How Employers Can Prepare for PPACA Compliance in 2014

Where has 2013 gone?

Has 2013 left you with questions about Benefit Reform, Human Resources, Retirement Reform or what's coming in 2014? Don't worry! We have an expert from each department to answer your questions. See how talking with our experts can give you the insight you need during health care reform.

Event Details

Time: Lunch will be served at 11:30 a.m.

[button color="#ffffff" background="#196042" size="medium" src="https://marketing.experience-6.com/acton/form/1515/0270:/1/1515:e-07fd-1311/-/l-tst/l-tst:5/index.htm?utm_medium=email&utm_source=Act-On+Software&utm_content=email&utm_campaign=TEST-Saxon%20U%3A%20Where%20has%20%27013%20gone&utm_term=SAX.SaxonU.Nov.Form&cm_mmc=Act-On%20Software-_-email-_-TEST-Saxon%20U%3A%20Where%20has%20%27013%20gone-_-SAX.SaxonU.Nov.Form"]Reserve Seat[/button]

When we say experts, we mean EXPERTS

Jamie Charlton and Frank Lopez were on a recent episode of Business Talk. Watch the video now to hear what they had to say about Health Care Reform, how it will effect you, and what employers need to know moving forward.

Speakers

Jamie Charlton, CFP

Is it time to offer your employees more?

Show your employees that their company understands the impact this payroll tax change has had at home and that you are there to help them by offering a Financial Wellness Workshop.

We will come on-site to conduct a Lunch & Learn.

2014 Annual Benefit Plan Amounts

Originally posted on www.shrm.org The Internal Revenue Service announced on Oct. 31, 2013, cost-of-living adjustments for tax year 2014, also charted here and here, that apply to dollar limits for 401(k) and other defined contribution retirement plans and for defined benefit pension plans. Some plan limits will remain unchanged because the increase in the Consumer Price Index did not meet the statutory thresholds for their adjustment, while other limits will rise in 2014.

The announcement highlighted the following:

- 401(k), 403(b) and profit-sharing plan elective deferrals in 2014 will remain at $17,500; the catch-up contribution limit will stay at $5,500.

- The annual defined contribution limit from all sources will rise to $52,000 from $51,000.

- The amount of employee compensation that can be considered in calculating contributions to defined contribution plans will increase to$260,000 from $255,000.

- The limit used in the definition of a highly compensated employee for the purpose of 401(k) nondiscrimination testing remains unchanged at$115,000.

| Defined Contribution Plan Limits For 401(k), 403(b) and most 457 plans, the COLA increases for dollar limits on benefits and contributions are as follows: |

2014 |

2013 |

| Maximum elective deferral by employee |

$17,500 |

$17,500 |

| Catch-up contribution (age 50 and older during 2012) |

$5,500 |

$5,500 |

| Defined contribution maximum deferral (employer and employee combined) |

$52,000 |

$51,000 |

| Employee annual compensation limit for calculating contributions |

$260,000 |

$255,000 |

| Annual compensation of “key employees” in a top-heavy plan |

$170,000 |

$165,000 |

| Annual compensation of “highly compensated employee” in a top-heavy plan (“HCE threshold”) |

$115,000 |

$115,000 |

“A $1,000 increase to the overall defined contribution limit will allow participants to potentially get a little more ‘bang’ out of their plan—at least if their employer wants to give them more money,” noted retirement-planning firm Van Iwaarden Associates in an online commentary on the 2014 changes. Defined Benefit Plans

- The maximum annual benefit that may be funded through a defined benefit plan will increase to $210,000 from $205,000.

- For a participant who separated from service before Jan. 1, 2014,the limit for defined benefit plans is computed by multiplying the participant’s compensation limit, as adjusted through 2013, by 1.0155.

“The primary consequence of this change is that individuals who have very large DB benefits (say, shareholders in a professional firm cash balance plan) could see a deduction increase if their benefits were previously constrained by the [Internal Revenue Code Section 415] dollar limit,” the Van Iwaarden posting explained. Other Workplace Retirement Plan Limits

- For SIMPLE (savings incentive match plan for employees of small employers) retirement accounts, the maximum contribution limit will remain $12,000; the catch-up contribution limit will also stay the same, at$2,500.

