A 16-Year-Old Explains 10 Things You Need to Know About Generation Z

What was life like when you were a teenager? The world has been focused on understanding and adapting to Millennials. Now Generation Z is beginning to graduate and enter the workforce. Read this blog post for 10 things the world should know about Gen Z.

Think about what life was like when you were 16. The clothes you wore, the places you shopped. What was most important to you then?

Whenever I speak to an organization eager to learn about Generation Z, I always ask that question. I get responses that include everything from the fleeting fashion trends of the day (bell-bottom jeans, anyone?) to the time-honored tradition of getting a driver’s license.

What I hope to achieve as a 16-year-old in 2018 is probably not all that different from what anyone else wanted when they were my age. It’s the way people go about reaching their goals that evolves over time—and that’s what also forms the basis of most generational clashes.

For the past several years, the world has been focused on understanding and adapting to Millennials, the largest and most-educated generation in history. Born between 1981 and the mid-1990s, this group has inspired important dialogues about generational differences and challenged all industries to evolve to meet their needs. In the workplace, Millennials have helped drive a greater focus on flexibility and collaboration and a rethinking of traditional hierarchies.

Of course, any analysis of generations relies on generalities that can’t possibly describe every person or situation. It’s important to remember that generations exist on a continuum—and that there is a large degree of individual variation within them. The point of this type of research is to identify macro trends among age groups that can help foster workplace harmony. Essentially, it’s a way of attempting to understand people better by getting a sense of their formative life experiences. The generation to which one belongs is among the many factors, such as race, religion and socioeconomic background, that can shape how a person sees the world.

But there’s little doubt that gaps among the U.S. generations have widened dramatically. For example, an 8-year-old boy in the United States who grew up with a tablet will likely have more in common with an 8-year-old in China who used a similar mobile device than he will with his 70-year-old U.S. grandparents.

In thinking about the generations, a key thing to understand is that these groups are typically categorized by events rather than arbitrary dates. Generation Z’s birth years are generally recognized as 1996 to 2009. The start year was chosen so that the cohort would include only those who do not remember the Sept. 11 terrorist attacks. The belief is that if you were born in 1996 or later, you simply cannot process what the world was like before those attacks. For Generation Z, the War on Terror has always been the norm.

Like all other generations, mine has been shaped by the circumstances we were born into, such as terrorism, school shootings and the Great Recession. These dark events have had profound effects on the behavioral traits of the members of Generation Z, but they have also inspired us to change the world.

Earlier this year, XYZ University, a generations research and management consulting firm where I act as the director of Gen Z studies, surveyed more than 1,800 members of Generation Z globally and released a study titled “Ready or Not, Here Comes Z.” The results were fascinating.

We discovered key characteristics about Generation Z and what the arrival of my generation will mean for the future of work. At 57 million strong and representing the most diverse generation in U.S. history, we are just starting to graduate from college and will account for 36 percent of the workforce by 2020.

Needless to say, Generation Z matters. And it is more important than ever for HR professionals to become familiar with the following 10 characteristics so that they know how to engage with my generation.

1. Gen Z Always Knows the Score

Members of this generation will put everything on the line to win. We grew up with sports woven into the fabric of our lives and culture. To us, the NFL truly does own a day of the week. But it’s more than just professional, college or even high school teams that have shaped us; it’s the youth sports that we played or watched throughout our childhoods. This is the generation of elite young teams and the stereotypical baseball mom or dad yelling at the umpire from the bleachers.

Our competitive nature applies to almost everything, from robotics to debates that test mental fortitude. We carry the mindset that we are not necessarily at school just to learn but to get good grades that will secure our place in the best colleges. Generation Z has been thrown into perhaps the most competitive educational environment in history. Right or wrong, we sometimes view someone else’s success as our own failure or their failure as our success.

We are also accustomed to getting immediate feedback. A great example is the online grading portals where we can get frequent updates on our academic performance. In the past, students sometimes had to wait weeks or longer to receive a test grade. Now, we get frustrated if we can’t access our scores within hours of finishing an exam—and sometimes our parents do, too.

2. Gen Z Adopted Gen X’s Skepticism and Individuality

Generations are shaped by the behavioral characteristics of their parents, which is why clumping Millennials and Generation Z together is a mistake. In fact, when it comes to each generation’s behavioral traits, Millennials are most similar to their parents—the Baby Boomers. Both are large, idealistic cohorts with influences that will shape consumer and workplace behavior for decades.

Members of Generation Z, on the other hand, are more akin to their parents from Generation X—a smaller group with a skeptical, individualistic focus—than they are to Millennials. That’s why many generational traits are cyclical. Just because Millennials and members of Generation Z are closer in age does not necessarily mean they share the same belief systems.

3. Gen Z Is Financially Focused

Over the past 15 to 20 years, HR professionals have been hyper-focused on employee engagement and figuring out what makes their workers tick. What drives someone to want to get up in the morning and come to work for your organization?

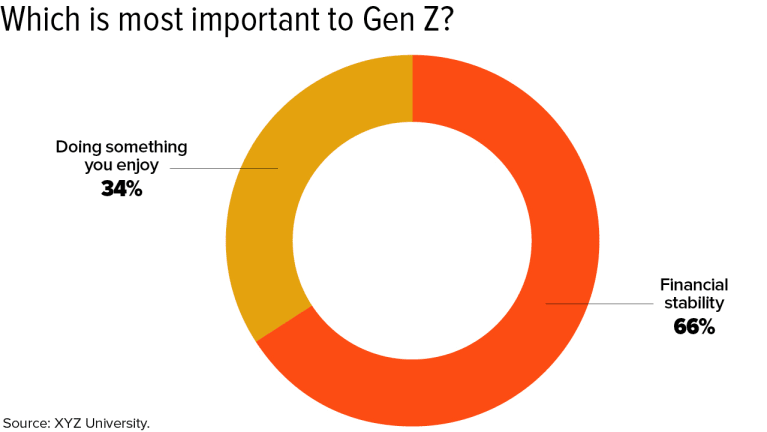

As it turns out, workplace engagement matters less to Generation Z than it did to previous generations. What’s most important to us is compensation and benefits. We are realists and pragmatists who view work primarily as a way to make a living rather than as the main source of meaning and purpose in our lives.

