A benefits wishlist for millennial employees

Did you know: 63 percent of millennials would struggle to cover an unexpected expense of $500. With millennials becoming the new core of today's workforce, many employers are tailoring their job postings, descriptions and benefits to correspond with the millennial wish list. Read the following article to learn more.

Millennials are the new core workforce. Their concept of work is different than the standards set by previous generations. They bring bold, new approaches of what work should be, how and where it should be performed, and what the rewards for work should be.

While this has made some employers uncomfortable, millennials are not likely to change their ways. Employers must reassess their concepts to bring out the best of the unique millennial personality.

When I look at the U.S. workforce, I see a dramatic shift in the attitudes, personalities and attributes of millennials, which makes up the majority of the workforce. Millennials bring many positive attributes to the table, including a preference for flat management structures, multiple degrees, technological skills, energy and self-confidence. They also have high expectations for themselves, prefer to work in teams, are able to multitask and seek out challenges.

However, millennials have the highest levels of stress and depression of any generation. About 20% of millennial workers have suffered work-related depression. Millennials want their own living space, but they’re less likely to become homeowners because of student loan debt. Only 6% of millennials feel they're making enough to cover basic needs, according to an Economic Innovation Group national survey of millennials. As a result, 63% of millennials would struggle to cover an unexpected $500 expense. This generation wants to live within their means, but they’ve never been taught how — they need and want to be educated on how to achieve financial independence.

Think about your corporate strategy for attracting millennials. Here are just a few of the ways companies are tailoring their job postings, descriptions and benefits to correspond with the millennial wish list.

Working with meaning. Millennials want to have meaning in their work. Past generations may have worked simply because they needed to pay the bills. Millennials want to get paid too, but they also want to know that their employer is doing more than making and selling products or services. They aspire to social causes and want to know why the organization exists and how they can personally participate and contribute in that culture.

Continued personal growth and career advancement. Millennials want to be coached and have work-life balance. They want management feedback, even if it’s negative. Regular pay increases and promotions are important to them too. It shows that you’re invested in their career path and value their contributions.

Flexible hours and the ability to work remotely. They want flexible hours and the option to work from a location of their choice. This flexibility also contributes to their desire for no added workplace stress. Technology has made it possible to connect 24/7 from anywhere on any device. If you have yet to adapt your culture to accept this new norm, you’ll likely be missing out on this generation of candidates.

Technology. Millennials are smart-device people. Who better to move your organization forward than the individuals who grew up knowing how to download and use an app, or create a widget that solves a problem? They think technology-first and is required for any organization looking to remain competitive.

Financial wellness. A robust financial wellness program that includes self-directed education, competitions, games and rewards will pique millennial interest. Products and services like financial coaching, cashflow tracking, early wage access and credit resources that address their financial challenges will keep them engaged. Above all, a financial wellness program must be tailored to each individual employee to achieve maximum participation and behavioral change.

Employers must be vigilant in order to keep the best and brightest talent. They should also be proactive in managing their employees on a personal level, especially millennials. Otherwise, they are likely to be disengaged and move on — and that will cost money.

As managers and leaders of the organization, it is your responsibility to ensure that millennials understand their future in the company and to communicate that they don’t have to go somewhere else to advance. Employers and leaders have a responsibility to provide millennials with a desirable place to land, and a culture that encourages them to thrive. Don’t give millennials reasons to leave your organization. We need to support them, engage them, reward them and give them reasons to stay.

SOURCE: Kilby, D. (6 November 2019) "A benefits wishlist for millennial employees" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/what-employee-benefits-do-millennials-want

A 16-Year-Old Explains 10 Things You Need to Know About Generation Z

What was life like when you were a teenager? The world has been focused on understanding and adapting to Millennials. Now Generation Z is beginning to graduate and enter the workforce. Read this blog post for 10 things the world should know about Gen Z.

Think about what life was like when you were 16. The clothes you wore, the places you shopped. What was most important to you then?

Whenever I speak to an organization eager to learn about Generation Z, I always ask that question. I get responses that include everything from the fleeting fashion trends of the day (bell-bottom jeans, anyone?) to the time-honored tradition of getting a driver’s license.

What I hope to achieve as a 16-year-old in 2018 is probably not all that different from what anyone else wanted when they were my age. It’s the way people go about reaching their goals that evolves over time—and that’s what also forms the basis of most generational clashes.

For the past several years, the world has been focused on understanding and adapting to Millennials, the largest and most-educated generation in history. Born between 1981 and the mid-1990s, this group has inspired important dialogues about generational differences and challenged all industries to evolve to meet their needs. In the workplace, Millennials have helped drive a greater focus on flexibility and collaboration and a rethinking of traditional hierarchies.

Of course, any analysis of generations relies on generalities that can’t possibly describe every person or situation. It’s important to remember that generations exist on a continuum—and that there is a large degree of individual variation within them. The point of this type of research is to identify macro trends among age groups that can help foster workplace harmony. Essentially, it’s a way of attempting to understand people better by getting a sense of their formative life experiences. The generation to which one belongs is among the many factors, such as race, religion and socioeconomic background, that can shape how a person sees the world.

But there’s little doubt that gaps among the U.S. generations have widened dramatically. For example, an 8-year-old boy in the United States who grew up with a tablet will likely have more in common with an 8-year-old in China who used a similar mobile device than he will with his 70-year-old U.S. grandparents.

In thinking about the generations, a key thing to understand is that these groups are typically categorized by events rather than arbitrary dates. Generation Z’s birth years are generally recognized as 1996 to 2009. The start year was chosen so that the cohort would include only those who do not remember the Sept. 11 terrorist attacks. The belief is that if you were born in 1996 or later, you simply cannot process what the world was like before those attacks. For Generation Z, the War on Terror has always been the norm.

Like all other generations, mine has been shaped by the circumstances we were born into, such as terrorism, school shootings and the Great Recession. These dark events have had profound effects on the behavioral traits of the members of Generation Z, but they have also inspired us to change the world.

