Recruiting in the Tight(est) of Labor Markets

Are you struggling to attract top talent? Recruiters are left searching for ways to recruit top talent in a seemingly shrinking talent pool. Read on for tips on recruiting in the tightest of labor markets.

The Job Market in 2019 is drastically different than the one we all became accustomed to for so many years. The unemployment rate is two percent for college graduates, and an even tighter market in the growth areas of Digital Strategy and Data. The result is more and more companies going after a seemingly shrinking talent pool of available candidates. What is a Recruiter to do?

Develop a Relationship

Enter into the mindset that everyone is a (passive) candidate, not just anyone that responds to your job post on Indeed or Linkedin. I find that the right passive candidate is very responsive to the inquiry along the lines of “you have an exceptional background, would you have 10/15 minutes for an informational call so we could learn more about you and tell you our story?” This accomplishes two things: the potential candidate’s defenses come down so they can’t say they are not in the market, and it develops a consultative relationship between organization and candidate. Now you can start to develop a robust candidate bench!

Tell Your Story

Today’s Candidate, especially those in the millennial generation, aren’t motivated solely by salary, but by the type of work they are doing. Is it innovative, is the workplace diverse (and is that reflected in the organization’s leadership), what is the organization’s standing in their industry and what is their social impact in the community? How is the organization viewed on Glassdoor and other workplace review websites? Develop a strategic plan bringing out the value of your organization, with an emphasis on your employees, and have a vision for your future. It’s mandatory in 2019 that a corporation has to be storytellers, using Video and Social Media, and that story has to be a compelling message to bring in the right candidates. Today’s workplace culture is not a “Grind it out” until retirement, it’s one focused on doing great work and being personally fulfilled.

Employee Growth

Identify multiple successful employee ambassadors throughout your organization that a candidate can speak with before going forward. Think of these conversations as positive interactions of transparency, more fact-finding for both parties and less “selling” the organization, the most sought after candidate pool is also the most sales-resistant. These ambassadors can also help report back to hiring managers their own honest feedback of the candidate and how they would fit into your unique culture. Finally, have clear examples of employee growth throughout the organization, and not always through title. It could be a successful cross-departmental project that an employee led, or skills acquired that made them the SME in the organization. Genuine accomplishment and fulfillment will always resonate more than financial metrics to your key candidate. EQ should be just as valued as IQ in finding the right hire!

SOURCE: McKinley, C. (17 January 2019) "Recruiting in the Tight(est) of Labor Markets" (Web Blog Post). Retrieved from https://blog.shrm.org/blog/recruiting-in-the-tightest-of-labor-markets

4 ways to help employees master their HDHPs in 2019

Now is a great time to help your employees better understand their High Deductible Health Plans (HDHP) for 2019. Continue reading this blog post for steps HR can take to help employees stay on the right track.

As 2018 draws to a close, it’s a great time to give HDHP veterans and newbies at your company some help understanding — and squeezing more value out of — their plans in 2019.

Here are four simple steps your HR team can take over the next few months to put employees on the right track.

1. Post a jargon-free FAQ page on your intranet

When: Two weeks before your new plan year begins

Keep your FAQ at ten questions (and answers!), maximum. Otherwise, your employees can get overwhelmed by their health plans and by the FAQ.

When writing up the answers, pretend you’re talking directly to an employee who doesn’t know any of the insurance jargon you do. Keep it simple, straightforward, and free of insurance gobbledegook.

[Image credit: Bloomberg]

Make sure your questions reflect the concerns of different employee types: Millennials who haven’t had insurance before, older employees behind on retirement, employees about to have a new kid, etc. To get a clear sense of these concerns, invite a diverse group of 5-7 employees out for coffee and ask them.

Some sample questions for your FAQ might be:

• Is an HSA different from an FSA?

• Do I have to open an HSA?

• How much money should I put in my HSA?

• This plan looks way more expensive than my PPO. What gives?

2. Send a reminder email about setting up an HSA and/or choosing a monthly contribution amount

When: The first week of the new plan year

When your employees don’t take advantage of their HSA not only do they miss out on low-hanging tax savings, your company misses out on payroll tax savings, too.

So right at the start of the new year, send an email that explains why it’s important to set up a contribution amount right away.

A few reasons why it’s really important to do this:

- You can’t use any HSA funds until your account is fully set up and you’ve chosen how much you’re going to contribute.

- If you pay for any healthcare at all next year, and don’t contribute to your HSA, you’re doing it wrong. Why? You don’t pay taxes on any of the money you put into your HSA and then spend on eligible health care…which puts real money back in your pocket. (Last year, the average HSA user contributed about $70 every two weeks and saved $267 in taxes as a result!)

