3 summer workplace legal issues and how to handle them

Issues such as hiring interns, dress code compliance and handling time off requests can cause legal issues for employers during the summer months. Continue reading this blog post for how to handle these three summer workplace legal issues.

Summer is almost here and with that comes a set of seasonal employment law issues. Top of the list for many employers includes hiring interns, dress code compliance and handling time off requests.

Here’s how employers can navigate any legal issues that may arise.

Summer interns

Employers looking to hire interns to work during the summer season or beyond should know that the U.S. Department of Labor recently changed the criteria to determine if an internship must be paid. In certain circumstances, internships are considered employment subject to federal minimum wage and overtime rules.

Under the previous primary beneficiary test, employers were required to meet all of the six criteria outlined by the DOL for determining whether interns are employees. The new seven-factor test is designed to be more flexible and does not require all factors to be met. Rather, employers are asked to determine the extent to which each factor is met. For example, how clear is it that the intern and the employer understand that the internship is unpaid, and that there is no promise of a paid job at the end of the program? The non-monetary benefits of the intern-employer relationship, such as training, are also taken into consideration.

Though no single factor is deemed determinative, a review of the whole internship program is important to ensure that an intern is not considered an employee under FLSA rules and to avoid any liabilities for misclassification claims.

Companies also should be aware of state laws that may impact internship programs. For example, California, the District of Columbia, Illinois, Maryland and New York consider interns to be employees and offer some protections under various state anti-discrimination and sexual harassment statutes.

All employers should be clear about the scope of their internship opportunities, including expectations for the relationship, anticipated duties and hours, compensation, if any, and whether an intern will become entitled to a paid job at the end of the program.

Summer dress codes

Warmer temperatures mean more casual clothing. This could mean the line between professional and casual dress in the workplace is blurred. The following are some tips when crafting a new or revisiting an existing dress code policy this summer.

If the dress code is new or being revised, the policy should be clearly communicated. Sending a reminder out to employees may be helpful in some workplaces. In all cases, the policy should be unambiguous. List examples to make sure there is no confusion about what is considered appropriate and explain the reasoning behind the policy and the consequences for any violations.

To serve their business or customer needs, companies may apply dress code policies to all employees or to specific departments. They should also make sure the dress code does not have an adverse impact on any religious groups, women, people of color or people with disabilities. Company policies may not violate state or federal anti-discrimination laws. If the policy is likely to have a disparate impact on one or more of these groups, employers should be prepared to show a legitimate business reason for the policy. Also, reasonable accommodations should be provided for employees who request one based on their protected status. For example, reasonable modifications may be required for ethnic, religious or disability reasons.

Finally, failure to consistently enforce a neutral dress code policy or provide reasonable accommodations can expose a company to potential claims. As always, dress codes and any discipline for code violations should be implemented equitably to avoid claims of discrimination.

Time off requests

Summer time tends to prompt an influx of requests for time off. Now is a good time to review policies governing time off, as well as the implementation of those policies to ensure consistency. Written time off policies should explicitly inform employees of the process for handling time off requests and help employers consistently apply the rules.

An ideal policy will explain how much time off employees receive and how that time accrues. It also will include reasonable restrictions on how time off is administered such as requiring advance approval from management, and how to handle scheduling so that business needs and staffing levels are in sync.

Most importantly, time off policies and procedures must not be discriminatory. For instance, if a policy denies time off or permits discipline for an employee who needs to be out of the office on a protected medical leave, the policy could be seen as discriminating against employees with disabilities. Companies should train their managers on how to administer time off requests in a non-discriminatory manner. Employers generally have the right to manage vacation requests, however protected leave available to employees under federal, state and local laws adds another layer of complexity that employers should consider when reviewing time off requests.

To minimize employment issues this summer and all year around: plan ahead, know the relevant employment laws and train managers and supervisors to apply HR best practices consistently throughout the organization.

SOURCE: Starkman, J.; Rochester, A. (23 May 2019) "3 summer workplace legal issues and how to handle them" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/how-employers-can-handle-summer-workplace-legal-issues

Changes are coming to paid leave. Here’s what employers should know

Many states and local governments are enacting their own paid leave policies, making it difficult for employers to navigate employee paid leave. Read this blog post for what employers should know about the coming changes for paid leave.

A growing number of states and local governments are enacting their own paid leave policies. These new changes can be difficult for employers to navigate if they don’t understand the changes that are happening.

Adding to the confusion among employers, paid sick leave and paid family leave are often used interchangeably, when in fact there are some important distinctions. Paid sick leave is for a shorter time frame than paid family leave and allows eligible employees to care for their own or a family member’s health or preventative care. Paid family leave is more extensive and allows eligible employees to care for their own or a family member’s serious health condition, bond with a new child or to relieve family pressures when someone is called to military service.

The best-known type of employee leave is job-protected leave under the Family Medical Leave Act, where employees can request to take family medical leave for their own or a loved one’s illness, or for military caregiver leave. However, leave under FMLA is unpaid, and in most cases, employees may use available PTO or paid leave time in conjunction with family medical leave.

