Digital approach to millennials can boost retirement savings participation

Do you need help boosting involvement in your retirement program? Take a look at this great article from Benefits Pro about how digital media can be the perfect vehicle for increase enrollment in your retirement program by Marlene Satter.

Retirement plan providers need a new approach—literally—when it comes to engaging millennials: going digital.

According to a blog post from Corporate Insight, millennials use, or seek to use, technology and mobile platforms to manage as many aspects of their lives as possible. But when it comes to retirement plans, many can’t.

While millennials are not only much more likely to value mobile access to their 401(k)s than their parents are, plan providers haven’t been as enthusiastic.

A Corporate Insight survey found that 57 percent of millennials consider the ability to manage their retirement plan account via a mobile app “very important” or “extremely important,” versus just 26 percent of baby boomers, but only 10 of the 19 leading retirement plan providers Corporate Insight tracks offer any kind of transaction capabilities via their iPhone apps.q

And that, considering millennials’ preferences, is a failure.

Although it’s considerably better than it was only four years ago, when only two out of 17 firms provided such service, the post says, “the industry has yet to reach the standard set by other financial industry verticals, like banking and brokerage, where mobile transaction functionality is the new normal.”

It’s true that many retirement plan providers have recently introduced mobile apps, but those apps have only limited capabilities compared with the functionalities millennials are looking for.

Then there’s the little matter of advice and education. Thanks to the Great Recession, millennials have a low risk tolerance and tend to stick to very conservative investments.

In addition, they “highly value advice and are not receiving enough of it,” the post says. With millennials the most likely of all generations to seek some degree of professional advice, at 89 percent compared with 78 percent of boomers, only 58 percent say they have been offered this assistance.

Of course, even among those offered advice, just 59 percent have actually taken advantage of it—possibly because they perceive it as expensive and don’t realize that the plan sponsor may be footing the bill instead of the employee.

Better communicating the menu of options available to employees could correct misperceptions, as well as alert employees unaware of the option to its availability.

Millennials are also more open to managed accounts, and those who have them are likely to say they’re satisfied or very satisfied with them.

Fintech firms offering low-cost robo options could boost the participation of young people in their retirement accounts, and as a means of customization they could be key to improving the results of defined contribution retirement accounts in helping employees prepare for retirement.

See the original article Here.

Source:

Satter M. (2017 March 24). Digital approach to millennials can boost retirement savings participation [Web blog post]. Retrieved from address https://www.benefitspro.com/2017/03/24/digital-approach-to-millennials-can-boost-retireme?ref=hp-news

What it Takes to Make Good Decisions in the New World of Work

With many companies taking employee education and training into their own hands employers must be properly prepared for the changing future. Check out this great article from SHRM about what employers must do to keep pace in the ever evolving workplace by Ross Smith and Madhukar Yarra

We live in a world where phenomena such as the internet, globalization, social media, and mobility are accelerating change faster than ever before. Today’s digital age fed by big data is manifested in new businesses disrupting existing business models, which are remnants of the industrial era. These new models, typified by the Ubers, Amazons, Teslas, Airbnb’s and Facebooks of the world, are fossilizing the older generation of companies.

It is difficult for the education system to keep pace with this kind of change. The education system is a behemoth whose design is evolving to address the need for agility and speed. They change after the fact and therefore almost always take refuge in ‘best practices’. The MBA as we know it, has also fallen prey to this.

The MBA has been designed to provide a pool of mid-level managers for large corporations and questions arise about the future. Armed with an MBA, new hires walk into a large corporation with a desire to prove their worth through a strong knowledge of historical best practices. They may miss the value of ‘first principles’ thinking, and more often than not, face challenges to make an impact. Over time, this can create a disconnected or disillusioned workforce.

The question then becomes - if emerging and disruptive business models no longer subscribe to historical best practices, and by extension, to business schools, as their source for leadership, where should they look? What is that institution or model that allows individuals to build decision making capabilities in today’s world?

The reliance on irrelevant frameworks, outdated textbooks, and a historical belief in “best practices” all run counter to how a leader needs to be thinking in today’s fast paced digital world. There are no established best practices for marketing in a sharing economy or creating a brand in a digital world. The best practices might have been established last week. The world is moving fast, and leaders need to be more agile. Today, Millennials are leading teams, calling the shots in many corporations, which means that the energy created is one that leaves little time for rules and structures to effectuate and/or create impact. Making good decisions in today’s business world requires a new and different kind of thinking, and there are tactics that can help grow these new types of leaders.

