Steer Clear of Misconceptions About FFCRA Tax Credits

As employers learn about the paid-leave requirements under the Families First Coronavirus Response Act (FFCRA) and corresponding tax credits, misconceptions have arisen related to such details as when to claim the credits and which employers are eligible to claim them.

The FFCRA requires employers with fewer than 500 employees to provide up to 80 hours of emergency paid sick leave and up to 12 weeks—10 of which are paid—of Emergency Family and Medical Leave Expansion Act time off to employees who can't work for specific reasons relating to the COVID-19 pandemic. "Under the FFCRA, the federal government will reimburse employers for the cost of this leave by way of refundable tax credits," said Jim Paretti, an attorney with Littler's Workplace Policy Institute in Washington, D.C.

Eligible employers can claim refundable tax credits under the FFCRA for all or part of the cost of providing qualified paid-sick or family leave taken from April 1 through Dec. 31, noted Dasha Brockmeyer, an attorney with Saul Ewing Arnstein & Lehr in Pittsburgh.

When to File

Some employers believe they must wait until the end of the quarter or end of the year to claim the credits, said Asel Lindsey, an attorney with Dykema in San Antonio.

Eligible employers claim the FFCRA tax credit by retaining payroll taxes—federal income taxes and Social Security and Medicare taxes—that would otherwise be deposited with the IRS, she said. If the retained payroll taxes are insufficient to cover the full amount of the tax credit, employers can file a request with the IRS on Form 7200 for an accelerated payment. Form 7200 can be filed before the end of the month following the calendar quarter in which the qualified sick- or family-leave payments were made.

Nonetheless, the form may not be filed later than the date on which the employer files the Form 941 for the fourth quarter of 2020, which generally is due Jan. 31, 2021, she said.

"If an eligible employer receives tax credits for qualified leave wages, those wages will not be eligible as payroll costs for purposes of receiving loan forgiveness under the CARES [Coronavirus Aid, Relief, and Economic Security] Act," said Carrie Hoffman, an attorney with Foley & Lardner in Dallas.

Additional common misconceptions concern the eligibility for or availability of the FFCRA paid-leave tax credits, according to Robert Delgado, KPMG's principal-in-charge of tax compensation and benefits in San Diego, and Katherine Breaks, KPMG's tax principal in Washington, D.C. They include these incorrect assumptions:

- The group aggregation rules for determining whether an employer is eligible for the paid-leave tax credits under the FFCRA are the same for determining employer eligibility for other COVID-19-related relief, such as the employee retention credit under the CARES Act. While some employers assume that the group aggregation rules used to determine eligibility for the paid-leave tax credits are driven by tax rules, they actually are defined by the labor rules and outlined in U.S. Department of Labor guidance, as the tax credit is secondary to the requirement to provide paid leave. Under these rules, a corporation is typically considered to be a single employer but must be aggregated with another corporation if considered joint employers under the Fair Labor Standards Act rules with respect to certain employees or if they meet the integrated employer test under the Family and Medical Leave Act (FMLA).

- Employers must choose between claiming tax credits for paid leave under the FFCRA or for wages paid to employees under the employee retention credit, but they may not claim both. In fact, eligible employers may receive tax credits available under the FFCRA for required paid leave, as well as the employee retention credit, but not for the same wage payments. Similarly, employers can provide both qualified sick-leave wages and qualified family-leave wages and claim a tax credit for both, but not for the same hours. Employers may not receive a double benefit by claiming a tax credit under Section 45S taking into account the same qualified leave wages.

Other Myths

Delgado and Breaks stated that other misconceptions include the following:

- The tax credit is limited to the qualified wages an employer must pay to an employee under the FFCRA for emergency paid sick leave and expanded FMLA. In fact, the tax credit is generally equal to 100 percent of the qualified wages an employer must pay under the FFCRA for emergency paid sick leave and expanded FMLA increased by the employer's share of Medicare owed on the wages, as well as any qualified health plan expenses.

- An employer may not receive tax credits for FFCRA-required paid leave if it receives a Small Business Administration Paycheck Protection Program loan. Actually, an employer may receive tax credits for paid leave under the FFCRA, as well as a Small Business Administration Paycheck Protection Program loan, but the qualified wages are not eligible as payroll costs for the purposes of loan forgiveness.

- Employers can exclude the amount of the paid-leave tax credit from gross income. In fact, employers must include the full amount of the credits in gross income—that is, qualified leave wages plus any allocable qualified health plan expenses and the employer's share of the Medicare tax on the qualified leave wages. But employers may deduct the amount paid for emergency paid sick leave and expanded FMLA as an ordinary and necessary business expense in the taxable year paid or incurred, including wages for which they expect to take a tax credit.

"If an employer fails to claim a paid-leave tax credit on their Form 941 for the applicable quarter in which the leave wages are paid, the employer can submit a Form 941-X to reflect the corrections, including eligibility for the credit," Delgado and Breaks also noted.

SOURCE: Smith, A. (13 November 2020) "Steer Clear of Misconceptions About FFCRA Tax Credits" (Web Blog Post). Retrieved from https://www.shrm.org/resourcesandtools/legal-and-compliance/employment-law/pages/coronavirus-misconceptions-ffcra-tax-credits.aspx

Justices Seem Unlikely to Strike Down Entire Affordable Care Act

The U.S. Supreme Court appears hesitant to invalidate the Affordable Care Act (ACA) in its entirety, based on questions the justices posed during oral argument Nov. 10.

The ACA requires that most Americans either maintain a minimum level of health care coverage or pay a specified amount to the Internal Revenue Service. In a 2012 opinion written by Chief Justice John Roberts Jr., the Supreme Court upheld this mandate as a legitimate exercise of Congress' taxing power. In 2017, and effective in 2019, Congress amended the ACA to set the penalty to zero, making the individual mandate provision unenforceable.

In two consolidated cases, California v. Texas and Texas v. United States, the Supreme Court has been asked to decide whether reducing the penalty to zero rendered the minimum-coverage provision unconstitutional—and, if so, whether the rest of the ACA can remain enforceable without it.

