Employers Consider Child Care Subsidies

Working parents have been put into situations that are causing them to almost choose between their careers and their children due to the coronavirus pandemic bringing families home and requiring work to be done virtually. Employers are now seeking ways to help employees with taking care of their children. Read this blog post to learn more.

Working parents have borne the brunt of the pandemic's impact on employees, as many must juggle their job responsibilities with overseeing their children's remote educations and overall well-being while quarantined. Some have had no choice but to quit their jobs or decided not to seek new employment when their jobs were eliminated due to the downturn, so that they could focus on caring for their kids.

In fact, an August survey by Care@Work of 1,000 working parents with children under the age of 15 showed that 73 percent were considering making major changes at work, such as revising their schedules (44 percent), looking for a different job (21 percent) or leaving the workforce entirely (15 percent).

One approach that is gaining steam among employers seeking to help employees with children is to provide child care subsidies. These typically are employer-provided spending accounts or bonuses designed to help cover the costs, in full or partially, of day care and pandemic-related educational expenses.

"Subsidizing professional child care arrangements for an organization's employees makes sound business sense because it potentially reduces the stress and anxiety that working parents might regularly experience while worrying about their children during their normal work hours," said Timothy Wiedman, a retired associate professor of management and human resources at Doane University in Crete, Neb. "And that stress and anxiety might well divert a parent's full attention from their assigned duties."

Making Sure It's Fair

To be sure, many companies have not considered offering any type of child care subsidy to working parents. A major reason often cited is that single employees, as well as those who are married without children or who have grown children, will feel slighted by an employer that offers a benefit they can't access.

"There is always that fairness doctrine that comes into play when you offer a subsidy to one employee because they have a special need that some other employee may not have or need," said Carol Kardas, SHRM-SCP, founding partner at KardasLarson, an HR consulting firm in Glastonbury, Conn. "Some may consider this a discriminatory practice, and [it] could be a cause for lower morale or productivity."

Some organizations overcome that issue by providing a different benefit instead to offset those perceptions. Wiedman suggested reviewing benefit allotments for such employer-paid offerings as elder care, the deductible required by the company-provided health care plan, the annual contribution to 401(k) retirement plans, health savings accounts, life insurance coverage (or additional disability insurance) and tuition reimbursement. The allotments can vary based on whether the employee also receives a child care subsidy.

Another option is to explain that by providing assistance to their colleagues, the workload will remain balanced and not fall more heavily on employees who don't have child care duties.

"Working parents who have to use paid time off to spend time with their children when no other arrangements can be made may also call out at the last minute, since arrangements can be canceled abruptly," Kardas said.

Alleviating Stress and Costs

Working parents who can't afford child care and don't receive a subsidy "are often interrupted by children wanting to share their toys or get a hug from dad," said Laura Handrick, an HR consultant in Phoenix. "I see the stress on parents' faces in Zoom meetings. It's too much to manage a full-time paid job and a full-time unpaid job [parenting] at the same time. The stress affects the worker's mental health, employee productivity and family relationships."

Offering child care subsidies can increase employee satisfaction and engagement, she said. "[Managers] earn employee loyalty and increased productivity from grateful employees who aren't ridiculously stressed by constant kid interruptions while working," Handrick said.

There is a financial benefit as well: Employers that supply child care subsidies can take advantage of an annual tax credit of up to $150,000 if they use it for qualified child care facilities and services. According to the IRS, "the credit is 25 percent of the qualified child-care facility expenditures, plus 10 percent of the qualified child-care resource and referral expenditures paid or incurred during the tax year." To receive the tax credit, employers must complete Form 8882.

Handrick said a company can start a child care subsidy program with flexible spending accounts (FSAs).

"The benefit of providing a child care subsidy to employees in the form of an FSA is that the employer contributes pretax dollars, reducing its payroll taxes," she said. "The employee can choose how much or how little to contribute. Those who prefer to send their children to a more expensive program can fund and pay for it through the FSA using pretax dollars."

Kardas said if workplaces hire essential workers, they could utilize government-run programs in their states, such as Connecticut's CTCARES for Child Care Program for first responders, grocery workers, state facility employees, and child care and group home workers. They could also tap into an employee assistance program (EAP) to help employees find or pay for child care, she said.

Another idea is to grant every employee a certain amount of personal time that can be used in special circumstances, such as when child care is closed or a child is sick or unable to attend a child care program on a given day.

"This type of personal time could also be given to and used by those who do not have children for attending appointments or other obligations that can't be done after work," Kardas said. "This time may not solve the issue of employees being absent, but the fact that all would share equally may help."

As workplaces reopen physical locations, HR can look for child care facilities in the immediate area and work with them to offer a discount to employees, Kardas recommended.

"Single moms and working parents rarely have an extra room at home to carve out a home office," Handrick said. "That means they're likely working from the kitchen or dining room with children at home demanding attention. Toddlers want to play, [and] school-age kids need help with online classes."

Larger employers and those with deeper resources may even consider establishing an onsite child care facility for employees and charging less than a typical child care facility, which experts agree would dramatically boost appreciation among working parents who could then visit their children during each workday.

SOURCE: Lobell, K. (22 September 2020) "Employers Consider Child Care Subsidies" (Web Blog Post). Retrieved from https://www.shrm.org/resourcesandtools/hr-topics/employee-relations/pages/many-workplaces-consider-child-care-subsidies.aspx

HR Professionals Struggle over FMLA Compliance, SHRM Tells the DOL

In addition to the daily struggles that HR Professionals have to resolve, they are faced with many frustrations that have stemmed from the federal Family and Medical Leave Act (FMLA). Read this blog post to learn more.

In a Sept. 15 letter to the U.S. Department of Labor (DOL), the Society for Human Resource Management (SHRM) highlighted many of the challenges and frustrations that confront HR professionals as they comply with the federal Family and Medical Leave Act (FMLA).

"SHRM supports the spirit and intent of the FMLA, and our members are committed to ensuring employees receive the benefits and job security afforded by the act," wrote Emily M. Dickens, SHRM's corporate secretary, chief of staff and head of Government Affairs. "While it has been more than 25 years since FMLA was enacted, SHRM members continue to report challenges in interpreting and administering the FMLA."