Rules vary by state, which makes it more difficult for multi-state employers to comply. The following is an overview of some new and changing state and local paid leave laws.

Paid sick leave

The states that currently have paid sick leave laws in place are Arizona, California, Connecticut, Maryland, Massachusetts, New Jersey, Oregon, Rhode Island, Vermont and Washington. There are also numerous local and city laws coming into effect across the country.

In New Jersey, the Paid Sick Leave Act was enacted late last year. It applies to all New Jersey businesses regardless of size; however, public employees, per diem healthcare employees and construction workers employed pursuant to a collective bargaining agreement are exempt. As of February 26, New Jersey employees could begin using accrued leave time, and employees who started after the law was enacted are eligible to begin using accrued leave 120 days after their hire dates.

Michigan’s Paid Medical Leave Act requires employers with 50 or more employees to provide paid leave for personal or family needs as of March.

Under Vermont’s paid sick leave law, this January, the number of paid sick leave hours employees may accrue rose from 24 to 40 hours per year.

In San Antonio, a local paid sick leave ordinance passed last year, but it may not take effect this August. The ordinance mirrors one passed in Austin that has been derailed by legal challenges from the state. Employers in these cities should watch these, closely.

Paid family leave

The five states that currently have paid family leave policies are California, New Jersey, Rhode Island, New York, Washington and the District of Columbia.

New York, Washington and D.C. all have updates coming to their existing legislation, and Massachusetts will launch a new paid family program for employers in that state. In New York, the state’s paid family leave program went into effect in 2018 and included up to eight weeks of paid family leave for covered employees. This year, the paid leave time jumps to 10 weeks. Payroll deductions to fund the program also increased.

Washington’s paid family leave program will begin on January 1, 2020, but withholding for the program started on January 1 of this year. The program will include 12 weeks of paid family leave, 12 weeks of paid medical leave. If employees face multiple events in a year, they may be receive up to 16 weeks, and up to 18 weeks if they experience complications during pregnancy.

The paid family leave program in Massachusetts launches on January 1, 2021, with up to 12 weeks of paid leave to care for a family member or new child, 20 weeks of paid leave for personal medical issues and 26 weeks of leave for an emergency related to a family member’s military deployment. Payroll deductions for the program start on July 1.

The Paid Leave Act of Washington, D.C. will launch next year with eight weeks of parental leave to bond with a new child, six weeks of leave to care for an ill family member with a serious health condition and two weeks of medical leave to care for one’s own serious health condition. On July 1, the district will begin collecting taxes from employers, and paid leave benefits will be administered as of July 1, 2020.

Challenging times ahead

An employer must comply with all state and local sick and family leave laws, and ignorance of a law is not a defense. Employers must navigate different state guidelines and requirements for eligibility no matter how complex, including multi-state employers and companies with employees working remotely in different jurisdictions.

These state paid leave programs are funded by taxes, but employers must cover the costs of managing the work of employees who are out on leave. While generous paid leave policies can help employers attract talent, they simply don’t make sense for all companies. For example, it can be difficult for low-margin businesses to manage their workforces effectively when employees can take an extended paid leave.

Not only must employers ensure compliance with state and local rules, but they also must make sure that their sick time, family and parental leave policies are non-discriminatory and consistent with federal laws and regulations. That’s a lot to administer.

Employers should expect to see the changes in paid sick leave and family leave laws to continue. In the meantime, companies should make sure they have the people and internal processes in place right now to track these changes and ensure compliance across the board.

SOURCE: Starkman, J.; Johnson, D. (2 May 2019) "Changes are coming to paid leave. Here’s what employers should know" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/what-employers-need-to-know-about-changing-paid-leave-laws?brief=00000152-14a7-d1cc-a5fa-7cffccf00000

Employers Must Report 2017 and 2018 EEO-1 Pay Data

The Equal Employment Opportunity Commission (EEOC) is requiring that all employers report their pay data, broken down by race, sex and ethnicity, from 2017 and 2018 by September 30. Continue reading this post from the SHRM to learn more.

The Equal Employment Opportunity Commission (EEOC) has announced that employers must report pay data, broken down by race, sex and ethnicity, from 2017 and 2018 payrolls. The pay data reports are due Sept. 30.

Employers had been waiting to learn what pay data they would need to file—if any at all—as litigation on the matter ensued. A federal judge initially ordered the EEOC to collect employee pay data for 2018. The National Women's Law Center (NWLC) and other plaintiffs wanted the EEOC to collect two years of data, as the agency was supposed to under a new regulation before the government halted the collection in 2017.

Judge Tanya Chutkan of the U.S. District Court for the District of Columbia sided with the plaintiffs and gave the EEOC the option of collecting 2017 pay data along with the 2018 information by the Sept. 30 deadline or collecting 2019 pay data during the 2020 reporting period. The EEOC opted to collect the 2017 data.

