Eligibility, lack of plans keep millennials from retirement saving

As millennials reach the age to save for retirement, there is a clear lack-of-knowledge in the arena of what plans they need and how to save for them with the continuing costs of their lifestyles. In this article, we take a look at why this is.

Millennials are way behind on retirement savings, but it has nothing to do with self-indulgence or feasts on avocado toast.

Instead, what they actually need are retirement plans, and earlier eligibility to save in them.

A new report from the National Institute of Retirement Security highlights millennials’ precarious retirement futures with the news that only a third are saving for retirement. It’s not because they don’t want to, or are being extravagant, because when the numbers are crunched they actually save at rates equal to or higher than those of their elders—even if not as many of them can do so.

Millennials are getting a raw deal. Not only are traditional defined benefit plans disappearing, with the likelihood that a millennial might actually be able to participate in one, they’re worried that Social Security—which runs way behind the cost of living anyway—will be of even less help to them in the future as an income replacement than it already is for current retirees. Add to that the fact that more than half of millennials are expected to live to age 89 or even older, and they have the added worry of outliving whatever savings they might have managed to stash.

In fact, millennials need to save way more than their elders to stand a chance of having a retirement that honors the meaning of the word. Says the report, “[S]ome experts estimate that millennials will need to make pretax retirement plan contributions of between 15 percent to 22 percent of their pretax salary, which at 22 percent, is more than double the recommendation of previous generations.”

They’re viewed as irresponsible, but 21 percent are already worried about their retirement security, says the report, and while 51 percent of GenXers and boomers contribute to their own retirement plans, just 34.3 percent of millennials participate in an employer’s plan, although 66 percent work for bosses that offer such plans.

In fact, 66.2 percent of millennials have no retirement savings at all. Zip, zilch, zero. And millennial Latinos? A whopping 83 percent have a goose egg, not a nest egg. Latinos have it much worse, incidentally, than any other millennials group, with just 19.1 percent of millennial Latinos and 22.5 percent of Latinas participating in an employer-sponsored plan, compared with 41.4 percent of Asian men and 40.3 percent of millennial white women—who have the highest rates of participation in a retirement plan.

Despite working for an employer who provides workers with a retirement plan, millennials don’t always have a way to save, since said employer may have set barriers in place to prevent participation until an employee has been with the company for at least a year. And millennials are, of course, known as the job-hopping generation—so if they don’t stay in one place they never qualify. Close to half of millennials—40.2 percent—say they’re shut out of retirement plans because of employers’ eligibility requirements, including working a minimum number of hours or having a minimum tenure on the job.

But don’t accuse them of having no desire to participate: when they’re eligible, more than 90 percent do so.

Read the article.

Source:

Satter M. (2 March 2018). "Eligibility, lack of plans keep millennials from retirement saving" [Web Blog Post]. Retrieved from address https://www.benefitspro.com/2018/03/02/eligibility-lack-of-plans-keep-millennials-from-re/

Trump urges legal action against opioid manufacturers

Where does Trump stand on the Opioid Crisis? Find out in this article from Benefits Pro.

President Trump says he wants his administration to take legal action against opioid manufacturers.

“Hopefully we can do some litigation against the opioid companies,” Trump said at an event organized at the White House on the opioid epidemic.

Earlier in the week, Attorney General Jeff Sessions announced that the Justice Department would be filing a statement of interest in support of a lawsuit launched by more than 400 local governments around the country against pharmaceutical manufacturers. The suit accuses drug-makers of using deceptive advertising to sell powerful, addictive pain medication and for covering up the dangers associated with their use.

It’s not clear whether Trump’s remarks were a reference to the action Sessions has already taken or whether the president is envisioning additional legal action, since he said during the event that he would ask the attorney general to sue.

Trump also promised during his presidential campaign to take on pharmaceutical companies over rising drug prices, accusing them of “getting away with murder.” Since his election, however, he has done very little to translate those tough words into policy. A meeting between Trump and pharmaceutical companies early in his administration was described in positive terms by both sides.

The president also has suggested stiffer sentences for drug dealers, even reflecting positively on countries that execute them.

“Some countries have a very, very tough penalty – the ultimate penalty,” he said. “And, by the way, they have much less of a drug problem than we do.”

In recent years, public opinion on criminal justice in general and the drug war specifically has shifted in favor of an approach that favors treatment over incarceration. Reducing the prison population has been a goal that has increasingly earned bipartisan support, both at the federal level and in state legislatures around the country. However, Trump and Sessions have both stuck to the “tough-on-crime” mantra that dominated in the 1990’s.

