Pressure Builds To Cut Medicare Patients In On Prescription Deals

In this article from Kaiser Health News, the stupendous rise of prescription costs is finally addressed. What steps are being taken to reduce costs for Medicare patients? Find out below.

Medicare enrollees, who have watched their out-of-pocket spending on prescription drugs climb in recent years, might be in for a break.

Federal officials are exploring how beneficiaries could get a share of certain behind-the-scenes fees and discounts negotiated by insurers and pharmacy benefit managers, or PBMs, who together administer Medicare’s Part D drug program. Supporters say this could help enrollees by reducing the price tag of their prescription drugs and slow their approach to the coverage gap in the Part D program.

The Centers for Medicare & Medicaid Services (CMS) could disclose the fees to the public and apply them to what enrollees pay for their drugs. However, there’s no guarantee that such an approach would be included in a proposed rule change that could land any day, according to several experts familiar with the discussions.

“It’s obvious something has to be done about this. This is causing higher drug prices for patients and taxpayers,” Rep. Earl “Buddy” Carter (R-Ga.), a pharmacist, said this week.

While Medicare itself cannot negotiate drug prices, the health insurers and PBMs have long been able to negotiate with manufacturers who are willing to pay rebates and other discounts so their products win a good spot on a health plan’s list of approved drugs.

Federal officials described these fees in a January fact sheet as direct and indirect remuneration, or DIR fees.

In recent years, pharmacies and specialty pharmacies have also begun paying fees to PBMs. These fees, which are different than the rebates and discounts offered by manufacturers, can be controversial, in part, because they are retroactive or “clawed back” from the pharmacies.

The controversy is also part of the reason advocates, such as pharmacy organizations, have lobbied for this kind of policy change.

PBMs have long contended that they help contain costs and are improving drug availability rather than driving up prices.

Pressure has been building for the administration to take action. Earlier this year, the federal agency’s fact sheet set the stage for change, describing how the fees kept Medicare Part D monthly premiums lower but translated to higher out-of-pocket spending by enrollees and increased costs to the program overall.

In early October, Carter led a group of more than 50 House members in a letter urging Medicare to dedicate a share of the fees to reducing the price paid by Part D beneficiaries when they buy a drug. Also in the House, Rep. Morgan Griffith (R-Va.) introduced a related bill.

On the Senate side, Chuck Grassley (R-Iowa) and 10 other senators sent a letter in July to CMS Administrator Seema Verma as well as officials at the Department of Health and Human Services asking for more transparency in the fees — which could lead to a drop in soaring drug prices if patients get a share of the action.

A response from Verma last month notes that the agency is analyzing how altering DIR requirements would affect Part D beneficiary premiums — a key point that muted previous political conversations.

But advocates say the tone of discussions with the agency and on Capitol Hill have changed this year. That’s partly because Medicare beneficiaries have become more vocal about their rising out-of-pocket costs, increasing scrutiny of these fees.

Ellen Miller, a 70-year-old Medicare enrollee in New York City’s borough of Queens, sent a letter to the Trump administration demanding lower drug prices. Miller’s prescription prices went up this year, sending her into the Medicare “doughnut hole” by April, compared with October in 2016. With coverage, Miller pays about $200 a month for several prescriptions that help her cope with COPD, or chronic obstructive pulmonary disease, as well as another chronic illness.

In the doughnut hole, where coverage drops until catastrophic coverage kicks in, her out-of-pocket costs climb to $600 a month.

It’s “ridiculous, and that doesn’t count my medical bills,” Miller said.

The number of Medicare Part D enrollees with high out-of-pocket costs, like Miller, is on the rise. And in 2015, 3.6 million Medicare Part D enrollees had drug spending above the program’s catastrophic threshold of $7,062, according to a report released this week by the Kaiser Family Foundation. (Kaiser Health News is an editorially independent program of the foundation.)

Supporters of the rule change say making the fees more transparent and applying them to what enrollees pay would provide relief for beneficiaries like Miller.

The Pharmaceutical Care Management Association (PCMA), which represents the PBMs who negotiate the rebates and discounts, says changing the fees would endanger the Part D program.

“In Medicare Part D, you have one of the most successful programs in health care,” said Mark Merritt, president and chief executive of PCMA. “Why anybody would choose to destabilize the program is beyond me.”

CMS declined to comment on a vague reference to a pending rule change, which was posted in September.