Obviously, we’d prefer to operate in an enjoyable environment, but financial stability takes precedence. XYZ University discovered that 2 in 3 Generation Zers would rather have a job that offers financial stability than one that they enjoy. That’s the opposite of Millennials, who generally prioritize finding a job that is more fulfilling over one that simply pays the bills.

That financial focus likely stems in part from witnessing the struggles our parents faced. According to a study by the Pew Charitable Trust, “Retirement Security Across Generations: Are Americans Prepared for Their Golden Years?,” members of Generation X lost 45 percent of their wealth during the Great Recession of 2008.

“Gen X is the first generation that’s unlikely to exceed the wealth of the group that came before it,” says Erin Currier, former project manager of Pew’s Economic Mobility Project in Washington, D.C. “They have lower financial net worth than previous groups had at this same age, and they lost nearly half of their wealth in the recession.”

Before Generation Z was decreed the ‘official’ name for my generation, there were a few other candidates, including the ‘Selfie Generation’ and ‘iGen.’

Employers will also need to recognize that members of Generation Z crave structure, goals, challenges and a way to measure their progress. After all, the perceived road to success has been mapped out for us our entire lives.

At the same time, it’s important to be aware of the potential for burnout among young overachievers—and to incorporate fun and breaks into the work environment and provide access to healthy escapes focused on relaxation and stress relief.

4. Gen Z Is Entrepreneurial

Even though they witnessed their parents grapple with financial challenges and felt the impact of the worst economic meltdown since the Great Depression, members of Generation Z believe there is a lot of money to be made in today’s economy. Shows like “Shark Tank” have inspired us to look favorably on entrepreneurship, and we’ve also seen how technology can be leveraged to create exciting—and lucrative—business opportunities with relatively low overhead. Fifty-eight percent of the members of my generation want to own a business one day and 14 percent of us already do, according to XYZ University.

Organizations that emphasize Generation Z’s desire for entrepreneurship and allow us space to contribute ideas will see higher engagement because we’ll feel a sense of personal ownership. We are motivated to win and determined to make it happen.

5. Gen Z Is Connected

Before Generation Z was decreed the “official” name for my generation, there were a few other candidates, including the “Selfie Generation” and “iGen.”

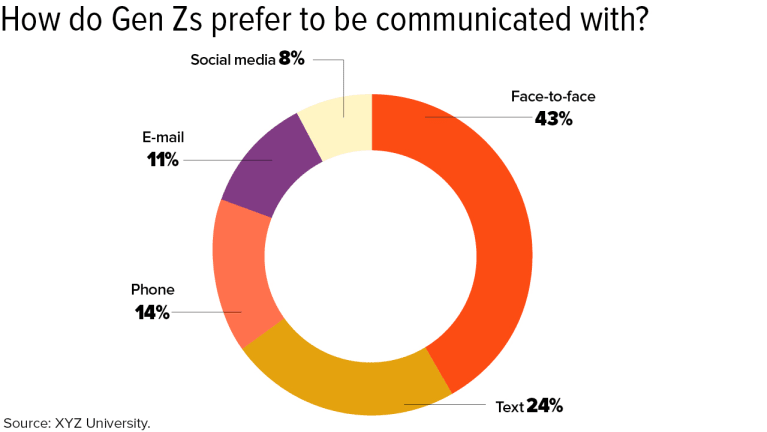

I find those proposed names both condescending and misleading. While it’s often assumed that Generation Z is focused solely on technology, talking face to face is our preferred method of communication. Sure, social media is important and has undoubtedly affected who we are as a generation, but when we’re communicating about something that matters to us, we seek authenticity and honesty, which are best achieved in person.

“Gen Z has the power of technology in their hands, which allows them to communicate faster, more often and with many colleagues at one time; but it also brings a danger when it’s used as a crutch for messages that are better delivered face to face,” says Jill Katz, CHRO at New York City-based Assemble HR. “As humans in the workplace, they will continue to seek empathy, interest and care, which are always best received face to face.”

XYZ University’s research found that cellphones and other electronic devices are primarily used for the purpose of entertainment and are tapped for communication only when the face-to-face option isn’t available.

However, successfully engaging with Generation Z requires striking a balance between conversing directly and engaging online. Both are important, and we need to feel connected in both ways to be fully satisfied.

6. Gen Z Craves Human Interaction

Given that members of Generation Z gravitate toward in-person interactions, HR leaders should re-evaluate how to best put the “human” aspect back into business. For example, hiring processes should emphasize in-person interviews more than online applications.

A great way to engage us is to hold weekly team meetings that gather everyone together to recap their achievements. Although members of Generation Z don’t necessarily need a pat on the back, it’s human nature to want to feel appreciated. This small gesture will give us something to look forward to and keep us feeling optimistic about our work. In addition, we tend to work best up against a deadline—for example, needing to have a project done by the team meeting—due to our experience facing time-sensitive projects at school.

7. Gen Z Prefers to Work Independently

Millennials generally prefer collaborative work environments, which has posed a challenge to conventional workplace cultures and structures. In fact, many workplaces have eliminated offices and lowered cubicle walls to promote more interaction. Yet recent studies indicate that totally open offices may actually discourage people from working together. The noise and lack of privacy could prompt more people to work at home or tune others out with headphones. Since different types of work require varying levels of collaboration, focus and quiet reflection, ideal workplaces incorporate room for both togetherness and alone time.

It’s important to be aware of the potential for burnout among young overachievers—and to incorporate fun and breaks into the work environment and provide access to healthy escapes focused on relaxation and stress relief.

The emphasis on privacy will likely only intensify under Generation Z. Unlike Millennials, we have been raised to have individualistic and competitive natures. For that reason—along with growing research into optimal office design—we may see the trend shift away from collaborative workplaces toward more individualistic and competitive environments.

8. Gen Z Is So Diverse That We Don’t Even Recognize Diversity

Generation Z marks the last generation in U.S. history where a majority of the population is white. Given the shifting demographics of the country, we don’t focus as much on someone’s color, religion or sexual orientation as some of our older counterparts might. To us, a diverse population is simply the norm. What we care about most in other people is honesty, sincerity and—perhaps most important—competence.

