Proposals for Insurance Options That Don’t Comply with ACA Rules: Trade-offs In Cost and Regulation

Now in the fifth year of implementation, the Affordable Care Act (ACA) standards for non-group health insurance require health plans to provide major medical coverage for essential health benefits (EHB) with limits on deductibles and other cost sharing. In addition, ACA standards prohibit discrimination by non-group plans: pre-existing conditions cannot be excluded from coverage and eligibility and premiums cannot vary based on an individual’s health status. The ACA also created income-based subsidies to reduce premiums (premium tax credits, or APTC) and cost-sharing for eligible individuals who purchase non-group plans, called qualified health plans (QHPs), through the Marketplace. ACA-regulated non-group plans can also be offered outside of the Marketplace, but are not eligible for subsidies.

New: A look at the tradeoffs in costs and protections involved in four proposed health plan alternatives that would operate outside the ACA’s rules and regulations

Individual market premiums were relatively stable during the first three years of ACA implementation, then rose substantially in each of 2017 and 2018. Last year, nearly 9 million subsidy-eligible consumers who purchased coverage through the Marketplace were shielded from these increases; but another nearly 7 million enrollees in ACA compliant plans, who do not receive subsidies, were not. Bipartisan Congressional efforts to stabilize individual market premiums – via reinsurance and other measures – were debated in the fall of 2017 and the spring of 2018, but not adopted. Meanwhile, opponents of the ACA at the federal and state level have proposed making alternative plan options available that would be cheaper, in terms of monthly premiums, for at least some people because plans would not be required to meet some or all standards for ACA-compliant plans. This brief explains state and federal proposals to create a market for more loosely-regulated health insurance plans outside of the ACA regulatory structure.

Background

When ACA Marketplaces first opened in 2014, on average, the cost of the benchmark silver QHP was lower than many had predicted. Many insurers underpriced QHPs at the outset, either because they couldn’t accurately predict the cost of providing coverage to a new population under new ACA rules, or to aggressively compete for market share, or both. As a result, insurers offering ACA-compliant policies generally lost money in 2014-2016. In the fall of 2016, for the 2017 coverage year, most issuers implemented a substantial corrective premium increase for their benchmark QHP – on average, a 21% increase for a 40-year-old consumer. This increase, along with growing experience with new market rules, allowed many insurers to regain profitability in 2017, and, going forward, stabilization of QHP rates might otherwise have been expected.

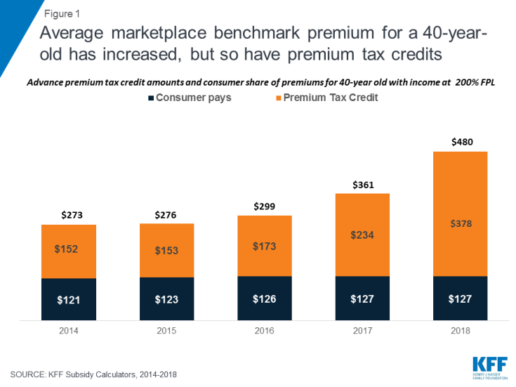

Instead, though, a new wave of uncertainty arose last year as Congress debated repeal of the ACA and as the Trump Administration threatened administrative actions with the stated intent of undermining the program, including by ending reimbursement to insurers for required cost-sharing reductions (CSRs) that, by law, they must offer low-income enrollees in silver QHPs. The value of CSRs was estimated by CBO to be $9 billion for 2018. To compensate for the lost reimbursement, most insurers significantly increased 2018 premiums for silver level QHPs, through which cost sharing subsidies are delivered. Largely due to this so-called “silver load” pricing strategy, the average benchmark silver QHP premium for a 40-year-old rose another 33% for the 2018 coverage year. (Figure 1) Premiums for bronze and gold plans rose more slowly, but still substantially given uncertainty on a number of issues, including whether the ACA’s individual mandate would be enforced.

https://bit.ly/2wctNPc

Figure 1: Average marketplace benchmark premium for a 40-year-old has increased, but so have premium tax credits

For consumers who are eligible for APTC and who buy the benchmark silver plan (or a less expensive plan) through the Marketplace, subsidies absorb annual premium increases and the net cost of coverage has remained relatively unchanged from 2014 through today. Roughly 85% of Marketplace participants in 2017 were eligible for APTC. (Figure 2) However, for the 15% of Marketplace participants who were not eligible for subsidies, and for another roughly 5 million individuals who bought ACA compliant plans outside of the Marketplace, these consecutive annual rate increases threatened to make coverage unaffordable. That threat was even greater in some areas, where 2018 QHP rate increases were much higher than the national average.

https://bit.ly/2joFWY4

Figure 2: Most in ACA-compliant plans are protected from rate increases by premium subsidies

Looking ahead, another round of significant premium increases is possible for the 2019 coverage year. A new source of uncertainty arose when Congress voted to end the ACA’s individual mandate penalty, effective in 2019. The Congressional Budget Office (CBO) estimated repeal of the mandate would fuel adverse selection – as some younger, healthier consumers might be more likely to forego coverage – and average premiums in the non-group market would increase by about 10 percent in most years of the decade, on top of increases due to other factors such as health care cost growth.

ACA opponents have argued QHP premium increases reflect a failure of the federal law. As an alternative, some have proposed different kinds of health plan options to offer premium relief to consumers who need non-group coverage but who are not eligible for premium subsidies, primarily by relaxing rules governing required benefits, coverage of pre-existing conditions, and/or community rating. These include:

Short-Term, Limited Duration Health Insurance Policies

In 2018 the Trump Administration proposed a new draft regulation that would promote the sale of short-term, limited duration health insurance policies that offer less expensive coverage because they are not subject to ACA market rules.

