Healthcare waste is costing billions — and employers aren’t doing anything about it

Providing your employees with healthcare insurance is expensive. A large chunk of healthcare costs is being wasted by the healthcare industry, according to a new survey. Read on to learn more.

Providing the workforce with healthcare coverage is expensive, but a new survey of 126 employers suggests a large chunk of that cost is being wasted by the healthcare industry on treatments patients don’t need.

The healthcare industry wastes $750 billion per year on unnecessary tests and treatments, according to a survey from the National Alliance of Healthcare Purchaser Coalitions and Benfield, a market research, strategy and communications consulting firm. Some 60% of employers don’t take steps to manage their healthcare plan’s wasteful spending, despite the fact that the same percentage of employers view it as a problem, the survey says.

“While waste has long been identified as a key concern and cost contributor, employers are operating blind and need to look at a more disciplined approach to address top drivers that influence waste,” says Michael Thompson, National Alliance president and CEO.

Employers are under the impression that prescription drugs are the culprit behind the spending waste, and they are, just not as much as other services. Around 54% of health spending waste is caused by unnecessary medical imaging tests, such as MRIs and X-rays, the survey says. Specialty drugs, unnecessary lab tests and specialists referrals are also major money pits.

However, the survey data isn’t suggesting these procedures and treatments shouldn’t be covered by employer health plans. The tests and treatments are potentially life-saving, they’re just used more than they should be. Sometimes previous test results can help with a current diagnosis, but medical staff don’t always check patient files before ordering new tests.

Most employers don’t monitor unnecessary healthcare spending. The 34% of employers who do rely entirely on their healthcare vendors to do it for them, trusting that it’s being taken care of.

“The idea of reducing waste in the healthcare system can be overwhelming,” says Laura Rudder Huff, senior consultant for Benfield. “While employers ask themselves: ‘Where to start?’ this is an issue where even small steps matter. Employers can begin by collecting data to identify where the inefficiencies are in their workforce and community and use assets such as vendors and organizations like coalitions to realize market improvements.”

The survey also recommends employers enlist the services of Choosing Wisely, an organization that counsels patients and employers on healthcare plans and medical treatments.

This article originally appeared in Employee Benefit Adviser.

SOURCE: Webster, K. (7 November 2018) "Healthcare waste is costing billions — and employers aren’t doing anything about it" (Web Blog Post). Retrieved from https://www.benefitnews.com/news/healthcare-waste-is-costing-billions-and-employers-arent-doing-anything-about-it

CenterStage: February is American Heart Month - Are Your Loved Ones Knowledgeable?

Heart disease is the leading cause of death for men and women in the United States. Every year, 1 in 4 deaths are caused by heart disease, according to the American Heart Association.

Talking with your loved ones about heart disease can be awkward, but it’s important. In fact, it could save a life. At the dinner table, in the car, or even via text, have a heart-to-heart with your loved ones about improving heart health as a family. Engaging those you care about in conversations about heart disease prevention can result in heart-healthy behavior changes.

Here are three reasons to talk to the people in your life about heart health and three ways to get the conversation started.

Three Reasons You Should Talk to Your Loved Ones About Heart Health

#1. More than physical health is at risk

Millions of people in the US don’t know that they have high blood pressure. High blood pressure raises the risk for heart attacks, stroke, heart disease, kidney disease and many other health issues. Researchers are learning that having high blood pressure in your late 40s or early 50s can lead to dementia later in life. Encourage family members to be aware of blood pressure levels and monitor them consistently.

#2. Feel Younger Longer

Just as bad living habits can age you prematurely and shorten your lifespan, practicing good heart healthy habits can help you feel younger longer. On average, U.S. adults have hearts that are 7 years older than they should be, according to the Center for Disease Control and Prevention. Just beginning the conversation with the people in your life that you care about can begin to make changes in their heart health.

#3. You Are What You Eat

Even small changes can make a big difference. Prepare healthier versions of your favorite family recipes by making simple ingredient swaps, simply searching the internet is all it usually takes to find an easy ingredient alternative. Find a new

recipe to cook for your family members, or get in the kitchen together and you’ll finish with something delicious and possibly making some new favorite memories as well. When grocery shopping, choose items low in sodium, added sugar, and trans fats, and be sure to stock up on fresh fruits and vegetables.

Three Ways to Start the Conversation

- Encourage family members to make small changes, like using spices to season food instead of salt.

- Motivate your loved ones to incorporate physical activity into every day. Consider a family fitness challenge and compete with each other to see who can achieve the best results.

- Avoid bad habits together. It has been found that smokers are twice as likely to quit if they have a support system. This applies to practicing healthier practices as well. Set goals and start by making small, positive changes, chances are they may have a big difference.

The key to heart health is a healthy lifestyle. It’s important to try to let go of bad habits that increase your risk of heart disease. By setting small, achievable goals and tracking those goals, you can possibly extend your life expectancy a little bit each day.

Heart disease can be prevented by making healthy choices and consciously monitoring health conditions. Making healthy choices a topic of conversation with your family and loved ones is a great way to open the door to healthier practices in all walks of life.

Download the PDF

SaveSaveSaveSaveSaveSave

Health Resolutions You Can Stick To In 2018

We ask the experts which resolutions we should be making this year, and how we can actually stick to them.

Whether it's giving up smoking, exercising more, or getting our 5-a-day, most of us have usually given up before January ends.

But with a little help from the pros, you can live a happier, healthier life in 2018...

1. Drink more water

Health and fitness mentor Sarah-Anne Lucas (birdonabike.co.uk) says starting a daily ritual is the answer to New Year resolutions. She suggests drinking more water: "Water intake is massive. Most people do not drink enough, but what we'd all like is more energy. That comes down to what you put in, so increase your water intake. It's the first thing you put in your body in the morning. Go and get yourself a minimum of 100ml water and get it into you. To progress that practice, add lemon, to make the body alkaline. Lemon water is amazing, it also adds a bit of flavour."

2. Learn to meditate

Life-coach and mindfulness practitioner Dr Caroline Hough (aspiring2wellness.com) says we can train our minds to reduce stress, making us more likely to achieve our goals: "It involves sitting and meditating for 20 minutes. Bring yourself into the moment and be aware. That's an awareness of your external environment, so just looking at the flowers and the trees and the sunshine and appreciating it instead of rushing through life. Be aware of your internal environment, by noticing if you're very stressed, for example if you're clenching your muscles. We tend to live our lives at a level of stress which is unhealthy."