The administration has signaled that it will not support legislation to reduce mandatory minimum sentences for drug offenses. And although the Justice Department has not yet gone after marijuana distributors in states that have legalized the drug, such as Colorado and California, Sessions has rescinded an Obama-era policy that stated that the DOJ would take a hands off approach to pot in those states.

Read the article.

Source:

Craver J. (2 March 2018). "Trump urges legal action against opioid manufacturers" [Web Blog Post]. Retrieved from address https://www.benefitspro.com/2018/03/02/trump-urges-legal-action-against-opioid-manufactur/

Apple launching concierge health care centers for employees

Did you know Apple is now offering healthcare centers for their employees? Check out this article from Benefit Pro for further information.

This spring, Apple employees will see the first phase of Apple’s new approach to employee health care: on-site health clinics.

According to Healthcare IT News, Apple plans to launch a group of internal health centers as it moves to boost the health and wellness of its employees. According to the report, the company has already “quietly published a webpage for the program, called AC Wellness Network, which includes a description of the company’s goals as well as information on a number of open positions.”

“AC Wellness Network believes that having trusting, accessible relationships with our patients, enabled by technology, promotes high-quality care and a unique patient experience,” Apple has said on the webpage. It continues, “The centers offer a unique concierge-like healthcare experience for employees and their dependents. Candidates must have an appreciation for the patient experience and passion for wellness and population health—integrating best clinical practices and technology in a manner that drives patient engagement.”

Apple’s move comes in the wake of an earlier declared partnership among Amazon, JPMorgan Chase and Berkshire Hathaway for their own independent health care company intended to bolster employee health at lower cost than conventional providers.

AC Wellness, says the report, will exist as “an independent medical practice,” although the company is a subsidiary of Apple. Job listings include not just physicians but also such positions as workflow designers, and the website listings suggest the first centers will be located in Santa Clara, California and in the company’s Cupertino, California campus.

Other recent health care steps taken by the company, according to an HRDive report, include its January announcement that it is making personal health records accessible on the latest iPhones, as well as its exploration of ways its Apple Watch could have medical applications, like detecting irregular heartbeats in wearers.

According to a CNBC report, some former Stanford Health Care employees have been affiliated with AC Wellness for at least five months. Says Healthcare IT News, “[t]hese sources also said that Apple will use the centers as a testing ground for its upcoming health and wellness products prior to large-scale consumer rollout, and that the company notified third-party vendors this week about its upcoming health clinics.”

Read the article.

Source: Satter M. (1 March 2018). "Apple launching concierge health care centers for employees" [Web Blog Post]. Retrieved from address https://www.benefitspro.com/2018/03/01/apple-launching-concierge-health-care-centers-for/

Employer Responsibility Under the Affordable Care Act

Here's a helpful chart from the Kaiser Family Foundation to decipher the penalties employers may have for not offering ACA coverage in 2018.

The Affordable Care Act does not require businesses to provide health benefits to their workers, but applicable large employers may face penalties if they don’t make affordable coverage available. The employer shared responsibility provision of the Affordable Care Act penalizes employers who either do not offer coverage or do not offer coverage that meets minimum value and affordability standards. These penalties apply to firms with 50 or more full-time equivalent employees. This flowchart illustrates how those employer responsibilities work.

Read the article.

Source:

Kaiser Family Foundation (5 March 2018). "Employer Responsibility Under the Affordable Care Act" [Web Blog Post]. Retrieved from address https://www.kff.org/infographic/employer-responsibility-under-the-affordable-care-act/

Ahead of the Midterms, Voters across Parties See Costs as their Top Health Care Concern

From Kaiser Health News is this poll deciphering where the public sits ahead of Midterms. What is there top healthcare concern? Costs. Get all the information in this article.

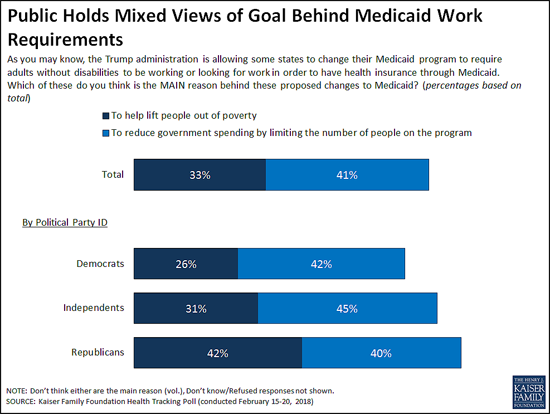

At a time when the Trump Administration is encouraging state efforts to revamp their Medicaid programs through waivers, the latest Kaiser Family Foundation tracking poll finds the public splits on whether the reason behind proposals to impose work requirements on some low-income Medicaid beneficiaries is to lift people out of poverty or to reduce spending.

