How to Handle Employee Requests for Time Off to Vote

Do you know how to handle employee requests for time off to vote? In some states, it is a requirement to give employees time off to vote. Read this blog post to learn more.

Many employees will be eligible to cast their ballot on Nov. 6, but will they have time to vote? Some states require employers to give workers time off to vote, and even in states that don't, some businesses are finding other ways to get employees to the polls.

With Election Day around the corner, employers should be mindful that, while no federal law provides employees leave to vote, many states have enacted laws in this area, said Marilyn Clark, an attorney with Dorsey & Whitney in Minneapolis. Depending on the state, employers may have to give workers notice about their voting rights and provide paid or unpaid time off to vote.

Even in states where there is no voting leave law, it is good practice to let employees take up to two hours of paid time off to vote if there isn't enough time for the employee to vote outside of working hours. "Encouraging and not discouraging employees should be the general rule," said Robert Nobile, an attorney with Seyfarth Shaw in New York City.

Encourage Employees

"Here in the United States, too many people don't vote because they don't have time due to jobs, child care and other responsibilities," said Donna Norton, executive vice president of MomsRising, an organization of more than 1 million mothers and their families. "Getting to the polls can be especially challenging for people in rural communities [or] single-parent households, and those who are juggling multiple jobs."

About 4 in 10 eligible voters did not vote in the 2016 presidential election, according to research conducted by Nonprofit VOTE and the U.S. Elections Project. And voter turnout has been historically lower for midterm elections, such as this year's, which are held near the midpoint of a president's four-year term, according to Pew Research Center.

"Businesses can help solve this problem by making sure that all employees have paid time off to vote," Norton said.

Some employers are offering solutions by making Election Day a corporate holiday, offering a few hours of paid time off for employees to vote and giving employees information about early and absentee voting, according to TheWashington Post.

Giving employees time off to participate in civic or community activities tends to improve worker performance, said Katina Sawyer, Ph.D., an assistant professor of management at George Washington University. Employers who are offering paid time off to vote will likely reap the benefits through improved employee attitudes and performance.

Know the Law

Employers in states with voting-leave laws should be familiar with the specific requirements, as some state laws have a lot of details. Even in states without such laws on the books, employers should check to see if there are any local voting leave ordinances in their cities.

Employers required to give workers time off to vote should plan for adequate work coverage to ensure that all employees can take time off, Clark said.

In many states, the employer may ask workers to give advance notice if they need time off and may require that workers take that leave at a specific time of the workday. In some states where leave is paid, employers might have the right to ask employees to prove they actually voted. Most states prohibit employers from disciplining or firing an employee who takes time off from work to vote.

"Ultimately, fostering an environment that generally encourages employees to exercise this important right is a good practice to mitigate the risk of a potential retaliation claim," Clark said.

Although state laws vary, "the general theme across the U.S. with respect to voting laws is that employees will be given time off to vote if there is insufficient time between the time the polls open and close within the state and the time employees start and finish work," Nobile said. "Typically, two to three consecutive nonworking hours between the opening and closing of the polls is deemed sufficient."

Some state laws provide unpaid leave to vote or do not address whether the leave must be paid. Oregon and Washington no longer have voting leave laws because they are "vote-by-mail" states.

In some states, such as California and New York, employers must post notices in the workplace before Election Day to inform employees of their rights. Employers might have to pay penalties if they don't comply.

The consequences for denying employees their voting rights can be harsh, with some states even imposing criminal penalties, Clark noted.

Create a Policy

At a minimum, employers should adopt a policy spelling out the voting rights available to employees under applicable laws, Clark said. For businesses that operate in states that don't have a voting-leave law, employers may still wish to adopt a policy outlining their expectations about time off for voting.

Multistate employers may elect to adopt a single policy that includes the most employee-friendly provisions of the state and local laws that cover them. "By taking this approach, employers avoid the administrative burden of adopting and promulgating multiple policies for employees working in different locales," Clark said. All voting-leave policies should be sure to include strong anti-retaliation provisions, which make clear that the employer will not take any adverse action against employees for exercising their voting rights.

"It's important to remember that the law sets the floor," said Bryan Stillwagon, an attorney with Sherman & Howard in Atlanta. "Companies with the happiest and most-engaged employees recognize that positive morale comes from doing more than what is required."

Nagele-Piazza, L. (29 October 2018) "How to Handle Employee Request for Time Off to Vote" (Web Blog Post). Retrieved from https://www.shrm.org/ResourcesAndTools/legal-and-compliance/state-and-local-updates/Pages/How-to-Handle-Employee-Requests-for-Time-Off-to-Vote.aspx

Dana Wilkie contributed to this article.

3 steps to negotiating a better employee benefit annual renewal

Do you know how to negotiate your annual employee benefits renewal? Employee benefits are commonly the second-highest expense for employers, coming in second behind employee payroll. Read on to learn more.

