How to Find an Old 401(k) — and What to Do With It

According to the U.S. Government Accountability Office, there are more than 25 million people with money left behind in a previous employer-sponsored retirement plan. Read this blog post from NerdWallet for information on how to find an old retirement plan and what to do with it.

There are billions of dollars sitting unclaimed in ghosted workplace retirement plans. And some of it might be yours if you’ve ever left a job and forgotten to take your vested retirement savings with you.

It happens. A lot.

The U.S. Government Accountability Office reports that from 2004 through 2013, more than 25 million people with money in an employer-sponsored retirement plan like a 401(k) left at least one account behind after their last day on the job.

But no matter how long the cobwebs have been forming on your old 401(k), that money is still yours. All you have to do is find it.

Following the money

Employers will try to track down a departed employee who left money behind in an old 401(k), but their efforts are only as good as the information they have on file. Beyond providing 30 to 60 days notice of their intentions, there are no laws that say how hard they have to look or for how long.

If it’s been a while since you’ve heard from your former company, or if you’ve moved or misplaced the notices they sent, there are three main places your money could be:

- Right where you left it, in the old account set up by your employer.

- In a new account set up by the 401(k) plan administrator.

- In the hands of your state’s unclaimed property division.

Here’s how to start your search:

Contact your old employer

Start with your former company’s human resources department or find an old 401(k) account statement and contact the plan administrator, the financial firm that held the account and sent you updates.

"You may be allowed to leave your money in your old plan, but you might not want to."

If there was more than $5,000 in your retirement account when you left, there’s a good chance that your money is still in your workplace account. You may be allowed to leave it there for as long as you like until you’re age 70½, when the IRS requires you to start taking distributions, but you might not want to. Here’s how to decide whether to keep your money in an old 401(k).

Plan administrators have more leeway with abandoned amounts up to $5,000. If the balance is $1,000 or less, they can simply cut a check for the total and send it to your last known address, leaving you to deal with any tax consequences. For amounts more than $1,000 up to $5,000, they’re allowed to move funds into an individual retirement account without your consent. These specialty IRAs are set up at a financial institution that has been federally authorized to manage the account.

The good news if a new IRA was opened for the rollover: Your money retains its tax-protected status. The bad: You have to find the new trustee.

Look up your money’s new address

If the old plan administrator cannot tell you where your 401(k) funds went, there are several databases that can assist:

- A good place to start is with the Department of Labor’s abandoned plan database.

- FreeErisa also maintains a rundown of employee benefit plan paperwork.

- If you were covered under a traditional pension plan that was disbanded, search the U.S. Pension Guaranty Corp. database of unclaimed pensions.

- There’s also the National Registry of Unclaimed Retirement Benefits, which works like a “missed connections” service whereby companies register with the site to help facilitate a reunion between ex-employees and their retirement money. Not every company is registered with this site, so if none of these searches yields results, move on to the next step.

Search unclaimed property databases

If a company terminates its retirement plan, it has more options on what it’s allowed to do with the unclaimed money, no matter what the account balance.

"If your account was cashed out, you may owe the IRS."

It might be rolled into an IRA set up on your behalf, deposited at a bank or left with the state’s unclaimed property fund. Hit up missingmoney.com, run in part by the National Association of Unclaimed Property Administrators, to do a multistate search of state unclaimed property divisions.

Note that if a plan administrator cashed out and transferred your money to a bank account or the state, a portion of your savings may have been withheld to pay the IRS. That’s because this kind of transfer is considered a distribution (aka cashing out) and is subject to income taxes and penalties. Some 401(k) plan administrators withhold a portion of the balance to cover any potential taxes and send you and the IRS tax form 1099-R to report the income. Others don’t, which could leave you with a surprise IRS IOU to pay.

What to do with it

You might be able to leave your old 401(k) money where it is if it’s in your former employer’s plan. One reason to do so is if you have access to certain mutual funds that charge lower management fees available to institutional clients — like 401(k) plans — that aren’t available to individual investors. But you’re not allowed to contribute to the plan anymore since you no longer work there.

Reasons to move your money to an IRA or to roll it into a current employer’s plan include access to a broader range of investments, such as individual stocks and a wider selection of mutual funds, and more control over account fees.

If your money was moved into an IRA on your behalf, you don’t have to — and probably shouldn’t — leave it there. The GAO study of forced-transfer IRAs found that annual fees (up to $115) and low investment returns (0.01% to 2.05% in conservative investments dictated by the Department of Labor regulations) “can steadily decrease a comparatively small stagnant balance.”

Once you find your money, it’s easy to switch brokers and move your investments into a new IRA of your choosing without triggering any taxes.

Unless you enjoyed this little treasure hunt, the next time you switch jobs, take your retirement loot with you.

SOURCE: Yochim, D. (27 February 2019) "How to Find an Old 401(k) — and What to Do With It" (Web Blog Post). Retrieved from https://www.nerdwallet.com/blog/investing/how-to-find-an-old-401k-and-what-to-do-with-it/

Wealthy vs Financial Fit. Here’s the Difference and Why It Matters

What is the difference between being wealthy and financially fit? Someone could be wealthy without being "financially fit". Read this blog post from Life Happens to learn more about the difference.

People can be wealthy without being financially fit, meaning they can have a lot of assets or money tied up in assets, but those assets aren’t “liquid.” Let me explain. Say you have a house that has escalated in value in the real estate market. You may have this large asset, but that doesn’t necessarily mean you’re financially comfortable from an income standpoint. You aren’t able to tap into that “wealth” to pay for your day-to-day expenses.

Considering Risk

The overall goal when I sit down with someone, or perhaps a couple, is to determine their wants and needs, and then give them a plan that helps them grow their assets, while achieving their income goals.