The letter, developed with input from SHRM members, was in response to a request for information issued by the DOL's Wage and Hour Division on July 17. The DOL solicited comments and data "to provide a foundation for examining the effectiveness of the current regulations in meeting the statutory objectives of the FMLA."

According to Ada W. Dolph, a partner at Seyfarth Shaw who practices labor and employment law in Chicago, “SHRM’s comments echo what we are hearing from clients in terms of their challenges in implementing FMLA leave, particularly now with the patchwork of additional state and local leave requirements that have emerged as a response to COVID-19."

She added, "Our experience shows that regulatory gray areas add significant costs to the administration of the FMLA and impact the consistency with which the FMLA is applied to employees. We are hopeful that [the DOL] will implement SHRM’s proposed revisions, which provide much-needed clarity for both employers and employees."

Wide-Ranging Challenges

In its comment letter, SHRM addressed several issues its members have reported:

CHALLENGES WITH CONSISTENTLY APPLYING THE REGULATORY DEFINITION OF A SERIOUS HEALTH CONDITION

"Continuing treatment by a health care provider" as currently defined in federal regulations creates uncertainty for SHRM members on how to treat an absence of more than three consecutive days, according to SHRM's letter. "If there is not 'continuing treatment,' then it does not constitute a 'serious health condition' under the regulations," the letter explained. "However, if the employee does receive additional treatment, it's not clear whether these initial three absences are related to a serious health condition."

SHRM pointed out that several members "have suggested increasing the time period of incapacity, indicating they spend a lot of time processing employee certifications for missing four days that they believe more readily falls under sick time or paid time off."

Further guidance, including criteria and examples of when employers may obtain second and third medical opinions, "would be helpful, as many SHRM members reported declining to challenge an employee's certification at all because the conditions under which they may challenge those certifications are unclear or cumbersome," SHRM said.

Members also reported that obtaining documentation from health care providers on the need for employees to take leave to care for a family member with a serious health condition was difficult, and that doctors were often vague about identifying how the employee fits into the caregiving equation.

CHALLENGES WITH INTERMITTENT LEAVE

SHRM members reported that intermittent leave-taking is the most likely FMLA leave to be abused by employees.

"Employees are permitted to take incremental leave in the smallest increment of time the employer pays, as little as .10 of an hour, which members reported allowed employees to use the time to shield tardiness or other attendance issues," the letter read. "SHRM strongly urges [the DOL] to increase the minimum increment of intermittent or reduced schedule leave that is unforeseeable or unscheduled, or for which an employee provides no advance notice." SHRM suggested several alternative approaches.

For instance, the DOL could:

- Require that employees take unforeseeable or unscheduled intermittent or reduced schedule leave in half-day increments, at a minimum.

- Establish a smaller increment, such as two hours, that automatically applies in any instance in which an employee takes unscheduled or unforeseeable intermittent or reduced schedule leave.

Additionally, when an employee takes intermittent or reduced FMLA leave, an employer may transfer an employee to an alternative position. However, under current regulations, employers may only require such a transfer when the leave taken is for "a planned medical treatment for the employee, a family member, or a covered servicemember, including during a period of recovery…."

"Given the potential burden and hardship that intermittent and reduced-schedule leave have on employers, SHRM believes that an employer should be permitted to temporarily transfer an employee on intermittent or reduced-schedule leave to an alternative position, regardless of whether the leave is foreseeable or unforeseeable or whether it is scheduled or unscheduled," SHRM told the DOL.

CHALLENGES REGARDING EMPLOYEES WHO ARE CERTIFIED FOR INTERMITTENT LEAVE FOR CONSECUTIVE YEARS

Employees continue to regularly exhaust and replenish their 12-week FMLA entitlement, based on the rolling 12-month entitlement period, SHRM members reported.

"Combined with the Americans with Disabilities Act Amendments Act requirements to accommodate absences under some circumstances, these unrelenting absences become unreasonable and unduly burdensome to employers," SHRM commented.

Similarly, many SHRM members reported being frustrated that there weren't more mechanisms to challenge potential abuses of intermittent leave (e.g., when employees take every Friday or Monday off).

FRUSTRATION WITH EMPLOYEES NOT PROVIDING SUFFICIENT NOTICE OF THE NEED FOR LEAVE

Many employees provide notice of even foreseeable leaves after the leave has begun, noted SHRM, which recommended that notice of foreseeable leave be required prior to the commencement of leave and not "as soon as practicable."

SHRM also suggested that "a more definitive requirement be imposed so that employees understand clearly that they must provide notice of leave prior to beginning leave," and that "if an employee does not give advance notice, it should be the employee's burden to articulate why it was not practicable to provide such notice prior to the start of the leave. If they are unable to meet this burden, the regulation should permit and specify the consequences."

DIFFICULTIES OBTAINING TIMELY RESPONSES FROM EMPLOYEES AND THEIR PHYSICIANS TO SUPPORT THE REQUESTED LEAVE

If an employee fails to provide sufficient information to demonstrate that he or she may seek FMLA leave, then the employee can be required to provide additional information "to determine whether an absence is potentially FMLA-qualifying," SHRM explained. "However, there is no deadline by which the employee must provide this clarifying information, resulting in extensive, continued delays and continued administrative burdens."

SHRM recommended tightening this time frame to seven days and that the DOL "endeavor to provide firmer and clearer deadlines and notice requirements throughout the regulations."

SHRM members also reported that health-provider fees for completing paperwork often slowed or halted the certification process and asked whether providers' ability to impose these fees could be limited.

New FMLA Forms

Overall, SHRM members expressed satisfaction with recently updated FMLA forms. However, members continue to report that the information received from medical providers is often unclear and that they struggle to determine whether the reported condition constitutes a serious health condition.

The new forms do not account for the possibility that an employee does not qualify for FMLA because the employee doesn't meet the requirement of being unable to perform the functions of his or her job. "As such, we suggest that the medical provider be given the option to indicate that an employee does not meet this requirement," SHRM wrote.

Many members suggested that the DOL allow completion of online forms to speed processing times and reduce the administrative burdens of processing FMLA leave.

Among other issues, SHRM members also reported struggling with how to effectively reconcile FMLA with other leave laws enacted in the wake of the COVID-19 pandemic.