- For simplified employee pensions (SEPs), the minimum compensation amount will remain $550, while the maximum compensation limit will jump to $260,000 from $255,000.

- In an employee stock ownership plan (ESOP), the maximum account balance in the plan subject to a five-year distribution period will rise to$1,050,000 from $1,035,000, while the dollar amount used to determine the lengthening of the five-year distribution period will increase to$210,000 from $205,000.

| Non-401(k) Workplace Retirement Plan Limits |

2014 |

2013 |

| SIMPLE employee deferrals |

$12,000 |

$12,000 |

| SIMPLE catch-up deferrals |

$2,500 |

$2,500 |

| SEP minimum compensation |

$550 |

$550 |

| SEP annual compensation limit |

$260,000 |

$255,000 |

| Social Security wage base |

$117,000 |

$113,700 |

Individual Retirement Accounts

- The limit on annual contributions to an individual retirement account (IRA) will stay at $5,500. The additional catch-up contribution limit for those ages 50 and over will remain $1,000.

- The deduction for taxpayers making contributions to a traditional IRA has been phased out for singles and heads of household who are covered by a workplace retirement plan and have modified adjusted gross incomes (AGIs) from $60,000 to $70,000, up from $59,000 to $69,000 in 2013.

- For married couples filing jointly, in which the spouse who makes the IRA contribution is covered by a workplace retirement plan, the AGI phase-out range will be $96,000 to $116,000, up from $95,000 to $115,000.

- For an IRA contributor who is not covered by a workplace retirement plan and is married to someone who is covered, the deduction has been phased out for couples with an AGI from $181,000 to $191,000, up from $178,000 to $188,000.

- For a married individual filing a separate return who is covered by a workplace retirement plan, the phase-out range is not subject to an annual cost-of-living adjustment and will remain $0 to $10,000.

- For a Roth IRA, the AGI phase-out range for taxpayers making contributions will be $181,000 to $191,000 for married couples filing jointly, up from $178,000 to $188,000 in 2013. For singles and heads of household, the income phase-out range will be $114,000 to $129,000, up from $112,000 to $127,000. For a married individual filing a separate return who is covered by a retirement plan at work, the phase-out range will remain $0 to $10,000.

- The AGI limit for the saver’s credit (also known as the retirement savings contributions credit) for low- and moderate-income workers will rise to $60,000 for married couples filing jointly, up from $59,500 in 2013;$45,050 for heads of household, up from $44,250; and $30,000 for singles and married couples filing separately, up from $29,500.

Contribution Misperceptions Hinder Savings Employees often have a skewed perception of retirement plan contribution limits. According to Mercer Workplace Survey results, the average participant believes that the tax-deferral limit is only $8,532, just under half the actual 2013 limit of $17,500. Looking at intended savings rates, most appear close to the perceived limit but are still far off from the actual. For those nearing retirement (age 50-plus), the perception gap is even bigger. The survey represents a national cross section of active 401(k) participants; online interviews were completed with 1,506 respondents between May 28 and June 5, 2013.

“This data not only points to a troubling disconnect between perception and reality but also points to a false sense of security among 401(k) participants,” according to Mercer’s analysts. “It also begs the question whether participants are leaving some tax efficiency—knowingly or unknowingly—on the table.”

Thirty-four percent said they would increase their 401(k) contribution to the tax-deferred maximum “if they could live the last 12 months over again,” the survey found, which highlights the value of effectively communicating maximum contribution limits to employees and conveying how even small annual contribution increases can substantially boost the size of their retirement nest egg.

More mid-market employers eligible for group voluntary benefits plans

Originally posted November 03, 2013 by Joanne Wojcik on www.businessinsurance.com

Many mid-market employers that previously could offer voluntary products to employees only on an individual or multi-life basis may now be eligible for group plans.

Perhaps the only exception is long-term care insurance, which is available primarily on an individual basis due to the recent spate of insurer withdrawals from the group LTC market.

“Now many insurers are offering voluntary benefit products on a group basis to make it possible to enroll on self-serve platforms,” said Bruce Sletton, senior vice president and national elective benefits practice leader at Aon Hewitt in Dallas.

“The trend has been toward group insurance products in the voluntary space,” said Beth Grellner, St. Louis-based co-chair of Towers Watson & Co.'s national voluntary benefits and services group. “For the third year in a row, we've seen group insurance (voluntary benefits) grow at a faster rate than voluntary products offered on an individual basis.”

