How AI can predict the employees who are about to quit

Employers are now utilizing artificial intelligence (AI) to help predict how likely it is that an employee will stay with their company. Read this blog post to learn more.

Tim Reilly had a problem: Employees at Benchmark's senior living facilities kept quitting.

Reilly, vice president of human resources at Benchmark, a Massachusetts-based assisted living facility provider with employees throughout the Northeast, was consistently frustrated with the number of employees that were leaving their jobs. Staff turnover was climbing toward 50%, and after many approaches to improve retention, Benchmark turned to Arena, a platform that uses artificial intelligence to predict how likely it is that an employee will stay in their job.

“Our new vision is about human connection,” he says. “With a turnover rate that’s double digits, how do you really transform lives or have that major impact and human connection with people who are changing rapidly?”

Since Benchmark started using Arena, staff turnover has fallen 10%, compared to the same time last year. During the hiring process, Arena looks at third-party data, like labor market statistics, combined with applicants' resume information and an employee assessment that will give them a better sense of how long a candidate is likely to stay in a role.

“The core problem we’re solving is that individuals aren’t always great at hiring,” says Michael Rosenbaum, chairman of Arena. “Job applicants don’t always know where they’re likely to be happiest. By using the predictive power of data, we’re essentially helping to answer that question.”

Arena isn’t interested in how an employee responds to assessment questions, he says. They’re much more interested in how employees approach the questions.

“What you’re really doing is your collecting some information about how people react to stress,” Rosenbaum adds.

For example, if an employee is applying for a housekeeping role, Arena may give them a timed advanced math question to complete — something they may never use in their actual job. Arena then studies how the candidate responds to the question — analyzing key strokes and tracking how the individual tackles the challenge. The software can then get a better sense of how an applicant responds under pressure.

Overtime, Arena’s algorithm learns from the data it collects. The system tracks how long a specific employee stays at the company and can then better predict, moving forward, whether other employees with similar characteristics will stay.

“Overtime they are able to sort of refine that prediction about those that are most likely to stay, or be retained with our organization,” Reilly says. “They may also make a prediction on someone who might not last very long.”

Reilly says he’s been encouraging hiring managers at the facilities to use the data given to them by Arena to take a closer look at the candidates the platform rates as highly likely to stay in their roles. Although it’s ultimately up to the hiring manager who they select.

“Focus your time on the [candidates] that are more likely to stay with us longer,” Reilly says.

For now, Arena exclusively works with healthcare companies. The platform is currently being used by companies like Sunrise Senior Living and the Mount Sinai Health System in New York. Moving forward, Rosenbaum says, they’re hoping to get into other industries, although he would not specify which.

Rosenbaum says Arena is not only focused on improving the quality of life for employees, but also for the patients and seniors that use the facilities. The happiness of patients, he says, is closely tied to those that are caring for them.

“Is someone who is in a senior living community happy? Do they have a positive experience? It is very closely related to who’s caring for them, who’s supporting them,” he says.

This article originally appeared in Employee Benefit News.

SOURCE: Hroncich, C. (15 November 2018) "How AI can predict the employees who are about to quit" (Web Blog Post). Retrieved from: https://www.employeebenefitadviser.com/news/how-ai-can-predict-the-employees-who-are-about-to-quit?brief=00000152-1443-d1cc-a5fa-7cfba3c60000

Give employees time back in an always-on working world

Occasionally, work extends beyond the traditional workday, no matter how efficient your employees are. With time being the most precious benefit of all, a growing number of employers are offering benefits designed to save employees time. Read on to learn more.

When it comes to employee benefits, what do people really want?

As HR and benefits professionals, we shouldn’t make broad assumptions or generalizations about what benefits our employees need or want. Each employee in any given organization is an individual with different circumstances to be met at every stage in their lives — from those entering the workforce to those preparing to retire, and everyone in between. This is why employers must differentiate their benefits packages to meet the needs of a diverse and multigenerational workforce. And as consumers demand more choice in how they spend their benefits dollars, employers are getting more creative and curating a more expansive set of options for everyone.

No matter how efficient an employee is, work inevitably extends beyond the traditional workday from time to time. Similarly, as the lines between home and work blur with flexible work arrangements and email available 24/7 on smartphones, employees still need to take care of personal tasks, like scheduling family dentist appointments, setting up child care, disputing medical bills or calling the veterinarian … all during the workday.