SOURCE: Miller, S. (21 September 2020) "HR Professionals Struggle over FMLA Compliance, SHRM Tells the DOL" (Web Blog Post). Retrieved from https://www.shrm.org/resourcesandtools/hr-topics/benefits/pages/hr-professionals-struggle-over-fmla-compliance-shrm-tells-the-dol.aspx

Trump Signs Coronavirus Relief Bill with Paid-Leave Mandate

As the COVID-19 pandemic cases increase, employees are stuck choosing between staying home to avoid spreading the illness and working for a paycheck to pay their household bills. Due to the effect that the spread of coronavirus has created, the U.S. Senate has approved the Families First Coronavirus Response Act. Continue reading this blog post from SHRM to learn more.

The U.S. Senate approved the Families First Coronavirus Response Act in a 90-8 vote on March 18, and President Donald Trump signed it into law a few hours later. The bill will provide free screening, paid leave and enhanced unemployment insurance benefits for people affected by COVID-19, the respiratory disease caused by the coronavirus.

The U.S. House of Representatives passed the bill late on March 13. After several days of negotiation, House Speaker Rep. Nancy Pelosi, D-Calif., announced that negotiators had reached a deal with the White House to pass the bill. "We cannot slow the coronavirus outbreak when workers are stuck with the terrible choice between staying home to avoid spreading illness and the paycheck their family can't afford to lose," Pelosi said.

Republican senators were concerned that the bill might hurt small businesses, and Sen. Mitch McConnell, R-Ky., said lawmakers are working on another bill that would include relief for small businesses. McConnell said he would not adjourn the Senate until the third COVID-19 economic stimulus package is passed, CNN reported.

Trump declared a national emergency March 13, which frees up billions of dollars to fund public health and removes restrictions on hospitals to treat more patients. The Families First Coronavirus Response Act (H.R. 6201) will provide:

- Free coronavirus testing.

- Paid emergency leave.

- Enhanced unemployment insurance.

- Additional funding for nutritional programs.

- Protections for health care workers and employees responsible for cleaning at-risk places.

- Additional federal funds for Medicaid.

We've rounded up articles and resources from SHRM Online and other trusted media outlets on the news.

Paid Family Leave

As originally drafted, H.R. 6201 would have temporarily provided workers with two-thirds of their wages for up to 12 weeks of qualifying family and medical leave for a broad range of COVID-19-related reasons. The revised version of the bill will only provide such leave when employees can't work because their minor child's school or child care service is closed due to a public health emergency. Workers who have been on the payroll for at least 30 calendar days will be eligible for paid family leave benefits, which will be capped at $200 a day (or $10,000 total) and expire at the end of the year.

(Littler)

Paid Sick Leave

Under the bill, many employers will have to provide 80 hours of paid-sick-leave benefits for several reasons, including if the employee has been ordered by the government to quarantine or isolate or has been advised by a health care provider to self-quarantine because of COVID-19. Employees could also use paid sick leave when they have symptoms of COVID-19 and are seeking a medical diagnosis, if they are caring for someone who is in quarantine or isolation, or their child's school or child care service is closed because of the public health emergency. Paid-sick-leave benefits will be immediately available when the law takes effect and capped at $511 a day for a worker's own care and $200 a day when the employee is caring for someone else. This benefit will also expire at the end of 2020.

(CNN)

Large and Small Business Exceptions

Private businesses with at least 500 employees are not covered by the bill. "I don't support U.S. taxpayer money subsidizing corporations to provide benefits to workers that they should already be providing," Pelosi said on Twitter. Treasury Secretary Steven Mnuchin also said that "big companies can afford these things."

Covered employers that are required to offer emergency FMLA or paid sick leave will be eligible for refundable tax credits. Employers with fewer than 50 workers can apply for an exemption from providing paid family and medical leave and paid sick leave if it "would jeopardize the viability of the business." Gig-workers and other self-employed workers will be eligible for a tax credit to cover the benefits.

Lawmakers Previously Approved $8.3 Billion Emergency Bill

Another emergency spending package to fight coronavirus rapidly worked its way through Congress, and President Donald Trump signed it into law March 6. The measure will provide funds to develop a vaccine, provide protective and laboratory equipment to workers who need it, and aid locations hit with the virus.

Coronavirus Prompts Employers to Review Sick Leave Policies

Do employees have the right to take time off if they are concerned about contracting coronavirus? Can employers send sick workers home? Should employees be paid for missed work time? HR and other business leaders are likely considering these questions and more as COVID-19 makes its way through the United States. "We believe employers would be wise to review their paid-time-off practices immediately," said Francis Alvarez, an attorney with Jackson Lewis in White Plains, N.Y. "Employers are likely to face unique circumstances that were not anticipated when they prepared their attendance and leave policies."

Visit SHRM's resource page on coronavirus and COVID-19.

SOURCE: Nagele-Piazza, L. (18 March 2020) "Trump Signs Coronavirus Relief Bill with Paid-Leave Mandate" (Web Blog Post). Retrieved from https://www.shrm.org/ResourcesAndTools/legal-and-compliance/employment-law/Pages/Senate-to-Vote-Soon-on-Coronavirus-Paid-Leave-Mandate.aspx

4 pitfalls of paid leave and how clients can avoid them

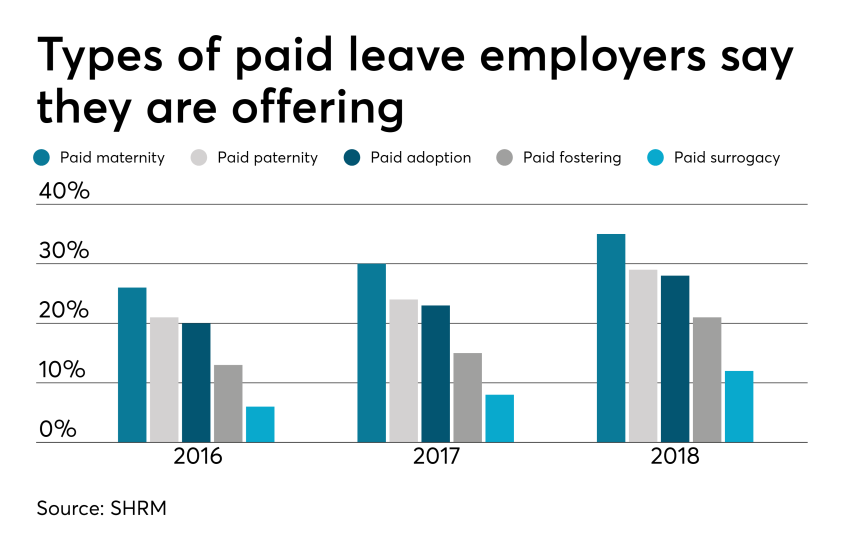

Employers are using paid leave options to help boost their employee benefits packages in efforts to better attract and retain talent. Read the following blog post from Employee Benefit Advisor for 4 common pitfalls of paid leave and how employers can avoid them.