The Centers for Medicare and Medicaid Services in January provided new guidance to states and has since approved such waivers in two states (Kentucky and Indiana). Eight other states have pending requests

When asked the goal of work requirements, four in 10 (41%) say it is to reduce government spending by limiting the people enrolled in the program, while a third (33%) say it is to lift people out of poverty as proponents say.

While larger shares of Democrats and independents say the reason is to cut costs, Republicans are more divided, with roughly equal shares saying it is to lift people out of poverty (42%) as to reduce government spending (40%). People living in the 10 states that have approved or pending work requirement waivers are similarly divided, with near-equal shares saying the goal is to lift people out of poverty (37%) as to reduce government spending (36%). This holds true even when controlling for other demographic variables including party identification and income.

In addition to work requirements, five states are currently seeking Medicaid waivers to impose lifetime limits on the benefits that non-disabled adults could receive under the Medicaid program. The poll finds the public skeptical of such a shift, with two thirds (66%) saying Medicaid should be available to low-income people as long as they qualify, twice the share (33%) as say it should only provide temporary help for a limited time.

Substantial majorities of Democrats (84%) and independents (64%) say Medicaid should be available without lifetime limits, while Republicans are divided with similar shares favoring time limits (51%) and opposing them (47%).

These views may reflect people’s personal experiences with Medicaid and the generally positive views the public has toward the current program, which provides health coverage and long-term care to tens of millions of low-income adults and children nationally.

Seven in 10 Americans report a personal connection to Medicaid at some point in their lives – either directly through their own health insurance coverage (32%) or their child being covered (9%), or indirectly through a friend or other family member (29%).

Three in four (74%) hold favorable views of Medicaid, including significant majorities of Democrats (83%), independents (74%) and Republicans (65%). About half (52%) of the public say the current Medicaid program is working well for low-income enrollees, while about a third (32%) say it is not working well.

Most Residents of Non-Expansion States Favor Medicaid Expansion to Cover More Low-Income People

Under the Affordable Care Act, most states expanded their Medicaid programs to cover more low-income adults. In the 18 states that have not done so, a majority (56%) say that their state should expand Medicaid to cover more low-income adults, while nearly four in 10 (37%) say their state should keep Medicaid as it is today.

Slightly more than half of Republicans living in the 18 non-expansion states (all of which have either Republican governors, Republican-controlled legislatures or both) say their state should keep Medicaid as it is today (54%) while four in 10 (39%) say their state should expand their Medicaid program.

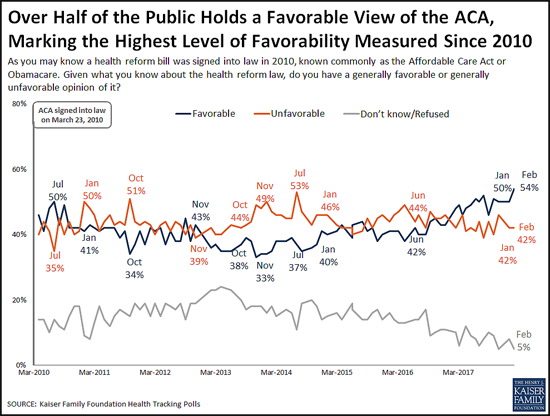

Favorable Views of the ACA Reach New High in More Than 80 KFF Polls

The poll finds 54 percent of the public now holds a favorable view of the Affordable Care Act, the highest share recorded in more than 80 KFF polls since the law’s enactment in 2010. This reflects a slight increase in favorable views since January (50%), while unfavorable views held steady at 42 percent.

The shift toward more positive views comes primarily from independents (55% view the ACA favorably this month, up slightly from 48% in January).

Public Remains Confused about Repeal of the ACA’s Individual Mandate

The poll also probes the public’s awareness about the repeal of the ACA’s requirement that nearly all Americans have health insurance or pay a fine, commonly known as the individual mandate. The tax legislation enacted in December 2017 eliminated this requirement beginning in 2019.

About four in 10 people (41%) are aware that Congress repealed the individual mandate, a slight increase from January, when 36 percent were aware of the provision’s repeal.