Importance of questions: most leadership and business programs today evaluate and assess students based on answers, not the ability to ask good questions. Thoughtful and incisive questions lead to innovation and as business problems become more granular and interconnected, this skill will help leaders arrive at better decisions.

Experimentation over experts: Students are encouraged to seek “expert advice” rather than formulating their own hypotheses that can be tested as low cost experiments. While consulting with those who have walked the same path has its benefits, relying on the experiences of others may hinder growth, particularly when change is accelerating. The shift to globalization, digitization, social, and agile are changing rapidly, there is no “right answer”, so experimentation is a crucial skill.

Interdisciplinary perspective: Disciplines and industry sector models are glorified at a time when discipline barriers are being broken to create new ideas. A conscious intermingling of disciplines creates more fertile minds for innovative thoughts to occur.

In today’s management programs, outdated content and old-school delivery mechanisms are limiting students and businesses alike. There is a dire need to help business and young talent alike embrace a new art of problem solving, essential for the realities of today.

Many companies are starting to take education and employee training into their own hands. The advent of online courses, MOOCs, and other innovative programs in employee education are supplementing traditional education.

HR professionals can learn from companies who have set up their own deep technical training programs. With the work they do to augment decision science skills, Mu Sigma University is a great example of a modern day tech company, building skills across technology, business, analytics, and design. The workforce is changing. Many traditional jobs are being replaced with automation, robots, cloud-based machine learning services, and artificial intelligence – while at the same time, the demand for high end engineering, analytics, business intelligence, data and decision science is booming. Many companies, such as Mu Sigma, are spinning up advanced technical training investments to ensure their employees are equipped for a rapidly evolving future.

See the original article Here.

Source:

Smith R. & Yarra M. (2017 March 15). What it takes to make good decisions in the new world of work [Web blog post]. Retrieved from address https://blog.shrm.org/blog/what-it-takes-to-make-good-decisions-in-the-new-world-of-work

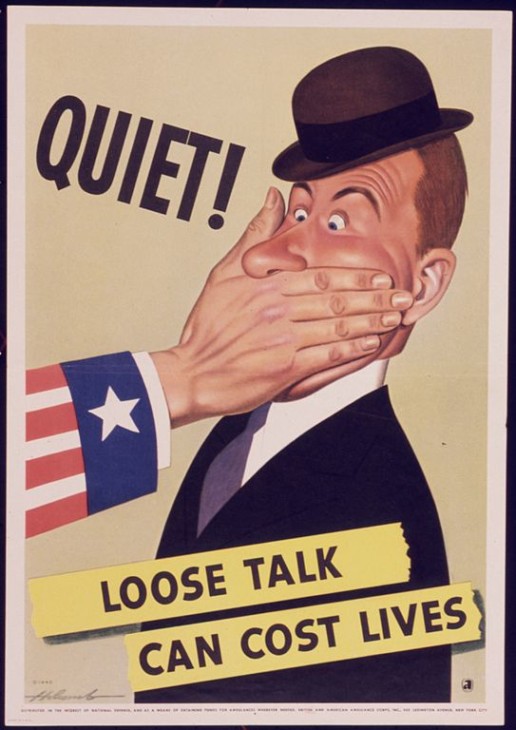

3 things managers can’t say after FMLA requests

Do you know which question you can ask any employee requesting FMLA leave? Look at this great article from HR Morning about what employers can and cannot say to an employee on FMLA leave Christian Schappel

You know when employees request FMLA leave, those conversations have to stick to the facts about what the workers need and why. The problem is, a lot of managers don’t know that — and here’s proof some of their stray comments can cost you dearly in court.

Three employers are currently fighting expensive FMLA interference lawsuits because their managers didn’t stick to the facts when subordinates requested leave.

Don’t say it!

The real kick in the pants: Two of the lawsuits were filed by employees who’d received all of the FMLA leave they requested — and the courts said the interference claims were still valid. How’s that even possible? Keep reading to learn about the latest litigation trend in the FMLA world.