Short-term limited-duration health insurance policies (STLD), sometimes referred to as limited-duration non-renewable policies, are designed to provide temporary health coverage for people who are uninsured or are losing their existing coverage but expect to become eligible for other, more permanent coverage in the near future. Historically, people who have used these policies include graduating students losing coverage through their parents or their school, people with a short interval between jobs, or newly hired employee subject to a waiting period before they are eligible for coverage from their job. Because these policies are not intended to provide long-term protection (they generally cannot be renewed when their term ends), they are lightly regulated by states and are exempt from many of the standards generally applicable to individual health insurance policies. They also are specifically exempt under the ACA from federal standards for individual health insurance coverage, including the essential health benefits, guaranteed availability and prohibitions against pre-existing condition exclusions and health-status rating. These differences can make them considerably less expensive (for those healthy enough to qualify to buy them) than ACA compliant plans.

STLDs are similar to major medical policies in that they typically cover both hospitalization and at least some outpatient medical services, but unlike ACA-compliant policies, they often have significant benefit and eligibility limitations. STLD policies often either exclude are have significant limitations on benefits for mental health and substance abuse, do not have coverage for maternity services, and have limited or no coverage for prescription drugs. Policies also generally have dollar limits on all benefits or specific benefits and may have deductibles and other cost sharing that is much higher than permitted in ACA-compliant plans. Insurers of STLD policies typically use medically underwriting, which means that they can turn down applicants with health problems or charge them higher premiums. Policies also exclude coverage for any benefits related to a preexisting health condition: a backstop for insurers in case a person with a health problem otherwise qualifies for coverage and seeks benefits. Because STLD policies are not renewable, people who become ill after their coverage begins are generally not able to qualify for a new policy when their coverage term ends.

Due to their lower premiums, some people have been purchasing STLD policies instead of ACA compliant plans. This has happened even though STLD policies are not considered minimum essential coverage, which means that people who purchase them do not satisfy the ACA mandate to have health insurance and may be subject to a tax penalty. In 2016, CMS expressed concern about these policies being sold as a type of “primary health insurance” and issued regulations shortening the maximum coverage period under federal law for STLD policies from less than 12 months to less than three months and prescribing a disclosure that must be provided to new applicants. The intent of the regulation was to limit sale of these policies to situations involving a short gap in coverage and to discourage their use a substitute for primary health insurance coverage. The rule took effect for policies issued to individuals on or after January 1, 2017. In February 2018, the Trump Administration issued a new proposed regulation to reinstate the “less than 12 months” maximum coverage term for STLD policies. The preamble to the proposed regulation specified that this would provide more affordable consumer choice for health coverage. For more information about STLD policies, see this issue brief.

Extending the coverage period for STLD policies back to just under a year is likely to make them a more attractive choice for healthier individuals concerned about the cost of ACA-compliant plans. This is particularly true beginning in 2019 when the individual mandate penalty ends and purchasers will no longer need to pay a penalty in addition to the premiums for these policies.

Under the ACA framework, STLD plans may provide a lower-cost alternative source of health coverage for people in good health. With ACA policies as a backup, people who purchase STLD policies and develop a health problem would not be able to renew their short-term policy at the end of its term, but would be able to elect an ACA-compliant plan during the next open enrollment.

It is possible, as one estimate concluded, that more healthy individual market participants may switch to short-term policies as a result. Such “adverse selection” would raise the average cost of covering remaining individuals in ACA-compliant plans, leading to further premium increases in those policies. For people with pre-existing conditions who do not qualify for subsidies, the rising cost of ACA-compliant coverage could challenge affordability, especially for people with pre-existing conditions who have incomes that make them ineligible for premium subsidies.

Association Health Plans

Another draft regulation proposed by the Trump Administration would permit small employers and self-employed individuals to buy a new type of association health plan coverage that does not have to meet all requirements applicable to other ACA-compliant small group and non-group health plans. While many types of health insurance are marketed though associations, including STLDs, hospital indemnity plans and cancer or other dread disease policies, current policy discussions about AHPs tend to focus on arrangements formed by groups of employers (called multiple employer welfare arrangements, or MEWAs) which could also offer group health insurance coverage to self-employed people without any employees (“sole proprietors”).

The U.S. Department of Labor recently proposed regulations under the Employee Retirement Income Security Act (ERISA) to expand the types of MEWAs that could offer health plans that would not be subject to certain ACA requirements. Under the draft regulation, AHPs – a type of MEWA – could offer health coverage to sole proprietors and to small businesses, but would be subject to large group health plan standards. Key ACA requirements for the non-group and small group market do not apply to large group health plans today, and so would not apply to AHP coverage sold to self-employed individuals or small employers. In particular, AHPs would not be required to cover essential health benefits; it would be possible under the proposed regulation for AHPs to offer policies that do not cover prescription drugs, for example.

Under the draft regulation, AHPs would be subject to a nondiscrimination standard that would prohibit basing eligibility or premiums on an enrollee’s health status. However, other ACA rating standards in the non-group and small group market would not apply; in particular, AHPs would be allowed to vary premiums by more than 3:1 for age and without limit based on gender, geography, and other factors such type of industry or occupation.

As a result, AHPs could provide self-employed individuals an alternative to individual health insurance that provides fewer benefits with more rating flexibility. As nearly one-third (31%) of individual market enrollees are self-employed, the impact of AHPs could be significant.