Regardless of generation, industry, position or title, people are yearning to find the right balance between work and life demand. Time is the most precious benefit of them all. As a result, there are a growing number of employers offering benefits designed to save employees time.

Previously offered predominantly by large, tech companies in Silicon Valley, we’re seeing time-saving benefits spread to employers and industries of all kinds and encompass a variety of conveniences, from on-site dry cleaning pickup, to employer-funded shuttles to get employees to and from work, gym memberships, grocery delivery and services like dog walking and personal errands. This benefits category can also include more significant, personalized benefits like concierge health services, assistance in evaluating elderly care options, telehealth for humans and pets, and emergency childcare services.

Once seen as just perks, these services run deeper. Employers care about their people, and these time-saving benefits — anything people leave work early for, or deal with during the work day — has created a new benefits category that increases employees’ productivity and capacity for work by eliminating distractions and freeing up mental space. While these types of benefits may seem like “nice to have” instead of essentials, they can add up and make a substantial difference in employees’ lives.

Life is complicated. Things go wrong that impact productivity, contribute to presenteeism and the well-being of our workforce; these employee benefits offered through employers are returning valuable time back into someone’s day, helping them focus on work and better balance work and life expectations.

Employees need HR’s help. By not offering a wide variety of benefits personalized to the workforce, employers are missing out on an opportunity to provide great value to employees and make a tremendously positive change in their lives. But many HR professionals falsely assume employees will ask for voluntary benefits directly and proactively make suggestions about what would help them. You may say, “My employees aren’t coming to me asking for things like elder care services, so they don’t need them.” My response is, of course, they’re not asking: they may not want you to know about challenges they’re facing in their personal lives.

Employee’s personal situations are just that - deeply personal. They may be suffering in silence. Americans are now facing the highest housing, education and medical costs in our history, meaning nearly everyone is stressed out about family, work and finances; it’s causing problems in the workplace. If their minds are somewhere else and not focused on work, their productivity could be suffering.

Open Enrollment is rapidly approaching. Don’t wait for your employees to ask you for benefits. Take advantage of OE to ask your employees what they’re looking for, as this is the time they’ll already be assessing what types of benefits they need in the coming year anyway. Use this time to survey the workforce to see what people do or don’t like about their benefits. Be sure to specifically ask “What can we offer you?”

It’s a question, and a gesture, that may matter more to employees than you know.

This article originally appeared in Employee Benefit Adviser.

SOURCE: Oldham, J. (14 September 2018) "Give employees time back in an always-on working world" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/give-employees-time-back-in-an-always-on-working-world?feed=00000152-18a4-d58e-ad5a-99fc032b0000

How to create a strong communication plan for open enrollment

What is your communication plan for open enrollment? Now that you have your plan changes locked in, it's time to focus on communicating those changes to your employees. Read this blog post to learn more.

Ready or not… the Benefits Super Bowl is here! Whether you are a broker, benefits manager or anywhere in between, you have been knee-deep on plan updates, rate reviews and benefit changes for months. Now that the plan changes are locked, it’s go-time! The focus is now on communicating and educating employees about their benefit options.

It takes an enormous amount of planning and execution to provide a productive open enrollment experience for employees. But, it is well worth it as this is often the only time during the year that employees stop to consider their benefit options.

Learn from past wins and misses

Consider previous years’ open enrollment communications and ask yourself the following:

- What is the feedback you received from employees (the good, the bad and the ugly)?

- What were the most common questions?

- Were there key pieces of information employees had difficulty finding?

Learn from the answers to these questions and then craft your content in a clear and concise manner that is easier for employees to digest.

The communication medium is key to your success

Now that you’ve developed the content to communicate, the next equally important step is determining how, when and where you deliver this information. Is there a centralized location where employees can find information for both core and voluntary benefits? Is the information in a format that the employee can easily share with his or her significant other?

It is critical to have multi-channel communications to reach your audience. Some employees may naturally gravitate to a company-wide email and the company intranet, while others lean on more interactive mediums like E-books, text messages, webinars or lunch and learns. Providing a variety of communication avenues ensures you are reaching employees where they want to receive information.

Make sure your communications campaign provides educational materials at each of the key milestones during the open enrollment journey–such as prior to enrollment, midway through enrollment, and right before enrollment closes. Wherever possible, always support employees through the process and give them options to reach out for help.