3. Start self-watching

Professor Jim McKenna, head of the Active Lifestyles Research Centre at Leeds Beckett University, advises we record our successes to motivate ourselves: "Whatever you want to do, whenever you achieve, write it down. You're trying to achieve it every day, so it needs to be nice and small, and all your job is then is to keep the sequence running. It's really as simple as that. What you're capitalising on there is positive self-regard, but also the fundamental process of self-watching. There's a lot of success in seeing your own achievements. When you collect all that up, you can start saying, 'Actually I've got nearly 10 occasions there when I did well, I'm doing well, I'm someone who can change'."

4. Look after your skin

Louise Thomas-Minns (uandyourskin.co.uk), celebrity skin therapist, recommends we pay more attention to protecting and caring for our skin: "Wash your skin nightly. Not removing make-up, daily dirt, oil, grime and pollutants from the skin every night will result in infections and outbreaks. Your skin regenerates at night too, so give it a helping hand. And don't pick! Picking at your skin will result in scarring and create more spotty outbreaks. Wear SPF every day to slow ageing and protect from the harmful effects of UV rays. Find out your skin type from a skin health expert, so you stop wasting time and money on incorrect products."

Read the original article.

Source:

Go Active (6 December 2017). "Health Resolutions You Can Stick To In 2018" [Web blog post]. Retrieved from address https://www.goactiveincumbria.com/get-started/other/article/Health-Resolutions-You-Can-Stick-To-In-2018-e9f9d40d-ca39-48ed-be2e-b2f88f4061eb-ds

SaveSave

SaveSave

5 Health Care Terms You Need to Know

We talk about health care A TON, but sometimes it's good to refer back to the basics of it all. Do you understand the meaning of deductible, premium or HSA? If so, give yourself a pat on the back. If not, don't worry! This blog post has got you covered.

Health care is confusing, but one thing's for certain: It's expensive. And health insurance companies don't always make it easy to understand what's covered, what's not, and how much you'll be on the hook for paying.

Deductible: The amount you pay before your insurance coverage kicks in. It resets annually.

Copay: The amount you pay after you have met your deductible. It's a fixed price for services and medications, and can vary by the type of physician you visit, the class of medication you're taking, and other factors.

Out-of-pocket maximum: The top limit of what you'll spend in a year out of pocket for deductibles and copays.

Premium: Your monthly fee for health insurance. If your employer provides you coverage, then you probably pay a portion of the premium, while your employer pays the rest. A higher premium may mean a lower deductible; on the other hand, a lower premium may mean a higher deductible.

Health savings account (HSA): A type of pre-tax savings account for health expenses. Funds roll over year to year, and some accounts even gain interest.

You can read the original article here.

Source:

Health.com (4 April 2017). "5 Health Care Terms You Need to Know" [Web blog post]. Retrieved from address https://www.health.com/mind-body/healthcare-terms-coinage

Despite Boost In Social Security, Rising Medicare Part B Costs Leave Seniors In Bind

How are the rising costs of Medicare Part B affecting Seniors? Don't be left in the dark. Find out more in this article.

Millions of seniors will soon be notified that Medicare premiums for physicians’ services are rising and likely to consume most of the cost-of-living adjustment they’ll receive next year from Social Security.

Higher 2018 premiums for Medicare Part B will hit older adults who’ve been shielded from significant cost increases for several years, including large numbers of low-income individuals who struggle to make ends meet.

“In effect, this means that increases in Social Security benefits will be minimal, for a third year, for many people, putting them in a bind,” said Mary Johnson, Social Security and Medicare policy consultant at the Senior Citizens League. In a new study, her organization estimates that seniors have lost one-third of their buying power since 2000 as Social Security cost-of-living adjustments have flattened and health care and housing costs have soared.

Another, much smaller group of high-income older adults will also face higher Medicare Part B premiums next year because of changes enacted in 2015 federal legislation.

Here’s a look at what’s going on and who’s affected:

The Basics

Medicare Part B is insurance that covers physicians’ services, outpatient care in hospitals and other settings, durable medical equipment such as wheelchairs or oxygen machines, laboratory tests, and some home health care services, among other items. Coverage is optional, but 91 percent of Medicare enrollees — including millions of people with serious disabilities — sign up for the program. (Those who don’t sign up are responsible for charges for these services on their own.)

Premiums, which change annually, represent about 25 percent of Medicare Part B’s expected per-beneficiary program spending. The government pays the remainder.

In fiscal 2017, federal spending for Medicare Part B came to $193 billion. From 2017 to 2024, Part B premiums are projected to rise an average 5.4 percent each year, faster than other parts of Medicare.

‘Hold Harmless’ Provisions

To protect seniors living on fixed incomes, a “hold harmless” provision in federal law prohibits Medicare from raising Part B premiums if doing so would end up reducing an individual’s Social Security benefits.

This provision applies to about 70 percent of people enrolled in Part B. Included are seniors who’ve been enrolled in Medicare for most of the past year and whose Part B premiums are automatically deducted from their Social Security checks.

Excluded are seniors who are newly enrolled in Medicare or those dually enrolled in Medicaid or enrolled in Medicare Savings Programs. (Under this circumstance, Medicaid, a joint federal-state program, pays Part B premiums.) Also excluded are older adults with high incomes who pay more for Part B because of Income-Related Monthly Adjustments (see more on this below).

Recent Experience

Since there was no cost-of-living adjustment for Social Security in 2016, Part B monthly premiums didn’t go up that year for seniors covered by hold harmless provisions. Instead, premiums for this group remained flat at $104.90 — where they’ve been for the previous three years.

Last year, Social Security gave recipients a tiny 0.3 percent cost-of-living increase. As a result, average 2017 Part B month premiums rose slightly, to $109, for seniors in the hold harmless group. The 2017 monthly premium average, paid by those who weren’t in this group and who therefore pay full freight, was $134.