- There’s no “use it or lose it” rule! Any money you put into your HSA this year is yours to use for medical expenses the rest of your life. And once you turn 65, you can use it for anything at all. A Mediterranean cruise. A life-size Build-a-Bear. You name it!

3. Give your HDHP newbies tips on navigating their first visit to the doctor and pharmacy

When: The week insurance cards are mailed out

When employees who are used to PPO-style co-pays realize they have to pay more upfront with their HDHP, they can get…cranky. And start to doubt their plan choice — or worse, you as their employer choice.

So set expectations ahead of time to avoid employee sticker shock and to prevent you from getting an earful. Specifically, remind employees which types of visits are considered preventative care (and likely free) and which aren’t. Then explain their options when it comes to paying for — and getting reimbursed for — the visit.

4. Share tips on saving money on care with all your HDHP users

When: Any time before the end of the first quarter of the year

Specifically, you might recommend that your employees:

- Check prescription prices on a site like Goodrx.com before they buy their meds

- Visit an urgent care center instead of the ER, if they’re sick or hurt but it’s not life-threatening

- Use a telemedicine tool (if your company offers one) to get free online medical advice without having to leave their Kleenex-riddled beds

Sure, following this communication schedule requires extra elbow grease. But if you defuse your employees’ stress and confusion early, they’ll feel more prepared to take control of their healthcare and get the most out of their plans. And as a bonus, you and your team get to spend less time answering panicked questions the rest of the year.

SOURCE: Calvin, H. (17 December 2018) "4 ways to help employees master their HDHPs in 2019" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/4-ways-to-help-employees-master-their-hdhps-in-2019?brief=00000152-14a5-d1cc-a5fa-7cff48fe0001

Call today, work tomorrow: The future of hiring?

A recent article from the Wall Street Journal states that more and more employees are being hired without a formal face-to-face interview. Continue reading to learn more about the future of hiring.

You just called a prospective candidate with a job offer, and they accepted. Pretty standard procedure — except you won’t meet the new hire until their first day of work.

In a hot job market, more workers are being hired without ever doing a formal face-to-face interview, according to a recent article in the Wall Street Journal. Hiring agencies and HR professionals are hearing more and more about hiring sight unseen, and the reviews are mixed. Agencies say it’s a fast and more efficient way to hire, while some HR professionals argue there’s no substitute for human interaction.

“We basically advertised jobs as call today, work tomorrow,” says Tim Gates, senior regional vice president of Adecco Staffing, which recently filled 15 openings without a formal in-person interview. “It makes it convenient for everybody involved.”

Adecco Staffing uses a digital hiring platform to prescreen candidates before setting up phone interviews. Applicants who ace the 20-minute phone conversation will likely be placed at a job site contracting Adecco. Gates says the practice gives his staffing agency a competitive edge by hiring people before they accept another position. He also believes this fast, straightforward approach is more attractive to job seekers seeking immediate employment.

Adecco hires sight unseen for entry level, manufacturing and specialized positions — like graphic design. They’re not alone. Susan Trettner, founder and director of direct hire placement firm Talent Direct 360, works with industries across the board but often hires workers for engineering, IT, HR, sales and marketing roles. Trettner says hiring without meeting a candidate is becoming more commonplace, especially for retail and e-commerce employers who have to hire large numbers of workers.

“Making a hiring determination over the phone is acceptable, and I think a lot of companies are doing that,” she says.

During the holidays, for example, retailers may not have the time to interview hundreds of candidates for a position, Trettner says. But, she adds, many companies that hire employees without meeting in person often have a “game plan” for onboarding that gets workers quickly up to speed on what they will be doing on the job. Making the hiring process more efficient is better for everyone, she says.

“It all comes down to filling the positions so they can remain productive,” she says.

Trettner says she would consider hiring workers without meeting them, but at the end of the day, it’s up to the employer client. If a client, for example, needs 300 new workers in a short period of time, Trettner says she would suggest they consider expediting the hiring process a bit to help save money and time.

“I open them up to anything I think is efficient,” she adds.

Some organizations would rather take extra time choosing candidates. Kathleen Sheridan, associate director of global staffing for Harvard Business Publishing, says she knows from 20 years of experience that phone interviews can’t tell you everything about a person. She once sat down with three candidates for a sales position; they all performed well during a phone interview, but completely fumbled while answering questions during a sit-down meeting. None of them were hired, Sheridan said.

“You can come across as a completely different person over the phone,” Sheridan says. “As cumbersome as interview process can be, the value of bringing people in and allowing them to see you is worth it.”

As someone who works with people on a daily basis, Sheridan says she would be distrustful of any job offer from someone she’s never met. She says higher-level executives at Harvard Business Publishing will travel out of the country to meet with prospective hires.