"The justices seem to be leaning toward, at a minimum, finding the individual mandate severable and preserving the remainder of the law," observed Benjamin Conley, an attorney with Seyfarth Shaw in Chicago. The most notable takeaway from the arguments, he said, was that Roberts and Justice Brett Kavanaugh "all but stated that they believe the individual mandate is severable."

Questions Before the Court

The court will first consider whether the plaintiffs have standing to challenge the ACA, then it will move to the merits of the case. Texas and other states that challenged the ACA argued that "Congress may not use its power to regulate interstate commerce to order Americans to buy health insurance" and that the only reason the individual mandate survived a legal challenge was because it was "fairly possible" to read the ACA's mandate as a tax trigger. "Because the mandate raises no revenue, it can no longer be read as a tax," they wrote in a brief to the Supreme Court.

The U.S. House of Representatives and a group of Democrat-led states are fighting to keep the ACA intact. If Texas successfully challenges the ACA, "more than 20 million Americans could lose their health care coverage, 130 million Americans with pre-existing conditions could lose protections, and drug costs could skyrocket for seniors," House Speaker Nancy Pelosi tweeted Nov. 10.

In December 2019, the 5th U.S. Circuit Court of Appeals sided with Texas, holding that the mandate is unconstitutional since there is no longer a penalty for people who fail to buy health insurance.

But the Supreme Court justices raised doubts about that argument. "I think it's hard for you to argue that Congress intended the entire act to fall if the mandate were struck down when the same Congress that lowered the penalty to zero did not even try to repeal the rest of the act," Roberts said during oral argument. "I think, frankly, that they wanted the court to do that. But that's not our job."

Justice Amy Coney Barrett, the court's newest justice and sixth conservative on the bench, has previously raised concerns with the Supreme Court's 2012 ruling. "Justice Barrett has criticized Justice Roberts' decision to uphold the ACA," said Sage Fattahian, an attorney with Morgan Lewis in Chicago. "The general view is that her vote may be the deciding vote in invalidating the ACA, but all of that remains to be seen."

Seyfarth Shaw's Conley noted that votes from Roberts and Kavanaugh, plus the three liberal justices—Justices Stephen Breyer, Elena Kagan and Sonia Sotomayor—would be enough to preserve the remainder of the law.

"The most interesting questions and comments, for me, came from Justice Kavanaugh," Fattahian observed. At oral argument, Kavanaugh said he thinks there is "a very straightforward case for severability" under Supreme Court precedent.

"Chief Justice Roberts also asked questions that seemed to indicate that the proper remedy in this case would be to sever the individual mandate from the rest of the ACA," Fattahian said. "This would mean that the ACA's plan mandates and employer mandate, along with ACA reporting requirements, would all remain intact."

Employer Takeaway

So what will a ruling in the case mean for employers? "While a ruling striking down the entire law could definitely have an impact in the long term, we don't think any short-term action is required," Conley said.

Even if, for instance, the Supreme Court invalidates the provision of the law allowing dependents to remain on their family's plans until age 26, an employer could certainly continue to offer such coverage even if it is no longer required. "So any plan-driven changes resulting from the ruling would be more incremental and long term," Conley added.

A decision in the case is not expected until June 2021. "In the meantime, employers should note that the health care law remains fully in effect during the litigation, including all coverage obligations and reporting requirements," said Chatrane Birbal, vice president of public policy for the Society for Human Resource Management. If there are changes to the health care law, employers should be aware that the changes will not take effect immediately, she noted.

Fattahian said, "Employers should continue down the path of compliance. Should the ACA be held to be unconstitutional, it will remain to be seen how it will all unwind and what, if anything, will take its place."

Labor Department Is Now Enforcing Coronavirus Paid-Leave Rules

As the U.S. Department of Labor gave employers sufficient time to comply with paid-leave through the Families First Coronavirus Response Act, many businesses can provide paid-sick-leave for employees if it is needed. Read this blog post to learn more.

The U.S. Department of Labor (DOL) initially gave employers time to comply with coronavirus-related paid-sick-leave and paid-family-leave mandates and correct mistakes without facing scrutiny, but the department has officially ramped up its enforcement efforts.

Under the Families First Coronavirus Response Act (FFCRA), many businesses with fewer than 500 employees must provide up to 80 hours of paid-sick-leave benefits if employees need leave to comply with a self-quarantine order or care for their own or someone else's coronavirus-related issues. The act also provides emergency paid family leave for parents who can't work because their children's schools or child care services are closed due to the pandemic.

The FFCRA's paid-leave provisions took effect April 1 and expire on Dec. 31. The DOL announced on April 20 that the nonenforcement period had officially ended, and the department issued its first enforcement order shortly thereafter. An electrical company based in Tucson, Ariz., was ordered to compensate an employee who was denied paid sick leave after he showed coronavirus symptoms and was told by a doctor to self-quarantine. The employer was ordered to pay the worker $1,600, which covered his full wages ($20 an hour) for 80 hours of leave.

"This case should serve as a signal to others that the U.S. Department of Labor is working to protect employee rights during the coronavirus pandemic," said Wage and Hour District Director Eric Murray in Phoenix. "We encourage employers and employees to call us for assistance to improve their understanding of new labor standards under the [FFCRA] and use our educational online tools to avoid violations like those found in this investigation."

We've rounded up articles and resources from SHRM Online on the FFCRA.

Paid-Sick-Leave Details

Under the FFCRA, covered employers will have to provide up to 80 hours of paid-sick-leave benefits if an employee:

- Has been ordered by the government to quarantine or isolate because of COVID-19.

- Has been advised by a health care provider to self-quarantine because of COVID-19.

- Has symptoms of COVID-19 and is seeking a medical diagnosis.

- Is caring for someone who is subject to a government quarantine or isolation order or has been advised by a health care provider to quarantine or self-isolate.

- Needs to care for a son or daughter whose school or child care service is closed due to COVID-19 precautions. (This leave can be combined with emergency paid family leave.)

- Is experiencing substantially similar conditions as specified by the secretary of health and human services, in consultation with the secretaries of labor and treasury.