For now, though, according to the CMS fact sheet, the fees pose two compounding problems for seniors and the agency:

- Enrollees pay more out-of-pocket for each drug, causing them to reach the program’s coverage gap quicker. In 2018, the so-called doughnut hole begins once an enrollee and the plan spends $3,750 and ends at $5,000 out-of-pocket, and then catastrophic coverage begins.

- Medicare, thus taxpayers, pays more for each beneficiary. Once enrollees reach the threshold for catastrophic coverage, Medicare pays the bulk cost of the drugs.

CVS Health, one of the nation’s top three PBMs, released a statement in February calling the fees part of a pay-for-performance program that helps improve patient care. The fees, CVS noted, are fully disclosed and help drive down how much Medicare pays plans that help run the program.

“CVS Health is not profiting from this program,” the company noted.

Express Scripts, also among the nation’s top three PBMs, agreed that the fees lower costs and give incentives for the pharmacies to deliver quality care. As for criticism from the pharmacies, Jennifer Luddy, director of corporate communications for the company, said, “We’re not administering fees in a way that penalizes a pharmacy over something they cannot control.”

Regardless, even if a rule is changed or a law is passed, there is some question as to how easily the fees can translate into lower costs for seniors, in part because the negotiations are so complicated.

When the Medicare Payment Advisory Commission, which provides guidance to Congress, discussed the negotiations in September, Commissioner Jack Hoadley thanked the presenters and said, “In my eyes, what you’ve revealed is a real maze of financial … entanglements.”

Tara O’Neill Hayes, deputy director of health care policy at the conservative American Action Forum, said passing on the discounts and fees to beneficiaries when they buy the drug could be difficult because costs crystallize only after a sale has occurred.

“They can’t be known,” said Hayes, who created an illustration of the negotiations.

“There’s money flowing many different ways between many different stakeholders,” Hayes said.

Source:

Tribble S. (10 November 2017). "Pressure Builds To Cut Medicare Patients In On Prescription Deals" [Web blog post]. Retrieved from address https://khn.org/news/pressure-builds-to-cut-medicare-patients-in-on-prescription-deals/

Despite Boost In Social Security, Rising Medicare Part B Costs Leave Seniors In Bind

How are the rising costs of Medicare Part B affecting Seniors? Don't be left in the dark. Find out more in this article.

Millions of seniors will soon be notified that Medicare premiums for physicians’ services are rising and likely to consume most of the cost-of-living adjustment they’ll receive next year from Social Security.

Higher 2018 premiums for Medicare Part B will hit older adults who’ve been shielded from significant cost increases for several years, including large numbers of low-income individuals who struggle to make ends meet.

“In effect, this means that increases in Social Security benefits will be minimal, for a third year, for many people, putting them in a bind,” said Mary Johnson, Social Security and Medicare policy consultant at the Senior Citizens League. In a new study, her organization estimates that seniors have lost one-third of their buying power since 2000 as Social Security cost-of-living adjustments have flattened and health care and housing costs have soared.

Another, much smaller group of high-income older adults will also face higher Medicare Part B premiums next year because of changes enacted in 2015 federal legislation.

Here’s a look at what’s going on and who’s affected:

The Basics

Medicare Part B is insurance that covers physicians’ services, outpatient care in hospitals and other settings, durable medical equipment such as wheelchairs or oxygen machines, laboratory tests, and some home health care services, among other items. Coverage is optional, but 91 percent of Medicare enrollees — including millions of people with serious disabilities — sign up for the program. (Those who don’t sign up are responsible for charges for these services on their own.)

Premiums, which change annually, represent about 25 percent of Medicare Part B’s expected per-beneficiary program spending. The government pays the remainder.

In fiscal 2017, federal spending for Medicare Part B came to $193 billion. From 2017 to 2024, Part B premiums are projected to rise an average 5.4 percent each year, faster than other parts of Medicare.

‘Hold Harmless’ Provisions

To protect seniors living on fixed incomes, a “hold harmless” provision in federal law prohibits Medicare from raising Part B premiums if doing so would end up reducing an individual’s Social Security benefits.

This provision applies to about 70 percent of people enrolled in Part B. Included are seniors who’ve been enrolled in Medicare for most of the past year and whose Part B premiums are automatically deducted from their Social Security checks.

Excluded are seniors who are newly enrolled in Medicare or those dually enrolled in Medicaid or enrolled in Medicare Savings Programs. (Under this circumstance, Medicaid, a joint federal-state program, pays Part B premiums.) Also excluded are older adults with high incomes who pay more for Part B because of Income-Related Monthly Adjustments (see more on this below).