But one thing many people fail to look at is the risk during this growth period. Let’s say you’re married, and again your major asset is your home, perhaps even with a large mortgage. What if something were to happen to either one of you? Would you still be able to pay the mortgage and retain the house? Or would you need to sell your largest asset just to pay day-to-day living expenses?

That’s where life insurance comes in as a foundational piece to financial fitness. It addresses the issue of someone dying too soon—that’s a risk factor you don’t want to leave chance. And the truth is, it’s an affordable solution for almost everyone. A healthy 30-year-old can get a 20-year $250,000 level term life insurance policy for about $13 a month. Most of us can afford to find that kind of money in our budget.

What Do Romantic Partners Want?

Life Happens did the survey, “What Do Romantic Partners Want?” and we discovered some great news for most of us—people prefer a partner who is financially fit (64%) over someone who is wealthy (16%). And we explored a whole host of factors, from looks to money to relationships. And I think it’s only natural that when people are dating, all the factors that we explored in the survey come into play.

It’s when things become serious and you’re looking to settle down that you have to start asking some of the tougher questions, questions that may make you feel uncomfortable. For example, does the other person have a lot of debt or other financial obligations?

Remember, if you marry and sign on the dotted line, you become responsible for each other’s debt. I’ve seen divorces happen where one partner was racking up a huge amount of credit card debt without the other one knowing, and then in the divorce proceedings the other partner finds out that they are responsible for half that debt.

In the end, it comes down to being financially aware, asking the appropriate questions, even if they are uncomfortable ones. You need to go into a long-term relationship with your eyes and ears wide open.

SOURCE: Feldman, M. (5 June 2018) "Wealthy vs Financial Fit. Here’s the Difference and Why It Matters" (Web Blog Post). Retrieved from https://lifehappens.org/blog/wealthy-vs-financial-fit-heres-the-difference-and-why-it-matters/

How 401(k) Taxes Work and How to Minimize the Tax Bill

Are you familiar with how 401(k) taxes work? Most 401(k) plans are tax-deferred, meaning that you won't pay income taxes until you withdraw the money you've put into your 401(k). Read this blog post for an overview of how these taxes work.

Most 401(k) plans are tax-deferred, which means you don’t pay income tax on the money you put into the account until you withdraw it. That makes the 401(k) not just a way to save for retirement; it’s also a great way to cut your tax bill. But there are a few rules about 401(k) taxes to know, as well as a few strategies that can get your tax bill even lower.

Here’s an overview of how 401(k) taxes work and how to pay less tax when the IRS asks for a cut of your retirement savings.

How do 401(k) taxes on contributions work?

Contributions to a traditional 401(k) plan come out of your paycheck before the IRS takes its cut. So if you earn $1,000 before taxes at work and you contribute $200 of it to your 401(k), that’s $200 less that you’ll be taxed on. When you file your tax return, you’d report $800 rather than $1,000.

- If your employer offers a Roth 401(k), that means you contribute after-tax money instead of pre-tax money as with the traditional 401(k). This has a few advantages (see the section about withdrawals).

- You still have to pay Medicare and Social Security taxes on your payroll contributions to a 401(k).

- In 2019, you can contribute up to $19,000 a year to a 401(k) plan, which means you can shield $19,000 a year from income taxes. If you’re 50 or older, you can contribute $25,000 in 2019.

- The annual contribution limit is per person, and it applies to all of your traditional or Roth 401(k) contributions in total.

- Your employer will send you a W-2 in January that shows how much it paid you during the previous calendar year, as well as how much you contributed to your 401(k) and how much withholding tax you paid.

Do 401(k) taxes apply while your money is in the account?

While money is in a traditional 401(k), you pay no taxes on investment gains, interest or dividends. This is true for a Roth 401(k), as well.

Roth 401(k) vs. Traditional 401(k)

| Traditional 401(k) | Roth 401(k) | |

| Tax treatment of contributions | Contributions are made pre-tax, which reduces your current adjusted gross income. | Contributions are made after taxes, with no effect on current adjusted gross income. Employer matching dollars must go into a pre-tax account and are taxed when distributed. |

| Tax treatment of withdrawals | Distributions in retirement are taxed as ordinary income. | No taxes on qualified distributions in retirement. |

| Withdrawal rules | Withdrawals of contributions and earnings are taxed. Distributions may be penalized if taken before age 59½, unless you meet one of the IRS exceptions. | Withdrawals of contributions and earnings are not taxed as long as the distribution is considered qualified by the IRS: The account has been held for five years or more and the distribution is:

Unlike a Roth IRA, you cannot withdraw contributions at any time. |

How do 401(k) taxes apply to withdrawals?

In technical terms, your contributions and the investment growth in a traditional 401(k) are tax-deferred — that is, you don’t pay taxes on the money until you make withdrawals from the account. At that point, you’ll owe income taxes to Uncle Sam. If you’re in a Roth 401(k), in most cases you won’t owe any taxes at all when you withdraw the money because you will have already paid the taxes upfront.

401(k) taxes if you withdraw the money in retirement

- For traditional 401(k)s, the money you withdraw is taxable as regular income — like income from a job — in the year you take the distribution (remember, you didn’t pay income taxes on it back when you put it in the account; now it’s time to pay the piper).

- For Roth 401(k)s, the money you withdraw is not taxable (you already paid the income taxes on it back when you put the money in the account).

- You can begin withdrawing money from your traditional 401(k) without penalty when you turn age 59½.

- You can begin withdrawing money from your Roth 401(k) without penalty once you’ve held the account for at least five years and you’re at least 59½.

- If you’ve retired, you have to start taking required minimum distributions from your account starting on April 1 of the year following the year in which you turn 70½.

- If you’re still working at age 70½, you can put off taking distributions from your traditional 401(k).