Smart employers are boosting their benefits packages with paid family leave — the most coveted work perk among all generations. In today’s low unemployment environment, paid leave benefits can be a huge differentiator in attracting and retaining talent.

Smart employers are boosting their benefits packages with paid family leave — the most coveted work perk among all generations. In today’s low unemployment environment, paid leave benefits can be a huge differentiator in attracting and retaining talent.

But some employers are getting themselves into trouble in the process, facing accusations of gender discrimination or improper use of leave.

Here are four potential pitfalls of paid leave, and how employers can avoid them.

1. Be careful what you call “maternity leave.”

Employers have long been granting leave for new moms in the form of disability coverage. In fact, the top cause of short term disability is pregnancy. Disability insurance usually grants new moms six to eight weeks of paid leave to recover from childbirth.

Because this coverage applies to the medical condition of recovering from childbirth, it shouldn’t be lumped in with bonding leave.

Guidance from the Equal Employment Opportunity Commission says leave granted for new moms for bonding must also be extended to new dads, so separating disability leave from bonding leave is crucial to avoiding gender discrimination.

2. Don’t make gender assumptions.

The amount of bonding time for new parents after birth, adoption or fostering must be granted equally for men and women. Companies that don’t provide the same amount of paid leave for men and women may find themselves in a discrimination lawsuit.

It’s not just the time away from work that matters, but also the return-to-work support provided. If new moms are granted temporary or modified work schedules to ease the transition back to work, new dads must also have access to this.

Some companies may choose to differentiate the amount of leave and return-to-work support for primary or secondary caregivers. That’s compliant as long as assumptions aren’t made on which gender is the primary or secondary caregiver.

The best way to avoid potential gender discrimination pitfalls is to keep all parental bonding and related return-to-work policies gender neutral.

3. Avoid assuming the length of disability.

Be careful about assuming the length of time a new mom is disabled, or recovering medically, after birth. Typical coverage policies allot six to eight weeks of recovery for a normal pregnancy, so assuming a new mom may be out for 10 weeks might be overestimating the medical recovery time, and under-representing the bonding time, which must be gender neutral.

4. Keep up with federal, state and local laws.

Mandated leave laws are ever-evolving, so employers should consistently cross-check their policies with state and local laws. For instance, do local paid leave laws treat adoption the same as birth? Are multistate employers compliant? What if an employee lives in one state but works in another: Which state’s leave policies take precedence?

Partnering with a paid leave service provider can mitigate the risk of improperly administering leave. Paid leave experts can help answer questions, review guidelines and provide information regarding job-protecting medical or family leave.

They can also help flag potential pitfalls, ensuring leave requests from all areas of your company are managed uniformly and in accordance with state and federal laws, including the EEOC.

SOURCE: Bennett, A. (12 September 2019) "4 pitfalls of paid leave and how clients can avoid them" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/list/4-pitfalls-of-paid-leave-and-how-clients-can-avoid-them

Changes are coming to paid leave. Here’s what employers should know

Many states and local governments are enacting their own paid leave policies, making it difficult for employers to navigate employee paid leave. Read this blog post for what employers should know about the coming changes for paid leave.

A growing number of states and local governments are enacting their own paid leave policies. These new changes can be difficult for employers to navigate if they don’t understand the changes that are happening.

Adding to the confusion among employers, paid sick leave and paid family leave are often used interchangeably, when in fact there are some important distinctions. Paid sick leave is for a shorter time frame than paid family leave and allows eligible employees to care for their own or a family member’s health or preventative care. Paid family leave is more extensive and allows eligible employees to care for their own or a family member’s serious health condition, bond with a new child or to relieve family pressures when someone is called to military service.

The best-known type of employee leave is job-protected leave under the Family Medical Leave Act, where employees can request to take family medical leave for their own or a loved one’s illness, or for military caregiver leave. However, leave under FMLA is unpaid, and in most cases, employees may use available PTO or paid leave time in conjunction with family medical leave.

Rules vary by state, which makes it more difficult for multi-state employers to comply. The following is an overview of some new and changing state and local paid leave laws.

Paid sick leave

The states that currently have paid sick leave laws in place are Arizona, California, Connecticut, Maryland, Massachusetts, New Jersey, Oregon, Rhode Island, Vermont and Washington. There are also numerous local and city laws coming into effect across the country.

In New Jersey, the Paid Sick Leave Act was enacted late last year. It applies to all New Jersey businesses regardless of size; however, public employees, per diem healthcare employees and construction workers employed pursuant to a collective bargaining agreement are exempt. As of February 26, New Jersey employees could begin using accrued leave time, and employees who started after the law was enacted are eligible to begin using accrued leave 120 days after their hire dates.

Michigan’s Paid Medical Leave Act requires employers with 50 or more employees to provide paid leave for personal or family needs as of March.

Under Vermont’s paid sick leave law, this January, the number of paid sick leave hours employees may accrue rose from 24 to 40 hours per year.

In San Antonio, a local paid sick leave ordinance passed last year, but it may not take effect this August. The ordinance mirrors one passed in Austin that has been derailed by legal challenges from the state. Employers in these cities should watch these, closely.

Paid family leave

The five states that currently have paid family leave policies are California, New Jersey, Rhode Island, New York, Washington and the District of Columbia.

New York, Washington and D.C. all have updates coming to their existing legislation, and Massachusetts will launch a new paid family program for employers in that state. In New York, the state’s paid family leave program went into effect in 2018 and included up to eight weeks of paid family leave for covered employees. This year, the paid leave time jumps to 10 weeks. Payroll deductions to fund the program also increased.