Current Situation

Social Security is due to announce cost-of-living adjustments for 2018 in mid-October. Based on the best information available, it appears to be considering an adjustment of about 2.2 percent, according to Juliette Cubanski, associate director of the program on Medicare policy at the Kaiser Family Foundation. (Kaiser Health News is another, independent program of the Kaiser Family Foundation.)

Apply a 2.2 percent adjustment to the average $1,360 monthly check received by Social Security recipients and they’d get an extra $29.92 in monthly payments.

For their part, the board of trustees of Medicare have indicated that Part B monthly premiums are likely to remain stable at about $134 a month next year. (Actual premium amounts should be disclosed by the Centers for Medicare & Medicaid Services within the next four to six weeks.)

Medicare has the right to impose that charge, so long as the amount that seniors receive from Social Security isn’t reduced in the process. So, the program is expected to ask older adults who paid $109 this year to pay $134 for Part B coverage next year — an increase of $25 a month.

Subtract that extra $25 charge for Part B premiums from seniors’ average $29.92 monthly Social Security increase and all that be left would be an extra $4.92 each month for expenses such as food, housing, medication and transportation.

“Many seniors are going to be disappointed,” said Lisa Swirsky, a policy adviser at the National Committee to Preserve Social Security and Medicare.

Higher Income Brackets

Under the principle that those who have more can afford to pay more, Part B premium surcharges for higher-income Medicare beneficiaries have been in place since 2007. These Income-Related Monthly Adjustment Amounts (IMRAA) surcharges vary, depending on the income bracket that individuals and married couples are in. Nearly 3 million Medicare members paid the surcharges in 2015.

For the past decade this is how surcharges have worked:

Bracket One: Individuals with incomes of $85,001 to $107,000 were charged 35 percent of Part B per-beneficiary costs, resulting in 2017 premiums of $187.50.

Bracket Two: Incomes of $107,001 to $160,000 were charged 50 percent, resulting in 2017 premiums of $267.90.

Bracket Three: Incomes of $160,001 to $214,000 were charged 65 percent, resulting in 2017 premiums of $348.30

Bracket Four: Incomes of more than $214,000 were charged 80 percent, resulting in 2017 premiums of $428.60.

(Information for married couples who file jointly can be found here.)

Now, under legislation passed in 2015, brackets two, three and four are adopting lower income thresholds, a move that could raise premiums for hundreds of thousands of seniors. Bracket two will now consist of individuals with incomes of $107,001 to $133,500; bracket three will consist of individuals making $133,501 to 160,000; and bracket four will include individuals making more than $160,000. (Thresholds for couples have been altered as well.)

As John Grobe, president of Federal Career Experts, a consulting firm, noted in a blog post, this change “will add another layer of complexity” to higher-income individuals’ decisions regarding “electing Part B.”

You can read the original article here.

Source:

Graham J. (5 October 2017). "Despite Boost In Social Security, Rising Medicare Part B Costs Leave Seniors In Bind" [web blog post]. Retrieved from address https://khn.org/news/despite-boost-in-social-security-rising-medicare-part-b-costs-leave-seniors-in-bind/

The Medicare Part D Prescription Drug Benefit

Below we have an article from the Kaiser Family Foundation providing detailed information and graphics on the benefit of the Medicare Prescription Drug Plan.

You can read the original article here.

Medicare Part D is a voluntary outpatient prescription drug benefit for people on Medicare that went into effect in 2006. All 59 million people on Medicare, including those ages 65 and older and those under age 65 with permanent disabilities, have access to the Part D drug benefit through private plans approved by the federal government; in 2017, more than 42 million Medicare beneficiaries are enrolled in Medicare Part D plans. During the Medicare Part D open enrollment period, which runs from October 15 to December 7 each year, beneficiaries can choose to enroll in either stand-alone prescription drug plans (PDPs) to supplement traditional Medicare or Medicare Advantage prescription drug (MA-PD) plans (mainly HMOs and PPOs) that cover all Medicare benefits including drugs. Beneficiaries with low incomes and modest assets are eligible for assistance with Part D plan premiums and cost sharing. This fact sheet provides an overview of the Medicare Part D program and information about 2018 plan offerings, based on data from the Centers for Medicare & Medicaid Services (CMS) and other sources.

Medicare Prescription Drug Plan Availability in 2018

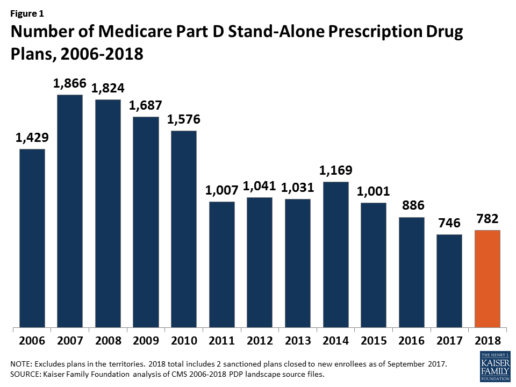

In 2018, 782 PDPs will be offered across the 34 PDP regions nationwide (excluding the territories). This represents an increase of 36 PDPs, or 5%, since 2017, but a reduction of 104 plans, or 12%, since 2016 (Figure 1).

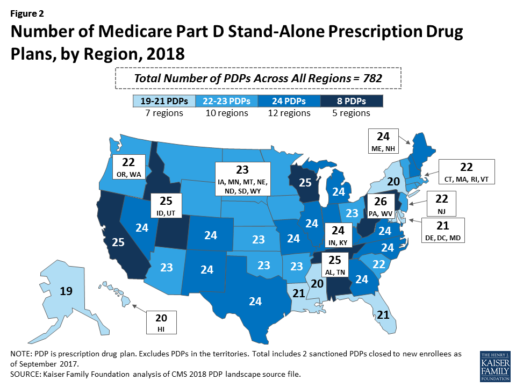

Beneficiaries in each state will continue to have a choice of multiple stand-alone PDPs in 2018, ranging from 19 PDPs in Alaska to 26 PDPs in Pennsylvania/West Virginia (in addition to multiple MA-PD plans offered at the local level) (Figure 2).