The draft regulation included other language related to state vs. federal regulatory authority over MEWAs, or AHPs. Currently, MEWAs are subject to a somewhat complex mix of regulatory provisions at the federal and state levels; the applicable standards vary depending on a number of things, including whether the MEWA is self-funded or provides benefits through insurance, whether the arrangement itself is considered to be sponsoring an employee benefit plan as defined in ERISA, the sizes of the employers participating in the arrangement, and how the states in which the arrangements operate approach MEWA regulation. The proposed rule generally leaves in place state authority over MEWAs/AHPs. However, the DOL requested comments on whether it should consider changes that would limit state regulation of self-funded AHPs to financial matters such as solvency and reserves, in effect, prohibiting states from regulating AHP rating and benefit design practices.

The degree of impact on individual health insurance markets will depend in part on the final rules, in particular whether the nondiscrimination provision is preserved and whether states retain current authority over AHPs.

Idaho Proposal for New State-Based Health Plans

In January 2018, pursuant to an executive order by Governor Otter, the Idaho Department of Insurance issued a bulletin outlining provisions of new individual health insurance products that insurance companies would be permitted to sell under state law. The new “State-Based Health Benefit Plans” would not have to comply with certain ACA requirements and, as a result, would likely be offered for premiums lower than those charged for ACA-compliant policies – at least for consumers who are younger and who don’t have pre-existing conditions.

State-Based Health Plans would be required to cover a package of health benefits and cost sharing that was less than that required for ACA-compliant plans. For example, certain essential health benefit categories, such as habilitation services and pediatric dental and vision, appear not to be required. In addition, ACA limits on cost sharing were not specified, and annual dollar limits on covered benefits could be applied. If consumers reach the annual dollar limit on coverage under a state-based plan, the insurer would be required to transfer their enrollment into an ACA-compliant plan.

In addition, state-based plans would not be allowed to deny applicants based on health status and could be sold year round, outside of Open Enrollment. However, State-Based plans could exclude coverage of pre-existing conditions for any individual who had experienced at least a 63-day break in coverage. These plans would also be permitted to vary premiums by a factor of 3:1 based on health status (prohibited by the ACA), and by 5:1 based on age (higher than the 3:1 ratio permitted by the ACA). In order to offer a State-Based Health Plan, insurers would also be required to offer at least one QHP through the Idaho Marketplace.

The bulletin required that state-based plans and exchange-certified plans must comprise a single risk pool, with a single index rate for all plans that does not account for differences in the health status of individuals who enroll, or are expected to enroll in a particular type of plan. However, the Academy of Actuaries noted that, because the two types of plans would not be competing under the same rules, “there would be, in effect, two risk pools – one for ACA coverage and one for state-based coverage. Premiums for ACA coverage would increase, threatening sustainability of the ACA market and its pre-existing condition protections.”

The Idaho State-Based Health Plan proposal is similar in many respects to an amendment offered by Senator Ted Cruz during the ACA repeal debate in 2017. The amendment, which was not enacted, would have allowed insurers that sell ACA-compliant marketplace plans to also offer other policies that could be medically underwritten and that would not have to meet other ACA standards. Although CBO did not estimate how the amendment would impact premiums or coverage, representatives of the insurance industry predicted that, “As healthy people move to the less-regulated plans, those with significant medical needs will have no choice but to stay in the comprehensive plans, and premiums will skyrocket for people with preexisting conditions. This would especially impact middle-income families that that are not eligible for a tax credit.”

The Idaho proposal appears to be not moving forward at this time. Recently, the director of the federal Center on Medicare and Medicaid Services (CMS) advised Idaho officials that these State-Based health plans would be in violation of federal law. Under the ACA, states do not have flexibility to authorize the sale of individual health insurance policies that do not meet federal minimum standards. In states that do not enforce federal minimum standards, the federal government is required to step in and enforce.

The CMS letter did generally express sympathy with Idaho’s approach, citing “damage caused by the [ACA],” and encouraged the state to pursue modified strategies to expand availability of more affordable plans that do not meet all ACA requirements. The letter specifically urged Idaho to consider promoting short-term policies as a legal alternative to ACA-compliant health plans, and it invited the State to develop other alternative strategies using ACA state waiver authority.

Farm Bureau Health Plans Exempt from State Regulation

A new Iowa law enacted this month would permit the sale of health coverage by the state’s Farm Bureau. The Farm Bureau is not a licensed health insurer. Under the new law, Farm Bureau health plans would be deemed to not be insurance and explicitly would not be subject to state insurance regulation. By extension, Farm Bureau plans also would not have to meet federal ACA standards for health insurance as these apply only to policies sold by state licensed health insurers.

The new Iowa law applies no other standards for Farm Bureau health plans – for example, it does not establish minimum benefit requirements, rating requirements, or rules prohibiting discrimination based on pre-existing health conditions. Appeal rights guaranteed to health insurance policyholders also would not apply to Farm Bureau enrollees, nor would state insurance solvency and other financial regulations. The law does require the Farm Bureau to administer coverage through a state licensed third party administrator, or TPA (expected to be Wellmark, Iowa’s Blue Cross Blue Shield insurer.) However, use of a TPA does not extend federal or state insurance law to the underlying Farm Bureau health plan.

The Iowa law closely resembles a Tennessee state law, enacted in 1993, which authorized the sale of health coverage by the Farm Bureau and deemed such coverage not to be health insurance subject to state regulation. In Tennessee, it has been reported that roughly 25,000 residents purchase non-group Farm Bureau health plans that are medically underwritten. (By comparison, more than 228,000 residents have ACA-compliant individual policies through the Marketplace this year.) Farm Bureau plan premiums can be as much as two-thirds lower than for ACA-compliant plans because the underwritten policies can and do deny coverage to people with pre-existing conditions. Adverse selection results, with sicker residents confined to the ACA-regulated market. An analysis of risk scores for state insurance markets finds that Tennessee’s individual market has one of the highest risk scores in the nation.