Washington’s paid family leave program will begin on January 1, 2020, but withholding for the program started on January 1 of this year. The program will include 12 weeks of paid family leave, 12 weeks of paid medical leave. If employees face multiple events in a year, they may be receive up to 16 weeks, and up to 18 weeks if they experience complications during pregnancy.

The paid family leave program in Massachusetts launches on January 1, 2021, with up to 12 weeks of paid leave to care for a family member or new child, 20 weeks of paid leave for personal medical issues and 26 weeks of leave for an emergency related to a family member’s military deployment. Payroll deductions for the program start on July 1.

The Paid Leave Act of Washington, D.C. will launch next year with eight weeks of parental leave to bond with a new child, six weeks of leave to care for an ill family member with a serious health condition and two weeks of medical leave to care for one’s own serious health condition. On July 1, the district will begin collecting taxes from employers, and paid leave benefits will be administered as of July 1, 2020.

Challenging times ahead

An employer must comply with all state and local sick and family leave laws, and ignorance of a law is not a defense. Employers must navigate different state guidelines and requirements for eligibility no matter how complex, including multi-state employers and companies with employees working remotely in different jurisdictions.

These state paid leave programs are funded by taxes, but employers must cover the costs of managing the work of employees who are out on leave. While generous paid leave policies can help employers attract talent, they simply don’t make sense for all companies. For example, it can be difficult for low-margin businesses to manage their workforces effectively when employees can take an extended paid leave.

Not only must employers ensure compliance with state and local rules, but they also must make sure that their sick time, family and parental leave policies are non-discriminatory and consistent with federal laws and regulations. That’s a lot to administer.

Employers should expect to see the changes in paid sick leave and family leave laws to continue. In the meantime, companies should make sure they have the people and internal processes in place right now to track these changes and ensure compliance across the board.

SOURCE: Starkman, J.; Johnson, D. (2 May 2019) "Changes are coming to paid leave. Here’s what employers should know" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/what-employers-need-to-know-about-changing-paid-leave-laws?brief=00000152-14a7-d1cc-a5fa-7cffccf00000

4 mistakes to avoid at the intersection of FMLA and PTO

Administration of the Family and Medical Leave Act (FMLA) can become extremely complex, especially when other leave entitlements are added. Read this blog post to learn about the four mistakes employers should avoid when it comes to FMLA and PTO.

By now, many employers can recite the basic requirements of the federal Family and Medical Leave Act (FMLA) in their sleep. The law provides eligible employees (those who have at least one year of service and 1,250 hours under their belt) with up to 12 weeks of unpaid, job-protected leave over a 12-month period for qualifying family-related or medical reasons. FMLA covers companies with 50 or more employees located within 75 miles of each other.

While the law itself is conceptually straightforward, administration can become incredibly complex — especially when you throw other types of leave entitlements into the mix such as workers' comp, disability leave, and paid time off (PTO).

HR Dive recently spoke with three employment law attorneys about the most common — and costly — leave administration errors employers make when it comes to the intersection of FMLA and paid leave.

Mistake #1: Not running leaves concurrently

"I would say that the biggest issue that we see is a lot of employers do not have policies that provide for the use of paid time off concurrently with the FMLA," said attorney Molly Batsch, an officer at the St. Louis office of Greensfelder, Hemker & Gale, P.C. "[Because] the FMLA regulations allow employers to require employees to use any paid time off concurrently with unpaid FMLA leave, we really encourage employers to put that specifically in their policies."

Attorney Jeff Nowak, a partner at the Chicago office of Franczek Radelet P.C., concurred via email: "A decent number of employers don't realize that they can run FMLA leave concurrently with paid leave benefits such as worker's compensation benefits — or they forget to run both at the same time."

Failing to run leaves concurrently, when permitted, can be costly for employers. A series of consecutive leaves strung together can mean longer absences and increased workplace disruption.

Mistake #2: Policy confusion

A similar mistake employers make is that they don't explicitly outline the concurrent rule to employees. Your FMLA policy should make clear that any paid time off will run concurrently with unpaid FMLA time, advised Batsch: "I think that employers have a few misconceptions about that.

"The first misconception would be that the employee gets to pick," she said. "If the employee doesn't want to run the two concurrently, then they can go ahead and take 12 weeks of unpaid FMLA and then they can take their five weeks of vacation after that, and that is not the case. It is permissible for an employer to require that time to run concurrently. So that's the first mistake I see."

Make sure your policy is abundantly obvious about that so employees don't get upset about that requirement when it's being administered.

Mistake #3: Missing an important caveat about FMLA and paid leave

There is an important exception to the general rule that employers may require an employee to use paid leave during unpaid FMLA leave, one that many employers miss, according to all three attorneys HR Dive spoke with.

"If an employee is on FMLA leave and simultaneously in receipt of a paid benefit, in any amount, FMLA leave is considered paid. When it's paid FMLA, an employer may not require that the employee substitute PTO — but it can permit that," said attorney David Mohl, a principal at the Atlanta office of Jackson Lewis PC.

For example, he said, if short-term disability provides 70% income replacement, an employer cannot require that the employee use PTO (or other paid leave) to make up the difference. If, however, there is a waiting period before that paid benefit kicks in — say, seven days — an employer may require the use of paid leave during that seven days.

Batsch noted that even if the employee is receiving paid time off via a third-party disability plan rather than an employer disability plan, "that's still a situation where you can't require an employee to run their paid time off concurrently with their FMLA time." This was clarified by the Seventh Circuit in a 2007 case (Repa v. Roadway Express, Inc., 477 F.3d 938).

Mistake #4: Forgetting to consider the patchwork of local laws

"The growing number of state and local laws heap a load of additional compliance concerns onto employers," said Nowak. "Not only are there additional considerations for accrual, carryover, and reasons for leave, but these new leave laws tend to provide job-protected leave in situations where the medical condition is not covered by the FMLA. As a result, employers cannot discipline an employee for an absence when he or she is utilizing leave covered by one of these leave laws."

Of course, those laws only make the interactions with FMLA management more complex.

"Paid parental leave policies interact with FMLA and gender discrimination laws," said Mohl. "PPL policies are, of course, a type of paid leave; some operate as a disability benefit."