Group voluntary benefits provide guaranteed issue, regardless of employees' health status or age, and often come at a lower price than if the benefits been underwritten on an individual basis.

The downside, however, is that group products are guaranteed to be renewable only on a one-, two- or three-year basis, Mr. Sletton said. “The insurer has the right to review the products and then make price adjustments,” or drop the group altogether, he said.

Senate approves workplace gay rights bill

Originally posted November 7, 2013 by Susan Davis on www.usatoday.com

The U.S. Senate approved, 64-32, a historic gay rights bill to ban workplace discrimination based on sexual preference or gender identity.

"It is time for Congress to pass a federal law that ensures all our citizens, regardless of where they live, can go to work unafraid to be who they are," said Senate Majority Leader Harry Reid, D-Nev.

Fifty-four Democrats and 10 Republicans supported the legislation.

Religious organizations and the U.S. military are exempt under the Employer Non-Discrimination Act, a stipulation that helped win GOP support. The bill applies to work sites with more than 15 people.

ENDA has been introduced in nearly every Congress since 1994. It came one vote shy of passage in 1996, but had not been given a full Senate vote since.

Existing federal laws ban employer discrimination based on race, color, sex, nationality, religion, age and disability.

The legislation is hitting a wall in the GOP-controlled House, where Speaker John Boehner's office said he does not plan to allow a vote. Boehner opposes the legislation because he says it will cost small-business jobs and increasing "frivolous" litigation.

In a statement, President Obama urged House leaders to bring it up for a vote. "One party in one house of Congress should not stand in the way of millions of Americans who want to go to work each day and simply be judged by the job they do," he said.

Opponents contend that the legislation is unnecessary because most private businesses, including the vast majority of Fortune 500 companies, have self-adopted policies that prohibit discrimination based on sexual orientation.

Twenty-two states and Washington, D.C., have already enacted laws prohibiting such discrimination.

A June 2013 Pew Research survey of lesbian, gay, bisexual and transgender adults reported 21% who said they have been treated unfairly at work because of their orientation.

Almost Half Of Workers Don’t Know What Impact Affordable Care Act Will Have On Them

Originally posted November 06, 2013 on https://www.insurancebroadcasting.com

Online resources cited as most reliable source of information about law

COLUMBIA, S.C.--(BUSINESS WIRE)--A survey conducted online by Harris Interactive on behalf of Colonial Life & Accident Insurance Company shows nearly half of American workers don’t feel knowledgeable about how the Affordable Care Act will impact them personally.

“Despite all the attention the Affordable Care Act has received in the past few years, nearly half of American workers still say they don’t know much about it”

In a poll of more than 1,000 U.S. employees (full-time and/or part-time)1, 47 percent of workers say they are not very knowledgeable or not at all knowledgeable about the impact the Affordable Care Act will have on them. Thirty-three percent say they’re not very knowledgeable about the law and its proposed personal impact, and 14 percent say they’re not at all knowledgeable.

“Despite all the attention the Affordable Care Act has received in the past few years, nearly half of American workers still say they don’t know much about it,” says Steve Bygott, assistant vice president of core market services at Colonial Life.

In other survey findings, 48 percent of workers say federal government websites are the most reliable source of information about the ACA and its personal impact on them. They rated internet or other online news sources as the next most reliable, cited by 44 percent of employees. Other sources viewed as reliable options include:

Their employers or HR departments

36 percent

Insurance company websites or literature

30 percent

TV news programs

25 percent

Printed magazines or newspapers

20 percent

Family or friends

18 percent

Other

8 percent

“Workers clearly need help understanding this law and its personal impact on them and their families,” says Bygott. “Because employers are viewed as one of the top three sources of reliable information on this topic, they have a tremendous opportunity to help their workers get the information they need when they communicate their benefits programs.”

Survey results were included as part of a white paper recently published by Colonial Life called “Beyond Health Care Reform.” The research paper outlines what employers should know about health care reform, employee benefits and the subsequent need for increased benefits education.

