Artificial intelligence enthusiasm outpacing adoption

A new survey by the RELX Group reports that adoption of artificial intelligence and machine learning is lagging among key decision makers. Read this blog post from Employee Benefit News to learn more.

Artificial intelligence and machine learning have become essential for organizations to stay competitive. But adoption is lagging even among key decision-makers championing change.

That is the finding of a new survey by the RELX Group, a global provider of information and analytics. The company surveyed 1,000 U.S.-based senior executives across government, healthcare, insurance, legal, science/medical and banking in September 2018, and found that 88% agree that AI and machine learning will help their businesses be more competitive.

While the value of the technologies is clear to executives, only 56% of organizations use machine learning or AI. In addition, only 18% of those surveyed plan to increase investment in these technologies.

“Organizations [that] can successfully use emerging technologies such as AI and machine learning to provide their customers with better products and advanced analytics can emerge as the leaders of the future,” said Kumsal Bayazit, chairman of RELX Group’s Technology Forum.

“While awareness of these technologies and their benefits is higher than ever before, endorsement from key decision makers has not been enough to spark matching levels of adoption,” Bayazit said.

The study showed that AI and machine learning are making their mark, with 69% of those surveyed saying the technologies have had a positive impact on their industry. Machine learning and AI are helping solve challenges by automating decision processes (cited by 40%); improving customer retention (36 percent); and detecting fraud, waste and abuse (33%).

This story originally appeared in Information Management.

SOURCE: Violino, B. (2 January 2019) "Artificial intelligence enthusiasm outpacing adoption" (Web Blog Post). Retrieved from https://www.benefitnews.com/news/artificial-intelligence-enthusiasm-outpacing-adoption?feed=00000152-a2fb-d118-ab57-b3ff6e310000

Creating a culture of recognition

Does your corporation have a culture of recognition? Companies can experience an increase in engagement, productivity and retention when employees are recognized for their work. Read this blog post to learn more.

When employees are recognized for their work, employers can see gains in engagement, productivity and retention.

But such efforts must be more than a one-time event; to really enjoy the benefits, employers need a culture of recognition, experts say. This has to start at the top and include clearly defined company values.

Live the culture you want

"A purposeful, positive, productive work culture doesn't happen by default — it only happens by design," S. Chris Edmonds, founder of The Purposeful Culture Group, told HR Dive via email.

And while HR can influence culture, a recognition culture must start at the top, experts say. And it must be part of an employer's performance management strategy.

Management can signal what's important, what it needs employees to care about, Scott Conklin, VP, HR at Paycor, said. "You have to live your words," he told HR Dive, adding that "if not seen at all levels, people aren't going to do it."

Senior leaders must create credibility for these "new rules" by modeling valued behaviors and coaching on them every day, Edmonds said. Coaching means senior leaders must praise aligned behaviors everywhere they see them and redirect misaligned behaviors in the same way. Only when senior leaders model these behaviors will others understand that these new rules aren't optional, Edmonds said.

In addition, Edmonds said, the organization must measure how well leaders are modeling the valued behaviors. This measurement often comes in the form of a regular values survey, generally twice a year, where everyone in the organization rates their boss, next-level leaders and senior leaders on the degree to which those leaders demonstrate the company's valued behaviors. Only by rating leaders on valued behavior alignment can values be as important as results, Edmonds said.

And only when everyone — from senior leaders to individual team members — demonstrates valued behaviors in every interaction will the work culture shift to purposeful, positive and productive, Edmonds said.

Create an industrial constitution

Many employers don't communicate their values well, Conklin said.

The path to great team citizenship can be clearly defined by creating an organizational constitution that includes a servant purpose statement explaining how the organization specifically improves quality of life for its customers — and defines values and measurable valued behaviors, strategies and goals, Edmonds said.

If company values don't explicitly define exactly how you want people to behave, they'll struggle to model your values, Edmonds continued. If an organization values integrity but doesn't define it in measurable terms, people won't know exactly how they're supposed to behave, he explained.

Find what works

Traditional models of employee recognition are good, but they're becoming outdated in some cultures, Conklin noted. Your recognition program has to fit your culture, he said.

SOURCE: Burden, L. (26 November 2018) "Creating a culture of recognition" (Web Blog Post). Retrieved from https://www.hrdive.com/news/creating-a-culture-of-recognition/542845/

DOL reverses course on ‘80/20’ limitations for tipped employees

On November 8, the Department of Labor (DOL) released four new opinion letters, providing insight into their views on compliance with federal labor laws. Read this blog post to learn more.

Last week, the DOL issued four new opinion letters providing both employers and employees further insight into the agency’s views regarding compliance with federal labor laws.

While the letters touch on a variety of issues, perhaps the most notable change involves the DOL’s about-face regarding the amount of “non-tipped” work an employee can perform while still receiving a lower “tip-credit” wage.