Indeed, we have been shaped by a society that celebrates diversity and openness. A black man occupied the White House for most of our lives, and we view gay marriage as a common and accepted aspect of society.

9. Gen Z Embraces Change

Compared to teenagers of other generations, Generation Z ranks as the most informed. We worry about our future and are much less concerned about typical teen problems, such as dating or cliques, than we are about becoming successful in the world.

The chaos and unrest in our political system have inspired us to want to get involved and make a difference. Regardless of which side of the aisle we are on, most of us are informed and passionate about the issues facing our society today. Witness, for example, the students of Marjory Stoneman Douglas High School in Parkland, Fla., who organized a political movement around gun control in the wake of a mass shooting at their school.

Social media allows us to have a voice in our political system even before we can vote. This opportunity has forced us to develop critical-thinking and reasoning skills as we engage in sophisticated debates about important issues that might not even affect us yet.

“Gen Z has a strong ability to adapt to change,” says Paul Carney, an author and speaker on HR trends and a former HR manager with the Navy Federal Credit Union. “For those of us who have spanned many decades in the workplace, we have seen the rate of change increase and it makes most of us uncomfortable. Gen Z are the people who will help all of us adapt better.”

According to numerous polls, the political views of Generation Z trend fiscally conservative (stemming from our need for financial stability) and socially liberal (fueled by diverse demographics and society).

10. Gen Z Wants a Voice

Given how socially aware and concerned its members are, Generation Z seeks jobs that provide opportunities to contribute, create, lead and learn.

“One of the best ways I have seen leaders engage with Gen Z is to ask them how they would build a product or service or design a process,” Carney says. “Gen Z has some amazing abilities to bring together information, process it and take action. When we do allow them to share ideas, great things happen.”

We’re also an exceptionally creative bunch. Managers will need to give members of this generation the time and freedom to come up with innovative ideas and accept that, despite our young age, we have valuable insights and skills to offer—just like the generations that came before us and those that will follow.

The HR tech disconnect: Are there too many digital tools?

According to a new survey of more than 500 HR employees, 87 percent of HR professionals reported that having tools that integrate with existing technology is key. Continue reading this blog post from Employee Benefit Advisor to learn more.

Investing in new technology that combines with current systems looks to be a priority for HR departments.

That’s according to a new survey of more than 500 HR employees from Reward Gateway, which found that 87% of HR professionals say having tools that integrate into their existing technology is key.

That priority is likely due to the fact that HR technology is siloed, the employee engagement technology company found. Many employers use separate platforms for tasks relating to employee communication, recognition, applicant tracking, onboarding and performance management.

More than a fifth of companies use 10 or more different systems and applications at work, and roughly 60% are using more than five systems every day. In addition, HR professionals spent 512 hours a year, nearly two hours a day, manually checking, responding to and keeping up with multiple HR applications, Reward Gateway says.

“Many companies have systems-of-record in place with up-to-date details on their employees,” says Will Tracz, chief technology officer at Reward Gateway. “Creating and maintaining data in other systems, outside of this, often takes time and is prone to error, particularly in fast-moving businesses.”

The new survey echoes similar findings, which indicate that while employers may be increasingly using HR tech, they may not be doing so efficiently. For instance, research from the Association of Executive Search and Leadership Consultants found that HR departments could be dropping the ball when it comes to using HR technology.

Karen Greenbaum, president and CEO of AESC told Employee Benefit News in November that total digital transformation is about more than just implementing new tech in the office.

“It’s not just, ‘Do they understand what artificial intelligence means,’ or what augmented reality means,” she says. “[It’s] ‘Do you really have an organization that can adapt to a new world?’”

Still, HR leaders are turning to tech solutions. Data from global talent acquisition and management firm Randstad Sourceright found that HR departments are going on a tech “buying spree.” The vast majority (92%) of those in the Randstad survey of more than 800 C-suite and HR leaders and 1,700 professionals believe that technology enhances the attraction, engagement and retention of talent.

Reward Gateway received similar responses. HR teams are hoping new tech will not only integrate with existing systems, but also help them achieve their goals, which include higher employee engagement, increased productivity and attracting talent.

This article originally appeared in Employee Benefit News.

SOURCE: Hroncich, C. (29 March 2019) "The HR tech disconnect: Are there too many digital tools?" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/news/hr-tech-disconnect-are-there-too-many-digital-tools?brief=00000152-146e-d1cc-a5fa-7cff8fee0000

7 ways employers can support employee caregivers

Seventy-three percent of employees in the United States act as caregivers for a child, parent or friend, according to research from Harvard Business School. Continue reading for seven ways employers can support employee caregivers.

The number of caregiving adults in the U.S. has reached a tipping point.

As the baby boomer generation gets older, an increasing number of people in the workforce are taking on the role of unpaid caregiver for a family member or friend. Many also are in the midst of raising their own children, which means they’re pulled in many different directions, trying to keep up with work commitments and family responsibilities. In fact, according to researchers at Harvard Business School, 73% of employees in the U.S. are caring for a child, parent or friend.

What do all these statistics point to? They mean that employers have an opportunity to play a role in helping employees balance these often competing priorities.

The Harvard study highlights the impact of employee caregiving responsibilities on the workplace. While only 24% of employers surveyed believed employee caregiving influenced their employees’ performance at work, 80% of the employees who were surveyed admitted that caregiving had an effect on their productivity at work and interfered with their ability to do their best work.

The survey also found that caregiving can affect employee retention, with 32% of the employees surveyed saying they had left a job because of their caregiving responsibilities. In addition, employees who are caregivers are more likely to miss work, arrive late or leave early, which affects not only productivity, but also the employees’ ability to progress in their careers.

Employers can take a proactive role in supporting employees who are caregivers. That support, in turn, can have a positive effect on productivity, morale and employee retention. Here are seven strategies employers should consider.

Create an organization-wide understanding of the challenges caregivers face.