Low-Income Subsidy Plan Availability in 2018

Through the Part D Low-Income Subsidy (LIS) program, additional premium and cost-sharing assistance is available for Part D enrollees with low incomes (less than 150% of poverty, or $18,090 for individuals/$24,360 for married couples in 2017) and modest assets (less than $13,820 for individuals/$27,600 for couples in 2017).1

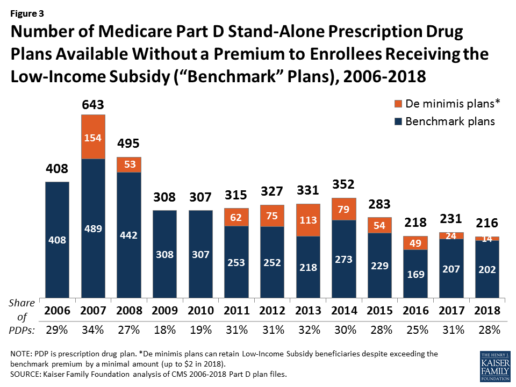

In 2018, 216 plans will be available for enrollment of LIS beneficiaries for no premium, a 6% decrease in premium-free (“benchmark”) plans from 2017 and the lowest number of benchmark plans available since the start of the Part D program in 2006. Roughly 3 in 10 PDPs in 2018 (28%) are benchmark plans (Figure 3).

Low-Income Subsidy Plan Availability in 2018

Through the Part D Low-Income Subsidy (LIS) program, additional premium and cost-sharing assistance is available for Part D enrollees with low incomes (less than 150% of poverty, or $18,090 for individuals/$24,360 for married couples in 2017) and modest assets (less than $13,820 for individuals/$27,600 for couples in 2017).1

In 2018, 216 plans will be available for enrollment of LIS beneficiaries for no premium, a 6% decrease in premium-free (“benchmark”) plans from 2017 and the lowest number of benchmark plans available since the start of the Part D program in 2006. Roughly 3 in 10 PDPs in 2018 (28%) are benchmark plans (Figure 3).

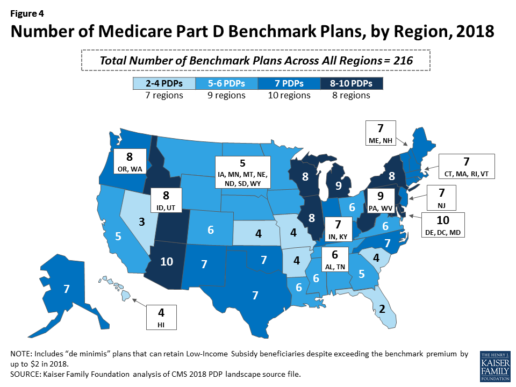

Benchmark plan availability varies at the Part D region level, with most regions seeing a reduction of 1 benchmark plan for 2018 (Figure 4). The number of premium-free plans in 2018 ranges from a low of 2 plans in Florida to 10 plans in Arizona and Delaware/Maryland/Washington D.C.

Part D Plan Premiums and Benefits in 2018

Premiums. According to CMS, the 2018 Part D base beneficiary premium is $35.02, a modest decline of 2% from 2017.2 Actual (unweighted) PDP monthly premiums for 2018 vary across plans and regions, ranging from a low of $12.60 for a PDP available in 12 out of 34 regions to a high of $197 for a PDP in Texas.

Part D enrollees with higher incomes ($85,000/individual; $170,000/couple) pay an income-related monthly premium surcharge, ranging from $13.00 to $74.80 in 2018 (depending on their income level), in addition to the monthly premium for their specific plan.3 According to CMS projections, an estimated 3.3 million Part D enrollees (7%) will pay income-related Part D premiums in 2018.

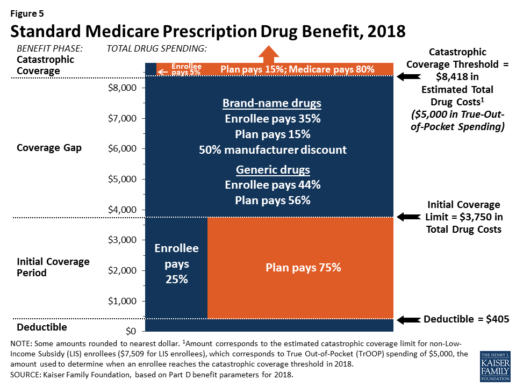

Benefits. In 2018, the Part D standard benefit has a $405 deductible and 25% coinsurance up to an initial coverage limit of $3,750 in total drug costs, followed by a coverage gap. During the gap, enrollees are responsible for a larger share of their total drug costs than in the initial coverage period, until their total out-of-pocket spending in 2018 reaches $5,000 (Figure 5).

After enrollees reach the catastrophic coverage threshold, Medicare pays for most (80%) of their drug costs, plans pay 15%, and enrollees pay either 5% of total drug costs or $3.35/$8.35 for each generic and brand-name drug, respectively.

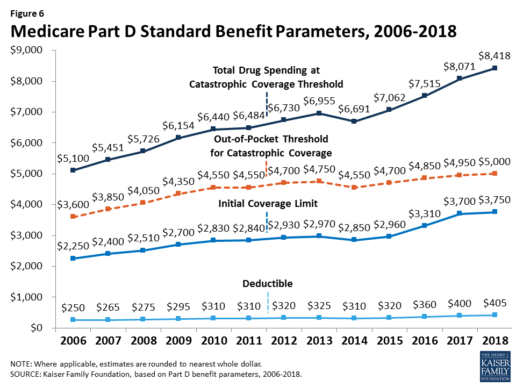

The standard benefit amounts are indexed to change annually by rate of Part D per capita spending growth, and, with the exception of 2014, have increased each year since 2006 (Figure 6).

Part D plans must offer either the defined standard benefit or an alternative equal in value (“actuarially equivalent”), and can also provide enhanced benefits. But plans can (and do) vary in terms of their specific benefit design, cost-sharing amounts, utilization management tools (i.e., prior authorization, quantity limits, and step therapy), and formularies (i.e., covered drugs). Plan formularies must include drug classes covering all disease states, and a minimum of two chemically distinct drugs in each class. Part D plans are required to cover all drugs in six so-called “protected” classes: immunosuppressants, antidepressants, antipsychotics, anticonvulsants, antiretrovirals, and antineoplastics.