Here’s what happened in each case (don’t worry, we’ve cut to the chase in all of them) — beginning with the words/phrases managers must avoid when a worker requests leave:

No. 1: ‘We expect you to be here’

James Hefti, a tool designer, was in hot water with his company, Brunk Industries, a metal stamping company.

Reason: Let’s just say he called a lot of people at work “my b____.”

After he ignored multiple warnings from management to stop using obscenities at work, the company planned to fire him. But it didn’t pull the trigger immediately.

Then, just prior to his termination, Hefti requested FMLA leave to care for his son, who was suffering from various mental health problems.

His manager, upon hearing of Hefti’s request, told him Brunk paid for his insurance and thus expected him to be at work.

When Hefti was fired a few days later, he sued for FMLA interference.

The company tried to get the suit thrown out, claiming his conduct and ignorance of repeated warnings gave it grounds to terminate him. But it didn’t win.

The court said the manager’s interactions with Hefti did raise the question of whether he was fired for requesting FMLA leave, so the judge sent the case to trial.

Cite: Hefti v. Brunk Industries

No. 2: ‘It’s inconsiderate’

Lisa Kimes, a public safety officer for the University of Scranton’s Department of Public Safety, requested FMLA leave to care for her son, who had diabetes.

Kimes was granted all the time off she requested. But in a meeting with her supervisor she was told that since the department was short staffed it was “inconsiderate” of her to take time off.

When her relationship with the department soured, she sued claiming FMLA interference.

The department tried to get her suit tossed before it went to trial. It had a seemingly reasonable argument: She got all of the leave she requested, so it couldn’t have interfered with her FMLA rights.

But Kimes argued that her supervisor’s comments prevented her from requesting more FMLA leave – thus the interference lawsuit.

The court sided with Kimes. It said she had a strong argument, so the judge sent her case to trial as well.

Suit: Kimes v. University of Scranton

No. 3: ‘I’m mad’

Judy Gordon was an officer with U.S. Capitol Police when she requested intermittent FMLA leave for periods of incapacitating depression following her husband’s suicide.

But before Gordon used any FMLA leave, a captain in the police department told her that an upper-level manager had said he was “mad” about FMLA requests in general, and he’d vowed to “find a problem” with Gordon’s request.

Then later, when she actually went to take leave, her manager became irate, denied her request and demanded a doctor’s note. He later relented and granted the request.

In fact, she was granted all the leave she requested.

Still, she filed an FMLA interference suit. And, again, the employer fought to get it thrown out before a trial on the grounds that Gordon had no claim because all of her leave requests were granted.

But this case was sent to trial, too. The judge said her superiors’ conduct could have a “reasonable tendency” to interfere with her FMLA rights by deterring her from exercising them — i.e., the comments made to her could’ve persuaded her not to request additional leave time to which she was entitled.

Suit: Gordon v. United States Capitol Police

Just the facts, please

Based on a thorough read-through of the court documents, each of these employers appeared to have a pretty good chance of winning summary judgment and getting the lawsuits thrown out before an expensive trial — that is, if it weren’t for the managers’ stray comments in each.

These cases have created two important teaching points for HR:

- Courts are allowing FMLA interference claims to be made if it appears an employee may have been coaxed into not requesting leave he or she was entitled to, and

- You never know when a stray remark will come back to bite you.

The best way to stay safe: Re-emphasize that managers must stick to the facts when employees request FMLA leave, as well as keep their opinions and other observations to themselves.

See the original article Here.

Source:

Schappel C. (2017 March 17). 3 things managers can't say after FMLA requests [Web blog post]. Retrieved from address https://www.hrmorning.com/3-things-you-cant-say-after-fmla-requests/

10 tips to boost retirement savings

Do you need help boosting your savings for your retirement? Check out these great tips from Benefits Pro on how to increasing your retirement savings by Marlene Y. Satter

Americans are struggling to save enough money for retirement.

Now that pensions are going the way of the dodo and workers are relying primarily on Social Security and 401(k) plans—the latter if they’re lucky—it’s a struggle to find extra money to set aside against the day they leave the workplace.

In fact, many workers never plan to retire.

Considering how many workers don’t even have access to a retirement plan at work, trying to stretch dollars even a little bit further to set aside money for retirement can be a real challenge.

That’s pretty clear from the zero-to-minimum savings held by many Americans.