Employees who aren’t sure that their managers and leaders would understand the juggling they’re doing and the stresses they face are more likely to not only have problems at work, but — because they face high stress levels trying to get everything done at home and work — they also are at higher risk for a number of health problems such as depression and heart disease. By creating a culture that allows employees to openly express their challenges and ask for support, employers can not only keep employees healthy and productive, they also can reduce secondary costs associated with decreased productivity and chronic health problems.

Know what challenges employees face.

Regular employee surveys can help employers assess employees’ needs in terms of caregiving and tailor the benefits the organization offers to help meet those needs.

Communicate the benefits that are available.

In many cases, employers already offer programs and benefits that can help employees who are caregivers such as an employee assistance program and referral services for finding caregivers who can help when the employee isn’t able to. However, many employees aren’t aware these programs are available, so it’s important to continuously share information about them in company newsletters, emails and at meetings.

Consider flex time and remote work options.

Depending on the employees’ work responsibilities, employers can offer flexible work arrangements that allow employees to work different hours or to telecommute for a certain number of days per week.

Change the approach to paid time off.

Rather than dividing paid time off into vacation days, sick days and personal days, consider grouping all time off into one category. That allows employees to take time off for caregiving as needed. A growing number of companies, including Adobe, Deloitte, Bristol-Meyers Squibb and Coca-Cola, are also offering paid family leave benefits so that employees can take time off to provide care.

Connect employees with resources.

Beyond an EAP and referral services, employers can offer programs that connect caregivers with resources for both their caregiving role and for the self-care they need to remain healthy and able to handle both job and caregiving roles better. Those resources can include:

Beyond an EAP and referral services, employers can offer programs that connect caregivers with resources for both their caregiving role and for the self-care they need to remain healthy and able to handle both job and caregiving roles better. Those resources can include:

- Advisory services that help employees connect with healthcare providers for their parents, children and themselves

- Nurse managers, case managers and geriatric care managers who can help employees who are managing the care of a family member who’s living with a serious health condition or disability

- Advocates who can help employees who are dealing with complex insurance claims for the person they care for, planning for long-term care, or managing the legal and financial complexities that can arise when a parent or spouse dies

Internal caregiver resources groups that bring together employees who are dealing with the issues surrounding caregiving so that they can share ideas and experiences

Measure how well your support is working.

The first step to supporting caregivers in the workforce is to implement policies, programs and benefits that offer them the tools they need to balance work and caregiving. An equally important second step is to regularly review what is offered, how much the offerings are used, and by which employees. Ask employees for feedback on how effectively what the organization provides is in helping them with issues they face as working caregivers and solicit ideas for new approaches and tools they’d like to have.

SOURCE: Varn, M. (25 March 2019) "7 ways employers can support employee caregivers" (Web Blog Post). Retrieved from https://www.benefitnews.com/list/7-ways-employers-can-support-employee-caregivers

DOL proposes new rule clarifying, updating regular rate of pay

The Department of Labor (DOL) recently released a proposal that defines and updates what forms of payment employers can include and exclude in the time-and-one-half calculation when determining overtime rates. Read this blog post to learn more.

For the first time in 50 years, the Department of Labor has proposed changing the definition of the regular rate of pay.

The proposal, announced Thursday, “defines and updates” what forms of payment employers include and exclude in the time-and-one-half calculation when determining workers’ overtime rates, according to the DOL.

The regulations the DOL is proposing to revise govern how employers must calculate the regular rate and overtime pay rate, including the types of compensation that must be included and may be excluded from the overtime pay calculation, says Tammy McCutchen, a principal at Littler Mendelson and former administrator of the Department of Labor’s Wage and Hour Division.

The regular rate of pay is not just an employee’s hourly rate, she says, but rather includes “all remuneration for employment” — unless specifically excluded by section 7(e) of the FLSA.

Under current rules, employers are discouraged from offering more perks to their employees as it may be unclear whether those perks must be included in the calculation of an employees’ regular rate of pay, the DOL says. The proposed rule focuses primarily on clarifying whether certain kinds of perks, benefits or other miscellaneous items must be included in the regular rate.

The DOL proposes that employers may exclude the following from an employee’s regular rate of pay:

- The cost of providing wellness programs, onsite specialist treatment, gym access and fitness classes and employee discounts on retail goods and services;

- Payments for unused paid leave, including paid sick leave;

- Reimbursed expenses, even if not incurred solely for the employer’s benefit;

- Reimbursed travel expenses that do not exceed the maximum travel reimbursement permitted under the Federal Travel Regulation System regulations and that satisfy other regulatory requirements;

- Discretionary bonuses;

- Benefit plans, including accident, unemployment, and legal services; and

- Tuition programs, such as reimbursement programs or repayment of educational debt.

The proposed rule also includes additional clarification about other forms of compensation, including payment for meal periods and call back pay.

The regulations will benefit employees, primarily, ensuring that employers can continue to provide benefits that employees’ value — tuition reimbursements, student loan repayment, employee discounts, payout of unused paid leave and gym memberships, McCutchen says.

“Remember, there is no law that employers must provide employees these types of benefits,” she adds. “Employers will not provide such benefits if doing so creates risk of massive overtime liability.”

Knowing when employers must pay overtime on these types of benefits, how to calculate the value of those benefits and overtime pay are all difficult questions, she adds. “Unintentional mistakes by good faith employers providing valued benefits to employees is easy. With this proposed rule, the DOL is embracing the philosophy that good deeds should not be punished.”

She notes the proposal does not include any specific examples of what reimbursements may be excluded from the regular rate.

“One big open question is whether employers must pay overtime when they provide employees with subsidies to take public transportation to work — as the federal government does for many of its own employees — I think around $260 per month in the DC Metro area,” she adds.

The DOL earlier this month proposed to increase the salary threshold for overtime eligibility to $35,308 up from the current $23,660. If finalized, the rule would expand overtime eligibility to more than a million additional U.S. workers, far fewer than an Obama administration rule that was struck down by a federal judge in 2017.

Employers are expected to challenge the new rule as well, based on similar complaints of administrative burdens, but a legal challenge might be more difficult to pass this time around.