However, misunderstandings persist. Most (61%) of the public is either unaware that the requirement has been repealed (40%) or is aware of its repeal but mistakenly believes the requirement will not be in effect during 2018 (21%). Few (13%) are both aware that it has been repealed and that it remains in effect for this year.

Costs are Voters’ Top Health Care Concern ahead of the 2018 Midterm Elections

Looking ahead to this year’s midterm elections, the poll finds Democratic, Republican and independent voters most often cite costs as the health care issue that they most want candidates to address.

When asked to say in their own words what health care issue that they most want candidates to discuss, more than twice as many voters mention health care costs (22%) as any other issue, including repealing or opposing the Affordable Care Act (7%). Costs are the clear top issue for Democrats (16%) and independents (25%), and one of the top issues for Republicans (22%) followed by repealing or opposing the ACA (17%).

Designed and analyzed by public opinion researchers at the Kaiser Family Foundation, the poll was conducted from February 15-20, 2018 among a nationally representative random digit dial telephone sample of 1,193 adults. Interviews were conducted in English and Spanish by landline (422) and cell phone (771). The margin of sampling error is plus or minus 3 percentage points for the full sample. For results based on subgroups, the margin of sampling error may be higher.

Read the article.

Source: Kaiser Family Foundation (1 March 2018). "Poll: Public Mixed on Whether Medicaid Work Requirements Are More to Cut Spending or to Lift People Up; Most Do Not Support Lifetime Limits on Benefits" [Web Poll Post]. Retrieved from address https://www.kff.org/medicaid/press-release/poll-public-mixed-medicaid-work-requirements-more-to-cut-spending-lift-people-up-most-do-not-support-lifetime-limits/

How Are Health Centers Responding to the Funding Delay?

Unfortunately, the funding delay is impacting healthcare centers everywhere - and not in a great way. Get the information you need to know in this article.

Health centers play an important role in our health care system, providing comprehensive primary care services as well as dental, mental health, and addiction treatment services to over 25 million patients in medically underserved rural and urban areas throughout the country. Health care anchors in their communities and on the front lines of health care crises, including the opioid epidemic and the current flu outbreak, health centers rely on federal grant funds to support the care they provide, particularly to patients who lack insurance coverage. However, the Community Health Center Fund (CHCF), a key source of funding for community health centers, expired on September 30, 2017, and has since been extended through only March 31, 2018. The CHCF provides 70% of grant funding to health centers. With these funds at risk, health centers have taken or are considering taking a number of actions that will affect their capacity to provide care to their patients. This fact sheet presents preliminary findings on how health centers are responding to the funding uncertainty.

WHAT FUNDING IS AT STAKE FOR HEALTH CENTERS

The Community Health Center Fund represents 70% of federal grant funding for health centers. Established by the Affordable Care Act, the CHCF increased federal grant fund support for health centers, growing from $1 billion in 2011 to $3.6 billion in 2017.1Authorized for five years beginning in 2010, and extended for two years through September 2017, the CHCF also provided a more stable source of grant funding for health centers that was separate from the annual appropriations process. Prior to the CHCF, federal 330 grant funds were appropriated annually. In fiscal year 2017, federal section 330 grant funding totaled $5.1 billion, $3.6 billion from the CHCF and $1.5 billion from the annual appropriation.

Federal health center grants represent nearly one-fifth of health center revenues. Federal Section 330 grant funds are the second largest source of revenues for health centers behind revenues from Medicaid. Overall, 19% of health center revenues (including US territories) come from federal grants; however, reliance on 330 grant funds varies across health centers. Federal grant funds are especially important for health centers in southern and rural non-expansion states where Medicaid accounts for a smaller share of revenue (Figure 1).2 These funds finance care for uninsured patients and support vital services, such as transportation and case management, that are not typically covered by insurance

HOW ARE HEALTH CENTERS RESPONDING TO THE LOSS OF FEDERAL FUNDS?

Health centers have taken or are considering taking a number of actions that will affect their ability to serve their patients. Overall, seven in ten responding health centers indicated they had taken or planned to take action to put off large expenditures or curtail expenses in face of reduced revenue. Some of these actions involve delaying or canceling capital projects and other investments or tapping into reserve funds. Other actions, however, have or will reduce the number of staff or the hours they work, which may in turn, affect the availability of services. Already 20% of health centers reported instituting a hiring freeze and 4% have laid off staff. Another 45% are considering a hiring freeze and 53% said they might lay off staff. While health centers seemed to focus on shorter-term actions that could easily be reversed were funding to be restored, 3% of responding health centers had already taken steps to close one or more sites and an additional 36% indicated they are considering doing so (Figure 2).