In fact, with 40 million working-age households lacking any retirement savings at all, and the average balance of retirement accounts a pitiful $2,500 across all households, it’s obvious that something needs to be done. But how much can people do on low incomes, fighting against the gender wage gap and shrinking benefits packages?

Perhaps it’s only baby steps they can take, but even those baby steps can pay off over the span of a career. So here are some suggestions that workers could definitely benefit from on how they might be able to squeeze just a little more out of that paycheck.

Depending on a worker’s age, some of these strategies will be more helpful for some than for others—but all can make a difference in the end result: stashing away enough money to pay for retirement.

Courtesy of a range of sources, including Schwab Retirement Plan Services, Forbes, Fidelity and others, here are 10 strategies to help workers boost their retirement savings.

10. Take advantage of the employer match.

If you’re lucky enough to work at a company that provides a 401(k) plan, Schwab suggests that you make sure your contribution level is high enough to take full advantage of the employer matching contribution.

Not saving enough to get the full employer match is leaving free money on the table. Look for economies elsewhere (fewer trips to the barista, brown-bag lunches) to increase your contribution till you get the full benefit of whatever your employer is willing to give.

9. No matter what you’re saving, keep increasing it.

Some people up their retirement contributions every time they get a raise; others do it when they hit some other significant milestone, such as an anniversary with the company.

Schwab, again, suggests that whether it’s a performance review, a birthday or some other occasion, you keep raising your retirement contribution even if it’s only by one percent at a time. It will all add up by the time you’re ready to retire.

8. Automate retirement plan increases.

While you’re busy increasing those contributions, automate them.

Set up an automatic increase that will add to your savings at regular intervals, even if you forget.

That way, whether you’re the type that actually remembers those special occasions on which you plan to boost contributions or you forget them, you can set it and forget it—and your retirement plan will do the rest.

7. Don’t forget the catch-up contribution.

If you’re 50 years old or older, remember that you’re allowed to put an extra $6,000 into your retirement account to catch up to where you ought to be.

That can help a lot as you approach retirement, particularly if you haven’t saved the maximum allowable in years past.

6. Check the fees on your investments.

This one doesn’t actually require you to find additional money to save. What it does require is that you review the investments in your retirement accounts and see how much the fees add up to.

If there are cheaper investments available in your plan—exchange-traded funds, for example, or target-date funds that offer lower fees—make sure they’re suitable for your particular needs and risk tolerance and then, if they’re appropriate, make the switch. Cutting down on the fees you pay will keep your balance growing.

5. Put yourself on a budget.

Particularly if you haven’t saved all that much for retirement and the Big Day is drawing near, see if you can adjust to a budget that reflects lower spending levels—something you might have to do in retirement anyway, if money is tight.

Whether or not you can sustain living on that budget, while you’re experimenting, take any money that you save from your usual outlay and put it into your retirement account. Better yet, open a Roth if you’re eligible. You’ll have already paid taxes on the money, if it’s coming out of your regular pay, and when you take it out of a Roth however much it’s grown to will be tax free. That will save you money both now and then.

4. Look into your health savings account.

If your benefits plan at work includes an HSA, check it out as a potential investment vehicle. While most people just put money in it to pay approved medical expenses, many don’t know that they can actually invest the money in an HSA and just let it grow; it’s not a use-it-or-lose-it account.

If it grows into retirement, you can then use the money to pay approved medical expenses tax free, which will stretch your other retirement savings further. (You can also use it for nonapproved expenses, but you’ll have to pay tax on the money upon withdrawal if you do that.)

3. Make sure you’re using the right kind of account.

Don’t just stick your money into a savings account and wait for retirement. Check out the potential of and differences among different types of accounts—savings, HSAs, Roths, traditional IRAs, 401(k)s—and put your money where you’ll get the most bang for the buck.

Contribute the maximum to your 401(k) to get full matching funds at work, and then look into opening a traditional or a Roth IRA. As previously mentioned, if you’ve already paid taxes on money contributed to a Roth, when you withdraw it in retirement it will be tax free (so it will go further).

2. Don’t forget about the Saver’s Credit.

Your income and income tax filing status determine whether you’re eligible for this one, aimed at low- to moderate-income households, but it’s a goodie—and if you’re married and filing jointly, both of you might be able to claim it.