Paid leave will likely continue to expand in scope in the coming months as more states and cities consider mandating it. Currently, 10 states and about 30 localities guarantee some type of paid sick leave. A number of federal policies have also been proposed, but no movement has been seen at that level yet.

SOURCE: Carsen, J. (27 November 2018) "4 mistakes to avoid at the intersection of FMLA and PTO" (Web Blog Post). Retrieved from https://www.hrdive.com/news/4-mistakes-to-avoid-at-the-intersection-of-fmla-and-pto/542962/

Top 11 Employer FMLA Mistakes

Original post shrm.org

Employers should never take a holiday from dealing with the Family and Medical Leave Act’s (FMLA’s) requirements. Legal experts say the law is full of traps that can snag employers that let their guard down, and they recommend that employers shore up FMLA compliance efforts by avoiding the following common missteps.

No FMLA Policy

Employers shouldn’t skip having a written FMLA policy, Annette Idalski, an attorney with Chamberlain Hrdlicka in Atlanta, told SHRM Online. “If employers adopt a written policy and circulate it to employees, they are able to select the terms that are most advantageous to the company,” she said. For example, employers can choose to use a rolling 12-month period (rolling forward from the time any leave commences) rather than leaving the selection of the 12-month period to employees, who almost inevitably would choose the 12-month calendar period. The calendar period, unlike the rolling period, allows for employees to stack leave during the last 12 weeks of one year and the first 12 weeks of the new year. Check to see if state or local laws give employees the right to choose a 12-month period that would give them the right to stack leave.

Counting Light-Duty Work as FMLA Leave

Idalski said employers also often make the mistake of offering light-duty work to employees and counting it as FMLA leave. Light-duty work can be offered but must not be required in lieu of FMLA leave. For example, an employer can offer tasks that don’t require lifting to an employee who hurt his or her back and cannot perform heavy lifting. But if the worker wants the time off, the individual is entitled to take FMLA leave.

Silent Managers

Managers sometimes fail to tell HR right away when an employee is out on leave for an extended period, Idalski noted. If a manager waits a week to inform HR, that could delay the start of the 12-week FMLA period. The employer can’t make the FMLA leave retroactive, and letting the employee take more than 12 weeks of leave affects staffing and productivity, Idalski said. “Management must initiate the FMLA process with HR right away,” she emphasized.

Untrained Supervisors

Untrained front-line supervisors might retaliate against employees who take FMLA leave, dissuade workers from taking leave or request prohibited medical information, all of which violate the FMLA, said Sarah Flotte, an attorney with Michael Best & Friedrich in Chicago. Just because front-line supervisors shouldn’t administer FMLA leave doesn’t mean they shouldn’t be trained on the FMLA, she noted.

Missed Notices

Employers sometimes fail to provide required notices to employees, Flotte said. “The FMLA requires employers to provide four notices to employees seeking FMLA leave; thus, employers may run afoul of the law by failing to provide these notices,” Flotte remarked. Employers must give a general notice of FMLA rights. They must provide an eligibility notice within five days of the leave request. They must supply a rights and responsibilities notice at the same time as the eligibility notice. And employers must give a designation notice within five business days of determining that leave qualifies as FMLA leave.

Overly Broad Coverage

Sometimes employers provide FMLA leave in situations that are not truly FMLA-covered, such as providing leave to care for a domestic partner or a grandparent or sibling, noted Joan Casciari, an attorney with Seyfarth Shaw in Chicago. If they count that time off as FMLA leave, this could prove to be a violation of the law if the employee later has an event that is truly covered by the FMLA, she said. But the leave may count as time off under state or local FMLA laws, depending on their coverage.

Incomplete Certifications

Casciari added that employers sometimes accept certifications of a serious health condition that are incomplete and inconsistent. In particular, she said that businesses sometimes make the mistake of accepting certifications that do not state the frequency and duration of the intermittent leave that is needed.

No Exact Count of Use of FMLA Leave

Another common mistake is failing to keep an exact count of an employee’s use of FMLA leave, particularly in regards to intermittent leave, said Dana Connell, an attorney with Littler in Chicago. This failure is “highly dangerous,” he stated. An employer might give the employee more FMLA leave than he or she is entitled to. “The even greater risk is that the employer counts some time as an absence that should have been counted as FMLA, and that counted absence then plays a role—building block or otherwise—in an employee’s termination.”

No Adjustment to Sales Expectations

Some employers take too much comfort in an FMLA regulation that says that if a bonus is based on the achievement of a specific goal, and the employee has not met the goal due to FMLA leave, the payment of the bonus can be denied. “Notwithstanding that regulation regarding bonuses, courts have held that employers need to adjust sales expectations in assessing performance to avoid penalizing an employee for being absent during FMLA leave,” Connell emphasized.

Being Lax About FMLA Abuse

The FMLA is ripe for employee abuse, according to Connell, who said, “Some employers, especially in the manufacturing sector, find themselves with large numbers of employees with certified intermittent leave.” Those employers need a plan to keep all employees “honest with respect to their use of FMLA.” Connell said that surveillance may be a necessary part of an employer’s plan for dealing with potential FMLA abuse.

Overlooking the ADA

Employers sometimes fail to realize that a serious health condition that requires 12 weeks of FMLA leave will likely also constitute a disability under the Americans with Disabilities Act (ADA), noted Frank Morris Jr., an attorney with Epstein Becker Green in Washington, D.C. Even after 12 weeks of FMLA leave, more leave may be required by the ADA or state or local law as a reasonable accommodation.

“Document any adverse effects on productivity, ability to timely meet client demands and extra workload on co-workers resulting from an employee on extended FMLA leave,” Morris recommended. While the FMLA doesn’t have an undue hardship provision, “The information will be necessary for a proper analysis of whether any request by an employee for further leave as an ADA accommodation is reasonable or is an undue hardship” under the ADA.

- See more at: https://www.shrm.org/legalissues/federalresources/pages/top-11-employer-fmla-mistakes.aspx#sthash.kOREknrz.dpuf

Limited Employer Impact Likely from Gay Marriage Ruling

Originally posted by Joanne Deschenaux on June 26, 2015 on shrm.org.