SOURCE: Otto, N. (28 March 2019) "DOL proposes new rule clarifying, updating regular rate of pay" (Web Blog Post). Retrieved from https://www.benefitnews.com/news/dol-proposes-new-rule-on-regular-rate-of-pay-calculation?brief=00000152-14a5-d1cc-a5fa-7cff48fe0001

A guide to managing employee website usage

With remote workers, employers need to be mindful of the types of websites their employees are accessing on company-issued technology. Continue reading for key considerations and best practices to review when properly managing employee website usage.

Whether employees are working from home, the coffee shop or the office, employers need to be mindful of the types of websites workers are accessing on their company-issued technology.

New accessibility creates greater flexibility, but employers need to be vigilant to ensure workers maintain the expectation of productivity and workplace privacy. Now more than ever, the workplace heavily relies on technology and companies must understand how to manage it to avoid risk.

Nowhere is the tension between technology and privacy rights more prevalent than in today’s workplace. At the forefront of this discussion is whether employers should block access to certain websites on company-issued technology. Here are key considerations and best practices to review when properly managing employee website usage.

Creating boundaries between work and personal affairs, without invading privacy. Employees typically emphasize that their private affairs should not be accessed by their employer. But the federal Electronic Communications Privacy Act (ECPA) states an employer-provided computer system is the property of the employer, so when an employee visits certain websites during typical office hours using company-issued technology, what is accessed by the employee becomes the employer’s business as well.

There is no denying that placing blocks on certain websites is an effective way to separate work and personal matters, maintain professionalism, protect the company’s security, respect company property and utilize work time appropriately. However, employers should beware of potential legality issues regarding privacy. For example, employees are given some protection from computer and other forms of electronic monitoring under certain circumstances.

Productivity distractions. Blocking certain websites will not prevent an employee from utilizing company time for personal reasons, but doing so reminds employees to have integrity, focus and discipline when it comes to using technology in the workplace. Some employees will use company-issued technology to visit a plethora of websites such as social media platforms, personal email accounts, instant messengers, financial institutions, sports, entertainment and music sites, as well as inappropriate websites. It is easy to become distracted with an overabundance of virtual activity at our fingertips, and blocking sites sends a serious message to workers that business technology and time is for business-purposes only.

Security of confidential company data and information. In today’s interconnected world, employers recognize the importance of protecting confidential company information. Employers often choose to block certain websites because of the risk of a security breach. Employers are concerned with the exposure of any release of its data, work products, ideas and information not otherwise disclosed to the public or its competitors. Blocking certain websites gives an organization an opportunity to decrease the risk of its confidential information being accessed by external influences.

What employers can do to be more transparent with staff

There are no foolproof methods to preventing an employee from using their work time for personal reasons or inadvertently exposing the company to security breaches.

Employees can still access many websites of their choosing through their personal technology. However, the aforementioned reasons are convincing enough for employees to take more accountability in using company-issued technology for business purposes only. An employer that endorses a policy and practice of business technology for business reasons sets a clear expectation for employees to remember and follow.

- Enforce a written policy that sets clear expectations for in-house and remote employees about not using company-issued technology to visit certain websites and explain the reason for such policies. Policies and procedures should be well-defined, widely communicated and reviewed at least annually.

- Inform new employees that certain websites are not accessible via company technology. Highlight the written policy for both new and existing employees. Again, explain the reason for this policy.

- Offer training and other educational opportunities that motivate productivity during times when work focus suffers.

- Work with the company’s internal IT department to ensure that websites are properly blocked.

Usually, when employers remain transparent with staff regarding why a policy exists, employees are more receptive. In general, employers are encouraged to consult with an experienced HR professional or employment lawyer to avoid any potential legality pitfalls in the workplace.

SOURCE: Banks, S. (11 March 2019) "A guide to managing employee website usage" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/a-guide-to-managing-employee-website-usage?brief=00000152-14a5-d1cc-a5fa-7cff48fe0001

What HR pros should know about clinical guidelines

Sets of science-based recommendations, also known as clinical guidelines, are designed to optimize patient care in areas such as screening and testing, diagnosis and treatment. Read this blog post for what HR professionals should know about these guidelines.

Your employees and their family members frequently face tough questions about their healthcare: How do I know when it’s time to get a mammogram? When does my child need a vision screening? Should I get a thyroid screening? If I have high blood pressure or diabetes, what is the best treatment for me?

For the providers who care for them, the key question is: How do we implement appropriate, science-backed treatments for our patients, testing where needed, but avoiding potentially harmful or unnecessary (and expensive) care? The answer is to seek guidance from and use clinical guidelines —along with existing clinical skills — wisely.

Clinical guidelines are sets of science-based recommendations, designed to optimize care for patients in areas such as screening and testing, diagnosis and treatment. They are developed after a critical review by experts of current scientific data and additional evidence to help inform clinical decisions across a spectrum of specialties.

Based upon this process, guidelines are then released by a number of sources and collaborations, including academic and non-profit healthcare entities, government organizations and medical specialty organizations.

From preventive care to treatment protocols for chronic conditions, guidelines provide a framework healthcare providers use with patients to help guide care. However, it’s important to note that clinical guidelines are not rigid substitutes for professional judgment, and not all patient care can be encompassed within guidelines.

The impact on healthcare and benefits

Clinical guidelines are used in myriad ways across the healthcare spectrum, and providers are not the only ones who utilize them. Insurers also may use guidelines to develop coverage policies for specific procedures, services and treatment, which can affect the care your covered population receives.

To illustrate a key example of an intended impact of guidelines on health plan coverage, consider those issued by the U.S. Preventive Services Task Force, whose A and B level recommendations comprise the preventive services now covered at no cost under the mandate of the Affordable Care Act.

As another example, the National Committee for Quality Assurance, which accredits health plans and improves the quality of care through its evidence-based measures, uses the American Heart Association guidelines when creating its quality rules for treating high cholesterol with statin drugs.

Other examples exist among commercial coverage policies. For example, some cancer drug reimbursement policies use components from nationally recognized guidelines for cancer care.

Because science is rapidly changing, guidelines are often updated, leading insurers to revisit their policies to decide if they will change how services and medications are covered for their members. Providers and health systems may modify processes of patient care in response to major changes in guidelines and/or resultant changes in payer reimbursement.