Since 2014, Tennessee residents who buy underwritten Farm Bureau health coverage are not considered to have “minimum essential coverage” and so may owe a tax penalty under the ACA individual mandate. However, this disincentive to purchase Farm Bureau plans in Tennessee and Iowa will end in 2019 when repeal of the mandate penalty takes effect.

Discussion

Each of these proposals follows a similar theme. Creating parallel insurance markets with different, lesser consumer protections, allows insurers to offer lower premiums and less coverage to people while they are healthy, leaving the ACA-regulated market with a sicker pool and higher premiums. Once repeal of the ACA individual mandate penalty takes effect in 2019, the net cost differential between regulated and less-regulated coverage will be even greater.

Premium subsidies in the ACA-regulated market will help to curb adverse selection, protecting people with lower incomes from the impact of higher premiums, and providing some continued stability in the reformed market. However, middle-income people who are not eligible for subsidies, and who have pre-existing conditions, will not have any meaningful new coverage choices under these proposals. Instead, the cost of health insurance that covers essential benefits and their pre-existing conditions will increase, potentially further pricing them out of affordable coverage altogether.

Source:

Pollitz K. (18 April 2018). "Proposals for Insurance Options That Don’t Comply with ACA Rules: Trade-offs In Cost and Regulation" [web blog post]. Retrieved from address https://kaiserf.am/2w89S3Z

Individual Insurance Market Performance in Late 2017

In this article from the Kaiser Family Foundation, we will take a look at the individual insurance market performance as of late 2017. This is a great article for employers to get the low down on how to understand and read performance charts, as well as prepare for any instability in the next quarter.

Concerns about the stability of the individual insurance market under the Affordable Care Act (ACA) have been raised in the past year following exits of several insurers from the exchange markets, and again with renewed intensity in recent months during the debate over repeal of the health law. Our earlier analysis of first quarter financial data from 2011-2017 found that insurer financial performance indeed worsened in 2014 and 2015 with the opening of the exchange markets, but showed signs of improving in 2016 and stabilizing in 2017 as insurers began to regain profitability.

In this brief, we look at recently-released third quarter financial data from 2017 to examine whether recent premium increases were sufficient to bring insurer performance back to pre-ACA levels. These new data from the first nine months of 2017 offer further evidence that the individual market has been stabilizing and insurers are regaining profitability, even as political and policy uncertainty and the repeal of the individual mandatepenalty as part of tax reform legislation cloud expectations for 2018 and beyond.

Third quarter financial data reflects insurer performance in 2017 through September, before the Administration ceased payments for cost-sharing subsidies effective October 12, 2017. The loss of these payments during the fourth quarter of 2017 will diminish insurer profits, but nonetheless, insurers are likely to see better financial results in 2017 than they did in earlier years of the ACA Marketplaces.

We use financial data reported by insurance companies to the National Association of Insurance Commissioners and compiled by Mark Farrah Associates to look at the average premiums, claims, medical loss ratios, gross margins, and enrollee utilization from third quarter 2011 through third quarter 2017 in the individual insurance market.1 Third quarter data is year-to-date from January 1 – September 30. These figures include coverage purchased through the ACA’s exchange marketplaces and ACA-compliant plans purchased directly from insurers outside the marketplaces (which are part of the same risk pool), as well as individual plans originally purchased before the ACA went into effect.

Medical Loss Ratios

As we found in our previous analysis, insurer financial performance as measured by loss ratios (the share of health premiums paid out as claims) worsened in the earliest years of the Affordable Care Act Marketplaces, but began to improve more recently. This is to be expected, as the market had just undergone significant regulatory changes in 2014 and insurers had very little information to work with in setting their premiums, even going into the second year of the exchange markets.

Loss ratios began to decline in 2016, suggesting improved financial performance. In 2017, following relatively large premium increases, individual market insurers saw significant improvement in loss ratios, averaging 81% through the third quarter. Third quarter loss ratios tend to follow the same pattern as annual loss ratios, but in recent years have been lower than annual loss ratios.2 Though 2017 annual loss ratios are likely to be impacted by the loss of cost-sharing subsidy payments during the last three months of the year, this is nevertheless a sign that individual market insurers on average were beginning to stabilize in 2017.

Margins

Another way to look at individual market financial performance is to examine average gross margins per member per month, or the average amount by which premium income exceeds claims costs per enrollee in a given month. Gross margins are an indicator of performance, but positive margins do not necessarily translate into profitability since they do not account for administrative expenses. As with medical loss ratios, third quarter margins tend to follow a similar pattern to annual margins, but generally look more favorable as enrollees are still paying toward their deductibles in the early part of the year, lowering claims costs for insurers.

Looking at gross margins, we see a similar pattern as we did looking at loss ratios, where insurer financial performance improved dramatically through the third quarter of 2017 (increasing to $79 per enrollee, from a recent third quarter low of $10 in 2015). Again, third quarter data tend to indicate the general direction of the annual trend, and while annual 2017 margins are unlikely to end as high as they are in the third quarter, these data suggest that insurers in this market are on track to reach pre-ACA individual market performance levels.

Underlying Trends

Driving recent improvements in individual market insurer financial performance are the premium increases in 2017 and simultaneous slow growth in claims for medical expenses. On average, premiums per enrollee grew 17% from third quarter 2016 to third quarter 2017, while per person claims grew only 4%.

Figure 3: Average Third Quarter Individual Market Monthly Premiums and Claims Per Person, 2011 – 2017

One concern about rising premiums in the individual market was whether healthy enrollees would drop out of the market in large numbers rather than pay higher rates. While the vast majority of exchange enrollees are subsidized and sheltered from paying premium increases, those enrolling off-exchange would have to pay the full increase. As average claims costs grew very slowly through the third quarter of 2017, it does not appear that the enrollees today are noticeably sicker than last year.