All 50 states must issue marriage licenses to same-sex couples and must recognize same-sex marriages legally performed out of state, the U.S. Supreme Court ruled June 26, 2015, in a historic victory for gay civil rights (Obergefell v. Hodges, No. 14–556).

“Under the Constitution, same-sex couples seek in marriage the same legal treatment as opposite-sex couples, and it would disparage their choices and diminish their personhood to deny them this right,” Justice Anthony Kennedy wrote for the majority. He was joined by the court’s liberal justices Ruth Bader Ginsburg, Stephen Breyer, Sonia Sotomayor and Elena Kagan.

Each of the four conservative justices who dissented from the opinion—Chief Justice John Roberts and justices Antonin Scalia, Clarence Thomas and Samuel Alito—wrote a separate opinion, saying that the court had usurped a power that belongs to the people.

Implications for Employers

The impact of this decision on many employers will be limited, Scott D. Schneider, an attorney in Fisher & Phillips’ New Orleans office, told SHRM Online.

In states where same-sex marriage is currently legal, this ruling will have no effect, he said. But in other states, “employers should sit down and ask, ‘Where do we stand in light of this ruling?’ ”

One area that may be impacted is the granting of leave under the Family and Medical Leave Act (FMLA), Schneider said. “Someone who enters into a same-sex marriage may be entitled to FMLA leave.”

Similarly, employers in states that have not allowed same-sex marriage to date should examine their medical insurance and retirement plans. Same-sex spouses may qualify as beneficiaries under these plans now, where previously they might have been legally excluded from participating.

“The bottom line is that all employer policies related to spouses should apply to same-sex marriages,” according to Nonnie Shivers, an attorney in the Ogletree Deakins Phoenix office. In addition, employers should require the same level and type of proof of a same-sex marriage as they would of any other marriage, she said.

In some ways, this will make things easier for employers, she noted. “They won’t have to try to figure out whether they need to recognize someone’s same-sex marriage performed in another state. Anyone who has entered into a same-sex marriage is protected as a spouse.”

But, as a practical matter, employers should be aware that in states that have not previously allowed same-sex marriage, things are not going to change overnight, Shivers added. “Some county clerks—the ones who issue marriage licenses—have said that they are going to wait to hear about changes from the attorney general,” she said. This means that employers should be somewhat cautious about changing certain policies. For example, if an employer has policies in place regarding domestic partnerships, it may not want to change those policies immediately, she suggested.

And she cautioned that just because the legality of same-sex marriage is now a settled issue, that doesn’t mean that it won’t sometimes be a “hot-button" issue in the workplace. Employers need to be prepared to deal with possible employee reactions—whether based on religious beliefs or other factors—to gay and lesbian employees in the workplace, she said.

Court Finds 14th Amendment Protection

Kentucky, Michigan, Ohio and Tennessee are four of the states that have defined marriage as a union between one man and one woman. Fourteen same-sex couples and two men whose same-sex partners are deceased had filed suits in federal district courts in their home states, claiming that state officials violated the 14th Amendment of the U.S. Constitution by denying them the right to marry or to have their marriages that were lawfully performed in another state given full recognition in their home state. Each district court ruled in the plaintiffs’ favor, but the 6th U.S. Circuit Court of Appeals consolidated the cases and reversed, ruling in favor of the states.

In reversing the 6th Circuit decision, the high court first examined the history of marriage as a union between two persons of the opposite sex, noting that while state officials arguing against same-sex marriage claimed that “it would demean a timeless institution if marriage were extended to same-sex couples,” the plaintiffs “far from seeking to devalue marriage, seek it for themselves because of their respect—and need—for its privileges and responsibilities.”

The court then noted the changes over time in the nature of marriage—such as the decline of arranged marriages and the abandonment of the laws that declared a wife the property of her husband—noting that these changes “have worked deep transformations in the structure of marriage, affecting aspects of marriage once viewed as essential.” These new insights “have strengthened, not weakened, the institution,” the court said.

The opinion next discussed the country’s experience with gay and lesbian rights. Well into the 20th century, many states condemned same-sex intimacy as immoral, the court noted, and homosexuality was treated as an illness. Later in the century, public attitudes shifted, allowing same-sex couples to lead more open lives. Then, questions about the legal treatments of gays and lesbians began reaching the courts, with numerous same-sex marriage cases reaching the federal courts and state supreme courts.

The Supreme Court’s majority opinion now sets forth its holding that the U.S. Constitution requires a state to license a marriage between two people of the same sex and to recognize a same-sex marriage performed out of state.

The court has long held that the right to marry is protected by the 14th Amendment, the opinion noted, and the reasons marriage is fundamental under the Constitution apply with equal force to same-sex couples. “The right to personal choice regarding marriage is inherent in the concept of individual autonomy. This is true for all persons, whatever their sexual orientation.”

Final Rule to Revise the Definition of “Spouse” Under the FMLA

Originally posted on www.dol.gov.

The Family and Medical Leave Act (FMLA) entitles eligible employees of covered employers to take unpaid, job-protected leave for specified family and medical reasons. The FMLA also includes certain military family leave provisions.

The Department of Labor issued a Final Rule on February 25, 2015 revising the regulatory definition of spouse under the Family and Medical Leave Act of 1993 (FMLA). The FMLA entitles eligible employees of covered employers to take unpaid, job-protected leave for specified family and medical reasons.

The Final Rule amends the regulatory definition of spouse under the FMLA so that eligible employees in legal same-sex marriages will be able to take FMLA leave to care for their spouse or family member, regardless of where they live. This will ensure that the FMLA will give spouses in same-sex marriages the same ability as all spouses to fully exercise their FMLA rights.

The effective date for the final rule is March 27, 2015.

On March 26, 2015, the United States District Court for the Northern District of Texas, in Texas v. United States, Civil Action No. 7:15-cv-00056 (N.D. Tex.), granted a request made by the states of Texas, Arkansas, Louisiana, and Nebraska for a preliminary injunction with respect to the Department's Final Rule revising the regulatory definition of spouse under the Family and Medical Leave Act (FMLA). The Government informed the Court of how the Government is complying with the injunction and the Government’s understanding of the scope of the injunction in a March 31 filing. A hearing date has been set for April 10th.