Health centers are considering cuts to patient services. While most health centers have not yet taken steps to cut or reduce patient care services, many reported they are weighing such actions if funding is not restored (Figure 3). Over four in ten indicated they might eliminate or reduce some enabling services, such as case management, translation, or transportation services. Additionally, over a third of reporting health centers indicated they might have to reduce the dental, medical, and/or mental health services they provide while 29% said cuts to addiction treatment services are being contemplated. Fewer health centers reported that cuts to pharmacy services might be made.

Figure 3: Services Health Centers Are Considering Eliminating or Reducing in Response to Funding Uncertainty

WHAT ARE THE IMPLICATIONS OF THE FUNDING DELAY?

Continued delays in restoring funding will likely lead to cuts in health center services and staff. To date, health centers have tried to mitigate the effects of the funding delay by forgoing major investments or dipping into reserve funds. However, the longer the funding delay continues, the greater the likelihood health centers will be compelled to cut services and staff, actions they are currently considering but have not yet adopted in large numbers. These cuts could reverse gains health centers have made in recent years in increasing patient care capacity and expanding the range of services they provide, particularly in the areas of mental health and addiction treatment. Health centers play a particularly important role in rural and medically underserved areas. The failure to reauthorize the CHCF and restore health center funding could jeopardize access to care for millions of vulnerable patients.

SOURCE: Kaiser Family Foundation (1 February 2018). "How Are Health Centers Responding to the Funding Delay?" [Web Blog Post]. Retrieved from address https://www.kff.org/medicaid/fact-sheet/how-are-health-centers-responding-to-the-funding-delay/

SaveSave

Employers using fast-feedback apps to measure worker satisfaction, engagement

In this article from Employee Benefit Advisors, we take a look at measuring worker satisfaction and engagement through the use of feedback applications. Let us know what your verdict is!

The days of employers conducting employee engagement surveys once every year might be coming to an end.

Thanks to “fast feedback” applications, employers can conduct quick online surveys of their employees to measure how engaged they are at their jobs. The data from these polls is then collated and presented, often in real time on dashboards, to employers to show their workforce’s level of engagement and satisfaction. Some of these web-based programs also can present CEOs with steps they can take to improve their environment and culture.

These tools are available from Culture Amp, Glint, TINYpulse, PeakOn and others.

One of the main benefits of fast feedback, according to Glint CEO Jim Barnett, is that it cuts down on “regrettable attrition,” which occurs when talented employees leave for better jobs.

Glint customers include eBay, Glassdoor, Intuit, LinkedIn and Sky Broadcasting. These clients send out e-mail invitations to workers and ask them to take a voluntary survey, which can feature either stock employee engagement questions or queries that can be fine-tuned for a specific workplace.

Glint recommends 10 to 20 questions per Pulse — what it calls employee engagement survey sessions — and results are sent back to the employer’s HR directors and senior executives. According to Barnett, the Pulses are confidential but not anonymous. Barnett explains that while anonymous surveys do not record the respondent’s name and job title, a confidential survey means that only Glint knows who took the Pulse. The employer is only presented data from specific job groups or job descriptors within an enterprise, such as a production team or IT support.

This month, Glint announced two new capabilities to its real-time employee feedback program, called Always-On and On-Demand Surveys. Always-On allows workers to express their concerns at any time and On-Demand Surveys gives managers and executives the opportunity to perform quick, ad hoc surveys of staffers.

“Some of our companies use the Always-On Survey if they want people on their team to give feedback at any time on a particular topic,” he says.

Firms also use fast feedback for onboarding new hires, Barnett says. Companies have set up Glint’s program to gauge new workers at their 30 and 60 day-mark of their employment to “see how that onboarding experience impacted their engagement,” he says.

Culture Amp also provides fast feedback tools via a library of survey templates that cover a range of employee feedback topics including diversity and inclusion, manager effectiveness, wellness and exit interviews. Culture Amp’s clients include Aligned Leisure, Box, Etsy, McDonalds, Adobe and Yelp.

“We encourage customers to customize surveys to make the language more relevant, and to ensure every question reflects something the company is willing to act on,” says Culture Amp CEO Didier Elzinga.

Culture Amp presents its survey results to employers via a dashboard that displays the top drivers of employee engagement in real time. “Users can then drill down to understand more about each question, including how participants responded across a range of different demographic factors,” Elzinga says.