Employee benefits are typically the second-highest expense for employers — right behind payroll. But unlike payroll, benefits are difficult to budget for each year because the upcoming annual renewal rate can feel like a total mystery.

Not knowing what the renewal rate will be until the end of the plan year complicates the balance that employers must strike between offering rich benefits employees appreciate at a cost the finance team can live with. It doesn’t have to be that way.

Knowing how to approach the annual renewal with your health carrier, pharmacy benefits manager and other players can help the savvy employer save some money while maintaining the same level of benefits as before. The ticket is planning for the annual renewal all year long, which removes the mystery and leads to a predictable rate.

Here are three steps to negotiating the annual renewal with your carrier.

1. Create a good carrier relationship. A great way to gain control of what happens at the end of the benefit plan year is to set the tone from the beginning. This means outlining expectations before signing a contract and communicating wants and needs throughout the plan period. If you’ve developed a good relationship with your carrier, you should have an easier time coming to an agreement on the annual renewal rate.

Building good carrier relationships extends beyond the carrier you’re currently working with to others in the market. One way to maintain a good relationship is to avoid marketing to all carriers for the best rate before each renewal period. Carriers spend time and money responding to requests for proposal (RFPs); if they respond year after year without winning the business, they may lose interest when you are ready to move your benefits plan.

2. Get plan renewals early. Left unchecked, most carriers hold the benefit plan renewal rate as long as possible (60-75 days before the end of a contract). But receiving your carrier’s initial renewal rate earlier gives you more time to evaluate the renewal and negotiate the rate. (Yes, it’s true — you don’t have to accept the first number the carrier offers.) The best way to ensure your request for an early renewal rate is heard and followed is to discuss it before signing a contract.

By receiving your renewal rate approximately 120 days before the end of your contract, you have enough time to evaluate the rate together with your health and welfare benefits broker and underwriting team and then respond with another offer. And if you feel that another carrier can offer better rates, you can also market your benefits plan and still have time to switch carriers before the contract ends.

3. Offer a fair and reasonable rate. After you receive your annual renewal rate, work with your internal team and your benefits broker to begin negotiations. Importantly, this doesn’t mean countering with a number so low that the carrier finds it untenable and unreasonable. In that case, the insurer may not meet your demand and you’ll be forced to turn to other carrier options without having planned for that possibility.

Instead, respond with a fair and reasonable rate increase backed by data. The goal is to counter offer with a number that creates stability and predictability for renewals in the future.

Learning your renewal rate for each plan year can be stressful, but it doesn’t have to be. Getting information early, negotiating a fair rate and maintaining good carrier relationships can help you create a better annual renewal with better predictability and improved budgeting year after year.

SOURCE: Strain, M (24 October 2018) "3 steps to negotiating a better employee benefit annual renewal" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/opinion/3-steps-to-negotiating-a-better-employee-benefit-annual-renewal?brief=00000152-1443-d1cc-a5fa-7cfba3c60000

5 things small business owners should know about this year's open enrollment

The benefits small business owners offer are crucial to the way they attract and retain employees. Read this blog post for five things small business owners should know for 2019 open enrollment.

As a small business owner, offering competitive employee benefits is a crucial way to attract and retain strong talent. Whether you currently provide them and are planning next year’s renewal, or you are thinking of offering them for the first time, here are five things you should consider before your employees enter the open enrollment period for next year on November 1st:

1. Small businesses don’t have to wait until open enrollment to offer benefits to their employees

While your employees won’t be able to enroll in health insurance plans until November comes along, small business owners don’t have to wait at all to secure health insurance for their employees. The sooner you act, the better, to guarantee that you and your employees are protected. According to recent studies, healthier employees are happier employees, and as a result, will contribute to a more productive workplace. And a more positive and constructive work environment is better for you, your employees, and your business as a whole.

2. Health literacy is important

Whether you’ve provided health insurance to your employees before, or you’re looking into doing so for the first time, it is always worthwhile to prioritize health insurance literacy. There is a host of terminology and acronyms, not to mention rules and regulations that can be overwhelming to wrap your head around.

Thankfully, the internet is full of relevant information, ranging from articles to explainer videos, that should have you up to speed in no time. Having a good understanding of insurance concepts such as essential health benefits, employer contributions, out-of-pocket maximums, coinsurance, provider networks, co-pays, premiums, and deductibles is a necessary step to being better equipped to view and compare health plan options side-by-side. A thorough familiarization with health insurance practices and terms will allow you to make the most knowledgeable decisions for your employees and your business.