In 2018, almost half (46%) of plans will offer basic Part D benefits (although no plans will offer the defined standard benefit), while 54% will offer enhanced benefits, similar to 2017. Most PDPs (63%) will charge a deductible, with 52% of all PDPs charging the full amount ($405). Most plans have shifted to charging tiered copayments or varying coinsurance amounts for covered drugs rather than a uniform 25% coinsurance rate, and a substantial majority of PDPs use specialty tiers for high-cost medications. Two-thirds of PDPs (65%) will not offer additional gap coverage in 2018 beyond what is required under the standard benefit. Additional gap coverage, when offered, has been typically limited to generic drugs only (not brands).

The 2010 Affordable Care Act gradually lowers out-of-pocket costs in the coverage gap by providing enrollees with a 50% manufacturer discount on the total cost of their brand-name drugs filled in the gap and additional plan payments for brands and generics. In 2018, Part D enrollees in plans with no additional gap coverage will pay 35% of the total cost of brands and 44% of the total cost of generics in the gap until they reach the catastrophic coverage threshold. Medicare will phase in additional subsidies for brands and generic drugs, ultimately reducing the beneficiary coinsurance rate in the gap to 25% by 2020.

Part D and Low-Income Subsidy Enrollment

Enrollment in Medicare drug plans is voluntary, with the exception of beneficiaries who are dually eligible for both Medicare and Medicaid and certain other low-income beneficiaries who are automatically enrolled in a PDP if they do not choose a plan on their own. Unless beneficiaries have drug coverage from another source that is at least as good as standard Part D coverage (“creditable coverage”), they face a penalty equal to 1% of the national average premium for each month they delay enrollment.

In 2017, more than 42 million Medicare beneficiaries are enrolled in Medicare Part D plans, including employer-only group plans.4 Of this total, 6 in 10 (60%) are enrolled in stand-alone PDPs and 4 in 10 (40%) are enrolled in Medicare Advantage drug plans. Medicare’s actuaries estimate that around 2 million other beneficiaries in 2017 have drug coverage through employer-sponsored retiree plans where the employer receives subsidies equal to 28% of drug expenses between $405 and $8,350 per retiree in 2018 (up from $400 and $8,250 in 2017).5 Several million beneficiaries are estimated to have other sources of drug coverage, including employer plans for active workers, FEHBP, TRICARE, and Veterans Affairs (VA). Yet an estimated 12% of Medicare beneficiaries lack creditable drug coverage.

Twelve million Part D enrollees are currently receiving the Low-Income Subsidy. Beneficiaries who are dually eligible, QMBs, SLMBs, QIs, and SSI-onlys automatically qualify for the additional assistance, and Medicare automatically enrolls them into PDPs with premiums at or below the regional average (the Low-Income Subsidy benchmark) if they do not choose a plan on their own. Other beneficiaries are subject to both an income and asset test and need to apply for the Low-Income Subsidy through either the Social Security Administration or Medicaid.

Part D Spending and Financing in 2018

The Congressional Budget Office (CBO) estimates that spending on Part D benefits will total $92 billion in 2018, representing 15.5% of net Medicare outlays in 2018 (net of offsetting receipts from premiums and state transfers). Part D spending depends on several factors, including the number of Part D enrollees, their health status and drug use, the number of enrollees receiving the Low-Income Subsidy, and plans’ ability to negotiate discounts (rebates) with drug companies and preferred pricing arrangements with pharmacies, and manage use (e.g., promoting use of generic drugs, prior authorization, step therapy, quantity limits, and mail order). Federal law prohibits the Secretary of Health and Human Services from interfering in drug price negotiations between Part D plan sponsors and drug manufacturers.6

Financing for Part D comes from general revenues (78%), beneficiary premiums (13%), and state contributions (9%). The monthly premium paid by enrollees is set to cover 25.5% of the cost of standard drug coverage. Medicare subsidizes the remaining 74.5%, based on bids submitted by plans for their expected benefit payments. Part D enrollees with higher incomes ($85,000/individual; $170,000/couple) pay a greater share of standard Part D costs, ranging from 35% to 80%, depending on income.

According to Medicare’s actuaries, in 2018, Part D plans are projected to receive average annual direct subsidy payments of $353 per enrollee overall and $2,353 for enrollees receiving the LIS; employers are expected to receive, on average, $623 for retirees in employer-subsidy plans.7 Part D plans’ potential total losses or gains are limited by risk-sharing arrangements with the federal government (“risk corridors”). Plans also receive additional risk-adjusted payments based on the health status of their enrollees and reinsurance payments for very high-cost enrollees.

Under reinsurance, Medicare subsidizes 80% of drug spending incurred by Part D enrollees above the catastrophic coverage threshold. In 2018, average reinsurance payments per enrollee are estimated to be $941; this represents a 7% increase from 2017. Medicare’s reinsurance payments to plans have represented a growing share of total Part D spending, increasing from 16% in 2007 to an estimated 41% in 2018.8 This is due in part to a growing number of Part D enrollees with spending above the catastrophic threshold, resulting from several factors, including the introduction of high-cost specialty drugs, increases in the cost of prescriptions, and a change made by the ACA to count the 50% manufacturer discount in enrollees’ out-of-pocket spending that qualifies them for catastrophic coverage. Analysis from MedPAC also suggests that in recent years, plans have underestimated their enrollees’ expected costs above the catastrophic coverage threshold, resulting in higher reinsurance payments from Medicare to plans over time.

Issues for the Future

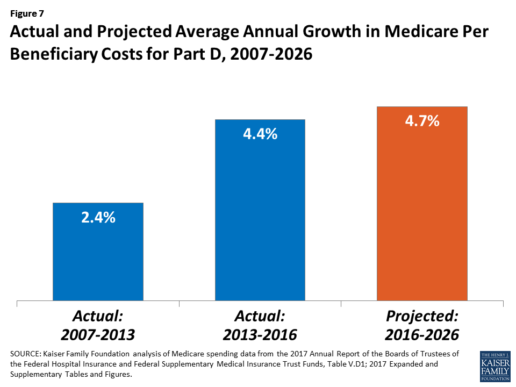

After several years of relatively low growth in prescription drug spending, spending has risen more steeply since 2013. The average annual rate of growth in Part D costs per beneficiary was 2.4% between 2007 and 2013, but it increased to 4.4% between 2013 and 2016, and is projected to increase by 4.7% between 2016 and 2026

(Figure 7).9

Medicare’s actuaries have projected that the Part D per capita growth rate will be comparatively higher in the coming years than in the program’s initial years due to higher costs associated with expensive specialty drugs, which is expected to be reflected in higher reinsurance payments to plans. Between 2017 and 2027, spending on Part D benefits is projected to increase from 15.9% to 17.5% of total Medicare spending (net of offsetting receipts).10 Understanding whether and to what extent private plans are able to negotiate price discounts and rebates will be an important part of ongoing efforts to assess how well plans are able to contain rising drug costs. However, drug-specific rebate information is not disclosed by CMS.