Recent Experience

Since there was no cost-of-living adjustment for Social Security in 2016, Part B monthly premiums didn’t go up that year for seniors covered by hold harmless provisions. Instead, premiums for this group remained flat at $104.90 — where they’ve been for the previous three years.

Last year, Social Security gave recipients a tiny 0.3 percent cost-of-living increase. As a result, average 2017 Part B month premiums rose slightly, to $109, for seniors in the hold harmless group. The 2017 monthly premium average, paid by those who weren’t in this group and who therefore pay full freight, was $134.

Current Situation

Social Security is due to announce cost-of-living adjustments for 2018 in mid-October. Based on the best information available, it appears to be considering an adjustment of about 2.2 percent, according to Juliette Cubanski, associate director of the program on Medicare policy at the Kaiser Family Foundation. (Kaiser Health News is another, independent program of the Kaiser Family Foundation.)

Apply a 2.2 percent adjustment to the average $1,360 monthly check received by Social Security recipients and they’d get an extra $29.92 in monthly payments.

For their part, the board of trustees of Medicare have indicated that Part B monthly premiums are likely to remain stable at about $134 a month next year. (Actual premium amounts should be disclosed by the Centers for Medicare & Medicaid Services within the next four to six weeks.)

Medicare has the right to impose that charge, so long as the amount that seniors receive from Social Security isn’t reduced in the process. So, the program is expected to ask older adults who paid $109 this year to pay $134 for Part B coverage next year — an increase of $25 a month.

Subtract that extra $25 charge for Part B premiums from seniors’ average $29.92 monthly Social Security increase and all that be left would be an extra $4.92 each month for expenses such as food, housing, medication and transportation.

“Many seniors are going to be disappointed,” said Lisa Swirsky, a policy adviser at the National Committee to Preserve Social Security and Medicare.

Higher Income Brackets

Under the principle that those who have more can afford to pay more, Part B premium surcharges for higher-income Medicare beneficiaries have been in place since 2007. These Income-Related Monthly Adjustment Amounts (IMRAA) surcharges vary, depending on the income bracket that individuals and married couples are in. Nearly 3 million Medicare members paid the surcharges in 2015.

For the past decade this is how surcharges have worked:

Bracket One: Individuals with incomes of $85,001 to $107,000 were charged 35 percent of Part B per-beneficiary costs, resulting in 2017 premiums of $187.50.

Bracket Two: Incomes of $107,001 to $160,000 were charged 50 percent, resulting in 2017 premiums of $267.90.

Bracket Three: Incomes of $160,001 to $214,000 were charged 65 percent, resulting in 2017 premiums of $348.30

Bracket Four: Incomes of more than $214,000 were charged 80 percent, resulting in 2017 premiums of $428.60.

(Information for married couples who file jointly can be found here.)

Now, under legislation passed in 2015, brackets two, three and four are adopting lower income thresholds, a move that could raise premiums for hundreds of thousands of seniors. Bracket two will now consist of individuals with incomes of $107,001 to $133,500; bracket three will consist of individuals making $133,501 to 160,000; and bracket four will include individuals making more than $160,000. (Thresholds for couples have been altered as well.)

As John Grobe, president of Federal Career Experts, a consulting firm, noted in a blog post, this change “will add another layer of complexity” to higher-income individuals’ decisions regarding “electing Part B.”

You can read the original article here.

Source:

Graham J. (5 October 2017). "Despite Boost In Social Security, Rising Medicare Part B Costs Leave Seniors In Bind" [web blog post]. Retrieved from address https://khn.org/news/despite-boost-in-social-security-rising-medicare-part-b-costs-leave-seniors-in-bind/

Medicare Advantage: How Robust Are Plans’ Physician Networks?

Looking for a comprehensive report on Medicare? Look no further. In this article - originally posted on Kaiser Family Foundation - we offer you informative graphs that indicate the size and breadth of provider networks between Medicare Advantage and traditional Medicare. Take a look below for more information.

You can read the original article here.