3. Offering health insurance increases employee retention

Employees want to feel like their health is a priority, and are more likely to join a company and stay for longer if their health care needs are being met. A current survey shows that 56 percent of Americans whose employers were sponsoring their health care considered whether or not they were happy with their benefits to be a significant factor in choosing to stay with a particular job. The Employee Benefit Research Institute released a survey in 2016 which showed a powerful connection between decent workplace health benefits and overall employee happiness and team spirit—59 percent percent of employees who were pleased with their benefits were also pleased with their jobs. And only 8 percent of employees who were dissatisfied with their benefits were satisfied with their jobs.

4. Alleviate health insurance costs

High insurance costs can be an obstacle for small business owners. A new survey suggests that 53 percent of American small business owners stress over the costs of providing health care to their employees. The 2017 eHealth report reveals that nearly 80 percent of small businesses owners are concerned about health insurance costs, and 62 percent would consider a 15 percent increase in premiums to make small group health insurance impossible to afford. However, there are resources in place to help reduce these costs, so they aren’t too much of a barrier. One helpful way to cut down on health insurance costs is to take advantage of potential tax breaks available to small business owners. All of the financial contributions that employers make to their employees’ premiums are tax-deductible, and employees’ financial contributions are made pre-tax, which will successfully decrease a small business’ payroll taxes.

Additionally, if your small business consists of fewer than 25 employees, you may be eligible for tax credits if the average yearly income for your employees is below $53,000. It is also beneficial to note that for small business owners, the biggest driver on insurance cost will be the type of plan chosen in addition to the average age of your employees. Your employees’ health is not a relevant factor.

5. Utilize digital resources

You don’t have to be an insurance industry expert to shop for medical plans. There are resources and tools available that make buying medical plans as easy as purchasing a plane ticket or buying a pair of shoes online – Simple, transparent. Insurance is a very complex industry that can easily be simplified with the use of the advanced technology and design of online marketplaces. These platforms are great tools for small business owners to compare prices and benefits of different plans side-by-side. Be confident while shopping for insurance because all of the information is laid out on the table. Technological solutions such as digital marketplaces serve as useful tools to modernize the insurance shopping process and ensure that you and your team are covered without going over your budget.

SOURCE: Poblete, S. (15 October 2018) "5 things small business owners should know about this year's open enrollment" (Web Blog Post). Retrieved from https://www.benefitspro.com/2018/10/15/5-things-small-business-owners-should-know-about-t/

Why employee performance management needs an HR tech overhaul

Are annual performance reviews necessary? A recent survey by Adobe reveals that 58 percent of people feel that performance reviews are not necessary. Continue reading to learn more.

According to a recent survey conducted by Adobe, 58% of people feel that performance reviews “are a needless HR requirement.” Adobe, in fact, no longer has an annual performance review process and instead has adopted an approach involving ongoing discussions between managers and employees that emphasize talent development and future productivity instead of formal ratings and rankings based on past performance.

Still, the vast majority of companies continue to persist with a backward-looking evaluation process that is time-consuming for managers, demotivating for employees and of negligible benefit to the business as a whole. They do this because, as Adobe’s survey respondents suspected, performance reviews are more about “compliance than customer service.”

Focusing on past performance is an industrial-era hangover from when employees were mainly required to hit targets in easily measurable, repetitive tasks. Although most people’s jobs have evolved to be more complex and creative since then, the process and the tools used to manage their efficacy and performance in those roles have not.

In many respects, HR is still a defensive function whose role is to protect the business from its own employees. This is reflected by HR technology that is built for compliance, rather than helping managers and employees become more productive.

HR’s on-premise or enterprise resource planning systems can track performance reviews to prove a dismissal was not unfair, rank employees to justify compensation distribution and demonstrate effective people management to the board or shareholders. What they can’t do is react positively to the ever-changing demands of the modern business world and help employees and managers meaningfully improve their skills to meet the challenges of tomorrow.

Performance management is changing — but HR tech is not

These days, a company’s and individual employee’s goals can change dramatically in the time between end-of-year reviews. Individual roles are more specialized and require frequent skill updates, while cross-functional teams have long since replaced the siloed departments that were standard just 10 years ago. In this environment, HR’s focus on past compliance is detrimental to future development.

Forward-thinking companies are changing the performance process to focus on development and continuous feedback that makes managers and employees more productive and engaged. The success of these trailblazers will encourage other businesses from a wide range of industries to follow suit.

This new model of performance management needs help from technology, but existing HR tech vendors are not keeping up. Their services are so embedded in the world of compliance, they cannot change to support the development needs of managers and employees. Fortunately, the solution already exists.

Creating a connected system of productivity

One of the key issues with performance reviews is that so much of the process involves looking back to gather the data. For managers, it is a huge time investment. For employees, end-of-year feedback about an issue that occurred months beforehand is too late to be useful.