Earlier this year, XYZ University, a generations research and management consulting firm where I act as the director of Gen Z studies, surveyed more than 1,800 members of Generation Z globally and released a study titled “Ready or Not, Here Comes Z.” The results were fascinating.

We discovered key characteristics about Generation Z and what the arrival of my generation will mean for the future of work. At 57 million strong and representing the most diverse generation in U.S. history, we are just starting to graduate from college and will account for 36 percent of the workforce by 2020.

Needless to say, Generation Z matters. And it is more important than ever for HR professionals to become familiar with the following 10 characteristics so that they know how to engage with my generation.

1. Gen Z Always Knows the Score

Members of this generation will put everything on the line to win. We grew up with sports woven into the fabric of our lives and culture. To us, the NFL truly does own a day of the week. But it’s more than just professional, college or even high school teams that have shaped us; it’s the youth sports that we played or watched throughout our childhoods. This is the generation of elite young teams and the stereotypical baseball mom or dad yelling at the umpire from the bleachers.

Our competitive nature applies to almost everything, from robotics to debates that test mental fortitude. We carry the mindset that we are not necessarily at school just to learn but to get good grades that will secure our place in the best colleges. Generation Z has been thrown into perhaps the most competitive educational environment in history. Right or wrong, we sometimes view someone else’s success as our own failure or their failure as our success.

We are also accustomed to getting immediate feedback. A great example is the online grading portals where we can get frequent updates on our academic performance. In the past, students sometimes had to wait weeks or longer to receive a test grade. Now, we get frustrated if we can’t access our scores within hours of finishing an exam—and sometimes our parents do, too.

2. Gen Z Adopted Gen X’s Skepticism and Individuality

Generations are shaped by the behavioral characteristics of their parents, which is why clumping Millennials and Generation Z together is a mistake. In fact, when it comes to each generation’s behavioral traits, Millennials are most similar to their parents—the Baby Boomers. Both are large, idealistic cohorts with influences that will shape consumer and workplace behavior for decades.

Members of Generation Z, on the other hand, are more akin to their parents from Generation X—a smaller group with a skeptical, individualistic focus—than they are to Millennials. That’s why many generational traits are cyclical. Just because Millennials and members of Generation Z are closer in age does not necessarily mean they share the same belief systems.

3. Gen Z Is Financially Focused

Over the past 15 to 20 years, HR professionals have been hyper-focused on employee engagement and figuring out what makes their workers tick. What drives someone to want to get up in the morning and come to work for your organization?

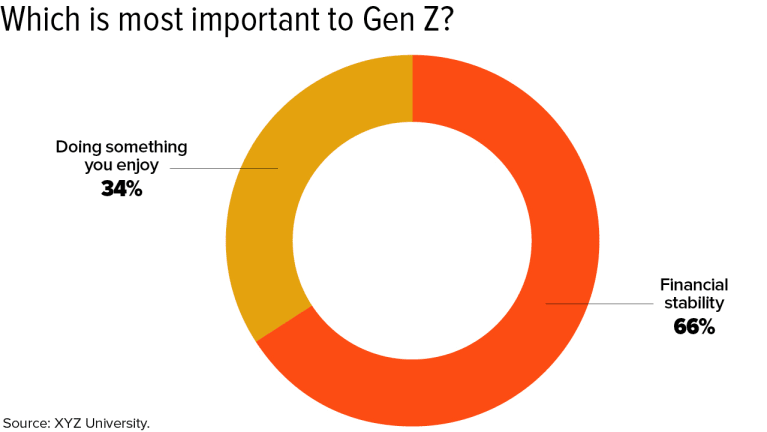

As it turns out, workplace engagement matters less to Generation Z than it did to previous generations. What’s most important to us is compensation and benefits. We are realists and pragmatists who view work primarily as a way to make a living rather than as the main source of meaning and purpose in our lives.

Obviously, we’d prefer to operate in an enjoyable environment, but financial stability takes precedence. XYZ University discovered that 2 in 3 Generation Zers would rather have a job that offers financial stability than one that they enjoy. That’s the opposite of Millennials, who generally prioritize finding a job that is more fulfilling over one that simply pays the bills.

That financial focus likely stems in part from witnessing the struggles our parents faced. According to a study by the Pew Charitable Trust, “Retirement Security Across Generations: Are Americans Prepared for Their Golden Years?,” members of Generation X lost 45 percent of their wealth during the Great Recession of 2008.

“Gen X is the first generation that’s unlikely to exceed the wealth of the group that came before it,” says Erin Currier, former project manager of Pew’s Economic Mobility Project in Washington, D.C. “They have lower financial net worth than previous groups had at this same age, and they lost nearly half of their wealth in the recession.”

Before Generation Z was decreed the ‘official’ name for my generation, there were a few other candidates, including the ‘Selfie Generation’ and ‘iGen.’

Employers will also need to recognize that members of Generation Z crave structure, goals, challenges and a way to measure their progress. After all, the perceived road to success has been mapped out for us our entire lives.

At the same time, it’s important to be aware of the potential for burnout among young overachievers—and to incorporate fun and breaks into the work environment and provide access to healthy escapes focused on relaxation and stress relief.

4. Gen Z Is Entrepreneurial

Even though they witnessed their parents grapple with financial challenges and felt the impact of the worst economic meltdown since the Great Depression, members of Generation Z believe there is a lot of money to be made in today’s economy. Shows like “Shark Tank” have inspired us to look favorably on entrepreneurship, and we’ve also seen how technology can be leveraged to create exciting—and lucrative—business opportunities with relatively low overhead. Fifty-eight percent of the members of my generation want to own a business one day and 14 percent of us already do, according to XYZ University.

Organizations that emphasize Generation Z’s desire for entrepreneurship and allow us space to contribute ideas will see higher engagement because we’ll feel a sense of personal ownership. We are motivated to win and determined to make it happen.