Paid sick leave must be paid at the employee's regular rate of pay, or minimum wage, whichever is greater, for leave taken for reasons 1-3 above. Employees taking leave for reasons 4-6 may be compensated at two-thirds their regular rate of pay, or minimum wage, whichever is greater. Part-time employees are eligible to take the number of hours they would normally work during a two-week period. Under the legislation, paid sick leave is limited to $511 a day (and $5,110 total) for a worker's own care and $200 a day (and $2,000 total) when the employee is caring for someone else.

Family Leave and Sick Leave Work Together

The Emergency Family and Medical Leave Expansion Act (EFMLEA), which is part of the FFCRA, provides paid leave to parents who can't work because their children's schools or child care services are closed due to the pandemic. An employee may take paid sick leave for the first 10 days of leave or substitute any accrued vacation, personal leave or sick leave under an employer's policy. For the following 10 weeks, the individual will be paid at an amount no less than two-thirds of the regular rate of pay for normally scheduled hours. The individual will not receive more than $200 per day or $12,000 for 12 weeks that include paid sick leave and EFMLEA leave, the DOL stated. As of April 1, workers who have been on the payroll for at least 30 calendar days are eligible for paid family leave benefits.

More Guidance

Many employers and workers have been confused about how to apply the law or access its benefits, so the DOL has been regularly releasing compliance information and updating its Q&A document. In addition to temporary regulations, the DOL released a fact sheet for employees and a fact sheet for employers. The department also provided model workplace posters for nonfederal employers and federal employers that are covered by the mandate. The DOL will continue to add resources to its website, so employers should keep checking for updates. "Please continue to use our website as a primary source of information," said DOL Wage and Hour Division Administrator Cheryl Stanton.

Answers to the Most Common Coronavirus Questions

Would an employee who is afraid of coming to work and contracting COVID-19 be eligible for paid sick leave? Are nonprofit organizations required to comply with the FFCRA? How do the new requirements interact with collective bargaining agreements? Here are some answers to FFCRA and other common coronavirus questions.

SOURCE: SHRM. (28 April 2020) "Labor Department Is Now Enforcing Coronavirus Paid-Leave Rules" (Web Blog Post). Retrieved from https://www.shrm.org/ResourcesAndTools/legal-and-compliance/employment-law/Pages/Labor-Department-Is-Now-Enforcing-Coronavirus-Paid-Leave-Rules.aspx

What to Do When Scared Workers Don’t Report to Work Due to COVID-19

Throughout the globe, many are terrified of contracting the communicable disease, the coronavirus. With this being said, many essential workers are refusing to go to work with that fear in their minds. Read this blog post from SHRM to learn more.

Some essential workers are refusing to come to work out of fear of contracting the coronavirus. Their employers must weigh the employees' legal rights and understandable health concerns with the organizations' business needs. It can be a tough balancing act.

"A good first step for an employer to respond to an essential worker who's expressing fears of returning to work is to actively listen to the employee and have a conversation," said Brian McGinnis, an attorney with Fox Rothschild in Philadelphia. "What are their specific concerns? Are they reasonable?"

McGinnis said that employers should consider whether it already has addressed those concerns or if additional steps are needed. Often, having a conversation with the employee "will avoid an unneeded escalation," he said.

Employees' Legal Rights

What if that doesn't work? Tread cautiously, as employees have many legal protections.

An employer usually can discipline workers for violating its attendance policy. But there are exceptions to that rule, noted Robin Samuel, an attorney with Baker McKenzie in Los Angeles. Putting hesitant employees on leave may be a better choice than firing them.

Christine Snyder, an attorney with Tucker Ellis in Cleveland, cautioned, "If an employer permits employees to use vacation or PTO [paid time off] for leave, it may soon find itself without a workforce sufficient to maintain operations. Therefore, an employer may want to rely upon the terms of its existing time-off policy, which typically requires approval to use vacation or PTO, to require that leave for this reason be unpaid."

OSH Act

Employees can refuse to work if they reasonably believe they are in imminent danger, according to the Occupational Safety and Health (OSH) Act. They must have a reasonable belief that there is a threat of death or serious physical harm likely to occur immediately or within a short period for this protection to apply.

Samuel explained that an employee can refuse to come to work if:

- The employee has a specific fear of infection that is based on fact—not just a generalized fear of contracting COVID-19 infection in the workplace.

- The employer cannot address the employee's specific fear in a manner designed to ensure a safe working environment.

NLRA

The National Labor Relations Act (NLRA) grants employees at unionized and nonunionized employers the right to join together to engage in protected concerted activity. Employees who assert such rights, including by joining together to refuse to work in unsafe conditions, are generally protected from discipline, Samuel noted.

"That said, the refusal must be reasonable and based on a good-faith belief that working conditions are unsafe," said Bret Cohen, an attorney with Nelson Mullins in Boston.

ADA

Employers should accommodate employees who request altered worksite arrangements, remote work or time off from work due to underlying medical conditions that may put them at greater risk from COVID-19, Samuel said.

The EEOC's guidance on COVID-19 and the Americans with Disabilities Act (ADA) notes that accommodations may include changes to the work environment to reduce contact with others, such as using Plexiglas separators or other barriers between workstations.

The Age Discrimination in Employment Act, unlike the ADA, does not have a reasonable-accommodation requirement, pointed out Isaac Mamaysky, an attorney with Potomac Law Group in New York City. Nonetheless, he "would encourage employers to be flexible in response to leave requests from vulnerable employees," such as older essential workers, as the right thing to do and to bolster employee relations.

FFCRA

If a health care provider advises an employee to self-quarantine because the employee is particularly vulnerable to COVID-19, the employee may be eligible for paid sick leave under the Families First Coronavirus Response Act (FFCRA), Cohen noted. The FFCRA applies to employers with fewer than 500 employees, and the quarantine must prevent the employee from working or teleworking.

FFCRA regulations permit employers to require documentation for paid sick leave, noted John Hargrove, an attorney with Bradley in Birmingham, Ala.

Employers may relax documentation requirements due to the difficulty some employees could have obtaining access to medical providers during the pandemic and to encourage ill employees to stay away from work, said Pankit Doshi, an attorney with McDermott Will & Emery in San Francisco.

Hazard Pay

Although not currently mandated by federal law, hazard pay—extra pay for doing dangerous work—might be appropriate for an employer to offer to essential workers, McGinnis said.