- If you don’t take the required minimum distribution when you’re supposed to, the IRS can assess a penalty of 50% of the amount not distributed.

- You can withdraw more than the minimum.

401(k) taxes if you withdraw the money early

For traditional 401(k)s, there are three big consequences of an early withdrawal or cashing out before age 59½:

- Taxes will be withheld. The IRS generally requires automatic withholding of 20% of a 401(k) early withdrawal for taxes. So if you withdraw the $10,000 in your 401(k) at age 40, you may get only about $8,000.

- The IRS will penalize you. If you withdraw money from your 401(k) before you’re 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government another $1,000 of that $10,000 withdrawal.

- You may have less money for later, especially if the market is down when you start making withdrawals. That could have long-term consequences.

There are a lot of exceptions. This article has more details, but in a nutshell, you might be able to escape the IRS’s 10% penalty for early withdrawals from a traditional 401(k) if you:

- Receive the payout over time.

- Qualify for a hardship distribution with the plan administrator.

- Leave your job and are over a certain age.

- Are getting divorced.

- Are or become disabled.

- Put the money in another retirement account.

- Use the money to pay an IRS levy.

- Use the money to pay certain medical expenses.

- Were a disaster victim.

- Overcontributed to your 401(k).

- Were in the military.

- Die.

You can withdraw money from a Roth 401(k) early if you’ve held the account for at least five years and need the money due to disability or death.

7 quick tips to minimize 401(k) taxes

- Wait as long as you can to take money out of your account. Withdrawals are what can trigger taxes.

- If you must make an early withdrawal from a 401(k), see if you qualify for an exception that will help you avoid paying an early withdrawal penalty.

- See if you qualify for the Saver’s Credit on your contributions.

- Be careful with how you roll over your account. Rolling an old 401(k) account into another 401(k) or into an IRA usually won’t trigger taxes — if you get the money into the new account within 60 days. Otherwise, the IRS might consider the move a distribution, triggering taxes and maybe even a penalty.

- Borrow from your 401(k) instead of making an early withdrawal. Not all 401(k) plans offer loans, though. Also, in most circumstances you’ll need to repay the loan within five years and make regular payments. Check with your plan administrator for the rules.

- Use tax-loss harvesting. You might be able to offset the taxes on your 401(k) withdrawal by selling underperforming securities at a loss in some other regular investment account you might have. Those losses can offset some or all of the taxes on your 401(k) withdrawal.

- See a tax professional. There are other ways to minimize your 401(k) taxes, too, so find a qualified tax pro and discuss your options.

SOURCE: Orem, T. (19 September 2019) "How 401(k) Taxes Work and How to Minimize the Tax Bill" (Web Blog Post). Retrieved from https://www.nerdwallet.com/blog/taxes/401k-taxes/

5 ways employers can make diabetes education programs more inclusive

Employees struggling with diabetes often have to make difficult decisions when it comes to their medications. Often, it can be difficult to manage blood sugar daily and feel healthy enough to function at work. Read the following blog post from Employee Benefit News for five ways employers can make diabetes education programs more inclusive.

Diabetes doesn’t quit. Employees struggling with the disease often have to make difficult decisions about their medications. It can be hard to keep control of blood sugar every day and feel healthy enough to function well at work.

Many workers don’t tell their employer they have diabetes. Some 81% of benefits decision-makers believe employees with diabetes at their companies keep it a secret.

Giving voice to an issue is the first step toward solving it. Diabetes in the workplace is in need of attention: rates are rising in the U.S., as are the associated costs — unplanned missed workdays, reduced productivity and the stress associated with uncontrolled diabetes add up to billions of dollars per year.

To help employers find solutions, Roche Diabetes Care commissioned a survey of more than 200 benefits decision-makers at self-funded companies to learn their perceptions of the human and financial burden of diabetes. What’s clear is that addressing the myriad of concerns related to this condition is a top priority for benefits decision-makers; indeed, 70% say it keeps them awake at night.

Benefits decision-makers say the impact of diabetes on their companies is significant:

- More than one in four report diabetes results in increased costs to replace workers (28%), increased administrative and other indirect costs of managing absenteeism (29%);

- One in three believe diabetes results in indirect costs resulting from fatigue and understaffing as well as reduced productivity;

- One in four feel diabetes is responsible for poor morale among employees who must perform work to cover absent co-workers.

The majority (87%) agree it is vital that employers offer continual support to employees with diabetes. Listening, education and help simplifying everyday diabetes management emerge as ways employers can improve the health of their employees with diabetes and the company bottom lines. The following are five approaches to consider.

Cultivate a collaborative, supportive environment to encourage employees with diabetes to feel comfortable and at ease about sharing concerns.

Four in five (81%) benefits decision-makers surveyed say they believe employees keep their condition a secret. Fear of discrimination is one reason those with diabetes keep quiet along with the general sense that their colleagues and superiors just don’t know or understand what it’s like to live with the condition.

Secrets are also stressful. Employers can address this by including diabetes more frequently in workplace wellness education programs and discussions, and creating safe forums for employees with diabetes to share concerns and express their needs. Listening and making employees with diabetes part of a two-way dialogue demonstrate the company values not only their opinions but also their important contributions to the company community.

Designate private places at the office where employees with diabetes can test their blood sugar during the workday.

Some 90% of benefits decision-makers surveyed think their employees would value company access and time to monitor blood sugar or take injections.

Simplify daily diabetes management so employees have what they need to be in control of their blood sugar levels at home and at work.

People with diabetes have different concerns and different needs at different times. A company-sponsored program to simplify the daily decision-making and management of diabetes needs to be personalized, easily accessible and help the user keep track of their blood sugar levels automatically. Benefits decision-makers believe employers supported in this way would be:

- Less distracted and less stressed at work (37%);

- More productive (45%) and have better morale;

- Take fewer sick days (39%);

- Feel their employer cared about them (41%).