5. Gen Z Is Connected

Before Generation Z was decreed the “official” name for my generation, there were a few other candidates, including the “Selfie Generation” and “iGen.”

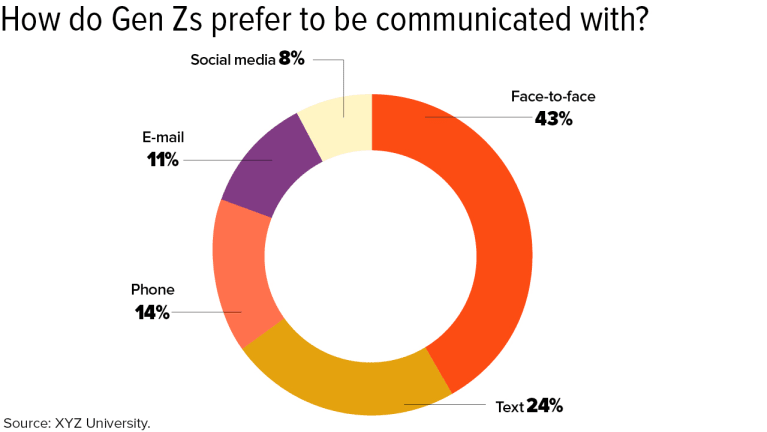

I find those proposed names both condescending and misleading. While it’s often assumed that Generation Z is focused solely on technology, talking face to face is our preferred method of communication. Sure, social media is important and has undoubtedly affected who we are as a generation, but when we’re communicating about something that matters to us, we seek authenticity and honesty, which are best achieved in person.

“Gen Z has the power of technology in their hands, which allows them to communicate faster, more often and with many colleagues at one time; but it also brings a danger when it’s used as a crutch for messages that are better delivered face to face,” says Jill Katz, CHRO at New York City-based Assemble HR. “As humans in the workplace, they will continue to seek empathy, interest and care, which are always best received face to face.”

XYZ University’s research found that cellphones and other electronic devices are primarily used for the purpose of entertainment and are tapped for communication only when the face-to-face option isn’t available.

However, successfully engaging with Generation Z requires striking a balance between conversing directly and engaging online. Both are important, and we need to feel connected in both ways to be fully satisfied.

6. Gen Z Craves Human Interaction

Given that members of Generation Z gravitate toward in-person interactions, HR leaders should re-evaluate how to best put the “human” aspect back into business. For example, hiring processes should emphasize in-person interviews more than online applications.

A great way to engage us is to hold weekly team meetings that gather everyone together to recap their achievements. Although members of Generation Z don’t necessarily need a pat on the back, it’s human nature to want to feel appreciated. This small gesture will give us something to look forward to and keep us feeling optimistic about our work. In addition, we tend to work best up against a deadline—for example, needing to have a project done by the team meeting—due to our experience facing time-sensitive projects at school.

7. Gen Z Prefers to Work Independently

Millennials generally prefer collaborative work environments, which has posed a challenge to conventional workplace cultures and structures. In fact, many workplaces have eliminated offices and lowered cubicle walls to promote more interaction. Yet recent studies indicate that totally open offices may actually discourage people from working together. The noise and lack of privacy could prompt more people to work at home or tune others out with headphones. Since different types of work require varying levels of collaboration, focus and quiet reflection, ideal workplaces incorporate room for both togetherness and alone time.

It’s important to be aware of the potential for burnout among young overachievers—and to incorporate fun and breaks into the work environment and provide access to healthy escapes focused on relaxation and stress relief.

The emphasis on privacy will likely only intensify under Generation Z. Unlike Millennials, we have been raised to have individualistic and competitive natures. For that reason—along with growing research into optimal office design—we may see the trend shift away from collaborative workplaces toward more individualistic and competitive environments.

8. Gen Z Is So Diverse That We Don’t Even Recognize Diversity

Generation Z marks the last generation in U.S. history where a majority of the population is white. Given the shifting demographics of the country, we don’t focus as much on someone’s color, religion or sexual orientation as some of our older counterparts might. To us, a diverse population is simply the norm. What we care about most in other people is honesty, sincerity and—perhaps most important—competence.

Indeed, we have been shaped by a society that celebrates diversity and openness. A black man occupied the White House for most of our lives, and we view gay marriage as a common and accepted aspect of society.

9. Gen Z Embraces Change

Compared to teenagers of other generations, Generation Z ranks as the most informed. We worry about our future and are much less concerned about typical teen problems, such as dating or cliques, than we are about becoming successful in the world.

The chaos and unrest in our political system have inspired us to want to get involved and make a difference. Regardless of which side of the aisle we are on, most of us are informed and passionate about the issues facing our society today. Witness, for example, the students of Marjory Stoneman Douglas High School in Parkland, Fla., who organized a political movement around gun control in the wake of a mass shooting at their school.

Social media allows us to have a voice in our political system even before we can vote. This opportunity has forced us to develop critical-thinking and reasoning skills as we engage in sophisticated debates about important issues that might not even affect us yet.

“Gen Z has a strong ability to adapt to change,” says Paul Carney, an author and speaker on HR trends and a former HR manager with the Navy Federal Credit Union. “For those of us who have spanned many decades in the workplace, we have seen the rate of change increase and it makes most of us uncomfortable. Gen Z are the people who will help all of us adapt better.”

According to numerous polls, the political views of Generation Z trend fiscally conservative (stemming from our need for financial stability) and socially liberal (fueled by diverse demographics and society).

10. Gen Z Wants a Voice

Given how socially aware and concerned its members are, Generation Z seeks jobs that provide opportunities to contribute, create, lead and learn.

“One of the best ways I have seen leaders engage with Gen Z is to ask them how they would build a product or service or design a process,” Carney says. “Gen Z has some amazing abilities to bring together information, process it and take action. When we do allow them to share ideas, great things happen.”