Not all guidelines are updated on a set schedule, making it even more important for providers and organizations that rely on guidelines to stay on top of changing information, as it can have a direct impact on how they work. Attending conferences, visiting the recently established ECRI Guidelines Trust, and regularly reviewing relevant professional association websites and journals can help ensure needed guidelines are current. Lack of current information can affect care decisions and potential outcomes for patients. Those who have access to the most up-to-date, evidence-based information are able to work together to make well-informed healthcare decisions.

Why it matters for employers

As employers or benefits consultants, it’s critical to ensure that your health plan, advocacy or decision support providers, and other partners that depend on this information to guide their practices and decisions understand and follow current, relevant guidelines.

Further, by combining information from relevant guidelines and data from biometric screenings, health risk assessments, claims and other sources, it’s possible for clinical advocacy and other decision support providers to identify employees with gaps in care and generate targeted communications (through a member website and/or mobile app) to help them take action to improve their health.

Clinical guidelines are science distilled into practical recommendations meant to be applied to most patients for quality healthcare. By maintaining current, relevant guidelines, organizations and providers who work with your covered population can ensure that all parties have the key information they need to make the best decisions for their health.

SOURCE: Sivalingam, J. (18 March 2019) "What HR pros should know about clinical guidelines" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/what-hr-managers-should-know-about-clinical-guidelines?feed=00000152-a2fb-d118-ab57-b3ff6e310000

To check or not to check: Managing blood sugar in diabetic employees

There's been a growing prevalence of Type 2 diabetes in the U.S. over the last 20 years. This chronic condition significantly impacts employees, their family members and even employers clinically and financially. Read this blog post to learn more.

Over the last 20 years, there’s been a growing prevalence in the U.S. of Type 2 diabetes, a chronic condition that significantly impacts employers, their employees and family members clinically, financially and through quality of life. With that comes an increase in the use of insulin for people with Type 2 diabetes to better control blood sugar to reduce long-term complications, which includes eye, kidney and cardiac disease, as well as neuropathic complications.

Most of these patients manage their condition with oral medicines versus insulin, and it’s estimated that 75% of patients with Type 2 diabetes regularly test their blood sugar, even though doing so may not be needed. Blood sugar testing is an important tool in managing diabetes as it can help a patient be more aware of their disease and potentially control it better. But it also can be painful, inconvenient and costly.

Blood sugar testing can be an important tool in managing diabetes, and there are two types of tests. The first is a test conducted at home by the patient that shows the blood sugar at a specific point in time. The second type is called HA1c (a measure of long-term blood sugar control) that shows the average blood sugar over the last two to three months. The value of at-home testing is now thought to be questionable.

In 2012, the Patient-Centered Outcomes Research Institute began a study to evaluate the value of daily blood sugar testing for people with Type 2 diabetes not taking insulin. The endpoint for the study was whether there was a difference in HA1c levels for those who did daily testing and those that did not. The conclusion of the study found that there were no significant differences between those two populations.

In response to these findings, the institute developed an initiative called Rethink the Strip that involves stakeholders including primary care practices, healthcare providers, patients, health plans, coalitions and employers. Given the cost for test strips and monitors for patients with Type 2 diabetes who test their blood sugar daily, it’s important to adopt an evidence-based patient-centered approach around the need for and frequency of self-monitoring of blood glucose.

As employees and employers cope with the costs associated with blood sugar testing, there are several strategies that should be considered to better manage this issue. They include:

1. Support shared decision-making. Like all interventions within healthcare, it’s important to weigh both the benefits and the risks of daily blood sugar testing in a thoughtful manner between the patient and their provider.

2. Managed benefit design. Employers should pay for daily blood sugar test strips in cases where it brings value (e.g., Type 1 and Type 2 patients who are taking insulin as well as patients that are either newly diagnosed or are going through a transition period, for example, post hospitalization or beginning a new medication regimen).

3. Involve vendors. To ensure alignment in all messaging to plan members, ask health systems and/or health plans and third-party vendors to align their communication, measurement and provider feedback strategies on when it’s appropriate for daily blood sugar testing.

These strategies can help employees with diabetes understand how their daily activities (nutrition, exercise and stress) and medications impact their condition. This benefits the employee in reaching treatment goals and feeling their best, while also helping employers and employees reduce the need for unnecessary and costly test strips.

This article originally appeared in Employee Benefit News.

SOURCE: Berger, J. (14 March 2019) "To check or not to check: Managing blood sugar in diabetic employees" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/opinion/managing-blood-sugar-in-diabetic-employees?brief=00000152-146e-d1cc-a5fa-7cff8fee0000

Do paycheck advance apps improve financial health?

Do you allow your employees access to draw money from their paycheck before payday? Many apps now let workers have early access to their money. Read this blog post to find out more about paycheck advance apps and how these may improve financial health.

Fintechs that let workers draw money from their paycheck before payday through an app are having a moment.

Such apps, including Even.com, PayActiv, EarnIn, DailyPay and FlexWage, are designed for consumers who live paycheck to paycheck — roughly 78% of the U.S. workforce according to one study.

More than 300,000 Walmart employees, for example, use this feature, called Instapay, provided by Even and PayActiv. PayActiv, which is available to 2 million people, announced a deal with Visa on Thursday that will let people put their pay advances on a feeless prepaid Visa card.

Earnin, which lets consumers retrieve up to $100 a day from upcoming paychecks, received $125 million in Series C funding from DST Global, Andreessen Horowitz, Spark Capital, Matrix Partners, March Capital Partners, Coatue Management and Ribbit Capital in December. The Earnin app has been downloaded more than a million times.

In theory, such apps are useful to those who run into timing problems due to large bills, like mortgage and rent, which come due a few days before their paycheck clears. Getting a payday advance from an employer through an app can be less expensive and less problematic than taking out a payday loan or paying overdraft fees.

But do these programs lead to financial health? Or are they a temporary Band-Aid or worse, something on which cash-strapped people can become overdependent?

Volatile incomes, gig economy jobs

One thing is clear — many working poor are living paycheck to paycheck. Pay levels have not kept up with the cost of living, even adjusted for government subsidy programs, said Todd Baker, senior fellow at the Richman Center for Business, Law and Public Policy at Columbia University.