We have created a program that offers the elements that enable personalized accessible support. Participants say they feel more positively engaged in their daily management and more confident at work.

Demonstrate the value of supported employees with diabetes by measuring impact productivity and absenteeism.

Most of those surveyed say they believe company-supported programs that help employees with diabetes simplify daily management of the condition would have myriad benefits:

- 89% say it would lead to a higher quality of life and reduced sick time and related expenses;

- More than four in five say a company-supported program would result in more company loyalty and less turnover (83%) and contribute to increased productivity (84%);

- 90% believe employees with diabetes would feel more empowered at work if they participated in a company-supported program that helped them keep their blood sugar levels in control.

Consider conducting brief surveys of employees about their perceptions of diabetes. These can be done before or after education or awareness efforts are in place. For companies with support programs in place, surveys can be conducted among participants. Qualitative and quantitative data help demonstrate the value of these investments. Just asking the questions among employees show the company cares.

Show your successes; don’t just tell.

Show the value of educating about diabetes and supporting your employees with the condition. There are a number of ways to accomplish this. Collect and tell their stories. Create testimonials in articles for internal newsletters and videos that can be shown on monitors around the office. Stories are powerful ways to educate, build empathy and understanding, and perhaps most importantly, get the secret of diabetes out in the open.

SOURCE: Berman, A. (30 September 2019) "5 ways employers can make diabetes education programs more inclusive" (Web Blog Post). Retrieved from https://www.benefitnews.com/list/how-to-make-diabetes-education-programs-more-inclusive

The Open Enrollment Checklist: Are You Poised for a Successful Season

Are you prepared for open enrollment? According to a recent survey, 56 percent of U.S. adults with employer-sponsored health benefits said health coverage satisfaction is a key factor in deciding whether they should leave their current job. Read this blog post from Employee Benefit News to learn more.

It’s here… the moment we’ve all been waiting for — or, in the case of HR, preparing for (at least we’d hope). That’s right, open enrollment season has arrived.

Open enrollment is a major opportunity for HR to contribute to their company’s performance — both in terms of healthcare savings and employee productivity. The better employees understand their benefits, the more likely they are to make cost-conscious decisions about their plan choices and their healthcare — saving themselves, and their employers, money. Not only that, but a recent survey found that 56% of U.S. adults with employer-sponsored health benefits said that whether or not they like their health coverage is a key factor in deciding to stay at their current job. And, interestingly, satisfaction with benefits and benefits communications have a tremendous impact on job satisfaction and engagement.

Not sure you’ve done everything you could to turn this annual necessity into a true financial, educational game-changer for your organizations? Ask yourself, did you:

Take stock of last year’s enrollment? Before diving into enrollment for 2020, employers should have taken stock of how the company fared last year. Post-mortem meetings with the enrollment team (along with key internal and external stakeholders) to assess what went well (or didn’t) can ensure the coming enrollment season runs smoothly.

In particular, identify the most time-consuming tasks and discuss how they could be streamlined in the future. Second, determine what questions employees asked the most about last year — and be prepared to answer them again this year. Third, consider whether the company achieved its overall open enrollment goals, and what contributed to those results. By addressing the peaks and pitfalls of last year’s season, HR should have a head start on planning for 2020.

Plan your communications strategy?With a defined approach to open enrollment in place, HR at this point should have developed an organized, well-communicated strategy to keep employees informed about their plan options at enrollment and throughout the year. Have you:

· Defined corporate objectives and how to measure success? · Assessed what messages to share with employees, especially anything that is changing — such as adding or eliminating plans or changing vendors? · Determined what information is best delivered in print (e.g. newsletters, posters, postcards, enrollment guides), online or in person through managers or one-on-one enrollment support? Adopting a multi-channel engagement strategy will ensure key messages reach the intended audience(s).

Make sure employees understand the deadline and process for enrolling — and the implications of missing the enrollment window. They must understand whether their existing coverage will roll over, if they’ll default to a specific plan and/or level of coverage (perhaps different from what they currently have), or end up with no coverage at all.

Take a pro-active approach to open enrollment? Ninety percent of employees report that they roll over their same health plan year over year — though this doesn’t indicate overwhelming plan satisfaction. More typically, it’s because they’re intimidated about what they don’t know, are confused about their choices or just don’t care. Employees don’t have the information they need, and aren’t likely to seek it out on their own.

Offering — or even requiring — one-on-one meetings with benefit experts during open enrollment provides a forum for employees to discuss their individual needs and ensure they are selecting the right coverage. These services — often available through brokers or outside engagement firms — provide employees with a safe space to ask specific questions about their health conditions, family history and potential life changes that could affect their insurance needs. This is the ideal time to remind employees that there is no one-size-fits-all plan, and that the least expensive plan on paper may not, ultimately, be the most cost-effective plan over time.

Revisit your SPD? The document we all love to hate, summary plan descriptions (SPDs) remain the best source for information about how each plan works, what it covers and the participant’s rights and responsibilities under that plan.

Having an SPD that is current, appealing (or at least not off-putting) and easy to access can answer many employee questions before they find their way to HR. Simple fixes like adding charts, callout boxes or icons can make your SPDs easier to navigate. Many employers are taking it a step further and offering interactive SPDs, which include robust search functionality and links to definitions, important forms, modeling tools and calculators, vendor sites and even short video clips. By making SPDs digital and interactive, employers can provide employees access to important information about their coverage 24/7 via any device. And, by adding a data analytics component, HR can track which sections employees visit most and pinpoint knowledge gaps about their benefit options to enhance understanding and drive increased benefits usage.

Account for all demographics? With all the focus on today’s multigenerational workforce, it’s important to remember that there’s more to “demographics” than age and gender. Worksite (office vs. shop floor vs. construction site vs. road warrior) can have a tremendous impact on the communications channels you use and when you use them.