The Medicare drug benefit helps to reduce out-of-pocket drug spending for enrollees, which is especially important to those with modest incomes or very high drug costs. Closing the coverage gap by 2020 will bring additional relief to millions of enrollees with high costs. But with drug spending on the rise and more plans charging coinsurance rather than flat copayments for covered brand-name drugs, enrollees could face higher out-of-pocket costs for their Part D coverage. These trends highlight the importance of comparing plans during the annual enrollment period. Research shows, however, that relatively few people on Medicare have used the annual opportunity to switch Part D plans voluntarily—even though those who do switch often lower their out-of-pocket costs as a result of changing plans.

Understanding how well Part D is working and how well it is meeting the needs of people on Medicare will be informed by ongoing monitoring of the Part D plan marketplace and plan enrollment; assessing coverage and costs for high-cost biologics and other specialty drugs; exploring the relationship between Part D spending and spending on other Medicare-covered services; and evaluating the impact of the drug benefit on Medicare beneficiaries’ out-of-pocket spending and health outcomes.

Endnotes

- Poverty and resource levels for 2018 are not yet available (as of September 2017).

- The base beneficiary premium is equal to the product of the beneficiary premium percentage and the national average monthly bid amount (which is an enrollment-weighted average of bids submitted by both PDPs and MA-PD plans). Centers for Medicare & Medicaid Services, “Annual Release of Part D National Average Bid Amount and Other Part C & D Bid Information,” July 31, 2017, available at https://www.cms.gov/Medicare/Health-Plans/MedicareAdvtgSpecRateStats/Downloads/PartDandMABenchmarks2018.pdf.

- Higher-income Part D enrollees also pay higher monthly Part B premiums.

- Centers for Medicare & Medicaid Services, Medicare Advantage, Cost, PACE, Demo, and Prescription Drug Plan Contract Report – Monthly Summary Report (Data as of August 2017).

- Board of Trustees, 2017 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, Table IV.B7, available at https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/ReportsTrustFunds/Downloads/TR2017.pdf.

- Social Security Act, Section 1860D-11(i).

- 2017 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds; Table IV.B9.

- Kaiser Family Foundation analysis of aggregate Part D reimbursement amounts from Table IV.B10, 2017 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds.

- Kaiser Family Foundation analysis of Part D average per beneficiary costs from Table V.D1, 2017 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds.

- Kaiser Family Foundation analysis of Part D benefits spending as a share of net Medicare outlays (total mandatory and discretionary outlays minus offsetting receipts) from CBO, Medicare-Congressional Budget Office’s June 2017 Baseline.

Read the full article here.

Source:

Kaiser Family Foundation (2 October 2017). “The Medicare Part D Prescription Drug Benefit” [Web Blog Post]. Retrieved from address https://www.kff.org/medicare/fact-sheet/the-medicare-prescription-drug-benefit-fact-sheet/#26740

Absent federal action, states take the lead on curbing drug costs

What's your state's stance on the cost of prescription drugs? See how Maryland has moved forward in their decision making for drug prices, giving themselves the ability to say "no" in this article from Benefits Pro written by Shefali Luthra.

You can read the original article here.

Lawmakers in Maryland are daring to legislate where their federal counterparts have not: As of Oct. 1, the state will be able to say “no” to some pharmaceutical price spikes.

A new law, which focuses on generic and off-patent drugs, empowers the state’s attorney general to step in if a drug’s price climbs 50 percent or more in a single year. The company must justify the hike. If the attorney general still finds the increase unwarranted, he or she can file suit in state court. Manufacturers face a fine of up to $10,000 for price gouging.

As Congress stalls on what voters say is a top health concern — high pharmaceutical costs — states increasingly are tackling the issue. Despite often-fierce industry opposition, a variety of bills are working their way through state governments. California, Nevada and New York are among those joining Maryland in passing legislation meant to undercut skyrocketing drug prices.

Maryland, though, is the first to penalize drugmakers for price hikes. Its law passed May 26 without the governor’s signature.

The state-level momentum raises the possibility that — as happened with hot-button issues such as gay marriage and smoke-free buildings — a patchwork of bills across the country could pave the way for more comprehensive national action. States feel the squeeze of these steep price tags in Medicaid and state employee benefit programs, and that applies pressure to find solutions.

“There is a noticeable uptick among state legislatures and state governments in terms of what kind of role states can play in addressing the cost of prescription drugs and access,” said Richard Cauchi, health program director at the National Conference of State Legislatures.

Many experts frame Maryland’s law as a test case that could help define what powers states have and what limits they face in doing battle with the pharmaceutical industry.

The generic-drug industry has already filed a lawsuit to block the law, arguing it’s unconstitutionally vague and an overreach of state powers. A district court is expected to rule soon.

The state-level actions focus on a variety of tactics:

“Transparency bills” would require pharmaceutical companies to detail a drug’s production and advertising costs when they raise prices over certain thresholds. Cost-limit measures would cap drug prices charged by drugmakers to Medicaid or other state-run programs, or limit what the state will pay for drugs. Supply-chain restrictions include regulating the roles of pharmacy benefit managers or limiting a consumer’s out-of-pocket costs.

A New York law on the books since spring allows officials to cap what its Medicaid program will pay for medications. If companies don’t sufficiently discount a drug, a state review will assess whether the price is out of step with medical value.

Maryland’s measure goes further — treating price gouging as a civil offense and taking alleged violators to court.

“It’s a really innovative approach. States are looking at how to replicate it, and how to expand on it,” said Ellen Albritton, a senior policy analyst at the left-leaning Families USA, which has consulted with states including Maryland on such policies.