Sometimes CEOs are presented with news they were not prepared to hear, according to Elzinga. Some customers take to the employee survey process with the mindset of ‘myth busting,’ he says. “They want to know if some truth they hold dear is actually just a story they’ve been telling themselves. Every now and then, an employee survey will provide surprising results to an HR or executive team,” he says. “Whether people go into a survey looking to bust myths or gather baseline data, the important part is being open to accepting the results.”

Glassdoor takes the pulse of its workforce

Glint customer Glassdoor, the online job recruitment site that also allows visitors to anonymously rate their current employer’s work environment, compensation and culture, not only urges its employees to rate the firm using its own tools, the company also uses Glint’s software to view employee engagement at a more granular level.

Glassdoor conducted its first Glint Pulse in October 2016 and has rolled out three since then. The next is scheduled for January 2018, according to Marca Clarke, director of learning and organizational development at Glassdoor.

“We looked at employee engagement and the things that drive discretionary effort [among employees who work harder],” Clarke says. “This is strongly correlated with retention as well.”

Clarke said that one Glint Pulse found that the employees’ view of Glassdoor culture varied from location to location. Of its 700-person workforce, people working in the newer satellite offices were happier than the employees in its Mill Valley, Calif., headquarters. She speculates that this response could be due to newer, more eager employees hired in brand new, recently opened offices.

“People think culture is monolithic that should be felt across the company but we could see that there was some variation from office to office. With Glint, we were able to slice the data not just by region and job function but [we could] go to the manager level to look at how people with different performance ratings think about the culture,” she says.

Recent research from Aon Hewitt found that a 5% increase in employee engagement is linked to a 3% lift in revenue a year later. According to Barnett, Glint clients that regularly conduct surveys and take steps to engage their employees often see a boost in the price of their company shares.

“Companies in the top quartile of Glint scores last year [saw] their stock outperform the other companies by 40%,” he says. “They now have the data and can see that employee engagement and the overall employee experience really do you have a dramatic impact on the result of their company.”

Read the original article.

Source:

Albinus P. (5 December 2017). "Employers using fast-feedback apps to measure worker satisfaction, engagement" [Web blog post]. Retrieved from address https://www.employeebenefitadviser.com/news/employers-using-fast-feedback-apps-to-measure-worker-satisfaction-engagement?brief=00000152-1443-d1cc-a5fa-7cfba3c60000

SaveSave

Some States Roll Back ‘Retroactive Medicaid,’ A Buffer For The Poor — And For Hospitals

From Kaiser Health News, let's take a look at the latest regarding Medicaid.

If you’re poor, uninsured and fall seriously ill, in most states if you qualify for Medicaid — but weren’t enrolled at the time — the program will pay your medical bills going back three months. It protects hospitals, too, from having to absorb the costs of caring for these patients.

But a growing number of states are rescinding this benefit known as “retroactive eligibility.” On Nov. 1, Iowa joined three states that have eliminated retroactive coverage for some groups of Medicaid patients since the Affordable Care Act passed. Each state had to secure approval by the federal government.

Retroactive eligibility has been a feature of Medicaid for decades, reflecting the program’s emphasis on providing a safety net for poor, disabled and other vulnerable people. In contrast to private insurance, determining Medicaid eligibility can be complex and the application process daunting, advocates say. A patient’s medical condition also may keep families from applying promptly for coverage.

All four states — Arkansas, Indiana and New Hampshire, in addition to Iowa — have expanded Medicaid under the health law, which allowed states to include adults with incomes up to 138 percent of the federal poverty level, or about $16,000 for one person. So, in theory, most adults are required to have insurance under the ACA. In practice, each state still has a significant number of uninsured, ranging from 5 to 8 percent of the population.

The retroactive coverage “can compensate for the sorts of errors and lapses that can so easily occur on the part of both the applicant and the government bureaucracy” that delay applications, said Gordon Bonnyman, staff attorney at the Tennessee Justice Center, a public interest law firm that represents low-income and uninsured residents.

State and federal officials say eliminating the retroactive coverage helps encourage people to sign up for and maintain coverage when they’re healthy rather than waiting until they’re sick to enroll. It also fits into federal officials’ efforts to make Medicaid, the federal-state program that provides health care for low-income adults and children, more like private insurance.

But consumer advocates and health care providers say the shift will saddle patients with hefty medical bills and leave hospitals to absorb more uncompensated care when patients can’t pay. Some worry this could be the start of a trend.