The agency said it could make the collection portal available to employers by mid-July and would provide information and training to employers prior to that date.

Immediate Steps

"We are awaiting confirmation from the EEOC or the contractor it is hiring to facilitate the pay-data collection on how to lay out the data file for a batch upload," said Alissa Horvitz, an attorney with Roffman Horvitz in McLean, Va.

But employers should take some steps immediately. They should reach out to their subject-matter and technical experts and pull together resources to ensure that the required data components can be captured, analyzed and reported by Sept. 30, said Annette Tyman, an attorney with Seyfarth Shaw in Chicago.

Filing the additional reports will impose unanticipated burdens for HR, IT and legal departments, as well as third-party consultants, she noted. "It is unclear whether any further litigation options will impact the Sept. 30 deadline, and we are instructing employers to assume they must comply."

Employers should keep in mind that they still must submit their 2018 data for Component 1 of the EEO-1 form by May 31, unless they request an extension. Note that the EEOC recently shortened the extension period for employers to report Component 1 data from 30 days to two weeks. So the extension deadline is now June 14.

Component 1 asks for the number of employees who work for the business by job category, race, ethnicity and sex. Component 2 data—which includes hours worked and pay information from employees' W-2 forms by race, ethnicity and sex—is the subject of the legal dispute.

Data Collection

Businesses with at least 100 employees and federal contractors with at least 50 employees and a contract with the federal government of $50,000 or more must file the EEO-1 form. The EEOC uses information about the number of women and minorities companies employ to support civil rights enforcement and analyze employment patterns, according to the agency.

The revised EEO-1 form will require employers to report wage information from Box 1 of the W-2 form and total hours worked for all employees by race, ethnicity and sex within 12 proposed pay bands.

The reported hours worked should show actual hours worked by nonexempt employees and an estimated 20 hours per week for part-time exempt employees and 40 hours per week for full-time exempt employees.

"Filling out the added data in the EEO-1 form will present a large amount of work, especially as there's great potential for human error when populating the significantly expanded form," said Arthur Tacchino, J.D., chief innovation officer at SyncStream Solutions, which provides workplace compliance solutions.

Employers should start looking at their data now and conduct an initial assessment of their systems, said Camille Olson, an attorney with Seyfarth Shaw in Chicago. Identify the systems that house the relevant demographic, pay and hours-worked data and determine how to pull the information together, she said.

Pulling EEO-1 data is much simpler for Component 1, she noted, because it only involves reporting the employer's headcount by race, ethnicity and sex—whereas collecting pay information involves more data points. Additionally, employers may use different vendor systems at different locations, some employees may have only worked for part of the year, and other employees may have been reclassified to exempt or nonexempt.

"Employers may want to inquire with their current vendors—payroll or otherwise—or look for outside vendors that may be able to assist them with this reporting requirement," Tacchino said.

Under some circumstances, employers may be able to seek an exemption (at the EEOC's discretion) if filing the information would cause an undue burden. "Mega employers" may not be able to show an undue burden, but this could be an option for smaller businesses, said Jim Paretti, an attorney with Littler in Washington, D.C. But that will depend on how the parties decide to move forward.

The Court Battle

The EEO-1 form was revised during President Barack Obama's administration to add the Component 2 data, but the pay-data provisions were suspended in 2017 by President Donald Trump's administration. The NWLC challenged the Trump administration's hold on the pay-data collection provisions, and on March 4, Chutkan lifted the stay—meaning the federal government needed to start collecting the information.

On March 18, however, the EEOC opened the portal for employers to submit EEO-1 reports without including the pay-data questions. Chutkan subsequently told the government to come up with a plan.

The EEOC proposed the Sept. 30 deadline for employers to submit Component 2 data, claiming that the agency needed more time to address the associated collection challenges. Furthermore, the EEOC's chief data officer warned that rushing the data collection may yield poor quality data. Even with the additional time, the agency said it would need to spend more than $3 million to hire a contractor to provide the appropriate procedures and systems.

Robin Thurston, an attorney with Democracy Forward and counsel for the plaintiffs, said at an April 16 hearing that the plaintiffs don't want the agency to compromise quality. But they also wanted "sufficient assurances" that the EEOC will collect the data by Sept. 30.

On April 25, Chutkan ordered the government to provide the court and the plaintiffs with periodic updates on the EEOC's progress and to continue collection efforts until a certain threshold of employer responses has been received.

SOURCE: Nagele-Piazza, L. (2 May 2019) "Employers Must Report 2017 and 2018 EEO-1 Pay Data" (Web Blog Post). Retrieved from https://www.shrm.org/resourcesandtools/legal-and-compliance/employment-law/pages/eeo-1-pay-data-report-2017-2018.aspx

Can Employers Require Measles Vaccines?

Can employers require that their employees get the measles vaccine? The recent measles outbreak is raising the question of whether employers can require that their workers get the vaccine. Read this blog post from SHRM to learn more.

The recent measles outbreak, resulting in mandatory vaccinations in parts of New York City, raises the question of whether employers can require that workers get the vaccine to protect against measles, mumps and rubella (MMR) or prove immunity from the illness.