“That’s particularly evident when you think of things like home prices and rental costs. A large portion of the population is living on the edge financially,” he said. “You see it in folks making $40,000 a year, teachers and others who are living in a world where they can’t handle any significant bump in their financial life."

A bump might be an unexpected expense like medical treatment or a change in income level, for instance by companies shifting to a bonus program. And about 75 million Americans work hourly, with unstable pay.

“Over the last several decades, we’ve changed the equation for many workers,” said John Thompson, chief program officer at the Center for Financial Services Innovation. “It’s harder to have predictable scheduling or even income flow from your job or jobs. But we haven’t changed the way we pay, nor have we changed the way bills are paid. Those are still due every month on a certain date. This income volatility problem that many people experience hasn’t been offset by giving the employee control of when they do have access to these funds.”

Where on-demand pay comes in

Safwan Shah, PayActiv's CEO, says he has been working on the problems for consumers like this for 11 years. The way he sees it, there are three possible ways to help: by paying these workers more, by changing their taxes, or by changing the timing of when they’re paid.

The first two seem out of reach. “I can’t give more money to people; that’s not what a Fintech guy does,” Shah said. “I can’t invent money. And I can’t change the tax laws.”

But he felt he could change the timing of pay.

“I can go to employers and say, your employees are living paycheck to paycheck,” Shah said. “They’re bringing that stress to work every day. And you are suffering too, because they are distracted — a Mercer study shows employers lose 15 hours a month in work from these distracted employees.”

Shah persuades employers to let their employees access a portion of the wages they have already earned. His early wins were at companies whose employees frequently request paycheck advances, which generates a lot of paperwork. Employees can access no more than 50% of what they have already earned — a worker who has earned $300 so far in a month could at most get $150.

Employees pay $5 for each two-week period in which they use PayActiv. (About 25% of the time, the employer pays this fee, Shah said.)

PayActiv also gives users unlimited free bill pay and use of a Visa prepaid card. In July, PayActiv became part of the ADP marketplace, so companies that use ADP can use its service.

PayActiv's largest employer is Walmart, which started offering it via the Even app in December 2017. In October, Walmart began allowing employees to pick up cash through the app in Walmart stores, so users who were unbanked could avoid ATM fees.

Shah said the service helps employers reduce employee turnover, improve retention and recruit employees who prefer real-time pay. He also has a guilt pitch.

“I was first in the market to this, in 2013,” Shah said. “People looked at me and said, ‘What? I’m not going to pay my employees in advance. Let them go to a payday lender.’ Then I’d show them pictures of their offices surrounded by payday loan shops. I’d say, ‘They’re here because of you.’ ”

Does early access to wages lead to financial health?

When Todd Baker was a Harvard University fellow last year, he studied the financial impact of PayActiv’s earned wage access program. He compared PayActiv’s $5 fee to payday loans and bank overdraft fees.

Baker found that a $200 salary advance from PayActiv is 16.7% of the cost of a payday loan. Payday lenders typically charge $15 per $100 borrowed, so $30 for a two-week, $200 loan. If the borrower can’t pay back the amount borrowed in two weeks, the loan gets rolled over at the original amount plus the 15% interest, so the loan amount gets compounded over time.

With PayActiv, "there is always a full repayment and then a delay before there is enough income in the employee’s payroll account for another advance," Baker said. "It never rolls over.”

Baker also calculated that the PayActiv fee was only 14.3%, or one-seventh, of the typical $35 overdraft fee banks charge.

So for people who are struggling to manage the costs of short-term timing problems and unexpected expenses, Fintech tools like PayActiv’s are a lot cheaper than alternatives, Baker said.

“Does it create extra income? No. What it does is help you with timing issues,” he said.

Aaron Klein, a fellow at the Brookings Institution, said workers should have access to money they’ve already earned, whether that’s through real-time payments or through apps that provide pay advances.

“I also am on board with the idea that by saving your $35 overdraft and saving your payday loan rate, you’ll be better off,” Klein said.

But he’s not willing to say these tools solve the problems of low-income people.

“If the core problem is I used to make $35,000 a year, now I make $30,000, and because of that shock I’m going to end up accruing $600 of payday loan and overdraft fees, eliminating that $600 makes you a lot better off,” Klein said. “But it doesn’t negate the overall income shock.”

Thompson at CFSI says it’s too soon to tell whether earned wage access brings about financial well-being.

“We’re just beginning to explore the potential for these tools,” he said. “Right now they feel very promising. They could give people the ability to act quickly in an emergency and have access to and use funds in lieu of a payday loan or some other high-cost credit or consequence they would rather avoid, like an overdraft fee.”

What could go wrong

Thompson also sees a potential downside to giving employees payday advances.

“The every-other-week paycheck is one of the few normal structures we have for people around planning, budgeting and managing their money,” he said.

Without that structure, which is a form of savings, “we’re going to have to work hard to make sure we don’t just turn people loose on their own with even less structure or guidance or advice on their financial life.”

Another common concern about payday advance tools is that if you give people access to their money ahead of time, they’ll just spend it, and then when their paycheck arrives, they will come up short.

But Klein, for one, doesn’t see this as an issue.

“I trust people more to manage their money,” he said. “The people who work paycheck to paycheck spend more time budgeting and planning than the wealthy, because it’s a necessity.”

A related fear is that people could become addicted to payday advance tools, and dig themselves into a deeper hole.

Jon Schlossberg, CEO of Even.com, somewhat surprisingly acknowledges this could happen.

“Getting access to your pay on demand is a tool you can use the right way or the wrong way,” he said. “If you offer only on-demand pay, that could cause the problem to get worse, because getting access to that money all the time triggers dopamine; it makes you want to do it more and more. If you are struggling with a very low margin and you’re constantly up against it, getting more money all the time accelerates that problem."

Quantitative and qualitative analyses have borne this out, he said.

Even has granted users $700 million worth of Instapays; they typically use Instapay 1.4 times a month. Schlossberg doesn't see high use of the feature as success.

“You shouldn’t need to be using Instapay,” he said. “You should be becoming financially stable so you don’t have to.”

Baker said addiction to payday advances isn't a danger because they don't roll over the way payday loans do. With a salary advance, “It’s conceivable you could get $200 behind permanently, but it’s not a growing obligation and it’s not damaging,” he said.