If hazard pay is offered, similarly situated employees should be treated the same, he said. Otherwise, the employer risks facing a discrimination claim.

Andrew Turnbull, an attorney with Morrison & Foerster in McLean, Va., noted that companies with multistate operations may have legitimate reasons for offering hazard pay to employees working at locations with a high risk of exposure and not where the risk is minimal.

Hazard pay might be a good choice for public-facing jobs, where employees may not be able to observe social distancing, said Román Hernández, an attorney with Troutman Sanders in Portland, Ore.

Some localities require hazard pay in some circumstances, Doshi noted. These localities include Augusta, Ga., Birmingham, Ala., and Kanawha County, W.Va.

Inform and Protect Workers

Lindsay Ryan, an attorney with Polsinelli in Los Angeles, said that employers should keep employees apprised of all measures the employer is taking to maintain a safe workplace, consistent with guidance from the U.S. Centers for Disease Control and Prevention (CDC), the Occupational Safety and Health Administration, and local health authorities.

If employers have the means to do so, they should screen employees each day by taking their temperatures and send workers who have fevers home, Snyder said. Alternatively, employers can require employees to take their own temperatures before reporting to work, she added.

"Finally, in light of recent CDC guidance regarding the use of cloth masks to prevent infection, employers should allow employees to wear masks in the workplace and consider providing employees with cloth masks if they are able to acquire them," she said.

What Happens When Employers Violate Shelter-in-Place Orders?

During the coronavirus pandemic, many states are allowing only essential businesses to stay open to the public, while other businesses are on a shelter-in-place order. Read this blog post to learn more.

In many states, only essential businesses can stay open to the public and only critical staff can remain at the worksite during the coronavirus pandemic. So what happens when employers ignore the rules? In some jurisdictions, employers can face civil or criminal penalties.

Officials in some states, including California, Georgia and New York, are asking people to report businesses that are violating shelter-in-place orders.

"Each and every one of us is called to work together and cooperate with emergency responders and public officials who are working hard to keep all New Yorkers safe," said New York Attorney General Letitia James.

We've rounded up articles and resources from SHRM Online and other trusted media outlets on shelter-in-place orders.

What Is an Essential Business?

To help combat the spread of COVID-19, the respiratory disease caused by the coronavirus, many state and local governments are issuing stay-at-home or shelter-in-place orders that only permit "essential" businesses to remain open. The distinction between "essential" and "nonessential" businesses isn't the same in each location, so employers need to review the specific orders that apply to their operations. Generally, essential businesses include health care, first responders, food production and delivery, medical supply, public utilities, communications and information technology, grocery stores, and gas stations. Nonessential businesses typically must allow employees to work remotely, close for a period of time or reduce their operations to certain activities that are necessary to preserve the business.

State and Local Coronavirus Decrees Raise Questions

Gray areas in state orders call for careful introspection and decision-making by businesses. Should they find a way to stay open to pay workers and maintain customers, or close for a less tangible public good—helping to prevent the spread of COVID-19? "Those are extremely difficult decisions to make and not the sort of thing most HR professionals were having to deal with five months ago," said Jackie Ford, a partner at Vorys, a labor and employment law firm in Houston, which issued its own citywide shelter-in-place rules on March 24. "It's a whole new skill set."

Civil and Criminal Penalties May Apply

Employers must follow shelter-in-place orders or they could face civil or criminal penalties. In Michigan, for example, violating the state's order is a criminal misdemeanor and businesses that don't comply can be fined and possibly shut down.

States with Shelter-in-Place Orders

Many state and local governments are implementing strict measures, but the duration of the orders vary. For instance, Alabama's order is in place until April 30, Virginia's expires June 10 and California's is effective until further notice. Here's a chart that shows which states have ordered nonessential businesses to close and where public officials have encouraged or mandated residents to stay at home.

Michigan Extends Retaliation Protections Amid COVID-19 Outbreak

Some states are also addressing coronavirus-related issues in their antiretaliation rules. For instance, on April 3, Michigan Gov. Gretchen Whitmer issued an executive order prohibiting employers from discharging, disciplining or otherwise retaliating against an employee for staying home from work because the employee tests positive for COVID-19, displays principal symptoms of COVID-19, or has had close contact with an individual who has tested positive or has symptoms.

Showing Compassion May Minimize Risk of Employee Claims

Care, show compassion, connect, communicate and be flexible—these are COVID-19's HR lessons. Johnny C. Taylor, Jr., SHRM-SCP, president and CEO of SHRM, summed things up as follows: "Every workplace operates under a set of guiding principles, whether overtly expressed or more subtly embedded in the culture. This is the moment to examine the principles that define you as an employer and a corporate citizen, and ensure they are ones you want to uphold and are prepared to live. Employees will rest easier knowing that you are operating under a strong value system that doesn't waver in good times or bad."

SOURCE: Nagele-Piazza, L. (13 April 2020 "What Happens When Employers Violate Shelter-in-Place Orders?" (Web Blog Post). Retrieved from https://www.shrm.org/resourcesandtools/legal-and-compliance/state-and-local-updates/pages/when-employers-violate-shelter-in-place-orders.aspx

Remote Work Policies Should Now Stress Flexibility

While employers are in the midst of distributing guidelines for employees working remotely, it's important for management to also outline policies and procedures for working remotely. Read this blog post to learn more.

Organizations are implementing remote-work arrangements for their employees due to the COVID-19 coronavirus outbreak—many for the first time—and need to be able to outline expectations and guidelines for working outside the office.

Generally, remote-work policies cover eligibility, working expectations, legal considerations and technology issues, but, during these extraordinary circumstances, flexibility is paramount.

We're undergoing one of the biggest changes in history in how people work, said Brian Kropp, chief of research in the HR practice at Gartner, a research and advisory firm in Arlington, Va. "We have a set of people who have never worked from home who are now doing it full time. We also have a set of managers who have never managed people working from home. Under these circumstances, the policies shouldn't be thought of as managing productivity, but more a set of guidelines and norms for people managing and working in a brand-new way."

Kropp said that employers should design their remote-work policies around outcomes, not workflows and processes. "The idea is that employees are expected to accomplish their goals, but how they do it and when they do it is flexible."