On average, the number of days individual market enrollees spent in a hospital through the third quarter of 2017 was similar to third quarter inpatient days in the previous two years. (The third quarter of 2014 is not necessarily representative of the full year because open enrollment was longer that year and a number of exchange enrollees did not begin their coverage until mid-year 2014).

Figure 4: Average Third Quarter Individual Market Monthly Hospital Patient Days Per 1,000 Enrollees, 2011 – 2017

Taken together, these data on claims and utilization suggest that the individual market risk pool is relatively stable, though sicker on average than the pre-ACA market, which is to be expected since people with pre-existing conditions have guaranteed access to coverage under the ACA.

Discussion

Third quarter results from 2017 suggest the individual market was stabilizing and insurers in this market were regaining profitability. Insurer financial results as of the third quarter 2017 – before the Administration’s decision to stop making cost-sharing subsidy payments and before the repeal of the individual mandate penalty in the tax overhaul – showed no sign of a market collapse. Third quarter premium and claims data from 2017 support the notion that 2017 premium increases were necessary as a one-time market correction to adjust for a sicker-than-expected risk pool. Although individual market enrollees appear on average to be sicker than the market pre-ACA, data on hospitalizations in this market suggest that the risk pool is stable on average and not getting progressively sicker as of late 2017. Some insurers have exited the market in recent years, but others have been successful and expanded their footprints, as would be expected in a competitive marketplace.

While the market on average is stabilizing, there remain some areas of the country that are more fragile. In addition, policy uncertainty has the potential to destabilize the individual market generally. The decision by the Administration to cease cost-sharing subsidy payments led some insurers to leave the market or request larger premium increases than they would otherwise. A few parts of the country were thought to be at risk of having no insurer on exchange, though new entrants or expanding insurers have since moved in to cover all areas previously at risk of being bare. Signups through the federal marketplace during the recently completed open enrollment period were higher than many expected, which could help to keep the market stable. However, continued policy uncertainty and the repeal of the individual mandate as part of tax reform legislation complicate the outlook for 2018 and beyond.

Methods

We analyzed insurer-reported financial data from Health Coverage Portal TM, a market database maintained by Mark Farrah Associates, which includes information from the National Association of Insurance Commissioners. The dataset analyzed in this report does not include NAIC plans licensed as life insurance or California HMOs regulated by California’s Department of Managed Health Care; in total, the plans in this dataset represent at least 80% of the individual market. All figures in this data note are for the individual health insurance market as a whole, which includes major medical insurance plans sold both on and off exchange. We excluded some plans that filed negative enrollment, premiums, or claims and corrected for plans that did not file “member months” in the third quarter but did file third quarter membership.

To calculate the weighted average loss ratio across the individual market, we divided the market-wide sum of total incurred claims by the sum of all health premiums earned. Medical loss ratios in this analysis are simple loss ratios and do not adjust for quality improvement expenses, taxes, or risk program payments. Gross margins were calculated by subtracting the sum of total incurred claims from the sum of health premiums earned and dividing by the total number of member months (average monthly enrollment) in the individual insurance market.

Source:

Cox C., Semanskee A., Levitt L. (4 January 2018). "Individual Insurance Market Performance in Late 2017" [web blog post]. Retrieved from address https://www.kff.org/health-reform/issue-brief/individual-insurance-market-performance-in-late-2017/

More than Half of Uninsured People Eligible for Marketplace Insurance Could Pay Less for Health Plan than Individual Mandate Penalty

Things are not looking up for the uninsured. Pay less and reach out to your health insurance professionals today. Want more facts? Check out this blog article from Kaiser Family Foundation.

A new Kaiser Family Foundation analysis finds that more than half (54% or 5.9 million) of the 10.7 million people who are uninsured and eligible to purchase an Affordable Care Act marketplace plan in 2018 could pay less in premiums for health insurance than they would owe as an individual mandate tax penalty for lacking coverage.

Within that 5.8 million, about 4.5 million (42% of the total) could obtain a bronze-level plan at no cost in 2018, after taking income-related premium tax credits into account, the analysis finds.

Most people without insurance who are eligible to buy marketplace coverage qualify for subsidies in the form of tax credits to help pay premiums for marketplace plans (8.3 million out of 10.7 million). Among those eligible for premium subsidies, the analysis finds that 70 percent could pay less in premiums than what they’d owe as a tax penalty for lacking coverage, with 54 percent able to purchase a bronze plan at no cost and 16 percent contributing less to their health insurance premium than the tax penalty they owe.

Among the 2.4 million uninsured, marketplace-eligible people who do not qualify for a premium subsidy, 2 percent would be able to pay less for marketplace insurance than they’d owe for their 2018 penalty, the analysis finds.

The Affordable Care Act’s individual mandate requires that most people have health coverage or be subject to a tax penalty unless they qualify for certain exemptions. The individual mandate is still in effect, though Congress may consider repealing it as part of tax legislation.

Consumers can compare their estimated 2018 individual mandate penalty with the cost of marketplace insurance in their area with KFF’s new Individual Mandate Penalty Calculator.

The deadline for ACA open enrollment in most states is Dec. 15, 2017.

You can read the original article here.

Source:

Kaiser Family Foundation (9 November 2017). "ANALYSIS: More than Half of Uninsured People Eligible for Marketplace Insurance Could Pay Less for Health Plan than Individual Mandate Penalty" [Web blog post]. Retrieved from address https://www.kff.org/health-reform/press-release/analysis-more-than-half-of-uninsured-people-eligible-for-marketplace-insurance-could-pay-less-for-health-plan-than-individual-mandate-penalty/

The 3 biggest ACA requirements you still have to worry about

Original post hrmorning.com

Congratulations … you’ve survived the vast majority of the Affordable Care Act’s (ACA) requirements. But your compliance headaches aren’t over yet. What Obamacare regulations are still slated to kick in?