The answer generally is no, but there are exceptions.

Offices and manufacturers probably can't require vaccination or proof of immunity because the Americans with Disabilities Act (ADA) generally prohibits medical examinations—unless the employer is in a location like Williamsburg, the neighborhood in Brooklyn where vaccinations are now mandatory. Health care providers, schools and nursing homes, however, probably can require them because their employees work with patients, children and people with weak immune systems who risk health complications from measles.

But even these employers must try to find accommodations for workers who object to vaccines for a religious reason or because of a disability that puts them at risk if they're vaccinated, such as having a weak immune system.

Proof of Immunity

Proof of immunity includes one of the following:

- Written documentation of adequate vaccination.

- Laboratory evidence of immunity.

- Laboratory confirmation of measles.

- Birth before 1957. The measles vaccine first became available in 1963, so those who were children before the late 1950s are presumed to have been exposed to measles and be immune.

Measles, which is contagious, typically causes a high fever, cough and watery eyes, and then spreads as a rash. Measles can lead to serious health complications, especially among children younger than age 5. One or two out of 1,000 people who contract measles die, according to the U.S. Centers for Disease Control and Prevention.

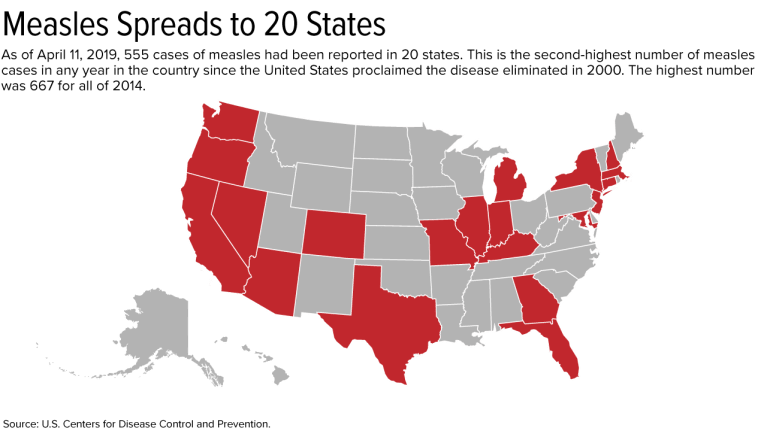

Outbreak Has Spread to 20 States

As of April 11, 555 cases have been reported in the United States this year. This is the second-greatest number in any year since the United States proclaimed measles eliminated in 2000; 667 cases were reported in all of 2014.

On April 9, New York City Mayor Bill de Blasio declared a public health emergency in Williamsburg, requiring the MMR vaccine in that neighborhood. Those who have not received the MMR vaccine or do not have evidence of immunity may be fined $1,000.

Since the outbreak started, 285 cases have been confirmed in Williamsburg, including 21 hospitalizations and five admissions to intensive care units.

If a city requires vaccinations, an employer's case for requiring them is much stronger, said Robin Shea, an attorney with Constangy, Brooks, Smith & Prophete in Winston-Salem, N.C. But employers usually should not involve themselves in employees' health care unless they are making an inquiry related to a voluntary wellness program, or the health issue is job-related, she cautioned.

The measles outbreak has spread this year to 20 states—outbreaks linked to travelers who brought measles to the U.S. from other countries, such as Israel, Ukraine and the Philippines, where there have been large outbreaks.

Strike the Right Balance

Health care employers typically require vaccinations or proof of immunity as a condition of employment, said Howard Mavity, an attorney with Fisher Phillips in Atlanta. He noted that most schoolchildren must be immunized, so many employees can show proof of immunity years later.

If an employee provides current vaccination records when an employer asks, the ADA requires that those records be kept in separate, confidential medical files, noted Meredith Shoop, an attorney with Littler in Cleveland.

All employers must balance their health and safety concerns with the right of employees with disabilities to reasonable accommodations under the ADA and the duty to accommodate religious workers under Title VII of the Civil Rights Act of 1964.

Under the ADA, a reasonable accommodation is required unless it would result in an undue hardship or direct threat to the safety of the employee or the public. The direct-threat analysis will be different for a registered nurse than for someone in a health care provider's billing department, for example, who might not work around patients.

Even if the ADA permitted mandatory vaccines in a manufacturing setting in limited circumstances, such as in Williamsburg now, any vaccination orders may need to be the subject of collective bargaining if the factory is unionized. Shoop has seen manufacturers shut down because employees were reluctant to come to work when their co-workers were sick on the job.

An employer does not have to accommodate someone who objects to a vaccine merely because he or she thinks it might do more harm than good but doesn't have an ADA disability or religious objection, said Kara Shea, an attorney with Butler Snow in Nashville, Tenn.

If someone claims to have a health condition that makes getting vaccinated a health risk, the employer does not have to take the person's word for it. The employer instead should ask the person to sign a consent form allowing the employer to learn about the condition and get documentation from the employee's doctor, she said. Before accommodating someone without an obvious impairment, the ADA allows employers to require medical documentation of the disability.