Just applying a traditional telecommuting policy to all workers during this unprecedented situation will lead to problems, Kropp said. "Look at your current policy and see what makes sense in this situation, and, if you're not sure, lean toward flexibility and trust as opposed to measuring and monitoring your employees. If employees are not given flexibility, it will be harder for them in their personal lives and they will feel that they are not trusted, which will come back to bite the organization when we come out of this."

Gregory Abrams, an attorney in the Chicago office of Faegre Drinker, said that being flexible with remote workers right now is not only good management practice but necessary, considering the quickly changing legal landscape.

"Clear policies are always advisable, but employers must be ready to adjust quickly as circumstances change," he said, noting that new Department of Labor guidelines could affect remote work. "Policies should clarify that expectations are subject to change quickly and unexpectedly given the current climate."

With flexibility as a guide, there are certain core elements of working from home that should be addressed in a written policy.

Define Eligibility and Duration

First, companies should define whom the policy covers and when it applies, as some workers may still be required to be at the worksite and others may not be able to work remotely. Employers may want to clarify whether the policy is only in effect during the coronavirus-related shutdown.

Kropp advised employers not to promise a definitive date to return to the office or termination of the telework policy due to general uncertainty about the duration of COVID-19.

A remote-work policy should include a clause that it may be discontinued at will and at any time.

Working Expectations

Experts agreed that evaluation of remote workers' performance should focus on work output and completion of objectives rather than on time-based performance.

"There are managers that think their employees are sitting at home watching TV all day instead of in front of their laptop working," Kropp said. "The mistake that these managers make is that they are confusing a remote-work policy with a performance management problem. The same employee who sits in front of the TV all day instead of working was probably already not working to his full potential in the office. That employee is not engaged, or the manager is not effectively providing direction."

An appropriate level of communication between employees and their managers should be spelled out in the policy, including expectations of availability, responsiveness and what modes of communication are to be used.

"When you're not meeting with team members in person, creating processes for collaboration and communication are key," said Rebecca Corliss, vice president of marketing for Owl Labs, a Boston-based telecommunications company. "Consider what types of communication tools work best in situations like manager one-on-ones, team all-hands meetings or employee learning and development activities."

Kropp said that, traditionally, there has been an expectation that video calls and meetings from home would be professional and "office-like." Companies are realizing that can be difficult with what's going on now, he added. "A lot of workers are parents with kids at home or taking care of an older parent. A kid will show up crying during one of your WebEx calls. It's going to happen, so companies are relaxing the constraints around what 'professional' and 'office-like' means. Obviously, you can't walk around in your underwear during a video call, but 'appropriate' rather than 'office-like' is a better way to show understanding of the struggles everyone is experiencing."

Legal Issues to Grant

Remote workers are entitled to the same legal protections that in-office workers have, Corliss said. "Working remotely can present some added challenges that need to be addressed to ensure your company is legally compliant," she noted.

One of the most obvious compliance areas to address with remote employees is recording the hours of workers not exempt from the overtime requirements of the Fair Labor Standards Act (FLSA).

Employers must ensure that hourly employees know "the number of hours they are expected to work, what they should do if they need to work outside of scheduled work hours, how to report time, and how to communicate about unanticipated overtime," Abrams said. "There are legions of cases where nonexempt employees allege that they worked off the clock while at home, and you can see a similar scenario playing out during this crisis."

The policy should be clear that all nonexempt telecommuting employees are required to accurately record all hours worked using the employer's time-keeping system. Hours worked in excess of those scheduled per day and per workweek should require the advance approval of a supervisor. But even if employees are instructed not to work more than 40 hours a week, they still must be paid overtime if they do.

"Set up a process to report hours for hourly remote workers," Corliss said. "To avoid high overtime costs, select times that employees should and shouldn't be working. With clear guidelines, they won't be able to work outside of these hours unless they have permission from their manager. This makes it easier to avoid employees accidentally working more hours than intended."

Abrams added that states have various laws about meal breaks, rest breaks, and how many consecutive hours one can work, and remote work policies need to be mindful of those as well. There could also be Americans with Disabilities Act issues, he said, if accommodations need to be made for remote workers.

Employers are also responsible for remote workers' health and safety. Some companies prefer or require an employee's remote work environment to be approved prior to working remotely.

Injuries sustained by an employee in a home office location and in conjunction with his or her regular work duties are normally covered by a company's workers' compensation policy. Remote employees are responsible for notifying the employer of such injuries as soon as possible.

Technology and Supplies

Remote workers need the right tools to complete their work. Employers need to be clear about what equipment and resources they will provide, whether laptops and videoconferencing tools or payments for office supplies, phone calls, shipping and home-office modifications.

Who pays for home technology is up to the company, but a policy should set expectations to make sure everyone is on the same page, Kropp said. "Both employees and employers must agree on what each is expected to deliver. For example, some companies will pay for high-quality home Wi-Fi, and others are expecting that the worker already have it at home."

For many employees, a laptop and a Wi-Fi connection might not be enough, Corliss said. "You'll also need policies and tools in place for remote team collaboration and communication, like live chat, synchronous screencast recording, live video conferencing and more to ensure technology doesn't get in the way of an effective and meaningful work relationship. Slack and Google Hangouts can act as a virtual water cooler, where employees can discuss the status of a project but also debrief on TV shows, share GIFs and bond over their favorite music."

Companies also should specify the level of tech support they will offer to remote workers and outline what remote employees should do when having technical difficulties.

Employers need to pay extra attention to securing the technology their remote workforce is using. The COVID-19 pandemic is providing plenty of new opportunities for cybercriminals to exploit unsecured technology systems, overworked information technology (IT) staff and panicked employees who are new to working from home.

"In the course of developing communications to employees, examine existing policies closely, such as confidentiality, information security, business continuity, BYOD," said Joseph Lazzarotti, an attorney in the Morristown, N.J., office of Jackson Lewis. "If companies have specific requests, for example if they don't want employees working on public Wi-Fi, then that should be stated in the policy."