No. 1: Reporting requirements

When: Feb. 29, 2016 (March 31 if filing electronically). The deadline for future year’s returns will be Feb. 28.

What: This is what’s taking up the majority of employers’ attention right now. The ACA’s reporting requirements kick in for the first time in 2016. These are the requirements that make the government’s enforcement of the employer mandate possible.

The information that must be reported will allow the IRS to determine whether “large employers” are meeting the ACA’s requirements to offer full-time workers with adequate, company-sponsored health insurance — and, thus, whether those employers should be hit with shared responsibility penalties.

The requirements are complicated (here’s our plain-English breakdown), and employers haven’t had a lot of time to mull them over, so it’s understandable that they’ve taken companies’ attention away from what else is coming down the road.

But it’s crucial that employers remember there are two more key ACA provisions still to come.

No. 2: The ‘Cadillac tax’

When: Jan. 1, 2018.

What: Beginning in 2018, employer sponsored health plans — whether self-insured or not — will be subject to a 40% excise tax on the “value” (translation: premiums) of any healthcare coverage that exceed $10,200 for single coverage or $27,000 for family coverage.

Those figures will be adjusted for inflation. But as most of you know, the speed at which healthcare costs are increasing in this country far exceeds the rate of inflation. As a result, it’s expected to only be a few short years before even average healthcare plans are slapped with this so-called “Cadillac tax“.

As a result, there’s a huge push from certain parts of Congress, and even from business groups, to repeal the tax.

Will those efforts succeed? Right now, it’s anyone’s guess.

One prediction: If the tax does get repealed, it likely won’t be until much closer to its implementation. Why? There are two factors at play:

- The old kick-the-can-down-the-road-mentality on Capitol Hill, and

- The upcoming presidential election.

For starters, the implementation is still a couple of years away, so it may not be early enough for lawmakers to feel like their feet are being held to the fire to act. Also, the tax hasn’t really entered the public eye, yet, so most voters don’t know how it’ll affect them. As a result, election officials don’t feel compelled to act just yet.

On top of all that, the presidential election really complicates matters. Political candidates may not want to bring up the subject, fearing their stance on it may cost them votes or draw attention away from other, larger parts of their campaign platforms. That means the issue may not truly surface until after the next administration takes office in 2017.

No. 3: Nondiscrimination requirements

When: To be determined … still.

What: When the ACA first became law, the feds said it would subject group health plans to nondiscrimination rules similar to those that apply to self-insured group health plans. Under these ACA rules, any generous healthcare coverage offered to current or former executives — referred to as highly compensated employees — that isn’t available to the bulk of employees will trigger big penalties from the feds.

The problem is, the feds said the rules wouldn’t apply until official guidance had been released about them. So the feds have kept employers waiting and searching for the guidance. It was expected to finally be released in 2014, but it was delayed due to some lingering questions IRS officials had.

Federal agencies have informally suggested these nondiscrimination rules aren’t a top priority, so they still haven’t given any clues as to when the rules may be issued. Therefore, it appears they’re not imminent.

It’s possible this is another issue that may not be tackled until a new administration has taken office.

What employers did get, however, is a completely different set of nondiscrimination rules — in proposed, not finalized, form. They look to snuff out all forms of race, sex, color, national origin, age and/or disability discrimination in the health insurance marketplace.

While some of these forms of discrimination had already been banned under the PPACA, the new rules further clarify and strengthen protections for individuals. For example, the proposed rule establishes that the prohibition on sex discrimination includes discrimination based on gender identity. Discrimination on the basis of sexual orientation would also be barred.

These nondiscrimination rules aren’t expected to take effect until well into 2016, although not official date has been established.

How Many Employers Could be Affected by the Cadillac Plan Tax?

Originally posted by Gary Claxton and Larry Levitt on August 25, 2015 on kff.org.

As fall approaches, we can expect to hear more about how employers are adapting their health plans for 2016 open enrollments. One topic likely to garner a good deal of attention is how the Affordable Care Act’s high-cost plan tax (HCPT), sometimes called the “Cadillac plan” tax, is affecting employer decisions about their health benefits. The tax takes effect in 2018.

The potential of facing an HCPT assessment as soon as 2018 is encouraging employers to assess their current health benefits and consider cost reductions to avoid triggering the tax. Some employers announced that they made changes in 2014 in anticipation of the HCPT, and more are likely to do so as the implementation date gets closer. By making modifications now, employers can phase-in changes to avoid a bigger disruption later on. Some of the things that employers can do to reduce costs under the tax include:

- Increasing deductibles and other cost sharing;

- Eliminating covered services;

- Capping or eliminating tax-preferred savings accounts like Flexible Spending Accounts (FSAs), Health Savings Accounts (HSAs), or Health Reimbursement Arrangements (HRAs);

- Eliminating higher-cost health insurance options;

- Using less expensive (often narrower) provider networks; or

- Offering benefits through a private exchange (which can use all of these tools to cap the value of plan choices to stay under the thresholds).

For the most part these changes will result in employees paying for a greater share of their health care out-of-pocket.

In addition to raising revenue to fund the cost of coverage expansion under the ACA, the HCPT was intended to discourage employers from offering overly-generous benefit plans and help to contain health care spending. Health benefits offered through work are not taxed like other compensation, with the result that employees may receive tax benefits worth thousands of dollars if they get their health insurance at work. Economists have long argued that providing such tax benefits without a limit encourages employers to offer more generous benefit plans than they otherwise would because employees prefer to receive additional benefits (which are not taxed) in lieu of wages (which are). Employees with generous plans use more health care because they face fewer out-of-pocket costs, and that contributes to the growth in health care costs.