In Iowa, the change applies to just about anyone coming into Medicaid — except for pregnant women and children under age 1. The change will affect up to 40,000 residents annually and save the program more than $36 million a year.

“We’re making it a lot more likely that Medicaid-eligible members are going to incur significant medical debt,” said Mary Nelle Trefz, health policy associate at the Child & Family Policy Center in Des Moines, whose organization opposed the change.

When someone has a traumatic health event, the initial focus is to get them stabilized, not figure out how to pay for it, said MaryBeth Musumeci, associate director of the Program on Medicaid and the Uninsured at the Kaiser Family Foundation. (Kaiser Health News is an editorially independent program of the foundation.)

Patients may neglect to apply immediately for Medicaid, leaving them financially responsible for days or months of care they received before they got in their application, even though they may have been eligible for Medicaid all along.

That’s not the only issue, advocates say. Unlike the commercial insurance market where re-enrollment through someone’s employer is routine, Medicaid requires that beneficiaries’ eligibility be reassesed every year.

“People fall through the cracks,” said Andrea Callow, associate director of Medicaid initiatives at Families USA, a consumer advocacy group.

In addition, complications can arise for people who might need Medicaid coverage for long-term care services. “The criteria are complicated. For a layperson to find those criteria and figure out if they’re eligible” is challenging and they may need extra time, said Musumeci. Once patients have secured coverage, they may already have accrued hefty expenses.

Maybe so, but some people argue that a 90-day retroactive eligibility guarantee is counterproductive.

“We’re trying to get people to behave more responsibly, not less responsibly,” said Gail Wilensky, an economist who oversaw the Medicaid and Medicare programs in the early 1990s under President George H.W. Bush. “That is not the signal you’re sending” with three months of retroactive eligibility. A 30-day time frame is more reasonable, Wilensky said.

In contrast to Iowa, the waivers in Arkansas, Indiana and New Hamsphire generally apply only to adults who gained coverage under the law’s Medicaid expansion. (Indiana’s waiver also applies to other groups.)

Kentucky has a request pending that, like Iowa, would eliminate retroactive Medicaid eligibility except for pregnant women and children under 1, according to KFF.

Under federal law, officials can waive some Medicaid coverage rules to give states flexibility to experiment with different approaches to providing services. And retroactive eligibility waivers in Medicaid are hardly new. A few states like Tennessee have had them in place for years. Tennessee officials eliminated retroactive eligibility for all Medicaid beneficiaries in 1994 when the state significantly expanded coverage under TennCare, as Medicaid is known there. At the time, the state even allowed uninsured people to buy into the program who wouldn’t otherwise qualify based on income, said Bonnyman.

“There was no reason for anybody to be uninsured except undocumented immigrants,” said Bonnyman. “It didn’t seem to have the potential for harm.”

But state officials revamped that program after serious financial problems. Eligibility for TennCare has become more restrictive again.

Other states that waived retroactive coverage for at least some Medicaid groups include Delaware, Maryland, Massachusetts and Utah, according to the Kaiser Family Foundation.

Bonnyman said his group frequently works with Medicaid beneficiaries who have medical bills they can’t afford that accumulated during the months before they applied for Medicaid.

“If you’re a moderate- to low-income working family, one or two days in the hospital is enough to ruin you financially,” he said.

You can read the original article here.

Source:

Andrews M. (14 November 2017). "Some States Roll Back ‘Retroactive Medicaid,’ A Buffer For The Poor — And For Hospitals" [Web blog post]. Retrieved from address https://khn.org/news/some-states-roll-back-retroactive-medicaid-a-buffer-for-the-poor-and-for-hospitals/

4 Main Impacts of Yesterday's Executive Order

Yesterday, President Trump used his pen to set his sights on healthcare having completed the signing of an executive order after Congress failed to repeal ObamaCare.

Here’s a quick dig into some of what this order means and who might be impacted from yesterday's signing.

A Focus On Small Businesses

The executive order eases rules on small businesses banding together to buy health insurance, through what are known as association health plans, and lifts limits on short-term health insurance plans, according to an administration source. This includes directing the Department of Labor to "modernize" rules to allow small employers to create association health plans, the source said. Small businesses will be able to band together if they are within the same state, in the same "line of business," or are in the same trade association.

Skinny Plans

The executive order expands the availability of short-term insurance policies, which offer limited benefits meant as a bridge for people between jobs or young adults no longer eligible for their parents’ health plans. This extends the limited three-month rule under the Obama administration to now nearly a year.