How to communicate the same benefits to a diverse workforce

You are likely communicating to a group of employees with diverse needs and wants. What may be appealing to an entry-level recent grad may not resonate with a senior-level employee nearing retirement. For example, employees with young children may be especially interested in accident insurance or pet owners might look to pet insurance to help offset the costs of well-visits and routine care. If possible, tailor your communications to different segments of the employee population.

Communicating voluntary health-related benefits

Core medical benefits are what employees gravitate to during the enrollment period. Are you offering voluntary benefits to employees? The most successful voluntary benefit programs are positioned next to core medical plans on the enrollment platform. This shows employees how those voluntary benefits (critical illness, accident insurance and hospital indemnity) complement the core offerings with extended protection.

When voluntary benefit programs are positioned as an integral part of the employee benefits experience, employees are more likely to understand the value and appreciate the support provided by their employer. For example, a critical illness program can help to bridge the gap of a high-deductible health plan in the case of a covered critical condition. Communicate that voluntary benefits can be an integral part of a “Total Rewards Package” and can contribute to overall financial wellness.

Review and refine

Finally, don’t miss your opportunity at the end of enrollment to review how your communication campaign performed. Pull stats and analyze your communication campaign for next year’s open enrollment… it is never too early to start! HR managers can glean valuable information and metrics from the employee experience.

SOURCE: Marcia, P. (1 November 2018) "How to create a strong communication plan for open enrollment" (Web Blog Post). Retrieved from https://www.benefitspro.com/2018/11/01/how-to-create-a-strong-communication-plan-for-open/

Civic time off: The benefit getting employees to the polls

Does your organization offer civic time off as an employee benefit? Some companies are looking to change low voter engagement by offering new benefits to employees who vote. Read on to learn more.

Voter engagement for midterm engagement historically has been poor. Some companies are offering new benefits to change that — even offering the day off to encourage employees to vote.

American employers that provide paid time off stands at about 44%, a record high, according to the latest research from the Society for Human Resource Management survey. The human resource organization estimates 29% of these companies offer employers more than an hour or two of voting time.

Despite such accommodations, about 60% of Americans didn’t vote in the last midterm election, according to research by Vote.org, a voters’ advocacy organization. The biggest obstacle to voting was scheduling conflicts; 35% of people said they couldn’t vote because of work and school.

“There’s no federal protection for voting leave for employees, which means it’s up to the states to set their own policies. Policies are inconsistent, but some states have no laws at all,” says Colette Kessler, director of partnerships at Vote.org. “This puts employers in a powerful position to enable employees to get to vote.”

But as more Americans prepare to head to the polls for key elections in 46 states, employers including Patagonia, Zenefits and Honest Tea, are opting to give employees paid time off to make their voice heard.

Outdoor retailer Patagonia, for instance, is closing its stores as well as its headquarters and distribution and customer-service center to give employees paid time off to vote. “No American should have to choose between a paycheck and fulfilling his or her duty as a citizen,” Patagonia CEO Rose Marcario wrote in a company blog post.

Meanwhile, human resource software company Zenefits implemented a new program in which employees can take time off to vote the same way they would for a doctor’s appointment. Voting won’t cut into their sick days, vacation time or paid time off. Instead, voting gets its own designation — civic time off, or CTO. That free time can be used for voting, volunteering for a candidate, attending a school board meeting or canvassing.

“Civic time off is a new concept for the industry, and we’re excited to be among the first to offer such a benefit,” says Beth Steinberg, chief people officer at Zenefits, in a letter on the company blog. “At Zenefits, it’s been a priority to help build our team’s skill set not only as it pertains to professional career growth, but also to encourage their development outside of the workplace as engaged and empowered citizens.”

Vote.org consults with companies interested in implementing a CTO program. Based on individual business models and company culture, the organization will suggest either full days off, half days or flexible scheduling.

“One benefit we’re really excited about is offering employees a half day. It gives employees the ability to get to their polling places and do their morning routine — like getting the kids to school and running errands,” Kessler says. “And later they can convene with colleagues and celebrate Election Day. We’re seeing HR teams create afternoon lunch parties to celebrate.”

Kessler says some companies are hesitant to provide time off for voting because they’re worried about losing productivity. However, most of the companies she’s worked with have been enthusiastic about providing their workforce with time off to vote.

“We don’t see any drawbacks to offering our employees flexibility on Election Day,” says Seth Goldman, co-founder and CEO emeritus of beverage company Honest Tea, which allows its 50 employees to take a few hours of paid time off go to the polls on Election Day, at their convenience. “It’s a right we all should be proud to recognize and support however we can.”