Essentially, this new guidance does away with the previous “80/20” rule regarding tipped employees. Under the 80/20 rule, businesses were barred from paying employees traditionally engaged in tip-based work, like servers and bartenders, a lower minimum wage and taking a tip credit for the other portion of the employee’s wage up to applicable state and federal minimum wage requirements when those employees’ side work, like napkin folding or making coffee, accounted for more than 20% of the employee’s time.

In recent years, there has been an explosion of litigation across the country over the 80/20 rule, questioning whether the tipped employee’s “side work” amounted to more than 20% of the employee’s duties and time. Likewise, in many of those same suits, plaintiffs would challenge individual tasks associated with their side work, attempting to claim that those tasks were not so closely related to their tipped duties, but rather rose to the level of a completely different or “dual job,” meaning that the employer should not be permitted to take the tip credit for hours worked performing those tasks.

What followed was case after case of lawyers, courts and employers quibbling over minutes spent folding napkins, wiping counters, slicing lemons, and painstakingly calculating and arguing as to whether those tasks added up to 20% and whether those tasks were not closely related enough to be included in the 20% calculation.

In these kinds of cases, we’d see arguments over circumstances like the server that moonlights as a “maintenance man” versus the server that changed the lightbulb or helped sweep underneath the tables.

The ultimate result: confusion, chaos and, frankly, a treasure trove for plaintiff’s attorneys who had another arrow in their quiver in which to seek additional purported wages for clients from employers that would find it difficult, if not impossible, to account for all minutes and tasks employees were performing in busy restaurants.

Following the DOL’s opinion letter, the landscape will change. Recognizing that the existing guidance and case law had created “some confusion,” the DOL expressly stated that they “do not intend to place a limitation on the amount of duties related to a tip-producing occupation that may be performed, so long as they are performed contemporaneously with direct customer-service duties...”

However, in attempting to provide additional clarity, the DOL may have instead opened up the proverbial Pandora ’s Box of uncertainty. In identifying the list of duties that the DOL would consider “core or supplemental,” the DOL refers to the Tasks section of the Details report in the Occupational Information Network (O*NET). It goes without saying that no document can provide an exhaustive list of tasks in today’s changing marketplace. While the DOL attempted to recognize the changing nature of today’s environment in a savings-type footnote, one does not have to look too far ahead to foreshadow the response from the plaintiff’s bar arguing over the related duties listed on O*NET.

While the DOL’s new position on the 80/20 rule will certainly come as a relief to many employers with tipped employees, employers should still be mindful in evaluating tipped employees’ job duties on a regular basis. Employees that are engaged in “dual jobs” are entitled to the full minimum wage, without the tip credit.

SOURCE: Kennedy, C. (15 November 2018) "DOL reverses course on ‘80/20’ limitations for tipped employees" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/dol-reverses-course-on-80-20-limitations-for-tipped-employees?brief=00000152-14a5-d1cc-a5fa-7cff48fe0001

This article originally appeared on the Foley & Lardner website. The information in this legal alert is for educational purposes only and should not be taken as specific legal advice.

7 Steps to Running Better Meetings

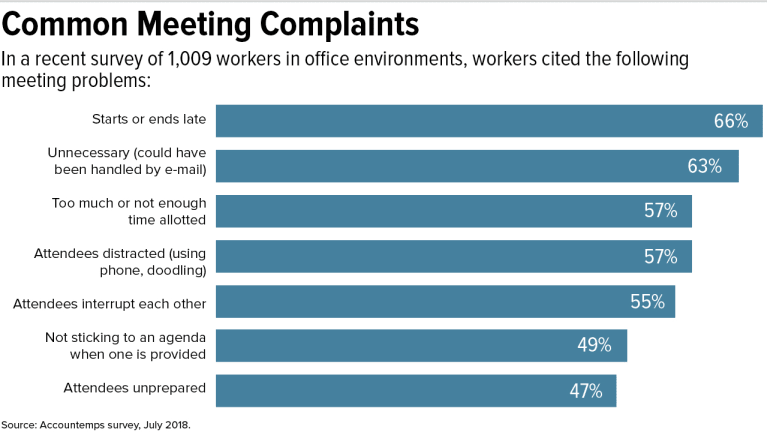

A recent Accountemps survey revealed that office workers spend 21 percent of their time in meetings and feel that 25 percent of it is wasted. Read this blog post for seven steps to running better meetings.

We love to hate meetings. We groan about how annoying they are. We crack jokes about how much time gets wasted, about bureaucracy run amok.

But it’s not really a laughing matter.

Poorly run meetings can sap the lifeblood out of an organization. Not only are they mentally draining, but they can leave staff disengaged and demoralized, experts say.

On average, office workers spend 21 percent of their time in meetings and feel 25 percent of it is wasted, according to the results of a recent survey of 1,000 employees by Accountemps. One of the top complaints was that meetings are called to relay information that could have been communicated via e-mail.

Managers are also dissatisfied. In a Harvard Business School study last year, researchers found that 71 percent of the 182 senior managers interviewed said meetings were unproductive and inefficient, and 65 percent said meetings kept them from completing their work.