Shah at PayActiv said users tend to withdraw less than they're allowed to — about 75%.

“When it comes to usage of their own salary, instead of asking for more, people behaviorally ask for less,” he said.

They see PayActiv more as a headache reliever like Tylenol, rather than an addictive candy or drug, Shah said.

Pay advances are just one of many tools that can help the working poor. They also need help understanding their finances and saving for goals like an emergency fund and retirement.

“This conversation about on-demand pay is a double-edged sword because people are paying attention to it now, which is good, but they’re viewing it as this magic tool to solve all problems,” Schlossberg said. “It isn’t that. It is a piece of the puzzle that solves a liquidity problem. But it is by no means going to help people turn their financial lives around.”

SOURCE: Crosman, P. (14 March 2019) "Do paycheck advance apps improve financial health?" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/news/do-paycheck-advance-apps-improve-financial-health?brief=00000152-146e-d1cc-a5fa-7cff8fee0000

Editor at Large Penny Crosman welcomes feedback at penny.crosman@sourcemedia.com.

This article originally appeared in American Banker.

Goodbye, suits and ties. Hello, sneakers

As the workplace evolves, one thing many managers have in common is that they are throwing out their traditional business dress code. Continue reading this blog post from Employee Benefit News to learn more.

Casual Friday? Try casual Monday through Friday.

As the modern U.S. workplace evolves, one thing many office managers have in common is that they are throwing the traditional business dress code out the window.

About 88% of employers today offer some type of casual dress benefit, up from 81% five years ago, according to the 2018 employee benefits survey from the Society for Human Resource Management.

The most recent company to join the ranks of the suit-and-tie-less workplace is banking giant Goldman Sachs. The decision — once believed unthinkable for such a straight-laced organization — comes as the company looks to keep up with “changing nature of workplaces,” according to a Goldman memo last week.

“Casual dress attire at work is just one of the many ways employers are trying to retain and attract top talent in this competitive job market,” says Amelia Green-Vamos, an employer trends analyst with Glassdoor. “The unemployment rate is at a historic low, and casual dress attire is an inexpensive perk creating a more approachable and comfortable culture for new and existing employees.”

All employers want to attract the best possible talent and in today’s job market that talent is younger. Indeed, more than 75% of Goldman Sachs’ employees are members of the millennial or Gen Z generations. When it comes to hiring younger talent the more traditional companies — such as big banks — are competing against tech giants and hedge funds that are offering a different kind of workplace.

Facebook, for example, has had a relaxed dress code since the beginning. “We don’t want our people to have a work self and a personal self,” says Facebook spokesman Kyle Gerstenschlager. “That aspect of our culture extends to our lack of a formal dress code.”

Google is another company with a simple dress policy. “You must wear clothes,” was the response Susan Wojcicki — current CEO of YouTube — gave in a 2007 interview with Bay area media outlet The Mercury News. She was VP of ad services at Google at the time.

But, it’s not just the Silicon Valley tech companies that have embraced a more laid back attire policy. When Mary Barra — current CEO of General Motors — was vice president of global human resources at the automaker, she set out to replace the company’s 10-page dress code exposition with two words: “Dress appropriately.”

It’s a simple idea, but Barra was perplexed when she received pushback from HR and one of her senior-level directors, she explained at the 2018 Wharton People Analytics Conference. But this actually led to what Barra called an “ah-ha” moment, giving her better insight into the company and teaching her a lesson about making sure managers feel empowered.

Office culture has been evolving for decades, with offices with sleep pods and ping-pong tables now commonplace. But it’s practicality rather than entitlement that is leading offices to adapt their dress codes.

“I have a hard time imagining a position where wearing a tie could be considered an essential part of the job’s responsibilities,” says SHRM member Mark Marsen, director of human resources at Allies for Health + Wellbeing. “Even using arguments that it contributes to or enhances corporate image, client perceptions, or establishing a form of respect. What matters at the end of all, for everyone concerned, is that a successful service was rendered.”

SOURCE: Shiavo, A. (12 March 2019) "Goodbye, suits and ties. Hello, sneakers" (Web Blog Post). Retrieved from https://www.benefitnews.com/news/goldman-sachs-embraces-casual-dress

Pay transparency: A new tool to boost employee engagement

Some companies require new hires to sign an agreement promising not to disclose their pay to co-workers. Continue reading this blog post to learn more about pay transparency.

For many companies, discussing salaries has always been taboo. Some firms even required new hires to sign an agreement swearing they wouldn’t disclose their pay to co-workers.

This “loose lips sink ships” approach is largely illegal, of course: Employees are generally free to talk about pay rates as part of their rights under the National Labor Relations Act.

Nonetheless, for years, companies held salary information very close to the vest.

But times are changing. Many firms have now gone to a policy of transparency in matters of compensation.

2 separate approaches

Stephanie Thomas, program director of the Institute for Compensation Studies at Cornell University, writes that pay transparency comes in two flavors: salary disclosure and pay process transparency.

1. Salary disclosure: In this approach, the company distributes a spreadsheet listing employees, their titles and their salaries.

This approach can be tricky. There are always going to be cases where an employee asks, “Why is Stephanie paid more than me? We have the same title and the same duties.”

Whole Foods explains the rationale for adopting its policy in a statement on its website:

“Salary information for all –including the company’s leadership – is available to all inquiring team members. Wage transparency helps promote inclusiveness and ensures our compensation system is fair.”

2. Pay process transparency: The second approach explores how compensation decisions are made, and explains to individuals why they’re making what they are and what they need to do to earn more.

This involves having detailed discussions with employees, either individually or in a group, about the overall compensation plan – salary ranges and midpoints, goals and objectives that need to be met, performance metrics, etc. Most companies prefer this approach because it focuses the conversation away from rankings of employees toward individual performance.

Both approaches signal a new trend in employee engagement – helping workers understand the inner workings of their organizations.

SOURCE: Mucha, R. (15 February 2019) "Pay transparency: A new tool to boost employee engagement" (Web Blog Post). Retrieved from https://www.hrmorning.com/pay-transparency-a-new-tool-to-boost-employee-engagement/