The program, the official name of which is the Retirement Savings Contributions Credit, can give you $1,000 for contributing to a qualifying retirement account. Whether your retirement plan is an IRA, a 401(k), 403(b), 457(b) or even a SEP or SIMPLE IRA, you contribute the allowable amount, assuming your income level makes you eligible, and the government credits you 10 percent, 20 percent, or 50 percent of the first $2,000 you contribute to retirement savings for the year.

1. Remember that payroll contributions to a retirement plan can lower your taxes.

Yes, by following the instructions in earlier steps and boosting your retirement contribution at work, you could lower your tax bracket—and that could have you losing less of your take-home pay to increase that contribution than you thought.

Depending on your withholding rate, an increased retirement contribution might hurt less than you think—and that can encourage you to do even more. You can check with human resources or the payroll department to find out just how much the hit will save you. And who knows? It might lower your adjusted gross income enough to let you qualify for the Saver’s Credit—a real win-win situation.

See the original article Here.

Source:

Satter M. (2017 March 07). 10 tips to boost retirement savings [Web blog post]. Retrieved from address https://www.benefitspro.com/2017/03/07/10-tips-to-boost-retirement-savings?ref=mostpopular&page_all=1

Caregiving Benefits Can Sharpen Your Competitive Edge

Interesting article from the Society of Human Resources about the benefits of leveraging caregiving benefits in your employee benefits program by Hank Jackson

Whether caring for an aging parent, welcoming a newborn child or handling family medical situations, life events can create some of the most stressful and demanding challenges in our personal and work lives. For those without employer-provided paid leave, the burden is even heavier. People often need extended periods of time off to cover responsibilities at home, but many are forced to rely on the federal floor of unpaid leave guaranteed by the Family and Medical Leave Act.

High costs are cited as the biggest barrier to paid leave, but now, more than ever, companies risk losing great talent to rivals with more robust policies—here and abroad. In addition, employers struggle with a growing patchwork of state and local leave laws that hinder innovation and add compliance costs. This is why SHRM is advocating for public policies that would provide relief to employers while guaranteeing paid leave and expanded flexibility options for full-time and part-time employees. The issue of paid leave is a hot one—featured during the presidential campaign and poised to be a focus of congressional consideration in 2017.

Last year, more than two dozen large U.S. employers—including American Express, Deloitte, Ernst and Young, Campbell’s, First Data and Etsy—announced they would significantly strengthen paid family leave benefits. Their approaches vary, ranging from extending the time employees can take paid leave to broadening categories of eligible individuals and covered situations. But in all instances, a powerful business case was behind the decision. They believe it is a winning strategy and are promoting it widely to stakeholders and shareholders.

A carefully analyzed and applied family leave benefit can be a differentiator in today’s hyper-competitive talent marketplace. Even medium-sized and small enterprises can offer budget- and family-friendly policies, such as flexible schedules. The important thing is to develop a workplace where an employee’s work-life needs are valued and supported, balanced with the right benefits, rewards and adaptability across an employee’s life cycle.

Paid parental leave and other work-flexible programs are not only about competing or compliance. They are about doing the right thing for the organization and the employee. As HR professionals, it’s up to us to help our organizations grow a culture where both employees and employers win. This is part of the compact to create the 21st Century workplace employees of all ages want—innovative, fair and competitive with other businesses.

See the original article Here.

Source:

Jackson H. (2017 March 09). Caregiving benefits can sharpen your competitive edge [Web blog post]. Retrieved from address https://blog.shrm.org/blog/caregiving-benefits-can-sharpen-your-competitive-edge

How to avoid a DOL 401(k) audit

Are you worried that your company's 401(k) plan might face a Department of Labor audit? Check out this great tips from Employee Benefits Network on how to avoid a 401 (k) aduit by Robert C. Lawton

There are many reasons for plan sponsors to do everything possible to avoid a Department of Labor 401(k) audit. They can be costly, time consuming and generally unpleasant.

The DOL, in its fact sheet for fiscal year 2016, indicates that the Employee Benefits Security Administration closed 2,002 civil investigations with 1,356 of those cases (67.7%) resulting in monetary penalties/additional contributions. The total amount EBSA recovered for Employee Retirement Income Security Act plan participants last year was $777.5 million.