Courts don't closely scrutinize religious objections to immunizations, Mavity remarked.

"Some people have extremely strong beliefs that they don't want a vaccine in their body," said Kathy Dudley Helms, an attorney with Ogletree Deakins in Columbia, S.C. If the employer works with vulnerable people but can't find an accommodation for a worker who refuses vaccination, the employee may have to work elsewhere, she said.

SOURCE: SHRM (17 April 2019) "Can Employers Require Measles Vaccines?" (Web Blog Post). Retrieved from https://www.shrm.org/resourcesandtools/legal-and-compliance/employment-law/pages/measles-outbreak-2019-vaccinations.aspx

Working interviews: How hiring trend can cause compliance issues

The federal government prefers that companies do not bring in applicants for a working interview and without paying them. Continue reading this blog post to learn how this hiring trend can cause compliance issues for companies.

News flash: The feds don’t like it when you bring in “applicants” for a “working interview” – and then refuse to pay them for the work they perform.

The lesson is going to cost a Nashville dental practice $50,000 after a settlement in federal district court.

The practice will pay $50k in back wages and liquidated damages to 10 employees for FLSA minimum wage, overtime and recordkeeping violations.

According to the DOL’s Wage and Hour Division, Smiley Tooth Spa:

- violated the federal minimum wage requirements by requiring candidates for hire to perform a “working interview” to conclude their application, but failed to pay the individuals for those hours worked

- failed to pay registered dental assistants and hygienists time-and-a-half for hours worked over 40 in a workweek

- authorized their accountant to falsify and alter time and payroll records to make it appear that the employer was paying proper overtime for all hours worked, and

- periodically required employees to attend training during their scheduled lunch breaks without paying them for that time.

THE CARDINAL RULE

Although it’s hard to believe that any employer could think such an approach could fly in this day and age, this case is a good reminder that people who perform duties for the benefit of any organization are, almost universally, entitled to be paid.

Even if they aren’t yet considered an “official” employee, they’re performing the work of one, and must be paid for it.

Some good news: With working interviews, employers don’t necessarily have to pay the position’s advertised salary. The law only says workers must receive at least minimum wage for their work, so companies do have some flexibility.

SOURCE: Cavanaugh, L. (1 March 2019) "Working interviews: How hiring trend can cause compliance issues" (Web Blog Post). Retrieved from https://www.hrmorning.com/working-interviews-how-hiring-trend-can-cause-compliance-issues/

DOL Focuses on ‘Joint Employer’ Definition

On April 1, the U.S. Department of Labor (DOL) announced a proposed rule that narrows the definition of "joint employer" under the Fair Labor Standards Act (FLSA). Read this blog post from SHRM to learn more about this proposed rule.

The U.S. Department of Labor (DOL) announced on April 1 a proposed rule that would narrow the definition of "joint employer" under the Fair Labor Standards Act (FLSA).

The proposed rule would align the FLSA's definition of joint-employer status to be consistent with the National Labor Relations Board's proposed rule and update the DOL's definition, which was adopted more than 60 years ago.

Four-Factor Test

The proposal addresses the circumstances under which businesses can be held jointly responsible for certain wage violations by contractors or franchisees—such as failing to pay minimum wage or overtime. A four-factor test would be used to analyze whether a potential joint employer exercises the power to:

- Hire or fire an employee.

- Supervise and control an employee's work schedules or employment conditions.

- Determine an employee's rate and method of pay.

- Maintain a worker's employment records.

The department's proposal offers guidance on how to apply the test and what additional factors should and shouldn't be considered to determine joint-employer status.

"This proposal would ensure employers and joint employers clearly understand their responsibilities to pay at least the federal minimum wage for all hours worked and overtime for all hours worked over 40 in a workweek," according to the DOL.

In 2017, the department withdrew an interpretation that had been issued by former President Barack Obama's administration that broadly defined "joint employer."

The Obama-era interpretation was expansive and could be taken to apply to many companies based on the nature of their business and relationships with other companies—even when those relationships are not generally understood to create a joint-employment relationship, said Mark Kisicki, an attorney with Ogletree Deakins in Phoenix.

The proposed test aligns with a more modern view of the workplace, said Marty Heller, an attorney with Fisher Phillips in Atlanta. The test is a modified version of the standard that some federal courts already apply, he noted.

Additional Clarity

Significantly, the proposed rule would remove the threat of businesses being deemed joint employers based on the mere possibility that they could exercise control over a worker's employment conditions, Heller said. A business may have the contractual right under a staffing-agency or franchise agreement to exercise control over employment conditions, but that's not the same as doing so.

The proposal focuses on the actual exercise of control, rather than potential (or reserved) but unexercised control, Kisicki explained.

The rule would also clarify that the following factors don't influence the joint-employer analysis:

- Having a franchisor business model.

- Providing a sample employee handbook to a franchisee.