“A decision to join a company is emotional as well as very practical. I think you need to give people a chance to check their emotional response and get a feel for the culture and vibe,” Sheridan says. “I would ask myself, ‘what is it about your organization that you would deny me the opportunity to meet the people who are in the headquarters of this company that I’m going to represent?’”

Peg Buchenroth, HR director of employment agency Addison Group, says most of her clients request in-person interviews for job placements in the IT, engineering, healthcare and finance accounting industries. She says it’s unlikely to change.

“It’s maybe more common in the seasonal retail industry for the holiday season. For our types of positions, there’s no reason not to interview when we have the ability to do Skype interviews,” Buchenroth says.

SOURCE: Webster, K. (5 December 2018) "Call today, work tomorrow: The future of hiring?" (Web Blog Post). Retrieved from https://www.benefitnews.com/news/call-today-work-tomorrow-the-future-of-hiring?brief=00000152-14a7-d1cc-a5fa-7cffccf00000

How employees really feel about asking for time off during the holidays

A new study reveals that 51 percent of employees feel uneasy about asking to use their vacation days during the holidays. Continue reading this blog post to learn more.

Are employers checking their PTO list? They may want to check it twice, according to new data, workers may be leaving vacation days on the table during the holidays because they feel uncomfortable asking for time off.

More than half of employees (51%) feel uneasy about asking to use their paid time off during the holidays, according to a new survey of more than 2,000 employees from management and technology consulting firm, West Monroe Partners. This discomfort was even more prevalent in smaller companies with smaller staffs, where employees work more closely with their managers and colleagues.

Michael Hughes, managing director at West Monroe Partners, says part of the reason employees are so nervous about asking for time off is the expectation that they have to be available 24/7. An employee may also be concerned they will appear to be slacking if aren’t in the office with many companies being short staffed to begin with, he says.

“With the war for talent, people are being asked to do more and more because either they’re shorthanded or can’t find people,” Hughes says.

Nearly two-thirds of employees working in the banking sector felt uncomfortable asking to use their PTO, according to the survey. Although Monroe Partners did not specifically review why this might be the case for banking, Hughes says he thinks that, like other service industries, bank employees often have to work during the holidays to attend to customers.

Banks were hit hard during the 2007 economic recession, he adds, and some have been cautious about beefing their workforce — forcing current employees to carry heavy workloads. But, he adds, this is fairly common across many industries.

“I think it’s something that impacts industries across the board,” he says. “[But] just based on the study banking is one that sticks out.”

West Monroe Partners recommends companies close the office on days other than just federal holidays and accommodate for remote working or flexible scheduling.

Training managers to fairly process PTO requests may also be necessary, the report notes. Managers can do a better job of having open conversations with employees around PTO and job satisfaction.

Despite worker’s anxieties, employers should communicate the importance of taking time off during the holidays, Hughes says. It’s good for workers to get time to rest, he adds. If employees are unhappy in the office, it will likely trickle down to the customer experience.

“A lot of it is just personal health,” he says. “If you give people the opportunity to recharge, they’re going to be more productive when they’re happy.”

SOURCE: Hroncich, C. (7 December 2018) "How employees really feel about asking for time off during the holidays" (Web Blog Post). Retrieved from https://www.benefitnews.com/news/how-employees-really-feel-about-asking-for-time-off-during-the-holidays?brief=00000152-14a7-d1cc-a5fa-7cffccf00000

More pay? Nah. Employees prefer benefits

A new report by the Institute of CPAs revealed that workers would choose a job that offers benefits over a job that offers 30 percent more salary but does not offer benefits. Read this blog post to learn more.

Workers across the country say you can't put a price on great benefits, according to a new survey.

By a four-to-one margin (80% to 20%), workers would choose a job with benefits over an identical job that offered 30% more salary with no benefits, according to the American Institute of CPAs, which released the results of its 2018 Employee Benefit Report, a poll this spring of 2,026 U.S. adults (1,115 of whom are employed) about their views on workplace benefits.

“A robust benefits package is often a large chunk of total compensation, but it’s the employees' job to make sure they’re taking advantage of it to improve their financial positions and quality of life,” said Greg Anton, chairman of the AICPA’s National CPA Financial Literacy Commission. “Beyond the dollar value of having good benefits, employees gain peace of mind knowing that if they can take a vacation without losing a week’s pay or if they need to see a doctor, they won’t be responsible for the entire cost.”

Employed adults estimated that their benefits represented 40% of their total compensation package, according to the study. The Bureau of Labor Statistics, though, states that benefits average 31.7% of a compensation package. Still, workers in the report see benefits as a vital part of their professional lives.