Fortunately, leaders can help improve how meetings are run. Indeed, their behavior is critical to achieving better results and a more positive outlook and engagement from employees, according to a 2017 study published in the Journal of Leadership & Organizational Studies. In an earlier University of North Carolina study, researchers found a link between how workers feel about the effectiveness of meetings and their job satisfaction.

Other studies have found that dysfunctional communication in team meetings can have a negative impact on team productivity and the organization’s success.

What happens in these gatherings is a reflection of the workplace culture, experts say.

“It gets down to identity and performance,” says J. Elise Keith, co-founder of Lucid Meetings in Portland, Ore., and author of Where the Action Is (Second Rise, 2018). “The way in which an organization runs its meetings determines how it views itself.”

“Bad meetings are almost always a symptom of deeper issues,” Keith notes in her book.

Unfortunately, many business leaders don’t receive adequate training on how to manage or facilitate meetings, she says. “I believe that a lot of leaders have bought into the idea that poor meetings are inevitable.”

Here are 7 steps to making the time employees spend together more meaningful:

1. Prepare. Are you clear on the meeting’s purpose? What is your desired outcome? How will you achieve that?

More prep time is typically devoted to senior-level meetings compared to those held for individuals in lower-level positions, says Paul Axtell, a corporate trainer and author of Meetings Matter (Jackson Creek, 2015). He says that executive get-togethers are more effective “because people take them seriously.”

2. Limit the number of participants. The most productive meetings have fewer than eight participants, Axtell says. A larger group will leave some disengaged or resentful that their time is being wasted.

3. Send an agenda and background material in advance. If you want a thoughtful discussion, give your team members time to think about the problem or proposal that the meeting will focus on, he says.

4. Start and end on time. Don’t punish people for being punctual by waiting on late stragglers to get started. At the same time, it’s best not to jump right to the heart of the discussion in the first few minutes, Keith says. Provide a soft transition that will help those coming from other meetings to refocus.

5. Make sure all attendees can participate. One common complaint about meetings is that a few people tend to dominate the conversation. Call on other individuals to share what they think, Axtell says. Who is most likely to hold a different view? Who will be most affected by the outcome? Who has institutional knowledge that might be useful? Think about who to draw out on specific topics as you prepare. You’ll collect more ideas and leave participants with a more positive experience.

To feel good about work, people need to feel included and valued. “That means you have a voice and are allowed to express your opinions,” Axtell says.

Because you’re a leader, your views already hold more weight. If you share them too early, you may discourage others from presenting alternate perspectives. Focus on listening, and stay out of the discussion as long as you can, he says. You might learn something.

Avoid PowerPoint slides or other technology if it’s not required for an agenda item. They tend to shut down dialogue, Axtell says.

A surefire way for leaders to alienate participants is to use up most of the meeting time presenting a proposal and leave only a few minutes for questions and comments, Keith says. When people do speak up, thank them for their contributions. And use their ideas, she says.

6. Keep a written record. Posting the meeting agenda and taking notes that everyone can access will help keep participants on track. Unfortunately, many organizations fail to do so, Keith says. The written record ensures that faulty memories or differing interpretations don’t lead people down the wrong path. Are the notes detailed enough to allow you to tackle the action items days later? Are the deadlines reasonable? Be realistic. It doesn’t help the team to accept a giant list of action items that it likely can’t complete, she says.

7. Follow up. What percentage of the action items get completed by the deadlines? If you don’t achieve 85 percent, participants’ sense of effectiveness breaks down and they may disengage, Axtell says. Most groups complete just 50 percent to 60 percent.

“Whether you pay attention to them or not, meetings are in fact where your teams and your people are learning how they should behave and what they should be doing,” Keith says. “So identify the specific types of meetings your organization needs to run. Find great examples of how to run those meetings. You shouldn’t have to invent it. And set up a system that people can use successfully to become the organization that you want to become.”

SOURCE: Meinert, D. (30 October 2018). "7 Steps to Running Better Meetings" (Web Blog Post). Retrieved from https://www.shrm.org/hr-today/news/hr-magazine/1118/pages/7-steps-to-running-better-meetings.aspx/

When Companies Should Invest in Training Their Employees — and When They Shouldn’t

Do you invest in training and development activities at your organization? According to an industry report, U.S. companies spent $90 billion in 2017 on training and development activities. Read on to learn more.

According to one industry report, U.S. companies spent over $90 billion dollars on training and development activities in 2017, a year-over-year increase of 32.5 %. While many experts emphasize the importance and benefits of employee development — a more competitive workforce, increased employee retention, and higher employee engagement — critics point to a painful lack of results from these investments. Ultimately, there is truth in both perspectives. Training is useful at times but often fails, especially when it is used to address problems that it can’t actually solve.