And while some “generational generalizations” hold true — many older workers prefer paper, and most young people prefer mobile communication channels — it’s more important to look at employee cohorts from the perspective of differing priorities (planning for retirement vs. retiring student debt), different levels of education and healthcare literacy, and experience with choosing and using benefits. Employees just starting their careers are likely to need more support and different information than a more seasoned worker who’s had years of experience with the enrollment process. Consider the most effective ways to engage the different demographics of your population to gain their attention and interest in choosing the right plan for them.

Equip employees for smart healthcare choices year-round? For most employees, becoming an educated healthcare consumer is a work in progress — which is why many employers offer year-round resources to support smart healthcare choices. That said, these resources are often under-utilized because employees don’t know they exist.

Open enrollment is the perfect time to spread the word about these programs and address the key question for employees: “What’s in it for me?” For example, many employers offer transparency services, which enable employees to research the potential cost of care and compare prices across several providers in their area.

Other resources, such as benefits advocates, can answer questions from employees in real time — including where to get care, how to get a second opinion and what the doctor’s instructions really mean. When used in conjunction, transparency and advocacy services can lower out-of-pocket spending for the employee and reduce costs for the employer. Does your open enrollment communications strategy highlight that these resources exist, outline how they work and explain how they benefit the employee?

What if open enrollment is only a week away and you haven’t taken most, if any, of these steps? It’s not too early to start your to-do list for next year — perhaps by first tackling your SPD and drafting that communications plan. Most importantly, get that post-mortem meeting on the schedule now, while the lessons learned from this year’s open enrollment are still fresh.

SOURCE: Buckey, K. (3 October 2019) "The Open enrollment checklist: Are you Poised for a successful season" (Web Blog Post) https://www.benefitnews.com/list/the-employers-open-enrollment-checklist

SIMPLE IRA vs. 401(k): How to Pick the Right Plan

Should you choose a SIMPLE IRA or a 401(k) for retirement saving? There are pros and cons to both types for employers. Read this blog post from NerdWallet for more on these two plan types and how to choose the right one for you.

The decision between a SIMPLE IRA and a 401(k) is, at its core, a choice between simplicity and flexibility for employers.

The aptly named SIMPLE IRA, which stands for Savings Incentive Match Plan for Employees, is the more straightforward of the two options. It’s quick to set up, and ongoing maintenance is easy and inexpensive. But if you have employees, you are required to provide contributions to their accounts. (See our SIMPLE IRA explainer.)

Although a 401(k) plan can be more complex to establish and maintain, it provides higher contribution limits and gives you more flexibility to decide if and how you want to contribute to employee accounts. Another big difference is that you can opt for a Roth version of the plan, whereas the SIMPLE IRA allows no Roth provision.

SIMPLE IRA vs. 401(k)

Here are the need-to-know differences between SIMPLE IRAs and 401(k)s:

SIMPLE IRA |

401(k) |

|

| Employer eligibility | Employers with 100 or fewer employees | Any employer with one or more employees |

| Employee eligibility | All employees who have compensation of at least $5,000 in any prior 2 years, and are reasonably expected to earn at least $5,000 in the current year |

All employees at least 21 years old who worked at least 1,000 hours in a previous year |

| Employer contribution rules |

|

|

| Contribution limits |

|

|

| Administrative responsibilities | No annual tax filing requirements; annual plan details must be sent to employees | Subject to annual compliance testing to ensure plan does not favor highly compensated employees |

| Fees | Minimal account fees | Varies by plan |

| Investment options | Any investments available through the financial institution that holds accounts | Investment selection curated by employer and plan administrator |

| Pros |

|

|

| Cons |

|

|

| More details | What Is a SIMPLE IRA? | What Is a 401(k)? |

SOURCE: IRS.gov

SIMPLE IRA or 401(k): How to decide

Startup costs and ease of setup often dictate the choice between retirement savings plans. But there are other factors to consider as well. To help decide which plan is best, answer the following questions:

Why are you setting up a retirement plan?

For many small-business owners, the answer is that they’re trying to maximize their own retirement savings dollars. If that’s the case, contribution limits should weigh heavily in your decision. For high earners especially, the higher contribution limit of the 401(k) makes it a more attractive choice than a SIMPLE IRA.

How important is it to offer the Roth option?

As mentioned earlier, the IRS allows employers to offer a Roth 401(k). (Quick reminder: A Roth 401(k) is funded with after-tax contributions in exchange for tax-free distributions in retirement.) There is no Roth version of the SIMPLE IRA. The account is subject to many of the same rules as a traditional IRA: Contributions reduce your taxable income for the year, but distributions in retirement are taxed as ordinary income. That said, the IRS allows participants to save in both a SIMPLE IRA and a Roth IRA at the same time.

Will you need to adjust employer contributions?

Although a nice perk to attract potential employees, employer contributions are not required of companies that offer 401(k) plans. You also have the freedom to set vesting terms, which allows you to require employees remain employed by you for a set time before taking ownership of your contributions to their accounts. Employer contributions to employee SIMPLE IRA accounts are mandatory, though you can choose between two matching arrangements dictated by the IRS. Contributions to a SIMPLE IRA are immediately 100% vested.

You have other choices

If you are self-employed or a small-business owner, SIMPLE IRAs and 401(k) plans aren’t your only options. There are a variety of retirement plans at your disposal.

For example, if you run a business with no employees, a solo 401(k) is worth considering. As the employer and (your own) employee, you’re allowed to contribute a total of up to $56,000 in 2019 (or $62,000 if you’re age 50 or older).

A SEP IRA also has a high contribution limit for business owners and self-employed individuals, though there is no catch-up contribution for savers 50 or older. The drawbacks: Like the SIMPLE IRA, a SEP requires employers to contribute to eligible employee accounts, and no Roth version is allowed.