SOURCE: Webster, K. (5 November 2018) "Civic time off: The benefit getting employees to the polls" (Web Blog Post). Retrieved from: https://www.employeebenefitadviser.com/news/civic-time-off-the-benefit-getting-employees-to-the-polls?feed=00000152-a2fb-d118-ab57-b3ff6e310000

Predictive Analytics Will Be The Silent Game-Changer In Employee Benefits

Employers can now use their own data to help fine-tune their employer-sponsored benefits packages. Continue reading to learn how this technology could be used to help fine-tune employee benefits offerings.

Last year’s World Series between the Houston Astros and the Los Angeles Dodgers came down to a seven-game battle based not only on talent, athleticism and coaching but also on data. Just as Sports Illustrated suggested back in 2014 via predictive data, the Astros were the victors.

The publication of Moneyball: The Art of Winning an Unfair Game spurred not only Major League Baseball teams to deploy predictive analytics, but also businesses to take a harder look at what their data means. It's no longer part of the hype cycle: Statista forecasts (paywall) that the predictive analytics market worldwide will reach $6.2 billion in 2018 and $10.95 billion in 2022.

I believe we are also at a transformational point in improving corporate employee benefits and our employees’ lives by embracing predictive analytics. HR is swimming in rich data. Instead of guesstimating needs across multiple generations of employees, employers can turn to their own data to fine-tune what they are offering as benefits solutions. Companies spend 25-40% of an employee’s salary on benefits. It simply makes strategic and financial sense to get it right.

Bring Employee Benefits Out Of The Dark Ages

Hiring and retaining great talent is at the very soul of almost every company’s strategy. Not surprisingly, more companies have turned to predictive analytics to give them a leg up in recruitment. However, HR benefits have lagged behind. As John Greenwood reported to Corporate Adviser, “More than half of reward and employee benefits professionals see predictive analytics as a game-changer, but 90 percent are still using spreadsheets to manage data, research from the Reward & Employee Benefits Association shows.”

One reason for benefits lagging behind recruitment in adopting predictive analytics is that the way companies choose new benefits varies greatly from business to business. Given that the majority of HR departments keep data in disparate spreadsheets, even if some HR departments conduct employee surveys or historical cost analyses, they often do not integrate the data about their workforce. If a new benefit offering is chosen based on a needs analysis, only some know the “why” behind a request from the workforce. Knowing how many employees are logging into a benefits platform is helpful; market standard benefit utilization reports provide this level of information. Yet they do not give insight into the underlying reason for an employee to utilize a benefit. The user of deeper analytics is required to look deeper into employees' behavior.

We have found firsthand that many HR departments do not have a full understanding of how their employees are utilizing their benefits across the entire offering suite. A one-size-fits-all or a one-off strategy no longer is effective. Companies must understand not only their employees’ needs but also the underlying data related to these needs to provide a valuable benefits offering.

Put Your Existing Data To Use

For the past five years, I have watched our clients glean valuable insights into what the real underlying issues are for their employees and what must be done to address these pressing needs. I also have been watching companies realize that what they thought were the core problems at hand sometimes were not.

For example, one of our national high-tech clients, with over 50,000 benefit-eligible employees, believed that a high number of their employees had children struggling with autism. This belief was initially based on input from some of their employees. After approximately 16 months, the client reviewed the masked utilization data from their benefit platform. The data illustrated that the overwhelming majority of employee families (tenfold) in fact faced challenges associated with youth anxiety, a concern that had never been expressed to HR previously. Once they reviewed what employees were doing within our platform, their results mirrored the National Institute of Mental Health’s report that approximately 31.9% of U.S. children ages 13-18 struggle with anxiety disorders.

Their own data helped them understand much more specifically where their employees’ stress lay, and their HR department was able to focus communications around it.

Getting Started

Mining and viewing use data across all benefits is ideal. This enables an employer to determine if the benefit suite is serving employees effectively. We have found that as quickly as year over year, users' behaviors shift. If a company solely chooses a benefit based on what they saw as most heavily utilized the previous year, they are not being strategic.

For that reason, HR should utilize past and current data to better predict future patterns of need for a truly strategic approach to benefit choice. With this insight, they can make better choices and serve their workforce more effectively.

Given the limitations across many employee benefit vendors today, to start initially:

1. Embrace KPIs. Agree upon them internally, and measure benefit vendors on them.

2. Work with your current vendors to determine what data they provide to support your internal analysis. Ensure you have access to all the data you need, and if not, consider a vendor change.