“Despite overestimating the value of their benefits as part of their total compensation, it is concerning that Americans are not taking full advantage of them,” Anton said. “Imagine how employees would react if they were not 100% confident they could get to all the money in their paycheck. Leaving benefits underutilized should be treated the same way. Americans need to take time to truly understand their benefits and make sure they’re not leaving any money on the table.”

Other notable findings from the report include:

- 63% of employed adults believe that being their own boss is worth more than job security with an employer, while 18% added that they will likely start or continue their own businesses next year.

- Millennials were the most likely generation to believe that being their own boss is worth more than job security. They were also the most likely generation to start their own businesses.

- 88% of employed adults are confident they understood all the benefits available to them when they were initially hired at their current job. However, only 28% are "very confident" they are currently maximizing all of their benefits.

- When asked which workplace benefits would help them best reach their financial goals, 56% of adults said a 401(k) match or health insurance, with 33% citing paid time off and 31% citing a pension.

- Baby boomers favor health insurance and having a 401(k) match more than younger generations, while 54% of baby boomers also prioritized a pension, versus only 16% of millennials.

- Millennials put the highest priority on work-life balance benefits, such as paid time off, flexible work hours, and remote work.

For the full report, visit the AICPA’s 360 Degrees of Financial Literacy site here.

This article originally appeared in Accounting Today.

SOURCE: McCabe, S. (3 December 2018) "More pay? Nah. Employees prefer benefits" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/news/workers-prefer-benefits-over-more-pay?brief=00000152-1443-d1cc-a5fa-7cfba3c60000

5 overlooked keys to attracting, retaining great workers (and keeping them beyond the holidays)

Disorganized or absent onboarding processes can severely impact how long employees stay with a company. Continue reading this blog post for the 5 overlooked keys to attracting and retaining employees.

As 2018 winds to a close, the lowest unemployment rate in almost 50 years seems like cause for celebration. But for bosses battling for talent on the front lines — particularly in high-turnover industries like retail, hospitality and food service — it’s anything but.

Rarely easy, recruiting and keeping hourly workers has become a pitched battle this frantic holiday season, with some employers going to new lengths to fill roles. Fast-food franchises are turning to seniors to flip burgers; sit-down restaurants are sending line cooks to culinary school.

But simpler — and far less costly — ways to boost recruitment and retention among hourly workers often go overlooked. Here are a few small steps that, in my experience, can go a long way in keeping workers happy and on the job this holiday season and beyond.

1. Don’t ignore onboarding.

Whether you’re running a restaurant that’s short on servers, or a retail store that sorely needs sales staff, it’s easy to throw new hires into the fray in the hope that they’ll hit the ground running. But doing so can seriously undermine their longevity in the job.

Studies show that a disorganized — or worse, absent — onboarding process can severely impact how long a new hire stays. Conversely, research from the Brandon Hall Group shows that a structured onboarding process can increase retention by 82% and boost productivity by more than 70%.

Too often, onboarding gets ignored in an hourly context — or confused with on-the-job training. Onboarding is much more than that. It’s an introduction to the company and the workplace culture, outlining expectations and opportunities for advancement. It can even include a peer mentor to help new hires with tips like where to park or a good place nearby to grab lunch. This might seem like a luxury — but in actuality, it’s this kind of onboarding that earns Whole Foods and Old Navy top employer honors year after year.

2. Crowdsource your schedules.

One of the greatest sources of frustration for hourly workers is unpredictable schedules. A recent study from Workjam found more than 60% of hourly workers said the most difficult aspect of their job search was finding a position that matched their availability, and more than half said they receive their schedules a week or less in advance.

Setting consistent work schedules around employees’ needs is an important signal that employers care about their work-life balance, family demands or school schedules.

But managing a complex schedule doesn’t have to fall solely on employers. In fact, including your employees in that process can have a positive impact on morale and retention. New platforms that allow workers to swap shifts directly with each other — without involving a manager — give hourly employees some autonomy over their time at work — something shown to boost retention even more than a pay raise.

3. Find meaning (even in the small stuff).

Research is clear: People who feel they have a purpose at work are more productive at their jobs and stay with them longer. And that goes double for millennials and Gen Z, who want to know they’re working for more than just a paycheck.

It might not be obvious from the outset, but showing hourly workers how their jobs make the world a better place can be a powerful tool for retention. It worked for 1-800-Got-Junk, whose commitment to the environment through recycling household items won kudos from its bought-in staff.

For employers who struggle to connect those dots, something as simple as adding a collection box for the food bank in your break room or regularly coordinating your team for volunteer efforts can work wonders in instilling a greater sense of purpose among your team.

4. Modernize your payroll.

We live in an instant world, but you wouldn’t know that by the way most workers are paid. Compared to our on-demand, digital existence, the traditional two-week pay cycle can seem hopelessly outdated. Not only does this hurt hourly workers who often struggle financially between paychecks — especially during the holiday season — it hurts employers competing for talent.