The process seems doubly inefficient when you realize that real-time, instantly-actionable performance data is already available in productivity systems like JIRA and Salesforce that are used by different teams. The problem is HR’s defensive mindset has made it difficult to integrate existing internal or ERP systems with these tools.

Dedicated performance management services that connect to both HR systems and the departmental productivity tools can take HR technology out of its silo. This will create a connected system of productivity that uses real-time data alongside transparent and flexible goal-tracking to drive ongoing development conversations between managers and employees.

It’s time for HR to evolve from a defensive function to make a positive contribution to key business goals and become what HR analyst Josh Bersin calls the “chief of productivity.” This demands a shift from a performance review process based on compliance to a human-centered, development-focused experience.

Adopting new performance technology that integrates with widely-used productivity tools is a key step to ensuring everyone from employees to managers to HR can work on what matters most in order to meet today’s goals and tomorrow’s challenges.

SOURCE: Dennerline, D. (15 October 2018) "Why employee performance management needs an HR tech overhaul" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/why-employee-performance-management-needs-an-hr-tech-overhaul?brief=00000152-14a7-d1cc-a5fa-7cffccf00000

Culture is key to attracting younger talent, but you can make it mutually beneficial

According to an article in Harvard Business Review, six in ten millennials are ready to change jobs at any moment, creating a great opportunity for recruitment. Read this blog post to learn how organizations can attract younger talent.

Millennials with jobs are more likely to be looking for a new job than any other generation in the workplace, according to a Harvard Business Review article by Brandon Rigoni and Amy Adkins. They report that six in ten millennials are ready to jump ship at any given time.

This is a challenge for keeping workers, but it’s also a golden opportunity for recruitment. For the most part, these are bright workers who are deconstructing the great American job search.

Firms can seize this opportunity by honing their HR brand to appeal to younger generations and balancing this with assessments that assure a good match with most new hires.

Compensation is still important, but millennials are looking for jobs that are in sync with their values and can help define who they are. Getting hired has become a matter of personal identity.

As an employer, you are being evaluated more than the candidates. How will your firm make the cut? And if you do, will you hire the right people?

Major corporations have overhauled their approach in the scramble for talent.

- General Mills began using virtual reality headsets to allow candidates to see themselves working inside General Mills, including using the company’s gym.

- Two Volvo engineers recently built a Baja racer for collegiate competitions to attract young engineers to the legacy truck builder.

- General Electric’s humorous “What’s the Matter with Owen” television campaign said bupkis about GE products. Instead, Owen touted the company’s geek chic HR brand as a bespectacled new employee being effusive about his job of programming life-changing technology to help people.

- McDonald’s eschews traditional media to engage 16 to 24-year-old candidates via Snapchat, offering “Snaplications” and video clips of young McDonald’s employees talking about their jobs.

Not everyone can serve up cold brew coffee in a corporate cafeteria. Still, there are practical steps most firms can take to enhance their HR brand for millennial and Gen Z values.

Does your organization operate with a high degree of transparency? Is it socially responsible? Do employees have paid leave for volunteer work? Are young team members valued and encouraged to contribute to relevant and visible projects and products?

Are there ways to present your products and services to be more relevant and important to society? For example, a textile manufacturer might not actually make exciting products anyone can buy, but its fabrics are used in the space program or to save lives in emergency rooms. Maybe a law firm has a pro bono clinic for low-income families.

Yes. HR needs to make your employer brand attractive to these talented but fickle job seekers, but this doesn’t mean that everyone who’s attracted to your organizational hipness is going to be cool for your company.

There are two tools to make sure both parties get what they want. The first is assessments.

Talent acquisition assessments greatly improve your odds of hiring an individual who is well matched to your company’s needs. The best are scientifically valid and EEOC compliant, focusing on the candidate’s motivation and likely work traits as compared to the job description. You’ll save a lot of money in not having to re-hire for a position.

The second tool is the “Shared Success Model,” which is a process hiring managers can establish that aligns individual development plans with organizational strategies to identify where overlap exists and where there may be gaps.

It has five components:

- Individual needs—What is important to the candidate, both professionally and personally? What aligns with their values and interests?

- Individual offer—What value does the organization bring to the candidate?

- Company needs—What does your organization require for success now and in the future? What do you need from your leaders and employees?

- Company offer—What is your corporate value proposition to the candidate? What opportunities do you provide? What culture do you provide?

- Plan—Analyze the gaps and overlap between each quadrant. Develop and implement a plan that balances your grid for shared success.

As younger candidates seek more of a cultural match, the Shared Success Model is a good way to make sure the culture you promise is a culture that supports your mission and business model.

SOURCE: Warrick, D. (8 October 2018) "Culture is key to attracting younger talent, but you can make it mutually beneficial" (Web Blog Post). Retrieved from https://www.benefitspro.com/2018/10/08/culture-is-key-to-attracting-younger-talent-but-yo/

How to Optimize Open Enrollment for Workers

From the rising cost of prescription medications to the ever-changing status of the ACA, benefit administrators are faced with many challenges when it comes to healthcare programs. Read this blog post to learn more.