In my experience, if a plan sponsor receives notification from the DOL that it has an interest in looking over their 401(k) plan, they need to be concerned. Not only do the statistics support the fact that DOL auditors do a good job of uncovering problems, but in my opinion, they are not an easy group to negotiate with to fix deficiencies.

As a result, the best policy plan sponsors should follow to ensure they don’t receive a visit from a DOL representative is to do everything possible to avoid encouraging such a visit. Here are some suggestions that may help plan sponsors avoid a DOL 401(k) audit:

1. Always respond to employee inquiries in a timely way. The most frequent trigger for a DOL 401(k) audit is a complaint received from a current or former employee. These complaints can originate from employees you have terminated who feel poorly treated or existing employees who feel ignored. Make sure you are sensitive to employee concerns and respond in a timely way to all questions. Keep copies of any correspondence. Be very professional in how you treat those individuals who are terminated — even though in certain instances that may be difficult. Terminated employees who feel they have been mistreated often call the DOL to “get back” at an employer.

2. Improve employee communication. Often employee frustrations come from not understanding a benefit program — or worse, misunderstanding it. If you are aware that employees are frustrated with your plan or there is a lot of behind the scenes discussion about it, schedule an education meeting as soon as possible to explain plan provisions.

3. Fix your plan — now. If the DOL decides to audit your 401(k) plan, as shown above, it frequently finds something wrong. Many times plan sponsors are aware that a certain provision in the plan is a friction point for employees. Or worse, they know the plan is brokenand no one has taken the time to fix it. Contact your benefits consultant, recordkeeper or benefits attorney to address these trouble spots before they cause an employee to call the DOL.

4. Conduct a “mock” DOL 401(k) audit. Many 401(k) plan sponsors have found it helpful to conduct a mock audit of their plan or hire a consulting firm to do one for them. If management hasn’t been responsive to your concerns about addressing a plan issue, having evidence to share with them that shows an audit failure can be very convincing.

5. Make sure your 5500 is filed correctly. The second most frequent cause of a DoL 401(k) audit relates to the annual Form 5500 filing. The most common 5500 errors include failing to file on time, not including all required schedules and failing to answer multiple-part questions. Ensure that your 5500 is filed by a competent provider and that it is filed on time. Most plan sponsors either use their recordkeeper or accountant to file their plan’s 5500. Don’t do it yourself. The fees a provider will charge to do the work for you are very reasonable.

6. Don’t be late with contribution submissions. Surprisingly, many employers still don’t view participant 401(k) contributions as participant money. They are, and the DOL is very interested in ensuring that participant 401(k) contributions are submitted promptly to the trustee. Be very consistent and timely with your deposits to the trust. Participants will track how long it takes for their payroll deductions to hit the trust. If they aren’t happy with how quickly that happens, they may call the DOL. If you have forgotten to submit a payroll to the trustee, or think you may have been late, call your benefits attorney. There are procedures to follow for late contribution submissions.

DOL audits are generally not pleasant. It wouldn’t be too strong to say that they are often adversarial. Because these visits are typically generated by employee complaints or Form 5500 errors, auditors have a pretty good idea that something is wrong. Consequently, I recommend that plan sponsors do everything they can to avoid a DOL 401(k) audit.

See the original article Here.

Source:

Lawton R. (2017 February 13). How to avoid a DOL 401(k) audit [Web blog post]. Retrieved from address https://www.benefitnews.com/opinion/how-to-avoid-a-dol-401-k-audit?brief=00000152-14a5-d1cc-a5fa-7cff48fe0001

4 Basic Elements of Successful People Analytics

- We need to be clear about what question we are trying to answer.

- We need to gather the best available evidence—which, even if it not good, will be better than no evidence.

- We need to assess the quality of the evidence so we can make an informed judgment.

- Often, basic math is all we need to inform our judgment.

See the original article Here.

Source:

Creelman D. (2017 February 09). 4 basic elements of successful people analytics [Web blog post]. Retrieved from address https://blog.shrm.org/blog/4-basic-elements-of-successful-people-analytics

10 tips for next generation benefits

Great article from Benefits Pro about ten tips to help improve your benefits for the next generation by Erin Moriarty-Siler,

If brokers and their clients want to continue to attract and, more importantly, retain millennials and other generations entering the workforce, they'll need to start rethinking benefits packages.