Many well-intended leaders view training as a panacea to obvious learning opportunities or behavioral problems. For example, several months ago, a global financial services company asked me to design a workshop to help their employees be less bureaucratic and more entrepreneurial. Their goal was to train people to stop waiting around for their bosses’ approval, and instead, feel empowered to make decisions on their own. They hoped, as an outcome, decisions would be made faster. Though the company seemed eager to invest, a training program was not the right way to introduce the new behavior they wanted their employees to learn.

Training can be a powerful medium when there is proof that the root cause of the learning need is an undeveloped skill or a knowledge deficit. For those situations, a well-designed program with customized content, relevant case material, skill-building practice, and a final measurement of skill acquisition works great. But, in the case of this organization, a lack of skills had very little to do with their problem. After asking leaders in the organization why they felt the need for training, we discovered the root causes of their problem had more to do with:

- Ineffective decision-making processes that failed to clarify which leaders and groups owned which decisions

- Narrowly distributed authority, concentrated at the top of the organization

- No measurable expectations that employees make decisions

- No technologies to quickly move information to those who needed it to make decisions

Given these systemic issues, it’s unlikely a training program would have had a productive, or sustainable outcome. Worse, it could have backfired, making management look out of touch.

Learning is a consequence of thinking, not teaching. It happens when people reflect on and choose a new behavior. But if the work environment doesn’t support that behavior, a well-trained employee won’t make a difference. Here are three conditions needed to ensure a training solution sticks.

1. Internal systems support the newly desired behavior. Spotting unwanted behavior is certainly a clue that something needs to change. But the origins of that unwanted behavior may not be a lack of skill. Individual behaviors in an organization are influenced by many factors, like: how clearly managers establish, communicate, and stick to priorities, what the culture values and reinforces, how performance is measured and rewarded, or how many levels of hierarchy there are. These all play a role in shaping employee behaviors. In the case above, people weren’t behaving in a disempowered way because they didn’t know better. The company’s decision-making processes forbid them from behaving any other way. Multiple levels of approval were required for even tactical decisions. Access to basic information was limited to high-ranking managers. The culture reinforced asking permission for everything. Unless those issues were addressed, a workshop would prove useless.

2. There is commitment to change. Any thorough organizational assessment will not only define the skills employees need to develop, it will also reveal the conditions required to reinforce and sustain those skills once a training solution is implemented. Just because an organization recognizes the factors driving unwanted behavior, doesn’t mean they’re open to changing them. When I raised the obvious concerns with the organization above, I got the classic response, “Yes, yes, of course we know those issues aren’t helping, but we think if we can get the workshop going, we’ll build momentum and then get to those later.” This is usually code for, “It’s never going to happen.” If an organization isn’t willing to address the causes of a problem, a training will not yield its intended benefit.

3. The training solution directly serves strategic priorities. When an organization deploys a new strategy — like launching a new market or product — training can play a critical role in equipping people with the skills and knowledge they need to help that strategy succeed. But when a training initiative has no discernible purpose or end goal, the risk of failure is raised. For example, one of my clients rolled out a company-wide mindfulness workshop. When I asked a few employees what they thought, they said, “It was interesting. At least it got me two hours away from my cubicle.” When I asked the sponsoring executive to explain her thought process behind the training, she said, “Our employee engagement data indicated our people are feeling stressed and overworked, so I thought it would be a nice perk to help them focus and reduce tension.” But when I asked her what was causing the stress, her answer was less definitive: “I don’t really know, but most of the negative data came from Millennials and they complain about being overworked. Plus, they like this kind of stuff.” She believed her training solution had strategic relevance because it linked to a vital employee metric. But evaluations indicated that, though employees found the training “interesting,” it didn’t actually reduce their stress. There are a myriad of reasons why the workload could have been causing employees stress. Therefore, this manager’s energy would have been better directed at trying to determine those reasons in her specific department and addressing them accordingly — despite her good intentions.

If you are going to invest millions of dollars into company training, be confident it is addressing a strategic learning need. Further, be sure your organization can and will sustain new skills and knowledge by addressing the broader factors that may threaten their success. If you aren’t confident in these conditions, don’t spend the money.

SOURCE: Carucci, R. (29 October 2018). "When Companies Should Invest in Training Their Employees – and When They Shouldn’t" (Web Blog Post). Retrieved from https://hbr.org/2018/10/when-companies-should-invest-in-training-their-employees-and-when-they-shouldnt

5 things small business owners should know about this year's open enrollment

For small business owners, the benefits they offer are crucial to the way they attract and retain employees. Read this blog post for five things small business owners should know for 2019 open enrollment.

As a small business owner, offering competitive employee benefits is a crucial way to attract and retain strong talent. Whether you currently provide them and are planning next year’s renewal, or you are thinking of offering them for the first time, here are five things you should consider before your employees enter the open enrollment period for next year on November 1st:

1. Small businesses don’t have to wait until open enrollment to offer benefits to their employees

While your employees won’t be able to enroll in health insurance plans until November comes along, small business owners don’t have to wait at all to secure health insurance for their employees. The sooner you act, the better, to guarantee that you and your employees are protected. According to recent studies, healthier employees are happier employees, and as a result, will contribute to a more productive workplace. And a more positive and constructive work environment is better for you, your employees, and your business as a whole.