SOURCE: Maurer, R. (02 April 2020) "Remote Work Policies Should Now Stress Flexibility" (Web Blog Post). Retrieved from https://www.shrm.org/hr-today/news/hr-news/Pages/Remote-Work-Policies-Should-Now-Stress-Flexibility.aspx

Trump Signs Coronavirus Relief Bill with Paid-Leave Mandate

As the COVID-19 pandemic cases increase, employees are stuck choosing between staying home to avoid spreading the illness and working for a paycheck to pay their household bills. Due to the effect that the spread of coronavirus has created, the U.S. Senate has approved the Families First Coronavirus Response Act. Continue reading this blog post from SHRM to learn more.

The U.S. Senate approved the Families First Coronavirus Response Act in a 90-8 vote on March 18, and President Donald Trump signed it into law a few hours later. The bill will provide free screening, paid leave and enhanced unemployment insurance benefits for people affected by COVID-19, the respiratory disease caused by the coronavirus.

The U.S. House of Representatives passed the bill late on March 13. After several days of negotiation, House Speaker Rep. Nancy Pelosi, D-Calif., announced that negotiators had reached a deal with the White House to pass the bill. "We cannot slow the coronavirus outbreak when workers are stuck with the terrible choice between staying home to avoid spreading illness and the paycheck their family can't afford to lose," Pelosi said.

Republican senators were concerned that the bill might hurt small businesses, and Sen. Mitch McConnell, R-Ky., said lawmakers are working on another bill that would include relief for small businesses. McConnell said he would not adjourn the Senate until the third COVID-19 economic stimulus package is passed, CNN reported.

Trump declared a national emergency March 13, which frees up billions of dollars to fund public health and removes restrictions on hospitals to treat more patients. The Families First Coronavirus Response Act (H.R. 6201) will provide:

- Free coronavirus testing.

- Paid emergency leave.

- Enhanced unemployment insurance.

- Additional funding for nutritional programs.

- Protections for health care workers and employees responsible for cleaning at-risk places.

- Additional federal funds for Medicaid.

We've rounded up articles and resources from SHRM Online and other trusted media outlets on the news.

Paid Family Leave

As originally drafted, H.R. 6201 would have temporarily provided workers with two-thirds of their wages for up to 12 weeks of qualifying family and medical leave for a broad range of COVID-19-related reasons. The revised version of the bill will only provide such leave when employees can't work because their minor child's school or child care service is closed due to a public health emergency. Workers who have been on the payroll for at least 30 calendar days will be eligible for paid family leave benefits, which will be capped at $200 a day (or $10,000 total) and expire at the end of the year.

(Littler)

Paid Sick Leave

Under the bill, many employers will have to provide 80 hours of paid-sick-leave benefits for several reasons, including if the employee has been ordered by the government to quarantine or isolate or has been advised by a health care provider to self-quarantine because of COVID-19. Employees could also use paid sick leave when they have symptoms of COVID-19 and are seeking a medical diagnosis, if they are caring for someone who is in quarantine or isolation, or their child's school or child care service is closed because of the public health emergency. Paid-sick-leave benefits will be immediately available when the law takes effect and capped at $511 a day for a worker's own care and $200 a day when the employee is caring for someone else. This benefit will also expire at the end of 2020.

(CNN)

Large and Small Business Exceptions

Private businesses with at least 500 employees are not covered by the bill. "I don't support U.S. taxpayer money subsidizing corporations to provide benefits to workers that they should already be providing," Pelosi said on Twitter. Treasury Secretary Steven Mnuchin also said that "big companies can afford these things."

Covered employers that are required to offer emergency FMLA or paid sick leave will be eligible for refundable tax credits. Employers with fewer than 50 workers can apply for an exemption from providing paid family and medical leave and paid sick leave if it "would jeopardize the viability of the business." Gig-workers and other self-employed workers will be eligible for a tax credit to cover the benefits.

Lawmakers Previously Approved $8.3 Billion Emergency Bill

Another emergency spending package to fight coronavirus rapidly worked its way through Congress, and President Donald Trump signed it into law March 6. The measure will provide funds to develop a vaccine, provide protective and laboratory equipment to workers who need it, and aid locations hit with the virus.

Coronavirus Prompts Employers to Review Sick Leave Policies

Do employees have the right to take time off if they are concerned about contracting coronavirus? Can employers send sick workers home? Should employees be paid for missed work time? HR and other business leaders are likely considering these questions and more as COVID-19 makes its way through the United States. "We believe employers would be wise to review their paid-time-off practices immediately," said Francis Alvarez, an attorney with Jackson Lewis in White Plains, N.Y. "Employers are likely to face unique circumstances that were not anticipated when they prepared their attendance and leave policies."

Visit SHRM's resource page on coronavirus and COVID-19.

SOURCE: Nagele-Piazza, L. (18 March 2020) "Trump Signs Coronavirus Relief Bill with Paid-Leave Mandate" (Web Blog Post). Retrieved from https://www.shrm.org/ResourcesAndTools/legal-and-compliance/employment-law/Pages/Senate-to-Vote-Soon-on-Coronavirus-Paid-Leave-Mandate.aspx

4 Sick-Leave Practices to Avoid During the Coronavirus Pandemic

While the spread of the coronavirus continuously increases, employees are urged to stay at home if they feel any symptoms that could be related to the virus. As employers begin to risk lost productivity due to sick leave, they may be tempted to adopt inflexible standards. Continue reading this blog post from SHRM to learn more.

Government officials are urging sick workers to stay home and employers to have flexible leave policies during the coronavirus pandemic. Don't let business pressures and reliance on past practices lead you to make bad decisions about attendance and leave policies during the public health emergency. Here are four mistakes employment law attorneys said businesses should avoid.

1. Being Inflexible

Many employers are understandably worried about the business impact of COVID-19, the respiratory disease caused by the coronavirus. They might be tempted to adopt inflexible sick time or general attendance policies to keep people coming to the workplace in an effort to maximize productivity, said Marissa Mastroianni, an attorney with Cole Schotz in Hackensack, N.J. "But it's a mistake to adopt an inflexible policy that would pressure a sick worker to come to the office," she noted.

Under Occupational Safety and Health Administration (OSHA) rules, employers have a duty to protect employees against known hazards in the workplace. "If one does not already exist, develop an infectious disease preparedness and response plan that can help guide protective actions against COVID-19," OSHA said in its Guidance on Preparing Workplaces for COVID-19.