3. Hold possible new vendors to similar data standards, and create a transparent relationship from the start.

4. Collect current and historical data. Existing vendors can provide this history, so make sure to collect at least 2-3 years of information.

These analytics need to go deeper than basic demographics to show patterns of activity. In order to understand the benefit needs of your workforce, you'll want to analyze trends across multiple data sets: medical, pharmacy, worker's compensation, biometric screenings, utilization patterns, FMLA requests and demographic trends. From there, you can start to pinpoint what your employees need -- and the “whys” behind the needs -- in order to make a measurable impact.

While predictive analytics is still in the nascent phase in the benefits and vendor worlds, the easiest and most proactive thing any employer can do is to focus on other insights vendors can provide related to the workforce and benefit use beyond simple utilization. In doing so, you will be able to support your employees both in their work lives and their personal lives by providing them with the benefits they need to be at their best.

SOURCE: Goldberg, A. (2 October 2018) "Predictive Analytics Will Be The Silent Game-Changer In Employee Benefits" (Web Blog Post). Retrieved from: https://www.forbes.com/sites/forbestechcouncil/2018/10/02/predictive-analytics-will-be-the-silent-game-changer-in-employee-benefits/#26648166e182

IRS bumps up 401(k) contribution limit for 2019

Do you offer a retirement plan to your employees? The IRS recently raised the annual contribution cap for 401(k) and other retirement plans. Continue reading to find out what the new contribution caps are.

Participants in 401(k) and other defined contribution retirement accounts will see their annual contribution cap raised from $18,500 to $19,000 in 2019, according to the Internal Revenue Service.

The catch-up contribution limit on defined contribution plans remains unchanged at $6,000.

Savers with IRAs will see the annual contribution cap raised from $5,500 to $6,000 — the first time the cap on IRA deferrals has been raised since 2013. The annual catch-up contribution for savers age 50 and over will remain at $1,000.

Cost-of-Living Adjustment (COLA) increases will also be applied to the deduction phase-out scale for IRA owners who are also covered by a workplace retirement plan:

- for single filers the scale will be $64,000 to $74,000, up $1,000

- for joint filers where the spouse contributing to an IRA is also covered by a workplace plan, the phase-out slot increase to $103,000 to $123,000

- for an IRA contributor whose spouse is covered by a plan, the income phase-out is $193,000 to $2003,000

Single contributors to Roth IRAs will see the income phase-out range increase to $122,000 to $137,000, up $2,000 from last year. For married couples filing jointly the range will increase to $193,000 to $203,000, up $4,000 from last year.

More low and moderate-income families may be able to claim the Saver’s Credit on their tax returns for contributions to retirement savings plans. The threshold increases $1,000 for married couples, to $64,000; $48,000 for head of households, up $750; and $32,000 for singles and single filers, up $500 from last year.

The deferred compensation limit in defined contribution plans for pre-tax and after-tax dollars will increase $1,000, to $56,000. And the maximum defined benefit annual pension will increase $5,000, to $225,000.

SOURCE: Thornton, N. (1 November 2018) "IRS bumps up 401(k) contribution limit for 2019" (Web Blog Post). Retrieved from https://www.benefitspro.com/2018/11/01/irs-bumps-401k-contribution-limit-for-2019/

How data science can help employers build better benefit plans

New approaches to data science are now allowing companies to have many different definitions of data and have them all coded. Read on to learn how data science can help you build a better benefits plan.

Is your data management system overdue for an overhaul? Benefit plan sponsors don’t need to feel stuck with old systems requiring hours of manual data entry, according to Marc Rind, chief data scientist for ADP.

“I’ve been in data for a long time,” he says. “For generations, the traditional data management approach has been people having to standardize data.”

But people in different companies — even different departments of the same company – could have different definitions and means of data. An organization’s governance team would have to come up with one definition for everyone to adhere to.

With new approaches to data science, Rind says, “you’re able to have many different definitions of your data and have them all coded. It’s not about governing the definition of data but more about enhancing and publishing that data.”

With data science, employers and those in HR can see trends much more easily using automated mapping and search capabilities. This will allow them to see trends over time, like what people are choosing for their benefit plans and how benefits impact employee productivity and engagement.

“It builds context around the data,” Rind says. “For employers, they have to not only understand which benefit offerings they have to offer to employees but the effect on retention. They can also see what similar employers are offering and if they are getting higher retention rates.”