Source:

Jacobson G. (5 October 2017). "Medicare Advantage: How Robust Are Plans’ Physician Networks?" [Web Blog Post]. Retrieved from address https://www.kff.org/medicare/report/medicare-advantage-how-robust-are-plans-physician-networks/

One of the biggest trade-offs between Medicare Advantage and traditional Medicare is that Medicare Advantage plans have a more limited network of doctors and other providers. The size and breadth of provider networks can be an important factor for beneficiaries when choosing between traditional Medicare and Medicare Advantage, and among Medicare Advantage plans. As of 2017, 19 million of the 58 million people on Medicare (33%) are enrolled in a Medicare Advantage plan, yet little is known about their provider networks.

This report is the first known study to examine the size and composition of Medicare Advantage plans’ physician networks. This analysis draws upon data from 391 plans, offered by 55 insurers in 20 counties, and accounted for 14% of all Medicare Advantage enrollees nationwide in 2015. Key findings include:

- More than three in ten (35%) Medicare Advantage enrollees were in narrow-network plans while about two in ten (22%) were in broad-network plans. To some degree, the relative narrowness of plan networks masks the total number of physicians that enrollees could access, particularly in larger counties.

- Medicare Advantage networks included less than half (46%) of all physicians in a county, on average.

- Network size varied greatly among Medicare Advantage plans offered in a given county. For example, while enrollees in Erie County, NY had access to 60% of physicians in their county, on average, 16% of the plans in Erie had less than 10% of the physicians in the county while 36% of the plans had more than 80% of the physicians in the county.

- Access to psychiatrists was typically more restricted than for any other specialty. Medicare Advantage plans had 23% of the psychiatrists in a county, on average; 36% of plans included less than 10% of psychiatrists in their county. Some plans provided relatively little choice for other specialties as well; 20% of plans included less than 5 cardiothoracic surgeons, 18% of plans included less than 5 neurosurgeons, 16% of plans included less than 5 plastic surgeons, and 16% of plans included less than 5 radiation oncologists.

- Broad-network plans tended to have higher average premiums than narrow-network plans, and this was true for both HMOs ($54 versus $4 per month) and PPOs ($100 versus $28 per month).

Insurers may create narrow networks for a variety of reasons, such as to have greater control over the costs and quality of care provided to enrollees in the plan. The size and composition of Medicare Advantage provider networks is likely to be particularly important to enrollees when they have an unforeseen medical event or serious illness. However, accessing the information may not be easy for users, and comparing networks could be especially challenging. Beneficiaries could unwittingly face significant costs if they accidentally go out-of-network. Differences across plans, including provider networks, pose challenges for Medicare beneficiaries in choosing among plans and in seeking care, and raise questions for policymakers about the potential for wide variations in the healthcare experience of Medicare Advantage enrollees across the country.

You can read the original article here.

Source:

Jacobson G. (5 October 2017). "Medicare Advantage: How Robust Are Plans’ Physician Networks?" [Web Blog Post]. Retrieved from address https://www.kff.org/medicare/report/medicare-advantage-how-robust-are-plans-physician-networks/

The Medicare Part D Prescription Drug Benefit

Below we have an article from the Kaiser Family Foundation providing detailed information and graphics on the benefit of the Medicare Prescription Drug Plan.

You can read the original article here.

Medicare Part D is a voluntary outpatient prescription drug benefit for people on Medicare that went into effect in 2006. All 59 million people on Medicare, including those ages 65 and older and those under age 65 with permanent disabilities, have access to the Part D drug benefit through private plans approved by the federal government; in 2017, more than 42 million Medicare beneficiaries are enrolled in Medicare Part D plans. During the Medicare Part D open enrollment period, which runs from October 15 to December 7 each year, beneficiaries can choose to enroll in either stand-alone prescription drug plans (PDPs) to supplement traditional Medicare or Medicare Advantage prescription drug (MA-PD) plans (mainly HMOs and PPOs) that cover all Medicare benefits including drugs. Beneficiaries with low incomes and modest assets are eligible for assistance with Part D plan premiums and cost sharing. This fact sheet provides an overview of the Medicare Part D program and information about 2018 plan offerings, based on data from the Centers for Medicare & Medicaid Services (CMS) and other sources.

Medicare Prescription Drug Plan Availability in 2018

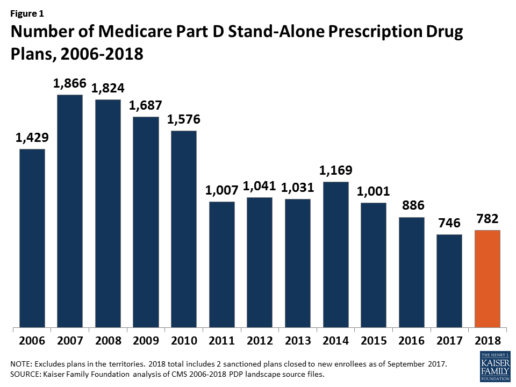

In 2018, 782 PDPs will be offered across the 34 PDP regions nationwide (excluding the territories). This represents an increase of 36 PDPs, or 5%, since 2017, but a reduction of 104 plans, or 12%, since 2016 (Figure 1).