We’re also an exceptionally creative bunch. Managers will need to give members of this generation the time and freedom to come up with innovative ideas and accept that, despite our young age, we have valuable insights and skills to offer—just like the generations that came before us and those that will follow.

Today’s workforce never learned how to handle personal finances

A bill was recently proposed in South Carolina that would require all students to take a personal finance course before they graduate. Continue reading to learn how this proposal could help today's workforce learn how to handle personal finances.

A bill was recently proposed in the South Carolina state legislature to require all students to take a half-credit personal finance course and pass a test by the end of the year in order to graduate.

This proposed legislation could prove to be a breakthrough idea because frankly, much of the high school-educated—or even college-educated—workforce has never had a formal education on how to take care of their personal finances, pay off their student loans, open an appropriate retirement account, select an insurance provider or generally prepare for personal financial success.

Without taking these now-required personal finance classes in high school, how is the current workforce expected to learn how to stay afloat and become financially stable?

For those in other states or for individuals who are past high school, the most logical solution for solving this problem is to put the onus on employers and business owners to teach their employees how to properly handle their financial well-being.

Having a staff full of financially prepared employees is in any businesses’ own interest, and there are statistics to show it. Numerous research studies have proven that companies with robust employee financial wellness programs are more productive because employees don’t have to spend company time handling personal financial problems. This results in an average three-to-one return for the organization on their financial wellness investment, according to studies from the Cambridge Credit Counseling Corp.

Employees who practice good financial wellness are also proven to stay with the company longer, be more engaged at work, less stressed and healthier—all of which add significant dollars to a company’s bottom line.

While understanding that HR, executives, and accounting have little time to spend teaching lessons in the workplace, how does a company go about offering financial wellness information to their employees?

There are several options available to companies when it comes to financial wellness. One of the most sought-after benefits in recent years is online financial wellness platforms that digitize the financial education process. This allows employees to work on their financial education on their own time from the privacy of their home computer, using a friendly and simple interface. And benefits solutions providers have access to a number of these resources – all companies need to do is inquire with their provider.

It is important to remember that not all financial wellness platforms are created equal in what they offer. Depending on the specific needs of an organization, they should assess the offerings available through each service provider to ensure they receive the program they intend to offer to their employees. Most platforms offer partial solutions and tools that could include financial assessments, game-based education, budgeting apps, student loan assistance, insurance options, savings programs, and even credit resources to help those who don’t have money saved to afford an emergency cost.

Not everyone goes to school to learn accounting, so we can’t assume that everyone knows what they are doing when it comes to personal finances. South Carolina is taking a major and important step towards improving their citizen’s futures by suggesting everyone take a personal finance course in high school. This could have a massive and positive effect on the economy in the future.

Finding a financial wellness solution that checks most, if not all, of these boxes will enable employees to take the initiative to either continue what they’ve learned (in the case of South Carolina students) or start down the path of gaining financial independence. Implementing a complete financial wellness toolset to give employees the ability to prepare for financial success is a huge step towards significantly increasing productivity.

As an engaged employer who cares about the well-being of their employees, it is important to offer as many resources as possible to encourage employees to stay financially well, decrease stress, and increase productivity in the workplace.

How to build a multigenerational benefits strategy

Employers and HR teams are now managing workforces that stretch across three to five different generations. Continue reading this blog post to learn more about why having a multigenerational benefits strategy is important.

Employers and HR teams are managing employees for a workforce that stretches across three to five generations. This workforce is complex, and its workers have varying needs from generation to generation. That’s why a multigenerational benefits strategy is in order.

Baby boomers preparing for retirement may have an ongoing relationship with doctors and a number of medical appointments in a given year. On the other hand, millennials and members of Generation Z— the latest generation to enter the workforce — may shy away from primary care doctors and focus more on options to pay off student loans and start saving for retirement.

Given these dynamics, it’s important that two separate departments, finance and HR, need to develop a benefits strategy that keeps costs as low as possible while being useful to employees. Finance leaders understand they need to retain employees — turnover is expensive — but they’re still interested in cost containment strategies.

Employers should approach their multigenerational benefits strategy on finding a balance between cost containment and employee engagement.

Cost containment

For the first time in six years, the number of employers offering only high-deductible health plans is set to drop 9%. But the idea of employee consumerism is here to stay as employers see modest rises in health insurance premiums.

To effectively contain costs, employers should first weigh the pros and cons of their funding model. While most companies start out with fully-insured models, employers should seriously evaluate a move toward self-funding. Sure, self-funding requires a larger appetite for risk, but it provides insight into claims and utilization data that you can leverage to make informed decisions about cost containment.

One way to move toward a self-funded model is with level-funding, which allows employers the benefit of claims data while paying a consistent premium each month. In a level-funded plan, employers work with a third-party administrator to determine their expected claims for the year. This number, plus administrative fees and stop-loss coverage, divided by 12, becomes the monthly premium.

A tiered contribution model might also help to contain costs without negatively affecting employees. In a typical benefit plan, employers cover a specific percentage and employees contribute the rest — say 90% and 10%, respectively. In a tiered contribution plan, employees with salaries under a certain dollar amount pay less than those high earners. That means your employee making $48,000 pays $50, while your employee making $112,000 pays more. It’s a way to distribute the contribution across the workforce that enables everyone to more easily shoulder the burden of rising healthcare costs.

Employee engagement

To create a roadmap that not only helps you gain control of your multigenerational benefits strategy but keeps employees of all ages happy, it’s necessary to consider employee engagement. While new options like student loan repayment could be useful to part of your workforce, it’s best to start much simpler with something that affects everyone: time away from work.

A more aggressive paid time off policy, telecommuting policies and paid family leave are becoming increasingly popular. Many companies are offering PTO just for employees to pursue charitable work — a benefit that resonates with younger workers and can improve company culture. And a generous telecommuting policy recognizes that employees have different needs and shows that employers understand their modern, diverse workforce. Beyond basic time away from work, an extended leave policy outside what the law guarantees is another tool that can keep employees engaged.