2. Health literacy is important

Whether you’ve provided health insurance to your employees before, or you’re looking into doing so for the first time, it is always worthwhile to prioritize health insurance literacy. There is a host of terminology and acronyms, not to mention rules and regulations that can be overwhelming to wrap your head around.

Thankfully, the internet is full of relevant information, ranging from articles to explainer videos, that should have you up to speed in no time. Having a good understanding of insurance concepts such as essential health benefits, employer contributions, out-of-pocket maximums, coinsurance, provider networks, co-pays, premiums, and deductibles is a necessary step to being better equipped to view and compare health plan options side-by-side. A thorough familiarization with health insurance practices and terms will allow you to make the most knowledgeable decisions for your employees and your business.

3. Offering health insurance increases employee retention

Employees want to feel like their health is a priority, and are more likely to join a company and stay for longer if their health care needs are being met. A current survey shows that 56 percent of Americans whose employers were sponsoring their health care considered whether or not they were happy with their benefits to be a significant factor in choosing to stay with a particular job. The Employee Benefit Research Institute released a survey in 2016 which showed a powerful connection between decent workplace health benefits and overall employee happiness and team spirit—59 percent percent of employees who were pleased with their benefits were also pleased with their jobs. And only 8 percent of employees who were dissatisfied with their benefits were satisfied with their jobs.

4. Alleviate health insurance costs

High insurance costs can be an obstacle for small business owners. A new survey suggests that 53 percent of American small business owners stress over the costs of providing health care to their employees. The 2017 eHealth report reveals that nearly 80 percent of small businesses owners are concerned about health insurance costs, and 62 percent would consider a 15 percent increase in premiums to make small group health insurance impossible to afford. However, there are resources in place to help reduce these costs, so they aren’t too much of a barrier. One helpful way to cut down on health insurance costs is to take advantage of potential tax breaks available to small business owners. All of the financial contributions that employers make to their employees’ premiums are tax-deductible, and employees’ financial contributions are made pre-tax, which will successfully decrease a small business’ payroll taxes.

Additionally, if your small business consists of fewer than 25 employees, you may be eligible for tax credits if the average yearly income for your employees is below $53,000. It is also beneficial to note that for small business owners, the biggest driver on insurance cost will be the type of plan chosen in addition to the average age of your employees. Your employees’ health is not a relevant factor.

5. Utilize digital resources

You don’t have to be an insurance industry expert to shop for medical plans. There are resources and tools available that make buying medical plans as easy as purchasing a plane ticket or buying a pair of shoes online – Simple, transparent. Insurance is a very complex industry that can easily be simplified with the use of the advanced technology and design of online marketplaces. These platforms are great tools for small business owners to compare prices and benefits of different plans side-by-side. Be confident while shopping for insurance because all of the information is laid out on the table. Technological solutions such as digital marketplaces serve as useful tools to modernize the insurance shopping process and ensure that you and your team are covered without going over your budget.

SOURCE: Poblete, S. (15 October 2018) "5 things small business owners should know about this year's open enrollment" (Web Blog Post). Retrieved from https://www.benefitspro.com/2018/10/15/5-things-small-business-owners-should-know-about-t/

Cash Balance Plans for Business Owners

The new tax law is a lucrative opportunity for many pass-through businesses. As long as the owner’s income does not exceed a certain threshold, businesses can earn significant tax savings. In this installment of CenterStage, Todd Yawit – the director of retirement services at Saxon – has provided the following insightful information on Cash Balance Plans and how they can be used to help businesses earn significant tax savings.

The New Tax Law

With the new tax law, some business owners can now deduct up to 20 percent of their qualified business income (QBI) as long as their income falls below a certain threshold. Todd explained, “The new tax law that went into effect treats certain business types differently than it used to. In order to take advantage of the full deductions, certain business owners might need to lower their income to accommodate getting the deductions.”

deductions.” The full 20 percent deduction is available to companies that have an income that falls below the set threshold amount. Because of this, many businesses will have lower effective tax rates. Business owners whose income does not fall below the set threshold amount can still reap significant benefits by placing the difference of their income in a Cash Balance Plan. This will cause their taxable income to fall below the set threshold.

What Are Cash Balance Plans

Cash Balance Plans are a type of retirement plan that combines the maximum benefit amount associated with Defined Benefit Plans with the flexibility and portability of a 401(k) plan.

Cash Balance Plans are trustee directed and assets are invested into a single pool. Participants receive individual statements with hypothetical account balances on them.

Cash Balance Plans are often preferred over traditional Defined Benefit Pension Plans. Individual statements received by participants reflect what participants could potentially collect in the form of a lump sum, if eligible.

