to live on comfortably.

Additionally, when a television personality or politician happens to address any of these financial items, it seems to be their mission to make the financial services business look bad. Often, they cast us in the light of our failure to provide benefits to everyone—even those who sat in multiple employee meetings and failed to purchase the voluntary benefits that could have replaced the missing income, paid the uncovered bills and so on.

It’s frustrating, but what do we see when we look in the mirror? In the voluntary benefits arena, we have choices of methods to use in the enrollment process: group meetings, one-on-one sessions, computer systems and IVR systems. We pay a lot of attention to choice of enrollment methods.

But one area we haven’t adequately addressed is helping employees understand the risk/reward of the various products. This is especially true when it comes to disability (income protection) insurance.

I have tried using many variations of this theme: How long can you maintain your standard living without a paycheck? For most, the answer is “not long.” This is an essential message. Yet in study after study, when employees are asked to rank benefit products, they consistently rank dental (low risk/low reward) and vision (low risk, low reward) over disability protection (high risk/high reward).

Since most of us also sell dental and vision coverage, we’re understandably hesitant to challenge employees to understand this risk/reward relationship. But is this hesitancy in the best interest of our clients? Shouldn’t we point out that you can skip dental coverage and still pay your bills, including the dentist, but if you decline disability coverage you can’t pay your bills at all—at least not for long.

Overcoming illiteracy requires engaging employees in understanding the risks and rewards of various benefit plan options. As in the dental/disability example above, it needs to go beyond “here’s a product to consider” into better understanding—and less illiteracy.