We’ve laid out the pros and cons for these and other retirement plan options for the self-employed.

SOURCE: Yochim, D. (8 June 2019) "SIMPLE IRA vs. 401(k): How to Pick the Right Plan" (Web Blog Post). Retrieved from https://www.nerdwallet.com/blog/investing/simple-ira-vs-401k-comparison-how-to-pick-the-right-plan/

Key elements to consider when researching financial wellness programs

With financial wellness programs becoming a staple employee benefit, organizations find themselves implementing programs that only offer a few tools or resources. Read the following blog post from Employee Benefit Advisor for key elements to consider when researching financial wellness programs.

Financial wellness programs are becoming a staple in the employee benefit universe. But what should a successful financial wellness program encompass? As a rapidly growing industry, we often lack a consistent definition for financial wellness. This leads to organizations believing they have implemented a financial wellness program, when they may only be offering a few tools like education or counseling.

I define financial wellness as the process by which an individual can efficiently and accurately assess their financial posture, identify personal goals, and be motivated to gain the necessary knowledge and resources to create behavioral change. Behavioral change will result in improved emotional and mental well-being, along with short- and long-term financial stability.

As the administrator of your company’s benefits, you are responsible for bringing the best possible solution to your employees. That’s a tough ask, given the growing number of service providers. So, what is the most efficient and effective way to assess financial wellness services to determine which solution best fits your organizational needs? Ask yourself these questions:

Does the platform offer a personal assessment of each employee’s current financial situation and help them identify their financial goals? If the answer is yes: Does the assessment return quantifiable and qualifiable data unique to each individual employee?

Does the platform address 100% of your employee base, including the least sophisticated employees at various levels of employment? Much of your ROI from a financial wellness program does not come from your top performers. It comes from creating behavioral changes within your employees who need the most financial guidance.

Does the platform integrate the various components to provide a personalized roadmap for each employee? It should connect program elements like personal assessments, educational resources, tools, feedback and solutions to ensure the employee is presented with a cohesive, comprehensive plan to attack and improve their financial situation.

Does the platform offer solutions for short-term financial challenges like cash flow issues, as well as long-term financial challenges associated with saving and planning? A major return on your investment comes from reduced employee stress, which is substantially driven by short-term needs versus long-term objectives. The program must help employees deal with current financial challenges before they can focus on their longer-term vision.

About 78% of U.S. workers live paycheck to paycheck to make ends meet, according to data from CareerBuilder.com. The need for financial wellness is clear, but there are consistent pillars that must be addressed in any successful financial wellness program to affect change: spend, save, borrow and plan. When evaluating financial wellness programs, it’s important that these dots all connect if you are truly going to motivate behavioral change and recognize the ROI of a comprehensive financial wellness program.

SOURCE: Kilby, D. (13 September 2019) "Key elements to consider when researching financial wellness programs" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/opinion/key-considerations-for-employee-financial-wellness-programs

4 pitfalls of paid leave and how clients can avoid them

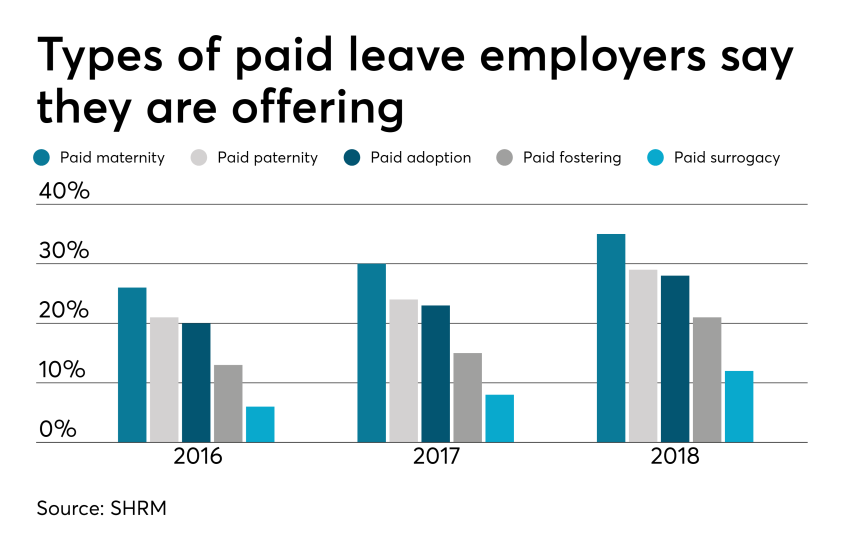

Employers are using paid leave options to help boost their employee benefits packages in efforts to better attract and retain talent. Read the following blog post from Employee Benefit Advisor for 4 common pitfalls of paid leave and how employers can avoid them.

Smart employers are boosting their benefits packages with paid family leave — the most coveted work perk among all generations. In today’s low unemployment environment, paid leave benefits can be a huge differentiator in attracting and retaining talent.

Smart employers are boosting their benefits packages with paid family leave — the most coveted work perk among all generations. In today’s low unemployment environment, paid leave benefits can be a huge differentiator in attracting and retaining talent.

But some employers are getting themselves into trouble in the process, facing accusations of gender discrimination or improper use of leave.

Here are four potential pitfalls of paid leave, and how employers can avoid them.

1. Be careful what you call “maternity leave.”

Employers have long been granting leave for new moms in the form of disability coverage. In fact, the top cause of short term disability is pregnancy. Disability insurance usually grants new moms six to eight weeks of paid leave to recover from childbirth.

Because this coverage applies to the medical condition of recovering from childbirth, it shouldn’t be lumped in with bonding leave.