Here are the top 6 features of a Cash Balance Plan:

- Niche Retirement Plan – Cash Balance Plans are a great fit for physician groups, dental groups, and other professional practices, as well as small business owners or self-employed individuals.

- Tax Deferred Contributions – All contributions are tax-deductible, and the investment earnings are tax-deferred. Assets are not subject to income tax until they are withdrawn from the Cash Balance Plan or a rollover IRA.

- Higher Contribution Limits – Cash Balance Plans allow for high tax-deductible contributions than a 401(k). The maximum contribution amount is dependent on the individual’s age and normally increases as participants get older.

- Creditor Protection – Plan assets in a Cash Balance Plan are ERISA creditor protected.

- Flexible Plan Design – Cash Balance Plans can easily provide for many different levels of benefits and contributions.

- Supplement to a 401(k) Plan – Cash Balance Plans can be used as a companion to a 401(k) plan, providing a more favorable contribution cost design.

How Can Cash Balance Plans Help Business Owners Take Advantage of the New Tax Law?

“One of the best ways for a business to lower their income is to make contributions into a retirement plan. The advantage of a Cash Balance Plan retirement plan is it benefits the owner and key other people, as opposed to a 401(k) where it’s benefiting everybody,” explained Todd.

The 20 percent pass-through deduction is “phased out” for business owners with taxable income between the threshold limit and phase-out limit. By taking advantage of Cash Balance Plans, businesses can fall within these limitations.

Please contact Todd Yawit with any questions regarding Cash Balance Plans. You can reach him at (513) 573-0129 or send him an email at tyawit@gosaxon.com.

Wanted: Female financial advisors to shrink industry gender gap

Recent studies show that just 16 percent of all financial advisors are women, creating a substantial gender gap. Do you want to close the gap?

If you want more female financial advisors, leverage the ones you already have.

That’s among the findings of the J.D. Power 2018 U.S. Financial Advisor Satisfaction Study, which says that despite the fact that women control 51 percent of assets, just 16 percent of all financial advisors are women.

That kind of a gender gap is nothing to be proud of, especially since it also finds that female financial advisors are generally more satisfied and loyal to their firm than their male counterparts.

That said, female advisors have “some unique pain points” that firms looking to better their position in the industry would be wise to correct.

“The wealth management industry clearly recognizes that aligning the gender mix of advisors with the shifting demographics of investors is critical for their success,” Mike Foy, director of the wealth management practice at J.D. Power, says in a statement. Foy adds, “But firms that want to be leaders in attracting and retaining top female talent need to differentiate on recognizing and addressing those areas that women’s perceptions and priorities may differ from men’s.”

The study, which measures satisfaction among both employee advisors and independent advisors, bases its evaluation on seven factors: client support; compensation; firm leadership; operational support; problem resolution; professional development; and technology support.

Considering that even though overall satisfaction with firms is improving, women are “more satisfied and loyal, bigger brand advocates.” The study finds that female advisors’ average overall satisfaction score is 786 among employee advisors—an impressive 59 points higher than among their male counterparts. Among independent advisors, overall satisfaction among women is also higher, at 793, topping their male counterparts by 39 points.

In addition, female advisors also are more likely than male advisors to say they “definitely will” remain at the same firm over the next 1–2 years (68 percent, compared with 56 percent) and are more likely to say they “definitely will” recommend their firm to others (60 percent, compared with 50 percent).

But as far as female advisors are concerned, their firms fall short in a number of areas. Women are significantly more likely than men, the report finds, to say they do not have an appropriate work/life balance (30 percent, compared with 22 percent). And 90 percent of women who do have that balance say they “definitely will” recommend their firm, while only 68 percent of those who do not will do so.

Women are also less likely than men to say they “completely” understand their compensation (60 percent, compared with 66 percent) and less likely to believe it reflects their job performance (60 percent, compared with 68 percent). They’re also less likely than men to believe mentoring programs are effective (44 percent, compared with 53 percent).

The mean tenure for female advisors at their current firms, the study reports, is 18 years, while the mean tenure for male advisors at their current firms is 20 years.

SOURCE:

Satter, M (13 July 2018) "Wanted: Female financial advisors to shrink industry gender gap" [Web Blog Post]. Retrieved from https://www.benefitspro.com/2018/07/12/wanted-female-financial-advisors-to-shrink-industr/

What’s ahead for HR technology?

As technology modernizes business, HR has worked hard to keep up. In 2017, there were numerous innovations, so we can't wait to see what 2018 brings! Check out this article from Employee Benefit Advisor on some trends in HR Technology this year.

The past year saw a number of HR technology innovations and significant product introductions — and 2018 promises to bring about even bigger changes.

“The whole field of HRIS is really exciting right now,” says Vanessa DiMauro, CEO of consulting firm Leader Networks and a Columbia University faculty member. “There is so much change and innovation happening.”

Indeed, experts contend, innovations in artificial intelligence and analytics, along with development in cloud, social and mobile technologies, are making HR systems more intelligent and more engaging.

So what will smarter, friendlier HR systems do?