The guidance noted that workers might be absent because they are sick or caring for sick family members, need to care for children whose schools or day care centers are closed, have at-risk people at home, or are afraid to come to work because they think they'll be exposed to the virus.

"Don't make employees feel pressured to come in when they shouldn't," Mastroianni said. If employees feel sick or think they have been exposed, they should be told to stay home. "We don't want to wait until someone is actually diagnosed."

Under OSHA rules, employees who reasonably believe they are in imminent danger can't be fired for refusing to come to the worksite. But what if an employee just doesn't feel comfortable reporting to work?

"Be more flexible with existing policies," said Susan Kline, an attorney with Faegre Drinker in Indianapolis. Employers should also consider providing additional sick time for instances of actual illness. If someone can't work from home, decide if offering paid time off is possible.

Some employees may take advantage of a flexible leave policy, Mastroianni said, but the employer's potential for liability is significant if employees are required to report to the workplace when they should stay home.

The analysis could be very fact-specific, and employers may want to contact a lawyer before denying time off.

"For a lot of companies, it's a challenge," Kline said, "because they want to be supportive but also don't know how big this is going to get."

2. Applying Policies Inconsistently

"Employers may choose to relax certain procedures set forth in sick-leave policies under extenuating circumstances, such as the current outbreak," said Jason Habinsky, an attorney with Haynes and Boone in New York City. "However, it is critical that employers apply any such modifications uniformly in order to avoid any claims of discrimination or unfair treatment."

For example, if an employer chooses to excuse absences for or to advance paid time off or vacation time to employees as a result of a COVID-19-related illness, the employer must be certain to do the same for all employees who are absent under similar circumstances.

"This requires employers to ensure that all decision-makers are aware of any temporary or permanent modifications to sick-leave policies to maintain consistency," Habinsky said.

3. Ignoring Leave Laws

All sick-leave policies must comply with applicable state and local paid-sick-leave laws, and these laws may require employers to provide leave for COVID-19-related absences. Although employers may be required to provide leave, they should note that many laws allow employees to decide when to use it.

Employers must also avoid forcing a sick employee to perform services while out on leave, Habinsky noted, as this may constitute interference or retaliation under certain leave laws, such as the Family and Medical Leave Act (FMLA). In fact, employers must avoid taking any actions against employees that could be construed as retaliation in violation of the FMLA, the Americans with Disabilities Act, and applicable state and local paid-sick-leave laws.

"This could include any form of discipline in response to an employee's use of sick time or request to use sick-leave time," Habinsky said. "Likewise, to the extent employees are performing services while working remotely from home, they must be paid for time worked in accordance with applicable federal and state wage laws consistent with their classification as exempt or nonexempt."

Laura Pasqualone, an attorney with Lewis Roca Rothgerber Christie in Phoenix, noted that many paid-sick-leave laws prohibit employers from requiring a doctor's note unless the absence is for at least three days. But requiring a medical certification at all could further burden emergency rooms and urgent care facilities and could expose employees to more germs, she said.

The U.S. Centers for Disease Control and Prevention (CDC) has urged employers not to require employees to provide a doctor's note to verify their COVID-19-related illness or to return to work.

4. Failing to Actively Encourage Sick Workers to Stay Home

According to the CDC, employers should actively encourage sick employees to stay home by:

- Telling employees to stay home if they have symptoms of acute respiratory illness, a fever of 100.4 degrees or higher, or signs of a fever. Employees should be fever-free for 24 hours without the use of medication before returning to work.

- Urging employees to notify their supervisor and stay home if they are sick for any reason.

- Ensuring that the company's sick-leave policies are flexible and consistent with public health guidance and that employees are aware of the policies.

- Making sure contractors and staffing agencies inform their employees about the importance of staying home when ill and urging business partners not to reprimand workers who need to take sick leave.

- Not requiring employees with acute respiratory illness to provide a doctor's note to verify their illness or to return to work, since health care providers may be overwhelmed with requests.

- Maintaining flexible policies that allow employees to stay home to care for a sick relative.

"Employers should be aware that more employees may need to stay at home to care for sick children or other sick family members than is usual," the CDC said.

[Visit SHRM's resource page on coronavirus and COVID-19.]

SOURCE: Nagele-Piazza, L. (18 March 2020) "4 Sick-Leave Practices to Avoid During the Coronavirus Pandemic" (Web Blog Post). Retrieved from https://www.shrm.org/ResourcesAndTools/legal-and-compliance/employment-law/Pages/4-Sick-Leave-Practices-to-Avoid-During-the-Coronavirus-Pandemic.aspx

Can Employers Require Measles Vaccines?

Can employers require that their employees get the measles vaccine? The recent measles outbreak is raising the question of whether employers can require that their workers get the vaccine. Read this blog post from SHRM to learn more.

The recent measles outbreak, resulting in mandatory vaccinations in parts of New York City, raises the question of whether employers can require that workers get the vaccine to protect against measles, mumps and rubella (MMR) or prove immunity from the illness.

The answer generally is no, but there are exceptions.

Offices and manufacturers probably can't require vaccination or proof of immunity because the Americans with Disabilities Act (ADA) generally prohibits medical examinations—unless the employer is in a location like Williamsburg, the neighborhood in Brooklyn where vaccinations are now mandatory. Health care providers, schools and nursing homes, however, probably can require them because their employees work with patients, children and people with weak immune systems who risk health complications from measles.

But even these employers must try to find accommodations for workers who object to vaccines for a religious reason or because of a disability that puts them at risk if they're vaccinated, such as having a weak immune system.

Proof of Immunity

Proof of immunity includes one of the following:

- Written documentation of adequate vaccination.

- Laboratory evidence of immunity.

- Laboratory confirmation of measles.

- Birth before 1957. The measles vaccine first became available in 1963, so those who were children before the late 1950s are presumed to have been exposed to measles and be immune.

Measles, which is contagious, typically causes a high fever, cough and watery eyes, and then spreads as a rash. Measles can lead to serious health complications, especially among children younger than age 5. One or two out of 1,000 people who contract measles die, according to the U.S. Centers for Disease Control and Prevention.