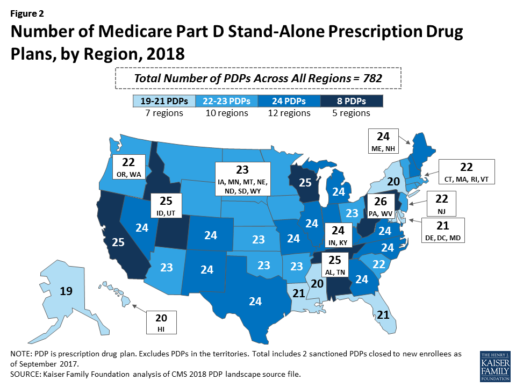

Beneficiaries in each state will continue to have a choice of multiple stand-alone PDPs in 2018, ranging from 19 PDPs in Alaska to 26 PDPs in Pennsylvania/West Virginia (in addition to multiple MA-PD plans offered at the local level) (Figure 2).

Low-Income Subsidy Plan Availability in 2018

Through the Part D Low-Income Subsidy (LIS) program, additional premium and cost-sharing assistance is available for Part D enrollees with low incomes (less than 150% of poverty, or $18,090 for individuals/$24,360 for married couples in 2017) and modest assets (less than $13,820 for individuals/$27,600 for couples in 2017).1

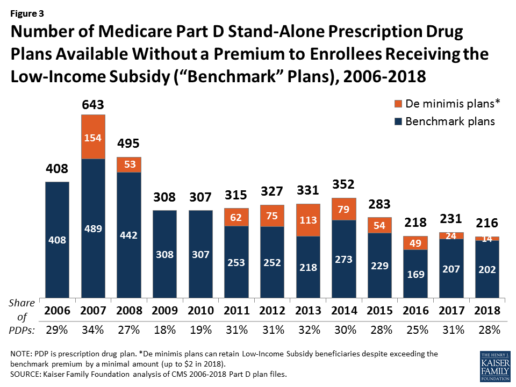

In 2018, 216 plans will be available for enrollment of LIS beneficiaries for no premium, a 6% decrease in premium-free (“benchmark”) plans from 2017 and the lowest number of benchmark plans available since the start of the Part D program in 2006. Roughly 3 in 10 PDPs in 2018 (28%) are benchmark plans (Figure 3).

Low-Income Subsidy Plan Availability in 2018

Through the Part D Low-Income Subsidy (LIS) program, additional premium and cost-sharing assistance is available for Part D enrollees with low incomes (less than 150% of poverty, or $18,090 for individuals/$24,360 for married couples in 2017) and modest assets (less than $13,820 for individuals/$27,600 for couples in 2017).1

In 2018, 216 plans will be available for enrollment of LIS beneficiaries for no premium, a 6% decrease in premium-free (“benchmark”) plans from 2017 and the lowest number of benchmark plans available since the start of the Part D program in 2006. Roughly 3 in 10 PDPs in 2018 (28%) are benchmark plans (Figure 3).

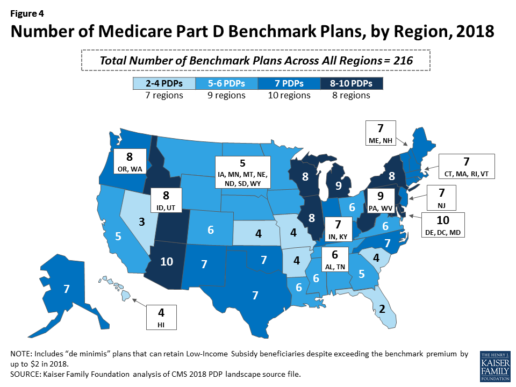

Benchmark plan availability varies at the Part D region level, with most regions seeing a reduction of 1 benchmark plan for 2018 (Figure 4). The number of premium-free plans in 2018 ranges from a low of 2 plans in Florida to 10 plans in Arizona and Delaware/Maryland/Washington D.C.