To begin with, they’ll provide more targeted support for employees by helping them gain access to the benefits and services they need. Employees with a new baby, for instance, would not only have their benefits packages updated automatically, but would also receive alerts and recommendations for store discounts, childcare facilities and other products and services geared toward helping them better manage their new family responsibilities.

Smarter HR systems also will deliver the type of workforce analytics that employers need to make better staffing decisions. The manager of a chain of convenience stores, for example, might want to schedule employees who have demonstrated a higher level of job performance for the late shift, because they can be counted on to close a store. The supervisor at a large hospital, on the other hand, might look to assign the facility’s most reliable employees — those who are more likely to show up for work on time — to care units that need to remain in compliance with their government-mandated staffing requirements.

But automatic updates and more efficient workforce scheduling are only two ways in which the latest digital advances will enhance human capital management. There are many others, including:

- Increased employee retention and more effective recruitment.

- Less biased performance management and KPIs.

- Improved knowledge sharing and employee collaboration.

- Greater workforce diversity and inclusion.

To illustrate this, DiMauro points to a new set of talent acquisition tools aimed at helping employers take advantage of underutilized labor pools by increasing the diversity of their workforce. These include applications to help improve outreach efforts to military veterans and people with disabilities, among other populations.

Offering another example, she cites an emerging category of applications designed to minimize gender, ethnic and other forms of bias, when it comes to performance reviews and considering employees for raises and promotions.

Building a smart system

What gives these new applications their power and joins them together, as part of an integrated HR information system (HRIS), is their ability to feed and draw from the same set of employee records. Building this smart HR system — and setting forth on the employer’s digital “journey,” of which it is a part — is likely to begin with the deployment of an employee-collaboration or knowledge-management platform that serves as the hub for all of the employer’s future HR tech endeavors.

The knowledge platform is linked through a single sign-on to the organization’s employee records database. HR staffers and other employees can organize the information into groups, which employees can join. A new hire might begin by logging into the “new employee orientation” group, which might auto-join the employee into a “benefits” group or a “training” group.

Over time, employees can continue to be auto-joined to different groups and auto-fed applicable content, as they experience different life events (such as a home purchase) or reach various milestones (such as a promotion) in their careers. Each of the groups might be built around a corresponding app — some of which might be designed for a mobile device.

Utilizing a hub and spoke model, different HR applications can be added to the system and tied into the employee database. In this way, employers are able to incrementally build out a 360-degree HRIS “wheel” that eventually includes performance reviews, employee engagement portals and talent acquisition tools that auto-reward employees for successful referrals.

The auto-classification and auto-taxonomy features embedded in the collaboration platform and corresponding apps, DiMauro explains, eliminate many of the purely rote administrative tasks that HR is saddled with today.

Meeting employee needs

Citing consumer research, the consultant notes that most customers — including most employees — want to self-serve. “Who wants to wait until morning, if you have a middle-of-the-night problem?” she asks. “When employees can readily find their own answers to less complex questions, that is a win-win for both the employee and the HR rep who would’ve had to handle the request.”

Behind all these innovations are a number of new technologies that will continue to gain steam in 2018. The most important of these is the cloud.

“From a technology standpoint, this is the biggest trend in HRIS,” says Lisa Rowan, vice president for HCM and talent management at market researcher International Data Corp.

Cloud-based HRIS solutions, which are hosted at remote facilities and maintained by the service provider, offer employers many advantages over traditional on-premise solutions that they had to maintain themselves. Chief among these are lower maintenance costs, faster transaction times, a more streamlined and easier-to-use interface, and software that is always up to date.

Human resource execs are embracing applicant tracking, training management, performance management and other software applications.

Keeping HRIS software current is important, if the employer wants to take advantage of other leading-edge technologies as they become available, including more graphically-oriented, intuitive applications for complex undertakings like a benefits enrollment. But it does require certain tradeoffs.

Traditionally, if an HRIS system didn’t support the precise way an HR organization handled a given task or function, custom software code would be written to adapt the system to the process. This was expensive and time-consuming, and forced companies to delay adopting new versions of the software, since every upgrade required complex rewrites of their customized code. Cloud-based systems eliminate these requirements and are much easier to deploy, but the HR department must adapt to the workflow prescribed by the system — and not the other way around.

As cloud-based systems become prevalent, says Rowan, “HR professionals will have to face the fact that they will have to do things a little differently to fit within the scope of a configurable, but not customizable, system.”

The cost efficiencies and operational advantages associated with a cloud-based system pave the way for other break-through HRIS technologies as well. Chief among them are:

- Social media, which offers employees new ways to share work and collaborate, and provides employers with new tools for disseminating their message and attracting job candidates.

- Mobile devices, which let employers tailor their outreach to select groups of employees, and allow employees to clock-in, enroll for benefits and handle many other tasks remotely, at a time and place of their choosing.