The HCPT taxes plans that exceed certain cost thresholds beginning in 2018. The 2018 thresholds are $10,200 for self-only (single) coverage and $27,500 for other than self-only coverage, and after that they generally increase annually with inflation. The amount of the tax is 40 percent of the difference between the total cost of health benefits for an employee in a year and the threshold amount for that year.

While the HCPT is often described as a tax on generous health insurance plans, it actually is calculated with respect to each employee based on the combination of health benefits received by that employee, and can be different for different employees at the same employer and even for different employees enrolled in the same health insurance plan. While final regulations have not yet been issued, the cost for each employee generally will include:

- The average cost for the health insurance plan (whether insured or self-funded);

- Employer contributions to an (HSA), Archer medical spending account or HRA;

- Contributions (including employee-elected payroll deductions and non-elective employer contributions) to an FSA;

- The value of coverage in certain on-site medical clinics; and

- The cost for certain limited-benefit plans if they are provided on a tax-preferred basis.

The inclusion of FSAs here is important. FSAs generally are structured to allow employees the opportunity to divert some of their pay to pretax health benefits, which means that they can avoid payroll and income taxes on money they expect to use for health care. Employees often are permitted to elect any amount of contribution up to a cap (which is $2,550 in 2015), which means that the amount of benefits for an employee subject to the HCPT in a year could vary depending on their FSA election.

The amount and structure of the HCPT provide a strong incentive for employers to avoid hitting the thresholds. The tax rate of 40 percent is high relative to the tax that many employees would pay if the benefits were merely taxed like other compensation, and the ACA does not allow the taxpayers (e.g., the employer) to deduct the tax as a cost of doing business, which can significantly increase the tax incidence for for-profit companies. Further, to avoid the perception that this was a new tax on employees, the HCPT was structured as a tax on the service providers of the health benefit plans providing benefits an employee: insurers in the case of insured health benefit plans; employers in the case of HSAs and Archer MSAs; and the person that administers the benefits, such as third party administrators, in the case of other health benefits. While it is generally expected that insurers and service providers will pass the cost of the tax back to the employer, doing so may not always be straightforward. Because there can be numerous service providers with respect to an employee, the excess amount must be allocated across providers. In some cases, it may not be possible to know whether or not the benefits provided to an employee will exceed the threshold amount until after the end of a year (for example, in the case of an experience-rated health insurance plan), which means that service providers may need to bill the employer retroactively for the cost of the tax they must pay. Amounts that employers provide to reimburse service providers for the HCPT create taxable income for the service provider, which the parties will want to account for in the transaction. The IRS has requested comments on potential methods for determining tax liability among benefit administrators, including a way that could assign the responsibility to the employer in cases other that insured benefit plans. The proposed approach could simplify administration of the tax.

To read the full story go to the Kaiser Family Foundation website at kff.org.

Understanding Exchanges Still a Struggle for Consumers

Source: https://www.benefitspro.com

By Kathryn Mayer

Yet another poll is out underscoring one of the main concerns over health reform — that consumers just don’t get it.

According to this survey, released Thursday by InsuranceQuotes.com, 90 percent of Americans don’t know when the new health insurance exchanges will open.

A major component of the Patient Protection and Affordable Care Act, the new health insurance exchanges will be available for online and telephone enrollments beginning Oct. 1. Coverage begins on Jan. 1, 2014. Exchanges are intended to give families and small-business owners accurate information to make apples-to-apples comparisons of private insurance plans and get financial help to make coverage more affordable if they’re eligible.

The exchanges are a core component of the individual mandate that will require all Americans to obtain health insurance or pay a fine. As a result, tens of millions of previously uninsured Americans are expected to gain access to health insurance.

The survey of roughly 1,000 U.S. adults found that 40 percent expect health reform to have a major effect on their lives, while 39 percent think the law will have a minor effect and 19 percent expect no effect.

The survey found that Americans were more knowledgeable about other aspects of health reform. For instance, 73 percent correctly answered that health plans cannot deny coverage based on preexisting health conditions. And 66 percent accurately said that health plans must extend coverage to dependent children up to age 26. Those two provisions have been among the most popular.

Still, insurance experts say having only some knowledge isn’t enough.

“A lot of people need to study up on health care reform and what it means to them,” said Laura Adams, senior insurance analyst at InsuranceQuotes.com. “We found a very inconsistent understanding of the Affordable Care Act, and we fear that many people will miss key deadlines and benefits because they don’t adequately understand the new law.”

Uninformed consumers who are unaware of what the exchanges do and what health reform means for them has been a huge hurdle of PPACA. It’s something that government officials are working to alleviate. In January, The Department of Health and Human Services relaunched healthcare.gov, a website aimed at informing consumers about the health reform law while giving them a place to purchase insurance.

In total, 39 percent of Americans said they are somewhat knowledgeable about PPACA, 28 percent said they aren’t too knowledgeable, 21 percent said they aren’t at all knowledgeable and only 10 percent said they are very knowledgeable.

The survey was conducted March 7-10 by telephone by Princeton Survey Research Associates International.

States get more time on exchanges

Source: benefitspro.com

By: Kathryn Mayer

The Obama administration is giving states extra time to decide whether they’ll work on implementing a key feature of health reform.

Health and Human Services Secretary Kathleen Sebelius told state governors in a letter Friday that they can have another three months to decide if they will split the task of running an exchange with the HHS or if they want to leave it entirely up to the government.