Administrators of employer-sponsored healthcare programs face myriad challenges these days, from the rising cost of medications to the fluctuating status of the Affordable Care Act and state healthcare exchanges. As we head into the 2019 open enrollment season, it’s clear that these issues will continue to impact every type and rank of employee in the coming year.

To that end, I’ve outlined several key trends in open enrollment that frazzled HR leaders should explore before enrollment season begins. If it’s too late to make changes to your program this year, use these key points as a basis for measuring and evaluating current programs so you can begin planning for a more engaging, transparent and streamlined process next year.

You don’t have to take it all on yourself.

Employers are realizing that as great as some decision support and health advocacy tools may be, attempts to make employees better healthcare consumers have been only marginally effective. High-performing (aka narrow) networks may be a viable solution as they enable better rates negotiated with the carriers and providers while reducing waste, errors and unnecessary costs. It’s the steerage option, but plan designs can provide incentives for employees to elect these plans and networks. In turn, the HPNs can provide:

- more concierge-like service;

- better coordinated care between providers for high-cost claimants—where much of runaway costs reside; and

- support to ensure compliance with treatment protocols—for chronic conditions such as diabetes, CAD, COPD, etc.

In turn, these plans have the potential for shaving points off healthcare cost trend.

But it’s vital that communication strategies help reduce fears of reduced network choices (avoiding bad memories of restrictive HMO networks) while increasing confidence in the ability of the HPNs to drive results that actually enhance care while also reducing costs.

The best strategy is to provide easy-to-understand examples and scenarios that represent typical situations based on your company’s demographics and employee personas.

Use all the channels you have.

Education and engagement need to be done through a variety of channels to address the specific needs and preferences of demographic groups. Employees need to compare their options based on anticipated needs to look at both premiums (per paycheck costs) and out-of-pocket costs (deductible, copays, coinsurance), as well as employer-provided HSA contributions and incentives. The premium doesn’t tell the whole story—some people over-insure themselves by paying a higher premium for coverage that they may not use because they fear a higher deductible and out-of-pocket maximum.

Cost-comparison tools, interactive personalized assessment tools, microsites that are mobile-optimized with clear, consistent messaging, and extremely brief interactive videos make the message relevant to each individual.

Remember too that your company portal is both a useful tool in ensuring a personalized message to the employee, and a way for you to collect aggregated data about your employees’ interests, needs, action or inaction, and the user experience.

Don’t try to hit all the bases.

Trying to communicate too much information at one time tends to obscure the key message. Focus only on providing information needed to make effective enrollment decisions and use other points during the year to educate about broader topics like wellness.

A common failure is going paperless and forgetting that you really need to drive employees to resources to get them to pay attention. There may be very robust online content and resources but a very low rate of use of that valuable information. Remember that spouses at home often may be making the majority of the healthcare decisions for a family or, at the very least, for themselves. So going too far with the paperless approach can miss getting the message—and the needed information—to those key stakeholders.

Don’t fear transparency.

It’s intriguing to me that some employers are wary about communicating their level of cost-sharing with employees and how it benchmarks against peer companies. Employees often assume they are paying a far larger share than they are. There are other ways of being transparent about cost-sharing beyond the employer-employee split. For instance, we created an infographic for a client to explain the concept of self-insurance and are using it in an ongoing educational series with fact sheets and videos, getting across the idea that the decisions each of us make about our health and informed healthcare purchasing affect the costs in our individual as well as collective pockets.

The bottom line is that helping employees get smart about how they use healthcare and choose insurance options will save your company money. That’s not as callous as it sounds. If employers can’t find more and better ways to control healthcare and benefits costs, they’ll simply have to shift more of the burden to employees. Healthcare access is onerous enough. No one wants to make it harder or deprive workers of needed care. Healthy, satisfied, financially stable workers are better for business, productivity and the overall economy. Commit to exploring these key trends and making meaningful improvements to open enrollment in 2019 and beyond.

SOURCE: Brooks, B. (16 October 2018) "How to Optimize Open Enrollment for Workers" (Web Blog Post). Retrieved from https://hrexecutive.com/how-to-optimize-open-enrollment-for-workers/

5 ways employers can leverage tech during open enrollment

Are you leveraging technology advancements during open enrollment? Advances in technology are creating a more seamless and interactive healthcare experience for employees. Read on for five ways employers can leverage technology during 2019 open enrollment.

Technology continues to reshape how employers select and offer healthcare benefits to employees, putting access to information at our fingertips and creating a more seamless and interactive healthcare experience. At the same time, these advances may help employees become savvier users of healthcare, helping simplify and personalize their journey toward health and, in the process, help curb costs for employers.