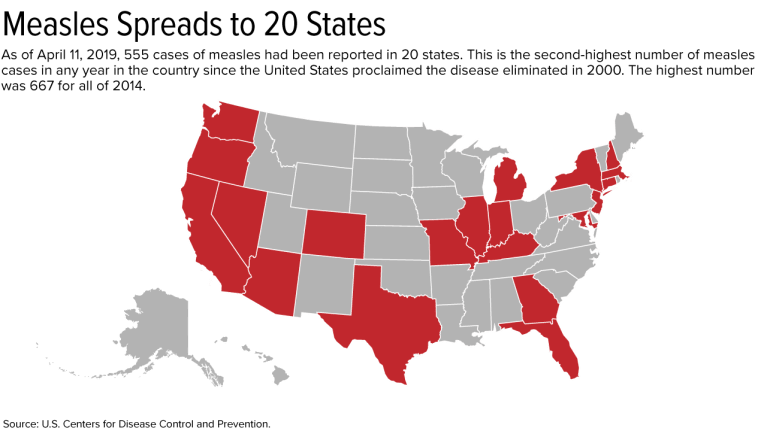

Outbreak Has Spread to 20 States

As of April 11, 555 cases have been reported in the United States this year. This is the second-greatest number in any year since the United States proclaimed measles eliminated in 2000; 667 cases were reported in all of 2014.

On April 9, New York City Mayor Bill de Blasio declared a public health emergency in Williamsburg, requiring the MMR vaccine in that neighborhood. Those who have not received the MMR vaccine or do not have evidence of immunity may be fined $1,000.

Since the outbreak started, 285 cases have been confirmed in Williamsburg, including 21 hospitalizations and five admissions to intensive care units.

If a city requires vaccinations, an employer's case for requiring them is much stronger, said Robin Shea, an attorney with Constangy, Brooks, Smith & Prophete in Winston-Salem, N.C. But employers usually should not involve themselves in employees' health care unless they are making an inquiry related to a voluntary wellness program, or the health issue is job-related, she cautioned.

The measles outbreak has spread this year to 20 states—outbreaks linked to travelers who brought measles to the U.S. from other countries, such as Israel, Ukraine and the Philippines, where there have been large outbreaks.

Strike the Right Balance

Health care employers typically require vaccinations or proof of immunity as a condition of employment, said Howard Mavity, an attorney with Fisher Phillips in Atlanta. He noted that most schoolchildren must be immunized, so many employees can show proof of immunity years later.

If an employee provides current vaccination records when an employer asks, the ADA requires that those records be kept in separate, confidential medical files, noted Meredith Shoop, an attorney with Littler in Cleveland.

All employers must balance their health and safety concerns with the right of employees with disabilities to reasonable accommodations under the ADA and the duty to accommodate religious workers under Title VII of the Civil Rights Act of 1964.

Under the ADA, a reasonable accommodation is required unless it would result in an undue hardship or direct threat to the safety of the employee or the public. The direct-threat analysis will be different for a registered nurse than for someone in a health care provider's billing department, for example, who might not work around patients.

Even if the ADA permitted mandatory vaccines in a manufacturing setting in limited circumstances, such as in Williamsburg now, any vaccination orders may need to be the subject of collective bargaining if the factory is unionized. Shoop has seen manufacturers shut down because employees were reluctant to come to work when their co-workers were sick on the job.

An employer does not have to accommodate someone who objects to a vaccine merely because he or she thinks it might do more harm than good but doesn't have an ADA disability or religious objection, said Kara Shea, an attorney with Butler Snow in Nashville, Tenn.

If someone claims to have a health condition that makes getting vaccinated a health risk, the employer does not have to take the person's word for it. The employer instead should ask the person to sign a consent form allowing the employer to learn about the condition and get documentation from the employee's doctor, she said. Before accommodating someone without an obvious impairment, the ADA allows employers to require medical documentation of the disability.

Courts don't closely scrutinize religious objections to immunizations, Mavity remarked.

"Some people have extremely strong beliefs that they don't want a vaccine in their body," said Kathy Dudley Helms, an attorney with Ogletree Deakins in Columbia, S.C. If the employer works with vulnerable people but can't find an accommodation for a worker who refuses vaccination, the employee may have to work elsewhere, she said.

SOURCE: SHRM (17 April 2019) "Can Employers Require Measles Vaccines?" (Web Blog Post). Retrieved from https://www.shrm.org/resourcesandtools/legal-and-compliance/employment-law/pages/measles-outbreak-2019-vaccinations.aspx

Working interviews: How hiring trend can cause compliance issues

The federal government prefers that companies do not bring in applicants for a working interview and without paying them. Continue reading this blog post to learn how this hiring trend can cause compliance issues for companies.

News flash: The feds don’t like it when you bring in “applicants” for a “working interview” – and then refuse to pay them for the work they perform.

The lesson is going to cost a Nashville dental practice $50,000 after a settlement in federal district court.

The practice will pay $50k in back wages and liquidated damages to 10 employees for FLSA minimum wage, overtime and recordkeeping violations.

According to the DOL’s Wage and Hour Division, Smiley Tooth Spa:

- violated the federal minimum wage requirements by requiring candidates for hire to perform a “working interview” to conclude their application, but failed to pay the individuals for those hours worked

- failed to pay registered dental assistants and hygienists time-and-a-half for hours worked over 40 in a workweek

- authorized their accountant to falsify and alter time and payroll records to make it appear that the employer was paying proper overtime for all hours worked, and

- periodically required employees to attend training during their scheduled lunch breaks without paying them for that time.

THE CARDINAL RULE

Although it’s hard to believe that any employer could think such an approach could fly in this day and age, this case is a good reminder that people who perform duties for the benefit of any organization are, almost universally, entitled to be paid.

Even if they aren’t yet considered an “official” employee, they’re performing the work of one, and must be paid for it.

Some good news: With working interviews, employers don’t necessarily have to pay the position’s advertised salary. The law only says workers must receive at least minimum wage for their work, so companies do have some flexibility.

SOURCE: Cavanaugh, L. (1 March 2019) "Working interviews: How hiring trend can cause compliance issues" (Web Blog Post). Retrieved from https://www.hrmorning.com/working-interviews-how-hiring-trend-can-cause-compliance-issues/