Making it easier for employees to get care is another trending benefit, which can keep employees happy and contribute to cost containment. Concierge telemedicine has been called the modern version of a doctor’s house call. This relatively inexpensive benefit provides your employees access to care 24/7 by phone or video chat, which is convenient regardless of the user’s generation.

Employees and other covered individuals can connect to a doctor to discuss symptoms and get advice, whether they are prescribed a medication or they need to seek further care. This is another benefit that’s useful for young workers who may not have a primary care doctor or older workers with families.

Finally, your tech-savvy workforce expects to access their plan information wherever they need it. Ensure your carrier offers a mobile app to house insurance cards, coverage and provider information.

When it comes to a multigenerational benefits strategy, creating harmony between finance and HR might seem like a daunting task. But considering some relatively small benefit changes could be what allows you to offer a benefits package that pleases both departments — and all of your employees.

This article originally appeared in Employee Benefit News.

SOURCE: Blemlek, G. (26 February 2019) "How to build a multigenerational benefits strategy" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/opinion/how-to-build-a-multigenerational-benefits-strategy?brief=00000152-146e-d1cc-a5fa-7cff8fee0000

Millennials and money — How employers can be a financial literacy resource

Recent reports show student loan debts reached a $1.5 trillion crisis in 2018, leading many to believe Americans need a little help with money. Read on to learn how employers can help with financial literacy.

It’s clear that Americans need a little help with their money — in 2018 student loan debts reached a staggering $1.5 trillion crisis, employees continue to retire at a later age every year, and studies have shown that 65% of Americans save little to nothing of their annual income.

One subset of the American population that has even greater troubles with their finances is millennials, or those aged 23 to 38 as of 2019. This age group has lofty goals — 76% believe that they’re headed for a better financial future than their parents and 81% plan to own a home — but many millennials aren’t saving money in a way that actually leads them towards that future. In the last year, 43% of young adults had to borrow money from their parents to pay for necessities and 30% had to skip a meal due to lack of funds. Where’s the disconnect between millennials’ financial optimism and the reality of their financial circumstances?

Part of the problem lies in a lack of financial literacy. A study conducted by the National Endowment for Financial Education found that only 24% of millennials answered three out of five questions correctly on a survey looking at financial topics, indicating only a basic level of literacy. This same survey found that only 8% of millennials who took the test were able to answer all five questions correctly.

That’s not to say that understanding the intricacies of financial planning is easy. Everything from taxes to investing often requires professional advice. It’s no wonder that millennials are struggling with their finances: only 22% of those in this age group have ever received financial education from an educational institution or workplace. Millennials are struggling to pay for basic necessities and financial advice is simply not a priority. Many avoid seeking the help they need because they perceive it to be too costly.

This is an opportunity for employers that want to provide valuable resources to their employees, as financial wellness programs are likely to be the next employee benefit that millennials ask for.

Right now, millennials are the largest segment in the workforce, and by 2030 the U.S. Bureau of Labor Statistics estimates that this age group will make up a staggering 75%. In a tight labor market, current job seekers can be more selective when deciding where they want to work. For employers, studies have shown that 60% of people report benefits and perks as a major deciding factor when considering a job offer.

To stand out from competitors and provide true value to young employees, companies should consider including financial wellness plans in their overall benefits package. The most comprehensive financial wellness plans generally include access to advice from a certified financial planner in addition to legal, tax, insurance and identity theft support. For millennials trying to get in control of their finances, these types of programs can be invaluable. For example, young employees can get assistance setting up a 401(k) account, dealing with taxes for the first time or learning to save and invest.

In 2019 and beyond, millennials are going to be looking for employers that support them not only in the office but outside the office as well. By providing financial planning tools in the workplace, companies can be a valuable resource to younger employees who will appreciate early and frequent conversations around how to manage their money.

SOURCE: Freedman, D. (19 February 2019) "Millennials and money — How employers can be a financial literacy resource" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/how-employers-can-be-a-financial-literacy-resource?brief=00000152-14a7-d1cc-a5fa-7cffccf00000

Goodbye group benefits. Hello personalized pay

Do you offer a uniform benefits package to your employees? With five generations in the workplace now, off-the-shelf benefit options are presenting employers with a challenge. Read this blog post to learn more.

In the past, it was typical for a company to provide all employees with access to the same group benefits — regardless of their age, demographics or education level. From health insurance to retirement plans and paid time off, these uniform benefit packages were designed to meet the needs of the entire workforce in one fell swoop.

But over the past few years, these off-the-shelf benefit options have presented a bit of a challenge. With five generations now in the workplace — Gen Z, Millennials, Gen X, Baby Boomers and the silent generation — there are diverse expectations about pay and benefit packages.

For example, baby boomers and the silent generation tend to value health insurance and a robust retirement plan. Meanwhile, Gen X workers seek a healthy work-life balance, advancement opportunities and a competitive 401(k) — or a retirement savings plan that lets you set aside and invest money from your paycheck, to which your employer can then contribute. Millennials and Gen Z prioritize flexibility — they want more paid time off, the ability to work when and where they wish and tuition reimbursement.

There is no one-size-fits-all compensation package that can fairly satisfy each generation of workers. Employees today want to feel heard, understood and cared for by their employer. Furthermore, most want a job that fits with their personal interests and lifestyle.

As a result, companies are moving away from traditional group benefits and taking a more personalized approach to compensation.

Many organizations are using social listening tools, focus groups and surveys to gather information about the types of benefits employees want. Others are taking it a step further and having one-on-one conversations to determine what motivates each individual worker and provides them with a sense of purpose at work. How else will we know what, specifically, each employee wants unless we ask them?

By collecting this information, organizations can tailor packages that effectively meet the varying wants and needs of the diverse workforce. They’re offering mixes of pay, bonuses, flex time, paid time off, retirement plans, student loan repayment assistance and professional growth opportunities. Some companies have designed an a la carte menu of benefits, with which employees can pick and choose the perks they care most about.