- Allowing an employer to operate a facility on the company's grounds.

- Jointly participating with an employer in an apprenticeship program.

- Offering an association health or retirement plan to an employer or participating in a plan with the employer.

- Requiring a business partner to establish minimum wages and workplace-safety, sexual-harassment-prevention and other policies.

"The proposed changes are designed to reduce uncertainty over joint employer status and clarify for workers who is responsible for their employment protections, promote greater uniformity among court decisions, reduce litigation and encourage innovation in the economy," according to the DOL.

The proposal provides a lot of examples that are important in the #MeToo era, said Tammy McCutchen, an attorney with Littler in Washington, D.C., and the former head of the DOL's Wage and Hour Division under President George W. Bush.

Importantly, companies would not be deemed joint employers simply because they ask or require their business partners to maintain anti-harassment policies, provide safety training or otherwise ensure that their business partners are good corporate citizens, she said.

Review Policies and Practices

Employers and other interested parties will have 60 days to comment on the proposed rule once it is published in the Federal Register. The DOL will review the comments before drafting a final rule—which will be sent to the Office of Management and Budget for review before it is published.

"Now is the time to review the proposal and decide if you want to submit a comment," Heller said. Employers that wish to comment on the proposal may do so by visiting www.regulations.gov.

"Take a look at what's been proposed, look at the examples in the fact sheet and the FAQs," McCutchen said. Employers may want to comment on any aspects of the examples that are confusing or don't address a company's particular circumstances. "Start thinking about your current business relationships and any adjustments that ought to be made," she said, noting that the DOL might make some changes to the rule before it is finalized.

"The proposed rule will not be adopted in the immediate future and will be challenged at various steps by worker-advocacy groups, so it will be quite some time before there is a tested, final rule that employers can safely rely upon," Kisicki said.

SOURCE: Nagele-Piazza, L. (1 April 2019) "DOL Focuses on ‘Joint Employer’ Definition" (Web Blog Post). Retrieved from https://www.shrm.org/resourcesandtools/legal-and-compliance/employment-law/pages/labor-department-seeks-to-revise-joint-employer-rule.aspx

DOL proposes new rule clarifying, updating regular rate of pay

The Department of Labor (DOL) recently released a proposal that defines and updates what forms of payment employers can include and exclude in the time-and-one-half calculation when determining overtime rates. Read this blog post to learn more.

For the first time in 50 years, the Department of Labor has proposed changing the definition of the regular rate of pay.

The proposal, announced Thursday, “defines and updates” what forms of payment employers include and exclude in the time-and-one-half calculation when determining workers’ overtime rates, according to the DOL.

The regulations the DOL is proposing to revise govern how employers must calculate the regular rate and overtime pay rate, including the types of compensation that must be included and may be excluded from the overtime pay calculation, says Tammy McCutchen, a principal at Littler Mendelson and former administrator of the Department of Labor’s Wage and Hour Division.

The regular rate of pay is not just an employee’s hourly rate, she says, but rather includes “all remuneration for employment” — unless specifically excluded by section 7(e) of the FLSA.

Under current rules, employers are discouraged from offering more perks to their employees as it may be unclear whether those perks must be included in the calculation of an employees’ regular rate of pay, the DOL says. The proposed rule focuses primarily on clarifying whether certain kinds of perks, benefits or other miscellaneous items must be included in the regular rate.

The DOL proposes that employers may exclude the following from an employee’s regular rate of pay:

- The cost of providing wellness programs, onsite specialist treatment, gym access and fitness classes and employee discounts on retail goods and services;

- Payments for unused paid leave, including paid sick leave;

- Reimbursed expenses, even if not incurred solely for the employer’s benefit;

- Reimbursed travel expenses that do not exceed the maximum travel reimbursement permitted under the Federal Travel Regulation System regulations and that satisfy other regulatory requirements;

- Discretionary bonuses;

- Benefit plans, including accident, unemployment, and legal services; and

- Tuition programs, such as reimbursement programs or repayment of educational debt.

The proposed rule also includes additional clarification about other forms of compensation, including payment for meal periods and call back pay.

The regulations will benefit employees, primarily, ensuring that employers can continue to provide benefits that employees’ value — tuition reimbursements, student loan repayment, employee discounts, payout of unused paid leave and gym memberships, McCutchen says.

“Remember, there is no law that employers must provide employees these types of benefits,” she adds. “Employers will not provide such benefits if doing so creates risk of massive overtime liability.”

Knowing when employers must pay overtime on these types of benefits, how to calculate the value of those benefits and overtime pay are all difficult questions, she adds. “Unintentional mistakes by good faith employers providing valued benefits to employees is easy. With this proposed rule, the DOL is embracing the philosophy that good deeds should not be punished.”

She notes the proposal does not include any specific examples of what reimbursements may be excluded from the regular rate.

“One big open question is whether employers must pay overtime when they provide employees with subsidies to take public transportation to work — as the federal government does for many of its own employees — I think around $260 per month in the DC Metro area,” she adds.