Part D Plan Premiums and Benefits in 2018

Premiums. According to CMS, the 2018 Part D base beneficiary premium is $35.02, a modest decline of 2% from 2017.2 Actual (unweighted) PDP monthly premiums for 2018 vary across plans and regions, ranging from a low of $12.60 for a PDP available in 12 out of 34 regions to a high of $197 for a PDP in Texas.

Part D enrollees with higher incomes ($85,000/individual; $170,000/couple) pay an income-related monthly premium surcharge, ranging from $13.00 to $74.80 in 2018 (depending on their income level), in addition to the monthly premium for their specific plan.3 According to CMS projections, an estimated 3.3 million Part D enrollees (7%) will pay income-related Part D premiums in 2018.

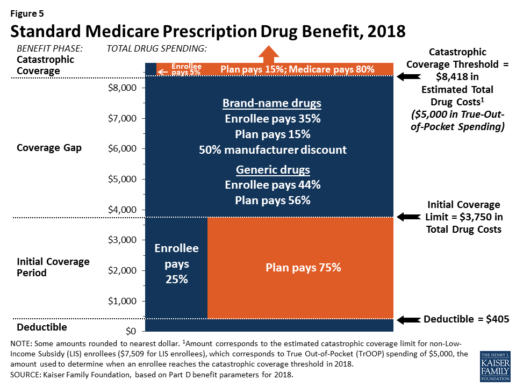

Benefits. In 2018, the Part D standard benefit has a $405 deductible and 25% coinsurance up to an initial coverage limit of $3,750 in total drug costs, followed by a coverage gap. During the gap, enrollees are responsible for a larger share of their total drug costs than in the initial coverage period, until their total out-of-pocket spending in 2018 reaches $5,000 (Figure 5).

After enrollees reach the catastrophic coverage threshold, Medicare pays for most (80%) of their drug costs, plans pay 15%, and enrollees pay either 5% of total drug costs or $3.35/$8.35 for each generic and brand-name drug, respectively.

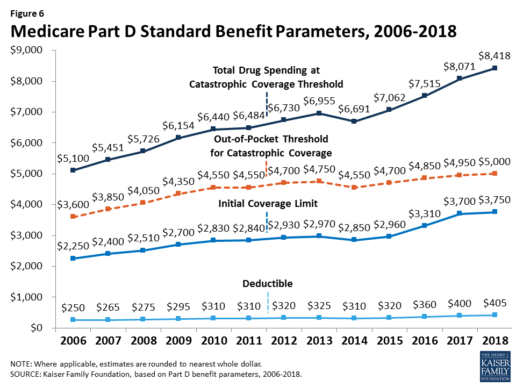

The standard benefit amounts are indexed to change annually by rate of Part D per capita spending growth, and, with the exception of 2014, have increased each year since 2006 (Figure 6).

Part D plans must offer either the defined standard benefit or an alternative equal in value (“actuarially equivalent”), and can also provide enhanced benefits. But plans can (and do) vary in terms of their specific benefit design, cost-sharing amounts, utilization management tools (i.e., prior authorization, quantity limits, and step therapy), and formularies (i.e., covered drugs). Plan formularies must include drug classes covering all disease states, and a minimum of two chemically distinct drugs in each class. Part D plans are required to cover all drugs in six so-called “protected” classes: immunosuppressants, antidepressants, antipsychotics, anticonvulsants, antiretrovirals, and antineoplastics.

In 2018, almost half (46%) of plans will offer basic Part D benefits (although no plans will offer the defined standard benefit), while 54% will offer enhanced benefits, similar to 2017. Most PDPs (63%) will charge a deductible, with 52% of all PDPs charging the full amount ($405). Most plans have shifted to charging tiered copayments or varying coinsurance amounts for covered drugs rather than a uniform 25% coinsurance rate, and a substantial majority of PDPs use specialty tiers for high-cost medications. Two-thirds of PDPs (65%) will not offer additional gap coverage in 2018 beyond what is required under the standard benefit. Additional gap coverage, when offered, has been typically limited to generic drugs only (not brands).

The 2010 Affordable Care Act gradually lowers out-of-pocket costs in the coverage gap by providing enrollees with a 50% manufacturer discount on the total cost of their brand-name drugs filled in the gap and additional plan payments for brands and generics. In 2018, Part D enrollees in plans with no additional gap coverage will pay 35% of the total cost of brands and 44% of the total cost of generics in the gap until they reach the catastrophic coverage threshold. Medicare will phase in additional subsidies for brands and generic drugs, ultimately reducing the beneficiary coinsurance rate in the gap to 25% by 2020.