As part of our marketing and sales tips series, we asked our audience for their thoughts on the next generation and their benefits needs.

Here are the 10 tips we liked best.

1. Show appreciation

“Even if you don't have the time and resources to roll out the red carpet each time an employee joins your team, they should feel as if you do. Even something as simple as a team lunch to welcome them and a functioning computer can go a long way toward making a new employee feel valued and at home.” Sanjay Sathe, president & CEO, RiseSmart.

2. Real world benefits

“It's important for benefits professionals and brokers to transform their organizations’ benefits offerings to align better with what both the individual and the generational millennials value — benefits that reflect the real world in which all generations in today's workforce think about the interconnection between their careers, employers, and personal lives.” Amy Christofis, client account executive, Connecture, Inc.

3. A millennial world

“One can no longer think of millennials as the ‘kids in the office.’ They are the office.” Eric Gulko, vice president, Summit Financial Corporation

4. New normal

Millennials are no longer just data and descriptors in a PowerPoint slideshow about job recruitment. They are now the majority, and how they do things will soon be the norm. It's important to consider these implications.

5. Innovation

“If we want to build organization that can innovate time and again, we must recast our understanding of what leadership is about. Leading innovation is about creating the space where people are willing and able to do the hard work of innovative problem solving.” Linda Hill, professor of business administration, Harvard Business School

6. Don't make assumptions

“Just because millennials are comfortable using the internet for research doesn't mean they don't also like a personal touch. Employers need to be wary of relying on only one communication vehicle to reach millennials. Sixty percent of millennials say they would be willing to discuss their benefits options with someone face to face or over the phone.” Ken Meier, vice president, Aflac Northeast Territory

7. The power of praise

“The prevailing joke is that millennials are ‘the participation trophy generation,’ having always been praised just for showing up, not necessarily winning. Turn that negative perception into a positive by realizing that providing constructive, encouraging feedback when it's earned motivates this generation to strive for even more successes.” Kristen Beckman, senior editor, LifeHealthPro.com

8. Embrace diversity

“For the first time, employers are likely to have up to five generations working together — matures, baby boomers, Generation X, millennials (Generation Y) and now Generation Z. From their workstyles to their lifestyles, each generation is unique.” Bruce Hentschel, leads strategy development, specialty benefits division, Principal Financial Group

9. Non-traditional needs

“Millennials have moved the needle in terms of work-life balance. They don't expect to sit in their cubicles from 9-5. They want flexibility in their work location and hours. However, on the flip side of that, they are more connected to their work than generations before, often logging ‘non-traditional’ work hours that better fit into their lives.” Amy Christofis, client account executive at Connecture, Inc.

10. Listen in

“If there's one thing the Trump victory teaches us, it's to listen to the silence in others. Millennials may be giving the financial industry the silent treatment, but that doesn't mean they don't want to talk.” Christopher Carosa, CTFA, chief contributing editor,FiduciaryNews.com

See the original article Here.

Source:

Moriarty-Siler E. (2017 February 03). 10 tips for next generation benefits [Web blog post]. Retrieved from address https://www.benefitspro.com/2017/02/03/10-tips-for-next-generation-benefits?page_all=1

Target employee financial needs by finding the right technology

Are you looking for new ways to help improve your employees' financial needs? Take a look at this interesting article from Employee Benefits Advisors about how the use of technology can improve your employees' financial needs by Mark Singer

We have seen how a large percentage of the American workforce has an inadequate degree of financial literacy, and how the lack of basic financial knowledge causes personal problems and workplace stress. We have also seen the importance of financial education and how raising employee literacy directly benefits the bottom lines of companies.

The financial health of employees can vary greatly between companies, as can employee numbers. Work schedules and available facilities are other issues of variance. There is also the interest factor to address. Employees must find programs interesting and beneficial, or they will not attend or glean maximum results. Financial wellness programs that may be beneficial and successful for one company may be burdensome and unsuccessful for another. To meet pressing personal financial problems effectively, cutting-edge technologies need to be applied that both address immediate employee issues and limit company expense.