Employees can use the data to see what benefits others with similar backgrounds have chosen to get, helping them decide what their perfect healthcare plan looks like. However, they cannot yet see how satisfied people similar to them were with these benefits. Rind says that this feedback loop is important, and will become more prominent for the next generation of data science systems.

SOURCE: Spiezio, C. (16 June 2016) "How data science can help employers build better benefit plans" (Web Blog Post). Retrieved from https://www.benefitnews.com/news/how-data-science-can-help-employers-build-better-benefit-plans

9 Simple Ways to Deal With Stress at Work

The Centers for Disease Control and Prevention reports that 29 to 40 percent of Americans are extremely stressed at work. Read this blog post for nine simple ways to deal with stress at work.

According to research, the percentage of Americans who are stressed at work is high, and it’s only getting higher. According to the CDC’s National Institute of Occupational Safety and Health, studies have found the number of Americans who are “extremely stressed at work” range between 29 percent to 40 percent.

Unfortunately, work stress has significant health consequences that range from the relatively benign—more colds and flus—to the more serious, like heart disease and metabolic syndrome. But, because stress at work is so common, finding a low-stress job may be difficult or impossible for many people. A more realistic choice would be to simply adopt more effective strategies to reduce stress at work. Here are some stress management techniques to try.

Start Your Day Off Right

After scrambling to get the kids fed and off to school, dodging traffic and combating road rage, and gulping down coffee in lieu of something healthy, many people come in already stressed, and more reactive to stress at work. In fact, you may be surprised by how much more reactive to stress you are when you have a stressful morning. If you start off the day with good nutrition, proper planning, and a positive attitude, you may find the stress of the workplace rolling off your back more easily.

Be Clear on Requirements

A factor that contributes to job burnout is unclear requirements. If you don’t know exactly what’s expected of you, or if the requirements keep changing with little notice, you may find yourself much more stressed than necessary. If you find yourself falling into the trap of never knowing if what you’re doing is enough, it may help to have a talk with your supervisor and go over expectations, and strategies for meeting them. This can relieve stress for both of you!

Stay Away From Conflict

Because interpersonal conflict takes a toll on your physical and emotional health, and because conflict among co-workers is so difficult to escape, it’s a good idea to avoid conflict at work as much as possible. That means don’t gossip, don’t share too many of your personal opinions about religion and politics, and try to steer clear of colorful office humor. Try to avoid those people at work who don’t work well with others. If conflict finds you anyway, learn how to deal with it appropriately.

Stay Organized

Even if you’re a naturally disorganized person, planning ahead to stay organized can greatly decrease stress at work. Being organized with your time means less rushing in the morning to avoid being late and rushing to get out at the end of the day. Keeping yourself organized means avoiding the negative effects of clutter, and being more efficient with your work.

Be Comfortable

Another surprising stressor at work is physical discomfort. You may not notice the stress you experience when you’re in an uncomfortable chair for a few minutes. But if you practically live in that chair when you’re at work, you can have a sore back and be more reactive to stress because of it. Even small things like office noise can be distracting and cause low-grade frustration. Do what you can to ensure that you’re working from a quiet, comfortable and soothing workspace.

Forget Multitasking

Multitasking was once heralded as a fantastic way to maximize one’s time and get more done in a day. Then people started realizing that when they had a phone in their ear and were making calculations at the same time, their speed and accuracy (not to mention sanity) suffered. There is a certain kind of frazzled feeling that comes from splitting one’s focus that doesn’t work well for most people. Rather than multitasking, try a new strategy known as chunking.

Walk at Lunch

Many people are feeling ill effects from leading a sedentary lifestyle. One way you can combat that, and manage stress at work at the same time, is to get some exercise during your lunch break and perhaps take short exercise breaks throughout the day. This can help you blow off steam, lift your mood, and get into better shape.

Keep Perfectionism In Check

Being a high achiever can help you feel good about yourself and excel at work. Being a perfectionist, on the other hand, can drive you and the people around you a little nuts. Especially in busy, fast-paced jobs, you may not be able to do everything perfectly. But striving to just do your best and then congratulating yourself on the effort is a good strategy. Your results will actually be better and you’ll be much less stressed at work.

Listen to Music on the Drive Home

Listening to music brings many benefits and can offer an effective way to relieve stress after work. Combating the stress of a long day at work with your favorite music on the drive home can make you less stressed when you get home, and more prepared to interact with the people in your life.