A survey of more than 1,000 people by the Centre for Generational Kinetics showed the majority of millennial and Gen Z workers would prefer to be paid daily or weekly. Further, more than 75% of Gen Z workers and more than 50% of millennials said they’d be more interested in applying for jobs that offered an instant-pay option.

Companies like Uber and Lyft are already updating the pay paradigm, and winning workers, with same-day pay options for drivers. Online platforms now enable any employer to offer that same convenience, in a way that’s easy to implement and cost-effective. But there’s one important caveat here: to work as a retention tool, on-demand pay needs to be free for employees. Charging people fees to access their own money just makes workers feel like they’re being nickeled and dimed.

5. Culture counts (even when you’re on the clock).

Strong company culture is a major contributor to engagement and belonging — a huge predictor of retention. But it’s too often ignored by hourly employers, as evidenced by the fact that hourly workers consistently rate their company culture to be worse than that of salaried workers.

Particularly in the service sector, where the focus is so directed at customer experience, it’s important for employers to spend time making sure employees feel just as valued. For example, Kimpton Hotels and Restaurants clinched the No. 6 spot on Fortune’s list of the 100 best employers with culture-building policies like allowing employees to bring pets to work and recognizing good grades among employees’ kids.

With the U.S. job market predicted to remain tight for the foreseeable future, competition for talent will continue to be a big hurdle for hourly employers. But a few small changes can yield big returns in retention and recruitment — without breaking the bank.

SOURCE: Barha, S. (3 December 2018) "5 overlooked keys to attracting, retaining great workers (and keeping them beyond the holidays)" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/keys-to-attracting-retaining-great-workers-beyond-holidays

How AI can predict the employees who are about to quit

Employers are now utilizing artificial intelligence (AI) to help predict how likely it is that an employee will stay with their company. Read this blog post to learn more.

Tim Reilly had a problem: Employees at Benchmark's senior living facilities kept quitting.

Reilly, vice president of human resources at Benchmark, a Massachusetts-based assisted living facility provider with employees throughout the Northeast, was consistently frustrated with the number of employees that were leaving their jobs. Staff turnover was climbing toward 50%, and after many approaches to improve retention, Benchmark turned to Arena, a platform that uses artificial intelligence to predict how likely it is that an employee will stay in their job.

“Our new vision is about human connection,” he says. “With a turnover rate that’s double digits, how do you really transform lives or have that major impact and human connection with people who are changing rapidly?”

Since Benchmark started using Arena, staff turnover has fallen 10%, compared to the same time last year. During the hiring process, Arena looks at third-party data, like labor market statistics, combined with applicants' resume information and an employee assessment that will give them a better sense of how long a candidate is likely to stay in a role.

“The core problem we’re solving is that individuals aren’t always great at hiring,” says Michael Rosenbaum, chairman of Arena. “Job applicants don’t always know where they’re likely to be happiest. By using the predictive power of data, we’re essentially helping to answer that question.”

Arena isn’t interested in how an employee responds to assessment questions, he says. They’re much more interested in how employees approach the questions.

“What you’re really doing is your collecting some information about how people react to stress,” Rosenbaum adds.

For example, if an employee is applying for a housekeeping role, Arena may give them a timed advanced math question to complete — something they may never use in their actual job. Arena then studies how the candidate responds to the question — analyzing key strokes and tracking how the individual tackles the challenge. The software can then get a better sense of how an applicant responds under pressure.

Overtime, Arena’s algorithm learns from the data it collects. The system tracks how long a specific employee stays at the company and can then better predict, moving forward, whether other employees with similar characteristics will stay.

“Overtime they are able to sort of refine that prediction about those that are most likely to stay, or be retained with our organization,” Reilly says. “They may also make a prediction on someone who might not last very long.”

Reilly says he’s been encouraging hiring managers at the facilities to use the data given to them by Arena to take a closer look at the candidates the platform rates as highly likely to stay in their roles. Although it’s ultimately up to the hiring manager who they select.

“Focus your time on the [candidates] that are more likely to stay with us longer,” Reilly says.

For now, Arena exclusively works with healthcare companies. The platform is currently being used by companies like Sunrise Senior Living and the Mount Sinai Health System in New York. Moving forward, Rosenbaum says, they’re hoping to get into other industries, although he would not specify which.

Rosenbaum says Arena is not only focused on improving the quality of life for employees, but also for the patients and seniors that use the facilities. The happiness of patients, he says, is closely tied to those that are caring for them.

“Is someone who is in a senior living community happy? Do they have a positive experience? It is very closely related to who’s caring for them, who’s supporting them,” he says.

This article originally appeared in Employee Benefit News.