There are numerous new technologies that can be utilized in a mix-and-match fashion that successfully target employee financial needs. This age of the World Wide Web brings a host of financial education tools directly to the audience. Informational videos, virtual learning programs, webinars, training portals and other virtual solutions are easily accessible over the Internet and most are quite user-friendly. This mode of education is significant. For example, 84% of respondents to a survey conducted by Hewlett-Packard and the National Association for Community College Entrepreneurship said that e-tools were valuable. The study went on to show that modalities containing some degree of online training were preferred by 56% of respondents.

Gaming and data

One form of online educational technology that is gaining momentum as well as results is known as game-based learning. This method of learning is particularly popular with the millennial generation that has grown up with an ever-increasing variety of online gaming. In 2008, roughly 170 million Americans engaged in video and computer games that compel players to acquire skills necessary to achieve specific tasks. It has been found that well-designed learning programs that utilize a gaming sequence improve target learning goals. Such games teach basic financial lessons in a fun and innovative way that requires sharpened financial skills to progress through the programs.

Technological tools not only benefit those that are utilizing them directly, but they also assist the entire community through the collection of key data. Many of the mentioned tools embed surveys within programs or collect other data such as age, income and location, which can be used to create even better educational materials or better target groups in need of specialized services.

Employers need to realize that they benefit when they utilize these new technologies in their financial wellness programs, since these tools assist workers in taking control of their financial lives. Thereby reducing their stress levels, which in turn leads to happier and more productive employees. Sometimes it is best to meet the employees where they are, with tools that are easy and fun to use.

See the original article Here.

Source:

Singer M. (2017 February 02). Target employee financial needs by finding the right technology [Web blog post]. Retrieved from address https://www.employeebenefitadviser.com/opinion/target-employee-financial-needs-by-finding-the-right-technology

Why technology is not just a ‘thought but a necessity’

Are you utilizing your technology to its advantages? Check out this article from Employee Benefits Advisors about the importance of technology in today's marketplace by Brian M. Kalish

More than half of all brokers nationwide are still using paper and have no online database of their clients — but the industry is about to reach a tipping point, where those still using old processes will be left behind.

According to a recent survey of 10,000 brokers by hCentive, 54% still use paper and 53% have no online database.

Having no online database is the most challenging part, Lisa Collins, director of business development at hCentive said a recent event for brokers sponsored by the company in Reston, Va. Those brokers, she said, lack a central place for their resources.

But for brokers still using these old processes, the industry is reaching a tipping point, she said, where “technology is not just a thought [but] a necessity.”

It will become necessary, she explained, because the industry is demanding technology solutions as employers look to their brokers to provide more services with less commissions. On top of that, HR broker tech startups, such as Zenefits, Namely and Gusto are taking business away. These firms offer technology solutions for free and become the broker of record — and they are moving upmarket, Collins added. The tech startups, Collins added, are taking business from more traditional brokers.

These tech startups are directly approaching adviser’s clients, she said. Clients are responding to these HR tech startups because of challenging and changing requirements of HR, including Affordable Care Act compliance.

“Clients are asking for more than ever,” she said. “It used to [broker’s] sold insurance. Now they are a true consultant and risk mitigator.”

“Clients want more and more and it is challenging with less commission dollars to work with,” she added. “You have more competition than you have ever had.”

Advisers need to provide value, as benefits are likely to be a top three expense for an employer, added Brian Slutz, regional sales manager at hCentive.

The future

Looking toward the future, many questions still remain about President Donald Trump’s plans for healthcare and employee benefits, but a few things are likely to be consistent, which can be streamlined with technology, including:

- Consumer-driver healthcare is staying, Collins said, and with that comes the growth of health savings accounts. As a result, more voluntary products can be sold. Technology enables that through decision support tools that suggest these products to employees.

- Cost transparency tools: “A really critical tool,” Collins said. Viable systems are hitting the marketplace now and technology provides answers employees are seeking on healthcare costs

- Personalized communications: With more choice and more complication comes the need for education, Collins said. Technology solutions are becoming more customized to speak to an individual employee with targeted communication to a particular generation.

See the original article Here.

Source:

Kalish B. (2017 January 31). Why technology is not just a 'thought but a necessity' [Web blog post]. Retrieved from address https://www.employeebenefitadviser.com/news/why-technology-is-not-just-a-thought-but-a-necessity?brief=00000152-1443-d1cc-a5fa-7cfba3c60000