The revolution can be important to remember during open enrollment, which occurs during the fall when millions of Americans select or switch their health benefits for 2019. With that in mind, here are five tips employers should be aware of during open enrollment and year-round.

Make sense of big data

Help people understand their options

Encourage your people to move more

Offer incentives to employees who comparison shop for care

Integrate medical and ancillary benefits

5 things small business owners should know about this year's open enrollment

For small business owners, the benefits they offer are crucial to the way they attract and retain employees. Read this blog post for five things small business owners should know for 2019 open enrollment.

As a small business owner, offering competitive employee benefits is a crucial way to attract and retain strong talent. Whether you currently provide them and are planning next year’s renewal, or you are thinking of offering them for the first time, here are five things you should consider before your employees enter the open enrollment period for next year on November 1st:

1. Small businesses don’t have to wait until open enrollment to offer benefits to their employees

While your employees won’t be able to enroll in health insurance plans until November comes along, small business owners don’t have to wait at all to secure health insurance for their employees. The sooner you act, the better, to guarantee that you and your employees are protected. According to recent studies, healthier employees are happier employees, and as a result, will contribute to a more productive workplace. And a more positive and constructive work environment is better for you, your employees, and your business as a whole.

2. Health literacy is important

Whether you’ve provided health insurance to your employees before, or you’re looking into doing so for the first time, it is always worthwhile to prioritize health insurance literacy. There is a host of terminology and acronyms, not to mention rules and regulations that can be overwhelming to wrap your head around.

Thankfully, the internet is full of relevant information, ranging from articles to explainer videos, that should have you up to speed in no time. Having a good understanding of insurance concepts such as essential health benefits, employer contributions, out-of-pocket maximums, coinsurance, provider networks, co-pays, premiums, and deductibles is a necessary step to being better equipped to view and compare health plan options side-by-side. A thorough familiarization with health insurance practices and terms will allow you to make the most knowledgeable decisions for your employees and your business.

3. Offering health insurance increases employee retention

Employees want to feel like their health is a priority, and are more likely to join a company and stay for longer if their health care needs are being met. A current survey shows that 56 percent of Americans whose employers were sponsoring their health care considered whether or not they were happy with their benefits to be a significant factor in choosing to stay with a particular job. The Employee Benefit Research Institute released a survey in 2016 which showed a powerful connection between decent workplace health benefits and overall employee happiness and team spirit—59 percent percent of employees who were pleased with their benefits were also pleased with their jobs. And only 8 percent of employees who were dissatisfied with their benefits were satisfied with their jobs.

4. Alleviate health insurance costs

High insurance costs can be an obstacle for small business owners. A new survey suggests that 53 percent of American small business owners stress over the costs of providing health care to their employees. The 2017 eHealth report reveals that nearly 80 percent of small businesses owners are concerned about health insurance costs, and 62 percent would consider a 15 percent increase in premiums to make small group health insurance impossible to afford. However, there are resources in place to help reduce these costs, so they aren’t too much of a barrier. One helpful way to cut down on health insurance costs is to take advantage of potential tax breaks available to small business owners. All of the financial contributions that employers make to their employees’ premiums are tax-deductible, and employees’ financial contributions are made pre-tax, which will successfully decrease a small business’ payroll taxes.

Additionally, if your small business consists of fewer than 25 employees, you may be eligible for tax credits if the average yearly income for your employees is below $53,000. It is also beneficial to note that for small business owners, the biggest driver on insurance cost will be the type of plan chosen in addition to the average age of your employees. Your employees’ health is not a relevant factor.

5. Utilize digital resources

You don’t have to be an insurance industry expert to shop for medical plans. There are resources and tools available that make buying medical plans as easy as purchasing a plane ticket or buying a pair of shoes online – Simple, transparent. Insurance is a very complex industry that can easily be simplified with the use of the advanced technology and design of online marketplaces. These platforms are great tools for small business owners to compare prices and benefits of different plans side-by-side. Be confident while shopping for insurance because all of the information is laid out on the table. Technological solutions such as digital marketplaces serve as useful tools to modernize the insurance shopping process and ensure that you and your team are covered without going over your budget.

SOURCE: Poblete, S. (15 October 2018) "5 things small business owners should know about this year's open enrollment" (Web Blog Post). Retrieved from https://www.benefitspro.com/2018/10/15/5-things-small-business-owners-should-know-about-t/

Ready for the sounds of office sniffles?