According to a recent survey conducted by WorldatWork and KornFerry, organizations also are offering more non-traditional benefits that can further acknowledge employees’ concerns and responsibilities outside of work. Eldercare resource and referral services, women advancement initiatives and disaster relief funds all became significantly more prevalent in employee benefits programs within the last year. Telemedicine, identity theft insurance and paid parental leave offerings increased as well.

And many organizations are taking innovation one step further. One firm recently introduced a new benefits reward program in which employees earn points based on both personal and company-wide achievements and then cash them in for perks across various categories: health and wellness, travel, housing, transportation, time off, annual grocery passes — you name it. The purpose is to give employees the power to choose the types of perks that mean the post to them.

Personalized pay can boost attraction and retention

The unemployment rate is the lowest it’s been in decades, and the war for talent is extremely tough. The average tenure for workers is 4.6 years. For millennials, it’s half that.

This sort of high employee turnover can take a massive toll on a company’s bottom line: Experts estimate that it can cost up to twice an employee’s salary to recruit and train a replacement. Not to mention, employee churn can damage company morale and tarnish your company’s reputation.

Customized pay and benefits plans can make an employer be more attractive in a tight, crowded job market. If you want to not only attract top talent but retain them as well, it’s worth taking the time to understand what matters to your candidates and offering them personalized pay and reward packages.

Organizations need to introduce more flexibility into their pay packages and adapt to the needs of the changing workforce. After all, when you invest in your employees, you invest in the overall success and performance of your business.

This article originally appeared in Employee Benefit News.

SOURCE: Wesselkamper, B. (11 February 2019) "Goodbye group benefits. Hello personalized pay" (Web Blog Post). Retrieved from https://www.employeebenefitadviser.com/opinion/tailored-employee-benefit-plans-gaining-popularity

No primary care doc, no problem: How millennials are changing healthcare

Do you have a primary care physician? Forty-five percent of 18- to 29-year-olds reported that they do not have a primary care physician. Read this blog post from Employee Benefit News to learn more.

Millennials, and Generation Z behind them, are changing the way they access healthcare. In fact, 45% of 18- to 29-year-olds say they don’t have a primary care physician. Instead, they’re opting for on-demand healthcare.

Traditionally, individuals and families see primary care physicians several times a year and build relationships with their doctors over time. Visiting the same primary care physician when an illness strikes, or for an annual wellness checkup, can help the doctor notice changes in a patient’s health and catch issues before they become more serious (and costly).

But for millennials, having a primary care physician isn’t necessarily a priority.

That’s in part because they seem to prefer on-demand healthcare options, such as urgent care, drug store clinics and telemedicine services, which are easily accessible and typically include shorter wait times. The number of urgent care centers reflects the trend — they’re projected to grow by 5.8% in 2018, according to the Urgent Care Association.

Then there is employers’ shift away from health maintenance organizations, which often required that each employee choose a primary care doctor at the start of the plan. HMOs also require a referral from the primary care physician to see specialists. Recent research shows that most often, employers offer preferred provider organizations (84%), while 40% offer consumer-directed health plans and 35% offer HMOs.

Finally, physician shortages are leading to longer wait times for appointments. The U.S. population continues to grow and age, which may lead to a shortage of 120,000 primary and specialty doctors by 2030, according to the Association of American Medical Colleges.

For employers, it’s important to understand the reasons behind the shift to on-demand healthcare and educate employees to ensure they can get appropriate medical attention when they need it.

One crucial part of this education is helping employees understand when they should visit urgent care versus the emergency room, and reminding them that telemedicine is available. More than 95% of large employers and just over one-third of small- and mid-size employers offer telemedicine benefits. But adoption rates among employees remain low — only 20% of large employers report utilization rates above 8%, according to the National Business Group on Health.

Ensure your employees know that the service is available throughout the year and help them understand the cost if any is associated with the service. You may consider offering $0 copays for telemedicine visits to encourage employee use.

Encourage employees to get a wellness visit each year to help uncover health issues and take steps to prevent others. One way to do this without forcing employees to wait for an appointment or commit to a doctor is to bring the service in-house. Increasingly, large employers are adding this service to help employees stay healthy. In fact, one-third of employers with more than 5,000 employees and 16% of employers with 500-4,999 employees now have onsite clinics. Another 8% of midsize employers plan to add clinics in 2019.

Providing health assessments as part of a health and wellness program is another way to get employees, especially money conscious millennials, in front of a doctor. Younger workers are likely to embrace incentives or premium discounts that are tied to a physician visit.

Direct primary care is yet another employer option to provide easy-to-access primary care. With direct primary care, employers partner with primary care physicians to offer a designated doctor for their employees. The benefit for employees is more face time with a doctor and the opportunity to get personalized care.

Importantly, employees who have known chronic issues should see a primary care doctor regularly to help monitor and manage their condition.

The trend toward seeking on-demand healthcare at alternative sites isn’t likely to reverse direction any time soon. Instead, it’s up to employers to understand why it’s happening and educate employees of all ages on their options for care.

SOURCE: Milne, J. (7 January 2019) "No primary care doc, no problem: How millennials are changing healthcare" (Web Blog Post). Retrieved from https://www.benefitnews.com/opinion/no-primary-care-doc-no-problem-how-millennials-are-changing-healthcare?brief=00000152-14a5-d1cc-a5fa-7cff48fe0001

3 trends and 4 survival tips for managing millennials in 2019

Millennials: America's most diverse and overly stereotyped generation. Whether you like or dislike millennials, it's hard to avoid the fact that they are going to be the prime engine of the workplace for years to come. Continue reading to learn more.

anyone knows more about millennials than an actual millennial, it’s Brian Weed, CEO of Avenica. Founded in 1998, Avenica’s personnel services are focused exclusively on recent college graduates and the companies who are looking for such talent.