Guidance from the Equal Employment Opportunity Commission says leave granted for new moms for bonding must also be extended to new dads, so separating disability leave from bonding leave is crucial to avoiding gender discrimination.

2. Don’t make gender assumptions.

The amount of bonding time for new parents after birth, adoption or fostering must be granted equally for men and women. Companies that don’t provide the same amount of paid leave for men and women may find themselves in a discrimination lawsuit.

It’s not just the time away from work that matters, but also the return-to-work support provided. If new moms are granted temporary or modified work schedules to ease the transition back to work, new dads must also have access to this.

Some companies may choose to differentiate the amount of leave and return-to-work support for primary or secondary caregivers. That’s compliant as long as assumptions aren’t made on which gender is the primary or secondary caregiver.

The best way to avoid potential gender discrimination pitfalls is to keep all parental bonding and related return-to-work policies gender neutral.

3. Avoid assuming the length of disability.

Be careful about assuming the length of time a new mom is disabled, or recovering medically, after birth. Typical coverage policies allot six to eight weeks of recovery for a normal pregnancy, so assuming a new mom may be out for 10 weeks might be overestimating the medical recovery time, and under-representing the bonding time, which must be gender neutral.

4. Keep up with federal, state and local laws.

Mandated leave laws are ever-evolving, so employers should consistently cross-check their policies with state and local laws. For instance, do local paid leave laws treat adoption the same as birth? Are multistate employers compliant? What if an employee lives in one state but works in another: Which state’s leave policies take precedence?

Partnering with a paid leave service provider can mitigate the risk of improperly administering leave. Paid leave experts can help answer questions, review guidelines and provide information regarding job-protecting medical or family leave.

They can also help flag potential pitfalls, ensuring leave requests from all areas of your company are managed uniformly and in accordance with state and federal laws, including the EEOC.

SOURCE: Bennett, A. (12 September 2019) "4 pitfalls of paid leave and how clients can avoid them" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/list/4-pitfalls-of-paid-leave-and-how-clients-can-avoid-them

8 renewal considerations for 2020

Are you prepared for open enrollment 2020? With renewal season quickly approaching, plan administrators have a lot of considerations to make regarding employee health plans. Read the following blog post from Employee Benefit News for eight things to consider this year.

The triumphant return of the Affordable Care Act premium tax (the health insurer provider fee).

This tax of about 4% is under Congressional moratorium for 2019 and returns for 2020. Thus, fully insured January 2020 medical, dental and vision renewals will be about 4% higher than they would have been otherwise. Of note, this tax does not apply to most self-funded contracts, including so-called level-funded arrangements. Thus, if your plans are presently fully insured, now may be a good time to re-evaluate the pricing of self-funded plans.

Ensure your renewal timeline includes all vendor decision deadlines.

As the benefits landscape continues to shift and more companies are carving out certain plan components, including the pharmacy benefit manager, you may be surprised with how early these vendors need decisions in order to accommodate benefit changes and plan amendments. Check your contracts and ask your consultant. Further, it seems that our HRIS and benefit administration platforms are ironically asking for earlier and earlier decisions, even with the technology seemingly improving.

Amending your health plan for the new HSA-eligible expenses.

In July of this year, the U.S. Treasury loosened the definition of preventive care expenses for individuals with certain conditions.

While these regulations took effect immediately, they won’t impact your health plan until your health plan documents are amended. Has your insurer or third-party administrator automatically already made this amendment? Or, will it occur automatically with your renewal? Or is it optional? If your answer begins with “I would assume…,” double-check.

Amending your health plan for the new prescription drug coupon regulations.

As we discussed in July of this year, these regulations go into effect when plans renew in 2020. In short, plans can only prevent coupons from discounting plan accumulators (e.g., deductible, out-of-pocket maximum) if there is a “medically advisable” generic equivalent.

If your plan is fully insured, what action is your insurer taking? Does it seem compliant? If your plan is self-funded, what are your options? If you can keep the accumulator program and make it compliant, is there enough projected program savings to justify keeping this program?

Is your group life plan in compliance with the Section 79 nondiscrimination rules?

A benefit myth that floats around from time to time is that the first $50,000 in group term life insurance benefits is always non-taxable. But, that’s only true if the plan passes the Section 79 nondiscrimination rules. Generally, as long as there isn’t discrimination in eligibility terms and the benefit is either a flat benefit or a salary multiple (e.g., $100,000 flat, 1 x salary to $250,000), the plan passes testing. Ask your attorney, accountant, and benefits consultant about this testing. If you have two or more classes for life insurance, the benefit is probably discriminatory. If you fail the testing, it’s not the end of the world. It just means that you’ll likely need to tax your Section 79-defined “key employees” on the entire benefit, not just the amount in excess of $50,000.

Is your group life maximum benefit higher than the guaranteed issue amount?

Surprisingly, I still routinely see plans where the employer-paid benefit maximum exceeds the guaranteed issue amount. Thus, certain highly compensated employees must undergo and pass medical underwriting in order to secure the full employer-paid benefit. What often happens is that, as benefit managers turnover, this nuance is lost and new hires are not told they need to go through underwriting in order to secure the promised benefit. Thus, for example, an employee may think he or she has $650,000 in benefit, while he or she only contractually has $450,000. What this means is the employer is unknowingly self-funding the delta — in this example, $200,000. See the problem?

Please pick up your group life insurance certificate and confirm that the entire employer-paid benefit is guaranteed issue. If it is not, negotiate, change carriers, or lower the benefit.

Double-check that you haven’t unintentionally disqualified participant health savings accounts (HSAs).

As we discussed last December, unintentional disqualification is not difficult.

First, ensure that the deductibles are equal to or greater than the 2020 IRS HSA statutory minimums and the out-of-pocket maximums are equal to or less than the 2020 IRS HSA statutory maximums. Remember that the IRS HSA maximum out-of-pocket limits are not the same as the Affordable Care Act (ACA) out-of-pocket maximum limits. (Note to Congress – can we please align these limits?)