Part D and Low-Income Subsidy Enrollment

Enrollment in Medicare drug plans is voluntary, with the exception of beneficiaries who are dually eligible for both Medicare and Medicaid and certain other low-income beneficiaries who are automatically enrolled in a PDP if they do not choose a plan on their own. Unless beneficiaries have drug coverage from another source that is at least as good as standard Part D coverage (“creditable coverage”), they face a penalty equal to 1% of the national average premium for each month they delay enrollment.

In 2017, more than 42 million Medicare beneficiaries are enrolled in Medicare Part D plans, including employer-only group plans.4 Of this total, 6 in 10 (60%) are enrolled in stand-alone PDPs and 4 in 10 (40%) are enrolled in Medicare Advantage drug plans. Medicare’s actuaries estimate that around 2 million other beneficiaries in 2017 have drug coverage through employer-sponsored retiree plans where the employer receives subsidies equal to 28% of drug expenses between $405 and $8,350 per retiree in 2018 (up from $400 and $8,250 in 2017).5 Several million beneficiaries are estimated to have other sources of drug coverage, including employer plans for active workers, FEHBP, TRICARE, and Veterans Affairs (VA). Yet an estimated 12% of Medicare beneficiaries lack creditable drug coverage.

Twelve million Part D enrollees are currently receiving the Low-Income Subsidy. Beneficiaries who are dually eligible, QMBs, SLMBs, QIs, and SSI-onlys automatically qualify for the additional assistance, and Medicare automatically enrolls them into PDPs with premiums at or below the regional average (the Low-Income Subsidy benchmark) if they do not choose a plan on their own. Other beneficiaries are subject to both an income and asset test and need to apply for the Low-Income Subsidy through either the Social Security Administration or Medicaid.

Part D Spending and Financing in 2018

The Congressional Budget Office (CBO) estimates that spending on Part D benefits will total $92 billion in 2018, representing 15.5% of net Medicare outlays in 2018 (net of offsetting receipts from premiums and state transfers). Part D spending depends on several factors, including the number of Part D enrollees, their health status and drug use, the number of enrollees receiving the Low-Income Subsidy, and plans’ ability to negotiate discounts (rebates) with drug companies and preferred pricing arrangements with pharmacies, and manage use (e.g., promoting use of generic drugs, prior authorization, step therapy, quantity limits, and mail order). Federal law prohibits the Secretary of Health and Human Services from interfering in drug price negotiations between Part D plan sponsors and drug manufacturers.6

Financing for Part D comes from general revenues (78%), beneficiary premiums (13%), and state contributions (9%). The monthly premium paid by enrollees is set to cover 25.5% of the cost of standard drug coverage. Medicare subsidizes the remaining 74.5%, based on bids submitted by plans for their expected benefit payments. Part D enrollees with higher incomes ($85,000/individual; $170,000/couple) pay a greater share of standard Part D costs, ranging from 35% to 80%, depending on income.

According to Medicare’s actuaries, in 2018, Part D plans are projected to receive average annual direct subsidy payments of $353 per enrollee overall and $2,353 for enrollees receiving the LIS; employers are expected to receive, on average, $623 for retirees in employer-subsidy plans.7 Part D plans’ potential total losses or gains are limited by risk-sharing arrangements with the federal government (“risk corridors”). Plans also receive additional risk-adjusted payments based on the health status of their enrollees and reinsurance payments for very high-cost enrollees.

Under reinsurance, Medicare subsidizes 80% of drug spending incurred by Part D enrollees above the catastrophic coverage threshold. In 2018, average reinsurance payments per enrollee are estimated to be $941; this represents a 7% increase from 2017. Medicare’s reinsurance payments to plans have represented a growing share of total Part D spending, increasing from 16% in 2007 to an estimated 41% in 2018.8 This is due in part to a growing number of Part D enrollees with spending above the catastrophic threshold, resulting from several factors, including the introduction of high-cost specialty drugs, increases in the cost of prescriptions, and a change made by the ACA to count the 50% manufacturer discount in enrollees’ out-of-pocket spending that qualifies them for catastrophic coverage. Analysis from MedPAC also suggests that in recent years, plans have underestimated their enrollees’ expected costs above the catastrophic coverage threshold, resulting in higher reinsurance payments from Medicare to plans over time.