Major features of the Final Rule

- The Department has moved from a “state of residence” rule to a “place of celebration” rule for the definition of spouse under the FMLA regulations. The Final Rule changes the regulatory definition of spouse in 29 CFR §§ 825.102 and 825.122(b) to look to the law of the place in which the marriage was entered into, as opposed to the law of the state in which the employee resides. A place of celebration rule allows all legally married couples, whether opposite-sex or same-sex, or married under common law, to have consistent federal family leave rights regardless of where they live.

- The Final Rule’s definition of spouse expressly includes individuals in lawfully recognized same-sex and common law marriages and marriages that were validly entered into outside of the United States if they could have been entered into in at least one state.

Additional Information on the Final Rule.

Download the "Final Rule to Revise the Definition of 'Spouse' Under the FMLA" article here.

Download the Department of Labor - Wage and Hour Division's updated "Fact Sheet On The Final Rule" here.

Download the full text of the Final Rule here.

Download the FMLA Final Rule FAQs here.

Download the Press Release - "US Labor Dept. updates Family and Medical Leave Act's definition of spouse" here.

Download the FMLA - An Overview and News Updates here.

Tips for Handling Employee Pay Issues Caused By Mother Nature

Originally post February 9, 2015 by Laura Kerekes on www.thinkhr.com.

If you are inclined to believe “Punxsutawney Phil,” we’re in for another six weeks of wintry weather. When the groundhog emerged from his dwelling at Gobbler’s Knob in west-central Pennsylvania on February 2nd, he did not see his shadow. Let’s all hope for an early spring while we stay vigilant for more bad weather. Super storms packed punches in the Midwest and Northeast to start the New Year and continue adding to the area’s already taxed weather relief efforts. While your business may not have been affected by the recent superstorms, it is a great wakeup call to think through how businesses should handle the employee relations and pay issues that arise when they are forced to close due to inclement weather and/or when employees simply cannot get to work due to transportation or personal difficulties.

What should an employer do? Pay employees to stay at home? After all, in most cases, they are not at work through no fault of their own. Many businesses, however, do not have the financial resources to pay employees not to work. What follows are the rules regarding paying employees who miss work due to Mother Nature, along with some practical tips. From an employee relations perspective, the more generous you can afford to be to your employees who are suffering as a result of a weather-related disaster, the better. Employees (and their families) do pay attention to how they are treated, and a little extra time off and compassion for individual circumstances can go a long way towards enhancing employee loyalty.

If the company has no power and sends employees home for the day, should they be paid? And does it matter if the employee is exempt or nonexempt?

In general, there are two sets of rules for paying employees depending upon their classification under the Fair Labor Standards Act (FLSA) as it relates to eligibility for overtime. With nonexempt employees (those eligible for overtime pay), there is no obligation under federal or state law to pay for time not worked. However, under certain state laws, employers may have an obligation to compensate nonexempt employees under call-in/reporting pay laws, especially if the employees were not advised that they should not report to work and were denied work upon arrival at the workplace.

These pay obligations vary by state. With respect to salaried exempt employees who must be paid on a “salary basis” under the FLSA, employers may not make salary deductions for absences that result from an employer’s partial-week closing of operations, including closings due to weather-related emergencies or disasters. The bottom line is that exempt employees must be paid their full salary if they perform any work in a workweek and only miss work time due to the employer’s closure of operations. Closures for a full workweek need not be paid if no work is performed.

Are these rules different if the company can tell the employee not to come to work the next day?

For nonexempt employees, if they are told in advance not to come to work and the employees stay home, then the employer is under no obligation to pay them for the time off. The employer and the employee can choose to use accrued paid time off to compensate the employee for the missed workdays.

For exempt employees, the “salary basis” rule still applies. In some cases the employee may be working from home during the bad weather days. If state laws permit employers to do so, employers may deduct from the exempt employees’ accrued paid time off balances to resolve the issues related to “salary basis” compliance. The employer should ensure, however, that these employees have not done any work from home during the office closure prior to deducting time from the accrued paid time off bank balances.

If an employee is on Family and Medical Leave Act (FMLA) leave, do those “bad weather days” count against the employee’s 12-week allotment of time off?

The FMLA regulations are silent about bad weather office closures. However, the regulations do allow for situations when the employer’s business stops operating for a period of time and employees are not expected to come to work (plants closing for a few weeks to retool, mandatory company-wide summer vacation, etc). In that case, the week the business is closed and no employees are reporting to work would not count against the employee’s FMLA leave entitlement. If the business is closed for a shorter period of time, the general thinking is that the FMLA regulations relating to holidays would likely apply. Under those rules, if the business is closed for a day or two during a week in which the employee is on FMLA leave, then the entire week would count against the employee’s FMLA leave entitlement. If, however, the employee is on intermittent FMLA leave, then only the days that the business is closed and the employee is expected to be at work would count against the leave entitlement.

How do we handle attendance issues where the office is open but public transportation is not available due to the weather and employees cannot come to work?

If the business remains open but employees cannot get to work because of the weather, employers will need to consider their own attendance policies and practices in determining what flexibility to give employees as it relates to attendance. Employers may encourage employees to car pool or assist them in establishing alternative methods of transportation to get to work.

Under the FLSA rules as it relates to pay, however, employers do not need to pay nonexempt employees if they perform no work. For exempt employees, if the business remains open but an employee cannot get to work because of the weather, an employer can deduct an exempt employee’s salary for a full day’s absence taken for personal reasons without jeopardizing the employee’s exempt status. Employers cannot, however, deduct an exempt employee’s salary for less than a full-day absence without jeopardizing the employee’s exempt status.

Does a company have to allow employees to work from home (exempt or nonexempt) if the office is closed due to bad weather?

No, the employer does not need to allow employee to work from home, regardless of their FLSA status (exempt or nonexempt). The employer can make those decisions based upon the work that can be done remotely and based on the needs of the business. The employer should have clearly communicated policies and expectations regarding working from home during office closures.

The bottom line is that every employer should think about the needs of the business, its financial resources, and employees’ needs and have plans in place to manage business issues due to inclement weather. Thinking through what the wage and hour laws require and developing your policies and then applying them consistently and fairly with all employees can reap huge dividends in employee loyalty and retention.