Also, remember that in order for a family deductible to have a compliantly embedded single deductible, the embedded single deductible must be equal to or greater than the statutory minimum family deductible.

Complicating matters, also ensure that no individual in the family plan can be subject to an out-of-pocket maximum greater than the ACA statutory individual out-of-pocket maximum.

Finally, did you generously introduce any new standalone benefits for 2020, like a telemedicine program, that Treasury would consider “other health coverage”? If yes, there’s still time to reverse course before 2020. Talk with your tax advisor, attorney, and benefits consultant.

Once all decisions are made, spend some time with your existing Wrap Document and Wrap Summary Plan Description.

For employers using these documents, it’s easy to forget to make annual amendments. And, it’s easy to forget, depending on the preparer, how much detail is often in these documents. For example, if your vision vendor changes or even if your vision vendor’s address changes, an amendment is likely in order. Ask your attorney, benefits consultant, and third party administrators for help.

SOURCE: Pace, Z. (Accessed 9 September 2019) "8 renewal considerations for 2020" (Web Blog Post). Retrieved from https://www.benefitnews.com/list/healthcare-renewal-considerations-for-2020

Putting Humanity into HR Compliance: Stop Tolerating Toxicity

HR departments who have a detox mission and address toxic workplace relationships can prove incredibly valuable to their organizations. Not only are employees and their well-being impacted by toxic workplace relationships, but also the organizational success and the well-being of employees' family members. Continue reading this blog post to learn more.

In my prior career as an employment attorney and in my current one as an organizational consultant and coach, I have encountered numerous toxic workplace relationships. The cost of these relationships—to organizational success, employee well-being and the well-being of employees' family members—is astronomical.

And the greatest tragedy is this: Almost all of this loss, pain and suffering is preventable.

Why are toxic workplace relationships so common? And why are they tolerated?

The answer to the first question is that good people make bad decisions. Typically, employee relationships start out fine. Employees cooperate and collaborate in their relationships with their bosses and peers.

But then something goes awry. A trust gap opens. The employee does not address the problem promptly, directly and constructively, but the employees' avoidance instinct kicks in. Nothing constructive is done to close the trust gap. As a result, the problem festers and grows. Eventually, any remaining trust evaporates, and the relationship degenerates into aggression, passive aggression or both.

Note that I'm not talking about the incorrigible "work jerk," whose behavior should never be tolerated. Rather, I'm talking about people stuck in toxic work relationships producing jerkish and other negative behavior.

Managers and HR practitioners succumb to the avoidance instinct, too. Although aware of the toxicity, they don't intervene and are wary of wading into others' dysfunctional relationships.

What are the costs of tolerating toxicity?

- Personal suffering. The immediate parties may think they have nothing in common, but they do: They're equally disengaged and miserable.

- Work loss. Toxic relationships do nothing to improve the quantity or quality of work, customer service or on-the-job innovation. There is increased absenteeism and what Colleen McManus, SHRM-SCP, an HR executive with the state of Arizona, calls "presenteeism," in which people are at work but not focused on work, dwelling on negativity instead of doing their jobs properly.

- Secondhand anxiety. Co-workers who witness the toxic behavior suffer, as does their contribution to the organization. They are the truly innocent victims.

- Collateral damage. Employees affected by workplace toxicity typically bring their stress home. This doesn't reduce their stress; rather, it elevates their loved ones' stress. "So true! In the most serious situations," McManus said, "I have seen greater instances of alcoholism and domestic violence due to problems at work."

How HR Can Help

HR departments with a detox mission can prove incredibly valuable to their organizations and the people in them. It's not hard to identify toxic relationships. The challenge is taking action.

I can say with confidence that intervention is always better than tolerating toxicity. You'd be surprised how easily many toxic relationships can be reset when a skilled third party steps in. HR professionals are ideally positioned to help employees stuck in toxic relationships get back on track. Or, if there's too much baggage, HR professionals can facilitate a respectful relocation of the parties to different positions in the organization. This method is a good way to start.

Many times, a toxic relationship is rooted in an unwitting and unaddressed offense one employee gave the other. As a result, the offended party started behaving differently toward the offender, which produced more offensive behavior, and so on. "I'm always surprised," McManus said, "when I ask the parties to the conflict what a resolution looks like. Often, it's simply an opportunity to be heard."

She adds that a sincere apology goes a long way toward rebuilding trust. "They feel validated, which is important to them."

Sometimes there's a structural misfit in the workers' roles that needs to be clarified, or how the jobs interact needs to be modified. HR can help figure out how the jobs can function without recurrent friction. "This is our profession's bread and butter!" McManus said.

There may be a personality conflict, in which case the parties need better understanding of how to interact with people whose styles differ from theirs. If that can't be achieved, though, there can be an agreement to disagree and respectfully move on—whether to a different position inside or outside the organization.

An HR team that makes a commitment to identify and resolve toxic relationships is empowered by the CEO, and is supported by the leadership team will prove to be incredibly valuable to its organization and the people in it. HR team members can directly coach others to resolve conflicts and show managers how to coach their employees who are stuck in toxic relationships.

There's also a risk management, compliance and claim-prevention component. In my employment lawyer days, most of my billable hours arose from conflict caused by toxic workplace relationships. An HR profession with a detox mission will become painfully costly to my former profession.

SOURCE: Janove, J. (Sept 06, 2019) "Putting Humanity into HR Compliance: Stop Tolerating Toxicity" (Web Blog Post) Retrieved from https://www.shrm.org/resourcesandtools/hr-topics/employee-relations/pages/putting-humanity-into-hr-compliance-stop-tolerating-toxicity-.aspx