The DOL earlier this month proposed to increase the salary threshold for overtime eligibility to $35,308 up from the current $23,660. If finalized, the rule would expand overtime eligibility to more than a million additional U.S. workers, far fewer than an Obama administration rule that was struck down by a federal judge in 2017.

Employers are expected to challenge the new rule as well, based on similar complaints of administrative burdens, but a legal challenge might be more difficult to pass this time around.

SOURCE: Otto, N. (28 March 2019) "DOL proposes new rule clarifying, updating regular rate of pay" (Web Blog Post). Retrieved from https://www.benefitnews.com/news/dol-proposes-new-rule-on-regular-rate-of-pay-calculation?brief=00000152-14a5-d1cc-a5fa-7cff48fe0001

7 ways to reduce stress this tax season

Does tax season leave you stressed out? Tax season is here, leaving many employers face-to-face with a number of demands. Continue reading this post from Employee Benefit News for seven ways employers can reduce stress during tax season.

Tax filing season is here, which means many employers will come face-to-face with a number of demands. Whether they do their own taxes, use online tax software or meet with a trusted tax adviser, there are many useful resources out there that will help employers work smarter, not harder.

Here are seven ways employers can reduce stress during tax season.

2019 U.S. Master Tax Guide

The U.S. Master Tax Guide contains timely and precise explanations of federal income taxes for individuals, partnerships and businesses. This guide contains information including tax tables, tax rates, checklists, special tax tables and explanatory text.

Legislative resources

Find a trusted, reputable resource for the latest news, opinions and laws regarding healthcare. Many companies in the industry have a designated section on their website that is dedicated to providing employers with updates and trends in the health insurance industry and how it will affect taxes.

Content Continues Below

Payroll calculators

Employers can use payroll calculators to determine gross pay, withholdings, deductions, net pay after Social Security and Medicare and more. Calculator types include salary payroll calculators, hourly paycheck calculators, gross pay calculators, W-4 assistants, percentage bonus calculators and aggregate bonus calculators.

Keep, shred, toss

Now is the perfect time to organize tax records so that they’re easy to find in case they’re needed to apply for a loan, answer IRS questions or file an amended return.

The IRS has some helpful guidance you can share with your clients on what records to keep and for how long. They should remember to:

- Keep copies of tax returns and supporting documents for at least three years.

- Keep some documents for up to seven years.

- Keep healthcare information statements for at least three years. These include records of employer-provided coverage, premiums paid, advance payments of the premium tax credit received and type of coverage.

Make sure records are kept safe — but when it’s time, shred or destroy

Whether they consist of paper stacked in a shoebox, electronic files stored on a device or in the cloud, it’s important to safeguard all personal records, especially anything that lists Social Security numbers. Consumer Affairs recommends scanning paper and keeping records stored securely on a flash drive, CD or DVD.

It’s more important than ever for employers to keep personal information out of the hands of identity thieves. That means not tossing records in the trash or recycling bin. Home paper shredders are often inadequate for large piles of paper, but many communities have professional, secure document shredding services.

Content Continues Below

Start as early as possible

A deadline looming always makes the situation more stressful. It’s very important for employers to not wait until the last minute to start their tax return. If they choose to use a tax professional, be sure that they get in early. Tax professionals take on many clients, and only have a short timeframe to get all the work done.

Be honest

It may be tempting for employers to tell a white lie on their taxes to maximize their tax breaks or return, but that comes at a great risk. If they are audited by the IRS, they will liable for whatever was reported.

SOURCE: Waletzki, T. (12 March 2019) "7 ways to reduce stress this tax season" (Web Blog Post). Retrieved from https://www.benefitnews.com/list/how-to-reduce-stress-this-tax-season?brief=00000152-14a5-d1cc-a5fa-7cff48fe0001

DOL proposes $35K overtime threshold

Recently, the Department of Labor proposed an increase in the salary threshold for overtime eligibility. The current overtime threshold is set at $23, 660. Continue reading this blog post to learn more about this proposed change.

The Labor Department proposed to increase the salary threshold for overtime eligibility to $35,308 a year, the agency announced late Thursday.

If finalized, the rule’s threshold — up from the current $23,660 — would expand overtime eligibility to more than a million additional U.S. workers, far fewer than an Obama administration rule that was struck down by a federal judge in 2017.

Unless exempt, employees covered by the Fair Labor Standards Act must receive at least time and one-half their regular pay rate for all hours worked over 40 in a workweek.

The proposal doesn’t establish automatic, periodic increases of the salary threshold as the Obama proposal had. Instead, the department is asking the public to weigh in on whether and how the Labor Department might update overtime requirements every four years.

The department’s long-awaited proposal comes after months of speculation from employers and will likely be a target of legal challenges from business groups concerned about rising administrative challenges of the rule. The majority of business groups were critical of Obama’s overtime rule, citing the burdens it placed particularly on small businesses that would be forced to roll out new systems for tracking hours, recordkeeping and reporting.