Survey Methodology

This survey was conducted online within the United States by Harris Interactive on behalf of Colonial Life from September 3-5, 2013 among 2,046 adults ages 18 and older, among whom 1,023 are employed full-time or part-time. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. For complete survey methodology, including weighting variables, please contact Jeanna Moffett at Colonial Life at JMoffett@ColonialLife.com.

1 Online survey conducted within the United States for Colonial Life & Accident Insurance Company by Harris Interactive, Sept. 3-5, 2013, among 2,046 U.S. adults age 18 and older, among whom 1,023 are employed full-time or part-time.

IRS Releases Tax Benefit Inflation Adjustments for 2014

Originally posted https://www.ifebp.org

Internal Revenue Service (IRS) Revenue Procedure 2013-35 provides the cost-of-living adjustments to certain items for 2014 as required under the Internal Revenue Code. This revenue procedure includes updates for numerous items including:

Adoption Assistance Programs

For taxable years beginning in 2014, under § 137(a)(2) the amount that can be excluded from an employee’s gross income for the adoption of a child with special needs is $13,190. Under § 137(b)(1) the maximum amount that can be excluded for amounts paid or expenses incurred by an employer for qualified adoption expenses furnished through an adoption assistance program for other adoptions by the employee is $13,190. The amount excludable from gross income begins to phase out for taxpayers with modified adjusted gross income in excess of $197,880 and completely phases out with modified adjusted gross income of $237,880 or more.

Health Flexible Spending Arrangements (Health FSA)

The Affordable Care Act amended § 125 to provide limitations on Health FSAs. The dollar limitation on voluntary employee salary reductions for a health FSA is adjusted for inflation for taxable years beginning after December 31, 2013. For taxable years beginning in 2014, the dollar limitation is $2,500.

Medical Savings Accounts

- Self-only coverage. For taxable years beginning in 2014, the term "high deductible health plan" as defined in § 220(c)(2)(A) means, for self-only coverage, a health plan with an annual deductible not less than $2,200 and not more than $3,250, and under which the annual out-of-pocket expenses required to be paid (other than for premiums) for covered benefits do not exceed $4,350.

- Family coverage. For taxable years beginning in 2014, the term "high deductible health plan" means, for family coverage, a health plan with an annual deductible not less than $4,350 and not more than $6,550, and under which the annual out-of-pocket expenses required to be paid (other than for premiums) for covered benefits do not exceed $8,000.

Qualified Transportation Fringe Benefit

For taxable years beginning in 2014, the monthly limitation under § 132(f)(2)(A) regarding the aggregate fringe benefit exclusion amount for transportation in a commuter highway vehicle and any transit pass is $130. The monthly limitation under § 132(f)(2)(B) regarding the fringe benefit exclusion amount for qualified parking is $250.

Cost of benefits, ACA compliance main concerns of midsized businesses

Originally posted by Andrea Davis on https://ebn.benefitnews.com

The cost of health coverage, the Affordable Care Act and the volume of government regulations are the top three concerns of midsized business owners and executives, according to a new survey from the ADP Research Institute.

Seventy percent of midsized businesses – those with between 50 and 999 employees – surveyed said their biggest challenge in 2013 is the cost of health coverage and benefits. ACA legislation came in as the No. 2 concern, cited by 59%, a 16% increase over last year. And rounding out the top three list of concerns was the level and volume of government regulations, cited by 54%.

“What was a surprise to us was that midsized business owners’ level of confidence in their ability to comply with the laws and regulations doesn’t reflect reality,” says Jessica Saperstein, division vice president of strategy and business development at ADP.

For example, the survey finds that, overall, 83% of midsized businesses are confident they’re compliant with payroll tax laws and regulations, nearly one-third reported unintended expenses – fines, penalties or lawsuits – as a result of not being compliant.

“The majority say they’re confident but many of them are experiencing these fines and penalties,” says Saperstein. “On average, it’s about six times a year and the average cost of one of these penalties or fines is $90,000.”

Nearly two-thirds of benefits decision-makers at midsized companies are not confident they understand the ACA and what they need to do to be compliant. Ninety percent aren’t confident their employees understand the effects of the ACA on their benefits choices.