SOURCE: Hroncich, C. (15 November 2018) "How AI can predict the employees who are about to quit" (Web Blog Post). Retrieved from: https://www.employeebenefitadviser.com/news/how-ai-can-predict-the-employees-who-are-about-to-quit?brief=00000152-1443-d1cc-a5fa-7cfba3c60000

When Companies Should Invest in Training Their Employees — and When They Shouldn’t

Do you invest in training and development activities at your organization? According to an industry report, U.S. companies spent $90 billion in 2017 on training and development activities. Read on to learn more.

According to one industry report, U.S. companies spent over $90 billion dollars on training and development activities in 2017, a year-over-year increase of 32.5 %. While many experts emphasize the importance and benefits of employee development — a more competitive workforce, increased employee retention, and higher employee engagement — critics point to a painful lack of results from these investments. Ultimately, there is truth in both perspectives. Training is useful at times but often fails, especially when it is used to address problems that it can’t actually solve.

Many well-intended leaders view training as a panacea to obvious learning opportunities or behavioral problems. For example, several months ago, a global financial services company asked me to design a workshop to help their employees be less bureaucratic and more entrepreneurial. Their goal was to train people to stop waiting around for their bosses’ approval, and instead, feel empowered to make decisions on their own. They hoped, as an outcome, decisions would be made faster. Though the company seemed eager to invest, a training program was not the right way to introduce the new behavior they wanted their employees to learn.

Training can be a powerful medium when there is proof that the root cause of the learning need is an undeveloped skill or a knowledge deficit. For those situations, a well-designed program with customized content, relevant case material, skill-building practice, and a final measurement of skill acquisition works great. But, in the case of this organization, a lack of skills had very little to do with their problem. After asking leaders in the organization why they felt the need for training, we discovered the root causes of their problem had more to do with:

- Ineffective decision-making processes that failed to clarify which leaders and groups owned which decisions

- Narrowly distributed authority, concentrated at the top of the organization

- No measurable expectations that employees make decisions

- No technologies to quickly move information to those who needed it to make decisions

Given these systemic issues, it’s unlikely a training program would have had a productive, or sustainable outcome. Worse, it could have backfired, making management look out of touch.

Learning is a consequence of thinking, not teaching. It happens when people reflect on and choose a new behavior. But if the work environment doesn’t support that behavior, a well-trained employee won’t make a difference. Here are three conditions needed to ensure a training solution sticks.

1. Internal systems support the newly desired behavior. Spotting unwanted behavior is certainly a clue that something needs to change. But the origins of that unwanted behavior may not be a lack of skill. Individual behaviors in an organization are influenced by many factors, like: how clearly managers establish, communicate, and stick to priorities, what the culture values and reinforces, how performance is measured and rewarded, or how many levels of hierarchy there are. These all play a role in shaping employee behaviors. In the case above, people weren’t behaving in a disempowered way because they didn’t know better. The company’s decision-making processes forbid them from behaving any other way. Multiple levels of approval were required for even tactical decisions. Access to basic information was limited to high-ranking managers. The culture reinforced asking permission for everything. Unless those issues were addressed, a workshop would prove useless.

2. There is commitment to change. Any thorough organizational assessment will not only define the skills employees need to develop, it will also reveal the conditions required to reinforce and sustain those skills once a training solution is implemented. Just because an organization recognizes the factors driving unwanted behavior, doesn’t mean they’re open to changing them. When I raised the obvious concerns with the organization above, I got the classic response, “Yes, yes, of course we know those issues aren’t helping, but we think if we can get the workshop going, we’ll build momentum and then get to those later.” This is usually code for, “It’s never going to happen.” If an organization isn’t willing to address the causes of a problem, a training will not yield its intended benefit.

3. The training solution directly serves strategic priorities. When an organization deploys a new strategy — like launching a new market or product — training can play a critical role in equipping people with the skills and knowledge they need to help that strategy succeed. But when a training initiative has no discernible purpose or end goal, the risk of failure is raised. For example, one of my clients rolled out a company-wide mindfulness workshop. When I asked a few employees what they thought, they said, “It was interesting. At least it got me two hours away from my cubicle.” When I asked the sponsoring executive to explain her thought process behind the training, she said, “Our employee engagement data indicated our people are feeling stressed and overworked, so I thought it would be a nice perk to help them focus and reduce tension.” But when I asked her what was causing the stress, her answer was less definitive: “I don’t really know, but most of the negative data came from Millennials and they complain about being overworked. Plus, they like this kind of stuff.” She believed her training solution had strategic relevance because it linked to a vital employee metric. But evaluations indicated that, though employees found the training “interesting,” it didn’t actually reduce their stress. There are a myriad of reasons why the workload could have been causing employees stress. Therefore, this manager’s energy would have been better directed at trying to determine those reasons in her specific department and addressing them accordingly — despite her good intentions.