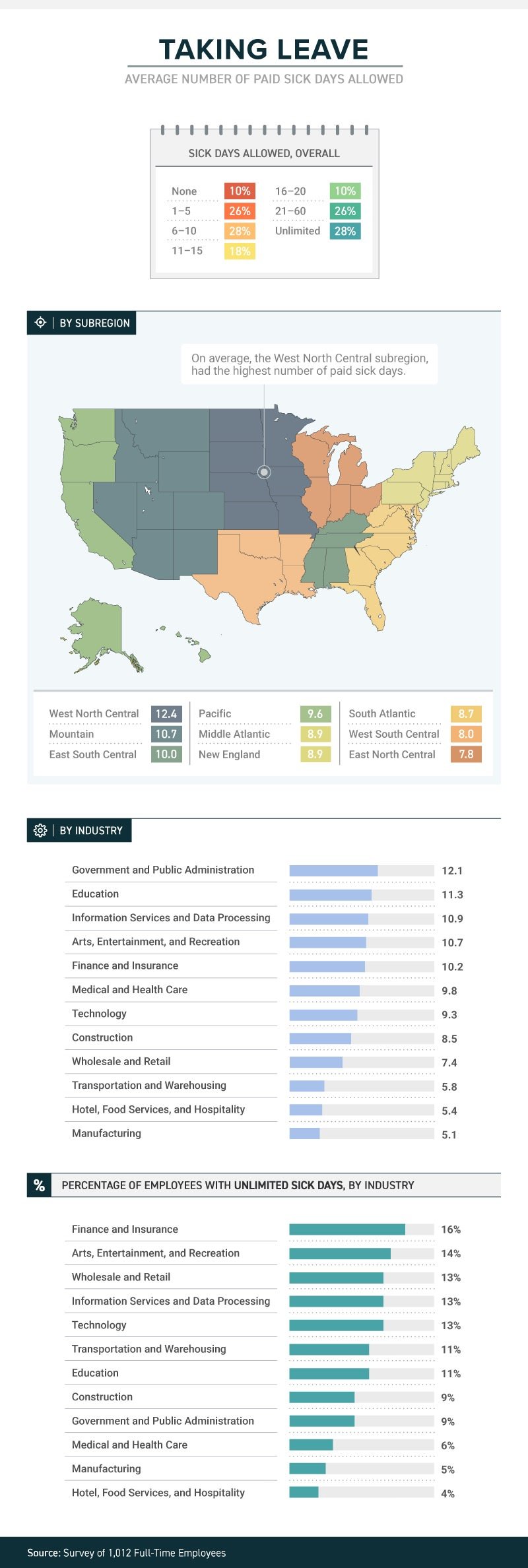

A recent study by law firm, Farah and Farah, states that one in four full-time workers receive between 1 and 5 sick days. Continue reading to learn more.

It’s not just a matter of whether they feel well enough to work, or whether they have sick days. The boss’s attitude about whether workers should take sick days or not can determine whether they actually do stay home when they’re sick, or instead come to work to spread their germs to all and sundry.

A new study from law firm Farah & Farah finds that even though it can take a person some 10 days to fully recover from a cold, approximately 10 percent of full-time workers in the U.S. get no sick days at all (part-timers don’t usually get them either), while more than 1 in 4 have to make do with between 1 and 5 sick days. Just 18 percent get enough sick time to actually recover from that cold—between 11 and 15 days.

The amount (or presence) of sick time varies from industry to industry, with government and public administration providing the most (an average of 12.1) and both hotel, food services and hospitality and manufacturing providing the least (an average of 5.4 for the hospitality industry and 5.1 for manufacturing). Some lucky souls actually get unlimited sick days, although even then they don’t always use them.

Regardless of industry, or quantity, just because workers get sick days it doesn’t mean they use them. Workers often worry that they’ll be discouraged from using them, with employers who may provide them but not encourage employees to stay home when ill. In fact, 38 percent of workers show up to work whether they’re contagious or not. Sadly for the people they encounter at work, the most likely to do so are in hospitality, medical and healthcare and transportation. Plenty of germ-spreading to be done in those professions!

And their employers’ attitudes play a role in how satisfied they are with their jobs. Among those who work for the 34 percent of bosses who encourage sick employees to stay home, 43 percent said they’re satisfied with their jobs in general. Among those who work for the 47 percent of bosses who are neutral about the use of sick days, that drops to 21 percent—and among the unfortunate workers who work for the 19 percent of bosses who actually discourage workers from staying home while ill, just 12 percent were satisfied with their jobs.

When it comes to mental health days (no, not that kind; the ones people really need to deal with diagnosed mental health conditions), fewer than 1 in 10 men and women were willing to call in sick. Taking “mental health days” when physically healthy, however, either to play hooky or simply have a vacation from the office, is something that 15 percent of respondents admitted to.

SOURCE: Satter, M (5 October 2018) "Ready for the sounds of office sniffles?" (Web Blog Post). Retrieved from https://www.benefitspro.com/2018/10/05/ready-for-the-sounds-of-office-sniffles/

Original report retrieved from https://farahandfarah.com/studies/sick-days-in-america

6 Books on the Future of Work That Every HR Professional Should Read

What do the next 50 or 100 years have in store for organizations and workers? Read this blog post for six books on the future of work that every HR professional should read.