- Artificial intelligence, which is paving the way for new and different ways to respond to employee demands. Chat boxes, for instance, will soon replace human operators at HR call centers. Employees who phone or text in will still feel as though they are dealing with a person, but it will be a computer algorithm at the other end of the line.

- Data analytics, which give HR pros tools to gauge and influence employee behaviors, improve open enrollment outcomes and deepen employee engagement. But data analytics can also be utilized in a more strategic manner: By correlating workforce composition and activity with specific business outcomes, employers can systematically reshape their workforce to improve those outcomes.

“Analytics allow employers to identify useful trends by asking simple questions,” explains Bob DelPonte, general manager for the workforce ready group at Kronos, a provider of human capital management products and services. “For example, what’s the turnover rate for employees who live more than 20 miles away from work, compared with those who live less?”

The answer, he says, can inform the employer’s hiring and scheduling decisions. “Why risk losing a hard-to-replace employee because you’re forcing her to travel farther than she needs to, if you have the option of transferring her to a closer facility?”

Proceeding with caution

While technologies like artificial intelligence can be a boon to HR, they can also pose challenges. By increasing automation, AI will free HR staff from many repetitive tasks, allowing them to focus on more strategic concerns. But analysts like Rowan are not demure about the fact that some HR staffers will also be replaced by the software.

“How does that play out?” she asks. “You have HR personnel today who are geared toward answering phone calls, and when there are fewer calls, they may no longer be needed. There’s no point to sugar-coating that reality. There are HR professionals that need to think about re-skilling themselves.”

DiMauro also offers a word of caution. “It’s important that HR executives don’t get drunk at the bar of tools. There are so many new applications,” she says, “that they need to keep their wits about them and determine what they really need. Look for the right tool to solve the problem. Don’t just collect and decorate because it’s all out there and available.”

Read the original article.

Source: Kass E. (17 January 2018). "What’s ahead for HR technology?" [Web Blog Post]. Retrieved from address https://www.employeebenefitadviser.com/news/whats-ahead-for-hr-technology?feed=00000152-175f-d933-a573-ff5f3f230000

Top 10 Corporate Wellness Habits to Adopt During 2018

With the New Year in full swing, you may be considering how to turn your life around for the better - drop pounds, kill unhealthy chocolate addictions, quit binging every Netflix season ever, etc... But what about making lasting habits within the workplace?

Too often, we make a list of resolutions, and we forget where we spend most our time. Work is work, but that doesn’t mean we can’t implement some of the changes we make in our personal lives in the workplace, as well.

Today, we thought we’d offer up 10 different ideas for employers (or for employees to offer to their boss) to try and implement within the workplace – from wellness challenges to recess. Try one, combine a few, or do them all! The best part about making resolutions is making them unique to yourself and your company. So, don’t be afraid to get creative!

-

Offer healthy alternatives to traditional junk food items

Just a simple switch of snack foods in the office can cut unnecessary calories! Snacking on healthy items can make mindless snacking not so bad.

-

Offer standing desks

This easy switch will be one of the new year’s trendiest wellness tactics. Select desk options that allow users to easily switch between standing and sitting while working to allow for better blood flow throughout the day.

-

Try a wellness challenge

There’s nothing like some healthy interoffice competition to get people motivated. Select a wellness challenge that is easy and effortless to incorporate into your workplace. This could be a monthly or a weekly challenge, switch it up each month/week to keep things interesting!

-

On-site yoga classes

Another wellness trend that will continue into 2018 is managing stress through yoga. Mindfulness and meditation offer a slew of benefits to help employees relieve stress. Invite an instructor to your office every couple of weeks to guide the team through a yoga class.

-

Celebrate “Wellness Wednesday”

Make hump day something to celebrate and begin to tackle wellness in the office in a manageable way. One day a week can be a gateway to a much healthier lifestyle.

-

Listen to your employees

Survey employees to find out what is working and what isn’t instead of wasting time and energy on things that aren’t engaging your employee population. Use a site like Survey Monkey or Google Forms to create a survey to collect feedback from employees.

-

Participate in a 5K or other group fitness activities

Find a 5K in your community or choose another group fitness activity and cover the entry fee for anyone choosing to participate.

-

Post signs near elevators and escalators encouraging employees to take the stairs instead

Sometimes just seeing this reminder is all the motivation needed to be a little more active!

-

Schedule recess

Pick a 15-minute time of the afternoon for everyone to get away from his or her desk. Go outside, socialize with each other and enjoy some fresh air! Taking walks has also been shown to increase creativity.

-

Reward volunteers

Pay your employees for any volunteer hours up to a certain amount or allot a certain amount of time each month for employees to get away from their desk and get active in the community. Ideas include volunteering at a local food bank or cleaning up a local park, beach, or trail. You’ll benefits from both team building and group physical exercise!

Give one or more of these ideas a try and if they work out for you, let us know! The important lesson here is to remember your work-life is just as important to better as your personal life. When it comes to New Year Resolutions, make sure they encompass every aspect of your life and definitely don’t forget to include your employees in your thoughts.