Issues for the Future

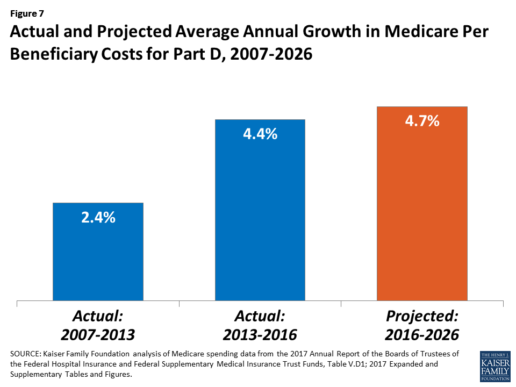

After several years of relatively low growth in prescription drug spending, spending has risen more steeply since 2013. The average annual rate of growth in Part D costs per beneficiary was 2.4% between 2007 and 2013, but it increased to 4.4% between 2013 and 2016, and is projected to increase by 4.7% between 2016 and 2026

(Figure 7).9

Medicare’s actuaries have projected that the Part D per capita growth rate will be comparatively higher in the coming years than in the program’s initial years due to higher costs associated with expensive specialty drugs, which is expected to be reflected in higher reinsurance payments to plans. Between 2017 and 2027, spending on Part D benefits is projected to increase from 15.9% to 17.5% of total Medicare spending (net of offsetting receipts).10 Understanding whether and to what extent private plans are able to negotiate price discounts and rebates will be an important part of ongoing efforts to assess how well plans are able to contain rising drug costs. However, drug-specific rebate information is not disclosed by CMS.

The Medicare drug benefit helps to reduce out-of-pocket drug spending for enrollees, which is especially important to those with modest incomes or very high drug costs. Closing the coverage gap by 2020 will bring additional relief to millions of enrollees with high costs. But with drug spending on the rise and more plans charging coinsurance rather than flat copayments for covered brand-name drugs, enrollees could face higher out-of-pocket costs for their Part D coverage. These trends highlight the importance of comparing plans during the annual enrollment period. Research shows, however, that relatively few people on Medicare have used the annual opportunity to switch Part D plans voluntarily—even though those who do switch often lower their out-of-pocket costs as a result of changing plans.

Understanding how well Part D is working and how well it is meeting the needs of people on Medicare will be informed by ongoing monitoring of the Part D plan marketplace and plan enrollment; assessing coverage and costs for high-cost biologics and other specialty drugs; exploring the relationship between Part D spending and spending on other Medicare-covered services; and evaluating the impact of the drug benefit on Medicare beneficiaries’ out-of-pocket spending and health outcomes.

Endnotes

- Poverty and resource levels for 2018 are not yet available (as of September 2017).

- The base beneficiary premium is equal to the product of the beneficiary premium percentage and the national average monthly bid amount (which is an enrollment-weighted average of bids submitted by both PDPs and MA-PD plans). Centers for Medicare & Medicaid Services, “Annual Release of Part D National Average Bid Amount and Other Part C & D Bid Information,” July 31, 2017, available at https://www.cms.gov/Medicare/Health-Plans/MedicareAdvtgSpecRateStats/Downloads/PartDandMABenchmarks2018.pdf.

- Higher-income Part D enrollees also pay higher monthly Part B premiums.

- Centers for Medicare & Medicaid Services, Medicare Advantage, Cost, PACE, Demo, and Prescription Drug Plan Contract Report – Monthly Summary Report (Data as of August 2017).

- Board of Trustees, 2017 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, Table IV.B7, available at https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/ReportsTrustFunds/Downloads/TR2017.pdf.

- Social Security Act, Section 1860D-11(i).

- 2017 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds; Table IV.B9.

- Kaiser Family Foundation analysis of aggregate Part D reimbursement amounts from Table IV.B10, 2017 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds.

- Kaiser Family Foundation analysis of Part D average per beneficiary costs from Table V.D1, 2017 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds.

- Kaiser Family Foundation analysis of Part D benefits spending as a share of net Medicare outlays (total mandatory and discretionary outlays minus offsetting receipts) from CBO, Medicare-Congressional Budget Office’s June 2017 Baseline.

Read the full article here.

Source:

Kaiser Family Foundation (2 October 2017). “The Medicare Part D Prescription Drug Benefit” [Web Blog Post]. Retrieved from address https://www.kff.org/medicare/fact-sheet/the-medicare-prescription-drug-benefit-fact-sheet/#26740