As HR professionals and organizational leaders, it seems we are increasingly bombarded with messages about disruptive innovations and the changing nature of work. While calls to prepare strategically for the "future of work" might sometimes seem over-the-top, it doesn't change the fact that we've seen tremendous shifts in the global economy (including the labor economy) and technological innovation over the past 50 years that have had significant implications for the nature of work.

So what do the next 50 years have in store for organizations and workers? How will disruptive technologies like robotics, artificial intelligence/machine learning, pharmacogenetics, quantum entanglement, virtual presence/augmented reality, 3-D printing, and blockchain (among many others) influence future labor markets?

Here are six books I believe every HR professional and organizational leader should read to better understand these trends and the drivers influencing the shifting trajectories in the future of work.

1. The Future of the Professions: How Technology Will Transform the Work of Human Experts(Oxford University Press, 2017) by Richard Susskind and Daniel Susskind

The Future of the Professions closely examines the intersection of rapidly advancing innovative technologies and the shifting nature and transformation of work and the professions, providing theoretically grounding and ample examples of emerging technologies, organizations and work arrangements. It is intended for organizational leaders and policy practitioners of all stripes who are interested in the effects of disruptive technologies on the future of work.

2. The Future of Work: Robots, AI, and Automation (Brookings Institution Press, 2018) by Darrell M. West

In The Future of Work, West sees the U.S. and the world at a "major inflection point" where we have to grapple with the likely impact of an increasingly automated and technologically advanced society on work, education and public policy. The insights provided will be useful to those who manage others and to those who are managed in the workplace of the future.

3. Rise of the Robots: Technology and the Threat of a Jobless Future (Basic Books, 2016) by Martin Ford

Rise of the Robots is a somewhat unsettling vision of a future world dominated by artificial intelligence, machine learning and highly automated industries, where most members of the current workforce find themselves replaced by technology and machines; in other words, a jobless future. Based on recent economic and innovation trends, Ford argues that the rapid technological advancement will ultimately result in a fundamental restructuring of corporations, governments and even entire societies as middle-class jobs gradually disappear, economic mobility evaporates and wealth is increasingly concentrated among the elite super-rich.

4. Gigged: The End of the Job and the Future of Work (St. Martin's Press, 2018) by Sarah Kessler

Gigged examines the shifting psychological contract between organizations and workers, discusses trends in the organization of work, and documents the movement in recent decades away from traditional employment models and toward part-time work and contingent employment arrangements such as independent contracting and project-based "gig" work. While such work has always been a part of informal economies around the world, the trend is increasingly common in traditional organizations as well, bolstered by the success of companies like Uber and Airbnb.

5. The Future of Work: Attract New Talent, Build Better Leaders, and Create a Competitive Organization (Wiley, 2014) by Jacob Morgan

In The Future of Work, Morgan continues the argument that the world is changing at an accelerated pace. He demonstrates that the way we work today is fundamentally different from how previous generations worked (due to globalization, technological innovation and shifts in the composition of national economies) and suggests that the future of work will be drastically different from what we experience today (a shift from knowledge workers to learning workers), where employees can work anytime and anywhere and can use any devices.

6. Shaping the Future of Work: A Handbook for Action and a New Social Contract (MITxPress, 2017) by Thomas A. Kochan

Probably the most academic book on this list, Shaping the Future of Work acknowledges an increasingly digitized economy and examines the resulting shift in social contract with regard to work and the professions. Kochan provides a road map for what leaders across contexts need to do to create high-quality jobs and develop strong and successful businesses.

What Does All This Mean?

In the next 50 years, we will likely see:

-

A continually shifting geopolitical landscape.

-

Continued movement from linear organizations to a more latticed/connected framework.

-

The displacement of jobs and the hunt for talent in a more automated economy.

-

An increasingly mobile and flexible labor force, and a push toward a reskilling agenda within organizations to continually leverage human capital value.

-

Technological advancements that continue to disrupt traditional organizational models and shift the very nature of work and professions.

So what does this all mean for HR professionals and organizational leaders? What are the core competencies of organizations that are prepared for these technological disruptions? How does the shifting nature of work influence needed HR competencies?

Regardless of what the future holds, these are questions we need to be asking and discussions we need to be having so that we are prepared for the future of work.

SOURCE: Westover, J. (5 September 2018) "6 Books on the Future of Work That Every HR Professional Should Read" (Web Blog Post). Retrieved from https://www.shrm.org/hr-today/news/hr-magazine/book-blog/pages/6-books-on-the-future-of-work-that-every-hr-professional-should-read.aspx/