U.S. Obesity Rate Climbing in 2013

Originally posted November 1, 2013 by Lindsey Sharpe on https://www.gallup.com

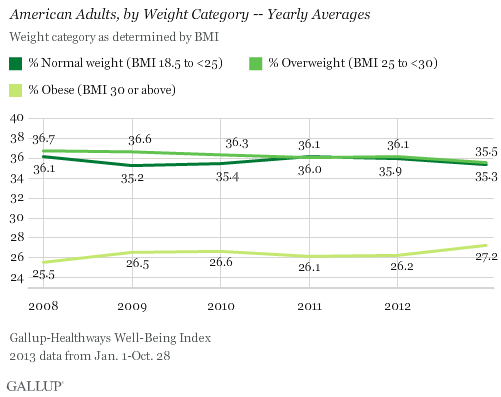

WASHINGTON, D.C. -- The adult obesity rate so far in 2013 is 27.2%, up from 26.2% in 2012, and is on pace to surpass all annual average obesity rates since Gallup-Healthways began tracking in 2008.

The one-percentage-point uptick in the obesity rate so far in 2013 is statistically significant and is the largest year-over-year increase since 2009. The higher rate thus far in 2013 reverses the lower levels recorded in 2011 and 2012, and is much higher than the 25.5% who were obese in 2008.

The increase in obesity rate is accompanied by a slight decline in the percentage of Americans classified as normal weight or as overweight but not obese. The percentage of normal weight adults fell to 35.3% from 35.9% in 2012, while the percentage of adults who are overweight declined to 35.5% from 36.1% in 2012. An additional 1.9% of Americans are classified as underweight in 2013 so far.

Since 2011, U.S. adults have been about as likely to be classified as overweight as normal weight. Prior to that, Americans were most commonly classified as overweight.

Gallup and Healthways began tracking Americans' weight in 2008. The 2013 data are based on more than 141,000 interviews conducted from Jan. 1 through Oct. 28 as part of the Gallup-Healthways Well-Being Index. Gallup uses respondents' self-reported height and weight to calculate body mass index (BMI) scores. Individual BMI values of 30 or above are classified as "obese," 25 to 29.9 are "overweight," 18.5 to 24.9 are "normal weight," and 18.4 or less are "underweight."

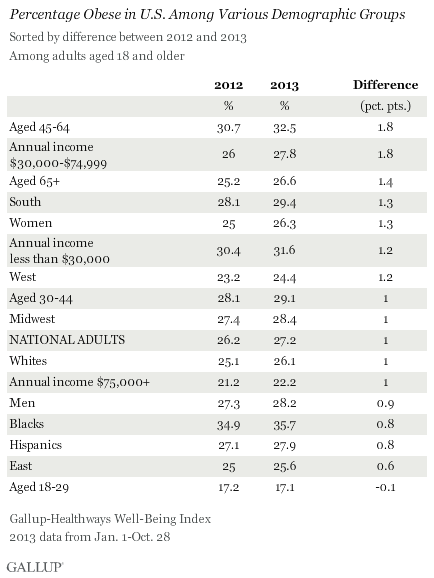

Obesity Rates Increase Across Almost All Demographic Groups

Obesity rates have increased at least slightly so far in 2013 across almost all major demographic and socioeconomic groups. One exception is 18- to 29-year-olds, among whom the percentage who are obese has remained stable. The largest upticks between 2012 and 2013 were among those aged 45 to 64 and those who earn between $30,000 and $74,999 annually. The obesity rate within both groups increased by 1.8 points, which exceeds the one-point increase in the national average.

At 35.7%, blacks continue to be the demographic group most likely to be obese, while those aged 18 to 29 and those who earn over $75,000 annually continue to be the least likely to be obese.

Bottom Line

The U.S. obesity rate thus far in 2013 is trending upward and will likely surpass all annual obesity levels since 2008, when Gallup and Healthways began tracking. It is unclear why the obesity rate is up this year, and the trend since 2008 shows a pattern of some fluctuation. This underscores the possibility that that the recent uptick is shorter-term, rather than a more permanent change. Still, if the current trend continues for the next several years, the implications for the health of Americans and the increased burden on the healthcare system could be significant.

Blacks, those who are middle-aged, and lower-income adults continue to be the groups with the highest obesity rates. The healthcare law could help reduce obesity among low-income Americans if the uninsuredsign up for coverage and take advantage of the free obesity screening and counseling that most insurance companies are required to provide under the law.