“Our goal is to place recent college graduates on the right career-track, finding entry-level positions for them at companies offering strong professional growth,” Weed says.

Millennials have been given “kind of a bad rap” by being overly stereotyped and studied. “Millennials are America’s most diverse generation. They hold more college degrees than any other generation, and they’ve experienced economic and political turmoil. They’re savvy, educated, skeptical, and on top of it all, they’re idealists. All of this has led to vast changes in the ways today’s workforce views business, engages with their organizations and leaders and makes decisions about their careers,” he says. And yet, just as with any generation, one must be cautious about assuming one profile fits all.

However one feels about this generation, there’s the fact that millennials are going to be the prime engine of the workplace for years to come. “The truth is that companies have to adapt to them, not the other way around,” he says.

Given the company’s focus and its tenure of service, BenefitsPRO asked Weed to identify three top millennial worker trends for 2019. Here’s his list:

1. Shifting motivations

Salary and culture continue to rank high on the list for attracting millennial and Gen Z candidates, but the following factors are increasingly important:

Flexibility: They expect more control over where and when they can work, with the ability (enough PTO and work-life balance) to travel and have other life experiences.

Mission driven: They are more in touch with the environment, society, and the future of both. They feel they are not only representative of their organization, but their organization also represent who they are as individuals and want to be a part of organizations that share similar views. They look for leaders who will make decisions that will better the world, not just their organizations, and solve the problems of the world through their work.

Development and training opportunities: Because millennials have seen such dramatic shifts in the economy, they seek to have more control over the future of their careers. Not only to “recession proof” but also to “future proof” their careers by constantly learning and developing.

2. Declining levels of loyalty and increased job hopping

These phenomena, well-known to employers or millennials, are largely due to:

Shifting motivations (outlined above): The key to managing this group is understanding the shifting motivations and finding ways to meet those needs/wants will help organizations attract and retain top talent.

Higher value placed on experiences, constantly wanting to try and learn new things: Managers need to give these employees opportunities to grow and develop in their roles is essential, but also opportunities to explore different fields and disciplines is also key. Keeping the work and the environment interesting and diverse will keep millennial employees engaged for longer.

Less patience, with a desire for frequent indicators of career progress (higher pay and/or promotions): Job hopping often allows the quickest opportunity to make more money and climb the career ladder. As a result, organizations are building in a quicker cadence for promotions and pay raises.

3. An increasing lack of basic professional skills/awareness

Many of these talented young people lack essential knowledge about what to wear, how to act and how to/engage in an office setting. Here’s how to respond:

Managers need to be ready to guide these new workforce entries into the professional skills areas. They often don’t have a network of older (parents/relatives) professionals around them to set an example and advise on what “professionalism” looks like and means. And colleges often don’t provide education in professionalism in an office setting: aside from business schools, many colleges don’t prepare students—especially those in the liberal arts—on meeting etiquette, business apps and technology, and other everyday professional practices.

Corporate onboarding of new entry-level employees often excludes the “basics” (meeting protocols, MS Office skills, etc.). While companies typically have some type of job-specific training programs, they often assume these basic office skills are there and aren’t able to see a candidate’s potential when lack of professional skills/awareness is present. This can create a barrier for highly qualified but more “green” candidates, especially first-generation graduates. Effective companies will develop training, coaching, and mentorship programs can help once on the job.

Weed’s 4 survival tips to managers of millennials

1. Create clear and fast-moving career tracks.

- Create distinct career tracks with clear direction on how to advance to each level.

- Restructure promotion and incentive programs that give smaller, more incremental promotions and salary raises, giving more consistent positive reinforcement and closer goals that make it more enticing to stay.

- Create professional development opportunities that help them advance in those career tracks and build other skills they need and want.

- Create ways young employees can explore other career tracks without leaving the company. Millennials and Gen Z’s have a higher propensity for changing their minds and/or wanting different experiences, so consider ways that enable employees to make lateral moves, or create rotational programs that allow inexperienced professionals to get experience in a variety of business capacities and are then more prepared to choose a track.

2. Alongside competitive compensation packages that include 401k matching programs and comprehensive insurance offerings, provide benefits that allow them to have a sense of flexibility when it comes to how they work.

- Working remotely, flex schedules/hours

- Floating holidays–especially beneficial as the workforce becomes more and more diverse

- Restructure PTO that gives employees more autonomy and responsibility for their work

- Tuition reimbursement programs to increase retention and build leaders internally

3. Create a strong company culture: company culture is one of the strongest recruiting and retention tools. Go beyond the flashy tactics of having an on-site game room and fun company outings and bring more focus to the company’s mission. Create and live/work by a set of core values that represents your company’s mission. People will be more engaged and move beyond just being their role or position when they feel connected to the mission.

4. Challenge without overworking. Boredom and stress are equally common as factors for driving millennials out of a workplace. Allow involvement in bigger, higher-level projects and discussions to provide meaningful learning opportunities, and create goals that stretch their capabilities but are attainable.

SOURCE: Cook, D. "3 trends and 4 survival tips for managing millennials in 2019" (Web Blog Post). Retrieved from https://www.benefitspro.com/2018/11/13/3-trends-and-4-survival-tips-for-managing-millenni/

Culture is key to attracting younger talent, but you can make it mutually beneficial

According to an article in Harvard Business Review, six in ten millennials are ready to change jobs at any moment, creating a great opportunity for recruitment. Read this blog post to learn how organizations can attract younger talent.

Millennials with jobs are more likely to be looking for a new job than any other generation in the workplace, according to a Harvard Business Review article by Brandon Rigoni and Amy Adkins. They report that six in ten millennials are ready to jump ship at any given time.

This is a challenge for keeping workers, but it’s also a golden opportunity for recruitment. For the most part, these are bright workers who are deconstructing the great American job search.

Firms can seize this opportunity by honing their HR brand to appeal to younger generations and balancing this with assessments that assure a good match with most new hires.