Pretax Dollars

This executive order also targets widening employers’ ability to use pretax dollars in “health reimbursement arrangements”, such as HSAs and HRAs, to help workers pay for any medical expenses, not just for health policies that meet ACA rules. This is a complete reversal of the original provisions of the Obama policy.

Research and Get Creative

The executive order additionally seeks to lead a federal study on ways to limit consolidation within the insurance and hospital industries, looking for new and creative ways to increase competition and choice in health care to improve quality and lower cost.

SELF-INSURED GROUP HEALTH PLANS

Are you looking to switch your company's healthcare plan to a self-funded option? Take a look at this informative column by the Self-Insurance Institute of America and find out everything you need know when researching the best self-funded plan for your company.

Q. What is a self-insured health plan?

A. A self-insured group health plan (or a 'self-funded' plan as it is also called) is one in which the employer assumes the financial risk for providing health care benefits to its employees. In practical terms, self-insured employers pay for each out of pocket claim as they are incurred instead of paying a fixed premium to an insurance carrier, which is known as a fully-insured plan. Typically, a self-insured employer will set up a special trust fund to earmark money (corporate and employee contributions) to pay incurred claims.

Q. How many people receive coverage through self-insured health plans?

A. According to a 2000 report by the Employee Benefit Research Institute (EBRI), approximately 50 million workers and their dependents receive benefits through self-insured group health plans sponsored by their employers. This represents 33% of the 150 million total participants in private employment-based plans nationwide.

Q. Why do employers self fund their health plans?

A. There are several reasons why employers choose the self-insurance option. The following are the most common reasons:

- The employer can customize the plan to meet the specific health care needs of its workforce, as opposed to purchasing a 'one-size-fits-all' insurance policy.

- The employer maintains control over the health plan reserves, enabling maximization of interest income - income that would be otherwise generated by an insurance carrier through the investment of premium dollars.

- The employer does not have to pre-pay for coverage, thereby providing for improved cash flow.

- The employer is not subject to conflicting state health insurance regulations/benefit mandates, as self-insured health plans are regulated under federal law (ERISA).

- The employer is not subject to state health insurance premium taxes, which are generally 2-3 percent of the premium's dollar value.

- The employer is free to contract with the providers or provider network best suited to meet the health care needs of its employees.

Q. Is self-insurance the best option for every employer?

A. No. Since a self-insured employer assumes the risk for paying the health care claim costs for its employees, it must have the financial resources (cash flow) to meet this obligation, which can be unpredictable. Therefore, small employers and other employers with poor cash flow may find that self-insurance is not a viable option. It should be noted, however, that there are companies with as few as 25 employees that do maintain viable self-insured health plans.

Q. Can self-insured employers protect themselves against unpredicted or catastrophic claims?

A. Yes. While the largest employers have sufficient financial reserves to cover virtually any amount of health care costs, most self-insured employers purchase what is known as stop-loss insurance to reimburse them for claims above a specified dollar level. This is an insurance contract between the stop-loss carrier and the employer, and is not deemed to be a health insurance policy covering individual plan participants.

Q. Who administers claims for self-insured group health plans?

A. Self-insured employers can either administer the claims in-house, or subcontract this service to a third party administrator (TPA). TPAs can also help employers set up their self-insured group health plans and coordinate stop-loss insurance coverage, provider network contracts and utilization review services.

Q. What about payroll deductions?

A. Any payments made by employees for their coverage are still handled through the employer' s payroll department. However, instead of being sent to an insurance company for premiums, the contributions are held by the employer until such time as claims become due and payable; or, if being used as reserves, put in a tax-free trust that is controlled by the employer.

Q. With what laws must self-insured group health plans comply?

A. Self-insured group health plans come under all applicable federal laws, including the Employee Retirement Income Security Act (ERISA), Health Insurance Portability and Accountability Act (HIPAA), Consolidated Omnibus Budget Reconciliation Act (COBRA), the Americans with Disabilities Act (ADA), the Pregnancy Discrimination Act, the Age Discrimination in Employment Act, the Civil Rights Act, and various budget reconciliation acts such as Tax Equity and Fiscal Responsibility Act (TEFRA), Deficit Reduction Act (DEFRA), and Economic Recovery Tax Act (ERTA).

See the original article Here.

Source:

Self-Insurance Institute of America (Date). Self-insured group health plans [Web blog post]. Retrieved from address https://www.siia.org/i4a/pages/index.cfm?pageID=4546