If you are going to invest millions of dollars into company training, be confident it is addressing a strategic learning need. Further, be sure your organization can and will sustain new skills and knowledge by addressing the broader factors that may threaten their success. If you aren’t confident in these conditions, don’t spend the money.

SOURCE: Carucci, R. (29 October 2018). "When Companies Should Invest in Training Their Employees – and When They Shouldn’t" (Web Blog Post). Retrieved from https://hbr.org/2018/10/when-companies-should-invest-in-training-their-employees-and-when-they-shouldnt

Interact Sensitively with Employees Addicted to Opioids

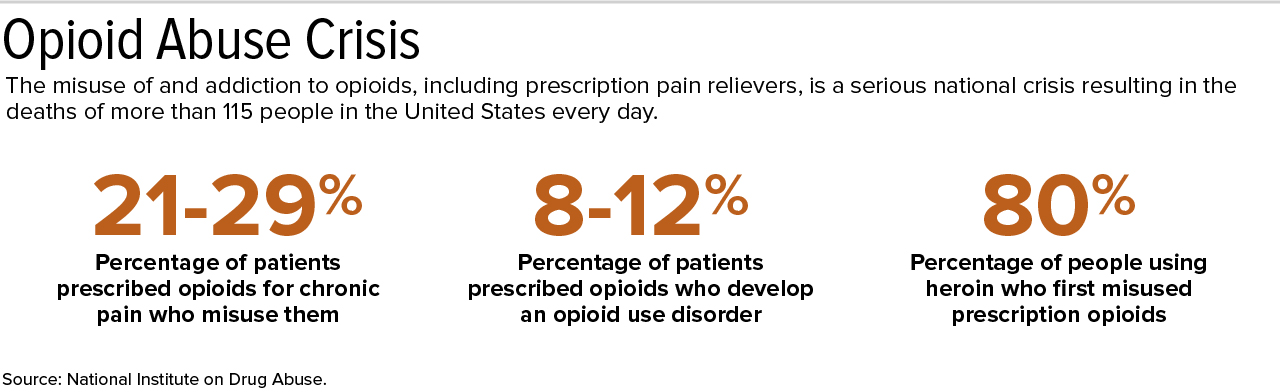

Opioid addiction is running rampant across the U.S. According to the National Institute of Drug Abuse, 8-12 percent of patients prescribed opioids develop an opioid use disorder. Read this blog post to learn more.

Employees who abuse opioids often are given a second chance by their employers. But well-meaning employers could wind up being sued for discriminating against those workers in violation of the Americans with Disabilities Act (ADA) if they don't handle the situation very carefully.

Opioid addiction has been rampant in the U.S. for some time. More than three out of five drug overdose deaths last year involved an opioid, and overdoses rose 70 percent in the 12 months ending September 2017, according to the Centers for Disease Control and Prevention.

So what can HR professionals do about it? If a worker admits to the problem, the path is fairly clear. But if the employer merely suspects that an employee is addicted to prescription pain relievers but has no real proof, the employee should be treated like any other employee who is having attendance or performance issues, said Kathryn Russo, an attorney with Jackson Lewis in Melville, N.Y.

An employer should never accuse someone of having an addiction, because if the employer is wrong, the accusation could lead to an ADA claim, Russo cautioned. Although current drug use isn't considered an ADA disability, a history of drug addiction is. Moreover, someone using prescription drugs might have an underlying condition covered by the ADA.

If an employee admits to opioid abuse, or the problem is discovered through drug testing, the employer should discuss it with the employee to determine if he or she needs a reasonable accommodation, such as leave to obtain treatment, Russo said. The illegal use of drugs need not be tolerated at work, she added.

Reasonably accommodate the employee so long as there's no direct threat to the health and safety of himself or herself, or others, recommended Nancy Delogu, an attorney with Littler in Washington, D.C.

Drug Testing

The Equal Employment Opportunity Commission has opined that employers may ask about an employee's use of prescribed medicine or conduct a drug test to determine such use only if the employer has reasonable suspicion that its use will interfere with the employee's ability to perform the job's essential functions or will pose a direct threat.

Many employers are expanding their drug-testing panels to include semisynthetic opioids such as hydrocodone, hydromorphone, oxycodone and oxymorphone, in addition to traditional opioids such as heroin, codeine and morphine, Russo said. This is lawful in most states as long as the employer does not take adverse employment actions when drugs are used legally, she noted, which is why an employer should use a medical review officer in the drug-testing process. If the medical review officer concludes that the positive test result is the result of lawful drug use, the result is reported to the employer as negative.