Compensation is still important, but millennials are looking for jobs that are in sync with their values and can help define who they are. Getting hired has become a matter of personal identity.

As an employer, you are being evaluated more than the candidates. How will your firm make the cut? And if you do, will you hire the right people?

Major corporations have overhauled their approach in the scramble for talent.

- General Mills began using virtual reality headsets to allow candidates to see themselves working inside General Mills, including using the company’s gym.

- Two Volvo engineers recently built a Baja racer for collegiate competitions to attract young engineers to the legacy truck builder.

- General Electric’s humorous “What’s the Matter with Owen” television campaign said bupkis about GE products. Instead, Owen touted the company’s geek chic HR brand as a bespectacled new employee being effusive about his job of programming life-changing technology to help people.

- McDonald’s eschews traditional media to engage 16 to 24-year-old candidates via Snapchat, offering “Snaplications” and video clips of young McDonald’s employees talking about their jobs.

Not everyone can serve up cold brew coffee in a corporate cafeteria. Still, there are practical steps most firms can take to enhance their HR brand for millennial and Gen Z values.

Does your organization operate with a high degree of transparency? Is it socially responsible? Do employees have paid leave for volunteer work? Are young team members valued and encouraged to contribute to relevant and visible projects and products?

Are there ways to present your products and services to be more relevant and important to society? For example, a textile manufacturer might not actually make exciting products anyone can buy, but its fabrics are used in the space program or to save lives in emergency rooms. Maybe a law firm has a pro bono clinic for low-income families.

Yes. HR needs to make your employer brand attractive to these talented but fickle job seekers, but this doesn’t mean that everyone who’s attracted to your organizational hipness is going to be cool for your company.

There are two tools to make sure both parties get what they want. The first is assessments.

Talent acquisition assessments greatly improve your odds of hiring an individual who is well matched to your company’s needs. The best are scientifically valid and EEOC compliant, focusing on the candidate’s motivation and likely work traits as compared to the job description. You’ll save a lot of money in not having to re-hire for a position.

The second tool is the “Shared Success Model,” which is a process hiring managers can establish that aligns individual development plans with organizational strategies to identify where overlap exists and where there may be gaps.

It has five components:

- Individual needs—What is important to the candidate, both professionally and personally? What aligns with their values and interests?

- Individual offer—What value does the organization bring to the candidate?

- Company needs—What does your organization require for success now and in the future? What do you need from your leaders and employees?

- Company offer—What is your corporate value proposition to the candidate? What opportunities do you provide? What culture do you provide?

- Plan—Analyze the gaps and overlap between each quadrant. Develop and implement a plan that balances your grid for shared success.

As younger candidates seek more of a cultural match, the Shared Success Model is a good way to make sure the culture you promise is a culture that supports your mission and business model.

SOURCE: Warrick, D. (8 October 2018) "Culture is key to attracting younger talent, but you can make it mutually beneficial" (Web Blog Post). Retrieved from https://www.benefitspro.com/2018/10/08/culture-is-key-to-attracting-younger-talent-but-yo/

5 reasons to offer a student loan repayment benefit in 2019

Are you looking for ways to help add more value to your talent through your 2019 benefits packages? Continue reading to learn why you should offer student loan repayment as one of your employee benefits.

With human resources managers across the country working to finalize their 2019 benefits packages this month, many are asking themselves: How can we add more value for our talent and help the company grow? For many employers, the answer is helping employees manage their student loan debt.

Over the years, student loan debt has reached an astronomical sum. As of 2008, college tuition fees rose by 439% from 1982. And by the first quarter of 2018, 44 million Americans owed a total of $1.5 trillion in student loan debt, exceeding both credit card debt and auto loan debt, according to the Federal Reserve. Not only is this an extreme amount of debt, but has also taken an enormous emotional toll, with more than half of college-educated adults (54%) surveyed by Laurel Road in 2018 feeling that they will never make enough money to reach their financial goals.

Fast forward to today, and borrowers are seeking creative ways to tackle their debt and save more. Recently, in a private ruling, the IRS granted Abbott Laboratories, a national healthcare company, the option to contribute to employee 401(k) plans based on the employee’s student loan payments. Other companies — from corporate behemoths to busy startups — have partnered with student loan refinancing companies to offer employees refinancing options that can help them save, often at no cost to the company.

With Americans quitting their jobs at the fastest rate since 2001, keeping employees happy is imperative. And part of keeping millennials happy is to provide practical benefits, not just the fun perks. Employees are looking to foster meaningful relationships with their employers — so looping in student loan repayment benefits can pay off for both the employer and the employee.

So what’s to gain? Here are some of the top reasons employers should consider incorporating student loan repayment benefits into their 2019 benefits package.

1. Recruit, retain and stand out

2. It’s flexible and free

3. Eliminate the student loan vs. retirement conflict

4. Help employees save

One of the reasons why the student loan benefit is attractive for employees is the significant savings it can lead to. If refinancing is an option, employees have the potential to save thousands of dollars over the life of their loan through a lower loan interest rate and lower monthly payments.

In the long run, the cumulative savings can add up to several thousand dollars or more. Employers should keep in mind that the savings amount will change depending on the financing company you choose to work with. Many can offer employer customers exclusive rates, which leads to even greater savings.

5. Boost morale and productivity

According to another benefits company, 31% of employees surveyed say their money concerns affect their work. Meanwhile, 74% of people feel stress daily about their student loan debt and spend time at work thinking about it, impacting their overall productivity in the workplace. So in addition to the hard savings employees are earning through these programs, they are also rewarded with the soft benefits of reduced stress and anxiety at work.

With student loan debt reaching record highs in recent years, employers have recognized that there’s a crucial need to provide employees with options to help them pay down their student loan debt. And when options like refinancing come at no cost to them, this benefit will likely become more popular. In the future, we can expect more employers to pave the way for student loan repayment programs. Will you be one of the trailblazers?