Lawmakers have introduced similar legislation in states such as Massachusetts, Rhode Island, Tennessee and Montana. And in Ohio voters are weighing a ballot initiative in November that would limit what the state pays for prescription drugs in its Medicaid program and other state health plans.

Meanwhile, the California legislature passed a bill earlier in September that would require drugmakers to disclose when they are about to raise a price more than 16 percent over two years and justify the hike. It awaits Democratic Gov. Jerry Brown’s signature.

In June, Nevada lawmakers approved a law similar to California’s but limited to insulin prices. Vermont passed a transparency law in 2016 that would scrutinize up to 15 drugs for which the state spends “significant health care dollars” and prices had climbed by set amounts in recent years.

But states face a steep uphill climb in passing pricing legislation given the deep-pocketed pharmaceutical industry, which can finance strong opposition, whether through lobbying, legal action or advertising campaigns.

Last fall, voters rejected a California initiative that would have capped what the state pays for drugs — much like the Ohio measure under consideration. Industry groups spent more than $100 million to defeat it, putting it among California’s all-time most expensive ballot fights. Ohio’s measure is attracting similar heat, with drug companies outspending opponents about 5-to-1.

States also face policy challenges and limits to their statutory authority, which is why several have focused their efforts on specific parts of the drug-pricing pipeline.

Critics see these tailored initiatives as falling short or opening other loopholes. Requiring companies to report prices past a certain threshold, for example, might encourage them to consistently set prices just below that level.

Maryland’s law is noteworthy because it includes a fine for drugmakers if price increases are deemed excessive — though in the industry that $10,000 fine is likely nominal, suggested Rachel Sachs, an associate law professor at Washington University in St. Louis who researches drug regulations.

This law also doesn’t address the trickier policy question: a drug’s initial price tag, noted Rena Conti, an assistant professor in the University of Chicago who studies pharmaceutical economics.

And its focus on generics means that branded drugs, such as Mylan’s Epi-Pen or Kaleo’s overdose-reversing Evzio, wouldn’t be affected.

Yet there’s a good reason for this, noted Jeremy Greene, a professor of medicine and the history of medicine at Johns Hopkins University who is in favor of Maryland’s law.

Current interpretation of federal patent law suggests that the issues related to the development and affordability of on-patent drugs are under federal jurisdiction, outside the purview of states, he explained.

In Maryland, “the law was drafted narrowly to address specifically a problem we’ve only become aware of in recent years,” he said. That’s the high cost of older, off-patent drugs that face little market competition. “Here’s where the state of Maryland is trying to do something,” he said.

Still, a ruling against the state in the pending court case could have a chilling effect for other states, Sachs said, although it would be unlikely to quash their efforts.

“This is continuing to be a topic of discussion, and a problem for consumers,” said Sachs.

“At some point, some of these laws are going to go into effect — or the federal government is going to do something,” she added.

Kaiser Health News, a nonprofit health newsroom whose stories appear in news outlets nationwide, is an editorially independent part of the Kaiser Family Foundation. KHN’s coverage of prescription drug development, costs and pricing is supported in part by the Laura and John Arnold Foundation.

Source:

Luther S. (29 September 2017). "Absent federal action, states take the lead on curbing drug costs" [Web Blog Post]. Retrieved from address https://www.benefitspro.com/2017/09/29/absent-federal-action-states-take-the-lead-on-curb?page=2

4 Reasons Employers Should Offer Supplemental Life Insurance

Is life insurance included in your employee benefits program? For many employees, their only form of life insurance they have is the basic group life plan provided by an employer. This standard version of life insurance is usually not enough to maintain most employees financial wellness. Supplemental life insurance plans can enhance the standard coverage provided by most employers by providing employee financial security for their futures. While these plans can be a great way to boost an employees financial wellness only about one-half of employers across the nation offer supplemental life insurance with their employee benefits. Take a look at this great list put together by Mike Wozny from Think Advisor and find out the top 4 reasons why you should be offering your employees supplemental life insurance.

Depending on an individual family’s needs, supplemental life insurance can build on the employer-provided life insurance benefit, and helps employers give their employees the future financial security their employees need. For those employers who are not currently offering supplemental life, here are four key reasons they should start:

- Many employers can offer employees the financial security of supplemental life insurance without increasing their benefits budget. Because supplemental life insurance is opt-in and chosen by individual employees as appropriate for their situations, employers can offer supplemental life insurance as an option at no additional cost to the employer. Employees can then customize their coverage to their needs depending on their financial responsibilities.

- Many group carriers offer employers help in enrolling employees in supplemental life. Employers can host on-site enrollment sessions lead by a life insurance expert or hold a webinar led by the carrier followed by online enrollment. Many carriers even offer customized enrollment materials for each employee — all without adding to the employer’s human resources teams’ workload.

- Financial security is tied to employees' productivity. The Consumer Financial Protection Bureau has found that when employees have to spend time and energy worrying about providing for their families, they are more productive. Appropriate life insurance is a key factor in overall financial health, and provides employees with the peace of mind that lets them focus their energy elsewhere.

- Comprehensive benefits packages contribute to higher employee satisfaction and retention.The Society for Human Resource Management has also found that benefits offerings are important to employees’ decisions about what companies to work for and how long to stay. Offering a benefits package that includes supplemental life insurance coverage allows employees to customize benefits to their own needs.

With the loss of a loved one, many families also lose their income, which can be not only emotionally devastating, but financially devastating as well. When employers offer a complete benefits package, including one that promotes financial wellness, it gives their employees peace of mind, and helps attract and retain top workers.

Though life insurance is rarely a topic that families want to think about, employers can help employees obtain the right amount of insurance to protect their finances by offering supplemental life insurance options. For those employers who are not currently offering these benefits, in many cases they can be added at no expense, with little additional time required to administer them, and at great potential benefit to both the company and its employees.

See the original article Here.

Source:

Wozny M. (2016 October 19). 4 reasons employers should offer supplemental life insurance [Web blog post]. Retrieved from address https://www.thinkadvisor.com/2016/10/19/4-reasons-employers-should-offer-supplemental-life

5 Benefits Communication Mistakes That Kill Employee Satisfaction

Are you using the proper communication channels to inform your employees about their benefits? Take a look at this great article from HR Morning about how to manage to communicate with your employees to keep them satisfied at work by Jared Bilski.