Labor Secretary Alexander Acosta said in a statement that the new proposal would “bring common sense, consistency, and higher wages to working Americans.”

Under the Obama administration, the Labor Department in 2016 doubled the salary threshold to roughly $47,000, extending mandatory overtime pay to nearly 4 million U.S. employees. But the following year, a federal judge in Texas ruled that the ceiling was set so high that it could sweep in some management workers who are supposed to be exempt from overtime pay protections. Business groups and 21 Republican-led states then sued, challenging the rule.

The Department said it is asking for public comment for periodic review to update the salary threshold.

SOURCE: Mayer, K. (7 March 2019) "DOL proposes $35K overtime threshold" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/news/dol-proposes-35k-overtime-threshold?brief=00000152-1443-d1cc-a5fa-7cfba3c60000

4 FAQs about W-2 business email compromise attacks during tax season

Has your business been a victim of tax season cyber attacks? The most popular time of the year for W-2 related cyber attacks is during tax season. Read this blog post to learn more.

The most likely cyber attack a company will face will come in the form of an email. One of the most common forms of email attack is the business email compromise (BEC), and the most popular time of the year for the W-2 version of BEC is right now — tax season.

A BEC attack involves attackers sending emails disguised as coming from high-level executives within a company, such as the CEO, to lower level personnel. During tax season, the spoof email will often request that W-2s for employees be provided by return email.

While the email looks identical to the executive’s email, it is coming from — and then returned to — the criminal, not the executive, along with the W-2s and the personal information associated with the documents.

If an employee falls for the scam, the company now has experienced a serious data breach and must comply with certain legal requirements. Worse yet, the company’s employees’ sensitive personal information has been given to the attackers and they have this problem to worry about instead of performing their job. The disruption is substantial in their personal lives and for the company’s operations.

How do attackers use W-2 information?

In most cases, once the attackers have that W-2 information, they use it to attempt to file fraudulent tax returns for those employees and have their tax refunds sent to them instead of the employee. They also use it for traditional identity theft.

The attackers act very quickly once the information is obtained. In some cases, they have begun to fraudulently use the information on the same day they obtained the W-2 information from the company. Time is truly of the essence in responding to these attacks and legal assistance is necessary for properly responding to these data breach events.

Why do so many attacks happen during tax season?

Law enforcement officers and cybersecurity professionals report a drastic increase in these types of attacks during the beginning of each year because of tax season. This is consistent with what is seen in helping companies with these cases in past years, as well. The reason this type of attack is so common during tax season is because of the tax-related fraud aspect of this type of attack. That is, the attackers monetize their attacks by using the fraudulently obtained information to file fraudulent tax returns and obtain refunds from innocent victims.

And the sooner they can do this, the better their chances are of getting the refund before the taxpayer files and receives their tax refund.

If a company has not yet been targeted, it is likely that it will be very soon so it is important to be prepared.

What can you do to protect your company?

Educating employees is critical because they will be the ones who receive the emails from the attackers.

- Make them aware of this issue by sharing the information in this article with them so that they understand the threat, how it works and how it could affect them personally.

- Train them by having appropriate personnel discuss this threat with them and help them understand that they should be very suspicious of any requests to email out anything of this nature (or make payments, such as with the very similar wire transfer version of the BEC).

Have appropriate internal controls in place to protect against these types of attacks. These controls can include:

- Limit who has access to your company’s W-2s and other sensitive information as well as who has the authority to submit or approve wire payments.

- Have established procedures in place for sending W-2 information or other sensitive information as well as for submitting or approving wire payments so that dual approvals are required for these activities.

- Require employees to use an alternative means of confirming the identity of the person making the request. If the request is by email, the employee should talk to the requestor in-person or call and speak to the requestor using a known telephone number to get verbal confirmation. If the request is by telephone or fax (many times they are), then use email to confirm by using an email address known to be correct to confirm with the purported requestor. Never reply to one of these emails or call using a telephone number that is provided in one of these emails, faxes, or telephone calls.

What to do if your company is hit by an attack

- Immediately contact experienced legal counsel who understands how to guide a company through these incidents and, ideally, has appropriate contacts with law enforcement and the IRS to assist in reporting this incident quickly.

- Report the incident to the FBI or Secret Service and appropriate IRS investigators so that the IRS can implement appropriate procedures to protect the employees whose information was exposed in the W-2s.

- Prepare appropriate notifications to the people whose information was exposed and comply with all legal and regulatory reporting requirements. This should be a part of an existing incident response plan. Companies should have such a procedure in place to be better prepared if and when a security breach occurs.

- Inform employees that the IRS will never contact them directly, for the first time, via email, telephone, text message, social media or any way other than through a written “snail mail” letter.

SOURCE: Tuma, S. (19 February 2019) "4 FAQs about W-2 business email compromise attacks during tax season" (Web Blog Post). Retrieved from https://www.benefitspro.com/2019/02/19/4-faqs-about-w-2-business-email-compromise-attacks-during-tax-season/