Employers can also take an active role to help lower obesity rates. Gallup has found that the annual cost for lost productivity due to workers being above normal weight or having a history of chronic conditions ranges from $160 million among agricultural workers to $24.2 billion among professionals. Thus, employers can cut healthcare costs by developing and implementing strategies to help workers maintain or reach a healthy weight.

Gallup has also found that employees who are engaged in their work eat healthier and exercise more. Therefore, employers who actively focus on improving engagement may see healthier and more productive workers, in addition to lower healthcare costs.

About the Gallup-Healthways Well-Being Index

The Gallup-Healthways Well-Being Index tracks well-being in the U.S. and provides best-in-class solutions for a healthier world. To learn more, please visit well-beingindex.com.

Results are based on telephone interviews conducted as part of the Gallup-Healthways Well-Being Index survey Jan. 1-Oct. 28, 2013, with a random sample of 141,935 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of national adults, one can say with 95% confidence that the margin of sampling error is ±0.5 percentage points.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by region. Landline and cellphone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, and cellphone mostly). Demographic weighting targets are based on the March 2012 Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the July-December 2011 National Health Interview Survey. Population density targets are based on the 2010 census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit www.gallup.com.

FSA use-it-or-lose-it rule changed!

Originally posted October 31, 2013 by Kathryn Mayer on https://www.benefitspro.com

Use-it-or-lose-it is no more.

The U.S. Department of the Treasury and the IRS on Thursday issued a notice modifying the longstanding “use-or-lose” rule for health flexible spending arrangements. Participants now can carry over up to $500 of their unused balances remaining at the end of a plan year.

The rule will go into effect for the 2014 plan year.

Effective immediately, employers that offer FSAs that don't include a grace period will have the option of allowing employees to roll over up to $500 of unused funds at the end of this plan year.

An employer cannot offer a FSA carryover provision and an FSA grace period at the same time, officials said.

For nearly 30 years, employees eligible for FSAs have been subject to the use-it-or-lose-it rule, meaning any account balances remaining unused at the end of the year are forfeited.

FSAs allow employees to contribute pre-tax dollars to pay for out-of-pocket health care expenses – including deductibles, copayments, and other qualified medical, dental or vision expenses not covered by the individual’s health insurance plan.

Health savings accounts, on the other hand, are similar vehicles, but allow participants to build up savings over time.

The move, the departments announced, is making “FSAs more consumer-friendly and provide added flexibility.”

“Across the administration, we’re always looking for ways to provide added flexibility and commonsense solutions to how people pay for their health care,” Treasury Secretary Jacob Lew said in a statement. “Today’s announcement is a step forward for hardworking Americans who wisely plan for health care expenses for the coming year.”

The change responds directly to more than 1,000 public comments the Treasury fielded. Employers and employees complained about the difficulty for employees to predict future needs for medical expenditures. Many FSA users said they scrambled at year end to spend the remaining amounts, often buying unnecessary medical supplies.

IRS officials said they believe a $500 rollover cap is appropriate because most employees who lost money under the rule lost far less than that amount.

Bob Natt, executive chairman of Alegeus Technologies, a health and benefits payments firm, said he’s grateful the administration has “eliminated the most significant barrier to FSA participation – namely consumers’ fear of losing their money.”

He said that though more than 85 percent of large employers offer FSAs, only about 20 percent of eligible employees actually enroll, mainly for “fear of forfeiting unused funds at the end of the plan year.”

“With this new provision in effect, there is really no reason for eligible employees not to enroll and contribute to an FSA," Natt said. "All contributions are tax-free, the employee’s full election is available on the first day of the plan year, and now unused funds up to $500 can be rolled over to the next plan year.”

Alegeus Technologies has been lobbying for four years to modify the use-it-or-lose-it provision, he said.

Wageworks, a benefits management provider of consumer-directed benefits, has also been pushing the administration for flexibility on FSA provisions. The company's CEO, Joe Jackson, said it's a very "positive change" and a long time coming.

"The timing of this change could not be better, as most companies are now in their open enrollment period," Jackson said. "We encourage all eligible employees to take advantage of this change and sign up for an FSA and lower their health care expenses.”

The rule will have far-reaching effects: An estimated 14 million families participate in FSAs.