Good benefits communication is more important than the actual benefits you offer – at least when it comes to employee satisfaction.

Proof: When a company with a rich benefits program (i.e., better than industry standard) communicated poorly, just 22% of workers were satisfied with their benefits.

On the other hand, when an employer with a less rich benefits program communicated effectively, 76% of employees were satisfied with the benefits.

These findings come from a Towers Watson WorkUSA study.

At the at the 2017 Mid-Sized Retirement & Healthcare Plan Management Conference in Phoenix, AZ., Julie Adamik, the former head of Employee Benefits Training and Solutions at PETCO, highlighted the five most common benefits communication mistakes that put firms in the former category.

Satisfaction killers

1. The information is boring. Many employees assume that if the info is about benefits, it’s probably boring. As a result, they tend to tune out and miss critical material.

2. The learning styles and preferences of different generations aren’t taken into account. With multiple generations working side-by-side, a one-size-fits-all approach is doomed to fail.

3. The budget is too low. If your company has a $15 million benefits package, you shouldn’t accept upper management’s argument that a $2,500 communication budget should cover it. HR and benefits pros need to take a stand in this area.

4. The language is “too professional.” Assuming that official-sounding language is better than “plain speak” is a common but costly communication mistake.

5. There’s too much information being covered. Cramming everything into a single open enrollment meeting is guaranteed to overwhelm employees.

Cost, wellness, personal issues and care

Employers also need to be wary of relying too heavily on tech when it comes to benefits communication. Even though there are plenty of technological innovations in the world of benefits services and communications, but HR pros should never forget the importance of old-fashioned human interaction.

That’s one of the main takeaways from a recent Health Advocate study that was part of the whitepaper titled “Striking a Healthy Balance: What Employees Really Want Out of Workplace Benefits Communication.”

The study broke down employees’ preferred methods of benefits communications in a number of areas. (Note: Employees could select more than one answer.)

When asked how they preferred to receive health cost & administrative info, the report found:

- 73% of employees said directly with a person by phone

- 69% said via a website/online portal, and

- 56% preferred an in-person conversation.

Regarding their wellness benefits:

- 71% of employees preferred to receive the info through a website/online portal

- 62% said directly with a person by phone, and

- 56% preferred an in-person conversation.

In terms of personal/emotional wellness issues:

- 71% of employees preferred to receive the info directly with a person by phone

- 65% preferred an in-person conversation, and

- 60% would most like to receive the info via a website/online portal.

Finally, when it came to managing chronic conditions:

- 66% of employees preferred to receive the info directly with a person by phone

- 63% would most like to receive the info via a website/online portal, and

- 61% preferred an in-person conversation.

See the original article Here.

Source:

Bilski J. (2017 April 4). 5 benefits communication mistakes that kill employee satisfaction [Web blog post]. Retrieved from address https://www.hrmorning.com/5-benefits-communication-mistakes-that-kill-employee-satisfaction/

Are Healthcare Cost-Shifting Efforts at a Tipping Point?

Are you having trouble controlling your healthcare cost? Take a look at this interesting article from Employee Benefits Advisor on how rising healthcare costs are affecting employers by Bruce Shutan.

With the fate of healthcare reform in limbo, new research suggests employers are moving forward with a host of incremental changes to their health and wellness plans in hopes of curtailing costs on their own.

Kim Buckey, VP of client services at DirectPath, an employee engagement and healthcare compliance technology company, has noticed a slowdown in adoption of high-deductible health plans and cost-shifting strategies that aren’t quite living up to expectations. DirectPath’s 2017 Medical Plan Trends and Observations Report, based on an analysis of about 975 employee benefit health plans, found employers applying creative methods for cost control.

Buckey noted greater use of health savings accounts, wellness incentives, price transparency tools and alternative care options.

Slightly more than half of the employers studied by DirectPath offer a price transparency tool, while another 18% plan to do so in the next three years. Price-comparison services were found to save employees and employers alike an average of $173 and $409, respectively, per procedure.

In an effort to reduce costs and the administrative burden of tracking coverage for dependents, surcharges on spouses who can elect coverage elsewhere soared more than 40% within the past year to $152 per month.

The number of plans that offer wellness incentives rose to 58% from 50% between 2016 and 2017. Rewards included paycheck contributions, plan premium discounts, contributions to HSAs and health reimbursement arrangements and reduced co-pays for office visits. HSAs were far more popular than employee-funded HRAs (67% vs. 15% of employers examined), while employer contributions to HSAs increased nearly 10%.

Barriers to care and cost containment

A separate survey conducted by CEB, a technology company that monitors corporate performance, noted that although as many as one-third of organizations offer telemedicine, more than 55% of employees aren’t even aware of their availability and nearly 60% believe they’re difficult to access.

DirectPath and CEB both found that the average cost of specialty drugs increased by more than 30%. This reflects research conducted by the National Business Group on Health. Nearly one-third of NBGH members said the category was their highest driver of healthcare costs last year.

The pursuit of a panacea for rising group health costs has been meandering. When Buckey’s career began, she recalls how indemnity plans gave way to HMOs and managed care, then HDHPs, consumer-directed plans and private exchanges. “There is no one silver bullet that’s going to solve this problem,” she explains, “and I think employers and their advisers are starting to understand that it’s got to be a combination of things.”

More employers are now realizing that cost-shifting isn’t a viable long-term solution and that “whatever changes are put in place will require a well thought-out, year-round and robust communication plan,” she says.

There’s also a serious need to improve healthcare literacy, with Buckey noting that many employees still struggle to understand basic concepts such as co-pays, deductibles and HSAs. Consequently, she says it’s no wonder why they often “just shut down and do whatever their doctor tells them.

“So I think anything that advisers and brokers can do to support their employers in explaining these plans, or whatever changes they choose to implement,” she continues, will help raise understanding and eventually have a positive influence on behavior change. This, in turn, will help lower employee healthcare costs.”

See the original article Here.

Source:

Shutan B. (2017 April 5). Are healthcare cost-shifting efforts at a tipping point? [Web blog post]. Retrieved from address https://www.employeebenefitadviser.com/news/are-healthcare-cost-shifting-efforts-at-a-tipping-point