Sometimes an employer will say it has reasonable suspicion that the employee came to work impaired by drug use and is considering a mandatory drug test. At that point, some employees will say the drug test would be positive and the test consequently is not necessary.

Discussions with Employees

If there are performance problems and the employee has admitted to opioid addiction, some employers tell employees that they can remain employed so long as they go through inpatient treatment. Delogu discourages that approach. Employers aren't workers' doctors, so they shouldn't be deciding whether someone needs a treatment program, she explained.

But if someone voluntarily seeks to enter an addiction-recovery program, that person may have legal protections under state law, said Wendy Lane, an attorney with Greenberg Glusker in Los Angeles. For example, California has a law requiring employers with 25 or more employees to reasonably accommodate alcohol and drug rehabilitation.

Delogu recommended that employers that believe there is a problem with substance abuse ask if the addicted employee needs assistance from the employee assistance program.

An employer can require that an employee who has violated a policy be evaluated by a substance abuse professional and complete treatment prescribed for them, without dictating what that treatment will be, she said. The employer may choose to forgo disciplinary action if an employee agrees to these terms and signs an agreement to this effect. The employer then would not have to be informed about the person's decided course of treatment, whether inpatient, outpatient or no treatment at all, she said. The employee typically will be subjected to follow-up drug testing to make sure he or she hasn't resumed the use of illegal drugs.

Many employers are willing to give employees with performance problems resulting from opioid addiction a second chance, she noted.

SOURCE: Smith, A. (1 November 2018) "Interact Sensitively with Employees Addicted to Opioids" (Web Blog Post). Retrieved from https://www.shrm.org/ResourcesAndTools/legal-and-compliance/employment-law/Pages/employees-addicted-to-opioids.aspx

8 scary benefits behaviors employees should avoid

Nothing is more scary to benefits professionals than employees failing to review their open enrollment materials. Continue reading for eight of the scariest benefit mistakes and tips on how you can correct them.

Halloween is already frightening enough, but what really scares benefits professionals are the ways employees can mishandle their benefits. Here are eight of the biggest mistakes, with tips on correcting them.

Participants don’t review any annual enrollment materials

Why it’s scary: Employees are making or not making decisions based on little or no knowledge.

Potential actions: Employers can implement a strategic communications campaign to educate and engage employees in the media and format appropriate for that employee class, or consider engaging an enrollment counselor to work with participants in a more personalized manner.

Employees don’t enroll in the 401(k) or don’t know what investment options to choose

Why it’s scary: U.S. employees are responsible for much of their own retirement planning and often leave money on the table if there is an employer match.

Potential actions: Employers can offer auto-enrollment up to the matching amount/percent; consider partnering with a financial wellness partner, and provide regular and ongoing communications of the 401(k)’s benefits to all employees.

Employees don’t engage in the wellness program

Why it’s scary: The employee is potentially missing out on the financial and personal benefits of participating in a well-being program.

Potential actions: Employers need to continuously communicate the wellness program throughout the year through various media, including home media. Employers also should ensure the program is meeting the needs of the employees and their families.

Employees don’t update ineligible dependents on the plan

Why it’s scary: Due to ambiguity where the liability would reside, either the employee or the plan could have unexpected liability.

Potential action: Employers can require ongoing documentation of dependents and periodically conduct a dependent audit.

Employees don’t review their beneficiary information regularly

Why it’s scary: Life insurance policy proceeds may not be awarded according to the employee’s wishes.

Potential action: Employers can require beneficiary confirmation or updates during open enrollment.

Employees do not evaluate the options for disability — whether to elect a higher benefit or have the benefit paid post-tax

Why it’s scary: Disability, especially a short-term episode, is very common during one’s working life; maximizing the benefit costs very little in terms of pay deductions, but can reap significant value when someone is unable to work.

Potential action: Employers can provide webinars/educational sessions on non-medical benefits to address those needs.

Employees do not take the opportunity to contribute to the health savings account

Why it’s scary: The HSA offers triple tax benefits for long-term financial security, while providing a safety net for near-term medical expenses.

Potential actions: Employers can select the most administratively simple process to enroll participants in the HSA and allow for longer enrollment periods for this coverage.

Employees do not use all of their vacation time

Why it’s scary: Vacation allows an employee an opportunity to recharge for the job.

Potential actions: Employers can encourage employees to use their vacation and suggest when the workload might be more accommodating to time off for those employees who worry about workloads.

SOURCE: Gill, S. & Manning-Hughes, R. (31 October 2018) "8 Scary Benefits Behaviors Employees Should Avoid" (Web Blog Post). Retrieved from https://www.benefitnews.com/slideshow/8-scary-benefits-behaviors-employees-have?brief=00000152-14a5-d1cc-a5fa-7cff48fe0001