Under the Patient Protection and Affordable Care Act, the amount an employee can set aside in an FSA dropped to $2,500 this year. The $500 carryover won’t reduce the $2,500 maximum a worker can contribute to a FSA each year, Treasury officials said.

5 myths about millennials and benefits

Originally posted by Lindsey Pollak on https://www.benefitspro.com

Millennials (ages 18-31), also known as Gen Y, are 80 million strong, according to the U.S. Census Bureau. As this generation climbs into leadership roles, they’ll change many aspects of the workplace, including the benefits landscape.

To help better understand this giant generation of consumers and employees, it’s time to dispel five common myths about who millennials are and what they want.

1.) Millennials all live at home and don’t have financial responsibilities.

True, many millennials are living at home today. Three out of 10 parents (27 percent) have at least one adult child, between the ages of 21 and 40, still living with them at home, according to the National Housing Federation. But that doesn’t mean they don’t have financial responsibilities: Mom and Dad might be asking Junior to chip in on rent or expecting him to pay off his student loans they co-signed.

The Hartford 2013 Benefits for Tomorrow Study found two-thirds of workers today have loved ones relying on their paycheck, with 10 percent of millennials reporting that their parents rely on their salary. That’s all the more reason for millennials to protect their paycheck by signing for disability insurance at work.

For many millennials living at home, one of their primary financial responsibilities is dealing with student loan debt. The average debt for students graduating in 2013 is $35,000, according to Fidelity. If parents are co-signers on those student loans, it’s in their best interest to encourage their kids to sign up for disability and life insurance at work. Disability insurance can help keep an income coming in (and the ability to pay back loans) should the millennial worker become ill or injured off the job, while life insurance can help provide funding to pay off student loan debt.

Help the millennials make the connection between benefits and their very real financial responsibilities.

2.) Millennials want all digital communications all the time.

True, millennials are considered “digital natives.” They’ve grown up with technology their entire lives. While they like digital options, many appreciate help in real life, as well. They appreciate an advisor who can provide advice in whatever way they desire — text, email, instant message, phone call, or an in-person meeting.

Help millennials by providing the benefits advisors that they’re looking for. They want to be able to review their benefits options online but have a real-live person available to answer their specific questions. Help your clients make this connection possible.

3.) Millennials all want to start their own companies like Mark Zuckerberg.

True, many millennials think like entrepreneurs. Many even have side projects, like a blog, in addition to their 9-to-5 jobs. But the vast majority of millennials like to work for companies of all sizes — as long as those companies understand them and their needs.

Help the millennials on your team feel like entrepreneurs, by allowing them to express their individuality and effect change around them. And share this advice with your employer clients, as well.

For example, some companies allow millennials to pursue small projects related to their particular interests or participate in occasional community service projects during work hours.

4.) Millennials don’t want baby boomers’ help or advice.

True, millennials enjoy their independence. But in the workplace they actually appreciate theirbaby boomer co-workers’ experience and knowledge. Don’t forget that the millennials are the children of baby boomers, and many raised their kids in their own image. Millennials tend to like and appreciate their baby boomer bosses and colleagues.

The Hartford 2013 Benefits For Tomorrow Study found that 93 percent of baby boomers believe millennials bring new skills and ideas to the workplace, and 89 percent of millennials agree baby boomers in the workplace are a great source of mentorship.

Help millennials by making connections between the two generations — either at your workplace or among your employer clients. Consider the idea of co-mentoring, in which employees of different generations share knowledge and skills with each other.

When you are having discussions around company policies and decisions, make sure to have representative employees present from all generations in your company. This way there will be someone who can offer each generation’s point of view on the items under discussion.

5.) Millennials aren’t serious about being leaders.

True, millennials are often viewed as “entitled” and carefree. Case in point: the YOLO (you only live once) catchphrase. But many are leaders in all aspects of life. In fact, 15 percent of millennials are already in management positions, and there are many young people who want to move into leadership positions soon.

Help millennial leaders to understand that they need to protect their potential. Show them how insurance benefits can keep them on track to meet their professional and personal goals. For example, if they can’t work because they tore a ligament during a 5K, disability insurancemay help them pay bills — and stay on track to buying a house or traveling around the world.

By helping millennials as both consumers and employees, you can better advise your clients and manage your business today — and into the increasingly millennial-dominated future.