SOURCE: Scott, E. (12 November 2018) "9 Simple Ways to Deal With Stress at Work" (Web Blog Post). Retrieved from https://www.verywellmind.com/how-to-deal-with-stress-at-work-3145273

Healthcare waste is costing billions — and employers aren’t doing anything about it

Providing your employees with healthcare insurance is expensive. A large chunk of healthcare costs is being wasted by the healthcare industry, according to a new survey. Read on to learn more.

Providing the workforce with healthcare coverage is expensive, but a new survey of 126 employers suggests a large chunk of that cost is being wasted by the healthcare industry on treatments patients don’t need.

The healthcare industry wastes $750 billion per year on unnecessary tests and treatments, according to a survey from the National Alliance of Healthcare Purchaser Coalitions and Benfield, a market research, strategy and communications consulting firm. Some 60% of employers don’t take steps to manage their healthcare plan’s wasteful spending, despite the fact that the same percentage of employers view it as a problem, the survey says.

“While waste has long been identified as a key concern and cost contributor, employers are operating blind and need to look at a more disciplined approach to address top drivers that influence waste,” says Michael Thompson, National Alliance president and CEO.

Employers are under the impression that prescription drugs are the culprit behind the spending waste, and they are, just not as much as other services. Around 54% of health spending waste is caused by unnecessary medical imaging tests, such as MRIs and X-rays, the survey says. Specialty drugs, unnecessary lab tests and specialists referrals are also major money pits.

However, the survey data isn’t suggesting these procedures and treatments shouldn’t be covered by employer health plans. The tests and treatments are potentially life-saving, they’re just used more than they should be. Sometimes previous test results can help with a current diagnosis, but medical staff don’t always check patient files before ordering new tests.

Most employers don’t monitor unnecessary healthcare spending. The 34% of employers who do rely entirely on their healthcare vendors to do it for them, trusting that it’s being taken care of.

“The idea of reducing waste in the healthcare system can be overwhelming,” says Laura Rudder Huff, senior consultant for Benfield. “While employers ask themselves: ‘Where to start?’ this is an issue where even small steps matter. Employers can begin by collecting data to identify where the inefficiencies are in their workforce and community and use assets such as vendors and organizations like coalitions to realize market improvements.”

The survey also recommends employers enlist the services of Choosing Wisely, an organization that counsels patients and employers on healthcare plans and medical treatments.

This article originally appeared in Employee Benefit Adviser.

SOURCE: Webster, K. (7 November 2018) "Healthcare waste is costing billions — and employers aren’t doing anything about it" (Web Blog Post). Retrieved from https://www.benefitnews.com/news/healthcare-waste-is-costing-billions-and-employers-arent-doing-anything-about-it

7 Steps to Running Better Meetings

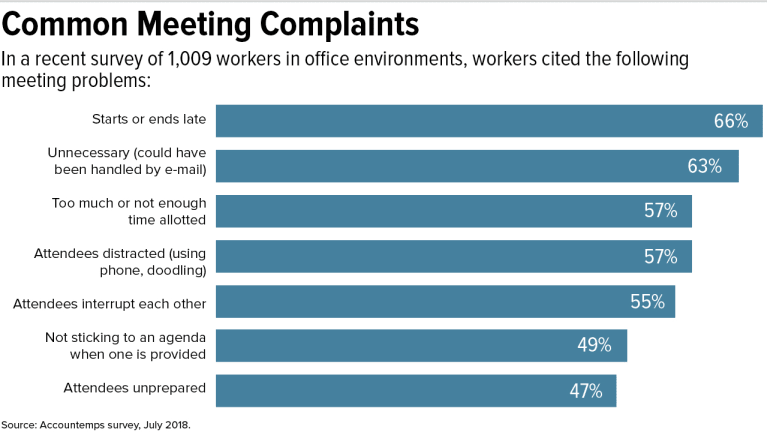

A recent Accountemps survey revealed that office workers spend 21 percent of their time in meetings and feel that 25 percent of it is wasted. Read this blog post for seven steps to running better meetings.

We love to hate meetings. We groan about how annoying they are. We crack jokes about how much time gets wasted, about bureaucracy run amok.

But it’s not really a laughing matter.

Poorly run meetings can sap the lifeblood out of an organization. Not only are they mentally draining, but they can leave staff disengaged and demoralized, experts say.

On average, office workers spend 21 percent of their time in meetings and feel 25 percent of it is wasted, according to the results of a recent survey of 1,000 employees by Accountemps. One of the top complaints was that meetings are called to relay information that could have been communicated via e-mail.