Sebelius said she still wants states to tell HHS their intentions by the original Nov. 16 deadline, but they now have until Dec. 14 to submit blueprints showing how they would operate the exchanges. Those who want to partner with the federal government have until Feb. 15 to tell the federal government so.

The move may be a concession to the many states who had said they were waiting until after the presidential election to comply with the PPACA mandates. Many Republicans and opponents of reform hoped that Republican Mitt Romney would win and begin work on repealing the law.

Under the Patient Protection and Affordable Care Act, exchanges would operate in every state to allow individuals to buy health insurance. Exchanges can be run by individual states, by the federal government or by a combination of the two under an arrangement known as a “state partnership exchange.” The exchanges are scheduled to begin operating on Jan. 1, 2014.

“This Administration is committed to providing significant flexibility for building a marketplace that best meets your state's needs,” Sebelius wrote in her Nov. 9 letter. “We intend to issue further guidance to assist you in the very near future.”

Though the law intended that each state run its own exchange, many governors have refused to do so. Others have complained there hasn’t been enough guidance from the government on how to do so. For those that don’t intend to set up an exchange, the government will set up one for them.

Despite the looming deadline, most states haven’t told the government what their plans are for their state exchange. About 15 states are working on setting up their own.

Since last week's election, a handful of states, including Texas and Florida, have said they will not pursue a state-based exchange. Some conservative groups have been encouraging states to not take action on exchanges, telling them that resistance shows the government their dissatisfaction with health reform.

Small business owners have poor grasp of health reform

Source: https://eba.benefitnews.com

By Health Data Management

A survey by online health benefits seller eHealthInsurance of 439 small business clients finds most do not understand applicable provisions of the Affordable Care Act.

The act requires employers with 50 or more full-time employees to provide coverage. Only two of the surveyed clients were large enough to fall under the requirement, yet 34% believed they had to provide coverage, and another 35% didn’t know. Thirty-one percent correctly knew that they were not required to pay a tax if they did not offer insurance because of the size of their business.

More than three-quarters of surveyed small businesses were not familiar with reform-mandated insurance exchanges, designed to be one-stop shopping sites for health benefits for employees and those who don’t have work-related benefits.

Sixty-eight percent of surveyed employers have no plans to drop coverage for employees in 2014, 29% would consider dropping coverage and 3% expect to drop it.

More than three-quarters of respondents are not doing long-term planning on how health reform, including insurance exchanges, may affect their business. In addition, 51% would consider increasing employees’ share of premium costs and 39% would consider increasing the deductible. More results are available here.

Not as Simple as Paying or Playing

By Jenny Ivy

With roughly half of employers saying they'll definitely be offering health coverage even after insurance exchanges begin, speculating with certainty (a bit of an oxymoron) that it's only a matter of time before companies drop health coverage is a futile argument.

Likewise, it's fair to say that there are several legitimate reasons for companies (particularly the bigger ones) to keep offering coverage, but we're only assuming the status quo won't change dramatically once health reform is in full effect. All you have to do is look at the numbers that are already dropping, and dropping hard. [See: Reform driving up health plan costs]

Studies, including the one released last week by Towers Watson and the National Business Group on Health, show there is a commitment among employers to do what they can to keep offering coverage in the near-term. Beyond 10 years, however, is when things get debatable. According to their employer survey, only 3 percent of employers are somewhat to very likely to discontinue health care plans for active employees in 2014 or 2015 without providing a financial subsidy. By the same measure, 45 percent of employers are somewhat to very likely to offer coverage to only a portion of their work force and direct the others to the exchanges.

While most employers will remain focused on sponsoring the design and delivery of their health care programs through 2015 (77 percent), they are much less confident that health care benefits will be offered at their organization over the longer term. Less than one in four (23 percent) companies are very confident they'll continue to offer health care benefits 10 years from now, down from a peak of 73 percent in 2007.

Unless there's a revolutionary way of delivering health insurance, employers will be circulating through all the options to combat high health care costs. The Towers Watson/NBGH survey shows health care costs per employee are expected to rise 5.9 percent this year, as compared to 5.4 percent in 2011. Health care costs per employee averaged $10,982 last year, and is expected to rise to $11,664 in 2012. Employees’ share of costs increased 9.3 percent during this period, to $2,764. This amount represents a 40 percent increase in costs from just five years ago, as compared to a 34 percent increase for employers over the same time period.

“As employers try to maintain the balance between containing costs and offering competitive total rewards packages, they are realizing that their future health care benefit choices are not quite as simple as ‘paying or playing,’” says Ron Fontanetta, senior health care consulting leader at Towers Watson. “In fact, there is a wide spectrum of design choices that will allow employers to develop a health care strategy that matches their unique objectives and workforce demographics.”

Besides actually cultivating healthier employees, the survey shows there are several emerging tactics they plan to use to control their costs:

- Spousal and dependent coverage surcharges: Roughly half of the companies (47 percent) increased employee contributions in tiers with dependent coverage, and about a quarter (24 percent) are using spousal surcharges, with another 13% planning to do so next year.

- Growth in Account-Based Health Plans (ABHPs): Nearly one in six companies (59 percent) are offering an ABHP today, and another 11 percent plan to do so by 2013. ABHP enrollment has nearly doubled in the last two years, from 15 percent in 2010 to 27 percent in 2012.

- Changing pharmacy landscape: Six in 10 companies have added or expanded step therapy or prior authorization programs, and 21 percent reduced pharmacy copays last year for those using a generic with a chronic condition (with another 16 percent planning to add this feature in 2013).

- Vendor management and transparency: Three in 10 companies (30 percent) have consolidated their health plan vendors in the past two years, and 11 percent plan to do so next year.