Managers are also dissatisfied. In a Harvard Business School study last year, researchers found that 71 percent of the 182 senior managers interviewed said meetings were unproductive and inefficient, and 65 percent said meetings kept them from completing their work.

Fortunately, leaders can help improve how meetings are run. Indeed, their behavior is critical to achieving better results and a more positive outlook and engagement from employees, according to a 2017 study published in the Journal of Leadership & Organizational Studies. In an earlier University of North Carolina study, researchers found a link between how workers feel about the effectiveness of meetings and their job satisfaction.

Other studies have found that dysfunctional communication in team meetings can have a negative impact on team productivity and the organization’s success.

What happens in these gatherings is a reflection of the workplace culture, experts say.

“It gets down to identity and performance,” says J. Elise Keith, co-founder of Lucid Meetings in Portland, Ore., and author of Where the Action Is (Second Rise, 2018). “The way in which an organization runs its meetings determines how it views itself.”

“Bad meetings are almost always a symptom of deeper issues,” Keith notes in her book.

Unfortunately, many business leaders don’t receive adequate training on how to manage or facilitate meetings, she says. “I believe that a lot of leaders have bought into the idea that poor meetings are inevitable.”

Here are 7 steps to making the time employees spend together more meaningful:

1. Prepare. Are you clear on the meeting’s purpose? What is your desired outcome? How will you achieve that?

More prep time is typically devoted to senior-level meetings compared to those held for individuals in lower-level positions, says Paul Axtell, a corporate trainer and author of Meetings Matter (Jackson Creek, 2015). He says that executive get-togethers are more effective “because people take them seriously.”

2. Limit the number of participants. The most productive meetings have fewer than eight participants, Axtell says. A larger group will leave some disengaged or resentful that their time is being wasted.

3. Send an agenda and background material in advance. If you want a thoughtful discussion, give your team members time to think about the problem or proposal that the meeting will focus on, he says.

4. Start and end on time. Don’t punish people for being punctual by waiting on late stragglers to get started. At the same time, it’s best not to jump right to the heart of the discussion in the first few minutes, Keith says. Provide a soft transition that will help those coming from other meetings to refocus.

5. Make sure all attendees can participate. One common complaint about meetings is that a few people tend to dominate the conversation. Call on other individuals to share what they think, Axtell says. Who is most likely to hold a different view? Who will be most affected by the outcome? Who has institutional knowledge that might be useful? Think about who to draw out on specific topics as you prepare. You’ll collect more ideas and leave participants with a more positive experience.

To feel good about work, people need to feel included and valued. “That means you have a voice and are allowed to express your opinions,” Axtell says.

Because you’re a leader, your views already hold more weight. If you share them too early, you may discourage others from presenting alternate perspectives. Focus on listening, and stay out of the discussion as long as you can, he says. You might learn something.

Avoid PowerPoint slides or other technology if it’s not required for an agenda item. They tend to shut down dialogue, Axtell says.

A surefire way for leaders to alienate participants is to use up most of the meeting time presenting a proposal and leave only a few minutes for questions and comments, Keith says. When people do speak up, thank them for their contributions. And use their ideas, she says.

6. Keep a written record. Posting the meeting agenda and taking notes that everyone can access will help keep participants on track. Unfortunately, many organizations fail to do so, Keith says. The written record ensures that faulty memories or differing interpretations don’t lead people down the wrong path. Are the notes detailed enough to allow you to tackle the action items days later? Are the deadlines reasonable? Be realistic. It doesn’t help the team to accept a giant list of action items that it likely can’t complete, she says.

7. Follow up. What percentage of the action items get completed by the deadlines? If you don’t achieve 85 percent, participants’ sense of effectiveness breaks down and they may disengage, Axtell says. Most groups complete just 50 percent to 60 percent.

“Whether you pay attention to them or not, meetings are in fact where your teams and your people are learning how they should behave and what they should be doing,” Keith says. “So identify the specific types of meetings your organization needs to run. Find great examples of how to run those meetings. You shouldn’t have to invent it. And set up a system that people can use successfully to become the organization that you want to become.”

SOURCE: Meinert, D. (30 October 2018). "7 Steps to Running Better Meetings" (Web Blog Post). Retrieved from https://www.shrm.org/hr-today/news/hr-magazine/1118/pages/7-steps-to-running-better-meetings.aspx/